Transcription

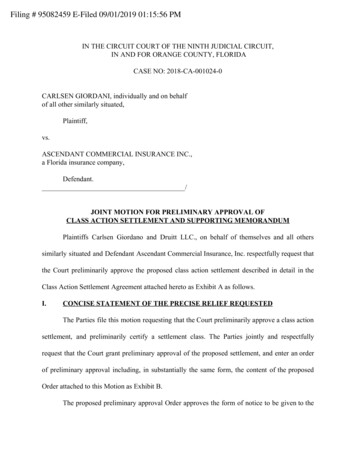

Filing # 95082459 E-Filed 09/01/2019 01:15:56 PMIN THE CIRCUIT COURT OF THE NINTH JUDICIAL CIRCUIT,IN AND FOR ORANGE COUNTY, FLORIDACASE NO: 2018-CA-001024-0CARLSEN GIORDANI, individually and on behalfof all other similarly situated,Plaintiff,vs.ASCENDANT COMMERCIAL INSURANCE INC.,a Florida insurance company,Defendant./JOINT MOTION FOR PRELIMINARY APPROVAL OFCLASS ACTION SETTLEMENT AND SUPPORTING MEMORANDUMPlaintiffs Carlsen Giordano and Druitt LLC., on behalf of themselves and all otherssimilarly situated and Defendant Ascendant Commercial Insurance, Inc. respectfully request thatthe Court preliminarily approve the proposed class action settlement described in detail in theClass Action Settlement Agreement attached hereto as Exhibit A as follows.I.CONCISE STATEMENT OF THE PRECISE RELIEF REQUESTEDThe Parties file this motion requesting that the Court preliminarily approve a class actionsettlement, and preliminarily certify a settlement class. The Parties jointly and respectfullyrequest that the Court grant preliminary approval of the proposed settlement, and enter an orderof preliminary approval including, in substantially the same form, the content of the proposedOrder attached to this Motion as Exhibit B.The proposed preliminary approval Order approves the form of notice to be given to the

class, establishes a scheduling process for the submission of any objections or requests forexclusion from the class, and provides for a fairness hearing to be held by the Court. Prior to thefairness hearing, the Parties will file another motion requesting final approval of the Settlement.II.STATEMENT OF THE BASIS FOR THE REQUESTThe Parties have reached a Settlement Agreement for the purpose of providing tomembers of a Settlement Class the payment of 6% sales tax, and tag transfer and title transferfees as provided in the Settlement Agreement.III .MEMORANDUM OF LEGAL AUTHORITYBACKGROUNDThe Parties reached the Agreement after more than a year of litigation, including adecision by the Court denying the Defendants’ Motion for Summary Judgment. The Parties alsoconducted a day-long mediation session with Ricardo Cata, Esq., followed by lengthy furthernegotiations.As the Court is aware, this case involves allegations that Defendant breached automobileinsurance policies issued to Plaintiffs and members of the proposed class by failing to include inpayments for insured total loss vehicle claims an amount for sales tax calculated based on theState sales tax of 6% that would be due on the purchase of a comparable vehicle as well asamounts representing mandatory fees for tag and title transfer. Amongst other defenses, theDefendant contended that Section 626.9743 Fla. Stat., is a part of the Policies at issue, and that,in particular, subsection (9) of the statute permits an insurer to defer payment of sales tax unlessand until the obligation has actually been incurred. Defendant also denied that tax transfer and2

title transfer fees are payable as part of the Actual Cash Value of the total loss vehicle.If they were to proceed through final judgment in this Court, and then an appeal to theFifth District Court of Appeals, both sides would bear substantial risk. The putative class wouldbear the risk of recovering nothing if class certification were denied or reversed on appeal, or ifthe Fifth District ruled in favor of the Defendant on the merits. Defendant would bear the risk ofhaving to pay the state sales tax and tag transfer and title transfer fees to the putative classmembers’, plus substantial interest and attorneys’ fees, if Plaintiffs prevailed on classcertification, at trial, and on appeal.THE PROPOSED SETTLEMENTThe proposed settlement requires Defendant to do the following: (1) make payment, to allsettlement class members, sales tax of 6% made a part of the agreed adjusted vehicle value of thetotal loss vehicle, plus state tag transfer fees of 4.60, and title transfer fees of 75.25, for a totalof 79.85 in transfer fees; (2) to pay attorneys’ fees, incentive awards and costs in the amount of 185,000; and (3) to pay the costs of the Class Administration. It should be noted that therecovery provides for payment to every class member to be paid the 6% sales tax, plus 100% ofmandatory tag and title fees claimed in the Complaint directly, without the need to submit aclaim.PRELIMINARY APPROVAL OF THE SETTLEMENT IS WARRANTEDPreliminary approval of a class action settlement is not binding, and it is granted unless aproposed settlement is obviously deficient. Smith v. Wm. Wrigley Jr. Co. , 2010 U.S. Dist.3

1LEXIS 67832, *6 (S.D. Fla. June 15, 2010).Preliminary approval is appropriate where theproposed settlement is the result of the parties’ good faith negotiations, there are no obviousdeficiencies and the settlement falls within the range of reason. Id . at *7. These requirements arereadily satisfied here, as demonstrated above and in the exhibits hereto. City of L.A. v.Bankrate, Inc. , 2016 U.S. Dist. LEXIS 115071, *14-15 (S.D. Fla. Aug. 24, 2016) (grantingpreliminary approval of proposed class action settlement where the proposed settlement wasmade after mediation was conducted, A[t]he negotiations appear to have been made in good faithand there do not appear to be any obvious deficiencies, and the settlement amount appears to bewithin the range of reasonableness); Almanzar v. Select Portfolio Servicing, Inc. , 2015 U.S Dist.LEXIS 178149, *5-6 (S.D. Fla. Oct. 15, 2015) (granting preliminary approval, finding thatproposed class action settlement was based on informed, good-faith, arms-length negotiationsbetween the Parties and their capable and experienced counsel, and settlement was within therange of reasonableness and possible judicial approval.).In deciding whether to grant preliminary approval, some courts have also made apreliminary inquiry into whether the requirements of Rule 1.220 for certification of a class forsettlement purposes are satisfied. Each of those requirements are satisfied here for settlementpurposes.The numerosity requirement is satisfied for purposes of settlement because Defendantshave produced records demonstrating that they determined that there are more than 269 members(policyholders) during the class period who had total loss auto claims in Florida and may be1Florida Rule of Civil Procedure is patterned on Rule 23 of the Federal Rules so Florida courts consider case lawinterpreting Rule 23 as persuasive. Broin v. Philip Morris Co . 641 So.2d 888, n.1 (Fla. 3 rd DCA 1994).4

entitled to additional payment for sales tax and tag/title fees as members of the proposedsettlement class.The commonality requirement is satisfied for purposes of settlement because there is acommon question of law regarding whether the Defendant was required to pay sales tax andtag/title fees at the time that Defendant made payment of the actual cash value of the vehicle,based on the cost of a vehicle comparable to the total loss vehicle. This issue applies to all of theclaims of the proposed settlement class and would be a central issue on an appeal if the case werefurther litigated. Defendants could also contest the source of all of the clients or the attorneys’award at the trial court or appellate level.The typicality requirement is satisfied for purposes of settlement because the NamedPlaintiffs’ claims are typical of those of the putative class members in that the classrepresentatives were not paid part or all of the State sales tax and tag/title transfer fees that areclaimed to be owed.The adequacy of representation requirement is satisfied for purposes of settlement.There is also no evidence that the Named Plaintiffs have any conflict of interest with theProposed Class, and the Proposed Class Counsel is experienced in class action litigation,including having been approved Class Counsel in numerous Federal Courts, on Class Actions, onthis exact issue.See Sos v. State Farm Mut. Automobile Ins. Co., M.D. Fla. Case No.6:17-cv-890-Orl.-40-KRS; Rothv. GEICO General Ins. Co. , S.D. Fla. Case No.16-62942-Civ.-DIMITROULEAS; Jones, et al., v. GEICO General Ins. Co., et. al., M.D. Fla.Case No. 6:17-cv-891-Orl-40LRH, and Joffe, et al., v. GEICO Indemnity Company, et al., CaseNo. 18-61361-CIV-DIMITROULEAS/SNOW.5

With respect to the requirements of Fla. R. Civ. P. 1.220(b)(3), for purposes of thissettlement, common questions of law or fact predominate over any questions affecting onlyindividual members, and a class action is superior to other available methods for fairly andefficiently adjudicating the controversy. Given that Defendant has, by agreeing to the proposedSettlement, agreed to make payments of additional sales tax and tag/title fees in amounts basedonly upon the vehicle valuations that were previously performed, and have effectively waived,for purposes of settlement, any opportunity they may have to present evidence with regard tovehicle valuations, individualized questions do not predominate and a class action is superior toother available methods of adjudication.CONCLUSIONThe parties jointly and respectfully request that the Court grant preliminary approval ofthe proposed Settlement, and enter an order of preliminary approval including, in substantiallythe same form, the content of the proposed Order attached as Exhibit B to Agreement.The proposed preliminary approval Order approves the form of notice to be given to theClass, establishes a schedule and process for the submission of any objections or request forexclusion from the class, and provides for a fairness hearing to be held by the Court. The Partiesanticipate later requesting final approval of the settlement in advance of the fairness hearing.Dated September 1, 2019/s/ Wendy J. Stein FultonFBN: 389552Bonner Kiernan Trebach& Crociata, LLP110 East Broward Boulevard/s/ Ed NormandEdmund A. NormandFBN: 865590Jacob L. PhillipsFBN: 1201306

Suite 1700Fort Lauderdale, Florida 33301Telephone: 954-308-8100Facsimile: rkiernan.comNormand PLLC3165 McCrory Place, Ste. 175Orlando, FL 32803Tel: ndpllc.comservice@normandpllc.comCounsel for Ascendant CommercialInsurance, Inc.Christopher J. LynchFBN: 3310416915 Red Road, Suite 208Coral Gables, FL 33143Tel: terlynchlaw.comCounsel for Plaintiffs7

SETTLEMENT AGREEMENT AND RELEASEThis Settlement Agreement and Release (the "Settlement Agreement") is made and enteredinto this day of September, 2019, by and among Plaintiffs, Carlsen Giordani and Druitt,LLC (“Plaintiffs”), individually and on behalf of the Settlement Class; and Defendant, AscendantCommercial Insurance, Inc. (“Ascendant”), subject to preliminary and final approval as requiredby Rule 1.220 of the Florida Rules of Civil Procedure. As provided herein, Plaintiffs, ClassCounsel and Ascendant hereby stipulate and agree that, in consideration for the promises andcovenants set forth in this Agreement and upon entry by the Court of a Final Order and Judgment,all claims of the Settlement Class against Ascendant in the action titled, Giordani v. Ascendant(the “Action”) shall be settled and compromised upon the terms and conditions contained herein.I.Recitals1.On April 11, 2018 this litigation was filed against Ascendant alleging breach of contractfor allegedly failing to pay sales tax, and tag and title transfer fees for total loss automobileclaims, and seeking, inter alia, monetary damages.2.Class Counsel served written discovery and documents requests on Ascendant and took thedeposition of Ascendant. Ascendant also filed a Motion for Summary Judgment which wasbriefed by the parties, heard, and ultimately denied.3.Based on the Parties’ grasp of the relative strengths and weaknesses of their cases throughdiscovery, on May 16, 2019, the Parties mediated this matter. Negotiations continuedthrough the present for formal class wide settlement discussions, resulting in an agreementin principle to settle the Action.4.Following further negotiations and discussions, the Parties resolved all remaining issues,culminating in this Agreement.EXHIBIT A

5.The Parties now agree to settle the Action in its entirety, without any admission of liability,with respect to all Released Claims, as defined below. The Parties intend this Agreementto bind Plaintiffs, Ascendant, and all members of the Settlement Class who do not timelyrequest to be excluded from the settlement.NOW, THEREFORE, in light of the foregoing, for good and valuable consideration, thereceipt of which is hereby mutually acknowledged, the Parties agree, subject to approval by theCourt, as follows:II.DefinitionsIn addition to the terms defined at various points within this Agreement, the followingDefined Terms apply throughout this Agreement:6.“Action” means Carlsen Giordani, and Druitt, LLC, Individually and on behalf of allothers similarly Situated v. Ascendant Commercial Insurance, Inc., 9th Circuit Court Casein Orange County, Florida, Case No. 2018-CA-001024-O.7.“Class Counsel” means:Edmund A. NormandJacob L. PhillipsNormand PLLC3165 McCrory Place, Suite 175Orlando, FL 32803Christopher J. Lynch, PA6915 Red Road, Suite 208Coral Gables, FL 331438.“Class Period” means the period from April 11, 2013 through the date of this Agreement.9.“Class Representatives” means Carlsen Giordani and Druitt, LLC.10.“Court” means the Circuit Court in the Ninth Judicial Circuit in and for Orange County,Florida.2EXHIBIT A

11.“Effective Date” means the fifth business day after which all of the following events haveoccurred:a.The Court has entered without material change the Final Approved Order; andb.The time for seeking rehearing or appellate or other review has expired, and noappeal or petition for rehearing or review has been timely filed; or the Settlementis affirmed on appeal or review without material change, no other appeal or petitionfor rehearing or review is pending, and the time period during which further petitionfor hearing, review, appeal, or certiorari could be taken has finally expired andrelief from failure to file same is not available.12.“Final Approval” means the date that the Court enters an order and judgment granting finalapproval to the Settlement and determines the amount of fees, costs, and expenses awardedto Class Counsel and the amount of a Service Award to the Class Representative. Theproposed Final Approval Order, defined below, shall be in a form agreed upon by ClassCounsel and Ascendant. In the event that the Court issues separate orders addressing theforegoing matters, then Final Approval means the date of the last of such orders.13.“Final Approval Order” means the order and final judgment that the Court enters uponFinal Approval. In the event that the Court issues separate orders addressing the mattersconstituting Final Approval, then Final Approval Order includes all such orders.14.“Notice” means the notices of proposed class action settlement that the Parties will ask theCourt to approve in connection with the motion for preliminary approval of the Settlement.15.“Notice Program” means the methods provided for in this Agreement for giving the Noticeand consists of Mail Notice and Long-Form Notice. The forms of the proposed Notices3EXHIBIT A

agreed upon by the Class Counsel and Ascendant, subject to Court approval and/ormodification, are attached to the Settlement Agreement and Release.16.“Notice Administrator,” also known as “Escrow Agent,” means KCC Class Services(“KCC”). Class Counsel and Ascendant may, by agreement, substitute a differentorganization as Notice Administrator, subject to approval by the Court if the Court haspreviously approved the Settlement preliminarily or finally. In the absence of agreement,either Class Counsel or Ascendant may move the Court to substitute a differentorganization as Notice Administrator upon a showing that the responsibilities of NoticeAdministrator have not been adequately executed by the incumbent.17.“Opt-Out Period” means the period that begins the day after the earliest date on which theNotice is first mailed, and that ends no later than 30 days prior to the Final ApprovalHearing. The deadline for the Opt-Out period will be specified in the Notice.18.“Parties” means Plaintiffs and Ascendant.19.“Preliminary Approval” means the date that the Court enters, without material change, anorder preliminarily approving the Settlement in the form jointly agreed upon by the Parties.20.“Release Claims” means all claims to be released as specified in this Agreement. The“Releases” mean all of the releases contained in this Agreement.21.“Released Parties” means those persons and entities released as specified in the Releases.22.“Releasing Parties” means Plaintiffs and all Settlement Class Members who do not timelyand properly opt-out of the Settlement, and each of their respective executors,representatives, heirs, predecessors, assigns, beneficiaries, successors, bankruptcy trustees,guardians, joint tenants, tenants in common, tenants by the entireties, agents, attorneys, andall those who claim through them or on their behalf.4EXHIBIT A

23.“Settlement” means the settlement into which the Parties have entered to resolve theAction.24.“Settlement Administrator” means KCC.Class Counsel and Ascendant may, byagreement, substitute a different organization as Settlement Administrator, subject toapproval by the Court if the Court has previously approved the Settlement preliminarily orfinally. In the absence of agreement, either Class Counsel or Ascendant may move theCourt to substitute a different organization as Settlement Administrator upon a showingthat the responsibilities of Settlement Administrator have not been adequately executed bythe incumbent.25.“Settlement Class” is defined in paragraph 31 hereof.26.“Settlement Class Member” means any person included in the Settlement Class who doesnot opt-out of the Settlement.27.“Settlement Costs” means all costs incurred for notice and settlement administrationcosts,28.“Settlement Fund” means the 162,690.67 cash fund to be established pursuant to theAgreement.29.“Settlement Fund Payment” means the cash dollar amount of the Settlement Fund that eachSettlement Class Member will receive.30.“Tax Administrator” means KCC. Class Counsel and Ascendant may, by agreement,substitute a different organization as Tax Administrator, subject to approval by the Courtif the Court has previously approved the Settlement preliminarily or finally. In the absenceof agreement, either Class Counsel or Ascendant may move the Court to substitute adifferent organization as Tax Administrator upon a showing that the responsibilities of Tax5EXHIBIT A

Administrator have not been adequately executed by the incumbent.The TaxAdministrator will perform all tax-related services for the Settlement Fund Account asprovided in this Agreement.III.Certification of the Settlement Class31.For settlement purposes only, Plaintiffs and Ascendant agree to ask the Court to certify thefollowing “Settlement Class,” consisting of approximately 268 potential “Settlement ClassMembers” listed in the attached “Total Loss Claims Class Action – DIST” spreadsheet,under Rule 1.220 of the Florida Rules of Civil Procedure:All persons and entities in the State of Florida whose (1) vehicle was insured by Ascendantfrom April 13, 2013 to the present with a For Hire Policy or Commercial AutomobileCoverage, (2) experienced a total loss with their vehicle, and (3) were not paid theapplicable sales tax on the actual cash value of the total loss vehicle, 75.25 in title transferfees, or 4.60 in license plate (tag and registration) transfer fees by Ascendant. Thefollowing are excluded from the Settlement Class: (1) the trial judge presiding over thiscase; (2) Ascendant, as well as any parent, subsidiary, affiliate or control person ofAscendant, and the officers, directors, agents, servants or employees of Ascend

Commercial Insurance, Inc. (“Ascendant”), subject to preliminary and final approval as required by Rule 1.220 of the Florida Rules of Civil Procedure. As provided herein, Plaintiffs, Class Counsel and Ascendant hereby stipul