Transcription

R E A LT Y2012 Annua l Repo r t

A bout the CompanyL etter from the Chairman22012 Operating Review14Form 10-K21Shareholder Information 119Corporate DirectoryIBCKimco Realty Corporation (NYSE: KIM) is a real estate investmenttrust (REIT) headquartered in New Hyde Park, N.Y., that ownsand operates North America’s largest portfolio of neighborhoodand community shopping centers. As of December 31, 2012,the company owned interests in 896 shopping centers comprising131 million square feet of leasable space across 44 U.S. states,Puerto Rico, Canada, Mexico and South America.

FOCUSEDFrom our first shopping center in Miami in 1958, to our nearly 900 shopping centers acrossNorth America today, growth has always been a part of Kimco’s DNA.It still is. But as we enter the next chapter in our history, our path to growth is becoming evenmore focused – on top markets, quality and value, serving retailers and, as always, on results.We’re paying close attention to what really matters, with one goal in mind: to be the bestneighborhood and community shopping center company in North America.We will achieve that goal by staying FOCUSED. ON TOP MARKETS . 6ON QUALITY AND VALUE .8ON RETAILERS . 10ON RESULTS . 12

CH AIRMAN’S LETTERDear Fellow Shareholders and Associates:When Marty Kimmel and I developed our firstshopping center in 1958, our primary focus was on thecash flow that could be generated from tenant leases;this would amortize the mortgage loan and provide ourinvestors with stable and predictable cash distributions.The investment thesis was simple: Construct abuilding where a retailer wanted to serve its customersand lease it at a rate that would pay the investors a safeand reasonable return over the life of the lease. Wecould earn money while we slept.During the ’70s and ’80s, we shifted to acquiringproperties with the same characteristics – low rentrelative to the anchor tenant’s sales, strong locationsin densely populated markets and a steady cash flowproviding distributions to the investors.In 1991, when we completed our initial publicoffering, we provided investors access to ownership ofshopping centers in a new public vehicle for the firsttime in a very long time. Our shareholders enjoyeda safe and growing dividend and growth in cashflow from retail real estate, along with a vehicle toopportunistically capitalize on the needs of distressed,real-estate rich retailers.Fast forward to Kimco’s Investor Day in September2010 when, after the worst recession since theGreat Depression, we made a commitment to our2shareholders to simplify our strategy and once againfocus on recurring cash flow from high-qualityshopping centers. We are making excellent progressfulfilling that commitment. To put our transformationin perspective, in 2008 our non-retail investmentbalance was 1.1 billion. After the impending sale ofthe InTown Suites extended-stay portfolio, that balanceis expected to be below 300 million.Since our Investor Day, we’ve also shed shoppingcenters that didn’t fit our criteria, generating proceedsto Kimco of more than 500 million.We have used these proceeds, together with thosegenerated from our non-retail dispositions, to reducedebt and acquire higher-quality shopping centers inwell-located areas.The table on the next page illustrates our transformation.Today, the demand for space for our type of retailproperty continues to improve. Absorptions areforecast to outpace completions of new constructionfor the foreseeable future. Despite prevailingeconomic uncertainties, planned store openings are ata multiyear high.Our tenants are generally strong credits, includingdiscounters, off-price retailers, drugstores, supermarkets and warehouse clubs, supplying everyday

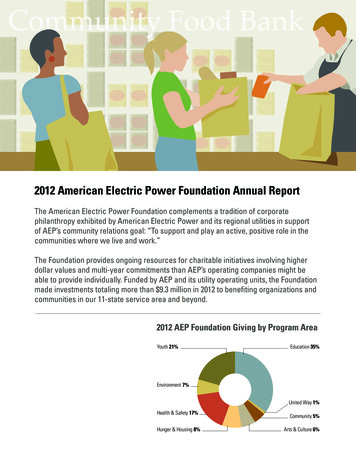

Our Quality Trade-Up: U.S. Shopping Center Acquisitions & DispositionsSince Investor Day 2010 (as of 12/31/12)AcquiredDisposedSitesSitesVarianceNumber of properties59108-45.4% 1,290,868 825,25056.4%Gross Leaseable Area in square feet %Average Base Rent per square foot* 13.92 8.7559.1%Estimated Population91,62176,32920.0%1,2731,06419.6%Median Household Income† 74,390 58,45827.3%Average Household Income† 88,935 65,32836.1%Gross Price (000’s)†Household Density per square mile†* Represents Kimco’s pro-rata interest†Within a three-mile radiusnecessities. Many of our leases were entered intodecades ago, and contain very low contract rents. Veryfew public companies have entered into leases 40 yearsago; these legacy contract rents are obviously belowmarket, and they form a basis for future rental growthas the leases expire. A recent illustration of this was a41-year-old lease with a major retailer that provided uswith annual rental revenues of 315,000. When thelease expired in the first quarter of 2012, we enteredinto a new ground lease with a credit tenant for oversix times that rent. There are more such leases in ourportfolio, which should result in additional rentalgrowth as the leases expire.Like other retail property owners, we are still navigatingthrough some headwinds. Many consumers are feelingthe impact from the end of the payroll tax holiday, andgasoline prices are up. And yet some major economicindicators are pointing in the right direction.The unemployment rate, while still too high, is slowlyimproving, and home prices continue to recover.Interest rates remain low. We remain focused on leasingour space to smart retailers who will benefit from bettereconomic conditions in the years ahead.3

Having evolved from that first shopping center manyyears ago, there are three aspects of Kimco’s business thatdistinguish us today.1. We have a very large operating platform – 896shopping centers with approximately 8,400 tenants –that enables us to service the needs of major nationaland regional retailers. Having this breadth oflocations provides us with access to most, if not all,of the retailers that are experiencing the most rapidgrowth today. Among our peers, we are the largestlandlord to Costco, TJX Companies (T.J. Maxx,Marshalls, etc.), Royal Ahold (Stop & Shop, Giant,etc.) and others. Home Depot and Walmart, two ofthe most creditworthy companies in America today,are among our largest tenants. Given our scale,we are afforded a seat at the table when a retailer islooking to expand or open a new store. In the retailreal estate industry, size matters.2. We are a manager and owner in joint ventures thathold approximately 10 billion of retail real estate.This platform has enabled us to acquire interests innumerous high-quality properties and to generatehigh returns on our shareholders’ equity due to ourmanagement role. Recently, an added benefit ofthis business has been the opportunity to increaseour investment in select assets when some of ourpartners have expressed a desire to monetize theirinvestments or modify their investment allocations.Since our Investor Day in 2010, we have disposedof 55 joint venture properties that were not strategic4to our portfolio and acquired 10 properties frompartners in which we had a minority interest stakeand a management role. For example, duringthe year, we acquired Towson Marketplace inTowson, Maryland. This is a wonderful shoppingcenter anchored by both Target and Walmart,with a full-line Weis Market on site. This propertyshould provide stable and growing cash flows toour shareholders for many years to come. Anotherrecent example is Santee Trolley Square in Santee,California, where we increased our ownership from45 percent to 100 percent. This 98-percent-occupied,311,000-square-foot shopping center is anchoredby several prominent national retailers such as T.J.Maxx, PetSmart, Party City, Bed Bath & Beyond, 24Hour Fitness and Old Navy, and shadow-anchoredby Target.3. We have a long-term track record of capturing retailrelated opportunities. Our history is illuminatedby profitable transactions with Venture Stores,Gold Circle, Hechinger’s, Montgomery Ward,Service Merchandise, Kmart, Ames, Albertsons,Woolworth, Frank’s Nursery, Strawbridge &Clothier, Strauss Discount Auto, Penn Traffic, SaveMart and Shopko. While committed to our stableand growing base of recurring income, Kimco hasalways had an opportunistic culture, which is the“plus” in our “Income Plus” strategy. Our trackrecord of generating profits from transactions withretailers that are real-estate rich has proven timeand again that if you are fast with your footwork,

and well-known, reliable and trusted in the retailindustry, you can generate outsized returns foryour shareholders. Our most recent example ofan opportunistic investment is our participation ina consortium to restructure Supervalu. This is thesame group we partnered with in the Albertsonstransaction, which made Kimco shareholders fivetimes their initial investment – and we still maintaina valuable position in this investment. Kimco willcontinue to provide real estate advisory services tothe new Supervalu venture.In closing, please permit me to express a few thoughtsabout today’s retail real estate market prices. Theprices of high-quality shopping centers today appear“expensive” compared with long-term historicalaverages for market cap rates, which are the initialunleveraged yields available to property buyers.However, let’s dig a little deeper. When compared withthe risk-free interest rate available on the 10-year U.S.Treasury note, investment yields available on qualityretail real estate may be at historically attractive levels.Let me explain. The interest rate on 10-year Treasurieswas, as of this writing, approximately two percent.Treasury Inflation-Protected Securities (TIPS) for thesame duration show negative yields. An argument canbe made that real estate returns should be comparedwith TIPS, because the residual value of real estateoften increases in value with inflation, in some wayssimilar to the increasing yield on a TIPS bond.Clearly, by these measures, quality real estate bearingcap rates in the 5 to 6 percent range looks attractivelypriced. A similar conclusion might be reached if onecompares real estate cap rates with yields presentlyavailable on investment-grade corporate bonds. All thisconsidered, I’ll put my money in shopping centers attoday’s cap rates any day.Our goal at Kimco is to continue to be the premierowner of retail properties in North America; thisshould enable us to deliver safe and growing cash flowsfrom our investment portfolio, as well as increasingdistributions to our shareholders. In addition, we seekto continue generating profits and create value fromour retail-related opportunistic activities. In otherwords, “Income Plus.” We continue to work very hardto achieve these objectives.I want to thank all of our associates for the wonderfuljob they are doing executing our business plan; I’mquite proud of their achievements on behalf of Kimcoshareholders and stakeholders. I am very excited by thefuture opportunities I see ahead. It’s indeed a greattime to own high-quality, income-producing retailreal estate and I’m as proud as ever of our position inthe industry.Milton CooperExecutive Chairman5

We’re focusing our business on key U.S. markets,where population, income and growth prospects are highest.FOCUSEDon Top MarketsKimco’s strategy is to be where the consumers are. We’rerebalancing our portfolio so the vast majority of our shoppingcenters are in the most densely populated, highest-income areasof the U.S. – the places retailers value most.By deepening our presence in top markets, we’ll improve ouroverall asset values, gain operating efficiencies, and increaseoccupancy and income – factors that produce greater wealth forour investors.The median household income inour target markets is 14 percenthigher than the U.S. average.6Airport Plaza, Farmingdale, New YorkWilton Campus Shops in Wilton, Conn., is a prime exampleof our quality trade-up. Acquired last year, the center is 97percent occupied, commands rent of 30 per square foot, andis located in Connecticut’s affluent Gold Coast, an area whichhas an average household income of 241,000. In comparison,the properties we sold since Investor Day 2010 were, onaverage, 85 percent occupied, had rent of 8.75 per squarefoot, and average household income of 65,000. Early in 2013,Kimco acquired Wilton Executive Campus and Shoppes, amixed-use center adjacent to Wilton Campus Shops, securingfull ownership of the entire Wilton River Park development.Woodbridge Shopping Center, Houston,TexasLa Verne Towne Center, Los Angeles, California

“Wilton is growing but still has a small-town feel, and this shopping center is centralto keeping us a tight-knit community. With each trip to the Wilton Campus Shops,we have a chance to bump into neighbors and friends. I was pleased Kimcoacquired the center, because I know they will continue to add to the high-qualityshopping experience enjoyed by those of us who are proud to call Wilton home.”Jane Melani, local shopper,Wilton Campus Shops7

“I’m thrilled the 45-year-old Wilde Lake Village Center is being reinvented for thenext 45 years. Kimco’s new, environmentally friendly design, created with extensiveinput from the community, remains true to the original vision James Rouse had forColumbia, my home town. Wilde Lake residents should be excited about this project,and with the Downtown Columbia plan coming to life, the future of this communitycould not be brighter.”Ken Ulman, County Executive, Howard County, Maryland8

We’re focused on increasing the value of our centersfor consumers, communities and the company alike.–F O C U S E D on Quality and ValueOur redevelopment projects bring new life to outmodedshopping centers in strong locations.Whenever we rebuild, expand, or reconfigure space to attracthighly coveted national retailers, we create quality and value –in the form of increased economic activity, jobs, and taxrevenues for communities; more attractive shoppingenvironments and greater choice for consumers; and strongerreturns for Kimco shareholders.Even the environment benefits: using energy-efficient design andsustainable materials, our revamped centers are greener thanever before.With a 33 percent vacancy rate, Kimco saw an opportunity torevitalize the Wilde Lake Village Center in Columbia, Md., and onceagain make it a hub of community life in this affluent suburb ofBaltimore. The 45 million project, which includes a 17 millioninvestment by Kimco, will open up the center’s courtyard areaand add new retail, office and residential space. Expected to becompleted in 2014, the project is being built to LEED certification,with a new storm water management system and energy-efficientlighting and HVAC systems.230We expect to invest 400 millionin redevelopment projects over thenext few years.9

F O C U S E D on RetailersKimco and its retail partners enjoy some of the longest andstrongest relationships in the industry – each built on trust,dependability and service.Retailers count on Kimco for our national scale and local expertise,but they also appreciate how we’re always thinking beyond the box,offering programs like KEYS, which provides training and incentives tohelp entrepreneurs launch retail businesses.In return, our loyal tenants provide a steady, reliable sourceof income, and the opportunity, when conditions change,to participate in restructurings and retailer-owned asset sales thatcreate mutual value.Rudy Gonzales got the idea for his new business, Build-It Workshops,after watching his two young daughters play with blocks at SanDiego’s New Children’s Museum. With help from Kimco’s KEYSprogram, Rudy received the training and incentives he needed to turnthat idea into reality. Now, Build-It Workshops, located in Kimco’sNorth County Plaza shopping center in Carlsbad, Calif., offerschildren and their parents a creative play outlet fueled by a senseof fun and imagination. Rudy hopes to open other locations in thefuture, but no matter how far he goes, he will always appreciate thehead start he got from Kimco to get his initial idea off the ground.During 2012, 90 percent oftenants coming up for renewalor with options decided toremain with Kimco.10Mesa Riverview, Mesa, ArizonaColumbia Crossing, Columbia, MarylandPreston Forest Village, Dallas,Texas7

We’re focused on providing more services andgreater opportunity for retailers –the kind of support that builds long-term relationships.“I’ll always be grateful to Kimco for the encouragement and support they gave me tostart my own business. The advice and training I received through the KEYS programwere invaluable, and on top of that, Kimco is providing me with a year of free rent andother incentives. I can’t think of a better way to get my business off to a strong start.Thank you again, Kimco. You really helped make Build-It Workshops possible.”Rudy Gonzales, owner, Build-It Workshops11

T O TA L R E T U R NPERFORMANCESince IPOFull-Year ITDJIAS&P500KIM 100,000 invested at IPOwould be worth 1.3 millionat December 31, 2012NAREITDJIAS&P500Kimco outperformed majorindices for the 12 monthsended December 31, 2012Source: NAREIT, Bloomberg59%increase in average rent per square foot (bought vs. sold properties)since Investor Day 201010.5%94%170 2.1 billionof capital refinanced in 2012increase in cash dividend 13.2 billionof enterprise valueoccupancy rate, highest since 200827.8%spread on new U.S. leasesbasis-point increase in small-shop occupancy in 201211consecutive quarters of same-site NOI growth12Santee Trolley Square, San Diego, CaliforniaSince its 1991 IPO, Kimco has returned anaverage of 13 percent a year to its shareholders,outpacing the returns of the broader REITsector and leading market indices.

F O C U S E D on ResultsKimco follows an “Income Plus” strategy, making sure our portfolioof stable shopping centers delivers the consistent, reliable incomestream our investors expect, while offering an upside “plus” fromopportunistic retail investments.It takes effort and creativity to make that model work. Kimcoemployees focus everyday on generating maximum cash flowfrom our shopping centers by keeping space filled, rents paid andoperating expenses down, while finding new sources of revenuethrough value-added services and ancillary income programs.It also takes connections and intelligent risk-taking to capitalize onnew opportunities, such as our participation, announced earlier thisyear, in a buyout of five leading supermarket chains with nearly 900stores from Supervalu.In the end, it all adds up to a record of market-beating returns thatis the envy of our industry and the pride of our employees.13

2012 OPERATING REVIEWIn many ways, 2012was a banner year for Kimco.We delivered outstanding results, while improving the quality, valueand growth potential of our shopping center portfolio.De ar Fellow S hareholders and A sso ci a te s:In many ways, 2012 was a banner year for Kimco.Focused on both the present and the future, we deliveredoutstanding financial and operating results, whilestrengthening our balance sheet and making significantstrides toward improving the quality, value and growthpotential of our shopping center portfolio for the long term.Our reported funds from operations (FFO) as adjustedcame in at 514.2 million, or 1.26 per diluted share, up5 percent from 489.8 million, or 1.20 per diluted share,in 2011.For this solid performance, shareholders were rewardedwith a total return of nearly 24 percent, continuing a longhistory of sector- and market-beating returns enjoyed byKimco investors (see chart on page 12).Dividends, of course, make up a significant portion ofKimco’s total return. In October, the Board approveda 10.5 percent increase in our quarterly dividend, to anannualized rate of 0.84 per common share, reflectingour strong results and confidence in our future growthprospects.F U N DAMENTA L S L OOKING UPWe have good reason to

Kimco Realty 2012 Annual Report . the impact from the end of the payroll tax holiday, and gasoline prices are up. And yet some major economic indicators are pointing in the right direction. . continue to provide real estate advisory services to the new Supervalu venture. I