Transcription

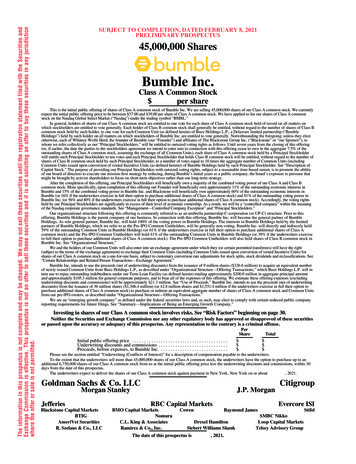

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registrationstatement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer tobuy these securities in any state where the offer or sale thereof is not permitted.SUBJECT TO COMPLETIONPRELIMINARY PROSPECTUS DATED SEPTEMBER 19, 2016PROSPECTUS19,925,333 SharesMEDEQUITIES REALTY TRUST, INC.Common StockMedEquities Realty Trust, Inc., a Maryland corporation, is a self-managed and self-administered company that investsin a diversified mix of healthcare facilities and healthcare-related real estate debt investments. We have elected to be taxedas a real estate investment trust, or REIT, for U.S. federal income tax purposes commencing with our short taxable yearended December 31, 2014.This is our initial public offering, and no public market currently exists for our common stock. We are offering19,000,000 shares of our common stock, and the selling stockholders named in this prospectus are selling925,333 shares of our common stock. We will not receive any proceeds from the sale of our common stock by theselling stockholders. Our common stock has been approved for listing, subject to official notice of issuance, on theNew York Stock Exchange, or the NYSE, under the symbol “MRT.” We expect the initial public offering price of ourcommon stock to be between 12.00 and 14.00 per share.To assist us in complying with the limitations on the concentration of ownership of a REIT imposed by theInternal Revenue Code of 1986, as amended, among other purposes, our charter prohibits, with certain exceptions,ownership by any person of more than 9.8% in value or in number of shares, whichever is more restrictive, of theoutstanding shares of our common stock, the outstanding shares of any class or series of our preferred stock or theaggregate outstanding shares of all classes and series of our capital stock. See “Description of Capital Stock—Restrictions on Ownership and Transfer.”We are an “emerging growth company” under the federal securities laws and will be subject to reducedpublic company reporting requirements. Investing in our common stock involves a high degree of risk. See“Risk Factors” beginning on page 27 of this prospectus for a discussion of certain risk factors that you shouldconsider before investing in our common stock.PerSharePublic offering price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Underwriting discounts and commissions(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . .Proceeds, before expenses, to us . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Proceeds, before expenses, to the selling stockholders . . . . . . . . . . . . . . . . . . . . Total (1) See “Underwriting” for a detailed description of compensation payable to the underwriters.We have granted the underwriters an option to purchase up to an additional 2,988,800 shares of our common stockat the public offering price, less the underwriting discount, within 30 days after the date of this prospectus, solely tocover over-allotments, if any.Neither the Securities and Exchange Commission nor any state securities commission has approved ordisapproved of these securities or determined if this prospectus is truthful or complete. Any representation tothe contrary is a criminal offense.The underwriters expect to deliver the shares of common stock on or aboutFBR, 2016.J.P. Morgan Citigroup KeyBanc Capital MarketsRaymond JamesRBC Capital MarketsJMP SecuritiesFifth Third SecuritiesThe date of this prospectus isCapital One Securities, 2016.

TABLE OF CONTENTSPagePROSPECTUS SUMMARY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .RISK FACTORS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS . . . . . . . . . . . . . . . . . . . .USE OF PROCEEDS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .DISTRIBUTION POLICY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .CAPITALIZATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .DILUTION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .SELECTED HISTORICAL AND PRO FORMA FINANCIAL DATA . . . . . . . . . . . . . . . . . . . . . . . . . . . . .MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTSOF OPERATIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .OUR BUSINESS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .MANAGEMENT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .INVESTMENT POLICIES AND POLICIES WITH RESPECT TO CERTAIN ACTIVITIES . . . . . . . . . . .PRINCIPAL STOCKHOLDERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .SELLING STOCKHOLDERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .DESCRIPTION OF CAPITAL STOCK . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .MATERIAL PROVISIONS OF MARYLAND LAW AND OF OUR CHARTER AND BYLAWS . . . . . . .OUR OPERATING PARTNERSHIP AND THE PARTNERSHIP AGREEMENT . . . . . . . . . . . . . . . . . . . .SHARES ELIGIBLE FOR FUTURE SALE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .UNDERWRITING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .LEGAL MATTERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .EXPERTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .WHERE YOU CAN FIND MORE INFORMATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .INDEX TO FINANCIAL STATEMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 213220220220F-1You should rely only on the information contained in this prospectus or in any free writing prospectusprepared by us or information to which we have referred you. No dealer, salesperson or other person isauthorized to make any representations other than those contained in this prospectus and supplementalliterature authorized by us and referred to in this prospectus. If anyone provides you with differentinformation, you should not rely on it. This prospectus and any free writing prospectus prepared by us isnot an offer to sell nor is it seeking an offer to buy these securities in any jurisdiction where the offer orsale thereof is not permitted. The information contained in this prospectus is accurate only as of the date ofthis prospectus or as of another date specified herein, regardless of the time of delivery of this prospectusor any sale of these securities. You should not assume that the delivery of this prospectus or that any salemade pursuant to this prospectus implies that the information contained in this prospectus will remainfully accurate and correct as of any time subsequent to the date of this prospectus.We use market data and industry forecasts and projections throughout this prospectus, including datafrom publicly available information and industry publications. These sources generally state that theinformation they provide has been obtained from sources believed to be reliable, but that the accuracy andcompleteness of the information are not guaranteed. The forecasts and projections are based on industrysurveys and the preparers’ experience in the industry and there can be no assurance that any of the forecastsor projections will be achieved. We believe that the surveys and market research others have performed arereliable, but neither we nor the underwriters have independently investigated or verified this information.The market data and industry forecasts and projections that we have included in this prospectus have notbeen expertized and are, therefore, solely our responsibility. As a result, the third parties that prepared themarket data and industry forecasts and projections do not and will not have any liability or responsibilitywhatsoever for any market data and industry forecasts and projections that are contained in this prospectus.Forecasts and other forward-looking information obtained from these sources are subject to the samequalifications and uncertainties as the other forward-looking statements contained in this prospectus.i

GLOSSARY OF CERTAIN TERMSThe following is a glossary of certain terms used in this prospectus:“Acute” refers to a disease or condition with a rapid onset and short course.“ACH” means acute care hospital. These facilities are general medical and surgical hospitals that provide bothinpatient and outpatient medical services and are owned and/or operated either by a non-profit or for-profithospital or hospital system. These facilities often act as feeder hospitals to dedicated specialty facilities.“ADA” means the Americans with Disabilities Act of 1990, as amended.“Affordable Care Act” means the Patient Protection and Affordable Care Act, as amended by the Health Careand Education Reconciliation Act of 2010.“ALF” means assisted living facility. These facilities are residential care facilities that provide housing, meals,personal care and supportive services to older persons and disabled adults who are unable to live independently.They are intended to be a less costly alternative to more restrictive, institutional settings for individuals who donot require 24-hour nursing supervision.“CCRC” means continuing care retirement community. These are retirement communities with accommodationsfor independent living, assisted living, and nursing home care, offering residents a continuum of care.“CMS” means the Centers for Medicare and Medicaid Services, which administers Medicare, Medicaid and theState Children’s Health Insurance Program.“EMTALA” means the Emergency Medical Treatment and Labor Act, as amended.“gross purchase price” means the contractual purchase price paid or to be paid by us for the applicable property,as well as any other amounts expended by us at or near the time of acquisition that will generate a return underthe lease for the applicable property. Gross purchase price excludes all transaction costs incurred by us to acquirethe applicable property, some of which may be capitalized in accordance with generally accepted accountingprinciples in the United States.“HHS” means the U.S. Department of Health and Human Services.“HIPAA” means the Health Insurance Portability and Accountability Act of 1996, as amended.“HITECH Act” means the Health Information Technology for Economic and Clinical Health Act.“IRF” means inpatient rehabilitation facility. These facilities provide inpatient rehabilitation services for patientsrecovering from injuries, organ transplants, amputations, cardiovascular surgery, strokes, and complexneurological, orthopedic and other medical conditions following stabilization of their acute medical issues.“LTACH” means long-term acute care hospital. These facilities are designed for patients with serious medicalproblems that require intense, special treatment for an extended period of time (typically at least 25 days), offermore individualized and resource-intensive care than a skilled nursing facility, nursing home or acuterehabilitation facility, and patients are typically transferred to a long-term acute care hospital from the intensivecare unit of a traditional hospital.“MOB” means medical office building. These are single-tenant or multi-tenant buildings where doctors,physician practice groups, hospitals, hospital systems or other healthcare providers lease space and are typicallylocated near or adjacent to acute care hospitals or other facilities where healthcare services are rendered. Medicaloffice buildings can include outpatient surgical centers, diagnostic labs, physical therapy providers and physicianoffice space in a single building.“Post-acute” refers to the period of time following acute care, in which the patient continues to require elevatedlevels of medical treatment.ii

“SNF” means skilled nursing facility. These facilities usually house elderly patients and provide restorative,rehabilitative and nursing care for patients not requiring more extensive and sophisticated treatment that may beavailable at acute care hospitals or long-term acute care hospitals. They are distinct from and offer a much higherlevel of care for older adults compared to senior housing facilities. Patients typically enter skilled nursingfacilities after hospitalization.“Sub-acute” refers to a disease or condition of less severity or duration than acute diseases or conditions.iii

PROSPECTUS SUMMARYThe following summary highlights some of the information contained elsewhere in this prospectus. It is notcomplete and does not contain all of the information you should consider before making an investment decision.You should read carefully the more detailed information set forth under the heading “Risk Factors” and theother information included in this prospectus. In this prospectus, unless the context suggests otherwise,references to “MedEquities,” “the Company,” “we,” “us” and “our” refer to MedEquities Realty Trust, Inc., aMaryland corporation, together with its consolidated subsidiaries, including MedEquities Realty OperatingPartnership, LP, a Delaware limited partnership, or our operating partnership, of which MedEquities OP GP,LLC, or the general partner, a wholly owned subsidiary of our company, is the sole general partner. Unlessindicated otherwise, the information included in this prospectus assumes that (i) the underwriters’ over-allotmentoption is not exercised and (ii) the common stock to be sold in this offering is sold at 13.00 per share, which isthe midpoint of the price range set forth on the front cover of this prospectus.Our CompanyWe are a self-managed and self-administered company that invests in a diversified mix of healthcareproperties and healthcare-related real estate debt investments. We have elected to be taxed as a real estateinvestment trust, or REIT, for U.S. federal income tax purposes commencing with our short taxable year endedDecember 31, 2014. As of the date of this prospectus, our portfolio is comprised of 24 healthcare facilities thatcontain a total of 2,345 licensed beds and, as of September 1, 2016, provided aggregate annualized base rent ofapproximately 46.7 million and had a weighted-average remaining lease term of 13.3 years. Our properties,which we acquired for an aggregate gross purchase price of 498.9 million, are located in Texas, California,Nevada and South Carolina and include 17 skilled nursing facilities, two acute care hospitals, two long-termacute care hospitals, one assisted living facility, one inpatient rehabilitation facility and one medical officebuilding. In addition, we have a 10.0 million healthcare-related debt investment that provides annual interestpayments of approximately 0.9 million. See “Our Business—Our Portfolio.”Our strategy is to become an integral capital partner with high-quality, facility-based, growth-minded providersof healthcare services, primarily through net-leased real estate investments, and to continue to diversify over timebased on our facility types, tenants and geographic locations. We invest primarily in real estate across the acute andpost-acute spectrum of care, where our management team has extensive experience and relationships and which webelieve differentiates us from other healthcare real estate investors. We believe acute and post-acute healthcarefacilities have the potential to provide higher risk-adjusted returns compared to other forms of net-leased real estateassets due to the specialized expertise and insight necessary to own, finance and operate these properties, which arefactors that tend to limit competition among owners, operators and finance companies. We target healthcareproviders or operators that provide higher acuity services, are experienced, growth-minded and that we believe haveshown an ability to successfully navigate a changing healthcare landscape. We believe that by investing in facilitiesthat span the acute and post-acute spectrum of care, we will be able to adapt to, and capitalize on, changes in thehealthcare industry and support, grow and develop long-term relationships with providers that serve the highestnumber of patients at the highest-yielding end of the healthcare real estate market. We expect to invest primarily inthe following types of healthcare properties: acute care hospitals, skilled nursing facilities, short-stay surgical andspecialty hospitals (such as those focusing on orthopedic, heart, and other dedicated surgeries and specialtyprocedures), dedicated specialty hospitals (such as inpatient rehabilitation facilities, long-term acute care hospitalsand facilities providing psychiatric care), large and prominent physician clinics, diagnostic facilities, outpatientsurgery centers and facilities that support these services, such as medical office buildings. Over the long-term, weexpect our portfolio to be balanced equally between acute and post-acute facilities, although the balance mayfluctuate from time to time due to the impact of individual transactions.1

We intend to continue to capitalize on what we expect will be a need for significantly higher levels ofcapital investment in new and updated healthcare properties resulting from an aging U.S. population, increasingaccess to traditional healthcare services enabled by the Affordable Care Act, increasing regulatory oversight,rapidly changing technology and continuing focus on reducing healthcare costs. We believe these factors presentopportunities for us to provide flexible capital solutions to healthcare providers as they seek the capital requiredto modernize their facilities, operate more efficiently and improve patient care.While our preferred form of investment is fee ownership of a facility with a long-term triple-net lease withthe healthcare provider or operator, we also may provide debt financing to healthcare providers, typically in theform of mortgage or mezzanine loans. In addition, we may provide capital to finance the development ofhealthcare properties, which we may use as a pathway to the ultimate acquisition of pre-leased properties byincluding purchase options or rights of first offer in the loan agreements. We intend to conduct our operations sothat neither we nor any of our subsidiaries will meet the definition of investment company under the InvestmentCompany Act of 1940, as amended, or the 1940 Act. Therefore, neither we nor any of our s

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed