Transcription

Asset Management PlanUpdate 2015

Unison Networks Limited Asset Management Plan Update 2015TABLE OF CONTENTSSECTIONS 1-71234567IntroductionPurpose of the AMPMaterial Changes to Network Development PlansMaterial Changes to Lifecycle Asset Management PlansReasons for any Material Changes to Expenditure ForecastsChanges to Asset Management Practices Affecting Schedule 13 ReportStakeholder FeedbackSECTION 8 - SCHEDULES8.18.28.38.48.58.6Schedule 11a:Schedule 11b:Schedule 12a:Schedule 12b:Schedule 12c:Schedule 12d:Report on Forecast Capital ExpenditureReport on Forecast Operational ExpenditureReport on Asset ConditionReport on Forecast CapacityReport on Forecast Network DemandReport Forecast Interruptions and DurationAPPENDIXCertification for Year-Beginning DisclosuresTable 1:Table 2:Table 3:Table 4:112557910182022242628Changes to network development plans due to localised load growthDevelopment options for localised load growthChanges to network development plans due to localised load growthChanges to network development plan due to large customer initiated development– Wairakei Pastoral Ltd.Table 5: Changes to network development plan due to large customer initiated development– Red Stag Timber expansionTable 6: Development options for large customer initiated development– Red Stag Timber expansionTable 7: Material changes to lifecycle asset management (maintenance or renewal) plansTable 8: Material changes to expenditure forecastsTable 9: Red Stag Timber development project inclusions and costingTable 10: Wairakei Pastoral Ltd project updated costingTable 11: Changes to asset management practices affecting Schedule 13 Report (AMMAT)455678Figure 1: AMMAT Comparison8This Asset Management Plan (AMP) Update is available for public disclosure andapplies for the period 1 April 2015 to 31 March 2025. The AMP is reviewed each yearand a revised AMP is expected to be available for public disclosure by 1 April 2016. UNISON NETWORKS LIMITED 201523344

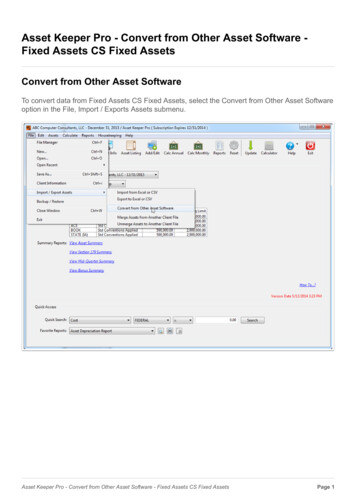

SECTIONS1-7UNISON NETWORKS LIMITED ASSET MANAGEMENTPLAN UPDATE 2015UNISON NETWORKS LIMITED ASSET MANAGEMENT PLAN UPDATE 20151IntroductionUnison’s Asset Management Plan (AMP) Update has been completed pursuant to clause 2.6 of the ElectricityDistribution Information Disclosure Determination 2012. It provides details of material changes to the full AMPdisclosed in March 2013, and the AMP Update disclosed in March 2014, and should be read as supplementaryto those documents. The purpose of the AMP Update is to ensure that the purpose of the AMP continues to bemet in years where it is not necessary for a full AMP to be disclosed. Unison will next disclose a full AMP inMarch 2016.2Purpose of the AMPAsset management planning is a critical part of any asset management system. It provides the structure toenable translation of asset management strategy and objectives into the right asset lifecycle interventions, andcontinuous improvement initiatives. This in turn enables realisation of the asset management goals within theAsset Management Policy, as well as the strategic objectives of the wider organisation over time.The primary purpose of Unison’s AMP is to provide stakeholders with a clear and comprehensive overview ofhow Unison manages its electricity distribution networks. The AMP is an important tool for fosteringunderstanding of the business and the industry, and facilitates informed dialogue between Unison, its owners,the communities and businesses it serves, and the organisations responsible for regulating the electricity industryin New Zealand. This dialogue, in turn, allows Unison to improve the quality of its asset management planning.The secondary purpose of the AMP is to fulfil Unison’s responsibilities under the Electricity DistributionInformation Disclosure Determination 2012. Clause 2.6.2 of the Determination provides the purpose ofdisclosure of asset management plans by New Zealand electricity distribution businesses, namely that the AMP: Must provide sufficient information for an interested person to assess whether;a. assets are being managed for the long term;b. the required level of performance is being delivered; andc. costs are efficient and performance efficiencies are being achieved. Must be capable of being understood by an interested person with a reasonable understanding of themanagement of infrastructure assets; Should provide a sound basis for the ongoing assessment of asset-related risks, particularly high impactasset-related risks.Interpretation of ‘material changes’ for AMP UpdateFor the purpose of the AMP Update, material changes are defined as significant deviations from the 2014 AMPUpdate with respect to how Unison manages its assets. Changes to processes, the adoption of new tools andtechniques are considered material. Adding, removing and rescheduling projects is considered material wherethe value of any change is greater than 300,000.page 1

SECTIONS 1-7UNISONLIMITED ASSETMANAGEMENTPLAN UPDATE2015UPDATE 2015UNISONNETWORKSNETWORKSLIMITED ASSETMANAGEMENTPLAN3Material Changes to Network DevelopmentPlansNetwork Development Plans have changed since publication of the 2014 AMP Update. The changes include there-phasing of projects on the southern outskirts of Rotorua and the development of electricity infrastructure tosupport large customer expansion to the east of Taupo. The re-phasing of projects in Rotorua is due to improvedasset utilisation that has been enabled by data derived from Unison’s Smart Network initiative.The changes to network development plans represent an accurate view of network development requirementsand associated expenditure. They are providing added confidence to Unison’s contractors and are facilitatingbetter resource planning and works delivery. The sections below outline and explain the changes.Enhanced asset utilisation from Smart NetworkAs part of the Smart Network implementation, Unison implemented fast transfer schemes to defer costly powertransformer replacements without having a negative effect on transformer design limits and life expectancy.A fast transfer scheme was implemented as part of the Smart Network at Tamatea zone substation in 2011. Areview of localised load growth and smart network data since the publication of the 2014 AMP Update hasenabled further capital deferral by shifting additional load away from Tamatea zone substation via the fasttransfer scheme. This has resulted in deferral of transformer and switchgear replacements at Tamatea zonesubstation by one year from 2014/15 to 2015/16. The associated work is to be carried out over two consecutiveyears, 2015/16 and 2016/17, to maintain continuity of supply during construction.The changes to network development plans as a result of enhanced asset utilisation from Smart Network aretabled below.Material changeDescription of change and implicationsTamatea 33/11kV transformers andswitchgear replacementDeferral of 33/11kV transformer and switchgear replacements at Tamatea zone substationthrough shifting more load away from Tamatea zone substation via a fast transfer scheme.Project implementation is now across 2015/16 and 2016/17 as a result of one year projectdeferral.Network CAPEX budget has changed by, 1,600,000 decrease in 2014/15 due to project start deferral; 1,745,000 increase in2015/16 due to re-phasing of the project. The project is now being completed in twoconsecutive years rather than two independent stages, across three years, as previouslyplanned; 300,000 decrease in 2016/17 due to refinement in budget upon completion of projectdesign.The sum of these changes is a total decrease in budget of 144,000 Table 1: Changes to network development plans due to localised load growthpage 2

SECTIONS 1-7UNISON NETWORKS LIMITED ASSET MANAGEMENT PLAN UPDATE 2015UNISON NETWORKS LIMITED ASSET MANAGEMENT PLAN UPDATE 2015Alternate development options that were considered include:Class of OptionOptionsDescriptionCostNon-NetworkEnhance load controlcapabilityOnly a marginal decrease in peak loads is possible due to the highproportion of industrial load in the Tamatea area. This option doesnot therefore adequately address the constraint.N/ATable 2: Development options for localised load growthAltered Project scope and deliveryUnison’s 33kV and 11kV feeder networks traverse different terrain, council jurisdictions, and tenure rights andconditions. Since the publication of the 2014 AMP Update, further investigation has been undertaken todetermine optimal solution delivery and feeder routes for two 33kV feeder projects in 2015/16.Until such time that the projects commence, Unison will continue to investigate non-network solutions topotentially further defer the significant line upgrades.The changes to network development plans as a result of the above changes are tabled below.Material changeDescription of change and implicationsArataki – Whakatu 33kV feederFeeder route changes to overcome physical constraints identified (through school grounds) andstreamline easement approval process. 1,100,000 increase in Network CAPEX budget in year 2015/16 as a result of a longer feederroute.Fleet Street – Taupo South 33kV tiefeederFeeder route changes to incorporate local council requirement on underground services, andchanges in resource deployment and delivery phasing by combining Taupo South switchgearreplacement with Fleet Street – Taupo South 33kV tie.Network CAPEX budget has changed by, 900,000 decrease in 2014/15 and 900,000 increase in 2015/16 due to changes inresource and delivery phasing; 900,000 increase in 2015/16 due to;o 400,000; combining Taupo South switchgear replacement to the project scopeo 500,000; feeder route changed to accommodate specific local council requirementsTable 3: Changes to network development plans due to altered project scope and deliveryLarge customer initiated developmentWairakei Pastoral LimitedLarge tracts of land to the east of Taupo are being converted from forest into dairy farms meaning significantnetwork development is required in this area from mid-2015. Since the publication of the AMP 2014, thedeveloper has modified the dairy farm conversion and irrigation pump station schedules. Less farms thanoriginally planned will be connected, and those that are being connected are being done so over a longer timeperiod and in locations that mean Unison can make better use of existing infrastructure. The result is theremoval of the requirement to build one complete double circuit line to supply the farms. This has caused amaterial reduction in network development plans, customer connection plans and expenditure forecasts. Theimpact on expenditure forecasts is detailed in Section 5.page 3

SECTIONS1-7LIMITEDUNISON NETWORKS ASSET MANAGEMENT PLAN UPDATE 2015UNISON NETWORKS LIMITED ASSET MANAGEMENT PLAN UPDATE 2015The changes to network development plans as a result of the Wairakei Pastoral Ltd development are tabledbelow.Material changeDescription of change and implicationsWairakei Pastoral development 11kV feedersExtensive 11kV network reinforcement.Network CAPEX budget has decreased by 2,200,000 and 1,900,000 in 2014/15 and 2015/16respectively, and increased by 500,000 and 992,000 in 2016/17 and 2018/19 respectively.Table 4: Changes to network development plan due to large customer initiated development – Wairakei Pastoral LtdRed Stag Timber expansionRed Stag Timber Ltd has committed to a staged expansion plan for the Waipa site on the southern outskirts ofRotorua. The first stage expansion from early 2016 will see a two-fold increase in electricity demand and of RedStag’s on-site generating capacity. The increase in demand and generation exceeds the existing supply capacityof Unison assets. Investment to address the shortfall in the existing infrastructure capacity is covered under theCustomer Connection CAPEX plan. The impact on expenditure forecasts is detailed in Section 5.The changes to network development plans as a result of the Red Stag Timber expansion are tabled below.Material changeDescription of change and implicationsWaipa zone substation and 33kVfeederEstablish the new Waipa zone substation with single 33/11kV transformer and construction of a33kV feeder from Rotorua Point of Supply. 6,300,000 increase in Customer CAPEX budget in year 2015/16.Table 5: Changes to network development plan due to large customer initiated development – Red Stag Timber expansionAlternate development options that were considered include:Class of OptionOptionsDescriptionCostNetworkEstablish new 11kVfeedersTwo new 11kV feeders from Rotorua POS and line connectedvoltage regulators to address increased load and generation fromRed Stag Timber expansion. 7,500,000Waipa substation andFernleaf 33kV feederWaipa zone substation establishment and Fernleaf 33kV feederupgrade. The increased load and generation is in excess of thefeeder capacity upgrade. This option does not therefore adequatelyaddress the constraint.N/AEnhance load controlcapabilityEnhanced load control will not have significant enough impact todefer the need for investment due to the scale of load increase.This option does not therefore adequately address the constraint.N/ANon-NetworkTable 6: Development options for large customer initiated development – Red Stag Timber expansionpage 4

SECTIONS 1-7UNISON NETWORKS LIMITED ASSET MANAGEMENT PLAN UPDATE 2015UNISON NETWORKS LIMITED ASSET MANAGEMENT PLAN UPDATE 20154Material Changes to Lifecycle AssetManagement PlansThere have not been material changes to Unison’s lifecycle asset management plans since the 2014 AMP wasdisclosed. The movement and re-phasing of some medium to small projects has occurred inside the planningperiod, however these are not considered material as the value of any single change is not greater than 300,000. Unison is commencing a comprehensive review of its asset replacement processes in 2015 and theoutcomes of this review will be reported in the 2016 AMP.Material changeDescription of change and implications-No material changesTable 7: Material changes to lifecycle asset management (maintenance or renewal) plans5Reasons for any Material Changes toExpenditure ForecastsMaterial changeDescription of change and implicationsChanges in the basis for preparationUnison has consolidated the network and contracting businesses for reporting purposes in theof forecasted CAPEX and OPEXAMP Update. Further details on changes to the basis for preparation are provided below.Changes in System Growth forecastsSystem Growth CAPEX forecasts have changed for the years 2014/15 to 2016/17.in years 14/15 to 16/17The drivers for this change and the implications are detailed in Section 3 (Material changes tonetwork development plans).Changes in Customer CAPEXForecasted Customer CAPEX has decreased by 1,300,000 in 2014/15, and increased byforecasts 5,200,000 in 2015/16, 2,000,000 in 2016/17 and 800,000 per year from 2017/18 to 2019/20 inthe planning period.The changes in forecasts are due to the inclusion of Red Stag Timber expansion project in2015/16, and developer driven changes on dairy farm and irrigation pump station schedules forthe Wairakei Pastoral Ltd project. Further detail is provided on the Wairakei Pastoral Ltd projectand Red Stag Timber expansion project below.Changes in Network OPEX forecastsNetwork OPEX forecasts have increased in years 2014/15 – 2018/19.The increase in forecasts in years 1-5 is due to the implementation of the Deuar pole testingsystem.Table 8: Material changes to expenditure forecastspage 5

SECTIONS1-7LIMITEDUNISON NETWORKS ASSET MANAGEMENT PLAN UPDATE 2015UNISON NETWORKS LIMITED ASSET MANAGEMENT PLAN UPDATE 2015Basis for preparationUnison procures capital and maintenance services from its related party contractor, Unison Contracting ServicesLimited (UCSL). In previous years, AMP forecasts have been prepared on the basis of estimated transactionvalues, which included margins to cover UCSL’s overhead costs, including plant and equipment costs. In thisyear’s AMP Update, a decision has been taken that the only sustainable basis for reporting the costs to Unison ofundertaking capital and operating works is to notionally consolidate the network and contracting businesses.This has the effect that: Overhead costs associated with running a contracting business are now recorded as operating expenses forUnison; UCSL’s capital costs (e.g. relating to purchase of plant and equipment, buildings) are recorded as nonsystem fixed asset expenditures; Margins associated with covering the above two items are no longer included in the network operating andcapital expenditures.The effect of this is that, compared to an arm’s length reporting approach, non-network operating and capitalexpenditure is higher and network operating and capital expenditure is lower. Overhead costs that wouldpreviously have been capitalised into asset values and recovered over time are now expensed, so in the shortterm this will mean that consumers will face higher costs and it will not be possible to make direct comparisons ofUnison’s expenditure profiles with other EDBs where they use third party contractors.Red Stag Timber ExpansionThe Red Stag Timber Expansion is a significant contributor to customer capital expenditure in 2015/16. Thedevelopment is detailed in Section 3. In total, the Red Stag Timber expansion will include:Project ComponentEstimated Cost (all years)Establish Waipa substation and 33kV feeder 6,200,000Establish dedicated 11kV local supply feeder connections 100,000Project Total 6,300,000Table 9: Red Stag Timber development project inclusions and costingWairakei Pastoral DevelopmentThe Wairakei Pastoral Ltd (WPL) development is a significant contributor to network and customer capitalexpenditure from 2014/15. Developer driven changes in dairy farm conversion and irrigation pump stationschedules have resulted in scope changes of 11kV backbone feeders and direct connections. In total, therevised WPL development will include:page 6

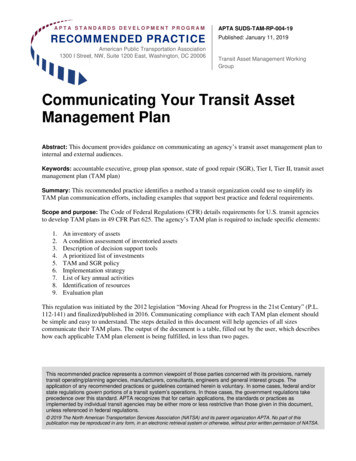

SECTIONS1-7UNISON NETWORKS LIMITED ASSET MANAGEMENTPLAN UPDATE 2015UNISON NETWORKS LIMITED ASSET MANAGEMENT PLAN UPDATE 2015Project ComponentEstimated Cost (all years)Establish Te Toke substation and 11kV feeders 6,792,000Havelock North and Taupo South 33/11kV transformers replacement and relocation 2,500,000Establish dedicated customer and irrigation pump connections 6,100,000Project Total 15,392,000Table 10: Wairakei Pastoral Ltd project updated costing6Changes to Asset Management PracticesAffecting Schedule 13 ReportIn 2012 the New Zealand Commerce Commission adopted a subset of the PAS55 evaluation questions (theAsset Management Maturity Assessment Tool, “AMMAT”) and required publication of self-assessed competenceagainst those criteria by New Zealand Electricity Distribution Businesses (EDBs) as part of the annualinformation disclosure requirements.Unison’s 2012 Asset Management maturity could be compared to other EDBs by using this condensed AMMATversion of PAS55 (Figure 1). Unison’s performance is encouraging relative to other New Zealand EDBs. Theinitial assessment of maturity ratings for each question resulted in an inconsistent range of interpretations by theparticipating group of EDBs. Industry-wide discussion narrowed this range but did not eliminate it since theAMMAT maturity level descriptions are, in many cases, broadly defined and subject to interpretation that willdiffer with organisational perspective.page 7

SECTIONS 1-7UNISON NETWORKSLIMITED ASSETMANAGEMENTPLAN UPDATE2015UPDATE 2015UNISONNETWORKSLIMITED ASSETMANAGEMENTPLAN2013 AMMAT ScoresSystems, Integration and InformationManagementStructure, Capacity and AuthorityDocumentation, Controls and ReviewsCompetency and TrainingCommunication and ParticipationAsset Strategy and Delivery01Unison234Other NZ EDBsFigure 1: AMMAT ComparisonThe Commerce Commission expects that collaborative work within the industry, such as the ElectricityEngineers’ Association’s (EEA) work that is underway to provid

UNISON NETWORKS LIMITED ASSET MANAGEMENT PLAN UPDATE 2015 Alternate development options that were considered include: Table 2: Development options for localised load growth Altered Project scope and delivery Unison’s 33kV and 11kV feeder networks traverse different terrain, council jurisdictions, and tenure rights and conditions.