Transcription

Your future is filled with possibilities,but life is full of uncertainties.NJEA INCOME PROTECTION PROGRAM:Disability Income and Critical Illnessenroll.njea.org1026910-00003-00

Help protect your financial future.Keep your promise to your familyand your students.GREY REPRESENTS TRIMMED AREA TO EXPOSE TABSAs an educator, you devote so much of your life to guiding the future of thiscountry. But what happens when an unexpected illness or disability preventsyou from keeping the promise you made to your family and your students?WHY NJEAENDORSEDCOVERAGE?There are two reliable ways you canhelp protect your financial futureand get back on track when lifethrows a curveball your way. Ourtwo NJEA Income Protection Plans:The NJEA Disability InsurancePlan and the NJEA Critical IllnessInsurance Plan, give you the powerto help protect your paycheck andyour future.COVERAGE YOU CAN RELY ON:All plans are designed formembers and are the onlyplans endorsed by NJEA.AFFORDABLE:Group discounted rates justfor members.Disability Insurance covers mostinjuries or illnesses that preventor limit people from working.Critical Illness Insurance coversseveral conditions usually limitedto acute illness, not chronic disease.IMPORTANT INFORMATIONTO KEEP IN MINDuNJEA plans pay cash benefits.Learn more about each beforedeciding if one, or both, is rightfor you.uChildbirth and complicationsof pregnancy are covered.uMental and behavioral healthis covered.uNJEA plans pay in addition to sickleave and continue when sickleave is exhausted.Coverage is issued by The PrudentialInsurance Company of America andplans are endorsed by the NJEA.uTo learn more or to apply visit16 NJEA INCOME PROTECTION PLANSOpen Enrollment opportunitiesoccur only once every three years.enroll.njea.org.CONVENIENT:Premiums automaticallydeducted from your paycheck.MEMBER-FOCUSED:Comprehensive benefitsthat are less restrictive thanemployer plans.COVERAGE STAYS WITH YOU:Even if you change jobs, as longas you remain a member.KEEP MORE OF YOUR MONEY:Benefits are income tax-freewhen monthly deductions arepaid with after-tax dollars.(IRC Section 104.)

How long could you survive without a paycheck if an illness or injuryprevented you from working? Having coverage under the NJEA DisabilityInsurance Plan is a key component of your financial wellness. Think of itas income protection–to help pay for things like the rent/mortgage, healthinsurance premiums, childcare–when you can’t work because of a covereddisability, but the bills are coming in.The NJEA Disability Insurance Plan covers disabilities such as:uMental and behavioral healthuPregnancyuIllnessuAccidental injuryuCancer-relatedNJEA INCOME PROTECTION PLANS 2DISABILITY INSURANCE PLANThe NJEA Disability Insurance Plan

Find the plan thatworks for youEARLY CAREERPruProtect Plus offers a combined short- and long-term disability plan withmaximum coverage. This plan covers you until age 65, perfect if you’re juststarting out in life and great for helping protect your income for the long haul.LATER IN LIFEPruProtect Six-Month is a short-term disability plan that may be a good choicefor those looking for only a short-term plan, or nearing retirement.PruProtect Two-Year is a short-term disability plan for those who want coveragebeyond six months, but do not need long-term disability coverage. Mainlyfor those close to retirement.3 YOUR FUTURE IS FILLED WITH POSSIBILITIES

financial well-being with the Disability Insurance Needs uresPruProtect Six-MonthPruProtect Two-YearPruProtect PlusCompare thePlan FeaturesA short-term disability planthat may be a good choicefor those who seek a shortterm income replacementsolution. Members close toretirement age or with otherresources to cover long-termabsences may want to selectthis plan.Provides additional coveragefor those who want coveragebeyond six months andseek a short-term incomereplacement solution.Members close to retirementage or with other resourcesto cover long-term absencesmay want to select this plan.A combined short- and long-term disability plan with maximumcoverage. This plan covers you until age 65, helping to protect youfor your working life. It also lets you select your elimination period.The longer the elimination period, the lower your paycheck deduction.Members with a large number of accrued sick days or other financialresources may prefer a longer elimination period.When DoBenefits Begin?Benefits for a covered disability are payable followingeither a 14-day or 60-day elimination period.How Long DoBenefitsContinue?Benefit payments continuefor up to six months,provided you remaindisabled and are treatedby a licensed physician.What Is aCoveredDisability?You are considered disabled when you are unable toperform the material and substantial duties of your ownoccupation, and you have a 20% or more loss in monthlyearnings due to the same sickness or injury, excludingsick leave pay.What IsPartial Disability?If you are disabled and return to work part-time, you will continue to receive a monthly payment, based on the percentageof income you are losing due to your disability.How May BenefitsBe Reduced?Monthly benefit payments will be reduced by other sourcesof income, such as workers’ compensation, but not bypension, Social Security Disability Benefits, or sick leavepay. Your benefits will never be less than 10% of yourmonthly benefit or 100, whichever is greater.What Is aPre-ExistingCondition?A disability that begins during the first 12 months and is due to a pre-existing condition is excluded. A pre-existing conditionis one that was diagnosed or treated during the three months prior to the effective date of your coverage.Will YourPayment BeAdjustedby a Cost ofLiving Increase?Only available with PruProtect PlusBenefit payments continuefor up to two years, providedyou remain disabled andare treated by a licensedphysician.Benefits for a covered disability are payable following the eliminationperiod you choose—14, 30, 90, or 180 days.Benefit payments continue, provided you remain disabled and aretreated by a licensed physician, until age 65 if disability beginsbefore age 60. If your disability begins at age 60 or later, benefitscontinue beyond age 65 according to a specified schedule.You are considered disabled when you are unable to perform thematerial and substantial duties of your own occupation due to yoursickness or injury; and you have a 20% or more loss in your indexedmonthly earnings due to that sickness or injury, excluding sick leavepay. After 24 months of payments, you are considered disabledwhen Prudential determines that due to the same sickness or injury,you are unable to perform the duties of any gainful occupation forwhich you are reasonably fitted by education, training, or experience.A gainful occupation is expected to provide you with an income ofat least 66 2/3% of your indexed monthly earnings within 12 monthsof your return to work.Monthly benefit payments will be reduced by other sources of income,such as workers’ compensation, Social Security Disability Benefits,retirement disability benefits, and your employer’s retirement plan(but not from your retirement contributions). Monthly benefit paymentswill not be reduced by sick leave pay. Your benefits will never be lessthan 10% of your monthly benefit or 100, whichever is greater.Prudential will make a cost-of-living adjustment (COLA) on July 1if you are disabled and not working on that date and have beendisabled for all of the 12 months before that date. Your paymentswill increase on that date by 3%. You will not receive more thanfive cost-of-living adjustments while you continue to receivepayments for your disability.NJEA INCOME PROTECTION PLANS 4DISABILITY INSURANCE PLANSee how the loss of your paycheck would impact your

A Few Things To KnowIf You Currently HaveDisability Coverage:1 Y ou may want to check yourbenefit level; benefits don’tautomatically increase asyour salary increases.2 Y ou can increase yourcurrent disability coverageup to 500 per month duringOpen Enrollment withouthealth questions.3 U se the charts on the rightto find the Maximum MonthlyBenefit Amount for your salary.Then, follow across the chartto find the Paycheck Deduction.5 LIFE IS FULL OF UNCERTAINTIES

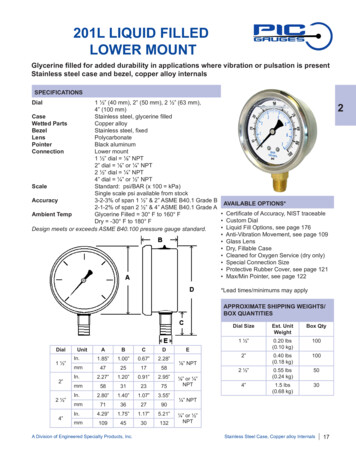

DISABILITY INSURANCE PLANNJEA Disability Insurance Plan RatesChoose the plan and benefit amount that fits your needsFind the chart that corresponds to your age and the Maximum Monthly Benefit Amount for yoursalary. Select the maximum monthly benefit or any lower amount that fits your needs. Followacross the chart and choose an elimination period (your waiting period to receive benefits) to seeyour Paycheck Deduction. Your Paycheck Deduction will change as you get older and move intothe next age group.Ages less than40*PruProtect Plus20 Paycheck Deductions Per YearAgesPruProtect Plus20 Paycheck Deductions Per Year40–49*Elimination PeriodAnnualSalaryMonthlyBenefit14Days 00090,00099,000108,000117,000 5006,0006,500 6.25171.88187.50203.1330Days 3.2569.0074.75Elimination Period90Days 825.5027.63180Days .6016.90AnnualSalaryMonthlyBenefit14Days 00090,00099,000108,000117,000 5006,0006,500 5.00181.50198.00214.50PruProtect Plus20 Paycheck Deductions Per YearAges 50 *MonthlyBenefit14Days30Days90Days 00090,00099,000108,000117,000 5006,0006,500 74.25191.68209.10226.53 .00148.50162.00175.50 5112.48122.70132.93How an Elimination Period Works 1.0079.8888.7597.63106.50115.38 44.0048.4052.8057.20 .8843.5047.13u Use the chart below and locate your age.180Days 90DaysTo find your Paycheck Deduction for a Monthly BenefitAmount not shown:Elimination PeriodAnnualSalary30Daysu Follow across and choose your elimination(waiting) period.u Multiply the rate shown by the Monthly BenefitAmount you’ve selected. And then divide by 2.PruProtect PlusAge as ofprecedingOctober 114Days30Days90Days180Days 4040-4950 04090.00520.01450.0312* Rates may change as the insured enters a higher age category or if plan experiencerequires a change for all insureds.Disability Period - Elimination Period Total Days PaidEXAMPLE: 42 Days (6 weeks x 7 days) - 30 Days (Elimination Period) 12 Days PaidNJEA INCOME PROTECTION PLANS 6

NJEA Disability Insurance Plan Rates (Continued)Choose the plan and benefit amount that fits your needsTo find the Maximum Monthly Benefit Amount for salaries not shown:u Divide your annual salary by 12 to find your monthly salary.u Then multiply your monthly salary by .667 and round down to the next 100 increment.14-DayElimination Period60-DayElimination tion PruProtect Six-MonthSalary 6840.7544.8348.9052.98T o find your Paycheck Deduction for an amount not shown, just multiply your desired Maximum MonthlyBenefit Amount by 0.0387 for 14-Day Elimination Period or 0.0163 for 60-Day Elimination Period.And then divide by 2.14-DayElimination Period60-DayElimination tion 0.50176.55192.60208.65 50135.85148.20160.55PruProtect Two-YearTo apply, visit us atenroll.njea.orgSalary 003,0003,5004,0004,5005,0005,5006,0006,500T o find your Paycheck Deduction for an amount not shown, just multiply your desired Maximum MonthlyBenefit Amount by 0.0642 for 14-Day Elimination Period and 0.0494 for 60-Day Elimination Period.And then divide by 2.7 YOUR FUTURE IS FILLED WITH POSSIBILITIES

DISABILITY INSURANCE PLANElimination Period for MaternityHow the timing of delivering your baby impacts the benefit amountYour elimination period (EP) begins when your doctor disables you, which is typically four weeksbefore your EXPECTED delivery date, but keep in mind that every situation is different. We considera member to be disabled for six weeks after their ACTUAL delivery. Benefits begin after the EP hasbeen met. You are not paid for the EP.Examples of How an Elimination Period Works (for all Disability Plans)EXAMPLE: Member has 3,000 monthly benefit (or a 100 a day) and 30-day elimination.BABY ARRIVES ON TIME:4 weeks before (28 days) 6 weeks after (42 days) 70 days - 30-day EP 40 days payableBABY ARRIVES EARLY (more than 4 weeks before):No disability time before birth.6 weeks after (42 days) - 30-day EP 12 days payable40 days @ 100 daily rate 4,000 disability benefit.12 days @ 100 daily rate 1,200 disability benefits.How Many Days Will You Be Paid for Your Disability? Disability Period - EP Total Days Paid EXAMPLE: 10 Weeks (10x7) 70 Days - 14 Day EP 56 Days PaidNJEA INCOME PROTECTION PLANS 8

Critical Illness Insurance PlanWith the NJEA-endorsed Critical Illness Insurance Plan you can have help tacklingunexpected life-changing illnesses, easing some of the financial burden so youcan focus on your recovery. It’s fast access to money to use however you like formedical and non-medical expenses that accompany a serious illness.A critical illness, such as cancer or heart attack, is not only a devastating physicalblow, but it can be a severe financial one as well. Even with health insurance,out-of-pocket medical and non-medical expenses such as deductibles, co-pays,over-the-counter medications, and home accommodations can really causefinancial strain. With reduced income during this time, family budgets arestretched to cover normal household expenses. And there are always extraexpenses, like transportation, childcare, and housekeeping. 100%o f all Critical Illnessclaims are paid within7 business days. S ource: Based on2019 claims results.19 LIFE IS FULL OF UNCERTAINTIESDisability vs.Critical Illness InsurancePre-ExistingCondition limitationsBoth types of coverage help protectyour financial future from the expensesthat result from illness or injury. Themain difference between the plansare how funds are distributed toyou. Disability insurance gives youa monthly benefit in the event thatyou are disabled while critical illnessinsurance gives you a lump sumpayment when you are diagnosed witha covered serious illness.A Critical Illness or Procedure is notcovered if it is caused by, contributedto, or resulted from a pre-existingcondition.Critical Illnessor Procedure:Percentagesof the Person’sAmountof InsuranceA person has a Pre-Existing Conditionif both (1) and (2) are true:1 T he person received medicaltreatment, consultation, care,or services, including diagnosticmeasures, from a doctor or tookprescribed drugs or medicines, orfollowed treatment recommendationin the six months just prior to theperson’s effective date of coverageor the date an increase in theperson’s benefits would otherwisebe availableAlzheimer’s Disease100Heart Attack100Invasive Cancer (full benefit)100Major Organ Transplant100Parkinson’s Disease100Renal (Kidney) Failure100Stroke100Blindness25Cancer in Situ (partial benefit)25Coma25Coronary Artery Obstruction25Deafness25coverages, exclusions, limitationsHeart Valve Malfunction25and restrictions can be foundTerminal Illness25in the Group Insurance Certificate.2 T he person’s Critical Illness orprocedure begins within six monthsof the date the person’s coverageunder the plan becomes effectiveDetails and descriptions of

Apply for CriticalIllness insuranceby answering afew health questions.Additional Benefits* Provide proofof diagnosisor treatment for acovered condition.No need to undergotreatment or provideproof of expenses.Use yourlump sum benefitfor out-of-pocketmedical andnon-medical expenses.Travel& LodgingMoney for costsassociated withround-trips betweenprimary residenceand hospital/medicalfacility.Benefitsfor dependents:Spouse, CivilUnion Partner,Domestic Partnerand Children.*Limitations and exclusions may apply. Certain benefits may not be available in all states. Please consult the booklet-certificate for details.NJEA INCOME PROTECTION PLANS 10CRITICAL INSURANCE PLANHow It Works

Critical Illness Insurance in Action 8.6million About Americans are livingwith some form ofcardiovascular diseaseor the after-effectsof stroke.11 American Heart Association,Statistical Fact Sheet 2016 UpdateMEET THE KINKADE FAMILY**Sarah age 43, Robert age 40, Christopher age 4 and Riley age 8Benefit BreakdownSarah: 20,000 Robert: 20,000 Christopher: 10,000 Riley: 10,000Paycheck Deduction: 15.19Sarah and Robert always took pride in planning for the unexpected. Thatwas put to the test when one day, after teaching at her high school, Sarahhad a sudden heart attack. Fortunately, having Critical Illness insurancemeant they had help paying for bills such as copays, deductibles, medicationsand transportation between home and her doctors. Most importantly, shewas able to focus on recovery instead of worrying about their finances.**Testimonials provided are compilations of feedback provided by participants.11 YOUR FUTURE IS FILLED WITH POSSIBILITIES

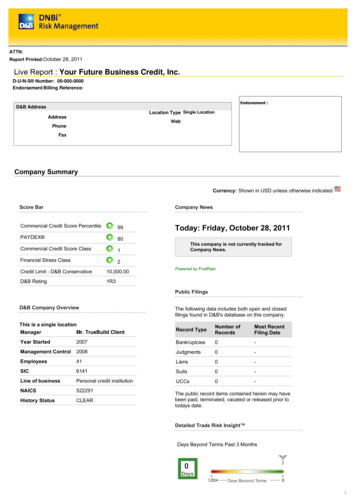

C R I T I C A L I N S U R A N C E P L A N R AT E SNJEA Critical Illness Insurance Plan RatesChoose your coverage amount and see how much it costsChoose your coverage in increments of 10,000, up to 200,000. Your spouse may take the same benefitamount as you. Your child may be covered for 50% of your benefit amount, to a maximum of 15,000.Then, follow the chart on the right to determine your rate per pay period.u Find your age.u Follow across the chart to see your deduction.u Multiply the rate per 10,000 for the coverage you want.Critical Illness Rates (Please note rates are based upon member’s age.)MemberOpen EnrollmentOpen EnrollmentCost per 10,000 of CoverageCost for 20,000 of CoverageCost for 30,000 of Coverage†AgeCost per PaycheckCost per PaycheckCost per Paycheck 74 0.791.181.792.834.627.4011.1616.4024.0033.2546.75 1.582.363.585.669.2414.8022.3232.8048.0066.5093.50 25†Coverage above 20,000 always requires Evidence of Insurability.SpouseMember’sAge 7475 Open EnrollmentOpen EnrollmentCost per 10,000 of CoverageCost for 20,000 of CoverageCost for 30,000 of Coverage†Cost per PaycheckCost per PaycheckCost per Paycheck 05 8.10 117.15(Coverage may not exceed member’s coverage.)†Coverage above 20,000 always requires Evidence of Insurability.ChildrenOpen EnrollmentOpen EnrollmentCost per 5,000 of CoverageCost for 10,000 of CoverageCost for 15,000 of CoverageAgeCost per PaycheckCost per PaycheckCost per Paycheck 26 0.64 1.27 1.91(Co

enroll.njea.org. WHY NJEA . ENDORSED COVERAGE? COVERAGE YOU CAN RELY ON: All plans are designed for members and are the only plans endorsed by NJEA. AFFORDABLE: Group discounted rates just for members. CONVENIENT: Premiums automatically deducted from your paycheck. MEMBER-FOCUSED: Comprehensive