Transcription

Version 28 November 2018GOLDMAN SACHS EQUITY FACTOR INDEX EUROPE NET TOTAL RETURN EURTABLE OF CONTENTS1. Overview2. Description of the Index and Methodology3. Risk Factors4. Conflicts of Interest and Potential Conflicts of Interest5. Disclaimers-1-

Version 28 November 2018OVERVIEWIntroductionThe Goldman Sachs Equity Factor Index Europe Net Total Return EUR (the "Index") is created byGoldman Sachs International (the "Index Sponsor") and is designed to synthetically represent theperformance of a portfolio of European equities reflecting five Investment Factors (as defined below)while taking into account various investment considerations, such as the expected tracking error ofthe Index to a Benchmark Portfolio (as defined below), the market liquidity of stocks, transaction costsand the turnover of stocks, using a rules-based methodology as described below, all as set out in thisdescription (the "Methodology").The synthetic portfolio of European equities is drawn from the Eligible Universe (as defined below)using a stock selection process as described in the section "Selection of Component Stocks andDetermination of the Weights" below. The Index aims to implement practices and methods describedin academic literature relating to the Investment Factors in a tradable, liquid and transparent manner.The Index attempts to capture returns arising from exposure to the following five investment factorsbelow (each an "Investment Factor" and together the "Investment Factors"). Sources of thesereturns in different markets have been documented in academic literature and have been explainedas arising from traditional risk sharing, structural and/or information processing constraints. Theexpected returns predicted by theory may be thought of as the premium received by a hypotheticalinvestor willing and able to take those identifiable risks and are therefore characterised as "riskpremia".Investment Factors:1. Quality Factor: This Investment Factor aims to capture the potential outperformance ofstocks that have a strong balance sheet compared to stocks that have a weaker balancesheet.2. Value Factor: This Investment Factor attempts to capture the potential outperformance of"inexpensive" companies compared to "expensive" companies, where such value measure isderived from various accounting ratios.3. Low Beta Factor: This Investment Factor attempts to capture the potential risk-adjustedoutperformance of stocks with low beta to the market compared to those with high beta,where beta is a measure of the sensitivity of a stock’s returns to the market returns.4. Momentum Factor: This Investment Factor attempts to capture the potential futureoutperformance of stocks with high historical returns compared to stocks with low historicalreturns. The calculation of such historical returns is described in more detail in the section"Selection of Component Stocks and Determination of the Weights" below.5. Size Factor: This Investment Factor attempts to capture the potential risk-adjustedoutperformance of smaller companies compared to larger companies, as measured by marketcapitalisation.The Index is designed to generate a synthetic exposure to the total return of a long-only basket ofcomponent stocks (the "Basket"). The Index uses an algorithm that determines the stocks to beincluded in the Basket on any day (such stocks the "Component Stocks") and the weight attributedto each such Component Stock.A new Basket of Component Stocks and their respective weighting (the "Weights") will be selectedfrom the potential universe of stocks (the "Eligible Universe"), as defined in the section "EligibleUniverse" below, at each Basket Rebalancing (as defined below).-2-

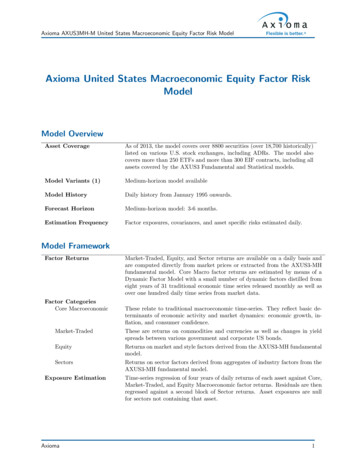

Version 28 November 2018Using the rules set out in the section "Selection of Component Stocks and Determination of theWeights" below, the Weights are calculated and the Component Stocks in the Basket are determined(in each case, as of the date of this document) by Axioma, Inc. (the "Weight Calculation Agent").Based on such Weights and Component Stocks, the value of the Index is calculated (as of the date ofthis document) by S&P Dow Jones Indices (the "Index Calculation Agent").The Index Sponsor may appoint one or more replacement Weight Calculation Agents and/or one ormore replacement Index Calculation Agents from time to time, including itself.The Index is rules-based and none of the Index Sponsor, Weight Calculation Agent or IndexCalculation Agent exercise any discretion or independent judgment as regards the application of theMethodology to the selection, weighting and on-going rebalancing of the Basket other than in certainlimited cases following the occurrence of an Extraordinary Event or a Disruption Event as set out inthe section "Extraordinary Events and Disruption Events" below. The Methodology may be amendedby the Index Committee as set out in the section "Availability and Publication of the Index Value,Changes in Methodology, and Termination of the Index" below.The Index is not an actively managed index and none of the Index Sponsor, the WeightCalculation Agent or the Index Calculation Agent are providing any investment advice orperforming a discretionary asset management role. None of the Index Sponsor, the WeightCalculation Agent or the Index Calculation Agent will owe any person any fiduciary duties inrespect of the Index and are not required to take the interests of any person into account inmaking any determination with respect thereto.Although the Index is linked to the return of the Basket of Component Stocks, investing in any productlinked to the Index will not make an investor a holder of, or give an investor a direct investmentposition or any legal or beneficial interest in, any of the Component Stocks.The Index is denominated in Euro (the "Index Currency"). The Index does not seek to hedge anyforeign currency exposure in respect of any Component Stocks that are not denominated in the IndexCurrency and will not provide any hedge against foreign exchange risk. Investors in any productlinked to the Index will therefore be exposed to the positive or negative effects of currency exchangerate fluctuations in the relevant currencies against the Index Currency on the values of suchComponent Stocks.The Weights of the Component Stocks in the Basket are calculated such that the expected trackingerror of the Basket to the Benchmark Portfolio (as defined below) does not exceed 2%. Thesubsequently realised tracking error of the Index to the Benchmark Portfolio may be lower or higherthan 2%.The Index is calculated so as to include deductions that are intended to synthetically reflect thetransaction costs that a hypothetical investor would incur if such hypothetical investor were to enterinto and maintain a series of direct investment positions to provide the same exposure to theComponent Stocks of the Basket. Investors should note that the actual costs of entering into andmaintaining such exposure may be lower or higher and, if they were lower, the effect of thesedeductions would be to benefit the Index Sponsor and/or any affiliate in its capacity as issuer of orcounterparty to products linked to the Index (a "Hedging Party").A Hedging Party will hedge its exposure or potential or expected exposure to the Index, productslinked thereto, stocks in the Eligible Universe and the Basket and investments linked to such stockswith an affiliate or a third party. A Hedging Party may make significant returns on this hedging activityindependently of the performance of the Index, including in scenarios where the levels at which itexecutes its hedges are different from the levels specified in the methodology for determining theIndex Value.The value of the Index is floored at zero. If on any day the value of the Index falls to zero, it willremain at zero for all future days. In such an event, any investment linked to the Index may lose all ofits value, in which case there may be no chance of such investment thereafter recovering.-3-

Version 28 November 2018Unless the context otherwise requires, references below to "The Goldman Sachs Group, Inc.","Goldman Sachs", "we", "our" and "us" refer only to The Goldman Sachs Group, Inc. and not to itsconsolidated subsidiaries, and the "Goldman Sachs Group" refers to The Goldman Sachs Group, Inc.and its consolidated subsidiaries. Goldman Sachs International owns the copyright and all other rightsto the Index.Goldman Sachs International does not have any obligation to continue to publish, and maydiscontinue publication of the Index at any time.This version of this document is dated 28 November 2018. Upon each update to a new version of thisdocument, the most recent version shall be deemed to be in force from the date of such update andreplace in its entirety the preceding version such that, in the event of any conflict between thepreceding version and the most recent version, the most recent version shall prevail. The most recentversion of this document will be published on https://etf.invesco.com or any successor page (the"Index Information Publication Data Source").-4-

Version 28 November 2018DESCRIPTION OF THE INDEX AND METHODOLOGY1.Overview of the Monthly Rebalancing ProcessThe Basket will be rebalanced approximately twice a month (a "Basket Rebalancing"). Each BasketRebalancing will comprise the following steps:(i) On 5 October 2016 and every eighth business day thereafter (each such day, subject toexchange holiday calendar adjustments, an "Observation Day") the Weight CalculationAgent will:(a) identify the securities comprising the Eligible Universe (each such security, an"Eligible Stock");(b) determine the Component Stocks from the Eligible Universe; and(c) determine the Weight for each Component Stock.(ii) On each day which falls four (4) business days (and further subject to exchange holidaycalendar adjustments if on such day not all the relevant exchanges are open for tradingduring their regular trading sessions) after an Observation Day (each such day a"Rebalancing Day") the Index will notionally sell and/or purchase Component Stocks toreach the relevant Weight for each Component Stock for such Rebalancing Day using theprocess set out in the section “Calculation and Publication of the Index Value” below.Other than on a Rebalancing Day, the Component Stocks in the Basket will remain unchanged,except for adjustments or modifications resulting from corporate actions and/or the changes arisingfrom Extraordinary Events or Disruption Events as set out in the section "Extraordinary Events andDisruption Events" below.2.Risk ModelAs described in more detail in the section "Selection of Component Stocks and Determination of theWeights" below, the Index is using the Axioma Portfolio Optimizer software package (the"Optimiser") and the data contained therein (together the "Risk Model") in order to calculate theWeights of the Component Stocks in the Basket. The Risk Model contains the Axioma EU21Estimation Universe (as described in more detail below), among other software and data. Moreinformation on the Optimiser and the Risk Model can be obtained from the portfolio user guideaccompanying the Risk Model and from http://www.axioma.com. The Index Sponsor may replace theOptimiser and/or the Risk Model from time to time.3.Eligible Universe and Market Cap Weighted PortfolioEligible UniverseTo qualify for inclusion in the Eligible Universe on an Observation Day, a stock must be a member ofthe Market Cap Weighted Portfolio (as defined below) on such day.Eligible CountriesThe "Eligible Countries" as of the date of this document are: Austria, Belgium, Denmark, Germany,Finland, France, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland andUnited Kingdom. On any subsequent day if the Index Sponsor determines that equities (a) from anyEligible Country have been excluded from, or (b) from any other country have been included in, oneor more major pan-European equity indices, then the Index Sponsor may exclude or include (as thecase may be) such country from the list of Eligible Countries. Following any such exclusion or-5-

Version 28 November 2018inclusion, the Index Sponsor will publish a notice to such effect on the Index Information PublicationData Source.Market Cap Weighted PortfolioIn order to determine the Market Cap Weighted Portfolio in respect of an Observation Day, the stockscomprising the Axioma EU21 Estimation Universe of stocks (which is part of the Risk Model andwhich is described in more detail below) on such day are associated with their respective countries.The relevant country for a stock is determined by reference to the Risk Model.The process to determine the Market Cap Weighted Portfolio in respect of an Observation Day isinitiated by determining a base portfolio of those stocks contained in the Axioma EU21 EstimationUniverse which the Risk Model associates with an Eligible Country. Next, each such stock which hadno trading volume on the relevant exchange on more than 10% of the scheduled trading days in the 3completed calendar months preceding such Observation Day will be removed. Such removal will notbe applied for stocks with an average price per share over the preceding one month period greaterthan USD 10,000 or the local currency equivalent (such filtering rules described in this paragraph, the"Universe Filter").As a next step, all remaining stocks are ranked by their market capitalisation in Euro, averaged overthe preceding one month period, starting with the stock with the highest market capitalisation andending with the stock with the lowest market capitalisation. The process seeks to select the stockswith the highest market capitalisation which in aggregate account for approximately 85% of theaggregate market capitalisation of the Axioma EU21 Estimation Universe.The "Market Cap Weighted Portfolio" in respect of an Observation Day consists of all stocks whichhave been selected in such way. The weight of a stock in the Market Cap Weighted Portfolio (the"Market Cap Stock Weight"), in respect of such day, is equal to its market capitalisation in Euro,divided by the sum of the market capitalisation in Euro in respect of all stocks in the Market CapWeighted Portfolio.The "Axioma EU21 Estimation Universe" is constructed by applying a set of exclusion rules to theAxioma EU21 Listed Universe, resulting in stocks with sufficient size and liquidity. More granular,“localized” rules are also applied on a per-market basis to filter certain exchanges, asset types, etc.As of 2011, the Axioma EU21 Listed Universe comprised roughly 7,300 securities, covering 36markets (including all of the Eligible Countries) as well as emerging markets which are not in theEligible Countries. As of 2011, the Axioma EU21 Estimation Universe comprised 2,500 securities onaverage.4.Selection of Component Stocks and Determination of the WeightsFactor ScoreOn each Observation Day the Weight Calculation Agent will determine the Component Stocks andtheir respective Weights by assigning a score (the "Factor Score") to each Eligible Stock in respect ofeach Investment Factor. The algorithm for calculating the Factor Score for each Eligible Stock inrespect of each Investment Factor is based on historically observed data and reflects academicresearch and publications in relation to such Investment Factors. On each Observation Day the FactorScores in respect of each Eligible Stock and each Investment Factor are calculated as follows:1. Quality Factor Score: The Weight Calculation Agent will obtain the following seven metricsusing data from the Thomson Reuters Worldscope database for each Eligible Stock: (i) returnon assets, (ii) operating cash flow to total assets, (iii) accruals, (iv) liquidity, (v) gross margin,(vi) asset turnover and (vii) leverage. The Quality Factor Score for an Eligible Stock iscalculated as the average of the seven metrics, whereby each metric has been winsorised to2.5 standard deviations (i.e. by replacing extreme values for each metric with the relevant-6-

Version 28 November 2018values based on the specified standard deviations) and subsequently standardised separatelyfor each industry group.2. Value Factor Score: The Value Factor Score for each Eligible Stock is obtained directly fromthe Risk Model and subsequently standardised within each industry group.3. Low Beta Factor Score: The Low Beta Factor Score of an Eligible Stock is equal to oneminus its “Beta” to the Benchmark Portfolio (as defined below), where Beta is a measure ofthe sensitivity of an Eligible Stock’s returns to the returns of the Benchmark Portfolio. Thevector 𝜷 of the Betas for all Eligible Stocks is calculated using the vector of the BenchmarkStock Weights 𝒘𝑩 (as defined below) and the covariance matrix 𝑪 of stock returns obtainedfrom the Risk Model:𝜷 𝑪. 𝒘𝑩′𝒘𝑩 . 𝑪. 𝒘𝑩4. Momentum Factor Score: The Weight Calculation Agent will determine the total returncumulative performance and the realised volatility over the 12 months preceding the relevantObservation Day, excluding the most recent month preceding the relevant Observation Day,for each Eligible Stock. Both metrics are then winsorised to 2.5 standard deviations andsubsequently standardised separately for each industry group to generate a momentum score𝒁𝑴 and a volatility score 𝒁𝝈 .The Weight Calculation Agent will run the cross-sectional regression 𝒁𝑴 𝛼 𝒁𝝈 𝜺 and theMomentum Factor Score is defined as the vector of residuals 𝜺.5. Size Factor Score: The Size Factor Score for an Eligible Stock is calculated as -1 (minusone) multiplied by the natural logarithm of an Eligible Stock’s market capitalisation and iswinsorised to 2.5 standard deviations and subsequently standardised separately for eachindustry group.In each case, the Weight Calculation Agent will determine the relevant industry group for an EligibleStock by reference to the country and the industry (broadly based on the Global IndustryClassification Standard, GICS) for such stock in the Risk Model. The industry (broadly based on GICSlevel 3) of an Eligible Stock contained in the Risk Model is associated with the corresponding industrygroup (broadly based on GICS level 2). More information on the Thomson Reuters Worldscopedatabase can be obtained from http://www.thomsonreuters.com.Basket ScoreIn respect of a Basket Rebalancing, the Weight Calculation Agent will calculate a score (a "BasketScore") for each Eligible Stock. The Basket Score is derived from the Factor Scores for such EligibleStock, weighted by the volatility of the factor portfolios. The volatilities 𝚺 of the factor portfolios 𝑾 arecalculated using the covariance matrix 𝑪 of the Risk Model as follows:Σ 𝑑𝑖𝑎𝑔(𝑊′𝐶𝑊)Determination of the WeightsOnce the Basket Score has been determined for each Eligible Stock, the Weight Calculation Agentwill assign a weight for each Eligible Stock using a rules-based non-discretionary mathematicalportfolio optimisation algorithm as described below. This algorithm assigns weights to Eligible Stocksin a manner which seeks to maximise the aggregated Basket Score over all Eligible Stocks, subject tothe following set of constraints:-7-

Version 28 November 20181. Long Only Constraint: The weight of each Component Stock cannot be less than zero.Consequently, the Index is a long only index.2. Country Constraint: The aggregate of the relative weights of each Component Stock in theBasket associated with a particular country must be within the range of /- 2% as comparedto the aggregate weight of all stocks associated with such country in the Benchmark Portfolio(as defined below).3. Industry Group Constraint: The aggregate of the weights of each Component Stock in theBasket associated with a particular industry group must be within the range of /- 2% ascompared to the weight of all stocks associated with such industry group in the BenchmarkPortfolio (as defined below).4. Maximum Weight Constraint: The weight of each Component Stock in the Basket must note

2. Risk Model As described in more detail in the section "Selection of Component Stocks and Determination of the Weights" below, the Index is using the Axioma Portfolio Optimizer software package (the "Optimiser") and the data cont