Transcription

FEBRUARY 9VOLUMETHREEAN EVENING SUN PUBLICATIONNBT Bank is a lifeline for communityand local businessesChenango UnitedWay raised morethan 140,000 forCOVID relief in 2020BY ZACHARY MESECKEvening Sun Reporterzmeseck@evesun.comNBT partnered with Morrisville College to distribute food at events held in 2020. NBT and their staff worked witha number of local organizations and businesses to support food distribution and other relief efforts.relief programs.“COVID made us focuson what’s most important,our employees, our cusNORWICH - As thetomers, and our communirepercussionsoftheCOVID-19 health crisis ties, and that’s where ourtook effect, NBT Bank investment was targeted.found itself at the center of It was technology-based inthe response as businesses terms of ensuring that weand customers turned to had all the products andtheir financial advisors on services that our customhow to weather the eco- ers need to use in this kindnomic fallout and navigate of environment, so we didBY TYLER MURPHYEvening Sun Managing Editortmurphy@evesun.coma very significant upgradeinto our mobile platform,”said NBT Bank Presidentand CEO John H. Watt, Jr.NBT made all its basicservices available on areal-time basis through anupgraded mobile app, socustomers could get thesame services as if theywere at their local bank.The bank had been investing in technology andonline services for a number of years before the pandemic, following a trendof demand coming froman increasingly tech-savvycustomer base. Being wellpositioned with technology, at least when it came toonline customer services,the bank had a solid foundation to expanded upon.“We had a mobile platContinued on Page 16Chenango Health Network adapts with newleadership and planningChenango Health Network Director Kimberly A. Lorraine and Mental Health First Aid Instructor Christine Pauldemonstrates what a virtual call could look like with their office as they adapt to the pandemic. (Screenshot byZachary Meseck)information.According to ChenangoHealth Network DirectorKimberly A. Lorraine,CHENANGO COUNTY Chenango Health Network– The Chenango Health is a rural health networkNetwork adapted to the whose objectives are tochallenges of the pan- increase access to healthdemic, providing a variety and wellness informationof services for Chenango and to health care services.County and people in needLorraine said the netof health and wellness work serves individualsBY ZACHARY MESECKEvening Sun Reporterzmeseck@evesun.comand works to effect changeat the community level.“ChenangoHealthNetwork operates collaboratively,” said Lorraine.“With our partners, weidentify needs and lookfor ways to address thoseneeds, all in keeping withour goals and objectives.”“The Board of Directorsis committed to maintain-ing a health network, whichprovides meaningful service to the community, andstaff members are dedicated to carrying out theseservices with integrity andrespect.”Shesaidstartingher role as director forChenango Health Networkat the beginning of theContinued on Page 20C H E N A N G OCOUNTY – ChenangoUnited Way worked withthe community throughout 2020, continuing services to people in need,raising funds for localnonprofits, and successfully leading COVID-19response efforts.According to ChenangoUnited Way Executive Director Elizabeth Monaco, 2020was an incredibly difficult year for nonprofits in thearea, but with incredible generosity from its community they were able to continue providing services to thepeople in need.Monaco said some of the focuses for the organization include education, financial stability, and health.She said those goals are met in part by United Way’swork with local nonprofits, and many of the peoplewho are struggling are working class families known asALICE families.“ALICE stands for Asset Limited, IncomeConstrained, Employed and these are families that earnmore than the Federal Poverty Level, but less than thebasic cost of living,” said Monaco. “Combined, the number of ALICE and poverty-level households equals thetotal population struggling to afford basic needs.”In 2020, Chenango United Way raised more than 428,000 and funded 19 programs along with fourcommunity impact initiatives.Monaco said those funds help people in needall throughout Chenango County, and all donationsreceived stay local.“We are local, and will always be local,” she said.“This year’s campaign was really tough, in December wewere at about 60 percent of our goal, but we managedto reach 95 percent with some incredibly generous lastminute donations.”“Campaign is always important because our organizations rely on it every year, but this year to have raisedjust under 140,000 on top of that for COVID relief isincredible.”She added that Chenango County continues to proveto be a really caring and generous area, even when thetimes get tough and there’s a global pandemic.“We were asked to open the COVID relief fundliterally the week that the governor shut everythingdown, and we were shocked by the number of requestswe received when we did,” said Monaco. “We’ve donedisaster relief funds in the past, but this one was by farone of our largest.”Monaco said to help determine the greatest needsin the area, Chenango United Way teamed up with multiple other organizations to create the Chenango AreaRecovery Team (CART). She said the team was initiallyformed in 2006 and reused after major floods occurredin the area, but that it proved to be incredibly beneficialfor COVID-19 response as well.“Anyone who is dealing with COVID communityneeds meets each week as part of the CART team, andwe discuss everything from recent changes from thegovernor’s office to growing needs in the community,”she added. “I really loved to watch people reachingout to collaborate with each other, sharing volunteers,sharing resources, and figuring out ways to help oneanother.”“That for me has been amazing and probably themost engaging part of the year.”Monaco said it was rewarding to see groups thatdon’t traditionally work together, teaming up to figureout how to deal with this pandemic.Continued on Page 19

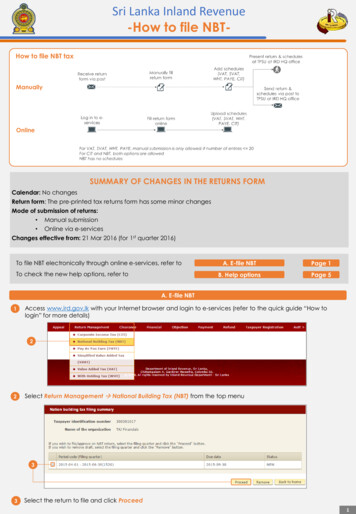

16 PROGRESS CHENANGOFEBURARY 9, 2021NBT Bank is a lifeline forcommunity and local businesses –Norwich Pharmaceuticals isproud to be a communitypartner in Chenango Countyfor over 130 years.6826 State Highway 12Norwich, NY 13815www.norwichpharma.comNBT Bank President and CEO John H. Watt, Jr.an essential service duringContinued from Page 15the lockdown, so NBTform that we enhanced also invested in installingand that made us accessi- safety equipment at theirble to customers who did facilities. They installednot want to take the risk plexiglass, adopted CDCof being out and about or advised policies such asin our branch bodies. That social distancing, and purwas very significant and it chased personal protectivehad been planned for years gear for onsite staff. Theyand we accelerated it to deployed the measuresmake sure that it was avail- across all 142 branchesable on a timely basis,” and at their core operaWatt said.tions centers in Norwich,Making adjustments Oneida and Canajoharie.for staff to perform their“A lot of the playbookwork roles online was more for 2020 was kind of nullof a challenge, so NBT and void come March,”Bank made significant said NBT Executive Viceinvestments to support a President and Consumingremote working environ- Lending Executive Shaunament. With more than a M. Hyle.1,000-plusemployees,She said NBT Bank wasWatt said it was critical committed to improvingthat staff working remotely its online consumer lendhad a reliable technology ing space. “We planned toplatform and that required implement a brand-newNBT Bank to invest in a platform for all of our homenumber of upgrades.loans and this enables ourThe bank bought 750 borrowers and customenhanced laptop comput- ers to have an enhanceders. “To replace the equip- online application portal.ment that some of our folks That allows them visibiliwere using at home that ty into the status of theirwas less user-friendly,” he loans, and ultimately, getexplained.them to the closing tableThe bank sought to keep more quickly.”staff feeling closer whereCOVID accelerated thepossible, favoring face-to- adoption of digital serface virtual engagements.vices. She said this was“So, you know there’s even more important in a750 people who have the suddenly changing marketcapacity to do what we’re with low interest rates anddoing right now, which is to an all-time high for mortparticipate in virtual meet- gages.ings in real time, live faces“Getting out ahead ofon the screen. It’s really that continued commitimportant to their produc- ment to investment wasreally important, and wetivity level,” said Watt.Banking was deemed really profited,” said Hyle.Thebankalsoembraced the signing oflegal contracts digitally, through a secure platform called DocuSign. Themove was ahead of others in the industry duringCOVID and was anotherexample of the how investing in technology had paidoff greatly during the pandemic.NBT Bank was also oneof the first banks able todevelop secure online signatures for most servicesby March of 2020.“Not all banks had gotten there by March 2020,”said Watt. “We were inthe final stages of gettingthere but it was takingtime, so we acceleratedthat because we wanted tomake sure our customerswere safe and did not haveto come to a conferenceroom to sign mortgagedocuments and could usethe DocuSign technologyto sign other contracts withus and again allow digitallyto provide efficiency andsafety,” said Watt.Advice on PPP loansand reliefOne of the key roles NBTBank played for many washelping businesses applyfor Paycheck ProtectionProgram, or PPP loans,that were passed as part ofa relief measure by the federal government. Part ofthat relief helped provideadditional employmentbenefits to laid off workers and spared businessesadditional expenses.“We made over 3,000PPP loans for 540 milliondollars and those loanssupported over 60,000jobs,” said Watt. Many ofthose jobs and businesseswere here in ChenangoCounty. Most recently,round three of the PPPloans began on Jan. 19.“Our focus is on MainStreet here, to ensure thatrestaurants and otherretail businesses that areseverely impacted by thepandemic have a bridgeto the other side of thevaccine and a bridge to anopportunity to recover,”said Watt.Calls came in to thebank from customersasking, “How do I openContinued on Page 17

FEBRURARY 9, 2021PROGRESS CHENANGO stepped up on our teamto ensure those customersare supported,” he said.A number of businesses without comparable knowledge or theresources to keep up withthe offered relief turnedto NBT for help to ensuretheir employees could getaid. He said the bank tookthose confidences veryseriously and knew thecommunity was looking tothem for help.“We are glad we couldbe that trusted advisorand you don’t earn thatposition easily. Your reputation out there is on theline and we’ve got to makesure we’re giving you theright advice because it’sreally critical to your success,” said Watt. “We haveto earn that respect everyday.”Continued from Page 16my business digitally andsafely?”The bank trained staffto respond to COVIDrelated relief calls. Staff atthe bank’s call centers allbegan working remotely,and answered customers’questions from first-handexperience, with the banklearning from its ownadaptations and sharingits technology and knowhow with smaller areabusinesses.“It was seamless andyou would not knowwhere they were sitting,”said Watt. The bankhelped small businesses and commercial customers adapt to the sametechnology and challenges. NBT provided theironline banking platformto ensure clients couldhandle deposits, loansand withdrawals throughthe website, or on mobiledevices.“Quite frankly, therewere no glitches of anymateriality or significancewhile we were doing that,”said Watt, praising thebank’s staff.While working and providing services remotelywas a relatively great success, Watt said it was notas sustainable or as productive as working alongside one another.“Over the long run, weneed to get back togetheras a team once it’s safefor us to do that, and weintend to do that. And, Ithink that will ensure longer term, higher levels ofproductivity, but in theshort run everybody hasA pandemic plan inwaitingIn mid-March of 2020,it became apparent that theworld was going to significantly change as New YorkState issued shelter in placeorders and businesses triedto work remotely.“Our technology platform allowed us to migrateto those environments, butwe have a very, very detailedand living contingency planand disaster recovery plan,which dictates how weaddress various kinds of challenges. Clearly a pandemicwould be one we plan for,”said Watt.About 10 years ago U.S.regulators raised an alarmfollowing an outbreak of a flulike virus from Hong Kong,and they told larger financialinstitutions to develop emergency plans just in case. SoJewelry Repair& Stone SettingNBT bank had a pre-established pandemic plan thatcalled on a committee ofexperts to review and executea response.The committee is led bythe bank’s chief risk officerand cybersecurity officers.“It brings together all ofthe various constituenciesacross the bank and there is avery thoughtful and ordereditinerary and agenda of itemsthat we review to determinethe safety and soundness andsecurity of the banking platform and then of our employees and then of our customers. It maps what we need todo going forward,” explainedWatt.The committee quickly formed and tailored theirplan to respond specifically tothe fall-out from COVID.“Clearly everybody wasat a heightened sense ofconcern because nobodyknew what it meant to be inan environment like that,”said Watt. “You know, weall have to sit there and takea deep breath and remember that we are responsiblefor half a million customers,275,000 plan participantsin our Retirement ServicesAdministration business,almost 2,000 employeesand that’s a very, very significant responsibility thatall of us take very seriously,”he said.The plan the bank cameup with closed the lobbies atthe branches and focused ondrive-up or walk-up service,along with using the mobiletechnology to substitute forin person transactions.“All those things andthousands and thousandsof other contingencies wereplanned for in countlessmeetings that turned outto be very successful andallowed us to continue to bea high performing bank andto service all of our customer needs,” said Watt.“I just can’t emphasizeenough that I think that theworld ended as we knew itand the first thing we triedto do was focus on the safetyof our employees and thenfollowed shortly thereafterwith the customers,” addedHyle.She said within twoweeks NBT had removedsales staff from externalsites, upgraded equipmentand had almost all theiremployees working fromhome.As employees wentremote, they all had todepend on their privatehousehold internet access todo work. Though most wereable, some living in ruralparts of Chenango Countyhad poor or no internet service available. Like many inthe county facing this issue,workers without reliableinternet were more likely tohave to do on-site work orbe laid off. Fortunately, thebank avoided the latter.“I think most of our people were able to work fromhome,” said Hyle. “Therewere some functions thatneeded to be performedin person at the bank, sothere were some essentialemployees in the building.Moving some paperworkaround that still exists insome of our processes, scanning documents, taking inmail. Those things werestaffed, and if folks didn’thave internet – and I thinkthere was a handful of folksthat have some internet con-Shauna M. Hyle, NBT Executive Vice President,Consumer Lending.nectivity issues – those werethe ones that would volunteer to be in the building,”Hyle said.Those coming into workhad to take temperaturechecks, observe social distancing and wear masks,along with other guidelines.The bank conducted dailycleanings of the work environments.“So, we felt really goodabout the environment thatthey were operating in. Itgave them an opportunity tostill contribute,” said Hyle.“Implied in the questionabout the internet is whatis the resiliency of ruralbroadband in the marketswe serve and what did welearn there? There are certainly areas in our territorythat definitely need to beenhanced,” said Watt.He said stimulus reformpassed by the Congress hadrural broadband supportincluded. “We as businessleaders need to ensure thatit’s properly distributed. Ithink in this next round ofstimulus that the presidentis talking about there will bemore money for that, andit’s really important, notonly for our employees butfor our customers.”NBT Bank is a majoradvocate for expandinginternet service in ruralareas they operate in. “Forthe most part the systemworks for us, but there werea couple of gaps,” he saidof Chenango County.Customers abovethe bottom lineAs the economic falloutContinued on Page 18LLC All Repairs Are Done On The Premises Custom Jewelry-Design Work Platinum Jewelry Gold Jewelry Silver JewelryEnjoy David Gantt OriginalsCast Your Unwanted Gold into JewelryAt the light in Downtown OxfordSherburne Jewelers42 North Main St., Sherburne, NY607-674-4944Hours: Tues. – Fri. 10 am – 3 pm;Sat. 10 am – 12 pmCall for appointments and holiday hoursDavid GanttCustom Jeweler Since 1981Sherburne Jewelers Since 1987Specializingin Kitchenand BathRemodelingFeaturing the latest trends and design options in countertops,cabinets, lighting, tiles, fixtures and much more.QUALITYPRE-OWNEDCARS & TRUCKSCompleteMechanical ServiceComplete AutoCollision ------------------------------Military & Senior Citizen Discounts AvailableCall Today for a FREE Consultation607-745-791417Please Remember To Shop Locally!

18 PROGRESS CHENANGOFEBURARY 9, 2021NBT Bank is a lifeline for community and local businesses –Continued from Page 17from COVID became apparent, the bank realized manycustomers with loans orother payment obligationsmay have a harder timemeeting them.“Initially we assembled and looked at ourloans across the companyand determined what support we need to provide toour customers in terms ofrelief,” said Hyle.Within the first fewweeks before the stateissued a mandatory lockdown, NBT began offeringemergency deferral programs and waived many oftheir own fees.“That was one of ourmost important focuses inthe onset,” said Hyle.“So basically, if a customer or a borrower cameto us and said I’m beingimpacted by the pandemic-reduced hours, loss ofjob, daycare challenges,whatever it was, I’m beingimpacted by the pandemic,we offered them deferralson their loan payments sothey did not have to pay usfor a certain period of time,”she said.“What did that do?It provided security andrelief to customers whoweren’t sure how they’regoing to pay the rent andweren’t sure how theywere going to make theirfamily budget stretch in anenvironment where theyweren’t sure they weregoing to be employed,”added Watt.The bank issued reliefon car loans and mortgages. However, manyonly took temporary reliefand the peak of deferralrequest has passed, theysaid. Individual circumstances became clearerafter the initial lockdown,and many customers beganto recover.“Now the number ofbusinesses and individualswho have sought deferrals isthe minimum relative to thehigh point,” said Watt.“It was just great to beable to provide that safetynet for those folks and makeone less thing that they hadto worry about in the middle of everything else thatthey had to worry about,”Hyle added.NBT Bank handled overa billion dollars in loansthat needed to have somelevel of relief associatedwith them at certain points,but as businesses began toadjust to the new normalthe amount dropped significantly.Comparingon-timepayment ratios in January2021 to January 2020, thebank reported they werenearly the same, meaningmost were back on track.“What’s that tell us?The customers are feelingthat their jobs are secureand they have faith, andthey are able to make thei

work roles online was more of a challenge, so NBT Bank made significant investments to support a . helped small business-es and commerc