Transcription

COVER TO BE UPDATEDTravelCardComprehensiveLeisure InternationalTravel InsuranceCOMBINED FINANCIALSERVICES GUIDE AND PRODUCTDISCLOSURE STATEMENTEffective 7th April 2018

Why TravelCard RealTime InsuranceDear Member of the TravelCard Travel Insurance family,Firstly, welcome on behalf of myself and my team, we hope your travels are everythingyou are dreaming of and rest assured that we have got the back of every policyholderwe serve and will treat everyone like one of our family.You will find that we are a unique organisation, offering products and services unlike anythingelse in the market. We see ourselves as the ‘good guys’ doing what is great for customersand making life easy.We love helping people who travel, that is why we had the idea of creating“Real-Time Travel Insurance.”Our purpose is to enrich the travel experience of Australians, by providing peaceof mind through the delivery of real-time solutions, when you need us most.Our philosophy is to assume the best in everyone and that all our customers are trustworthy.Our Vision is to constantly redefine the best level of care to travelling Australians.Our Goals are to constantly strive to deliver:1.Market Leading Benefits across all our Real Time Travel Insurance products.2.Real-Time claims approval and payment, while you’re still travelling,without endless paperwork.3.A customer experience you will be pleased to tell your colleagues, friends and family.We actually hope to be the first travel insurance and assistance team you can fall in love with.From myself and my team, we truly hope you enjoy your travels, they can be some of life’smost enriching experiences.Please remember, we are here for you 24/7 and always happy to hear from you and help you!Bon Voyage!Michael TauberCEO02TravelCard Leisure International Travel Insurance

ContentsPolicy 18General Conditions 18General Exclusions 20Introduction 5The Covers 23Product Disclosure Statement 5Your Duty Of Disclosure 5Section 1 – Overseas Medical, Dental AndAncillary Expenses 23How to Make A Claim 5Section 2 – Cancellation Fees And Loss Of Deposits 24Helpful Tips 5Section 3 – Additional Expenses 26Comprehensive Leisure Covers & Inclusions 7Section 4 – Hospital Related Expenses 28Table Of Benefits 7Section 5 – Accidental Death 29Table Of Benefits for Optional Covers 9Section 6 – Permanent Disability 29Who Can Purchase This Policy? 11Section 7 – Loss of Income 30Age Limits 11Section 8 – Travel Documents, Credit Cardsand Travellers Cheques 31Cover Types 11Section 9 – Theft of Cash 31Policy Types 11Section 10 – Luggage and Personal Effects 32Activities That We Cover 11Activities That We Do Not Cover 13Section 11 – Luggage and Personal EffectsDelay Expenses 33Cover Whilst Using Motorcycles And Mopeds 13Section 12 – Travel Delay Expenses 34Cover While Cruising 13Section 13 – Special Events 34Winter Sports Cover 13Section 14 – Personal Liability 35Search And Rescue Expenses Cover 13Section 15 – Rental Vehicle Insurance Excess 36Adventure Activities Cover 13Section 16 – Pet Care 37Golf Cover 14Section 17 – Optional Covers 37Business Cover 14Travelling With Pre-Existing Medical Conditions& When Pregnant 14Getting Cover For Your Pre-ExistingMedical Conditions 14What Is A Pre-Existing Medical Condition? 14If You Are Pregnant 15If You Do Not Tell Us About Your Pre-ExistingMedical Condition Or Pregnancy 15Pre-Existing Medical Conditions WeAutomatically Cover 15Pre-Existing Medical Conditions List 16Travelcard 24/7 Global Assistance 17TravelCard Medical Assistance 17TravelCard Travel Advice & Assistance 171. Cover While Cruising 372. Winter Sports Cover 393. Search and Rescue Cover 424. Adventure Activities Cover 435. Golf Cover 436. Business Cover 44Words With Special Meanings 45Important Information 50About TCA Insurance Services Pty Ltd 50Who Is the Insurer? 50The TravelCard 50General Advice 50Code of Practice 51Communication 51Cooling Off Period TravelCard Leisure International Travel Insurance5103

Cancellation of Your Insurance 51Cost Of Your Insurance 51Financial Claims Scheme AndCompensation Agreements 52If You Have A Complaint 52Managing Your Privacy 53Our Contract With You 53When Does Cover Under The Policy Begin And End? 53Financial Services Guide 54Who Is TCA Insurance Services Pty Ltd? 54The Financial Services That We Provide 54How We Are Paid 54TCA Insurance Services Pty Ltd CompensationArrangements 54Complaints Management Framework 54Any Questions 5404 TravelCard Leisure International Travel Insurance

IntroductionProduct Disclosure StatementThis Product Disclosure Statement (PDS) is designedto assist You in considering whether the TravelCardLeisure International Travel Insurance is suitable forYou. The PDS describes the features and benefits ofthe product by setting out the terms, limits, conditionsand exclusions of the insurance. This documents alsocontains important information about Your rights andobligations including Your Duty of Disclosure and theCooling Off Period available for retail clients.It is important that You read this Product DisclosureStatement with Your Schedule and any other changesto the terms of Your insurance, such as an Endorsementor Supplementary PDS. Together, these documentsform Your Policy of insurance.From time-to-time and where permitted by law, Wemay change parts of the Policy. If the changes aresubstantial We will issue a Supplementary PDS.It is important that You read this PDS thoroughly toensure that the product provides You with the coverthat You need. If You have any questions, pleasecontact Our Customer Service Team on 1300 123 413.This PDS Version 1-0 is dated 7th April 2018.How to Make A ClaimAs much as We want You to enjoy Your travels, Weunderstand that sometimes things don’t go as planned.We aim to make claims easy and simple for Ourcustomers.You can make a claim on Your Policy in a number ofways.1.If You are currently travelling overseas You can callUs on Our reverse charges number: 61 2 7909 2777.2.If You are in Australia and need to contact Us callOur Customer Service Team on: 1300 123 413.3.You can email Us on claims@travelcard.com.au andWe can call You back.4. You can Skype Call Us on SkypeID “TravelcardOZ”.5.You can also download a claim form from Ourwebsite www.travelcard.com.au and We will contactYou if We require any further information.We will always endeavour to complete the claimsprocess as quickly as possible, and We will explain toYou what happens next and what We may need tofinalise Our assessment.We may need original documents and receipts tosupport Your claim, so it is always important that Youkeep these safe.Helpful TipsYour Duty Of DisclosureTravelling With Your Luggage & Personal EffectsBefore You enter into an insurance Policy, You have aduty to tell Us anything You know, or could reasonablybe expected to know that may affect Our decision toinsure You and on what terms.When You’re at Home, You look after Your belongingsand You should take the same care when You aretravelling.You have this duty until We agree to insure You. Youhave the same duty before We renew, extend, vary orreinstate an insurance policy. You do not need to tell Usanything that: Keep Valuables with You and do not leave Valuablesin a vehicle at any time, even in the boot of a lockedcar. Report any loss or theft to the police within 24(twenty-four) hours, as an original police report willbe required for any claim involving loss or theft. If the Airline has lost or damaged Your belongingsit is important that You lodge an Airline PropertyIrregularity Report (P.I.R.). Don’t forget that luggage locks, storage lockersand hotel safes are all commonly available for Yourprotection, so why not use them? We will ask for the IMEI number if Your mobilephone is lost or stolen. You may request thisnumber from Your service provider. reduces the risk We insure You for; or is common knowledge; or We know or should know as an Insurer; or We waive Your duty to tell Us about.If You Do Not Tell UsIf You do not tell Us anything You are required to, Wemay cancel Your contract of insurance or reduce theamount that We will pay You if You make a claim, orboth. If Your failure to tell Us is fraudulent, We mayrefuse to pay a claim or treat the contract as if it neverexisted.What does this mean?TravelCard Leisure International Travel Insurance05

Travelling And Your Important DocumentsWe love holidays and We love travelling, but if Youlose Your original travel documents it can be difficultto replace them. So, You may want to take spare orscanned copies to speed up the replacement processand not waste Your holiday fun.Travelling And Natural DisastersTravelling to new places can be very exciting, butit is essential that You do Your research before Yougo. Natural Disasters can happen at any time andit is important that You understand what may behappening, e.g. if certain regions are prone to certainevents including Natural Disasters and if they areoccurring (known) before You book Your travels.You can register with the Department of Foreign Affairsand Trade (DFAT) for updates about the country Youare travelling to (http://smartraveller.gov.au/Pages/default.aspx). You can also register with the AustralianEmbassy in the country You are travelling to. It isimportant that You have a plan and You understandwhether You are covered by Travel Insurance.It is important to know that this Policy does not coverany event that occurred or was public knowledge priorto purchasing this Policy.Call Our Customer Service Team on 1300 123 413 todiscuss whether the Natural Disaster is a known event.06 TravelCard Leisure International Travel Insurance

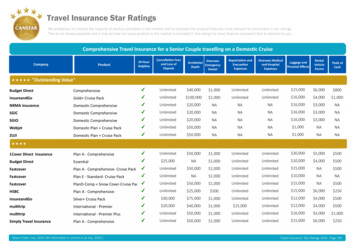

Comprehensive Leisure Covers & InclusionsTable Of BenefitsThe Table of Benefits is a summary of the benefits that Your Policy covers. It is important that You read the PDScarefully with the Schedule so that You will understand all the limits, terms, conditions and exclusions.Plan type: Single and Annual Multi Journey nlimitedUnlimitedUnlimitedUnlimitedUp to 1,000Up to 1,000Up to 1,000UnlimitedUnlimitedUnlimited3.2 Expenses due DeathReturning Your Body or Ashesto Australia; orOverseasFuneral or CremationUp to 20,000 orUp to 20,000 orUp to 20,000 orUp to 10,000Up to 10,000Up to 10,0003.3 Disruption due to Hijack, riot, strike orcivil protest, weather or accident 50,000 perInsured Person 50,000 perInsured Person 100,000 perInsured PersonUp to 1,000Up to 1,000 perInsured PersonUp to 1,000 perInsured PersonUp to 3,000Up to 3,000Up to 3,000Incidental Costs 75 per day up to 8,000 in total 75 per day up to 8,000 in total 75 per day up to 8,000 in totalRecovery Accommodation 100 per day up to 500 per InsuredPerson 100 per day up to 500 per InsuredPerson 100 per day up to 500 per InsuredPersonAccidental Death 50,000 per adultInsured Person 50,000 per adultInsured Person 50,000 per adultInsured Person 15,000 perDependantInsured Person 15,000 perDependantInsured PersonOverseas Medical Expenses,Dental and Ancillary ExpensesIncludesEvacuation and return Home2Cancellation Fees and Loss of Deposits2.1Amendments or Cancellations2.2 Financial Default of TravelServices Provider3Additional Expenses3.1Expenses Related to Medical EventsOther Reasons of Disruption3.4 Temporary Interruptions to Journey45Hospital Related ExpensesTravelCard Leisure International Travel Insurance07

Plan type: Single and Annual Multi Journey BenefitsSection6SingleDuoFamily 50,000 per adultInsured Person 50,000 per adultInsured Person 50,000 per adultInsured Person 25,000 perDependant InsuredPerson 25,000 perDependant InsuredPerson 25,000 perDependant InsuredPerson 50,000 per adultInsured Person 50,000 per adultInsured Person 50,000 per adultInsured Person 25,000 perDependant InsuredPerson 25,000 perDependant InsuredPerson 25,000 perDependant InsuredPerson 50,000 per adultInsured Person 50,000 per adultInsured Person 50,000 per adultInsured Person 25,000 perDependant InsuredPerson 25,000 perDependant InsuredPerson 25,000 perDependant InsuredPersonPermanent DisabilityLoss of sight in one or both eyesLoss of one or more limbsQuadriplegia7Loss of IncomeUp to 400 per weekfor up to 26 weeksto a maximum of 10,400Up to 400 per weekfor up to 26 weeksto a maximum of 10,400Up to 400 per weekper Insured Personfor up to 26 weeksto a maximum of 20,8008Travel Documents, Credit Cards& Travellers ChequesUp to 5,000Up to 5,000Up to 10,0009Theft of CashUp to 250Up to 250Up to 50010Luggage and Personal EffectsUp to 15,000Up to 15,000Up to 20,000Laptops, tablets, camerasand video camerasUp to 4,000Up to 4,000Up to 4,000Mobile phonesUp to 3,000Up to 3,000Up to 3,000Valuables for single item, pair or setUp to 1,000Up to 1,000Up to 1,000Immediate delayUp to 150Up to 150Up to 150Delay more than 12 hoursUp to 2,000Up to 2,000Up to 2,000Travel Delay ExpensesUp to 250 for each12 hours and up toUp to 250 for each12 hours and up toUp to 250 for each12 hours and up to 2,000 in total perInsured Person 2,000 in total perInsured Person 4,000 in total perInsured PersonAny one item:1112Luggage & Personal EffectsDelay Expenses13Special EventsUp to 5,000Up to 5,000Up to 10,00014Personal Liability 10,000,000 10,000,000 10,000,00015Rental Vehicle Insurance ExcessUp to 8,000Up to 8,000Up to 8,00008 TravelCard Leisure International Travel Insurance

Plan type: Single and Annual Multi Journey BenefitsSectionSingleDuoFamily16Up to 600Up to 600Up to 600Pet Care*Some benefits may have separate sub limits which are listed within the Policy Sections.Table Of Benefits for Optional CoversThe Table of Benefits for Optional Covers is a summary of the benefits that Your Policy may cover if You choose themand they are shown on Your Schedule. It is important that You read the PDS carefully with the Schedule so that Youcan understand all the limits, terms, conditions and exclusions.Plan type: Single and Annual Multi Journey BenefitsSingleDuoFamily17.1Cover while Cruising Benefit17.1.1Medical and Evacuation coverwhile CruisingUnlimitedUnlimitedUnlimitedEmergency Dental Expenses 1,000 perInsured Person 1,000 perInsured Person 1,000 perInsured PersonOverseas Funeral and Burialor cremation, or return remainsto AustraliaUp to 25,000Up to 25,000Up to 25,000Australian Funeral;Funeral ExpensesUp to 5,000Up to 5,000Up to 5,00017.1.2Cabin Confinement 75 per completed24 hours up to amaximum 2,500 75 per completed24 hours up to amaximum 2,500 75 per completed24 hours up to amaximum 2,50017.1.3Pre-paid Shore ExcursionCancellation 1,000 perInsured Person 1,000 perInsured Person 1,000 per InsuredPerson to a maximumof 2,00017.1.4Lost or Damaged Formal AttireUp to 1,000Up to 1,000Up to 2,000Delayed Arrival of Formal AttireUp to 250Up to 250Up to 500Marine Rescue Diversion 100 per day 100 per day 100 per day 250 total 250 total 500 total 100 for each missedport up to 500 100 for each missedport up to 500 100 for each missedport up to 1,000Injury or SicknessUp to 100,000Up to 100,000Up to 200,000Overseas Funeral Expenses 20,000 20,000 20,000Return remains Home 10,000 10,000 10,00017.2.2Own Winter Sports EquipmentUp to 2,000Up to 2,000Up to 4,00017.2.3Winter Sports Equipment hireUp to 2,000Up to 2,000Up to 4,00017.1.517.1.6Missed Port Cover17.2Winter Sports Cover17.2.1Emergency RescueTravelCard Leisure International Travel Insurance09

Plan type: Single and Annual Multi Journey BenefitsSingleDuoFamily17.2.4Ski Pack Pre-paid Fees Cancellation Up to 1,000Up to 1,000Up to 2,00017.2.5Piste ClosureUp to 1,000Up to 1,000Up to 2,00017.2.6Bad Weather & Avalanche ClosureUp to 1,000Up to 1,000Up to 2,00017.3Search and RescueExpenses CoverUp to 25,000 perevent and 120,000in total for all claimsUp to 50,000 perevent and 120,000in total for all claimsUp to 50,000 perevent and 120,000in total for all claims17.4Adventure Activities Cover17.5Golf CoverUp to 3,000 perInsured PersonUp to 3,000 perInsured PersonUp to 3,000 perInsured PersonGolf Equipment HireUp to 100 for each24 hours up to amaximum of 1,000Up to 100 for each24 hours up to amaximum of 1,000Up to 100 for each24 hours up to amaximum of 1,000Prepaid Golf FeesUp to 150 for each24 hoursUp to 150 for each24 hoursUp to 150 for each24 hours17.6Business CoverReplacing Business documents,samples, demonstration goods,tools of trade or storage mediaUp to 1,000 per single Up to 1,000 per single Up to 1,000 per singlearticle and up to aarticle and up to aarticle and up to amaximum of 2,000maximum of 2,000maximum of 2,000Value of business documentsand stationeryUp to 1,000 per single Up to 1,000 per single Up to 1,000 per singlearticle and up to aarticle and up to aarticle and up to amaximum of 2,000maximum of 2,000maximum of 2,000Replacement business equipmentcourier expenseUp to 500Up to 500Up to 500Hiring business equipmentUp to 100 per24 hours up to amaximum of 1,000Up to 100 per24 hours up to amaximum of 1,000Up to 100 per24 hours up to amaximum of 1,000Loss or theft of business moneyUp to 2,000 perInsured PersonUp to 2,000 perInsured Person upto a maximum of 4,000Up to 2,000 perInsured Person upto a maximum of 4,000*Some benefits may have separate sub limits which are listed within the Policy Sections.10 TravelCard Leisure International Travel Insurance

Who Can Purchase This Policy?Our insurance is available to travellers who are citizensor permanent Residents of Australia or non-permanentresidents who have a valid Medicare, Private HealthFund or Overseas Student Travel Insurance in Australia.If requested, You are required to provide one or more ofthe following documents as evidence:Family – provides cover for up to two adults and theirDependants who are travelling together and are namedon Your Schedule.Policy TypesYou may be a frequent traveller or just go on oneJourney every year. This Policy also provides You withthe following options for covering a single Journey orannual multi Journeys during an annual period. A copy of Your passport. Australian residency documents. A birth certificate.The Journeys covered by both options must involve: A copy of valid Medicare, Private Health Fund orOverseas Student Travel Insurance. An Overseas destination and/or Any other official documents proving residency orcitizenship.A domestic destination of no less than 100 km fromYour Home.We may request copies of these documents at the timethat You purchase the TravelCard Leisure InternationalTravel Insurance or We may ask at the time of Yourclaim. We are not obligated to pay a claim or provideassistance if such evidence cannot be supplied, ifrequested.Age LimitsIf You love to travel as much as We do, then You willagree that there is no age limit to travel. However:Single optionThis option provides cover for a single Journey, for thePeriod of Insurance and to the destinations You select,and which are shown on Your Schedule.Annual multi optionThis option provides cover for multiple Journeysundertaken during a 12 (twelve) month Period ofInsurance and to the destinations You select, and whichare shown on Your Schedule. You must be 18 (eighteen) years of age or over atthe date of applying for this insurance. If You are over the age of 18 (eighteen) You maypurchase this Policy on behalf of a financiallyDependant child or grandchild (including, fosteredor adopted) who is under 25 (twenty five) years ofage at the time of the application for this insurance.The full adult premium will apply if Dependants arenot travelling with parents and/or grandparents.Not all of Our travellers participate in the sameactivities whilst they are travelling. We automaticallycover many different activities listed below, but cover isonly available where: You are not competing professionally, part of acompetition or tournament; andIf You are 85 (eighty-five) years of age and overYour cover is conditional on obtaining writtenconfirmation from Your Registered MedicalPractitioner that You are

Travel Insurance COMBINED FINANCIAL SERVICES GUIDE AND PRODUCT DISCLOSURE STATEMENT Effective 7th April 2018 PASS0021_TravelCard_PDS_Template_v11.indd 2 3/4/18 9:35 am. 02 TravelCard Leisure International Travel Insurance PASS0021_TravelCard_PDS_Te