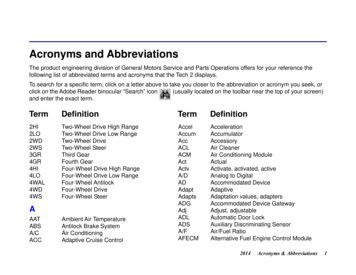

Transcription

General MotorsDealerStandard AccountingManual and Handbook 2021 General MotorsThis manual cannot be reproduced in whole or in part without the expressedwritten permission of General Motors.

TO THE GENERAL MOTORS DEALER:Accounting, the process of properly recording and classifying business transactions, is an important factor, recognized as essential to the successfulmanagement of a business.Control of capital and satisfactory profits are largely dependent upon the efficiency ofmanagement and its ability to direct the affairs of the business. Plans and decisions arenecessary and these should be based on facts. Without facts, decisions may be madebased on erroneous or unreliable information which, at worst, may jeopardize thebusiness and, at best, may not utilize resources to their fullest extent to producemaximum profits.Accounting itself will not correct mistakes and weaknesses which may exist in theoperation of a business. However, it will assist in revealing them and thus contribute tosound understanding and intelligent action aimed at their correction.Uniform accounting is necessary because it records the financial history of thebusiness; but, more important, it provides the basis for meaningful comparisons.There is, however, another important purpose of uniform accounting in dealerships.If the most successful results are to be attained, a close relationship must exist betweenthe dealers and the manufacturer. Dealership managers depend to an extent uponmarketing policies established by the manufacturer for its products. It is essential thatsuch policies be considered in the light of their effects upon the dealer organization.This fact is recognized by the manufacturer, but it must have factual information in orderto make decisions and establish policies that are fair and equitable to the dealers and inthe best interests of both parties. The Dealer’s Standard Accounting, properly operated,provides these facts when the operating data is forwarded to the manufacturer eachmonth.Adherence to the provisions of this GM Dealer Standard Accounting Manual andHandbook will also enhance internal control within the dealership.Your cooperation in this respect will do much toward the elimination of weaknesses andthe building of a stronger and sounder dealer organization, capable of increasing salesat a satisfactory profit.GENERAL MOTORS

TO THE DEALER’S ACCOUNTANT:The General Motors Dealer Standard Accounting Manual and Handbook is not an explanation of the basic and fundamental principles or methods ofbookkeeping, but is an accounting manual intended for use by an accountant.It is our desire to have the dealer employ a skilled accountant who recognizes theimportance of gauging the business and of assisting in the formulation of policies on thebasis of facts rather than guesswork.An accountant is one who understands the mechanics of bookkeeping and, in addition,has the ability to supervise the methods used in collecting the information to berecorded and to interpret and analyze the results disclosed by the operating data. Suchan individual should be able to interpret: The trends of the business The results of changes in policies The fluctuations in various accounts The effect of such fluctuationsThe accountant should be aware of changes in conditions of the business, which might prove detrimental to profits, be able to forecast the probableresults of any contemplated actions or changes in policy, and be able to determine the number of vehicles, which must be sold to cover theunabsorbed overhead and produce a desired profit.The value of the accountant is increased if he or she is able to furnish the dealer withthe information outlined above.The duties of a dealer accountant are:1.Maintain the Dealer’s Standard Accounting System in accordance with theinstructions contained in this manual and supervise all methods used in the businessfor the recording of transactions.2. Submit required trial balance information to FACTS 2.0 on a timely basis. Preparenecessary supporting schedules of accounts.3. Prepare sales and profit forecasts for future periods as a guide for the business andmake comparisons between these forecasts and the actual results.4. Use the FACTS 2.0 Compass Reports each month as a tool in managing thebusiness.

AssetsCash & Contracts200201202205260Cash On Hand (Petty Cash)Cash On HandCash in BankContracts in otes Receivable - CustomersAccounts Receivable - CustomersCash SalesFactory ReceivablesDue from Finance CompaniesWarranty ClaimsIns. Commissions 52258InventoriesDemonstratorsNew CarsNew Medium Duty TrucksNew TrucksOther AutomotiveUsed CarsUsed TrucksParts & AccessoriesTiresGas, Oil & GreasePaint & Body Shop MaterialsSublet RepairsWork in Process-LaborOtherMiscellaneous Assets Received in Trade270271274Prepaid ExpensesPrepaid TaxesPrepaid InsurancePrepaid-Other275277Working AssetsDriver Training VehiclesLease & Rental Vehicles280281282283284285286287288289Fixed AssetsLand (Auto Business Only)Buildings & Improvements (Auto Business Only)Machinery & Shop EquipmentParts & Accessories EquipmentFurniture & FixturesCompany VehiclesLeaseholdsIT - HardwareIT - SoftwareFixed Assets - Other291293294296Other AssetsLife Insurance-Cash ValueNotes & Accounts Receivable-OfficersNotes & Accounts Receivable-OtherOther Investments & Miscellaneous AssetsLiabilities

300305Accounts PayableAccounts Payable-Trade CreditorsWarranty Claims Advance310311312314Notes PayableNotes Payable-New Vehicle & DemosNotes Payable-Used VehiclesNotes Payable-Lease & Rental UnitsNotes ued LiabilitiesInterest PayableSalaries, Wages & Commissions PayableInsurance PayablePayroll Taxes PayableSales Taxes PayableOther Taxes PayableIncome Taxes PayableEmployee's Incentives/Bonuses PayableOwner's Bonuses PayableRetirement Benefits PayableOther Payable332333334335336337338Long Term LiabilitiesOther ReservesDeferred TaxesNotes Payable - Capital LoansMortgages Payable & Facility Related LoansOther Notes & ContractsOther Notes - OwnersNote Payable - Affiliated Companies340347351352353354355356357358359Contra AssetsAllowance for Doubtful AccountsAccumulated Depreciation Lease & Rental UnitsAccumulated Depreciation Buildings & ImprovementsAccumulated Depreciation Machinery & Shop Equip.Accumulated Depreciation Parts & Accessories EquipmentAccumulated Depreciation Furniture & FixturesAccumulated Depreciation Company VehiclesAccumulated Amortization of LeaseholdsAccumulated Depreciation IT - HardwareAccumulated Depreciation IT - SoftwareAccumulated Depreciation OtherOwner's Equity360370375380390399Net WorthCapital Stock &Additional Paid In CapitalRetained EarningsDividendsInvestmentsDrawingsProfit or LossNew Vehicle DepartmentSales & Cost of Sales400600ThruThruNew Cars-Retail418618420421620621New Cars-FleetNew Cars-Internal

423Thru438623Thru638New Trucks-Retail440441445457494640641645657694New Trucks-FleetNew Trucks-InternalNew Other AutomotiveAccessoriesDivisional Extended Warranties (Sales)Used Vehicle DepartmentSales & Cost of Sales446A 646AUsed Cars Retail - Certified647AReconditioning - Cert. Used Cars446B646BUsed Cars Retail - Other647BReconditioning - Other Used Cars450A 650AUsed Trucks Retail - Certified651AReconditioning - Cert. Used Trucks450B650BUsed Trucks Retail - Other651BReconditioning - Other Used Trucks448648Used Cars Wholesale649Adjustment-Used Car Inventory452652Used Trucks-Wholesale653Adjustment-Used Truck Inventory456656Used Other AutomotiveFixed Operations - MechanicalSales & Cost of Sales460A 660ACustomer Labor - Cars & Light Duty Trucks460B660BService Contracts Customer Labor - Cars & Light Duty Trucks460C660CQuick Service Labor - Cars & Light Duty Trucks461A 661ACustomer Labor - Commercial, Fleet & Medium Duty Trucks461B661BService Contracts Customer Labor - Commercial, Fleet & Medium Duty Trucks461C661CQuick Service Labor - Commercial, Fleet & Medium Duty Trucks462662Warranty Claim Labor - Mechanical463663Internal Labor - Mechanical464664New Vehicle Inspection Labor665Adjustment-Cost of Labor Sales - Mechanical466666Sublet Repairs469669Shop SuppliesBody ShopSales & Cost of Sales470670Customer Paint Labor - Cars & Trucks471671Customer Body Labor - Cars & Trucks472672Warranty Claim Labor - Paint & Body473673Internal Labor-Paint & Body675Adjustment-Cost of Labor Sales - Paint & Body476676Sublet Repairs479679Paint & Body Shop MaterialsParts & Accessories DepartmentSales & Cost of Sales467667Parts-Mechanical Repair Orders Cars & Light Duty Trucks468668Parts-Mechanical Repair Orders Commercial, Fleet & Medium Duty Trucks477677Parts-Body Customer Repair Orders - Cars & Trucks478678Parts-Quick Service-Repair Orders480680Parts-Warranty il483683Parts-Wholesale

484490491492684687688690691692AccessoriesPurchase AllowancesAdjustment-Parts & Accessories InventoryTiresGas, Oil & GreaseMiscellaneousLease & Rental ActivityClose End 710Recurring Lease PaymentsMaintenance IncomePartial Month (Pro-Rata) IncomeLate Payment ChargeAdministrative FeeOther Lease RevenueDirect CostInterestAmortizationInsurance (In Service Vehicles)License, Title & TaxPolicy-Leased VehiclesMaintenance & RepairsRent-Sublet UnitsOtherSelling Price of Disposed VehiclesCost of Sale of Disposed VehiclesOpen End Lease521522523524Recurring Lease PaymentsMaintenance IncomePartial Month (Pro-Rata) IncomeLate Payment Charge526527Administrative FeeOther Lease RevenueDirect CostInterestAmortizationInsurance (In Service Vehicles)License, Title & TaxPolicy-Leased VehiclesMaintenance & RepairsRent-Sublet UnitsOtherSelling Price of Disposed VehiclesCost of Sale of Disposed 536731732733734735736737738530730Late Payment ChargeRental IncomeAdministrative FeeDirect CostInterestAmortizationInsurance (In Service Vehicles)License, Title & TaxPolicy-Leased VehiclesMaintenance & RepairsRent-Sublet UnitsOtherSelling Price of Disposed VehiclesCost of Sale of Disposed Vehicles

F & I, Protection Plan Activity541542543544740741742743744Insurance Commissions EarnedF & I Manager CommissionsInsurance ChargebacksAccessoriesGM Protection PlansOther Protection PlansFinance & Insurance 850853855694NewFinance Income-NewInsurance Commission Earned-NewAccessories-NewGM Protection Plans – NewOther Protection Plans - NewFinance & Insurance ChargebacksRepossession Losses-NewF & I Compensation - NewDivisional Extended Warranties (Sales)861654655851854856UsedFinance Income-UsedInsurance Commissions Earned-UsedAccessories-UsedGM Protection Plans – UsedOther Protection Plans - UsedFinance & Insurance ChargebacksRepossession Losses-UsedF & I Compensation – UsedAdditions to Income902903905909910Bad Debts RecoveredCash Discounts EarnedOther IncomeGM ReimbursementsDocument Handling FeesDeductions from Income952953955LIFO AdjustmentCash Discounts AllowedOther DeductionsExpensesExpenses are to be distributed to each Department by creating sub-accounts formed by combining the three (3) digit expense account number with thetwo (2) digit department code.Department CodesNew Vehicles01Used Vehicles02Lease & Rental03Finance & Insurance04Mechanical05Body Shop06Parts & Accessories07(Not Used)08General & Administrative 09

For example, Delivery Expenses charged to the New Vehicle Department should be posted to Account 013-01, Delivery Expense (New). Freight forParts shipments should be posted to Account 033-07, Freight (Parts) – and so forth.011013015Variable Selling ExpensesVehicle Salespeople Compensation & OtherDelivery ExpensePolicy Work-Vehicles020021022023024025026027029Personnel ExpensesSalaries-Owners/Executive ManagersSalaries-SupervisionSalaries-ClericalOther Salaries & WagesAbsentee loyee BenefitsRetirement 071072074075076077078079Semi-Fixed ExpensesPostage / FreightCompany Vehicle ExpenseInsurance-Vehicle InventoryBad Debt ExpenseOffice Supplies & ExpensesOther SuppliesE-Commerce Advertising/FeesAdvertising RebatesAdvertisingContributionsPolicy Work-Parts & ServiceInformation Technology ServicesOutside Services (Other)Travel & EntertainmentMembership Dues & PublicationsLegal & Auditing ExpenseTelephoneTraining ExpenseInterest-Notes Payable-FloorplanMiscellaneous ExpenseInterest-Floorplan CreditInterest-Notes Payable d ExpensesRentAmortization-LeaseholdsRepairs-Real EstateDepreciation Buildings & ImprovementsTaxes-Real EstateInsurance Buildings & ImprovementsInterest-MortgagesUtilitiesInsurance pmentEquipment -OwnersIncome Taxes - Current Year6v GM-US-AC v2.5.1.1

Balance SheetAssets200 Cash on Hand (Petty Cash)AssetsCash and ContractsSynopsisAccount 200, is established to record the amount of Cash kept at the dealership toprovide change to customers and pay incidental bills, which are too small to warrantissuing a check.Debits1. The amount set aside when the fundis establishedCredits1. The amount removed to decreasethe fund2. The amount added to increase thefundExample 1Record a check for the amount of 400 to establish a petty cash fund at the dealership.Journal: Cash Disbursements and PurchasesEntry:Account 200Account 202Cash on Hand (Petty Cash)Cash in BankDebit 400Credit 400Example 2Record petty cash summary and reimbursement of 280 to the Petty Cash Fund.Journal: Cash DisbursementsEntry:Account 061-05Account 075-01Account 033-09Account 013-01Account 070-09Account 202DebitOther SuppliesTraining ExpensePostage/FreightDelivery ExpenseTravel and EntertainmentCash in BankCredit 30 85 15 25 225 280

201 Cash on HandAssetsCash and ContractsSynopsisAccount 201 is established to record the Cash receipts at the dealership.Debits1. The amount of Cash receivedCredits1. The amount of Cash deposited in thebankExample 1Record the payment of 375 from a wholesale parts customer on their account.Journal: Cash ReceiptsEntry:Account 201Account 220BCash on HandAccounts receivables – Customers –Service and PartsDebit 375Credit 375Example 2Record the receipt from customer for a down payment of 1,500 on a purchase of avehicle.Journal: Cash ReceiptsEntry:Account 201Account 220ACash on HandAccounts receivables – Customers –VehiclesDebit 1,500Credit 1,500Example 3Record the income of 85 from vending machines.Journal: Cash ReceiptsEntry:Account 201DebitCash on HandCredit 85

Account 905Other Income 85Example 4Record daily bank deposit of 1,960 for the above cash receipts.Journal: Cash ReceiptsEntry:Account 202Account 201Cash in BankCash on HandCommentsA debit balance represents undeposited receipts.Note:Bank deposits should be made daily.Debit 1,960Credit 1,960

202 Cash in BankAssetsCash and ContractsSynopsisAccount 202 is established to record the Cash deposited with banks and other financialinstitutions.DebitsCredits1. Cash deposits1. Withdrawals2. Savings deposits3. Time deposits2. Deposited checks returned by thebank4. Certificates of deposit3. Bank charges5. Interest on above depositsExample 1Record ACH (Automated Clearing House) deposit of 18,750 from a finance company onproceeds received on the sale of a new vehicle.Journal: Cash ReceiptsEntry:Account 202Account 205Account 262Cash in BankContracts in TransitDue from Finance CompaniesDebit 18,750Credit 18,450 300Example 2Record returned check of 1,500 from a customer on a down payment for a purchase ofa vehicle.Journal: General JournalEntry:Account 220AAccount 202DebitAccounts receivables – Customers –VehiclesCash in BankCredit 1,500 1,500

Example 3Record check of 5,595 issued to a vendor (trade creditor).Journal: Cash DisbursementsEntry:Account 300Account 202Accounts Payable – Trade CreditorsCash in BankDebit 5,595Credit 5,595Example 4Record petty cash summary and reimbursement of 205 to the Petty Cash Fund.Journal: Cash DisbursementsEntry:Account 061-05Account 246Account 033-09Account 013-01Account 070-09Account 202DebitOther SuppliesSublet RepairsPostage/FreightDelivery ExpenseTravel and EntertainmentCash in BankCredit 30 85 15 25 50 205CommentsA debit balance represents the amount of cash on deposit while a credit balancerepresents drafts written in excess of cash on deposits.Note:The month-end balance should be reconciled with that shown on the bank statements.All cash receipts should be cleared through Account 225, Cash Sales. When the bankdeposit is made, the balance in Account 225, Cash Sales should be zero. (Please referto Account 225, Cash Sales)Transactions, which are related, should be recorded in separate sub-accounts. Subaccounts serve to keep records organized for future analysis and auditing. The subaccounts in these examples are designated by a letter following the account number(suffix). Please refer to your DSP's instructions for establishing sub-accounts.

205 Contracts in TransitAssetsCash and ContractsSynopsisAccount 205 is established to record finance Contracts covering new and used vehiclesales which have been submitted to financial institutions for payment.Debits1. Amounts financed on customernotes discounted with financeinstitutionsCredits1. Payments received from financeinstitutions2. Principals withheld by financeinstitutions on customer notesdiscountedExample 1Record a new vehicle sale for the amount of 17,571 with a finance contract reserve of 300, sales tax of 879 and Registration Fees of 125. The inventory value is 16,721.Journal: New Vehicle SalesEntry:Account 205Account 262Account 600-618Account 400-418Account 231Account 324AAccount 806Account 905Contracts in TransitDue from Finance CompaniesCost of Sales – New Cars – RetailSales – New Cars – RetailNew Car InventorySales Taxes Payable – Excise TaxesFinance Income – NewOther Income (Registration Fees)Debit 18,575 300 16,721Credit 17,571 16,721 879 300 125Example 2Record an ACH (Automated Clearing House) deposit of 18,875 from the financeinstitution for payment of the customer contract above.Journal: Cash ReceiptsEntry:DebitCredit

Account 202Account 205Account 262Cash in BankContracts in TransitDue from Finance Companies 18,875 18,575 300CommentsA debit balance represents the amounts financed on customer notes discounted, whichare due from finance institutions.Note:At month end, a schedule of the notes for which payments have not been receivedshould be prepared.Transactions, which are related, should be recorded in separate sub-accounts. Subaccounts serve to keep records organized for future analysis and auditing. The subaccounts in these examples are designated by a letter following the account number(suffix). Please refer to your DSP's instructions for establishing sub-accounts.CUSTOMER RECEIVABLESSeparate general ledger accounts should be maintained for receivables resulting from vehiclesales, service and parts sales, leases and rentals, and other sales. Other should be forreceivables resulting from sales of items carried in Account 238 Other Automotive (inventory)and Account 252 Other (Inventory)For each general ledger account, a separate subsidiary ledger should be maintained. A detailof the debits and credits should be posted to the individual accounts in the subsidiary ledgers.A supporting schedule with an age analysis of each subsidiary account should be preparedat the month end. The net amount of each schedule should agree with the balance in therelated controlling account.For purposes of aging, the due date of customer receivables is that agreed on at the time ofthe sale. This stipulation would apply to extended and usual terms of payment.Receivables due from governmental agencies and collision claims with insurance companiesmay be aged. H

665 Adjustment-Cost of Labor Sales - Mechanical 466 666 Sublet Repairs 469 669 Shop Supplies Body Shop Sales & Cost of Sales 470 670 Customer Paint Labor - Cars & Trucks 471 671 Customer Body Labor - Cars &am