Transcription

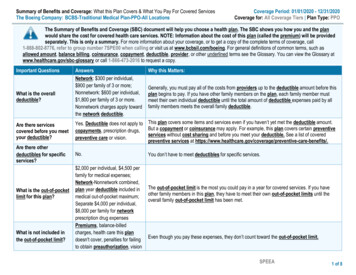

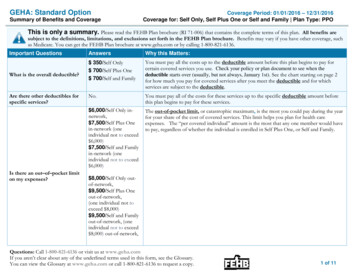

GEHA: Standard OptionSummary of Benefits and CoverageCoverage Period: 01/01/2016 – 12/31/2016Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPOThis is only a summary. Please read the FEHB Plan brochure (RI 71-006) that contains the complete terms of this plan. All benefits aresubject to the definitions, limitations, and exclusions set forth in the FEHB Plan brochure. Benefits may vary if you have other coverage, suchas Medicare. You can get the FEHB Plan brochure at www.geha.com or by calling 1-800-821-6136.Important QuestionsWhat is the overall deductible?Are there other deductibles forspecific services?Is there an out–of–pocket limiton my expenses?AnswersWhy this Matters: 350/Self Only 700/Self Plus One 700/Self and FamilyYou must pay all the costs up to the deductible amount before this plan begins to pay forcertain covered services you use. Check your policy or plan document to see when thedeductible starts over (usually, but not always, January 1st). See the chart starting on page 2for how much you pay for covered services after you meet the deductible and for whichservices are subject to the deductible.No.You must pay all of the costs for these services up to the specific deductible amount beforethis plan begins to pay for these services. 6,000/Self Only innetwork, 7,500/Self Plus Onein-network (oneindividual not to exceed 6,000) 7,500/Self and Familyin-network (oneindividual not to exceed 6,000)The out-of-pocket limit, or catastrophic maximum, is the most you could pay during the yearfor your share of the cost of covered services. This limit helps you plan for health careexpenses. The “per covered individual” amount is the most that any one member would haveto pay, regardless of whether the individual is enrolled in Self Plus One, or Self and Family. 8,000/Self Only outof-network, 9,500/Self Plus Oneout-of-network,(one individual not toexceed 8,000) 9,500/Self and Familyout-of-network, (oneindividual not to exceed 8,000) out-of-network,Questions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy.1 of 11

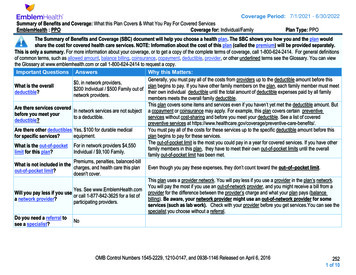

GEHA: Standard OptionSummary of Benefits and CoverageWhat is not included in the out–of–pocket limit?Coverage Period: 01/01/2016 – 12/31/2016Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPOPremiums, balance-billed Even though you pay these expenses, they don’t count toward the out-of-pocket limit.charges, any penalties,non-covered drugs orthe difference in pricebetween generic andbrand name, and healthcare this plan does notcover.No.The chart starting on page 2 describes any limits on what the plan will pay for specific coveredservices, such as office visits.Yes. Seewww.geha.com or call1-800-821-6136 for a listof participatingproviders.If you use an in-network doctor or other health care provider, this plan will pay some or all ofthe costs of covered services. Be aware, your in-network doctor or hospital may use an out-ofnetwork provider for some services. [We use the terms in-network or participating forproviders in our network.] See the chart starting on page 2 for how this plan pays differentkinds of providers.Do I need a referral to see aspecialist?No.You can see the specialist you choose without permission from this plan.Are there services this plandoesn’t cover?Yes.Some of the services this plan doesn’t cover are listed on page 6. See this plan’s FEHBbrochure for additional information about excluded services.Is there an overall annual limiton what the plan pays?Does this plan use a network ofproviders? Copayments are fixed dollar amounts (for example, 15) you pay for covered office visits, usually when you receive the service. Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example, if theplan’s allowed amount for an overnight hospital stay is 1,000, your coinsurance payment of 20% would be 200. This may change if youhaven’t met your deductible. The amount the plan pays for covered services is based on the allowed amount. If an out-of-network provider charges more than the allowedamount, you may have to pay the difference. For example, if an out-of-network hospital charges 1,500 for an overnight stay and the allowedamount is 1,000, you may have to pay the 500 difference. (This is called balance billing.) This plan may encourage you to use participating providers by charging you lower deductibles, copayments and coinsurance amounts.Questions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy.2 of 11

GEHA: Standard OptionSummary of Benefits and CoverageCommonMedical EventIf you visit a healthcare provider’s officeor clinicServices You May NeedPrimary care visit to treat aninjury or illnessSpecialist visitOther practitioner office visitPreventive care/screening/immunizationIf you have a testDiagnostic test (X-ray, bloodwork)Imaging (CT/PET scans, MRIs,MRA and Nuclear Cardiology)Coverage Period: 01/01/2016 – 12/31/2016Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPO 15 / visitYour Cost If You Usea Non- ParticipatingLimitations & ExceptionsProvider(plus you may bebalance billed)35% after –––––––––– 30 / visit15% after deductible foracupuncture.Manipulative therapy ofthe spine subject tobalance-billing.No charge35% after deductible35% after deductible foracupuncture.Manipulative therapy ofthe spine subject tobalance billing.35% after deductible15% after deductible35% after deductible15% after deductible35% after deductibleYour Cost If You Usea ParticipatingProviderQuestions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a �––––––––Acupuncture limited to 20 visits/year witha licensed covered provider. Manipulativetherapy of the spine limited to 20/visit,12 visits/year, and 25/year for spinalmanipulation related X-rays.Preventive services required by theAffordable Care Act are covered in fullwhen in-network.Outpatient lab work at Lab Card locations is available at no charge.Must be pre-authorized. If not, paymentreduced by 100; care may not be covered.3 of 11

GEHA: Standard OptionSummary of Benefits and CoverageCommonMedical EventIf you need drugs totreat your illness orconditionMore informationabout prescriptiondrug coverage isavailable atwww.geha.com.Services You May NeedCoverage Period: 01/01/2016 – 12/31/2016Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPOYour Cost If You Usea ParticipatingProviderGeneric drugsRetail - 10 or the cost ofthe drug whichever isless.Mail order – 20 or thecost of the drugwhichever is lessPreferredRetail - 50%, not toexceed 200 per 30 daysupply.Mail order – 50%, not toexceed 500 per 90 daysupplyNon-PreferredRetail - 50%, not toexceed 300 per 30 daysupply.Mail order – 50%, not toexceed 600 per 90 daysupplyQuestions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy.Your Cost If You Usea Non- ParticipatingLimitations & ExceptionsProvider(plus you may bebalance billed)Maximum days’ supply per fill is 30 days atSame as in-networkretail, 90 days at mail order. You pay inpharmacy, plus you payfull at an out-of-network pharmacy andexcess over oursubmit for reimbursement. You pay 100%in-network drug cost.for non-approved step therapy drugs.Your cost for non-approved step therapyis not included in the plan’s combined outof-pocket limit.Maximum days’ supply per fill is 30 days atSame as in-networkretail, 90 days at mail order. You pay inpharmacy, plus you payfull at an out-of-network pharmacy andexcess over oursubmit for reimbursement. You pay 100%in-network drug cost.for non-approved step therapy drugs.Your cost for non-approved step therapyis not included in the plan’s combined outof-pocket limit.4 of 11

GEHA: Standard OptionSummary of Benefits and CoverageCommonMedical EventServices You May NeedSpecialty drugsIf you haveoutpatient surgeryIf you needimmediate medicalattentionCoverage Period: 01/01/2016 – 12/31/2016Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPOYour Cost If You Usea Non- ParticipatingProvider(plus you may bebalance billed)Same as in-networkGeneric or Preferred:50% up to a maximum of pharmacy, plus you pay 500 per fill and any 200 for up to a 30-daydifference between oursupply.allowance and the cost ofNon-preferred: 50% up to the drug.a maximum of 300 forup to a 30-day supply.Your Cost If You Usea ParticipatingProviderFacility fee (e.g., ambulatorysurgery center)Physician/surgeon fees15% after deductibleEmergency room services15% after deductible.Nothing for accidentalinjury within 72 hours.Emergency medicaltransportation15% after deductibleNothing for accidentalinjuryUrgent care 35 copayNothing for accidentalinjury within 72 hours.15% after deductibleQuestions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy.Limitations & ExceptionsWhen specialty drugs are not dispensed byour specialty pharmacy, the additional 500 copayment you pay is applied to yourout-of-pocket limit.You pay in full at an out-of-networkpharmacy and submit for reimbursement.You pay 100% for non-approved steptherapy drugs, plus they are excluded fromyour out-of-pocket limit.Some services must be pre-authorized. Ifnot, care may not be covered.Some services must be pre-authorized. If35% after deductiblenot, care may not be covered.After deductible, 15% for Coinsurance/deductible applies tomedical emergency/35% accidental injury care after 72 hours.for other. Nothing foraccidental injury within72 hours.15% after deductibleAir ambulance must be pre-authorized. IfNothing for accidentalnot medically necessary, services will notinjurybe covered. Coinsurance/deductibleapplies to accidental injury care after 72hours.After deductible, 15% formedical emergency/35%for other. Nothing foraccidental injury within72 hours.35% after deductible5 of 11

GEHA: Standard OptionSummary of Benefits and CoverageCommonMedical EventIf you have ahospital stayIf you have mentalhealth, behavioralhealth, or substanceabuse needsServices You May NeedYour Cost If You Usea ParticipatingProviderFacility fee (e.g., hospital room)15% after deductiblePhysician/surgeon feeMental/Behavioral healthoutpatient services15% after deductible 15/visit for office visits15% after deductible forother outpatient services15% after deductibleMental/Behavioral healthinpatient servicesSubstance use disorderoutpatient servicesSubstance use disorder inpatientservicesIf you are pregnantCoverage Period: 01/01/2016 – 12/31/2016Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPO 15/visit for office visits15% after deductible forother outpatient services15% after deductiblePrenatal and postnatal careNo chargeDelivery and all inpatient services No chargeQuestions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy.Your Cost If You Usea Non- ParticipatingLimitations & ExceptionsProvider(plus you may bebalance billed)35% after deductibleSemi-private room. Must be preauthorized. If not, payment reduced by 500; care may not be covered.35% after ––––––––––35% after deductiblePsychological testing must be preauthorized. If not, care may not becovered.35% after deductibleSemi-private room. Must be preauthorized. If not, payment reduced by 500; care may not be covered.35% after ––––––––––35% after deductible35% after deductible35% after deductibleSemi-private room. Must be preauthorized. If not, payment reduced by 500; care may not be ��–––none–––––––––––6 of 11

GEHA: Standard OptionSummary of Benefits and CoverageCommonMedical EventServices You May NeedHome health careRehabilitation &Habilitation servicesIf you need helprecovering or haveother special healthneedsSkilled nursing careDurable medical equipmentHospice serviceEye examIf your child needsdental or eye careGlassesDental check-upCoverage Period: 01/01/2016 – 12/31/2016Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPOYour Cost If You Usea Non- ParticipatingLimitations & ExceptionsProvider(plus you may bebalance billed)Must be pre-authorized. If not, care may15% after deductible35% after deductiblenot be covered. Limited to 50 2-hourvisits/year with an RN or LPN.Outpatient only. Must be pre-authorized.15% after deductible35% after deductibleIf not, care may not be covered. Limitedto 60 visits/year by qualifiedphysical/occupational/speech therapistper person/year.Subject to balance-billing. Subject to balance-billing. Facility only. Must be pre-authorized. Ifnot, care may not be covered. Limited to 700/day for the first 14 days aftertransfer from an acute care hospital.Must be pre-authorized. If not, equipment15% after deductible35% after deductiblemay not be covered.Coverage limited to 15,000/period ofNothing, up to 15,000Nothing, up to 15,000limit. Deductible applies. limit. Deductible applies. care for combined in-patient and outpatient care.One routine eye exam per calendar yearNo chargeNo chargeAdditional benefits available throughEyeMed. Frequency and dollar limitsapply.Discounted eyewear available throughNot coveredNot coveredEyeMed.Coverage is limited to two exams,50% co-insurance;50% co-insurance;subject to balance-billing. subject to balance-billing. cleanings, and fluoride/year; dental X-raysare limited to 75/year.Your Cost If You Usea ParticipatingProviderQuestions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy.7 of 11

GEHA: Standard OptionCoverage Period: 01/01/2016 – 12/31/2016Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPOSummary of Benefits and CoverageExcluded Services & Other Covered Services:Services Your Plan Does NOT Cover (This isn’t a complete list. Check this plan’s FEHB brochure for other excluded services.) Cosmetic surgery Over-the-counter medications Routine eye care (adult) Long-term care Private-duty nursing Weight loss programsOther Covered Services (This isn’t a complete list. Check this plan's FEHB brochure for other covered services and your costs for theseservices.) Acupuncture Dental care (adult) Bariatric surgery Hearing aids Manipulative therapy of the spine Infertility treatment Non-emergency care while traveling outside theU.S. (see www.geha.com/outsideusa). Routine foot care for certain diagnosesYour Rights to Continue Coverage:If you lose coverage under the plan, then, depending on the circumstances, you may be eligible for a 31-day free extension of coverage, to convert to anindividual policy, and to receive temporary continuation of coverage (TCC). Your TCC rights will be limited in duration and will require you to pay a premium,which may be significantly higher than the premium you pay while covered under the plan. An individual policy may also provide different benefits than youhad while covered under the plan. Other limitations on your rights to continue coverage may also apply. For more information on your rights to continuecoverage, see the FEHB Plan brochure, contact your HR office/retirement system, contact your plan at 1- 800-821-6136 or visit www.opm.gov/insure/health.Your Appeal Rights:If you are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal. For information about your appeal rights please seeSection 3, “How you get care,” and Section 8 “The disputed claims process,” in your plan's FEHB brochure. If you need assistance, you can contact GEHA at1-800-821-6136.Does this Coverage Provide Minimum Essential Coverage?The Affordable Care Act requires most people to have health care coverage that qualifies as “minimum essential coverage.” Coverage under this planqualifies as minimum essential coverage.Does this Coverage Meet the Minimum Value Standard?The Affordable Care Act establishes a minimum value standard of benefits of a health plan. The minimum value standard is 60% (actuarial value). The healthcoverage of this plan does meet the minimum value standard for the benefits the plan provides.Language Access Services:Questions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy.8 of 11

GEHA: Standard OptionSummary of Benefits and CoverageCoverage Period: 01/01/2016 – 12/31/2016Coverage for: Self Only, Self Plus One or Self and Family Plan Type: PPOSpanish (Español): Para obtener asistencia en Español, llame al 1-800-821-6136.Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-821-6136.Chinese (中文): � 1-800-821-6136.Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' �––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next –––––––Questions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy.9 of 11

GEHA: Standard OptionCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Self Only -or- Self and Family Plan Type: PPOSummary of Benefits and CoverageAbout these CoverageExamples:These examples show how this plan might covermedical care in given situations. Use theseexamples to see, in general, how much financialprotection a sample patient might get if they arecovered under different plans.This isnot a costestimator.Don’t use these examples toestimate your actual costsunder this plan. The actualcare you receive will bedifferent from theseexamples, and the cost ofthat care will also bedifferent.See the next page forimportant information aboutthese examples.Having a babyManaging type 2 diabetes(normal delivery)(routine maintenance ofa well-controlled condition) Amount owed to providers: 7,540 Plan pays 7,370 Patient pays 170Sample care costs:Hospital charges (mother)Routine obstetric careHospital charges (baby)AnesthesiaLaboratory testsPrescriptionsRadiologyVaccines, other preventiveTotalPatient pays:DeductiblesCopaysCoinsuranceLimits or exclusionsTotalQuestions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy. 2,700 2,100 900 900 500 200 200 40 7,540 0 20 0 150 170 Amount owed to providers: 5,400 Plan pays 3,470 Patient pays 1,930Sample care costs:Prescriptions 2,900Medical equipment and supplies 1,300Office visits and procedures 700Education 300Laboratory tests 100Vaccines, other preventive 100Total 5,400Patient pays:DeductiblesCopaysCoinsuranceLimits or exclusionsTotal 80 300 1,510 40 1,93010 of 11

GEHA: Standard OptionSummary of Benefits and CoverageCoverage Period: 01/01/2015 – 12/31/2015Coverage for: Self Only -or- Self and Family Plan Type: PPOQuestions and answers about the Coverage Examples:What are some of theassumptions behind theCoverage Examples? Costs don’t include premiums.Sample care costs are based on nationalaverages supplied by the U.S.Department of Health and HumanServices, and aren’t specific to aparticular geographic area or health plan.The patient’s condition was not anexcluded or preexisting condition.All services and treatments started andended in the same coverage period.There are no other medical expenses forany member covered under this plan.Out-of-pocket expenses are based onlyon treating the condition in the example.The patient received all care from innetwork providers. If the patient hadreceived care from out-of-networkproviders, costs would have been higher.What does a Coverage Exampleshow?Can I use Coverage Examplesto compare plans?For each treatment situation, the CoverageExample helps you see how deductibles,copayments, and coinsurance can add up. Italso helps you see what expenses might be leftup to you to pay because the service ortreatment isn’t covered or payment is limited. Yes. When you look at the Summary ofDoes the Coverage Examplepredict my own care needs? No. Treatments shown are just examples.The care you would receive for thiscondition could be different based on yourdoctor’s advice, your age, how serious yourcondition is, and many other factors.Does the Coverage Examplepredict my future expenses? No. Coverage Examples are not costestimators. You can’t use the examples toestimate costs for an actual condition. Theyare for comparative purposes only. Yourown costs will be different depending onthe care you receive, the prices yourproviders charge, and the reimbursementyour health plan allows.Questions: Call 1-800-821-6136 or visit us at www.geha.comIf you aren’t clear about any of the underlined terms used in this form, see the Glossary.You can view the Glossary at www.geha.com or call 1-800-821-6136 to request a copy.Benefits and Coverage for other plans,you’ll find the same Coverage Examples.When you compare plans, check the“Patient Pays” box in each example. Thesmaller that number, the more coveragethe plan provides.Are there other costs I shouldconsider when comparingplans? Yes. An important cost is the premiumyou pay. Generally, the lower yourpremium, the more you’ll pay in out-ofpocket costs, such as copayments,deductibles, and coinsurance. Youshould also consider contributions toaccounts such as health savings accounts(HSAs), flexible spending arrangements(FSAs) or health reimbursement accounts(HRAs) that help you pay out-of-pocketexpenses.11 of 11

Please read the FEHB Plan brochure (RI 71-006) that contains the complete terms of this plan. All benefits are subject to the definitions, limitations, and exclusions set forth in the FEHB Plan brochure. Benefits may vary if you have other coverage, such as Medicare. You can get the FEHB Plan brochure at www.geha.com or by calling 1-800-821-6136.