Transcription

REPORTTitle: The Corner Store Retail AER PackagedRetrofit and Utility Incentive Program FinalFindingsReport Date: April 27, 2016Report Author: Leslie Billhymer (University ofPennsylvania)Funded by U.S. DOECBEI REPORT

ContentsProject IntroductionSmall Grocery MarketDirect Install ProgramsCorner Grocery Store Energy Project Final FindingsAbout this reportThe purpose of this report is to highlight the main project findings from the The Corner Store Retail AER Packaged Retrofitand Utility Incentive Program in a way that is accessible to the utility, policy, and energy efficiency services stakeholdersthe project is designed to support and inform. If the reader has inquiries related to the research or the content within, he orshe can reach out to the Principal Investigator, Leslie Billhymer, at leslieab@upenn.edu. This research was funded by theDepartment of Energy Building Technologies Office.Contact Information for Lead ResearcherName: Leslie BillhymerInstitution: University of PennsylvaniaEmail address: leslieab@upenn.eduPhone number: (215) 218-7590ContributorsDana Rice, University of PennsylvaniaBen Cohen, The Pennsylvania State UniversityMark Stutman, The Pennsylvania State UniversityErica Cochran, Carnegie Mellon UniversityParul Gulati, Carnegie Mellon UniversityContentsProject IntroductionSurvey of Regional Direct Install ProgramsIntroductionDI Program Availability to the Target PopulationSmall Commercial Grocery Barriers to RetrofitDI Program ProcessProject PartnersTrade Ally and Qualified Contractor Models in DISpecial ThanksDetails of the Work and Project AccomplishmentsSurvey of DI Marketing ApproachesParticipating StoresPresentations to Utility, Contractor, and Policy StakeholdersSmall Grocery MarketSmall Grocery Sector InformationSmall Grocery Energy Consumption ProfileLoad Distribution Characteristics Across the USSmall, Independently Owned Grocery Store RecruitmentStore and System Condition HighlightsSmall Grocery Building Energy ConsumptionDI Program Technical Packages for SmallGroceryStore Four Completed a DI RetrofitCorner Grocery Store Energy Project Final Report 2016

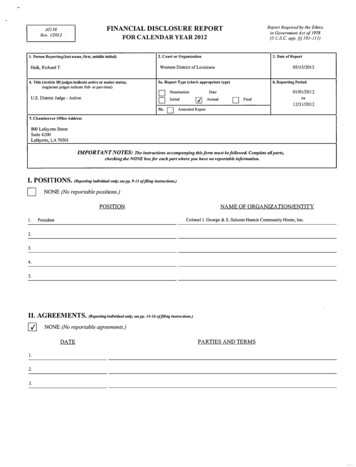

ContentsProject IntroductionSmall Grocery MarketDirect Install ProgramsProject Introduction“These findings are valuable to the Office of the Small Business Advocate, because they offer data-supported technicalsolutions that may increase kilowatt and kilowatt-hours savings projects achieved through Act 129 small business directinstall energy efficiency programs”- John Evans, PA PUC Office of the Small Business AdvocateIntroductionGrocery stores are highly energyconsumptive no matter what their size.Food service and food sales are firstand third in ranking of building typesthat are the most energy consumptiveaccording to the Commercial BuildingEnergy Consumption Survey. Smallgrocery stores ( 10,000 ft2) are bothhighly consumptive and are membersof the smallest and most populoussize class of US buildings. Commercial buildings that are less than10,000 FT2 in size account for 73%of all buildings.1 The Corner GroceryStore Energy Project is a Consortiumfor Building Energy Innovation initiative directed with U.S. Department ofEnergy funding during 2015 and 2016.The project assesses direct install(DI) energy efficiency programs andtheir work in independently owned andoperated small commercial grocerystores.Small Grocery Barriers toRetrofitThe well-documented barriers thathold members of this market segment back from pursuing deep energy efficient retrofits are important tonote. This project focused on grocerystores that fit the following profile:these are grocery stores that bothoccupy small buildings and are smallbusinesses, where the owner is oftenbusy keeping the store open andrunning basic operations: he or she ismanaging the cash register, acceptingshipments and stocking shelves, orcooking behind the deli counter. Manyutility contractors do not often havea specific mandate to reach profilebusinesses. They just have a mandateto implement energy efficiency in smallbuildings, and they can go to largerbusinesses with several locations thathave the capacity to consider energy efficiency as a strategic financialinvestment. Second, these businessesdo not have the human resources todevote to considering energy efficien-cy. These factors combined reveal howthe incentive for energy contractorslies in reaching chain store businessesdue to the economy-of-scale available,where contractors can execute onetransaction and touch several buildings at once. Second, small businesses often develop a distrust of a largemarket of enterprises that sell variousservices, not all of them legitimate.This issue arises in markets whereenergy is deregulated; consumerswho changed providers were soonsurprised by exceptionally high peakdemand charges. For example, as of1997 Pennsylvania is a deregulatedelectricity market. In 2010, rate capsthat were passed in 1997 expired.As a result, a host of businessescropped up that offered customers lowoff-peak demand charges with highpeak demand charges. These highpeak demand charges were buried inthe fine print of these contracts, andduring the peak demand periods, theelectricity prices rose to punishinglyexorbitant heights. Several stores theinvestigators visited experienced thisand spoke of extremely high monthlyelectricity bills under past providers.Pennsylvania is one of 46 states withpartial or full energy market deregulation. Third, the transactional complexity of an energy retrofit, at boththe “sell” and “follow-through” phases,is often daunting to a small businessowner. And fourth, a lack of availablePhiladelphia’s HealthyCorner Store Initiative2010–2012Made possible by funding from theDepartment of Health and Human Servicesand Get Healthy Philly, an initiative of thePhiladelphia Department of Public Health.Image Source: The Food Trustcapital for energy efficiency investmentin severely capital constrained organizations makes even small projectsoff-limits. Research in the field of smallbusiness energy efficiency has identified that DI projects are the only typeof rebate and incentive program thatconsistently impact the small commercial grocery market vertical.Project PartnersBased in Philadelphia, Pennsylvania,the project worked with The FoodTrust’s Healthy Corner Store Initiativeto conduct outreach to area smallgrocery store owners for researchproject participation. The projectsurveyed regional small business DIprograms through two aspects. First,assess the technical packages implemented through DI programs withan eye toward offering alternativesthat exceed current versions’ energyefficiency while meeting cost-benefitrequirements. For the first aspect, theproject aimed to expand the technicalpackage recommendations for thecorner stores beyond those currentlyoffered through DI programs to includeadditional systems and comprehensivesystem measures. Second, the projectaimed to offer best practice outreachmethods used to recruit and identifynew customers for the DI incentiveprograms.Special ThanksThis project would not have been possible without the generous support inthe form of client identification, energyaudits, energy efficiency measure recommendations, cost-benefit analysis,energy modeling, utility bill data analysis, and industry knowledge that wasprovided on a volunteer basis by thefollowing regional organizations: TheFood Trust, The Enterprise Center,The Tri-State Light & Energy, NationalResource Management, and CBEIpartners PennState University, UTRC,and Carnegie Mellon.Corner Grocery Store Energy Project Final Report 2016

Contents121212Project TNERS STORESSTORESVISITEDCHANNELPARTNERSVISITEDCHANNEL PARTNERSSTORES VISITEDSmall Grocery MarketDirect Install ESPARTICIPATINGSTORES PARTICIPATINGDetails of work of the projectand accomplishmentsthe following areas: Center City’s Oldor virtual presentations and discussionCity and Rittenhouse neighborhoods,with relevant stakeholders, beginningWestPhiladelphia’sBaltimoreAve.in early fall 2015, as soon as the firstThe Corner Grocery Store Project wasand52ndStreet,andLancasterAve.cost-benefit analyses were available toled by investigators from the Univercorridors,andtheSouthPhiladelphia,the team. The following table capturessity of Pennsylvania on behalf of theGermantown,Fairmount,Chinatown,thetypes USUSUNDER10,000FT2SALESSTORESIN 00FT2HIGHESTSAMPLECBEIFOODin AMPLEEUI EUIHIGHESTSAMPLEEUI LEThe area of research was the city ofgether, almost 100 stores received andate. While the study captures thePhiladelphia for the small groceryin-personvisitanddescriptionoftheregional context, there was an emstore energy audits and analysis andproject,12storesagreedtoparticipatephasis on engaging Pennsylvaniathe states of Pennsylvania, Maryland,inthestudy,andfivestoresreceivedutilities in discussion, the PA PublicNew Jersey, and New York for thecomprehensivesystemenergyauditsUtility Commission, and contractors,small business DI program ngthis year PA was orgaMEDIANSAMPLEEUISTATESINSURVEYPROGRAMSIN INSURVEYMEDIANSAMPLEEUISTATESINSURVEYPROGRAMSIN on analysis.tractorsput togetherenergy efficiennizingfor the third phase of their 2008MEDIAN SAMPLE EUISTATESIN SURVEYPROGRAMSIN SURVEYcy measure recommendations andAct 129 legislation. This presentedParticipating Storescost-benefit analysis for five stores.the opportunity to have utilities incorThe corner store visits were conductedporate new priorities into the programunder the guidance of The Food Trustdesign for the 2016-2021 cycle. ThesePresentations to utility,program managers. In addition, sevpresentations emphasized the technicontractor, and policyeral of the store owners who signedcal TRADEfindingsrelatedtoMODELSmeasure ODELSPENNSYLVANIA DI PROGRAMSTRADEALLYstakeholdersCRM SOFTWARE USERSup for the energy audit and AMSSOFTWAREUSERSALLY MODELS as relevant toTheseCRMfindings,the cost-benefitanal- TRADEalso participatein The Foodthe organization’s relationship to oneysis and recommendation for five ofHealthy Corner Store Initiative (insertor more policy-driven DI program(s).the 12 stores above, were compiledlink here). The project visited smallThese organizations will also receiveearly on to maximize the short onecommercial grocery stores acrossthis final findings report.year project span. These findingsthe city with concentrated efforts inwere shared in the form of in-personOLDESTBUSINESSDI STSMALLSMALLBUSINESSDI PROGRAMHVAC OLDEST SMALLBUSINESS DIPROGRAMHVAC hiaSmallGrocery StoresProjectPresentationsin Region LIGHTING ienceaudiencepresentationaudience11 1155 5utilities887PAPANJ NJNJMD MDNY NYMDNYNJMDNY4 444utilities utilitiesutilities57PA3 332 227 117 311 11210 101064 11 9 4 46 96 912 1210 124 6 9128 82 22222contractorscontractorscontractors- --- --2 2333 32222- --- --- -1 1111 11111-- -contractors2 222governmentgovernmentgovernmentgovernment2 orner Grocery Store Energy Project Final Report 2016

ContentsProject IntroductionSmall Grocery MarketCHANNEL PARTNERSDirect Install ProgramsSTORES VISITEDSmall Grocery MarketFOOD SALES STORES IN THE US UNDER 10,000FT2 HIGThis is an important market verticalto address for the retrofit industry,and CBECS data confirms this. Theaverage US grocery store spends justunder 4 per square foot on energybills per year, with electricity accounting for 3.70 of that cost, or 92.5% ofthat cost. This electricity cost is threeto four times the money spent on average for electricity by commercial officespace. CBEI collected and analyzedstore energy consumption data from12 small grocery stores in the city ofPhiladelphia, finding a wide range ofannual electricity energy expenditurelevels, from 4 to 13 a square foot.From small grocery, to conveniencestores, to bakeries, to meat markets,these businesses are more numerousthan might be expected in urban, suburban, and rural communities in theUS. According to CBECS, there are153,886 Food Sales buildings that areless that 10,000 FT2 in size, and thisrepresents 2.7% of the commercialbuilding population, a proportion con-PROGRAMSsistent with regional data at 2.5%. InIn addition to cost control, there is athe states studied here, stores 2500strong public benefit to energy effiFT2 comprises approximately 30% ofciency, especially in neighborhoods inthe small food store market, and those need of increased levels of economic 10,000 FT2 comprise 65% of theactivity. Jerrold Oppenheim is theMEDIAN SAMPLEEUI General ofSTATESfood store market.former AttorneyMassa-IN SURVEYchusetts and New York, and he writesThe US convenience store market isabout the positive economic impactsfragmented; the top 50 companiesof energy efficiency activity in thecontrol only 40% of industry sales ineconomy through the concept of athe US (First Research 2012), andmultiplier in a 2008 article titled Energytherefore there is a large market ofEfficiency Equals Economic Developsmall, independently ownedPENNSYLVANIAgroceryment:DITheEconomics of CRMPublicSOFTWAREUtilityPROGRAMSUSstores. There is a relatively low costSystem Benefit Funds. The logic isto establish a new business or buy anthat different investments cascadeexisting one in this vertical, so thereor “multiply” through the economyare low barriers to enter the industrydifferently, by creating jobs, whichand this makes it attractive for firstin turn create income, which in turntime business owners. Of nationalcreate measurable economic activityconvenience stores thatdonotincludeand growth.DIHePROGRAMargues that the mulOLDEST SMALL BUSINESSHVAC PROGgasoline sales, 68% of businessestiplier of energy efficiency investmenthave five or fewer employees andis 2.7 times that of new investmenta 1.4% average profit margin (IBISin manufacturing using data from theWorld2015). Therefore, cost control is Department of Commerce Bureaupresentationofaudiencea priority in order to thrive in the smallEconomic Analysis.grocery store business sector.Food Stores in Region of Study (Reference USA, 2016)1Food Stores( 10,000 SF)8 % of smallAll (all sizes) businesses5Food StoresFood StoresFood Stores ( 2,500 SF)/ Food Stores ( 10,000 SF)/( 2,500 SF) Food Stores ( 10,000 SF) Food StoresMD113416%360851%742111036 tiescontractorsgovernmentconferences3%Corner Grocery Store Energy Project Final Report 2016

ContentsProject IntroductionSmall Grocery MarketDirect Install ProgramsThis project has partnered withThe Food Trust (TFT), a Philadelphia-based organization that has beeninstrumental in helping recruit smallgrocery participants. They have gainednational recognition for their HealthyCorner Store Initiative, a programfunded by the Philadelphia Departmentof Public Health that helps hundreds ofsmall grocery stores and conveniencestores provide healthy unprocessedfoods in neighborhoods with high ratesof obesity and diabetes.2By being the first to map the relationship between proximity to access tofresh, healthy food and income levelin Philadelphia neighborhoods, TheFood Trust has developed a set ofpublic health programs to address this“grocery gap” phenomenon. A “grocerygap” occurs where urban communitieslack a full-service grocery store, a keyfinding for those who study nutritionand public health. With the HealthyCorner Store Initiative, The Food Trustis working to address systemic public health issues on a store-by-storebasis. They offer incentives for sellinghealthy foods and promoting healthyfood sales; recently they launched astore certification that continues tomatureSmallwith theprogram.GroceryEnergy Consumption profileGrocery Store Load Distribution Averages by Climate ZoneClimate Zone 1Climate Zone 2Climate Zone 3Heating 2%Cooling 4%Miscellaneous 3%Ventilation 1%Miscellaneous 4%Miscellaneous 3%Office Equipment 0%Office Equipment 0%Office Equipment 1%Heating 16%Heating 17%Water Heating 5%Cooling 5%Cooling 3%Ventilation 1%Ventilation 1%Lighting19%Water Heating 3%Water Heating 12%RefrigerationCooking 7%Lighting 19%Lighting 15%Refrigeration 44%Cooking 1%Refrigeration 57%Cooking 4%Climate Zone 4Heating 1%Miscellaneous 3%Office Equipment 1%Climate Zone 5Cooling 8%Ventilation 2%Water Heating 3%Heating 3%Miscellaneous 2%Office Equipment 1%Lighting 21%Lighting 15%Refrigeration 62%Refrigeration 55%Cooking 6%Cooling 1%Ventilation 4%Water Heating 12%Cooking 0%Corner Grocery Store Energy Project Final Report 2016

ContentsSmall Grocery MarketProject IntroductionDirect Install ProgramsSTORES VISITED STORES PARTICIPATINGSTORES PARTICIPATINGES VISITEDSALES STORES IN THE US UNDER 1Small Grocery Energy Consumption FOODProfileUSUNDER 10,000FT2HIGHESTSAMPLEEUI SAMPLELOWESTSAMPLE EUI10,000FT2HIGHEST SAMPLEEUILOWESTEUIMEDIAN SAMPLE EUILoad Distribution Characteris- which includes small commercial grocery, showing average load consumptics Across The USbuilding energy efficiency industry’slong validated knowledge of the splitincentive issue: store owners who alsoown the building are naturally moreinvested in the energy efficiency ofDI PROGRAMSthePENNSYLVANIAproperty from a long-terminvestment standpoint whereas renters arenot. This could by why more ownersthan renters opted to participate in theresearch.STATtion profiles across climate zones.Across all climate zones, the mostconsumptive systems in grocery storesSmall, Independently Ownedin descendingorder arePROGRAMSrefrigeration,STATESIN PROGRAMSSURVEYTES IN SURVEYIN SURVEYIN SURVEYCRMlighting, heating and cooling, and hotGrocery Store Recruitmentwater. In four of five climate zones, re- The Corner Grocery Store Energyfrigeration and lighting are the largestProject recruited and examined energyloads in these grocery stores, in one,and systems data for a sample ofheating and cooling are within 1% ofsmall grocery stores (12) in the citylighting. Refrigeration is by far the larg- of Philadelphia. These stores areStore and System Conditionest loadin the grocerymarketvertical,situatedin a variety of FTWAREUSERSTRADEALLYMODELSSMALL BUSINESS DI PROGRAMconsuming between 44% in climateacross the city. It is reported that manyOLDESTHighlights1.47zone three to 62% in climate arlier, the project1.60five. nofthe12investigatorsvisitedover 100 stores1.211.401.14 owneroccupied.andstudied12in-depth.Over the1.20 0.990.93on supermarketenergy consumption,A logical conclusion draws from thecourse of thismarket surveying, the1.000.750.750.800.54 0.450.53(kWh/SF/HR)0.51Size and OperatingHours Normalized Electric HTINGPROGRAMSHVAC 400.201.470.001.6011.21234567891011121.40 11.14presentation 280.4040.203utilities 0.00utilities2711 1112345678910 1012222contractors contractors30,000 28,124-22-----government government20,00030,000221 28,1241

The corner store visits were conducted under the guidance of The Food Trust program managers. In addition, sev-eral of the store owners who signed up for the energy audit and analysis also participate in The Food Trust Healthy Corner Store Initiative (insert link here). T