Transcription

White Paper2019 Trends & Opportunitiesin Branch BankingBy Ron Wellman, Industry Director for Banking, Reflexis Inc.In today’s banking environment, justifying any investment inbranch banking solutions can seem especially challenging,with the relentless focus on digital transformation proclaimingthe death of branches altogether. However, far from beingdead, branch banking is instead evolving to meet thechanging needs of the customer, and integrating moreof today’s modern banking strategies. One could callthis a renaissance of modern branch banking, as it is beingreshaped by new ideas and approaches.In fact, there are significant returns to be realized fromtransforming your branch strategy if you focus on two keyelements. First, ensure you have the right people with theright skills in the branch, and that they’re scheduled at theright time in order to maximize customer engagement.Second, simplify non-customer branch administration tasksso that employees have more time to focus on helpingcustomers who visit the branch.In order to understand the details, benefits, and driversof investing in branch transformation, let’s examine someof the challenges that many banks are facing today, andthe corresponding opportunities presented as a result.By studying these in detail, we can build a convincing casefor investing in solutions that help banks optimize networkstaffing and empower employee productivity.1. Market Trends:2. Opportunities:A. Shifts in routine transaction volumesto digital platformsA. Create more nimble staffing modelsB. Changes in required roles and skills at the branchC. Simplify non-customer branchactivities and ensure branch excellenceC. Focus on premium, high-touch retail experiencesB. Improve employee scheduling flexibility

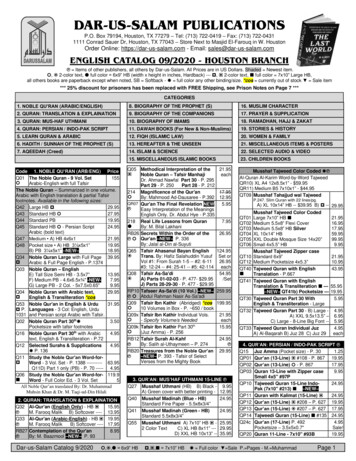

1: Market TrendsAShifts in routine transactionvolumes to digital platformsBranches are not going away, despite the many direpredictions to the contrary. However, given recentshifts in transaction volumes, branches are in needof a strategic overhaul to meet the new demands.Over the past few years, the rise of mobile andonline banking—including mobile deposit—hasled to fewer routine transactions at the teller line,and fewer routine sales and service requests tothe platform at the branch.The initial reaction by many banks has been to closebranches and reduce staff by an average of threeemployees per branch.1STAFFINGAverage number of employeesanticipated for new locations.5Last year, financial institutionsplanned on having 8 employeesper branch vs. 5 this year.Source: Codigo March 2017https://thefinancialbrand.comUnfortunately, customer satisfaction suffered asa result of these cuts, and many banks have notseen financial benefits from such cost-cutting atthe branch initiatives.The reason this strategy failed is that executiveshad “to balance between conflicting priorities –costs must be contained at the same time thatrevenue targets get higher.”2 So although costswere reduced, sales and Net Promoter Scores(NPS or customer service scores) also declined.Having fewer employees working, the remainingbranch staff struggled with longer wait times anddeteriorating customer experiences. Bankerswere also left dealing with more complex serviceand sales interactions, which cannot easily becompleted via the contact center, online, or onmobile. As a result, they were spending lesstime discussing customers’ financial needs andgoals, which would have driven additional salesopportunities. Ultimately, the savings from staffreduction were neutralized by both the lossof sales opportunities and customer attritionfollowing frustrating experiences.This self-fulfilling, negative trend persists.However, it is not the only trend in branchbanking. According to David Kerstein ofPeak Performance Consulting Group, “Banksand credit unions still open about 1,000 newbranches a year.”3 So why are banks openingnew branches and investing in existing branchexperiences if the branch is dead? It’s because“many consumers still prefer to speak to abanking officer for advice involving significantfinancial decisions even though they may havestarted their research online.”4

This pattern also pertains to millennialcustomers, who “use branches with roughlythe same frequency as the average bankcustomer. And, while it may change in thefuture, 85-90 percent of all new accountsare opened in branches, not online.”3Additionally, 46 percent of millennialconsumers believe technology cannotreplace the need for a branch nearby.5COULD TECHNOLOGY EVER REPLACECONSUMERS’ NEED TO HAVE A BRANCH NEARBY?NOT SUREYES14%NO39%46%Millennials19%24%57%Gen X19%22%59%Baby BoomersSource: Raddon

BChanges in required rolesand skills at the branchBranches are here to stay, but the key roles and skillsrequired to staff those branches are evolving. Studiesshow that customers prefer in-person service for certaintypes of interactions:“The call center may haveanswers to customers’ shortquestions, but when it comesto bigger financial needs,77 percent of customers preferto visit the branch. The mostcommon branch bankingscenarios cited by customersinclude investment advice,financial planning, and newaccount openings — big lifedecisions that consumersdon’t want to make withoutthe support and expertiseof their banks.”6“Given that there are fewer teller transactionsand that customers are expecting to speak withsomeone who can solve their more complexservice issues, help them open an account, orprovide them financial advice — what roles areneeded? The answer is not simply fewer tellers.Today’s branches need staff members whohave experience with problem resolution, morecomplex selling strategies, and can jump onthe teller line if needed. Staff members alsoneed to be trained and certified for other rolesand activities at the branch — like opening orclosing. This is why you see so many “universalbanker” programs to cross-train staff and enablethem with the skills to fulfill the many roles nowrequired at the branch.Another challenge is that scheduling thesemulti-skilled colleagues is complex. They needto be available when customers want to comeinto the branch — which is not always nine tofive, Monday to Friday. Banks also need someof these universal bankers to commute betweenmultiple branches to enable the most efficientstaffing models. These factors can make it moredifficult to recruit, staff, and retain these types ofemployees, especially considering the abundanceof new job opportunities on the market.Banks are also focused on staffing specialistpositions, who might use the branch as a homebase or as a location to provide consultancyservices, because “many higher margin productsare also more successful with directhuman interaction.”2These specialist bankers focusing on smallbusiness, wealth and brokerage, and mortgageproducts and services introduce two criticalelements for differentiating branch experiences.First, to capture the revenue from higher marginproducts, one needs an easy way for customersto schedule time with these specialists, like anonline scheduling application. We will discuss thescheduling element below in section 2.B.

Second, a more refined experience is important whenone meets with these customers at the branch. Forexample, a client might not appreciate going to arun-down branch that looks like it has not beenremodeled in decades, and which ironically introducesitself as the next trend in banking—the premier,high-touch retail experience.Focus on premium,high-touch retail experiencesAccording to Reginald Jones, Samsung’s head of salesfor financial services, “Banks are no longer competingagainst one another for experience. Now banksare competing with every other retail experience thattheir customers have taken part in throughout the day,week or even month.”7Think Apple, Nordstrom, Whole Foods, and similar,premium retail experiences. “While banking side-byside was once thought of as a luxury, banks realizethat to keep up with other retail experiences, thatneeds to be the norm.”7BRANCH APPOINTMENTS BYPRODUCT OR SERVICE NEEDBanks want to ensure customers see them as apremier brand, one offering a high-touch experiencewith trusted professional staff. To that end, we seebanks hiring retail store design teams to reconfigurethe layouts, branding, and branch work flows.MortgageAuto loanNew accountFor example, in Singapore, DBS incorporated humancentered design (HCD) into its flagship branch atMarina Bay Financial Center, and overhauled thetraditional retail banking experience. “The intentwas to optimize customers’ time and to make thebranch visit simple, and delightful.”4 These kinds oftransformations have reduced customer wait time inbranches by more than 10 percent.HELOCService issueBusiness servicesNotaryCredit card0%C5%10%Source: Financial Brandhttps://thefinancialbrand.com15%

2: OpportunitiesACreate more nimble staffing modelsThe market changes mentioned above reveal anumber of opportunities banks can take to driveadditional returns from the branch network. Theseopportunities generally fall into two categories:optimizing network staffing models andempowering employee productivity.Both of these approaches have demonstrable returnswith hard benefits like increased sales, and soft benefitslike increased NPS and employee satisfaction. Let’s startby considering network staffing optimization. With sofew branch staff and so many branch formats, how doyou ensure that the right people with the right skillsare scheduled in the branch at the right time? Thereare a number of typical ways to get started optimizingnetwork staffing, but ideally one wants to start byhaving a good understanding of the types and volumesof activities that each role will be performing, and thecyclicality and regularity of these at varying locations.Fortunately for banks, major retailers have alreadypaved the way to staffing optimization, driven by theimpact of e-commerce on brick-and-mortar storesand on store staffing models. Under similar pressuresfaced by bank branch managers today, retailers pushedtechnology providers to develop and refine powerfulworkforce management tools, which include impressiveforecasting functionality. In many cases, these tools canachieve forecasting accuracy above 90 percent. Someof these tools even marry-up capabilities for capturingand refining the labor standard data mentioned abovethrough their integrated task or activity managementcapabilities. A few of the other key features include: Dynamic forecasting Forecasting what-if scenarios Machine learning models (a formof Artificial Intelligence or AI) Data visualization and analytics tools Support for multi-skilled colleague scheduling(splitting their time between teller and platform) Support for floater & part-time staff poolsacross multiple branches in the network Support for roaming specialists(SMB, Mortgage, Wealth) The ability to apply granular jurisdictionalrules for compliance with local labor lawsMajor retailers have been quicker at adopting these staff forecasting capabilitiesthan banks have. However, interestingly, some banks have implemented themas well. Overall the tools have excellent benefits including:0.8%UP TO5%An increase in salesfrom 0.8 percent upto 5 percent810-20%3.9%A savings of 10-20% in laborcosts when compared tomanual efforts9A boost in customerservice scores of up to3.9 percent8

BImprove employeescheduling flexibilityBetter branch staff forecasting is only part of theoptimization equation. Banks also need to make iteasier for managers and colleagues to engage inthe process, so they will easily fill these more flexibleschedules with the right people. In order to ensuremaximum optimization of the branch network, banksalso need to free up time by simplifying non-customerbranch activities to ensure unscheduled activities donot invalidate forecasts. See section 2.C. for moreon that.The new staffing models needed for these high-touch,universal banker experiences make the schedulingprocess less static and more variable, which introducesadditional challenges, such as: Most managers are not forecasting or schedulingexperts, and they need an easy-to-use solutionwhich guides them through the process Typical bank scheduling tools and processes aremanual, or home-grown systems which lack themodern user interfaces, and advanced algorithmswhich offer flexibility and ease-of-use to staff whenfilling out their variable schedules Many tools do not allow colleagues to easilytrade or swap shifts with others, or enablethem to bid on available shiftsBanks can benefit from adopting the latest schedulingtechnology available. These modern solutions offeruser-centric design, drag-and-drop capabilities formanagers, and mobile-first functionality for employeeself-service. They also include integrated taskmanagement tools. This allows for the unification offorecasting with scheduling, and real-time activitymanagement, giving employees a single platform toaccess both their scheduling and work/task priorities,and a way for bank managers to understand thepriority of, and impact of, non-customer activities.These solutions also make it easier to manageschedules on the fly, for example, by broadcastingalerts to employees’ smartphones. Also, smallerbranches can quickly fill open slots, mitigating longwait times and the number of negative customerexperiences. There is also typically support to optimizescheduling based on skills, certificates, andemployee preferences.Not only do the above features make scheduling theright people easier for managers, these solutions alsoincrease employee satisfaction and reduce turnover.Some of these tools also enable employees to use amobile app in order to more easily view their schedules,request changes, and initiate shift swaps withqualified colleagues.KEY TAKEAWAYSIn summary, these scheduling capabilities offersignificant hard and soft benefits including:85158%Up to a 5-hour reductionper week, per managerfor schedulingUp to 15 hours per weekgiven back to colleaguesfor more time to sellUp to an 8 percent reductionin crew turnover rateSource: Reflexis Inc. Customer Case StudiesIn addition to scheduling, banks should also ensure thatany time and attendance applications for the brancheshave the same ease of use and flexibility for colleagues.The time and attendance capability should also operatenatively within the forecasting and scheduling solutionor be easily integrated, so that banks can easily auditadherence to published schedules, ensuring maximumoptimization of branch network staffing.

CSimplify non-customer branchactivities and ensure excellenceAs mentioned above, improving the forecastingand optimization of staff schedules is only part ofcreating the new, ultra-efficient, high-touch branchexperience. The final opportunity is in simplifyingnon-customer activities and ensuring operationalexcellence through three key processimprovement steps.The first step is to funnel and prioritize all noncustomer branch activity tasks, requests, andfollow-up actions onto a dashboard — on thesame platform managers and employees areusing to manage their schedules, time worked,and attendance. This enables forecasters andmanagers to accurately identify the resourcesneeded for these non-customer requests, andaudit their impact on branch staffing optimization.This information can be used to drive changesto the types, volume, priority, and time allocatedfor these non-customer tasks: improving theefficiency of non-customer activities andallowing colleagues to devote more timeto actual customer interactions.Similarly, using that same tool to digitize anynon-customer branch request form completionis critical for simplification and achieving branchexcellence. Again, the goal is to simplify allnon-customer activities, making it easier forcolleagues. Digitization of forms also ensures thatthe correct versions are immediately available tostaff, enabling them to set automatic escalationand routing, which streamlines the entire process.Finally, in order to ensure excellence with brand,security, and merchandising standards, banks mustprovide easy-to-use mobile inspection solutions forregional managers and operations review teams. Asmany bank managers know, your brand is one of yourmost valuable assets.Easy-to-use mobile inspection solutions andprocesses that assign critical follow-up activitiesdirectly to colleagues’ work dashboards can helpprotect brand equity. These inspection solutionsmake it simple to ensure brand standards, as wellas inspect elements like cleanliness and maintenance,or security elements that are essential for a premiumexperience. They can also drive routing, prioritization,and real-time response to any issues identified duringthe inspection.SUMMARYSo, what are the next steps for bank executives whowould like to take advantage of the opportunitiesoutlined above, and start a branch renaissance of theirown? As someone who worked in banking for 15 years,and spent a good part of that time developing businesscases for technology investment, I would recommendsharing your thoughts with key stakeholders andgetting their feedback on what resonates most withinyour organization. At the same time, I would reachout to analysts and vendors and begin learning aboutthe opportunities, gathering third party statistics andvalidation needed for funding requests. Finally, a goodreference to begin researching the business impactsand benefits of these new solutions is the retail industry,which has already been disrupted by the trends beingexperienced today in banking and is solving many ofthe same challenges.1. Confirm Key Stakeholder Requirements2. Collect Analyst and Vendor Intelon Opportunities3. Gather Third-Party Statistics and Validation4. Set a Reference Point for Researchto Support Action

ABOUT REFLEXIS SYSTEMS, INC.Reflexis is the leading provider of workforce management and real-time operations solutions. The Reflexis ONE forBanking platform transforms branch banking experiences by optimizing network staffing and empowering employeeproductivity. Our cloud-based platform leads the industry providing AI-powered forecasting, optimized scheduling,and employee self-service to empower branch staff.We have over 18 years of experience increasing sales, reducing costs, and enabling operational excellence for leadingbrands like CVS, Walgreens, Office Depot, Vera Bradley, Autozone, Ulta, and over 280 other clients, with more than6 million associates worldwideReflexis: Unleash the Power of YourBranch Colleagues.Learn more king/For more information, visit www.reflexisinc.com.Phone: 1 (781) 493-3400 // E-mail: ps://www.dbs.com/newsroom/branch as/Reflexis Case Studies: /, and upon workforce-management-application-banks

online banking—including mobile deposit—has revenue targets get higher.” led to fewer routine transactions at the teller line, and fewer routine sales and service requests to the platform at the branch. The initial reaction by many banks has been to close branches and r