Transcription

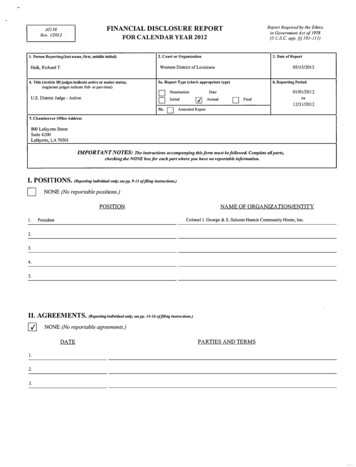

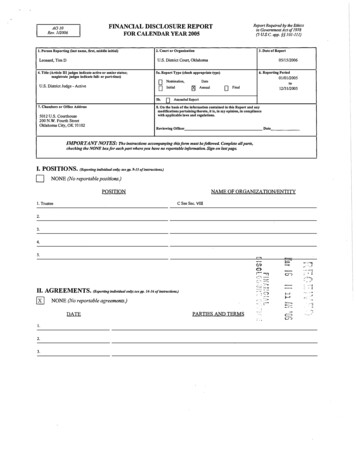

AOlORev. 112006Report Required by the Ethicsin Government Act of1978(5 U.S.C. app. §§ 101-111)FINANCIAL DISCLOSURE REPORTFOR CALENDAR YEAR 20052. Court or Organization1. Person Reporting (last name, first, middle initial)3. Date of ReportU.S. District Court, OklahomaLeonard, Tim D4. Title (Article Ill judges indicate active or senior statns;magistrate judges indicate full- or part-time)05115120066. Reporting PeriodSa. Report Type (check appropriate type)DDU.S. District Judge - ActiveSb.7. Chambers or Office inal12/31/2005Amended Report8. On the basis of the information contained in this Report and anymodifications pertaining thereto, it is, in my opinion, in compliancewith applicable laws and regulations.5012 U.S. Courthouse200 N.W. Fourth StreetOklahoma City, OK 73102Reviewing OfficerDateIMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,checking the NONE box for each part where you have no reportable information. Sign on last page.I. POSITIONS. (Reporting individual only; see pp. 9-13 ofinstructions.)DNONE(No reportable positions.)NAME OF ORGANIZATION/ENTITYPOSITIONI. TrusteeC See Sec.VIII2.3.4.5.!.! C ,.,.,;,'-:-:·:--'· 'i"·-'"'1;;ii. .·::;-: :. :::,, ' '; ., It II. AGREEMENTS. (Reporting individual only; see pp.NONE14-16; ofinstructions.)(No reportable agreements.)';o . PARTIES AND TERMS;I.2.3. --

FINANCIAL DISCLOSURE REPORTPage 2 of9Date of ReportName of Person Reporting0511512006Leonard, Tim DIII. NON-INVESTMENT INCOME.(Reporting individual and spouse; see pp. 17-24 of instructions.)A. Filer's Non-Investment IncomeDNONE(No reportable non-investment income.)INCOMESOURCE AND TYPE(yours, not spouse's)I. 2005 13,628.00Oklahoma Public Employees Retirement2.3.4.5.B. Spouse's Non-Investment Income - I/you were married during any portion of the reporting year, complete this section.(Dollar amount not required except for honoraria.)DNONE(No reportable non-investment income.)SOURCE AND TYPEI. 2005Leadership Oklahoma, Inc.2.3.4.5.IV. REIMBURSEMENTS-transportation, lodging, food, entertainment.(Includes those to spouse and dependent children. See pp. 25-27 of instructions.)DNONE(No reportable reimbursements.)SOURCEI. University of Tulsa School of Law2.3.4.5.DESCRIPTIONTulsa, OK, December 8, 2005, Symposium on the United States Supreme Court (hotel andmeal)

FINANCIAL DISCLOSURE REPORTPage 3 of9V. GIFTS.[KJName of Person ReportingLeonard, Tim DDate of Report05/15/2006(Includes those to spouse and dependent children. See pp. 28-31 ofinstructions.)NONE(No reportable gifts.)DESCRIPTIONSOURCEVALUEI.2.3.4.5.VI. LIABILITIES.[KJNONE(Includes those ofspouse and dependent children. See pp. 32-34 ofinstructions.)(No reportable liabilities.)CREDITORI.2.3.4.5.DESCRIPTIONVALUE CODE

Name of Person ReportingFINANCIAL DISCLOSURE REPORTPage 4 of9Leonard, Tim DVII. INVESTMENTS and TRUSTSDDate of Report-05/15/2006income, value, transactions (includes those of the spouse and dependent children. see PP· 34-s7 offiling instrucnonsJNONE (No reportable income, assets, or transactions.)A.B.c.D.Description of AssetsIncome duringGross value at end ofTransactions during reporting periodreporting period(including trust assets)Place "(X)" after each asset(2)(I)(2)AmountType(e.g .ValueValueI(A-H)div., rent,Code 2Methodor int.)(J-P)Code 3(Q-W)Codeexempt from prior disclosurereporting period(I)If not exempt from disclosure(I)Type (e.g.buy, sell,(2)(4)(3)(5)DateValuemergerMonth-Code2Code lbuyer/sellerredemption)Day(J-P)(A-H)(if privateGainIdentity oftransaction)I. Property# I, Beaver Co, OK (1980 for 50,000)cRentKR2. Leonard Mt Inv LLC real estateGunnison Co. COARentNR3. OilOKERoyaltyKw4. Oil & Gas Working Interest, Beaver Co,OK Armagost UnitERoyaltyLw5. Oil & Gas Working Interest, Beaver Co,OK, Leonard# IDRoyaltyLw6. Oil & Gas Working Interest, Beaver Co,DRoyaltyLw7. Oil & Gas Royalty Interest, Meade Co,KS appraisal 3/18/97DRoyaltyKQ8. IRA Acct - Fidelity GrowthMutual FundsADividendKT9. OK Public Employees Retirement, Okla.City, OKDDividendKwIO. Cash Value Life Insurance,Chattanooga, TNAInterestKT11. Bank of Okla - Checking Acct, Okla.City, OKAInterestJT12. Bank of Okla - Savings, Okla. City, OKAInterestKT13. Fidelity Mutual Funds - Spartan MarketIndex (X)ADividendKT14. Fidelity Mutual Funds - DividendGrowth (X)ADividendLTsell portion10/17K15. Fidelity MutualIncome (X)ADividendKTsell portion10/17K16. Fidelity Mutual Funds - GrowthCompany(X)ADividendJT17. Fidelity Mutual Funds - AggressiveGrowth(X)ADividendJT& Gas Royalty Interest, Beaver Co,OK, Barby# lFunds - Growth1. Income Gain Codes:(See Columns BI and 04)2. Value Codes(See Columns Cl and 03)3. Value Method Codes(See Column C2)& Income&A 1 ,000 or lessB 1,001 - 2.500c 2,501 - 5,0000 5,001 - 15,000F 50,001 -SI00,000G 100,00l - 1,000,000HI 1,000,001 - 5,000,000H2 More than 5,000,000J 15,000 orlessK 15,00I - 50,000L 50,001 -SI 00,000M 100,001 - 250,000N 250,001 - 500,0000 500,001-Sl,OOO,OOOPl 1,000,001 - 5,000,000P2 5,000,001 - 25,000;000P3 25,000,001- 50,000,000R Cost (Real EstateP4 More than 50,000,000T Cash MarketQ AppraisalU Book ValueV OtherOnly)S AssessmentW EstimatedE 15,00l - 50,000

Date of ReportName of Person ReportingFINANCIAL DISCLOSURE REPORTPage 5 of9Leonard, Tim D05/15/2006VII. INVESTMENTS and TRUSTS -income, value, transactions (includes those ofthe spouse and dependent children. See PP· 34-57 offiling instructions)DNONE (No reportable income, assets, or transactions.)A.B.c.D.Description of AssetsIncome duringGross value at end ofTransactions during reporting periodreporting periodreporting period(including trust assets)P lace "(X)11 after eachasset(2)(I)(2)AmountType (e.g.ValueValueType (e.g.div., rent,Code 2Methodbuy, sell,DateValueGainor int.)(J-P)Code 3merger,Month-Code 2Code(Q-W)redemption)Day(J-P)(A-H)Codeexempt from prior disclosure(I){I)I(A-H)If not exempt from disclosure(2)(5)(4)(3)Identity ofIbuyer/seller( if privatetransaction)18. Fidelity Mutual FUnds - Cash ReserveADividendJT19. Devon Energy - Common Stock (X)ADividendKT20. Noble Corporation - Common StockADividendKTAInterestJTNoneNQ(X)(X)21. Charles Schwab Money Market Fund(X)22. Property #1, Okla County, OK(appraisal July 2003) (X)cRentsold5/1724. Mortgage Note# l (X)BInterestreleased91525. Mortgage Note# 2 (X)BInterestKT26. Mortgage Note # 3 (X)BInterestKTNoneJwAInterestJT29. Bank of Okla - CD - Okla. City, OKAInterestKTIRA Acct - CD - Bank of Beaver,BInterestKT31. Vanguard 500 Index Mutual FundsADividendKT32. Vanquard Strategic Equity FundADividendJT33. Vanguard Strategic Equity FundADividendJTADividendKT23. Property#2, Beaver County, OKK(appraisal July 2003) (X)27. Non-producing Royalty Interest,Brazoria Co, TX (X)28. Bank of Okla - Checking Acct, Okla.City, OK30.34. Fidelity Mutual Funds - GrowthOK&Income1. Income Gain Codes:(See Columns Bl and 04)2. Value Codes(See Columns CI and D3)3. Value Method Codes(See Column C2)A 1,000 or lessB 1,001 - 2,500c 2,501 - 5,000D 5,001 - 15,000F 50,001 - 100,000G SJ00,001 - 1,000,000HI 1,000,001 - 5,000,000H2 More than 5,000,000J 15 ,000 or!essK 15,001 - 50,000L 50,00I - J00,000M 100,001 - 250,000N 250,001 - 500,0000 500,00 I - 1,000,000Pl 1,000,001 - 5,000,000P2 5,000,001 - 25,000,000P3 25,000,001 - 50,000,000R Cost (Real Estate Only)P4 More than 50,000,000T Cash MarketQ AppraisalV:::OtherU Book ValueS AssessmentW EstimatedE 15,00J - 50,000

Page 6 of9NONE0511512006Leonard, Tim DVII. INVESTMENTS and TRUSTSDDate of ReportName of Person ReportingFINANCIAL DISCLOSURE REPORT-income, value, transactions (includes those ofthe spouse and dependent c hildren. See PP. 34-57 offiling instructions)(No reportable income, assets, or transactions.)A.B.c.D.Description of AssetsIncome duringGross value at end ofTransactions during reporting periodreporting periodreporting period(including trust assets)Place " (X)" after each assetexempt from prior .g,div., rent,Code 2Methodbuy, sell,or int)(J-P)Code3CodeI(A-H)(Q-W)If not exempt from(I)(I)(2)GainDateValuemerger,Month-Code 2Ccideredemption)Day(J-P)(A-H )disclosure(5)(4)(3)Identity ofIbuyer/seller(if privatetransaction)35. Fidelity Small Capitol StockADividendJT36. Citizens Index Mutual FundsADividendJT37. Stillwater National Bank -Savings -AInterestJT38. Oakmark Equity & Income FundADividendJT39. Oakmark Equity & Income FundADividendJT40. Oakmark Global FundADividendJT41. ING Direct -CDAInterest42. ING Direct -CDAInterestJT43. ING Direct- CDAInterestJT44. ING Direct - CDAInterestJT45. Legacy - CDAInterestKT4.6. ReliaStar Insurance Annuity AcctAInterestJT47. TIAA CREF -AnnuityAInterestLT48. First Oklahoma Investment LLCAInterestJTAInterestStillwater, OKRedeemed814JBuy3110JClosed/Distr515See Sec. VIIIE 15,001 - 50,000(ING)49. PERSONAL REPRESENTATIVE TOnA "50. Bank of Okla -Checking Acct, Okla.City, OK51. PERSONAL REPRESENTATIVE TO"B"I. Income Gain Codes:(See Columns B1 and 04)2. Value Codes(See Columns Cl and DJ)3. Value Method Codes(See Column C2)A 1 ,000 or lessB 1,001 - 2,500c 2,501 - 5,0000 5,001- 15,000F 50,001 - 100,000G 100,001-Sl,000,000HI 1,000,001 - 5,000,000H2 More than 5;000,000J '."' 15,000 or lessK 15,001 - 50,000L 50,00 l - 100,000M 100,001 - 250,000N 250,001 - 500,0000 500,00 I - 1,000,000Pl 1,000,001- 5,000,000P2 5,000,001 - 25,000,000PJ 25,000,001 - 50,000,000R Cost (Real Estate Only)P4 More than 50,000,000S AssessmentT Cash MarketV OtherQ AppraisalU Book ValueW Estimated

Date of ReportName of Person ReportingFINANCIAL DISCLOSURE REPORTPage 7 of9Leonard, Tim D0511512006VII. INVESTMENTS and TRUSTS -income, value, transactions (includes those ofthe spouse and dependent children. see pp. 34-57 offiling instructions)DNONE(No reportable income, assets, or transactions.)A.B.c.D.Description of AssetsIncome duringGross value at end ofTransactions during reporting periodreporting. periodreporting period( including trust assets )Place(X)""after each assetexempt from prior disclosure(I)(2)(I)(2)AmountType (e.g.ValueValueCode Idiv., rent,Code 2Method(A-H)or int.)(J-P)(I)Type (e.g.If not exempt from disclosure(2)(4)(3)(5)buy, sell,DateValueGainCode 3merger,Month -Code 2Code 1buyer/seller(Q-W)redemption)Day(J-P)(A-H)(if privateIdentity oftransaction)52. Bank of Okla - Checking Acct, Okla.City, OKAInterestClosed/Distr4/18ARentTrust Closed5113LAInterestTrust Closed5113LSee Sec. VIII53. TRUSTEE TO "C"54. Leonard Mt Inv LLC, real estateGunnison Co, CO ( 60,000)55. Bank of Okla - Money Market, Okla.City, OK) . Income Gain Codes:(See Columns BJ and D4)2. Value Codes(See Columns Cl and 03)3. Value Method Codes(See Column C2)A 1,000 or lessB 1,001 - 2,500C 2,50 I - 5,000D 5,001 - 15,000F 50,001- 100,000G 100,00l - 1,000,000HI 1,000,001 - 5,000,000H2 More than 5,000,000J 15,000 or lessK 15,00l - 50,000L 50,00l -SI00,000M 100,001- 250,000N 250,001 - 500,0000 500,001- 1,000,000Pl 1,000, 0I- 5,000,000P2 5,000,001- 25,000,000PJ 25,000,001 - 50,000,000R Cost (Real Estate Only)P4 More than 50,000,000T Cash MarketV OtherS AssessmentQ AppraisalU Book ValueW EstimatedE 15,00J - 50,000

FINANCIAL DISCLOSURE REPORTPage 8 of9Date of ReportName of Person Reporting0511512006Leonard, Tim DVIII. ADDITIONAL INFORMATION OR EXPLANATIONS.(lndicate partofReporL)Sec. 1.4: As Trustee to "C", I received no income or benefits.Sec. VII, Lines 50: This account represents a small checking account left open to pay final cost of administration for the estate to which I was PersonalRepresentative in 2004.Sec. VII, Lines 52: This account represents a small checking account left open to pay final cost of administration for the estate to which I was PersonalRepresentative in 2004.

FINANCIAL DISCLOSURE REPORTPage 9 of9Date or ReportName or Person Reporting0511512006Leonard, Tim DIX. CERTIFICATION.I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) isaccurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutoryprovisions permitting non-disclosure.I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are incompliance with the provisions of 5 U.S.C. app. § 501 et. seq., 5 U.S.C. § 7353, and Judicial Conference regulations.DateSignature}11/S-.( '2.00 GNOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVILAND CRIMINAL SANCTIONS (5 U.S.C. app. § 104)FILING INSTRUCTIONSMail signed original and 3 additional copies to:Committee on Financial DisclosureAdministrative Office of the United States CourtsSuite 2-301One Columbus Circle, N.E.Washington, D.C. 20544

ORGANIZATION/ENTITY . -- 5. FINANCIAL DISCLOSURE REPORT Report Required by the Ethics AOlO in Govenment Act of 1978 . Rev. 112006 . FOR CALEDAR YEAR 2005 (5 U. app. §§ 101-111