Transcription

AIB Credit CardTravel InsurancePolicy Document

Contents04 The information you provide050508080909091010PART I – GENERAL INFORMATION1.1 Definitions1.2 Trips Covered1.3 Are You Eligible1.4 Trips Not Covered1.5 When Cover Operates for a Trip1.6 Medical Requirements1.7 Making a claim1.8 Aggregate limits of liability11 PART II – SERVICES11 1. Medical Emergency Services12 2. Non-insured facilitation services14141516171818222323232528PART III – YOUR COVERSection 1. Cancellation, Curtailment or RearrangementSection 2. Travel DelaySection 3. Personal AccidentSection 4. Medical and Additional ExpensesSection 5. Hospital benefitSection 6. Personal PropertySection 7. MoneySection 8. Loss of Passports/Green Cards/Driving LicencesSection 9. HijackSection 10. Personal LiabilitySection 11. Overseas Legal ExpensesSection 12. Winter Sports30303133343435PART IV – GENERAL INFORMATION4.1 General Exclusions4.2 General Conditions4.3 Claim Provisions4.4 Ending or Changing Your Cover4.5 Automatic Ending of Cover4.6 Renewal of Optional Cover36 PART V – COMPLAINTS PROCEDURES36 European Online Dispute Resolution Platform

Welcome to yourAIB Credit CardTravel InsurancePLEASE NOTE: Terms in bold have meanings given to them inthe Definitions Sections which appear in Parts I and III of the Policy.AIB Credit Card Travel InsuranceThis is Your AIB Credit Card Travel Insurance policy which, together with theinformation supplied in Your application, is a contract between You and Us.In return for payment of the premium by (i) AIB or (ii) by You if You have requestedoptional cover, We agree to insure You (and Your Partner, Children, AuthorisedUsers, if any, and Business Associates, if shown as insured on the Policy Schedule)provided that all Persons Insured are aged under 75 and Permanently Resident inRepublic of Ireland before travelling.The insurance will operate during the Period of Insurance and whilst the MarketingAgreement between AIB and Us is in force in the manner and to the extent provided,and subject to the Terms, Conditions and Exclusions contained in the AIB WorldwideTravel Insurance policy.Please read your policy and policy scheduleThe policy booklet shows the cover applicable and the Policy Schedule shows themost that We will pay for each benefit. If You have any questions please contact Uson 1800 24 24 67, Monday to Friday between 9am and 5pm.Changes to Your policyIf either Your insurance needs or any of the information You have given AIB changes,please advise AIB, in order to update our records.Michael DelaneyHead of General InsuranceAIB Insurance Services LimitedAIB Credit Card Travel Insurance 07/203

The information You provideWe use personal information whichYou supply to Us in order to write andadminister this Policy, including anyclaims arising from it.This information will include basic contactdetails such as Your name, address, andpolicy number, but may also includemore detailed information about You(for example, Your age, health, detailsof assets, claims history) where this isrelevant to the risk We are insuring,services We are providing or to a claimYou are reporting.You have a number of rights inrelation to Your personal information,including rights of access and, in certaincircumstances, erasure.This section represents a condensedexplanation of how We use Your personalinformation. For more information, Westrongly recommend You read Our userfriendly Master Privacy Policy, availablehere: aspx. You canask Us for a paper copy of the PrivacyPolicy at any time, by contacting Us atmailto:dataprotectionoffice.europe@chubb.com.We are part of a global group, and Yourpersonal information may be shared withOur group companies in other countriesas required to provide coverage underYour policy or to store Your information.We also use a number of trusted serviceproviders, who will also have access toYour personal information subject toOur instructions and control.4AIB Credit Card Travel Insurance 07/20

PART I General Information1.1 DefinitionsThe following words and phrases willalways have the same special meaningwherever they appear in the policy inbold type and starting with a capitalletter. Additional Definitions appear inPart III Sections 3, 6, 7 and 11. euroAbroadanywhere in the world outside Ireland.Accidentsudden identifiable violent external eventthat happens by chance and whichcould not be expected; or, unavoidableexposure to severe weather conditions.AIB; AIB’sAllied Irish Banks, p.l.c. of or pertaining toAllied Irish Banks, p.l.c. whose address isat Bankcentre, Ballsbridge, Dublin 4.Anniversary Dateeach annual anniversary of theCommencement Date.Authorised Useranother named person, as advised toand accepted by AIB, who has beenauthorised by the Principal Cardholderto effect card transactions on the Cardaccount.Business AssociateYour associate who is travelling withYou on a Trip in connection with Yourbusiness.AIB Credit Card Travel Insurance 07/20Cancellation, Curtailment andRearrangement Costscosts for unused travel and/oraccommodation (including ski hire,ski school and ski lift passes) whichthe Person(s) Insured has paid or iscontracted to pay and which cannotbe recovered from any other source.Curtailment and Rearrangement Costsinclude reasonable additional travel andaccommodation expenses provided that:a) such travel is of a standard no greaterthan the class of transport on theoutbound journey; andb) the standard of accommodation is notsuperior to that of the Trip.CardAIB Credit/Charge card that has beenissued in Ireland as described in thePolicy Schedule.Cardholderperson to whom or for whose use a Cardhas been issued by AIB.Child, ChildrenYour (and Your Partner’s) children,stepchildren, legally adopted childrenand children for whom You (or YourPartner) are the parent or legal guardian,each of whom must be:a) under 18 years old (or under 23 yearsold if in Full Time Education) at thecommencement of the Period ofInsurance and who is;b) dependent on You or Your Partnereven if he or she does not live witheither of You; andc) unmarried.5

Chubb AssistanceThe third Party provider with whom Wehave contracted to provide;a) The telephone advice, informationand counselling services; and orb) the travel assistance and emergencymedical and repatriation services.Claim(s)single loss or a series of losses Due Toone cause insured by this policy.Commencement Datethe day, month and year, as advised inwriting by AIB, for cover to start.DoctorDoctor or specialist, registered or licensedto practise medicine under the laws ofthe country in which they practise who isneither:1. a Person Insured; or2. a relative of a Person Insured unlessapproved by Us.Due Todirectly or indirectly caused by, arising orresulting from, in connection with.Excessthe first amount shown in the PolicySchedule of any Claim which eachPerson(s) Insured must pay except for:i. a loss of deposit only Claim when theExcess is the first 10 of any Claim; orii. a Claim for medical and additionalexpenses in European Unioncountries when there is no Excesswhere a reduction is obtained using aEuropean Health Insurance Card.6Fareoutbound and inbound travel costs of aTrip.Full Time Educationa programme of learning provided bya recognised educational body, whichleads to a qualification by examination orassessment which is either: full-time study; or a mixture of study and workexperience as long as at least twothirds of the total time for the courseis spent on study.Hijackunlawful seizure or taking control of anaircraft or other means of transport inwhich the Person(s) Insured is travellingas a passenger.Hijackersperpetrators of a Hijack.Immediate FamilyYour Partner, or fiancé(e) or thegrandchild, child (including fostered andadopted children), brother, sister, parent,grandparent, grandchild, step-brother,stepsister, step-parent, parent-in-law,son-in-law, daughter-in-law, sisterin-law, brother-in-law, aunt, uncle,nephew, niece of You or Your Partner, oranyone noted as next of kin on any legaldocument.Ireland; Irishthe island of Ireland and its islands exceptNorthern Ireland; of or pertaining toIreland.AIB Credit Card Travel Insurance 07/20

Marketing AgreementThe Agreement, or any replacementthereof between AIB and Us which setsout the terms under which We provideInsurance to the Cardholders of AIB.Partnera. Your spouse; or someone of eithergender with whom You have beenliving with for 3 months as thoughthey were Your spouse.Partyall the Person(s) Insured under this policywho are travelling together on the sameTrip.Period of Insurancetwelve months from 00.01 on theCommencement Date and eachsubsequent twelve-month period forwhich either AIB or You shall pay and Weshall accept a renewal premium, bothperiods falling entirely within the Periodof Cover. Dates refer to Local StandardTime at Your address as shown in thePolicy Schedule.Period of Covertime during which both the Card accountand the Marketing Agreement remain inforce.Permanently Residentresident in the first instance for at leastthree months and thereafter for fortyweeks each year.Person(s) Insuredpersons or class of persons described inthe Policy Schedule.AIB Credit Card Travel Insurance 07/20Policy Schedulethe document sent to You showing thesums insured excesses and other limits inthe cover provided for You and any otherPerson(s) Insured. If You or the Person(s)Insured has a Claim, We will deal with itbased on the details shown in the PolicySchedule sent to You immediately beforethe event giving rise to the Claim.Principal Cardholderperson in whose name the Card accountis maintained.Public Transportair, land or water vehicle operated underlicence for the transportation of feepaying passengers.Rearrangement CostsReasonable travel and accommodationcosts necessarily incurred in rearranginga Trip provided that:a) No claim has been made or willbe made for Cancellation Costs orCurtailment Costsb) Travel is of a standard no greaterthan the class of transport originallybooked; andc) The standard of accommodation isnot superior to that originally bookedd) The total amount payable will notexceed the cost of the original Tripe) The rearranged Trip must be bookedand fully paid no later than 6 monthsafter the date of commencement ofthe original Trip.SedgwickSedgwick Travel Claims, Merrion Hall,Strand Road, Sandymount, Dublin 4.7

Specially Designated Listmeans names of a person, entities, groups,corporates specified on a list who aresubject to trade or economic sanctionsor other such similar laws or regulationsof the United States of America, UnitedNations, European Union or UnitedKingdom.Tripjourney Abroad involving pre-bookedtravel or accommodation, where:i. travel begins and ends in Ireland; andii. 50% of the Fare for each PersonInsured has been charged to the Card.Wararmed conflict between nations, invasion,act of foreign enemy, civil War, hostilities(whether War be declared or not),rebellion, revolution, insurrection, militaryor usurped power.We/Our/UsChubb European Group SE; of orpertaining to Chubb European Group SE.Winter Sportsskiing (including skiing outside the area ofnormal compacted snow or ski slope i.e.off-piste when accompanied by or underthe instruction of a qualified guide,tobogganing, snow boarding and iceskating (other than on an indoor rink)but excluding competitive Winter Sports(including, but not limited to, ski or skibob racing, mono skiing, ski jumping,ski boarding, ice hockey, or the use ofbobsleighs or skeletons).You; Yourthe Principal Cardholder; of or pertainingto the Principal Cardholder.81.2 Trips coveredThis policy covers all Trips during thePeriod of Insurance provided they meetthe following conditions:i. each individual Trip begins and endsduring the Period of Insurance;ii. no individual Trip continues for morethan 45 consecutive days;iii each Trip in Ireland includes atleast 2 nights spent in accommodationthat is booked before the Tripbegins;iv. Up to 21 days Winter Sports coveris included during the Period ofInsurance.In addition, cover under Part III Section 3.Personal Accident shall also be operativewhilst the Person(s) Insured is riding asa Fare paying passenger in, or whilstboarding or alighting from, a PublicTransport within Ireland, provided that theFare for the Person(s) Insured has beencharged to the Card.1.3 Are you eligible?There is no insurance under the policyunless all of the following conditions aremet:A. each Person Insured must be;i. Permanently Resident in Ireland,and;ii aged under 75 years on theCommencement Date of any Periodof Insurance.B. Children travelling without You or YourPartner will only be insured if they aretravelling:i. in the company of an adult (i.e.someone not defined as a Childunder this policy) You or YourPartner know, or on an organisedAIB Credit Card Travel Insurance 07/20

school, college or university trip;ii. as an unaccompanied minor ona scheduled air service whichoperates an unaccompaniedminor scheme, and then onlyif they are travelling with theintention of joining, or beingsubsequently joined by, anotheradult insured under this policy.1.4 Trips not coveredWe will not cover any Tripa. which involves You travellingspecifically to obtain medical, dentalor cosmetic treatment;b. when You have been advised not totravel by Your Doctor or You havereceived a terminal prognosis;c. involving travel to areas wherethe Department of Foreign Affairsallocates a security status of ‘Avoidnon-essential travel’ or ‘Do not travel’.If You are not sure whether there is atravel warning for Your destination,please check their website www.dfa.ie1.5 When cover operates for aTripA. Insurance cover for Cancellationunder Part III Section 1 - Cancellation,Curtailment and Rearrangementbegins when a Trip is booked and theat least 50% of Fare is charged to theCard, or from the CommencementDate, whichever is later.B. Insurance cover under all otherSections operates for a Trip whichbegins and ends during the Periodof Insurance and includes traveldirectly to and from the home of eachPerson Insured provided the returnAIB Credit Card Travel Insurance 07/20home is completed within 24 hoursof return to Ireland. If the return ofthe Person(s) Insured from a Trip isunavoidably delayed Due To a Claim,he or she will continue to be insuredwithout any additional premium forthe period of the delay.NB All cover will cease from the date thatYou cease to be a Principal Cardholder.1.6 Medical requirementsWe have the right to refuse to pay anyClaim if:A. at the date on which a Trip is bookedand the Fare is paid, or at theCommencement Date if later, thePerson(s) Insured is aware of anyreason why a Trip might be cancelledor curtailed;B. at the date on which a Trip is bookedand the Fare is paid, or at theCommencement Date if later, thePerson(s) Insured is receiving or on a waiting list fortreatment in a hospital or nursinghome; is waiting for investigation orreferral, or the results of anyinvestigation, medical treatmentor surgical procedure, for anycondition, whether diagnosed orundiagnosed; is choosing not to take prescribedmedication, or the correct dose ofprescribed medicine. is travelling against the advice of amedically qualified doctor; is travelling to obtain medical,dental or cosmetic treatment; is travelling with a terminalcondition.9

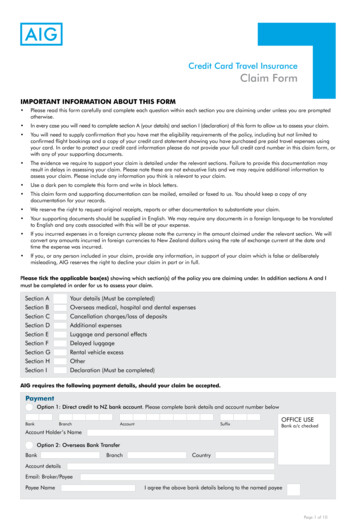

1.7 Making a claimA. Medical emergency onlyIn a medical emergency, please use theMedical Emergency Service T 353 (0) 1 4402792(part of the cover provided underPart III Section 4 MEDICAL ANDADDITIONAL EXPENSES) ContactingUs first may delay treatmentB. all other ClaimsSedgwick Travel ClaimsMerrion HallStrand RoadSandymountDublin 4T 353(0) 1 661 9133F 353(0) 1 661 5249management (in addition to the localPolice) within 24 hours of becomingaware of the loss.1.8 Aggregate limits of liabilityWe shall not be liable for any amountsin Excess of the amounts shown inthe Policy Schedule for any one Claiminvolving any one Party. If the aggregateamount of all benefits payable under thepolicy exceeds the appropriate amount,the benefit payable for each PersonInsured comprising the Party shall beproportionately reduced until the totalof all benefits does not exceed theAggregate Limit of Liability per Party.To make a Claim please phone or write toSedgwick within 30 days of the incident,or as soon as possible afterwards, andprovide Your name, address and policynumber. A claim form is available fromSedgwick. Alternatively You can print off aclaim form from Our website atwww.aib.ie/travelReporting lost or stolen propertyA. money, valuables or Personal PropertyYou must notify the local Police within24 hours of discovery and provide Uswith a copy of their written report.B. travellers’ chequesYou must notify the local branchor agent of the issuing companyimmediately on becoming aware ofthe loss.C. any property lost or stolen from ahotelYou must notify the hotel10AIB Credit Card Travel Insurance 07/20

PART II Services1. Medical emergency and referralservicesIMPORTANT: This is not Private MedicalInsurance. If You require medicaltreatment You must contact ChubbAssistance immediately. If You do not dothis, We may reject Your Claim or reduceits payment.If You require medical treatment inAustralia You must access the benefitsprovided under the reciprocal health careagreement between the Australian andRepublic of Ireland governments. If Youdo not do this, We may reject Your Claimor reduce its payment.Chubb AssistanceMedical Emergency and Referral /Non-Insured Facilitation Services :T 353 (0) 1 440 2792Assistance services are only availableduring a Trip Abroad. Chubb Assistancewill provide the Person(s) Insured withthe following services, in an emergency,when he or she is on a Trip. Please makesure You have details of this policy,including the policy number and Periodof Insurance when You call.If the policy covers a service or itemunder any of the Sections in Part III (e.g.medical expenses if You have to consulta Doctor) You will be able to recover thepayment.You must contact Chubb Assistancebefore incurring any costs covered underthis Section.AIB Credit Card Travel Insurance 07/20A. Medical Referralprovision of the names and addressesof local Doctors, hospitals, clinics anddentists when consultation or treatmentis required, arrangements for a Doctorto call, and, if necessary, for a PersonInsured to be admitted to hospital.B. RepatriationIf the Doctor appointed by ChubbAssistance believes treatment in Irelandis preferable, transfer will be arranged byregular scheduled transport services orby air or road ambulance services if moreurgent treatment and/or specialist care isrequired during the journey.C. Payment of BillsIf a Person Insured is admitted to hospitalAbroad, the hospital or attendingDoctor(s) will be contacted and paymentof their fees up to the policy limits will beguaranteed so a Person Insured doesnot have to make the payment from theirown funds.D. Drug Replacementassistance with the following:i. replacement of lost drugs or otheressential medication; orii. lost or broken prescription glassesor contact lenses, which areunobtainable Abroadiii. sourcing and delivery of compatibleblood supplies.Chubb Assistance will not pay for thereplacement costs of any item or thecosts of sourcing and delivering bloodsupplies.E. Transmission of urgent messagesto relatives or Business Associates11

F. Unsupervised Childreni. organisation of an accompanyingChild’s return home, with a suitableescort when necessary, if the Childis left unsupervised because You orYour Partner (if shown as insured onthe Policy Schedule) are hospitalisedor incapacitated.ii. medical advice and monitoring, untilYou or Your Partner returns home, ifa Child who has been left in Irelandbecomes ill or suffers injury.2. Non-insured facilitation servicesChubb Assistance will provide a PersonInsured with the following services, in anemergency, when he or she is on a TripAbroad.You will be responsible for paying

AIB Credit Card Travel Insurance This is Your AIB Credit Card Travel Insurance policy which, together with the information supplied in Your application, is a contract between You and Us. In return for payment of the premium by (i) AIB or (ii) by You if You have requested optional cover, We agree to insure You (and Your Partner, Children, Authorised