Transcription

AVIVA plcInterim results 200511 August 2005

DisclaimerThis presentation may contain certain “forward-looking statements” with respect tocertain of Aviva’s plans and its current goals and expectations relating to its futurefinancial condition, performance and results. By their nature, all forward-lookingstatements involve risk and uncertainty because they relate to future events andcircumstances which are beyond Aviva’s control including among other things, UKdomestic and global economic business conditions, market related risks such asfluctuations in interest rates and exchange rates, the policies and actions ofregulatory authorities, the impact of competition, inflation, deflation, the timingimpact and other uncertainties of future acquisitions or combinations withinrelevant industries, as well as the impact of tax and other legislation and otherregulations in the jurisdictions in which Aviva and its affiliates operate. As a result,Aviva’s actual future financial condition, performance and results may differmaterially from the plans, goals and expectations set forth in Aviva’s forwardlooking statements.Aviva undertakes no obligation to update the forward-looking statementscontained in this presentation or any other forward-looking statements we maymake.2 Aviva plc

Agenda OverviewRichard HarveyGroup Chief Executive Financial reviewAndrew MossGroup Finance Director Questions & Answers3 Aviva plc

Strong operations delivering good profitsOperating profit (EEV basis)Operating profit (IFRS)Life and pensions sales (PVNBP)New business contributionGeneral insurance CORInterim dividendROCE 1,318m 21% 943m 19% 11.0 bn 12% 393m 15%95% (FY 2004: 97%)9.83p 5%14.6% (FY 2004: 13.7%)4PVNBP – Present value of new business premiums Aviva plc

2005 interim results: key themes Strong new business sales with increased valuefrom our bancassurance network Strong performance in mature markets,particularly France Transforming our UK Life business to succeed ina competitive market Prospects for our developing businesses Excellent general insurance and health results5 Aviva plc

Strong growth in long-term savingsnew business m7,000Growth 26%H1 2004Total sales6,000H1 2005Growth flat5,0004,0003,0002,000Growth 35%1,0000ContinentalEuropeUKInternational Aviva plc6

Increasing value from our bancassurancenetworkNew business contribution on net basis* Bancassurance is anincreasing proportionof new business profitsnow over quarter ofbusiness m80706050H2H2Increase of 20%403020H1H1H120032004H1 200510 Businesses growing inFrance, Italy and theNetherlands Higher average margindelivering value growthin Spain07* net basis after capital, tax and minorities Aviva plc

France: benefiting from focus on unitlinked sales Total sales up 36% (PVNBP) to 1.9 billion– Contribution up 52% (gross) to 202 million– Total proportion of unit-linked sales now 40%(FY 2004: 32%)– Net margin at 2.6% (FY 2004: 1.9%) Benefit of Crédit du Nord(commenced October 2004) Increased attractiveness of equity markets Focus on unit-linked business delivering highermargins8 Aviva plc

UK Life: managing for value Operating in competitive market where growthmodest Holding volume whilst increasing margin Retaining a significant presence across theproduct portfolio Achieving an IRR of 11.4% (H1 2004: 11.0%)– IRR improves to 13.6% taking into accountdebt/equity mix9 Aviva plc

Strong UK market share consistentlymaintained in main product areas.Total market share at 11.5% (Q1 %14.3%10.8%8.6%8.3%6.4%0%AnnuitiesBonds &SavingsGroupPersonalPensionsIndividual Corporate Investment ProtectionPensions PensionsFundsNU Q1 '05 Market Share %Source: NU MSE 50% JV Q1 2005Source: NU press releaseFY '0410 Aviva plc

UK Life: transforming the business forthe long-term Expect to see a reduction in second half margins asproduct mix changes Continue to improve underlying value drivers– Broad distribution base– Innovative capital management– Aggressive transformation of the business Offshoring Assisted transformation of businessservices Ongoing customer servicing initiatives11 Aviva plc

Developing our presence in other markets Rapid expansion in India and China:– Total sales from operations of 82 million(2004: 29 million)– India: working with 8 banks– China: presence in 6 cities Broadening distribution and moving into newproduct markets in the US Enter new markets selectively, for exampleexploring entry into Russia and Taiwan12 Aviva plc

Excellent contribution from generalinsurance and healthGrowing premium income . whilst increasing ROCECOR % bnROCE 86420105100959020002001 2002 2003 2004 * H120052000 2001 2002 2003 2004CORH12005ROCE GI COR reduced from 109% to 95% between 2000 and 200513* 2005 Annualised Aviva plc

GI achievements in 2005Flood mapping delivery Corporate Partner deals– New Barclays contract– Extended Asda deal to 2009– Extending Canadian strategicalliance with LoblawsJune 04September 04December 04March 05In progress Digital flood map Telematics Improving customer service– Direct customer satisfaction at 91%– Customers feel cared for byNorwich Union at 92% 2,800 jobs now in India14 Aviva plc

UK: sustained profits Using our business model to win in acompetitive marketGWP Growth in 20046%4%2%0%-2%-4%-6%NUINext 5Market– 22% increase in Direct premiums– Rates increasing in personal lines– 5% in personal motor and 6%(including indexation) in homeowner,in line with claims inflation35%30%25%20%15%10%5%0%Personal Lines – CumulativeRate Increases2001 Q1– Commercial rates flat; profitabilityexcellent2002 Q12003 Q12004 Q12005 Q1Commercial Lines –Cumulative Rate Increases70%60%50%40%30%20%10%0%2001 Q12002 Q12003 Q12004 Q12005 Q1 Aviva plc15

RACThe RAC Opportunity RAC accelerates NUI’s strategy, bringingus closer to our customers, and willgenerate significant revenue and costsynergiesHome Insurance Took control of RAC on 4 MayProven scale advantagesTrack record of delivery Car Sales15 million policyholders No. 1 roadside company forcustomer satisfaction*RAC Insurecustomers 4.5m corporate roadside customers Vehicle inspection FinancialServicesRACWindscreen Services RoadsideDriving training Aviva plcMotor services provider across customer lifetimeGrow insurance revenueGrow rescue revenue– RAC brand potential– RAC growth static– NUI track record– Risk pricing proven on NUI Rescue– Match AA customer penetration– Increase sales to NUI customer baseInsurance– Management and structures in place– Hyundai distribution agreementtransferredNo.1 UK general insurer 2.2m individual roadsideVehicle LeasingCumulative Revenue Excellent progress on integration Vehicle HistoryChecking– RAC performance in line with plan– Confident in delivering pre tax 80mcost synergiesTravel InsuranceNUIMotor InsuranceRescueWe know she islikely to changeher Ford KA after 5years and is likelyto buy a Ford pidBonusPassPlusCar HPIPAYDRescueLeaseCarRescueLoanSmall bumpTelematicsshowed it wasnot her tiesWider financial and motoring services Motoring services across customer lifetime Match AA customer penetration in loans Extend NUI partner relationships Grow sales to both RAC and NUI brands Commercial insurance and motor services Aviva plc16 Aviva plc

Financial reviewAndrew MossGroup Finance Director

Improved operational performance acrossall businessesH1 2005H1 2004Growth † m d interest(213)(205)(3)Operating profit: EEV basis (1)1,3181,0762194378119EPS: IFRS basis27.1p21.8pROCE14.6%13.7%*NAV (2)533p511p*Life EEV operating returnFund managementGeneral insurance and healthNon-insurance operationsCorporate costsOperating profit: IFRS basis(1)Stated before amortisation of other intangibles, impairment of goodwill and exceptional items† On a constant currency basis* As at 31 December 2004(2)ON an EEV basisAll operating profit is from continuing operations18 Aviva plc

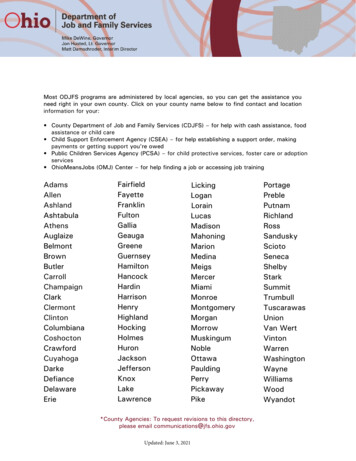

Growth from an international life portfolio UK: Improvement in unit-linkedH1 2005Sales Growth (2)PVNBP (1)% mLife and 2%SpainOther countriesGroup life and pensions(1)(2) bond sales and annuities, offsetby lower pension and protectionsalesFrance: Strong growth in unitlinked sales; strong start toCrédit du Nord partnershipNetherlands: Increased salesfrom ABN AMRO and in annuitybusinessItaly: Increases due to strongmarketing campaigns and BPUbranch extensionSpain: Stronger focus on highermargin protection products inthe first half of 2005Other countries: Strongdevelopment in internationalbusinessesPVNBP is equal to single premiums plus the present value of regular premiumsOn a constant currency basis19 Aviva plc

Life businesses creating shareholder valueH1 2005H1 2004FY 2004Contribution mMarginMarginMarginGross (1)3933.6%3.5%3.4%Gross, net of required capital2862.6%2.6%2.5%Net to shareholders (2)1581.7%1.7%1.6%UK741.7%1.7%1.6%Continental oupNet to shareholders (2)InternationalGroup(1)(2)Pre effect of required capital, pre tax and minoritiesPost effect of required capital, tax and minorities20 Aviva plc

New business profitability: focus on postrequired capital marginsH1 2005Contribution Margin (1) mUKH1 2004FY 2004Margin (1)Margin 0%Spain707.3%4.9%5.7%Other countries171.7%1.4%1.6%2862.6%2.6%2.5%Group(1)Post effect of required capital, pre tax and minorities21 Aviva plc

Life EEV operating returnH1 2005 H1 2004 m m Post required capital new businesscontribution up 35 million to 286million due to increased 32Poland4635Spain9281Other Europe1414International3628857799NetherlandsTOTAL Higher returns on opening embeddedvalue at start of 2005 up 27 million to 595 million (2004: 568 million) Small movement in operatingassumptions and experiencevariances to negative 24 million(2004: negative 20 million)22 Aviva plc

Life IFRS profits: businesses generatingcapital and cashH1 2005 H1 2004 m m UK: Lower with-profit result due to bonuscutUKWith profitNon 6)57TOTAL510520Other Europe France: Significant improvement due toprofitable business development andinvestment gains Netherlands: Growth in business whilstmaintaining cost base Italy and Spain: Reduced new businessstrain due to product growth and mix International: Lower level of realisedgains in 200523 Aviva plc

Sustainability and resilience in excellentgeneral insurance and health profitsH1 2005 H1 2004 mUnderwriting result 182 m92LTIR512491Operating 5553Canada6752Other countries4134694583TOTAL UK: Personal motor rates up 5%and homeowners up 6%(including indexation) Commercial rates flatAnalysed as:UK GI COR of 95% (2004: 97%) Ireland: Increasingly competitive,but motor rates beginning to stabilise Netherlands: Disciplinedunderwriting and costs containment Canada: Commercial marketsoftening, but favourable claimsfrequency in all our major classes24 Aviva plc

Asset management gathering momentum IFRS fund management operating profit up 94% to 33 million Morley UK and overseas businesses significantly increased from 7 million to 18 million Morley UK and overseas businesses: cost/income ratio 80% (2004: 89%) Award winning performances in France Worldwide investment sales up 35% to 1,062 million Funds under management up to over 290 billion25 Aviva plc

RAC profits up 13%RAC tradingfor the six monthsended 30 JuneTurnoverInsuranceNon-insurance6 months30 June2005 m6 months30 June2004 m2 months30 June2005 ing profitInsuranceNon-insuranceIntegration costs incurred to date(1)Roadside membership:Number of individual membersNumber of corporate membersPostacquisitionamountsincluded ininterim results(14)2.21m4.66m2.20m4.52m26(1)Total estimated one-off integration costs of 100 million pre-tax Aviva plc

Strong operational cash generation, withbenefits of innovative financingH105 mH104 m(210)(280)Life inforce profits646493Non life profits after interest costs316238Normalised operating profits after tax752451(264)(220)-100488331New business strainInterim dividend including preference shares andDCIBenefit from scrip dividend in H1 2004Normalised profits post tax retained to fund growthThe capital requirements on a realistic basis increased by 31 million, but include a release of 245 million arising from27the restructuring of the UK non-profit funds Aviva plc

Movement in EU groups directive solvencyIGD billion3.6As reported at 31 December 2004Less: previously signposted changesFSA valuation rules: market value of non-insurance(0.6)FSA valuation rules: pension deficit(0.4)Disposal of Asia0.2Acquisition of RAC(0.8)Sub-total(1.6)Capital generation in the period net of RMM increase0.6As estimated at 30 June 20052.628 Aviva plc

Movement in net asset value per shareReportedpenceAs at 31 December 2004 (restated for IFRS/EEV)511Deduct: 2004 final dividend(16)495Operating profit for the periodInvestment variancesForeign exchange and pension deficit3612(13)35Effect of issuing equity share capitalAs at 30 June 2005353329 Aviva plc

Aviva: a thriving business Strong and steady growth in profits frombusinesses operating efficiently– New business contribution 15%– Excellent COR at 95% Working to maximise our position in competitivelong-term savings environment Strong and sustainable outlook for generalinsurance Strong cash and statutory profits Good dividend growthAviva is financially fit and strongly positioned for profitable growth Aviva plc30

30 June 2005 resultsQuestions and answers

– Extended Asda deal to 2009 – Extending Canadian strategic . No.1 UK general insu re . Car PAYD Rescue Loan Car Loan PAYD Rescue Car HPI PAYD Rescue Lease Car Rescue Loan We know she is likely to change