Transcription

1

PresentersSarah FaneHead of ContentsharedserviceslinkPeter BoerhofVat DirectorVertexRoger LindelaufDirector SAP CoEVertex

Make the most of your time hereAsk us questions!Check your emailfor the slidesThe recording willbe available soonsharespace.digitalCPD Certificate in28 working daysLike ourwebinars?Spread the word.Share on LinkedInStay to the end forour 175 charityprize draw (moreon next slide)

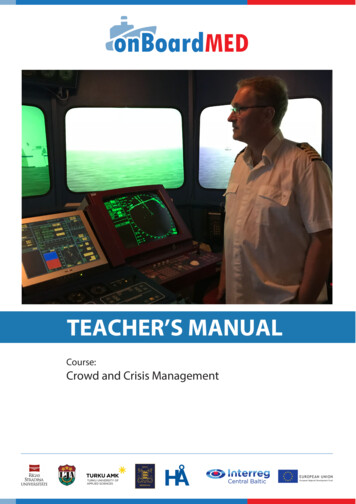

Agenda and ContextAs tax authorities get more digital, indirect tax teams are working hard to ensure their processesand technology will help them stay compliant.The right investment in tax technology can help ensure compliance and reduce costs, but it can bedifficult for the wider business to understand and engage with the details. Many tax teams struggleto get their priorities high on the CFO and CEO’s agenda.Today we explore how to build a business case for automation that appeals to the wider business,and the most important elements to include to make it attractive to the CFO, CEO and IT

The business casethat people will read23 March 2022

The Intangibles7

Poll 1Have you designed a business case for indirect taxautomation?Yes, and it has been successfulYes, but it has not been approved yetWe are working on one nowWe have not designed a business case yet8

IdentifygapsandrisksDo you need a business case?No system issues discovered no need for projectDo we need a cure?Quick scanorBusiness case ?We need a project to curethe system

Understand the bigger picture

Stakeholders and alliancesCOMPLIANCETaxITTax IT Vertex Inc.COMPLIANCE

Three angles for changeKeep us out of troubleGrowing numberof VAT utationalconsequencesBigger fines andsettlementsStiffersanctionsInternational dataexchangeCriminalindictmentsAll confusing and overdone Except when we get in troubleMake our business betterCoordinatedrisk activitiesEnhancedbusinessprocessesOptimized controlsImproved riskreporting anddisclosureEffective useof technologyReducedtotal riskspendMust do it But how do we do it better?Futureproof our businessAll SAP customerswill need to moveto S/4 Hana in thenext 5 to 10 yearsThe EU action planforesees to changethe VAT regime inthe EU within thenext 2-5 yearsE-invoicingrequirements andTax Compliancereporting getsmore complexEU “VAT in the digitalage” initiativeUncertain But coming!

Ambition of “TAX” to add more valueKey objectives of the "best fit" VAT technology solution are a reduction of transactional error rates, mitigation of risk, capturingopportunities, free up resources to focus on value-add activities and possibly reducing overall cost of VAT compliance .Planning and Decision Support Perform indirect tax planning Provide indirect tax input into transactions Provide indirect tax input into business changedecisions (new markets, products, customers) Manage SUT & VAT working capital effectivelyCost of indirect tax advisoryand compliance activitiesTodayIn the future?Reductionin cost offinance andtax functionControl Comply with internal control requirements Manage local country indirect tax risk Reduce frequency of errors/penaltiesReporting Manage policies and procedures Prepare tax accounts/reports Deliver/file reportsTransaction Processing Accounts payable SUT & VAT postings, vendorinvoice reviews and foreign VAT identification Intercompany and T&E SUT & VAT postings Accounts receivable SUT & VAT postings"value" of theactivity for thebusiness – addingor protecting.Changing the mix of processes towards a system of insights orcost reductionTechnology enablement will be key to delivering the benefits outlined above

CHANGING CONTROL FRAMEWORK FOR TAX

VATcomplianceconvergingWhereis the processimpact into core finance processesProcure toPayMasterDataInvoiceClearance( 2023)Record toReport(Near) real-timereporting( 2018)Order toCashIn the transactionTraditionalReporting( 2010) 1-4 days 1 month“Reporting delay”

Process-Systems-People-OrganizationPeopleProcess OptimizationAutomationCentralizationOutsourcing16

BUSINESS CASE FOR CHANGEQuestions to consider1. EstablishGoals2. AgreeApproach3. AgreeParameters How is a business case evaluated in your company? What activities are in scope for the business case? What are the alternatives to the solution for which the businesscase is being developed? Who are your stakeholders? Which functions should be involved? Are they available? What is your timeline? Explanation of the VBS calculation model Who will do what? There are up to 60 pre-defined parameters across the Tax, IT andFinance departments that we use to calculate the business case. Discuss the various parameters. Agree the relevant parameters for your case.Questions to considerQuestions to consider4. DataGathering5. PopulateModel6. AgreeAssumptions7. Evaluation Next Steps Is this information readily available? How much time will data gathering cost? How reliable and consistent is the data? Based on information gathered, Vertex to:- populate the VBS calculation model- assess and challenge the data- analyze and list gaps For missing or incomplete data, agree realisticassumptions based on our previous experience and yourteam’s knowledge of the organization. Assumptions integrated into the VBS calculation modeltogether with possible revised or additional data. Results produced in a finalized financial business casereport.

The tangiblesThe hidden costs ofdesigning and maintainingVAT in SAP S/4HANA

Poll 2What do you expect the cost would be to design and maintainyour VAT processes for SAP S/4 HANALess than 50,000Between 50,000 and 100,000Between 100,000 and 200,000More than 200,000Unsure / Don’t know19

How much does VAT determination cost in S/4HANA? SAP S/4HANA delivers a basic framework for VAT determination.This framework works perfectly for: Business transactions that don’t involve more than 2 parties (A-B transactions) Domestic transactions Simple cross border transactionsIs your business as simple and transparent as described above?Or can you compare your business with most businesses: Business transactions with 3 or more parties involved (Chain transactions) Complex exemption rules (extended reverse charge, High Seas/Out of the scope for VAT, Triangulations, Customer pick-ups etc.)If you recognize the above complexity: Are you aware of the cost of designing and maintaining VAT determination in S/4HANA?20

VAT determination cost in S/4HANA transparent?Business case calculations, project plans, Statements of Work,budget calculations .Did your implementation plan contain transparent VATdetermination cost?Often SAP S/4HANA implementation projects don’t state arealistic calculation for implementing fully automated andcompliant VAT determination process.VAT determination cost are famous “HiddenCost”; a well-kept secret in many organizationsTotal budget xx.xxx.xxxTax Engine implementation cost: xxx.xxxAdditional cost or not?21

Why are VAT determination cost not transparent? Initial implementation / migration to S/4HANA Cost often not recognized.– Perceived as “part of the sales process” “just” some master data, condition records and maybe anoccasionally enhancement– Perceived as “part of the finance process” “just” some tax codes and G/L Accounts to be created– In purchasing processes: AP staff will manually determine the “correct” tax code After go-live 22New business flows are created using a Change Request: VAT cost not specifiedNew entities / new countries of registration: VAT cost not specified in Change RequestBug fixing for unexpected VAT results: Not recognized as VAT costEtc.

Extracting the VAT costs from the big SAP S/4HANA project budget:What would the VAT set-up cost look like for an EU entity with 5-10 VAT registrations?23

Determining the legal partner for VAT purposes in SAPWhat does it take to ensure we always determine the correct“Legal partner for VAT purposes” in a sales transaction in SAP?24

Designing the “Legal Partner for VAT purposes”Who?-VAT ManagerExternal VAT advisorSAP SD consultantSAP Finance ConsultantSAP ABAP developerKey user SalesKey user FinanceAverage involvement each team member:Average days per month:Average hourly cost:2510%20 days 100SAPModuleThroughputtime (months)# staffinvolvedTotaldaysCostTotal cost Legal partner forVAT designSales2728 22.400 22.400

Designing EU TriangulationWho?-VAT ManagerExternal VAT advisorSAP SD consultantSAP Finance ConsultantSAP MM ConsultantSAP ABAP developerDeveloper AP scanning solutionKey user SalesKey user FinanceKey user PurchasingSAP ModuleThroughputtime (months)# staffinvolvedTotaldaysCostSales4864 51.200IntercompanyInvoices2728 22.400Scanned AP/Vendor portals2832 25.600Total costTriangulation design 99.200Average involvement each team member:Average days per month:Average hourly cost:2610%20 days 100

Reverse charge, Out of Scope, VAT groups etc.Legal Partner 22.400Extended Reverse charge rulesTriangulation 99.200SAP ModuleThroughputtime (months)# staffinvolved2864 25.600IntercompanyInvoices1.5728 16.800Scanned AP/Vendor portals1.5832 19.200SalesTotaldaysCostTotal cost ERC design 61.600 27

Reverse charge, Out of Scope, VAT groups etc.Legal Partner 22.400Out of the Scope for VATTriangulation 99.200Extended Reverse ChargeSAP ModuleThroughputtime (months)# staffinvolved1.5824 19.200IntercompanyInvoices1714 11.200Scanned AP/Vendor portals1816 12.800SalesTotaldaysCostTotal cost OSV design 61.600 43.200 28

Reverse charge, Out of Scope, VAT groups etc.Legal Partner 22.400VAT GroupsTriangulation 99.200Extended Reverse ChargeSAP ModuleThroughputtime (months)# staffinvolvedTotaldaysCostSales0.588 6.400IntercompanyInvoices0.2573.5 2.800Scanned AP/Vendor portals0.2584 3.200Total cost OSV design 61.600Out of the Scope for VAT 43.200 12.400 29

Reverse charge, Out of Scope, VAT groups etc.Legal Partner 22.400Default Services rulesTriangulation 99.200Extended Reverse ChargeSAP ModuleThroughputtime (months)# staffinvolved1816 12.800IntercompanyInvoices0.577 5.600Scanned AP/Vendor portals0.2584 3.200SalesTotaldaysCostTotal cost Services 61.600Out of the Scope for VAT 43.200VAT Groups 12.400 30 21.600

Reverse charge, Out of Scope, VAT groups etc.Legal Partner 22.400Mixed Goods/ServicesTriangulation 99.200Extended Reverse ChargeSAP ModuleThroughputtime (months)# staffinvolvedTotaldaysCostSales4864 51.200IntercompanyInvoices4756 44.800Scanned AP/Vendor portals4864 51.200Total costGoods/services 61.600Out of the Scope for VAT 43.200VAT Groups 12.400Default Services 21.600 31 147.200

Reverse charge, Out of Scope, VAT groups etc.Legal Partner 22.400Sequential Invoice number rangesTriangulation 99.200Extended Reverse ChargeSAP ModuleSalesThroughputtime (months)# staffinvolved15Totaldays10CostTotal cost Invoicenumbers 8.000 61.600 8.000Out of the Scope for VAT 43.200VAT Groups 12.400Default Services 21.600Mixed Goods/Services 147.200 32

Total design / implementation cost VAT determination S/4HANALegal Partner 22.400Triangulation 99.200Total for designing VAT exemptions in SAP during S/4HANAimplementation: 415.600Extended Reverse Charge 61.600Out of the Scope for VAT 43.200VAT Groups30% Possible efficiency gain if all designed and implemented as 1 project-/- 124.680 12.400Default Services 21.600Mixed Goods/ServicesOn off costs: 290.920 147.200Invoice number ranges 8.00033The implementation cost of a tax engine are replacing the “hidden cost” Tax engine is not an additional cost

Not included in the initial set-up costsOther special rules like Supply & Install, Specific domestic requirements in e.g. Poland, Hungary, Italy etc. Digital reporting requirements (e-invoicing) Basic set-up work, like: Tax procedure design, condition records, invoice layouts, master data (MTC/CTC) EtcOther regions like Brazil, India, US etc.Other financial platforms like Ariba, E-commerce platform, expense system, multiple ERP instances etc.34

Yearly maintenance cost of initial set-upNorm 15% of initial costNot included in this yearly maintenance: VAT rate changes, introducing new countries Tax research!35 43.638Assumptions made Solution based in a flexible, future proof way Solution however often build based on current Business requirements often hard coded solutions, which are not flexible enough to handlechanges / introductions of new countries. The more "hard-coded"solutions build, the more VAT requirements are built in "isolation", themore expensive it will become to implement Legislative changesand/or expanding to new countries The initial build team is still involved High quality of documentation

Key take awaysIntangible aspects of a business caseTangible aspects of a business case Understand your stakeholders VAT implementation cost are hidden make themvisible Understand the need for Tax automation Understand your business and its processes Implementing a Tax Engine are not additional cost they replace the hidden cost Maintaining an own designed VAT determinationsolution is not free of charge36

Q&A37

Thank exinc.com38

The trusted name in tax technology for over 40 years4,000 130Customers (1)Countries supported (1)59%of the Fortune 500 (1)Notes: (1) Based on information as of December 31, 2020.39

Copyright 2021 Vertex, Inc. All rights reserved. The information contained herein is intended forinformation purposes only, may change at any time in the future, and is not legal or tax advice. Theproduct direction and potential roadmap information is not a guarantee, may not be incorporated intoany contract, and is not a commitment to deliver any material, code, or functionality. This informationshould not be relied upon in making purchasing, legal, or tax decisions. The development, release, andtiming of any features or functionality described for Vertex’s products remains at the sole discretion ofVertex, Inc. Any statements in this release that are not historical facts are forward-looking statementsas defined in the U.S. Private Securities Litigation Reform Act of 1995. All forward-looking statementsare subject to various risks and uncertainties described in Vertex’s filings with the US Securities andExchange Commission (SEC) that could cause actual results to differ materially from expectations.Vertex cautions readers not to place undue reliance on these forward-looking statements which Vertexhas no obligation to update and which speak only as of their dates.40

Coming upwww.sharespace.digitalJanuary 16thJanuary 23rdJanuary 30th

BUSINESS CASE FOR CHANGE How is a business case evaluated in your company? What activities are in scope for the business case? What are the alternatives to the solution for which the business case is being developed? There are up to 60 pre-defined parameters across the Tax, IT and Finance departments that we use to calculate the business case. Discuss the various parameters.