Transcription

Personal Finance ProgramLESSON11 Credit CardsTeacher BackgroundL“Comparing costs andbenefits of buying on creditis key to making a goodpurchase decision.”— Money Management Standards,Jump tart Coalition BenchmarksTopic 4Credit — AMatter of Trustooking at statistics one might easily see that the United States is a nation ofcredit card holders. According to a 2006 report, the nation’s credit card debtwas about 665 billion on bank credit cards and about 105 billion on othercredit cards. The average debt was about 9,300 per household holding at leastone card.* Approximately four out of five college students have either their owncredit card or access to their parent’s credit card.**One man in the U.S. made the Guinness Book of World Records by acquiring 1,358different credit cards.AdvantagesCosts and BenefitsCredit cards offer consumers a myriad ofadvantages including the convenienceof making purchases online, shoppingnow and paying over an extended periodof time, and gaining access to goods andservices in almost every country in theworld. Many credit cards even offer theadvantage of frequent flyer airline milesor a charitable contribution made inthe name of the cardholder each time apurchase is made. A credit card purchasecould help a college alumni association,an environmental organization, or areligious group. There are cards to meetthe needs of everyone, including securedcredit cards for those who have beenrejected for a card without a securitydeposit.In this lesson students will analyze thecosts and benefits of credit card purchases.They will complete a comparison shoppingactivity for credit cards that will prove thatnot all cards are created equal. They willbe able to explain interest (APR) anddescribe how the longer people take topay off balances, the more expensive thegoods and services they purchased.*www.cardweb.com and the Federal tatistics.htm103Siebert PFPOne activity in this lesson provides anopportunity for students to calculatethe amount of interest and fees thatcardholders could pay for an item.Students will understand that credit cardpurchases can be far more expensive thanthey thought.

Student Objectives Students will be able to compare and list the differences among four credit cards(i.e., fees, interest, credit limit). Students will be able to identify and provide examples of the costs and benefits of creditcard use. Students will be able to analyze potential pitfalls of credit card use for college studentsand other young adults. Students will be able to calculate the annual percentage rate (APR) and fees on a credit card.Materials Needed Student Handout 11-A, To Market, To Market: ComparisonShopping for a Credit Card Student Handout 11-B, Calculating the Cost of Credit Card Purchases Optional: Credit card marketing materials (especially those brochures and advertisementstargeting college students and young adults). Optional: Credit card application forms, sample credit card bills, and disclosurestatementsConnecting With the Internet www.bankrate.comBankrate.com. This site allows consumers to compare credit card rates. Online calculators alsoallow the user to calculate mortgage payments and earnings on certificates of deposit, estimatetheir credit scores, and determine how much money can be saved through refinancing. shtmChoosing and Using Credit Cards. The Federal Trade Commission (FTC) offers tips onshopping around for credit cards on this webpage. www.creditcardnation.com/cced.htmlCredit Card Nation’s 3-Step Credit Card Education Program introduces students toprudent credit card use. reditwiseCredit Wise. A website on establishing and building good credit for young adults developedby Mastercard. ters home.htmlMoney Talks Teen Guides. The University of California Cooperative Extension’s MoneyTalks guides offer guidance to young people about credit and credit cards.104Topic 4 CREDIT — A MATTER OF TRUSTSiebert PFP

www.practicalmoneyskills.com/english/at home/consumers/creditPractical Money Skills for Life, a financial literacy program from Visa, has a Credit Cardssection with worksheets, interactive statements, puzzles, and quizzes on credit card benefits,costs, choices, and pitfalls. www.studentcredit.com/learn.htmStudentCredit.com. Students can visit this website to learn the basics of credit cards andhow to manage them properly.Focus QuestionWhat are the pros and cons of using a credit card?Procedures . . .1Ask students to imagine how it is possibleto buy something they really want withoutusing money they have today (i.e., it isall about credit). Distribute and/or postadvertisements and brochures about creditcards. Have students go online and connectwith some of the suggested websites, ifcomputer access is available. Ask studentsto read and list what credit cards areoffering to consumers. They will use thisinformation later in the lesson to complete a“comparison shopping trip” for a credit card.In small groups, have students discuss howcredit card companies target or attract certainconsumers (i.e., college students and youngadults). Ask students to also describe anypersonal experience they have had withcredit cards.2Have students work in the same groups todiscuss and list advantages anddisadvantages of having a credit card.A composite list of advantages anddisadvantages can be posted. A samplestudent list could include:Advantages of Using Credit Cards Siebert PFPBuy clothes now and enjoy while stillpaying for them.Establish a credit record.Obtain cash advances when broke. Rent sports equipment, get cell phoneservice, and other things that require acredit card.Have funds available for emergencies.Enjoy a sense of having money to spend(i.e., well being).Earn special credit card bonuses likeairline frequent flyer mileage.Be able to act on the spur of the momentwithout money.Easily buy tickets to events (over thephone and via the Internet).Disadvantages of Using Credit Cards Paying more for a product or service (ifbalance is not paid off in full).Paying large interest charges and fees.Being tempted to spend too much (i.e.,living beyond one’s income).Suffering the stress of making payments.Paying off cards can become a hugefinancial burden.Paying for purchases continues long afterthey have been enjoyed.They can make it “too easy” to shop.Using one card to pay off another card(i.e., downward spiral).Minimum payments can mean years topay off the balance on some accounts.Credit card companies may charge a feejust for having the card.Lesson 11 CREDIT CARDS105

3Discuss the trade-offs involved in creditcard use and the responsibility of the cardholder. Explain how the first responsibilityfor people considering the use of credit cardsis to comparison shop (i.e., analyze fees,interest rates, credit limit, etc.).4Distribute Student Handout 11-A, ToMarket to Market — Comparison Shoppingfor a Credit Card. Students will completethe handout using the brochures andadvertisements or by going online to variousbank sites that offer credit cards. This can beassigned to a small group or individuals.5Read the directions on Student Handout 11‑Aand review terms on the comparison chart.Have the students report back their findingsby posting their charts for review by othersin the class. Ask what major differences theydiscovered from one credit card to another.Discuss the importance of reading the smallprint to determine the rate of interest, annualfees, and overlimit fees that are included.67Organize students to review and check eachother’s calculations on the cost of credit cardpurchases (Student Handout 11-B). Reviewthat there are costs and benefits to creditcard transactions. The cost to the consumerillustrated on the handout is 555.93(cumulative interest and fees for one year).At the end of the year, the balance in thatcredit card account is approximately 2,572.(See answer key for calculations below.)8Encourage students to make additionalcalculations. For example, after month 6,they could choose higher monthly paymentsand/or fewer purchases, and compare results.9Ask students to compare the total amount ofpurchases made during the year ( 1,380) tothe cumulative interest and fees ( 555.93).Have students discuss the opportunity cost ofnot paying off the credit card every month.What other things could have been purchasedwith the 555 paid in interest charges?10Summarize by having each studentparticipate in reviewing the advantages anddisadvantages of credit card use. Alsoemphasize the importance of consumers“shopping for credit cards” by analyzinginterest rates, all fees, and credit limits.Distribute Student Handout 11-B, Calculatingthe Cost of Credit Card Purchases. Askstudents to calculate what this cardholderwill have paid in interest and fees at the endof one year.Calculating the Cost of Credit Card Purchases(Answer Key to Student Handout es 3,000.00 3,009.00 2,969.14 2,928.68 2,887.61 2,845.92 2,803.61 2,760.66 2,717.07 2,672.83 2,627.92 2,572.34 200 200 200 200 200 200 200 200 200 200 200 200 115 115 115 115 115 115 115 115 115 115 115 115Topic 4 CREDIT — A MATTER OF TRUSTInterest& FeeInterest & Fee(Cumulative) 49.00 45.00 45.14 44.54 43.93 43.31 42.69 42.05 41.41 40.76 40.09 39.42 35.59 94.00 139.14 183.68 227.61 270.92 313.61 355.66 397.07 437.83 477.92 517.34 555.93CONNECTIONS TO THE CONTENTSTANDARDSNCEE Voluntary National Content Standardsin Economics:1, 2, and 7Jump tart CoalitionPersonal Financial Management Guidelines:IIa, IIf, IIIa, and IIIbSiebert PFP

Extendingthe Lessonhe LessonStudent Credit Card DebtStudents research and write reports on college student credit card debt. Ask studentsto consider the issues related to credit card companies providing cards to youngadults (college students without the current income to repay the amount theycharge). Credit Card Nation (www.creditcardnation.com) is a site where students canbegin their research. Other websites to research are www.studentcredit.com andwww.practicalmoneyskills.com. Students report their findings to the class.Secured Credit CardsSecured credit cards are tied to the amount a person has in savings. The card issecured by the funds. Students compare rates and fees on various “secured” creditcards. They should outline the advantages and disadvantages of secured credit cards.Ask students to list reasons why a consumer might apply for a secured credit card.Disclosure StatementsStudents in small groups analyze credit card disclosure statements and reportback to the class. They should identify and give examples why reading everything,including small print, is very important. By law, all credit card solicitations mustinclude a disclosure statement that highlights the exact terms and conditions underwhich credit will be extended. Terms in the disclosure footnotes can also includethe stipulation that the card-issuing bank reserves the right to change the accountterms (including APR) at any time for any reason. When a credit card is signed, thelaw assumes that the consumer reads everything on the disclosure statement andthat all terms and conditions are accepted.The disclosure statement is often referred to as the “Schumer box,” after New YorkSenator Charles Schumer. As a congressman, he was responsible for the enactmentof the Fair Credit and Charge Card Disclosure Act of 1988, which requires that allcredit card solicitations provide terms and conditions in a clear and conspicuousmanner and in the form of a table or box.Siebert PFPLesson 11 CREDIT CARDS107

Vocabularyannual feeA charge by some credit card companies for use ofthe card and services.annual percentage rate (APR)A rate that shows the total cost of credit annually. Itincludes a percentage of the principal as interest ona loan plus other costs (e.g., points on a mortgageloan, service charges).consumer debtDebt that has been incurred primarily for thepurchase of consumer goods.credit cardA plastic card with a magnetic stripe on one sidethat can be used to purchase goods and services.The issuing company records the purchases, billsthe purchaser, receives payment, and subsequentlysettles the purchaser’s debts with the providers ofgoods and services. Some credit cards offer cashadvances to its holders.credit ratingA formal evaluation of an individual’s or business’credit history and capability of repayingobligations by a credit reporting agency. The creditrating is based on the number of outstandingdebts and whether debts are being repaid in atimely manner.disclosure statementFor credit cards, the reporting of the exact terms andconditions under which credit will be extended priorto applicant signing up for the card.due dateOn a credit card account, the date by which theminimum payment must be received every month,without incurring a late fee or other penalty.108Topic 4 CREDIT — A MATTER OF TRUSTfinance chargeThe cost of credit, including interest paid by acustomer or a consumer for a consumer loan orcredit. Under the Truth in Lending Act, the financecharge must be disclosed to the customer inwriting. It may include other charges associatedwith credit transactions such as cash advance fees.grace periodThe time allowed for payment of a debt or loanwithout penalty.installment planA sum of money due as one of several equalpayments for a purchase spread over an agreedperiod of time.minimum paymentOn a credit card account or loan, a fixed percentageof the balance due which must be paid eachmonth.overlimit feeA fee that is added to a credit account when theamount owed exceeds the limit on the account.reloadable cardAn electronic, stored value card that permits a userto increase the value on the card (e.g., prepaidcredit card, store cash card). A nonreloadable cardhas a fixed value stored on it (e.g., disposablephone card).revolving creditSystem of retail credit (e.g., department store orbank credit cards) in which buyers make periodicpayments on purchases and service charges.The service charge is based on the outstandingbalance; if the buyer pays the entire balance ontime, no service charge accrues.secured credit cardA credit card that is secured against loss by otherassets (often by money placed in a savings accountwith the credit card company).Siebert PFP

Student Handout 11-ALesson 11: Credit CardsName of StudentTo Market, To MarketComparison Shopping for a Credit CardDirections:Read credit card brochures and disclosure statements, make phone calls, or go online to compare creditcard offers. A good rule is always to compare four or more credit cards before applying for one. Read all the small print on brochures or disclosure statements before you complete the chart.(Name of Company)Credit nk VisaNational WildlifeFederationWorking AssetsUnited AirlinesCapital OneMastercardAnnualFeeCredit Limit(if listed)APRMinimumPaymentGracePeriod1.2.3.4.List other types of terms and conditions you discovered while “shopping for a credit card.”Siebert PFP109

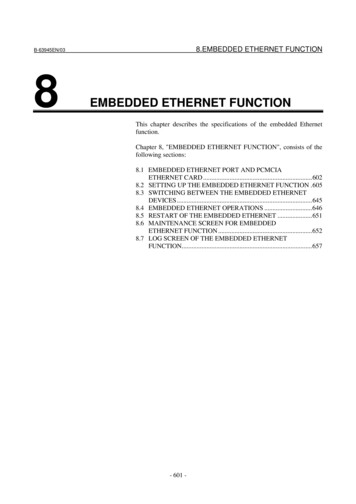

Student Handout 11-BLesson 11: Credit CardsName of StudentCalculating the Cost ofCredit Card PurchasesDirections:1Use the interest rate of 18% and an annual fee of 49 to complete this chart. In month 1, there was abalance due of 3,000. The borrower will make a monthly payment of 200 and keep new purchasesof goods and services at 115 per month for the year.2Calculate the interest for each month (balance x 1.5%). To obtain the balance for the next month,subtract the payment from the balance and add cost of new purchases plus monthly interest and fee.For example: 3,000 - 200 2800 115 94 3,009. (Note: The annual fee of 49 is paid onceeach year.)Interest rate: 18% (APR); 1.5% monthlyAnnual fee: 49MonthPurchasesInterest& Fee 3,000 200 115 49 452 3,009 200 115 45.143 2,969.14 200 115 44.5456789101112Siebert PFPPayments14110Balance 2,928.68 200Interest & Fee(Cumulative) 94 139.14 183.68 115 43.93 227.61 2,887.61 200 115 43.31 270.92 2,845.92 200 115 42.69 313.61 2,803.61 200 115 42.05 355.66 2,760.66 200 115 41.41 397.07 2,717.07 200 115 40.76 437.83 2,672.83 200 40.09 477.92 2,627.92 200 115 39.42 517.34 2,582.34 200 115 38.74 556.08 115

Personal Finance ProgramLESSON112010 Teacher Background UPDATECredit Cards The Credit Card Accountability,Responsibility, and Disclosure (CARD) ActNew rules under the CARD Act impact interest rates, fees,promotional terms, billing, and payments. The rules alsorequire credit card issuers to make disclosures that are clearlydefined and written in plain language for consumers. Under thelaw there are also new rules on how credit cards can be issuedand marketed to youth and young adults.The LegislationThe Credit Card Accountability,Responsibility, and Disclosure(CARD) Act was signed into lawby President Barack Obama onMay 22, 2009.Complete information on the provisions of the law (HR 267) canbe downloaded at www.federalreserve.gov/creditcard. As part of Lesson11, teachers might want to discuss some of the following provisions.PaymentsConsumers will have more time to pay their billsbecause the companies must mail the statements21 days before the due date and not 14 days,which had become customary. A payment abovethe minimum must now be applied to the debtthat carries the highest rate. Also consumers mustbe given the same billing due date each month,including provisions that if this date is a holidaythe amount is due on the next business day.The Plain Language of DisclosuresUnder the law credit card issuers must provideconsumers clear provisions of all termsbefore opening an account and on the billingstatements once an account is open. All billingstatements must inform consumers what itwould take to pay off the balance if they onlymade a minimum payment or how much theyshould pay each month to pay off the balance inthree years. The statements must also provide awarning about the fees or penalties of making aSiebert PFPlate payment. A section of a sample credit cardstatement that reflects some of these changes asmandated by the CARD Act may be found onpage 103-B.Youth and Young AdultsYoung people under 21 can no longer open creditcard accounts unless they are able to demonstratethat they are able to make the payments or havean adult co-signer. Young people who obtain acredit card with a co-signer must also obtain writtenpermission from that person if they are asking foran increase in their credit.Costs and BenefitsThe full enactment of the CARD Act of 2009goes into effect by August 22, 2010. A projectfor students could be to research and analyzehow the age provisions of the CARD Act areimpacting youth and young adults.Lesson 11 CREDIT CARDS103-A

Sample from Credit Card StatementFor more ment InformationNew BalanceMinimum Payment DuePayment Due DateThe Board of Governors of the Federal ReserveSystem has information on the new credit cardrules. 1,764.53 53.004/20/12Late Payment Warning: If we do not receive your minimumpayment by the date listed above, you may have to pay a 35late fee and your APRs may be increased up to the Penalty APRof 28.99%.The entire CARD Act (HR 267) can bedownloaded at: http://www.govtrack.us/congress/billtext.xpd?bill h111-627Minimum Payment Warning: If you make only the minimumpayment each period, you will pay more interest and it will takeyou longer to pay off your balance. For example:If you make noadditional charges usingthis credit card and eachmonth you pay.You will pay off thebalance shown onthis statement inabout .And you will endup paying anestimated totalof .Only the minimumpayment10 years 3,284 623 years 2,232(Savings 1,052)If you would like information about credit counseling services,call 1-800-XXX-XXXXX.Source: www.federalreserve.gov/creditcard103-BTop

www.practicalmoneyskills.com. Students report their findings to the class. Secured credit cards Secured credit cards are tied to the amount a person has in savings. The card is secured by the funds. Students compare rates and fees on various “secured” credit cards. They should outline the advantages an