Transcription

Schedule of Bank ChargesJanuary to June 2020The better way to bankCall Now: 111-786-DIB (342)

Our next branch.your home!The Dubai Islamic Internet Banking service offers you a range oftools that make your life so much easier.Instant online registrationInstant Funds transfer inlocal and foreign currencyOrder VISA Debit/ATMcardsInvest in Fixed DepositaccountsMake Payorders/DemandDraftsView/download accountstatementswww.dibpak.comThe better way to bankCall Now: 111-786-DIB (342)

Schedule of Charges (January to June 2020)TABLE OF CONTENTSGeneral BankingREMITTANCES.2INTER-BRANCH ONLINE TRANSACTIONS.3GENERAL BANKING SERVICES.3STANDING INSTRUCTIONS.4ATM/DEBIT CARD.4REPORTS & CERTIFICATES.5FOREIGN EXCHANGE PERMITS.5SMS BANKING.5PHONE BANKING.5INTERNET/MOBILE BANKING.6INTER BANK FUNDS TRANSFER FACILITY.6BASIC BANKING ACCOUNT.6INVESTOR PORTFOLIO SECURITIES ACCOUNT.6RTGS.6DIGITAL WALLET. 7Priority BankingWAJAHA PRIORITY BANKING. 8AAYAN PRIORITY BANKING.10Consumer FinanceHOME FINANCE.13BUSINESS FINANCE.14AUTO FINANCE.15FLEET FINANCING.15CONSUMER DURABLE FINANCE.16AUTO LEASING.16Trade ServicesIMPORTS.17EXPORTS.18INLAND BILLS.19GUARANTEES.19CORPORATE BANKING.20CASH MANAGEMENT.20NOTES. 211

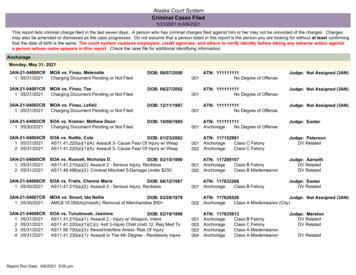

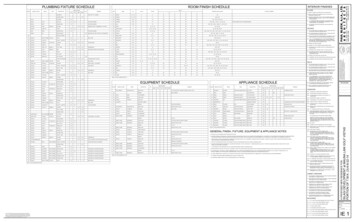

Schedule of Charges (January to June 2020)GENERAL BANKINGItemsChargesREMITTANCES (FCY)InwardIf own Bank (Home Remittances under PRI)FreeIf another Bank (Other than Home Remittance)Remittances where TT required(Other than Home Remittance)Free 3 plus Local SWIFT ChargesHome Remittances PRIFreeOutwardIssuance of Foreign Currency Demand Draft (FDD)0.1% Min 15, Max 25Foreign Remittance Telex/SWIFT Charges International 20Cancellation of FDDUSD 5 postage/SWIFT if anyStop Payment/Caution Marking of FDD 10Duplicate FDDService Charges for issuance ofEPRC against Advance PaymentSame as FDD issuance chargesRs. 300/-Cash holding charges - if remittance or conversionis done against FCY cash deposit within 15 days0.4% (of cash deposit)REMITTANCE (LCY)DDs, MTs and TTs (within Bank network)0.1%, Min Rs. 100/- Max: Rs. 5,000/-DDs, MTs and TTs (outside Bank network)0.1%, Min Rs. 500/- Max: Rs. 7,500/-DDs, MTs and TTs against cash for Account Holders 0.2%, Min Rs. 200/- Max: Rs. 10,000/Telex/SWIFT Charges - DomesticRs. 500/-Cancellation of DDRs. 250/-Rs. 150/- (Flat)0.50% of fees/dues or PKR 25/- perPay Order in favor of Education Institutesinstrument whichever is less(inclusive of FED)Rs. 300/Pay Order Issuance against Cash for Account HoldersPay Order IssuanceRs. 300/-Cancellation of Pay OrderRs. 250/-Stop Payment/Caution Marking of DD, PORs. 50/- (Flat)Revalidation of PO/DDIssuance of Duplicate DD, PORs. 200/-Note: Above charges are exclusive of Government Levies/ Duties.Correspondent charges where applicable are at actual.OTHER TELEX/SWIFT CHARGESLetter of Credit -Full Telex/SWIFTRs. 1,200/- or 20Letter of Credit - Short Telex / SWIFTAmendment by Telex / SWIFTRs. 600/- or 152

Schedule of Charges (January to June 2020)GENERAL BANKINGItemsChargesINTER-CITY TRANSACTIONS, CLEARING & COLLECTIONUSD clearing through NIFTSame day clearing of high value instruments viaNIFForeign bills sent for collection (FOBC) 5 or equivalentRs. 300/0.1%, Min 5, Max 25.Outward Bills for Collection ChargesIntercity Clearing (where NIFT isavailable) Rs. 100/OBC Clearing (where NIFT isnot available) Rs. 300/-Inward Bills for Collection Charges(for correspondent Bank collection)Rs. 400/- or 5 per collectionINTER-BRANCH ONLINE TRANSACTIONSInter-city account to account transferFreeCash/cheque deposit (within-city)FreeCash/cheque deposit (inter-city)FreeCash withdrawal (within-city)FreeCash withdrawal (inter-city)FreeGENERAL BANKINGIssue of SBP/NBP chequeRs. 500/-Cheque Book issuance (same charges for alleventualities including loss of Cheque Book)Rs. 11/- per leaf 3Cheque Book Issuance - FCY account(Per 25 leaves)AED 10GBP 2Euro 2Customized / Specialized Cheque BookRs. 20/- per leafStop payment of Cheque / Lost Cheque BookRs. 400/- per instructionRetrieval of paid cheque - Within 1 YearRs. 250/-Retrieval of paid cheque - After 1 YearRs. 500/-Cheque returned unpaid - Inward clearingRs.500/-Account Closure*Rs. 200/- or available balancewhichever is lowerHold mail serviceRs. 1,000/- per yearService Charges for Reminder LettersRs. 100/-Statement of Account on ad hoc basisRs. 35/- per statement(inclusive of FED)ASAAN ACCOUNTAsaan - Cheque Book (Saving Accounts only)Asaan - Pay OrdersRs. 5 per leafRs. 100 per Pay OrderAsaan - Pay Pak Debit CardRs. 300/- FED* Does not apply on regular savings accountAll charges are exclusive of FED, FED applicable as per law3

Schedule of Charges (January to June 2020)GENERAL BANKINGItemsChargesSTANDING INSTRUCTIONSRs. 200/Standing Instruction Charges per transaction (LCY)Standing Instruction Charges per transaction (FCY)US 5 per transactionRs. 100/AmendmentLOCKER FACILITYOne time security depositRs. 2,000/Rs. 3,500/Small - Annual FeeRs. 4,500/Medium - Annual FeeRs. 6,000/Large - Annual FeeRs. 100/Lockers - Late Payment Charge per Month**Upto Rs. 5,000/Breakage Charges per LockerCASH PICK UP & DEPOSITUpto Rs. 5,000/- within 20 km per trip; beyond will be as agreed with client.Vault charges if availedRs. 600/- per nightSeal chargesRs. 25/-per seal (if applicable)Note: Charges also to apply on customers availing cash manager account (Current/Savings)but not maintaining minimum requirementsATM / DEBIT CARDSilver/ JuniorGoldPlatinumSignatureRs. 875/-300/Rs. 1200/Rs. 3,500/Rs. 6,000/Existing ATM/Non ATM/PackagesDebit Card HolderDebit Card HolderVISA PrePayRs.250/Rs. 500/BasicDebit CardEnhanceRs. 350/Rs. 750/PremiumRs. 500/Rs. 1,250/GoldSilverUnionPay EMVDebit CardRs. 1,200/Rs. 875/CustomerIssuance/CardCategoryRenewal FeeReplacement FeeRs. 300/Rs. 250/Asaan AccountPay Pak*BLB AccountFREERs. 250/Home Remittance AccountRs. 300/Rs. 250/Rs. 1,000/Rs. 600/NRP AccountNormal Account*Rs. 700/Rs. 600/On DIBPL ATMsATM Balance inquiryFree ATM Mini-statementFreeATM cash withdrawalFree Statement of Account Request through ATMFreeOn Local Shared Network ATMsATM Balance Inquiry1 Link: Rs. 2.5/ATM cash withdrawalRs. 18.75/VISA Debit CardAnnual FeeNote:All charges are exclusive of FED, Supplementary cards are not offered by the Bank.*For Normal Customers other than the above customer category for PayPak**To be Deposited in the Charity Fund4

Schedule of Charges (January to June 2020)GENERAL BANKINGItemsChargesInternational Cash Withdrawal and POS TransactionsCash Withdrawal4.0% per transactionBalance InquiryPKR 200/- per enquiryDocument/Transaction Retrieval ChargesPKR 850/- per document/transactionPOS & Internet Purchase4.0% per transactionATM/Debit Card MiscellaneousReplacement of lost or damaged card - Debit Visa ClassicRs. 600/Replacement of lost or damaged card - Debit Visa GoldRs. 700/Replacement of lost or damaged card - Debit Visa PlatinumRs. 750/Replacement of lost or damaged card - Visa SignatureRs. 750/Replacement of lost or damaged card - UnionPay Debit EMV /Golootlo GoldRs. 700/Replacement of lost or damaged card (PrePay)Rs. 350/REPORTS & CERTIFICATESConfirmation of Balance to auditorsRs. 200/- per certificateObtaining credit reports on behalf of customerRs. 200/- per certificateCertificate regarding profit paid and tax deductedRs. 200/- per certificateduring the yearFinancial/Credit worthiness certificatesRs. 200/- per certificateProceeds Realization Certificate and EncashmentRs. 500/- per certificateCertificatesRs. 200/- per certificateBalance Confirmation certificateWHT CertificatesFreeRs. 200/- per certificateZakat CertificatesRs. 200/- per certificateOther CertificatesRs. 500/- over 1 yearProceeds Realization Certificate (Home Remittance)PKR 500/- for Duplicate IssuanceFOREIGN EXCHANGE PERMITSInitial RemittanceRs. 1,200/- per certificateSubsequent RemittancesRs. 500/- per certificateCOURIER & OTHER MISCELLANEOUSAt actualTelegram ChargesRs. 100/Courier InlandRs. 1,000/Courier ForeignRs. 200/Telephone ChargesRs. 200/Fax ChargesStamp paperAt actualBrinks charges where applicableAt actualReturn Mail chargesRs. 50/SMS BANKING PUSH/PULL SERVICESConsumer Asset Accounts (Auto/ Home)Upto Rs. 100/- per monthRs. 150/Per monthConsumer Retail AccountsRs. 780/Half yearly*(Individual Accounts)Rs. 1,550/Yearly*Upto Rs. 500/-per monthCompany Accounts* SMS Alerts on all ADC Channels/Products are free of charge”INTERNET BANKING / MOBILE BANKINGMonthly Service ChargesFreeStatement of AccountFreeAccount SummaryFree5

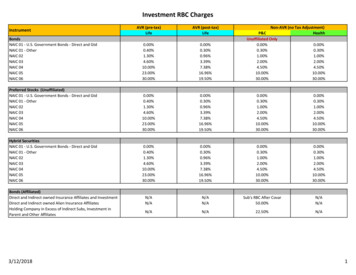

Schedule of Charges (January to June 2020)GENERAL BANKINGItemsChargesItemsINTERNET BANKING / MOBILE BANKINGFreeMini-statementFunds Transfer (Intra-Bank)SWIFT Remittance Request 20Utility Bill PaymentCheque Book Issuance RequestFreeGovernment Taxes /FBR TaxCollection Fee (Through Internetbanking / Mobile App/ ATM)Request for Issuance of PO / DDBook Fixed DepositsFreeMobile Top-up-as and whenthe service is offeredChargesFreeFreeUpto 100,000 Rs.10100,001- 1 M Rs.20Above 1 M Rs.50FreeFreeGENERAL BANKINGItemsINTER BANK FUND TRANSFER FACILITY (IBFT)*Silver/ Gold/Internet Banking/ Mobile AppPlatinum/ Signature & PayPakSilver/ Gold/ PayPak CardATMMPOSChargesPKR 90PKR 90PKR 275Note: All Charges are inclusive of FED & Switch Charges, FED applicable as per law. Chargesapply to All Scheme Cards as per product classification.BASIC BANKING ACCOUNT2 deposit transactions and 2 chequing withdrawals are allowed, free of charge. However,any subsequent deposit or withdrawal transaction will be charged at Rs. 100/- per transaction.INVESTOR PORTFOLIO SECURITIES ACCOUNT (IPS)0.25% of Investment Amount,Min: Rs. 2,500/- Max: Rs. 5,000/-Holding charges per annumAd Hoc Account StatementRs. 100/- eachTransaction Charges (Sale/Purchase)Rs. 500/- per transactionSecurity MovementRs. 500/- per transactionRTGSDays3rd Party Fund TransfersThrough PRISM SystemMonday(RTGS)toFridayTransactionTime Windows9:00AM to2:00 PM2:01PM to3:00 PM3:01 PM to4:30 PMPer TransactionCharges (PKR) SBPDIBPLCharges200/-20/-300/-30/-500/-50/-DIBPL - DOMESTIC MONEY TRANSFERTransaction SlabsRs. 1/- – 1000/Rs. 2,501/- – 4,000/Rs. 6,001/- – 8,000/Rs. 10,001/- – 13,000/-Charges*Transaction SlabsRs. 60/- Rs. 1001/- – 2500/Rs. 170/- Rs. 4,001/- – 6,000/Rs. 290/- Rs. 8,001/- – 10000/Rs. 375/- Rs. 13,001/- – 15,000/-* Inclusive of 16% Federal Excise Duty6Charges*Rs. 120/Rs. 240/Rs. 350/Rs. 400/-

Schedule of Charges (January to June 2020)DIGITAL WALLETItemsBill PaymentFreeChargesAir Time Top UpFreeIBFT Send35Wallet to WalletFreeNew Card550Card Renewal55050-250Virtual CardBased on Validity PeriodWallet to Other Wallet35Card Replacement Fees250Cash Withdrawl 1 Link18.75Wallet to CNIC35NIC to WalletFreeWallet to Bank AccountFreeInternational Home RemittanceFreeEWA Transactions3007

Schedule of Charges (January to June 2020)WAJAHASIGNATURE PLUSDeposit10M Checking /3M Checking /20M Overall6M OverallMonthly Average Balance Monthly Average BalanceAuto Finance5M & AboveHome Finance30M & AbovePersonal Finance2M & AboveBanca - Regular PremiumContribution in 1st Year800k & AboveExclusive ServicesSIGNATURE20M & Above500k & AboveFree VISA Signature Debit Card Free VISA Signature Debit CardFree Priority Pass**Complimentary Annual Membership & Unlimited Visits for Wajaha SIG PLUS MembersUpto 8-Guest Visits Accommodation in a Calendar Year, charges will be applicable onactuals on guest visits.BRANCH BANKING SERVICESCheque Book Issuance (Charges thesame for all eventualities includingloss of cheque book)FreeStop payment of chequeFreeCharges of cheque returned unpaidFreeDDs, MTs and TTs (Within Network)FreeDDs, MTs and TTs against Cash for Account HolderFreeTelex/SWIFT Charges - DomesticFreePay Order Issuance from accountFreeStop Payment/Caution Marking of DD, POFreeIssuance of foreign currency duplicate demand draft (FDD)FreeCancellation of FDDFreeUSD clearing through NIFTRs.250/Same day clearing of high value instruments via NIFTRs.250/Standing Instructions Charges per TransactionFreeStatement of Account (On ad hoc basis)FreeConfirmation of balance to auditorsFreeProfit and Tax CertificateFreeBalance Confirmation CertificateFreeZakat eeFreeRs.250/Rs.250/FreeFreeFreeFreeFreeFreeADC SERVICESFreeFreeSMS Alert ChargesPrimary Card - Annual FeeATM Balance InquiryATM Mini StatementATM Cash WithdrawalReplacement of lost or damaged ee8

Schedule of Charges (January to June 2020)LOCKER FACILITYSIGNATURE PLUS SIGNATUROne Time - Security DepositFreeFree1,8001,500SERVICE FEEService Fee (Membership Fee)50% Processing & Verification fee waiver on Consumer Finance Products uponmaintaining applicable customer categories for last three months.Service Fee (Membership Fee) will be applicable on monthly basis in case abovementioned Deposit, Financing or Bancassurance thresholds are not met.Note:In case of non - maintenance of Wajaha Priority Banking required thresholds, all Local andInternational airport lounge charges will be recovered on actual from the customer onMonthly Basis.All guests accompanying the Visa Signature Debit Card holders will be charged 27 pervisit to Local and International airport lounges.All required deposit thresholds are on Common/General Mudarbah Pool based relationship.All Signature Debit Cardholders are eligible for 8 Free Lounge Visits per year. Howeverafter 1st Lounge Visit, Cardholder needs to perform at least 1 International Transactionof minimum 1 to be eligible for remaining 7 complimentary lounge visits. OnceCardholder has availed all 8 Visits in a calendar year, Cardholder will be charged with 27for each visit there onwards.Consumer Finance thresholds mentioned above are on outstanding basis.Correspondent charges where applicable are at actual.9

Exclusive BankingSchedule of Charges (January to June 2020)AAYANAAYANPKR. 250,000 CASAor1M OverallMonthly Average BalanceDepositAuto Finance2.5 M & AboveHome Finance10 M & Above1 M & AbovePersonal FinanceBanca - Regular Premium Contribution in 1st YearBRANCH BANKING SERVICES100 k & AboveAAYANCheque BookFreePayordersFreeStatement of Account (On ad hoc basis)Free*Free Cheque Book, Up to 5 free Payorders per month and free Statement ofAccount (On ad hoc basis) will be applicable upon maintaining CASA PKR 250,000SERVICE FEEAAYAN500Service Fee (Membership Fee)25% Processing & Verification fee waiver on Consumer Finance Products uponmaintaining applicable customer categories for last three months.Note:In case of non - maintenance of Aayan Exclusive Banking required thresholds, allLocal and International airport lounge charges will be recovered on actual from thecustomer account on Monthly Basis.All required deposit thresholds are on Common/General Mudarbah Pool basedrelationship.Service Fee (Membership Fee) will be applicable on monthly basis in case abovementioned Deposit, Financing or Bancassurance thresholds are not met.Consumer Finance thresholds mentioned above are on outstanding basis.10

Schedule of Charges (January to June 2020)ENTITY SEGMENTTier-1Tier-2CASA Deposit1M CheckingMonthly AverageBalance10M CheckingMonthly AverageBalanceFreeFreeFreeFreeFree*FreeBRANCH BANKING SERVICESCheque BookPayordersCorporate Internet BankingSame Day ClearingAs per SOC*Installation, Initial Training & Transaction View11

Open a World of Solutions Unlimited number of withdrawals and deposits Free access to Dubai Islamic Internet BankingThe better way to bankCall Now: 111-786-DIB (342)

Schedule of Charges (January to June 2020)CONSUMER FINANCEItemsApplication Processing ChargesChargesHOME FINANCEUpto Rs. 25,000/-Overseas Pakistani - Application Processing Charges Upto Rs. 50,000/-*Property Appraisal ChargesAt actual / Upto Rs. 5,000/-Legal ChargesAt actual / Upto Rs. 10,000/-Income Estimation ChargesAt actual / Upto Rs. 10,000/-Title Documents Verification ChargesAt actual / Upto Rs. 10,000/-Property Takaful ChargesAs per the rate quoted by theTakaful CompanyCheque Return ChargesUpto Rs. 1,000/-Late Payment Charges*Upto 20% of the monthly rentoverdueIn case of Early SettlementPurchase price to be calculated as perfollowing formula:Outstanding fixed rental accrued andunpaid Variable Rental accrued andunpaid supplementary rental (if any) a sum equal to a maximum of 20% ofthe outstanding fixed rentalIn case of Partial SettlementPurchase price to be calculated as perfollowing formula:Partial settlement Portion of theoutstanding fixed rental accruedand unpaid Variable Rental accruedand unpaid Supplementary Rental (ifany) a sum equal to a maximum of5% of the Outstanding Fixed RentalPartial Settlement Processing ChargesUpto Rs. 5,000/-Finance Enhancement Processing ChargesUpto Rs. 10,200/-Asset Repossession ChargesAt ActualDuplicate Payment Schedule Issuance ChargesRs. 1,000/-Document Retrieval ChargesRs. 1,000/-Tax Certificate Issuance ChargesRs. 1,000/-Request for change In Financing TenorUpto Rs. 10,000/-Product Switching Charges to Relevant KIBOR**Upto Rs. 40,000/-Cash / Cheque Pick-up chargesCash Pick-up: Rs. 2,000/- andCheque Pick-up: Rs. 1,000/-Late payment charges will be transfered to the Charity Fund, as per the undertaking topay charity by the customer.** To be included in the subsequent first rental after execution of product switching request13

Schedule of Charges (January to June 2020)

POS & Internet Purchase 4.0% per transaction International Cash Withdrawal and POS Transactions Confirmation of Balance to auditors Obtaining credit reports on behalf of customer Certificate regarding profit paid and tax deducted . Brinks