Transcription

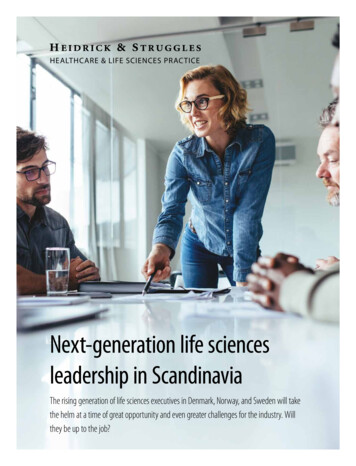

HEALTHCARE & LIFE SCIENCES PRAC TICENext-generation life sciencesleadership in ScandinaviaThe rising generation of life sciences executives in Denmark, Norway, and Sweden will takethe helm at a time of great opportunity and even greater challenges for the industry. Willthey be up to the job?18010034-hs-00313-Young Guns for flipbook.indd 114/02/2018 08:44

A changing of the guard is under wayThe next generation of leaders will inherit a vibrantin Scandinavian life sciences companiessmaller start-ups and large companies such as Coloplast,during a time of unprecedentedGetinge, LEO Pharma, Lundbeck, Mölnlycke Healthlife sciences industry in Scandinavia, spanning bothCare, and Novo Nordisk. In Medicon Valley, a networkchallenges in the industry. The nextof some 440 companies, 10 universities, and more thangeneration of executives moving into30 hospitals, as of 2016, has made the Øresund region athe C-suite faces a dramatically evolvinghotbed of pharmaceutical development and innovation.1From start-ups to multinationals, Scandinavia’s biotech,environment of economic, demographic,medtech, and pharma companies are poised to makesocial, technological, and digital disruptionsignificant breakthroughs in multiple therapeutic areas,that will buffet their organizations and testleaders also face major challenges, including:technologies, and treatments. But the industry and itstheir leadership ability. This report takes stock of those challenges, explores howA global trend toward increasingly patientcentric and cost-sensitive healthcare systems thatemphasize outcomesthese leaders see those challenges, and examines how well prepared they are toA rapidly aging population putting a growing burdenon the healthcare systemmeet them. The difficulty posed by chronic and intractablediseases that require ever more complex science,solutions, and technology Rapid digitization of life sciences and healthcare,opening the way for nontraditional entrants, e-health,and a big-data arms race Increasing cybersecurity concerns, including thepotential theft of intellectual property and thecompromising of patient privacy A looming talent shortage in areas from R&D, IT, andmarket access to senior leadership with a truly globalmind-set The need to reduce execution risk to achieve higherenterprise value, particularly in biotech A decline in venture financing, particularly in Denmark,as a consequence of fewer local venture financingfirms, the allocation of capital to other industries andgeographies, and comparatively less-favorable taxand incentive systems Increasingly stringent regulation, particularly for themedical device and diagnostic and rehab sectors1European Commission, “Life science LinkedIn group bridgesScandinavian talent gap,” August 8, 2016, ec.europa.eu.2 Next-generation life sciences leadership in Scandinavia18010034-hs-00313-Young Guns for flipbook.indd 214/02/2018 08:44

How well prepared is the new generation of leaders toconvert these challenges into opportunities to reimagineleadership, talent management, and organizationalpractices? What new ideas and perspectives are they likelyto bring to the companies? And what might they need todo to enhance their ability to lead alongside their moresenior colleagues and eventually replace them?Who they areOf the more than 100 life sciences executives whosedemographic and career data we analyzed, roughlytwo-thirds were drawn from Denmark, one-quarter fromSweden, and the remainder from Norway. From thisTo find out, we analyzed the demographic and careersample, we identified some 30 executives who are eitherdata of more than 100 senior life sciences executivesalready in the C-suite or on a clear path toward it—thebetween 35 and 45 years of age, drawn from all sectorsexecutives likely to be leading the industry in the comingand functions of the industry, who are excelling indecade and beyond. Their demographic and careertheir careers at a relatively young age. We then delvedprofiles look like this:deeper, conducting in-depth interviews with 30 of theseexecutives who serve in the C-suite or are on a clear pathtoward it. Together the interviewees represent companiesthat collectively account for about 90% of the total annualrevenues for the region.We asked these executives how they view theircompanies and the issues they face, how they manageand lead, and how they think about their lives andcareers. Their perspectives on these and other criticalissues are far from unanimous and indicate both acuteinsight and blind spots. On the positive side, many ofthese executives are inclined to take the long view, asopposed to “short-termism.” They generally take acollegial approach to leadership, they want to move fasteron digital transformation, and they embrace the kind ofcorporate social responsibility (CSR) that is essential toattracting top young talent. More worrisome are somestrong tendencies to underestimate the magnitude ofuncertainty and disruption they face, to see cybersecurityas an issue for the IT function only, and to fail to take fulladvantage of leadership and organizational developmentthat could help them and their organizations betterprepare for the future.Heidrick & Struggles 318010034-hs-00313-Young Guns for flipbook.indd 314/02/2018 08:44

How they seethe issues theircompanies faceThe respondents who are relatively unconcerned aboutVUCA generally fell into one of two categories: 1) thosewho minimize the effects of these forces in life sciences,and 2) those who acknowledge those effects and indicatea readiness to take them in stride. “At the end of the day,”said a member of the first group, “the healthcare systemis big, slow, and old, and it is not as affected by VUCA asother industries might be.” The sentiments of the secondgroup are typified by an executive who said, “When itMany executives may be ignoringor underestimating the magnitudeof disruptive forces on the horizonand the difficulty of managingthrough them.comes to management, uncertainty is a fundamentalissue. You have to deal with it 24/7.”The tendency to minimize the challenges of VUCA maybe shortsighted—from both a career and a companyperspective. Granted, VUCA may have become a catchallfor “Hey, it’s crazy out there,” but we were surprisedthat fully seven in ten of our interviewees do not seeThe most important question on the minds of next-VUCA requiring a new set of exigencies, when in factgeneration executives is how to make their company’slife sciences leaders will need to possess adaptive skills.business model viable in a future where change isAnd with the world likely to remain in a VUCA state forthe only constant. When we asked executives aboutsome time, winning companies will be those that canmanaging in an environment dominated by volatility,consistently turn uncertainty into opportunity.uncertainty, complexity, and ambiguity (VUCA), seven inten of them were not ready to concede that it is a majorstrategic concern.2“Sweden has always been stable, butnow it is changing—and it is harderto foresee what will happen and tonavigate around it.”Respondents almost unanimouslyagree that cybersecurity must beaddressed, but they expresseddiffering degrees of understandingand urgency.The military acronym VUCA arose in the 1990s andgained currency in the business world after the globalfinancial crisis of 2008–09. VUCA succinctly summarizesthe unprecedented risks constantly emerging andchallenging top executives—in the life sciences as inother industries. The life sciences industry increasinglyfaces all four elements: Volatility (mergers and acquisitions,While most respondents anticipate that cybersecuritythe rise of protectionist trade policies, centrifugal forceswill be a medium- and long-term issue for top managers,in the European Union); Uncertainty (cost of drugs,only about one-third say they have assessed the issue,the changing horizon of health benefits); Complexityand many report that their companies are not yet doing(increasingly advanced science required to addressenough about it. “Only a few people really understandchronic and intractable diseases); and Ambiguity (swingsthe scale of the threat,” said one interviewee, “includingin regulatory decisions in areas such as biosimilars).the potential for crime that comes with it.”2Colin Price, “VUCA, meet META: The 2017 list ofsuperaccelerators,” Heidrick & Struggles, June 13, 2017,heidrick.com.4 Next-generation life sciences leadership in Scandinavia18010034-hs-00313-Young Guns for flipbook.indd 414/02/2018 08:44

They may not be out of step with executives in otherindustries around the world. For example, in a recentsurvey of 400 managers from Germany, Japan, theUnited Kingdom, and the United States who are“Most people in my company are toorelaxed about cybersecurity.”Many executives say the pace of digitaltransformation is too slow.experts in Internet-of-Things (IoT) security, only 16%said their companies are well prepared to defend3against cyberattacks. In life sciences, such inadequatepreparation could be a matter of life and death forTo compete effectively, Scandinavian life sciencespatients, especially as the use of IoT tools proliferates incompanies, like companies in all industries around thenumerous areas, including patient monitoring, medicalworld, must be digitally savvy. Innovations in areas suchdevices, process validation, and cold-chain control,as genetic engineering, 3-D printing, cloud-based testingamong many more.and algorithm experiments, artificial intelligence (AI),machine-learning technology, and cutting-edge biotechshow the opportunities that await companies thatimprove their digital and technological capabilities.Our respondents conceded that their companies havea long way to go in the digital realm, with about fourin five agreeing that their firms need a more robustdigital culture. They also expressed some frustrationsover how the issue of digital development is currentlymanaged. “Digital transformation is needed, but thewhole project has been very much top-down controlled,”said one executive. But, he said, “Going forward thenew generation will know how to deal with it, and inthe future, it will be less of an issue than what we thinkof it today.” Another interviewee cited the difficulty ofdigital transformation: “It is expensive to restructure yourorganization and become more digital, which is why thisgoes way too slowly.”Given the rapidly increasing role of technology in allEfforts are afoot to help all industries, not just life sciences,aspects of business, attitudes toward cybersecurity willimprove in the digital arena. A 2016 Boston Consultingneed to change. They may already be doing so. TheGroup study commissioned by Google looked at thewidespread ransomware attack that struck Europe inDanish organizational landscape and concluded thatlate June 2017 (after our interviews were conducted)while Denmark has many pieces in place to go digitallikely renewed focus on this issue. The fact that Danishquickly—including infrastructure, flexible employmentmultinational A. P. Moller-Maersk was a prominentregulations, language skills, and high consumer usevictim—costing the company an estimated 200 millionof digital services—all Danish companies are movingto 300 million—made the attack top-of-mind in theat a relatively slow pace when it comes to digital4improvement. To that end, the government is preparingScandinavian region. MSD, the global pharmaceuticalcompany, was also severely affected by the attack,a digital growth plan aimed at improving educationalnotably raising awareness about the importance ofcurricula, instituting national workforce planning,cybersecurity among the life sciences executives wetargeting businesses to improve exports, promotingspoke with.43Harald Bauer, Gundbert Scherf, and Valerie von der Tann, “Sixways CEOs can promote cybersecurity in the IoT age,” McKinsey& Company, August 2017, mckinsey.com.Emanuelle Alm, Niclas Colliander, Gustav Gotteberg, FredrikLind, Ville Stohne, and Olof Sundström, Digitizing Denmark:How Denmark Can Drive and Benefit from an Accelerated DigitizedEconomy in Europe, Boston Consulting Group, August 2016, di.dk.Heidrick & Struggles 518010034-hs-00313-Young Guns for flipbook.indd 514/02/2018 08:44

Companies must focus more attentionon corporate social responsibility ifthey are to successfully attract andmotivate members of Generation Y.wider adoption of cutting-edge technologies and newbusiness models, and seeking international collaborationwithin Europe and beyond. Pursuing any or all of thesepathways could particularly benefit the life sciencesindustries.“Much more direct customer andconsumer communication is required,and the most relevant platforms aredigital.”More than two in three of our interviewees endorsedthe statement, “Companies must do more today and inthe future to assume social and ecological responsibility.Only in this way can Generation Y members be attractedto a company.” The remainder acknowledged CSR asan important, but not decisive, strategic issue. AlmostMeanwhile, digital advances in Silicon Valley will pose aall Swedish executives strongly endorsed CSR whilegrowing competitive threat. Apple, Google, and othersonly about two-thirds of their Danish counterpartsare pushing into medicine, harnessing their experiencedid so. Said a respondent who endorsed greater CSR,in big data analytics to improve healthcare and create“There are completely different expectations from thenew profit centers. In June 2017, the life sciences divisionyounger generation regarding CSR. Feeling proud ofof Google invested in a new fund that will buy stakesthe company they work for is really important to them.”in European biotech groups, underscoring the techThese responses confirm what many studies have shown:company’s growing interest in drug development. Indeed,companies that provide employees with social purposethe life sciences breakthroughs from Silicon Valleyand meaningful work enjoy a competitive edge inspan genetic engineering, 3-D printing, cloud-basedattracting key talent.5testing and algorithm experiments, AI, and machineFor those who did not find CSR strategically significant,learning technology—moves that are creating cutting-the argument was simple: “The business of business isedge biotech in areas where such progress would havebusiness—CSR is fine, but not crucial,” said one. Addedseemed like magical thinking until recently. Yet few of ouranother, “We need to be good citizens, but be rationalinterviewees indicated awareness of these developmentsabout it. We do not try to be an NGO [nongovernmentalor of the other innovation hubs propelling change in theirorganization], but we need to behave and be able to facesegments—changes that could produce great benefits forpeople outside the company.”their stakeholders and, most importantly, for patients.“In the future there will be hugepressure from employees for thebusiness to become much moresustainable.”And fewer still pointed to hubs of industry clustersgenerally, such as Boston, Singapore, and Switzerland.5See, for example, Vanessa C. Burbano, “Social responsibilitymessages and worker wage requirements: Field experimentalevidence from online labor marketplaces,” Organization Science,June 30, 2016.6 Next-generation life sciences leadership in Scandinavia18010034-hs-00313-Young Guns for flipbook.indd 614/02/2018 08:44

How they manageand leadskepticism about the primacy of quarterly results couldbe critical to the vitality of the industry over the long term.As recent research by the McKinsey Global Institute found,firms that favor the longer term over the shorter termexhibit stronger fundamentals, deliver superior financialperformance, and contribute more to economic growthA majority gauge success by quarterlyresults, but a substantial minorityappear ready to reject short-termthinking in favor of the longer view.Six in ten of our respondents agreed that “solid numbersare the essence of our entrepreneurial activities, which6and output.“If you do not look beyond quarterlyperformance, you will not be likely tomake long-term bets to transform yourbusiness to tomorrow’s market needs.”In companies more oriented toward short-term results,includes measuring them in shorter intervals.” Said onethe ”strategy ends up being focused on the shareholdersexecutive, “Today it’s all about the numbers and the topversus other stakeholders,” according to Unilever CEOand bottom line.” The remainder of our intervieweesPaul Polman. “If ultimately the purpose of a companyeither firmly agreed that “we have to look past the US wayis maximizing shareholder return, we risk ending upof focusing on quarterly numbers” or indicated that theirwith many decisions that are not in the interest ofcompanies have already done so.7society,” Polman has noted. Yet, in public and privateScandinavian companies alike, the Wall Street ritual ofthe corporate earnings report still dominates the wayP&Ls are run. And it creates a dilemma for the youngerexecutives: they feel accountable for delivering growthand profits above all else because CEOs and their CFOs areresponsible for maximizing returns for investors.A majority of executives prefer to maketough decisions in concert with theirteams, yet they are willing to go italone if necessary.About three in five respondents said they prefer to maketough decisions with their team, as opposed to makingthem on their own. However, just as many said, “I canoperate in a team most proficiently but, if need be, I ammore than willing to promote my goals and views, againstobjections” as those that said, “I am a typical team playerEven those interviewees who affirmed that theirand manage collegially.”companies strongly favor quarterly numbers viewedquarterly results as having limited utility in an industrythat requires long development cycles and a balance ofshort- and long-term thinking. Although the industryfaces rapid change, it still depends on long-run R&D,motivated by the imperative to innovate. Therefore,Dominic Barton, Jonathan Godsall, Timothy Koller, JamesManyika, Robert Palter, and Joshua Zoffer, Measuring theEconomic Impact of Short-termism, McKinsey Global Institute,February 2017, mckinsey.com.7Alana Semuels, “How to stop short-term thinking at America’scompanies,” Atlantic, December 30, 2016, theatlantic.com.6Heidrick & Struggles 718010034-hs-00313-Young Guns for flipbook.indd 714/02/2018 08:44

Even those who chose one option sometimes citedleadership only in terms of past achievements. Theexamples of doing the other. One “team player” said,executives said they require more action-oriented,“Business decisions are based on the team. Decisionsqualitative instruments that can assess leadershipregarding my team are my own.” Another said, “Itpotential, diagnose an organization’s capacity to execute,depends greatly on the decision. Often, the toughestand help focus improvement efforts. The problem,people decisions are about the people closest to you.”however, may be one of unfamiliarity on the part ofTo some, the value of teamwork itself is primary: “Youneed to accommodate your team and be flexible as aleader,” said one. “As a manager, you need to focus on theindividual to get the best out of your employees or team.”Or, as another leader put it, “It is important that everyonehave the feeling that they are a part of something bigger.”On the other hand, the buck must stop somewhere. Onerespondent said she learned “if the decision maker is notclear, this can lead to a lot of frustrations in teams, as theyexecutives, as many such tools already exist. The pastdecade has seen an explosion of powerful psychometricinstruments for the assessment of individuals, teams,and organizations.How they see theircareers and livesdo not know who will make the final call.”“It is important to have the input fromthe team, but come decision time youhave to make the right decision andnot necessarily the one preferred by thegroup.”Most respondents said they aresatisfied with their corporate career,though it may occasionally involvesome struggle.Respondents generally appreciate thevalue of leadership and organizationaldevelopment tools but know littleabout the specifics.paths. Several respondents specifically said they neverMost respondents said they focused on building acorporate career without considering alternativeconsidered following an entrepreneurial path, thoughthey do express respect for entrepreneurs, founders, andstart-up pioneers. Only two respondents have ever takena sabbatical or other form of career “time-out.”Respondents almost unanimously acknowledged thecapacity of development tools to assess and improveindividual and group performance and they are sensitiveto the need to inspire leadership in the workplace of thefuture, yet they struggle to execute with current tools andprocesses. Few of the executives could clearly distinguishwhat tools to apply for specific purposes. And theystruggled to articulate an approach to the assessmenttools they employ in attracting, recruiting, retaining, anddeveloping their associates and leaders; many say theysimply defer to their human resources departments tohandle the decision.Most critically, a number of the executives expresseddissatisfaction with tools that evaluate talent andHowever, some female leaders cited gender as acomplicating factor in getting ahead. “Specifically, as awoman leader you need resilience, persistence, focus, andhard work,” said one female executive.8 Next-generation life sciences leadership in Scandinavia18010034-hs-00313-Young Guns for flipbook.indd 814/02/2018 08:44

Nearly five in ten respondents said their careers are onan upward trajectory, possibly toward the CEO role. Justas many expressed optimism that they have not risenas high in their careers as they can, yet refrained frommentioning the CEO job as a specific possibility.But more than half also said that merit is only one ofseveral factors that figure into success. Said one executive,“Advancement is about being at the right place at the right“No school compares to the complexity of business life,with big and small matters, internal politics, changes,and people management,” said a respondent whotime.” Said another, “It is all about networking and politics.strongly endorsed on-the-job learning. Said another, “ToIt would be naive to think otherwise.” Less cynically,executives, an MBA is not crucial. It helps; it looks better;another noted, “[A] promotion can come from havingyour network will be broader and that can help you getthe right relationships, especially a senior executivethe job, but the experience you get on the job is mostsponsor who believes in you. In most cases this does notimportant.” One executive cited “cross-functional jobcome without merit, which is partly what generates therotations and mentors” as critical to his career.sponsor’s belief.”Some executives were careful to note that experienceMore than two-thirds of respondentssaid they received their bestmanagement training on the job.can be overrated. “It depends heavily on the diversity ofMost of the executives we studied have at least a master’slevel is important,” said one. “In the future, ‘on-the-jobdegree, so they already have a sound educationalexperience’ will no longer lead you to the top. You need abase. However, few seem to have a structured plan forgreat toolbox to build a good career.”professional development or lifelong learning, whichcould leave them ill-prepared as they ascend theorganizational ranks and find that new skill sets arerequired at each level, particularly as they move to theC-suite and the board of directors.experience possible in a job,” said one. “Not all jobs arecreated equal.” Others endorse a mix of both theoreticaland practical experience. Some flatly said that practicalexperience is not enough on its own. “A high educationalOnly half of the executives regularly read managementliterature, and those who do say they read less than theywould like. Of those who read sparingly, most cite a lackof time as the cause. Such time pressures have changedhabits for many executives—instead of reading books,they read articles or listen to podcasts or watch TED talks,which they can do during travel.Heidrick & Struggles 918010034-hs-00313-Young Guns for flipbook.indd 914/02/2018 08:44

Like executives everywhere,Scandinavian leaders in the lifesciences struggle to achieve worklife balance.Faced with the pressures of a 24/7 working environment,the next generation of executives seeks to staymentally and physically fit to meet the challenges oftheir leadership roles. They take seriously the need tobalance the demands of their jobs with life away from theworkplace.The road aheadScandinavia has a long history of innovation, world-classeducational institutions, established and emergingindustry clusters, cross-border collaboration, and aresearch infrastructure that includes information-richhealth-records repositories and biobanks. In a fewyears’ time, the leaders profiled in this report will fill themost important positions in the region’s life sciencescompanies. To keep the industry vibrant, they will needto create new business models, lead relentless innovation,and move their organizations toward patient-centric andoutcome-based healthcare, all while accommodatingdaunting social, demographic, and economic forces.They will be responsible for rewriting the rules ofcompetition. They will have to reimagine how to lead,develop, and engage the 21st-century workforce. Andthey will need to stay ahead of dizzying scientific andtechnological advances while building sustainable valuefor all stakeholders. It’s a tall order, but these fast-trackexecutives are looking ahead with confidence.nAbout the authorMartin F. Holm (mholm@heidrick.com) is a principalin Heidrick & Struggles’ Copenhagen office and amember of the Healthcare & Life Sciences and PrivateEquity practices.The author wishes to thank Catrine Frost for hercontributions to this report.Nearly all the respondents have children, but more thanhalf of the parents said they don’t spend enough timewith them. That’s not surprising, since two-thirds ofthese executives work more than 50 hours a week. Thosewho said they manage to spend enough time with theirchildren go to great lengths to do so. For example, oneexecutive said his family accompanies him on work travel.Another executive said she works intensely for threedays and leaves her children in her husband’s care. Then,“when I am at home, I am 100% at home.” Others said theytake time off to be with their children.10 Next-generation life sciences leadership in Scandinavia18010034-hs-00313-Young Guns for flipbook.indd 1014/02/2018 08:44

Healthcare & Life Sciences PracticeHeidrick & Struggles’ Healthcare & Life Sciences Practice helps leadingorganizations in these sectors align their talent strategies and business objectivesto foster innovation and enable growth in a fast-moving, rapidly changing world.Companies in the healthcare and life sciences sectors contend with ever-changing technology, patient populations,markets, pricing, and regulatory environments. Their leaders must have the competencies required to lead all aspectsof the business, while understanding the value of innovation and the relevance of science. With more than 80professionals in major cities around the world, our Healthcare & Life Sciences Practice team combines unparalleledsearch resources with a deeply consultative approach to help clients boost their leadership capabilities.We have expertise across all areas in the healthcare and life sciences sectors, including biotechnology, healthcareservices, managed care, medical devices and diagnostics, pharmaceuticals, research and development, andcontract research.Working closely with a broad range of clients, ranging from start-ups to global public companies and healthcareorganizations, Heidrick & Struggles identifies succession issues, considers team composition, and taps nontraditionaltalent pools. We advise and recruit in the context of an organization’s culture. We partner with our clients to find leaderswho can align and integrate the interests of complex stakeholder groups, build their organizations, and demonstrateshareholder value year after year.Leaders of Heidrick & Struggles’ Healthcare & Life Sciences PracticeJohn MitchellAndrew MacLeodJimson ChengGlobal PracticeManaging PartnerRegional Managing Partner,EuropeRegional Managing Partner,Asia Pacific and Middle eng@heidrick.com18010034-hs-00313-Young Guns for flipbook.indd 1114/02/2018 08:44

Heidrick & Struggles is a premier provider of senior-level executivesearch, culture shaping, and leadership consulting services. For morethan 60 years we have focused on quality service and built strongrelationships with clients and individuals worldwide. Today, Heidrick& Struggles’ leadership experts operate from principal businesscenters globally.www.heidrick.comCopyright 2018 Heidrick & Struggles International, Inc.All rights reserved. Reproduction without permission is prohibited.Trademarks and logos are copyrights of their respective owners.Cover image: ElenaNichizhenova/iStockOther images: Polina Shuvaeva/iStock, Thinkstock, The Noun Projecths-0031318010034-hs-00313-Young Guns for flipbook.indd 1214/02/2018 08:44

The next generation of leaders will inherit a vibrant life sciences industry in Scandinavia, spanning both smaller start-ups and large companies such as Coloplast, Getinge, LEO Pharma, Lundbeck, Mölnlycke Health Care, and Novo Nordisk. In Medicon Valley, a network of some 440 companies, 10 universities, and more than