Transcription

DOI: 10.21276/sjbmsSaudi Journal of Business and Management StudiesScholars Middle East PublishersDubai, United Arab EmiratesWebsite: http://scholarsmepub.com/ISSN 2415-6663 (Print)ISSN 2415-6671 (Online)Executive Compensation and Financial Performance; Industry Sensitivity TestSani Kabiru Saidu1, Musa Muhammed Bello2, Rabiu Saminu Jibril3Department of Business Administration, Federal University Birnin Kebbi, Nigeria2Department of Accountancy, Kano State Polytechnic, Nigeria3Department of Accountancy, Kano State Polytechnic, Nigeria1*Corresponding Author:Sani Kabiru SaiduEmail: sani.kabiru@fubk.edu.ngAbstract Owing to the apparent inconsistencies in empirical findings in executive compensation and financialperformance studies and the widening gap in the underpinning theories, this study examined the effect of change inindustry-type on compensation-performance study. The study used ex post-facto research design to test its objectivesusing ten year data drawn from banking and construction industries with results obtained from data analysis using bothdescriptive and inferential statistics. Both correlation and OLS results revealed significantly negative and positive resultson banking and construction industries respectively. The study concludes that industry characteristics like product type,existence of tangibles and magnitude of returns which differentiates the industries account for the variation of results.The research recommended investors and providers of funds should factor in the sensitivity of compensation to operatingreturns in the determination of investing industry. This is because the higher the sensitivity, the lower the agency costsand vice versa. Further research is suggested for wider comparative analysis in unrelated and highly diversified industriesfor potential theory development.Keywords: Executive Compensation, Financial Performance, Industry SensitivityINTRODUCTIONExecutive compensation refers to all forms ofrewards from various sources accruing to topmanagement staff and directors of a firm. The rewardsare either short or long term in nature. They includesalaries, bonuses, allowances, insurance, shares,pension contribution and perquisites, among others.Some elements of executive compensation like salary,allowances and insurance benefits are fixed, while thelikes of bonuses and shares are paid on bases consistentwith profit and other measures of financialperformance.Top executives of companies, if wronglycompensated, may not have the right motivation toperform in the best interest of shareholders [1] Thedebate over the nature, structure and pattern ofcompensation and its effect on the overall corporatewell-being of an enterprise has remained on the frontburner of arguments among economists, corporatedirectors, legislators and financial journalist [9], cited inNyaoga [2].Researchers have shown that misrepresentationof financial performance due to compensation issuesurrounding the corporate failures especially infinancial institutions. Turner [10] states that „ there isstrong prima facie case that inappropriate incentivestructures played a role in encouraging behaviour whichcontributed to the financial crisis‟. Also the year 2000,collapse of the energy giant Enron and other corporateentities in the United States and some distressed banksin Nigeria (like the Union Bank, Bank PHB, Afribank,Oceanic Bank and Intercontinental Bank) did not onlycreate concern over general corporate governanceissues, but also empirically exposed the counterproductive nature of executive compensation contractsand their consequences on earning management andmisrepresentation of financial performance.The choice of two industries is informed by theneed to establish whether same research structure,method and data if applied in different industries couldlead to similar of conflicting findings. Financialperformance- compensation studies on financialservices firms largely conducted outside Nigeria revealnegative sensitivity as against studies drawn from nonfinancial services firms which exhibit significant andpositive relationships. As such, this study intends tocompare the outcome of the two industries in order toestablish whether industry is characteristics like size,degree of profitability and existence of tangibles affectthe sensitivity of financial performance to executivecompensation.Regarding studies on the relationship pensation, the literature shows that studies like [11,2-4], et al. [12, 13], et al. [14], use different (1)approaches, assumptions and methods (2) variables and732

Sani Kabiru Saidu et al.; Saudi J. Bus. Manag. Stud.; Vol-2, Iss-8 (Aug, 2017):732-736measure of financial performance on executivecompensation (3) control variables and their proxies (4)time horizon or periods of the sampled data (5) datatype (cross-sectional or panel data) and industry type.The choices made, as cited above, mightexplain the causes of the mixed and ambiguousoutcomes from the empirical studies in this area. Assuch, the important question to ask is: why theambiguity and often conflicting conclusions? Thisquestion triggers this research with the view toextending the frontiers of knowledge by adopting aslightly different methodological approach. The patternof results from previous studies trigger the need forcomparative study across non-related industry to becarried out, as this study intends. The result of thiscomparative study would determine whether industrycharacteristics affect the results of previous studies.LITERATURE REVIEWEl-Akremi & Treppo [5] used chi-figure andcorrelation on a surveyed data obtained from quotedJordanian firms in a study on CEO compensationstrategy. The study discovered that balance of powerbetween boards and CEOs determines pay. Theyfurther concluded that economic, political and symbolicfactors allowed CEO to influence compensation.Although this study took an entirely differentapproach going by its theme and methodology, yet itexposed other behavioural factors and corporate politicsand power play as key determinants of executivecompensation. The only reservation about the findingslies in the fact that where code of corporate governanceexists and its application is strictly supervised andregulated, the excesses of CEOs may be minimised.Towing the line of El-Karemi [5] on the use ofstocks or equity is the work of Gerrard & Santers [15].The study looked at behavioural responses of CEOsstock ownership and stock options through a randomsurvey of 500 firms on S & P index over a five yearperiod. The research found that asymmetrical risksproperties embedded in stock options would lead todifferent resource allocation decisions.Suchownership, according to the study, could lead to riskaversion by the management. Such position wouldaffect future profitability by implication. The weaknessof this study lies in its failure to use historical data toprove risk aversion implication on the performance ofthe surveyed firms over time.In an effort to expose the major short-comingsof short-term compensation arrangement and thisunethical behaviours that have great impact onaccounting disclosures and corporate governance, Gao& Strives [16] used Panel data to examined earningmanagement and executive compensation.TheAvailable Online: http://scholarsmepub.com/sjbms/research evaluated the impact of overdose of the use ofoption (long term) and under dosed of salary (shortterm) in executive compensation. The study exposed astrong evidence of poorly designed compensationcontract as it induces earning management. It furtherconfirmed that managers were using the opportunity(given to them) to exploiting timing options in reportingsome accounting numbers.Although the findings revealed the unethicalconsequences associated with lopsided compensationarrangement which emphasised on short term ratherthan long term, it was unable to measure thebehavioural responses of CEO who received options asincentives. Because their deliberate risk aversiontendencies may be considered as un- ethical since theprice safety of their stocks holding was their keyconcern.Babchuck & Fried [17] found that executivepay was strongly influenced by managerial powers anddisposition of shareholders. The study moved a stepahead of El-Akremi whose main focus was onmanagerial powers. However, the power of interplay asrevealed by Babchuck (cited) became obviouslystronger appears where corporate governance practicewas strong and compensation committee was doing itswork well. Just as the postulations of Donaldson (cited),Parmar et al [18] reviewed stakeholder theory whichenthused that “truth and business freedom are bestserved by seeing business and ethics connected”.Levinsohn [19] Shivdasani & Fich [6] andKaplan & Abowd [20] used accounting and marketbasis of performance on executive pay. Their separatestudies indicated significant but weakening correlationover a long period. They agreed on the relevance of thecontinuous of stock options and stock indexing in theright proportion and value for optimal outcome. Kaplan& Abowd (cited) particularly described stock option asan aligning factor between non-executive directors andshareholders. On the issue of whether executive pay (inall its ramifications and contents) affect financialperformance, recent studies kept the argument as wideas it has always been.Nulla [7], Fernandez [8], Jegede [21], Aduda[22] and Nyoaga et al. [2] discovered negative andinsignificant relationships between executive pay andperformance.Although differences existed inmethodology, time, industry analytical tools and scopeof samples, yet their consensus created a block ofresearch position and fact.On the contrary, Lambert and Larker [23],Houmes & Dickins [24] Babatunde & Olaniran [25] andKurawa & Saidu [11] found strong link between payand performance. The present researcher observe that733

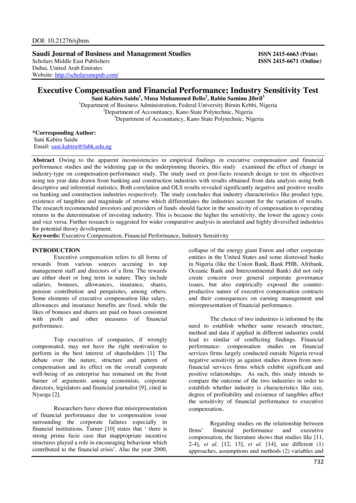

Sani Kabiru Saidu et al.; Saudi J. Bus. Manag. Stud.; Vol-2, Iss-8 (Aug, 2017):732-736the structural differences of these studies are similar tothose with weak and negative relationships as cited.In the light of these reviews, it is pertinent andtimely to use both accounting and market basis ofperformance on executive compensation across selectedfirms with tangibles density and non-tangibles densityindustries.In examining the impact of financialperformance on executive compensation of selectedcompanies in Nigeria, seven theories have been foundrelevant in providing explanation and description offinancial performance-compensation. They are theagency, stakeholders and stewardship, equity,tournament, social comparison and upper echelon‟stheories.Agency theory, having its roots in economictheory, is widely use in pay-performance studies. Therelationship between shareholders, on one the hand, andtop executives on the other in public companies is aclassic example of principal agent relationshipsuccinctly described by the agency theory literature[26]. Though the theory underwent refinement, it is stillrelevant because of its simplicity. It reduces the firminto two character situation.It is necessary to note that generally, agencytheory predicts that compensation policy will tie theagents expected utility to the principal objectives [26]cited in Brown et al. [27]. They note that the objectiveof shareholders in corporations is to maximize wealth.Agency theory predicts that CEO compensation policiesdepend on changes in shareholders wealth. Thispostulations, according to Murphy [28] and Aduda [22],are (1) there is a potential divergence of interestbetween shareholders and the CEO (2) the existence ofinformation asymmetry which makes it harder for theshareholders to observe the full activities of paidmanagers (3) the CEO as a rational agent seek tomaximize his/her utility and at the same time has anaversion for risk” El-Akremi et al [5].METHODOLOGYThe study employs ex-post-facto researchdesign. The reason for the choice of such researchdesign is informed by the fact that the variables of thestudy are the uncontrolled type since the phenomenonto be studied has already occurred. The population ofthe study consists of 16 banks and ten (10) listedconstruction firms as at 31st December, 2014. For anylisted firm to qualify as the working population, it musthave been listed on the floor of the Nigerian Stockexchange on or before 31st December, 2004 and havenot been delisted during the study period 2005 through2014. As a result of these criterions, eight and sevenbanks and construction firms emerged respectively.Available Online: http://scholarsmepub.com/sjbms/Since the working population is not large and theannual report and accounts of the listed constructionfirms can be obtained from the stock exchange, the postfiltered population was adopted as the sample of thestudy because of its relative size [29].Descriptive statistics, correlation matrix andOLS regression have been used to analyse datacollected from the annual reports and accounts of thesampled listed construction firms. The tools have beenfound suitable for describing the structure and pattern ofthe data as well as drawing inferences to permit theattainment of the research objective.The dependent variable is the executivecompensation which is proxied using cash and stockpayment made to executives after eliminating paymentsmade to non-executive directors which appears as amodification of the approach used by Aduda [22] andNyoaga [2]. For the explanatory variables, financialperformance (FP) is the independent variable denotedby return on assets; return on equity, earnings beforeinterest and tax, earnings per share and tobin‟s Q. whileage and firm size were used as control variable. Themeasurements of the variables are explained below.RESULTS AND DISCUSSIONThe comparative summary of tables 4.3 and4.6 for the OLS regression results of banks andconstruction industries. The results show positivecoefficient of all explanatory variables (financialperformance) in the case of construction firms. Amongthe element of financial performance with positivecoefficients, returns on assets and earnings per share arefound to be significant at 0.036 and 0.178. The resultsclearly indicate that executive compensation pattern inthe industry is influenced by financial performanceelements like the returns on equity and earnings pershare.Conversely, the ordinary least square results ofdata drawn from banks exhibit mixed patterns in termsof impact magnitude depicted by positive and negativecoefficients. However, the relationship betweenfinancial performance and executive compensationappears insignificant. Therefore, other factors outsidefinancial performance determine the executivecompensation of Nigerian banks.Since the two industries differ by age oflistings, assets size, degree of profitability and extent ofregulations, the differences in OLS regression result isclearly attributable to any of these characteristics thatare inherent and peculiar to these industries. Therefore,the comparative regression result on table 2 provides asufficient ground for achieving the objective of thepaper which seeks to investigate the impact of industrytype on the relationship between financial performance734

Sani Kabiru Saidu et al.; Saudi J. Bus. Manag. Stud.; Vol-2, Iss-8 (Aug, 2017):732-736and executive compensation in the Nigerian bankingand construction/building industries.CONCLUSION AND RECOMMENDATIONSThe study concludes that variation in industrycharacteristics, like the existence of tangibles, size andlevel of profitability between financial and nonfinancial industries, is found to influencing thesensitivity of FP and EC of companies in Nigeria. Thisis because other industry‟s inherent characteristicsaffect the sensitivity of financial performance toexecutive compensation.The overall effects of the two regressionresults established in 4.0 above is the affirmation thatexecutive compensation of banks does not lead to goalalignment between shareholders and paid executives.Instead, it creates an agency problem by putting the twostakeholders in competition for the lean resources oforganization. Conversely, the picture from the buildingand construction industry clearly exhibit a managementpractice in which payments made to top executivesconforms to financial performance. Such practice createan amenable atmosphere for goal congruence andreduction of agency costs by minimizing opportunisticbehaviours of top executives.Appendicesi.Variables Of The StudyVariableAcronymThe study recommends that investors and otherstakeholders should prioritise their investments inindustries where shareholders‟ and managers‟ goals arealigned. Doing so would lead to performanceimprovement, corporate growth and reduction of risksassociated with business failures.DefinitionDependentTECTotal ExecutiveCompensationExplanatoryFSFirm SizeROAReturns On AssetROEReturns Of EquityEarnings Before Interestand TaxEBITii.EPSEarnings Per ShareT‟s QTobin‟s QSizeLog. Of AssetROAROEEPSTobin‟s QEbitAgeAssetsconsProfit before tax divide by number ofequityTotal Market Value of Firm Divideby Total Asset Value of FirmNatural Logarithm of AssetOLS ResultsBuilding & ConstructionVariablesMeasurementTotal value of salary, bonuses, lifeand health assurance, bonus stockaccruing to executives directorsAggregate the logarithms of assets ineach financial yearNet profit as a percentage of totalassetNet profit as a % of shareholders fundNet profit earned before taxation 0193.180.0007710814.42- .000086753762Stad ErrTp /t/BankingCoefficientStd .036 11713.2780945.3211957.050.900.369- 55151.8520238.98.000048-1.800.076 ource: Generated by the Researcher from Stata 14, 2005-2014REFERENCES1. Barney, J. B. (1990). Employee stock ownershipand the cost of equity in Japanese electronics firms.Organization Studies, 11(3), 353-372.Available Online: http://scholarsmepub.com/sjbms/2.tp 310.8610.8850.008*0.0000.002Erick, T. K., Kefah, B. A., & Nyaoga, R. B. (2014).The Relationship between Executive Compensationand Financial Performance of Insurance Companiesin Kenya. Research Journal of Finance andAccounting, 5(1), 113-122.735

Sani Kabiru Saidu et al.; Saudi J. Bus. Manag. Stud.; Vol-2, Iss-8 (Aug, ndey, R., Vithessonthi, C., & Mansi, M. (2015).Busy CEOs and the performance of family firms.Research in International Business and Finance, 33,144-166.Feng, Y., Nandy, D. K., & Tian, Y. S. (2015).Executive compensation and the corporate spin-offdecision. Journal of Economics and Business, 77,94-117.El Akremi, A., Roussel, P., & Trépo, G. (2001).CEO compensation strategies: Consequences onthe structure and management of executive pay.Shivdasani, A. and Yermack, D., (2005). CEOInvolvement in the Selection of New BoardMembers; an Empirical Analysis. Journal ofFinance, 54, no 5.Nulla, Y. M. (2012). The CEO CompensationSystem of New York Stock Exchange (NYSE)Technology Companies: An Emperical Studybetween CEO Compensation, Firm Size, FirmPerformance, and CEO Power.Fernandes, N. (2008). EC: Board compensation andfirm performance: The role of “independent” boardmembers. Journal of multinational financialmanagement, 18(1), 30-44.Meyer, M. S., Alon, R., & Shibolet, S. (1987).ncreased 25-hydroxyvitamin D levels in portalblood following cholecystokinin injection in thedog. FEBS letters, 212(1), 138-140.Turner, R., Zolin, R., & Remington, K. (2009).Monitoring the performance of complex projectsfrom multiple perspectives over multiple timeframes. In Proceedings of the 9th InternationalResearch Network of Project ManagementConference. IRNOP.Saidu, S., & Dauda, U. (2014). An Assessement ofCompliance with IFRS Framework at First-TimeAdoption by the Quoted

Sani Kabiru Saidu1, Musa Muhammed Bello2, Rabiu Saminu . returns in the determination of investing industry. This is because the higher the sensitivity, the lower the agency costs and vice versa. Further research is suggested for wider comparative analysis in unrelated and highly diversified industrie