Transcription

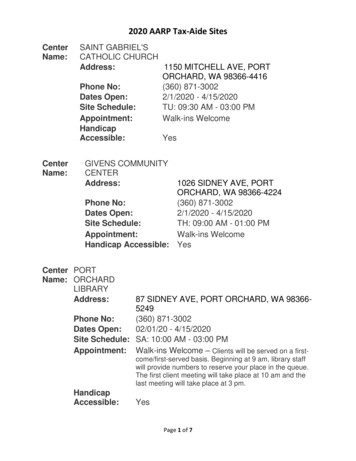

2020 AARP Tax-Aide SitesCenterName:CenterName:SAINT GABRIEL'SCATHOLIC CHURCHAddress:1150 MITCHELL AVE, PORTORCHARD, WA 98366-4416Phone No:(360) 871-3002Dates Open:2/1/2020 - 4/15/2020Site Schedule:TU: 09:30 AM - 03:00 PMAppointment:Walk-ins WelcomeHandicapAccessible:YesGIVENS COMMUNITYCENTERAddress:Phone No:Dates Open:Site Schedule:Appointment:Handicap Accessible:1026 SIDNEY AVE, PORTORCHARD, WA 98366-4224(360) 871-30022/1/2020 - 4/15/2020TH: 09:00 AM - 01:00 PMWalk-ins WelcomeYesCenter PORTName: ORCHARDLIBRARYAddress:87 SIDNEY AVE, PORT ORCHARD, WA 983665249Phone No:(360) 871-3002Dates Open:02/01/20 - 4/15/2020Site Schedule: SA: 10:00 AM - 03:00 PMAppointment: Walk-ins Welcome – Clients will be served on a firstcome/first-served basis. Beginning at 9 am, library staffwill provide numbers to reserve your place in the queue.The first client meeting will take place at 10 am and thelast meeting will take place at 3 pm.HandicapAccessible:YesPage 1 of 7

CenterName: OLYMPICCOLLEGEAddress:1600 CHESTER AVE, BREMERTON, WA98337-1600Phone No:(360) 697-9318Dates Open:2/1/2020 - 4/15/2020Site Schedule: WE: 11:00 AM – 03:00 PMTH: 11:00 AM – 03:00 PMComments:Health Occupations Bldg Room 138Appointment: Walk-ins WelcomeHandicapAccessible:YesCenterName:SHERIDAN PARKCENTERAddress:680 LEBO BLVD, BREMERTON, WA98310-3308Phone No:(360) 377-9494Dates Open:2/1/2020 - 4/15/2020Site Schedule:WE: 09:00 AM - 02:00 PMTH: 09:00 AM - 01:00 PMComments:Will be closed for spring breakAppointment:Walk-ins WelcomeHandicap Accessible: YesCenterName:THE SUMMITAddress:Phone No:Dates Open:Site Schedule:Comments:Appointment:Handicap Accessible:4650 BAY VISTA BLVD,BREMERTON, WA 98312-4734(360) 792-24282/1/2020 - 4/15/2020MO: 10:00 AM - 02:00 PMFR: 10:00 AM - 02:00 PMClosed on Monday, 2/17/20, PresidentsDay NEAR WINCOWalk-ins WelcomeYesPage 2 of 7

CenterName:BAINBRIDGE ISLANDMAIN LIBRARYAddress:Phone No:Dates Open:Site Schedule:Comments:Appointment:Handicap Accessible:CenterName:1270 MADISON AVE N, BAINBRIDGEISLAND, WA 98110-2721(206) 780-09312/1/2020 - 4/15/2020MO: 10:30 AM - 01:00 PMAddtl hrs: 05:30 PM - 07:30 PMWE: 10:30 AM - 01:00 PMFR: 01:30 PM - 04:00 PMClosed on Monday 2/17/20, PresidentsDay.Walk-ins WelcomeYesGOLDEN TIDES IIAddress:9239 BAYSHORE DR NW, SILVERDALE,WA 98383-9163Dates Open:2/1/2020 - 4/15/2020Site Schedule:TU: 10:00 AM - 02:00 PMTH: 10:00 AM - 02:00 PMAppointment:Walk-ins WelcomeLanguages:EnglishHandicapAccessible:YesPage 3 of 7

CenterName:POULSBOLIBRARYAddress:Dates Open:Site cessible:700 NE LINCOLN RD, POULSBOWA, 98370-76882/1/2020 - 4/15/2020SU: 02:00 PM – 05:30 PMTU: 3:30 PM – 6:30 PMTH: 2:00 PM – 5:00 PMTuesday & Thursday are by appointments360-621-3925Walk-ins WelcomeEnglishYesCenter PORT GAMBLEName: S'KLALLAM TRIBEAddress:Phone No:Dates Open:Site Schedule:Comments:Appointment:Handicap Accessible:31948 BOSTON RD NE,KINGSTON, WA 98346-9700(360) 297-96672/1/2020 - 4/1/2020MO: 1:00 PM - 5:00 PMTU: 1:00 PM - 5:00 PMClosed on Monday 2/17/20,Presidents DayWalk-ins WelcomeYesPage 4 of 7

Center VILLAGE GREENName: COMMUNITY CENTERAddress:Phone No:Dates Open:Site Schedule:Comments:Appointment:Handicap Accessible:26159 Dulay Rd. NE, KINGSTON,WA 98346-5500(360) 297-12632/1/2020 - 4/15/2020WE: 11:00 AM – 2:00 PMTH: 10:00 AM - 2:00 PMFR: 10:00 AM - 2:00 PMSA: 11:00 AM – 3:00 PMAppointment required 360-2971263, call two weeks priorRequiredYesPage 5 of 7

The checklist below includes items you need to bring when you visit an AARPFoundation Tax-Aide site for us to help you prepare your tax return(s) Last year’s tax return(s)Social Security cards or other official documentation for yourself and allyour dependentsPhoto I.D. required for all taxpayers.Checkbook if you want to direct deposit any refund(s).Income W-2 from each employerUnemployment compensation statementsSSA-1099 form showing the total Social Security benefits paid to you forthe year, or Form RRB-1099, Tier 1 Railroad Retirement benefits1099 forms reporting interest (1099-INT), dividends (1099-DIV), proceedsfrom sales (1099-B), as well as documentation showing the originalpurchase price of your sold assets1099-R form if you received a pension, annuity, or IRA distribution1099-Misc formsInformation about other forms of IncomeState or local income tax refundPaymentsAll forms and canceled checks indicating federal and state income tax paid(including quarterly estimated tax payments)Continued on next page .Page 6 of 7

DeductionsMost taxpayers have a choice of taking either a standard deduction or itemizingtheir deductions. If you have a substantial amount of deductions, you may want toitemize. You will need to bring the following information: 1098 form showing any home mortgage interest1098-T and 1098-E forms (Tuition and Student Loan Interest payments)A list of medical/dental expenses (including doctor and hospital bills andmedical insurance premiums), prescription medicines, costs of assistedliving services, and bills for home improvements such as ramps and railingsfor people with disabilitiesSummary of contributions to charityReceipts or canceled checks for all quarterly or other paid taxProperty Tax bills and proof of paymentHealth Insurance Form 1095A if you purchased through Marketplace (Exchange)Any exemption correspondence from the Marketplace (if applicable)Credits Dependent care provider information (name, employer ID, or Social Securitynumber)1099 forms related to continuing education and related receipts andcancelled checksPage 7 of 7

the year, or Form RRB-1099, Tier 1 Railroad Retirement benefits 1099 forms reporting interest (1099-INT), dividends (1099-DIV), proceeds from sales (1099-B), as well as documentation showing the original purchase