Transcription

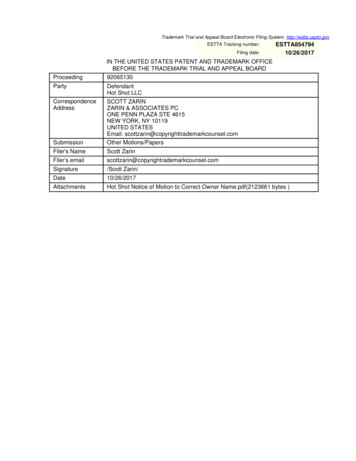

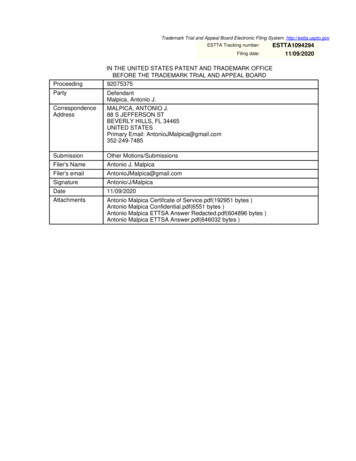

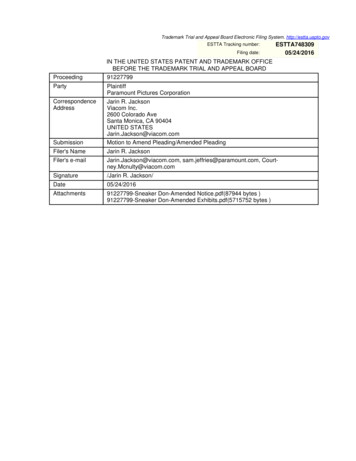

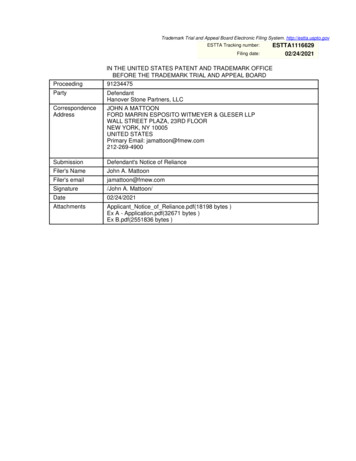

Trademark Trial and Appeal Board Electronic Filing System. http://estta.uspto.govESTTA Tracking number:Filing date:ProceedingESTTA111662902/24/2021IN THE UNITED STATES PATENT AND TRADEMARK OFFICEBEFORE THE TRADEMARK TRIAL AND APPEAL BOARD91234475PartyDefendantHanover Stone Partners, LLCCorrespondenceAddressJOHN A MATTOONFORD MARRIN ESPOSITO WITMEYER & GLESER LLPWALL STREET PLAZA, 23RD FLOORNEW YORK, NY 10005UNITED STATESPrimary Email: s Notice of RelianceFiler's NameJohn A. MattoonFiler's emailjamattoon@fmew.comSignature/John A. Mattoon/Date02/24/2021AttachmentsApplicant Notice of Reliance.pdf(18198 bytes )Ex A - Application.pdf(32671 bytes )Ex B.pdf(2551836 bytes )

IN THE UNITED STATES PATENT AND TRADEMARK OFFICEBEFORE THE TRADEMARK TRIAL AND APPEAL BOARDWESTGUARD INSURANCE COMPANY,Opposition No. 91234475Appln. Serial No. 87142642Opposer,v.HANOVER STONE PARTNERS, LLC,Applicant.APPLICANT’S NOTICE OF RELIANCEPursuant to 37 C.F.R. §2.122, Applicant HANOVER STONE PARTNERS, LLC(“Applicant”) hereby gives notice that it will or may rely on the following materials relevant tothe issues in the above-captioned proceeding, copies of which are attached to this Notice to theextent such documents were not already submitted by Opposer Westguard Insurance Company(“Westguard”) with Opposer’s own Notice of Reliance:2479601.1.The Application; (attached hereto as Exhibit A)1.2.Documents produced by Applicant during discovery, including printouts of pagesfrom the web site maintained at www.hanoverstonepartners.com; (attached heretoas Exhibit B); and1.3.Documents attached to Opposer’s Notice of Reliance and Trial Testimony;1

Dated: February 24, 2021FORD MARRIN ESPOSITOWITMEYER & GLESER, LLPBy: /s/ John A. MattoonJohn A. Mattoon, Esq.Wall Street Plaza88 Pine Street, 16th FloorNew York, NY 10005-1875P: (212) 269-4900F: (212) 344-4294E-mail: jamattoon@fmew.comAttorneys for Hanover Stone Partners, LLC2479602

CERTIFICATE OF SERVICEI hereby certify that a true and complete copy of the foregoing APPLICANTHANOVER STONE PARTNERS, LLC’S NOTICE OF RELIANCE has been served oncounsel for Westguard Insurance Company by forwarding said copy on 2/24/2021, via email to:Jeffrey H. KaufmanTechMark1751 Pinnacle Drive, Suite 1000, Tysons, VA 22102 USAEmail: JHK@techmark.comSignature: /s/ John A. MattoonJohn A. MattoonAttorney for ApplicantDate: 2/24/20212479603

Under the Paperwork Reduction Act of 1995 no persons are required to respond to a collection of information unless it displays a valid OMB control number.PTO Form 1478 (Rev 09/2006)OMB No. 0651-0009 (Exp 02/28/2018)Trademark/Service Mark Application, Principal RegisterSerial Number: 87142642Filing Date: 08/18/2016The table below presents the data as entered.Input FieldSERIAL NUMBEREntered87142642MARK INFORMATION*MARKWorkersComp GuardSTANDARD CHARACTERSYESUSPTO-GENERATED IMAGEYESLITERAL ELEMENTWorkersComp GuardMARK STATEMENTThe mark consists of standard characters, without claim to anyparticular font, style, size, or color.REGISTERPrincipalAPPLICANT INFORMATION*OWNER OF MARKHanover Stone Partners, LLC*STREET260 Madison Avenue, 8th Fl*CITYNew York*STATE(Required for U.S. applicants)New York*COUNTRYUnited States*ZIP/POSTAL CODE(Required for U.S. applicants)10016PHONE212-269-4900EMAIL ADDRESSXXXXLEGAL ENTITY INFORMATIONTYPElimited liability companySTATE/COUNTRY WHERE LEGALLY ORGANIZEDDelawareGOODS AND/OR SERVICES AND BASIS INFORMATIONINTERNATIONAL CLASS036*IDENTIFICATIONProviding information in the field of workers' compensation;Providing information regarding workers' compensationinsurance policy rates; Insurance consulting in the field ofworkers' compensation insurance; Advising clients with respectto the purchase and cost of workers' compensation insurance;Advising clients with respect to claims administration in thefield of workers' compensation insuranceFILING BASISSECTION 1(b)

ADDITIONAL STATEMENTS SECTIONDISCLAIMERNo claim is made to the exclusive right to use WorkersCompapart from the mark as shown.ATTORNEY INFORMATIONNAMEJohn A. MattoonATTORNEY DOCKET NUMBER1960-1FIRM NAMEFord Marrin Esposito Witmeyer & Gleser LLPSTREET88 Pine Street, 23rd FlCITYNew YorkSTATENew YorkCOUNTRYUnited StatesZIP/POSTAL CODE10005PHONE212-269-4900EMAIL ADDRESSjamattoon@fmew.comAUTHORIZED TO COMMUNICATE VIA EMAILYesCORRESPONDENCE INFORMATIONNAMEJohn A. MattoonFIRM NAMEFord Marrin Esposito Witmeyer & Gleser LLPSTREET88 Pine Street, 23rd FlCITYNew YorkSTATENew YorkCOUNTRYUnited StatesZIP/POSTAL CODE10005PHONE212-269-4900*EMAIL ADDRESSjamattoon@fmew.com*AUTHORIZED TO COMMUNICATE VIA EMAILYesFEE INFORMATIONAPPLICATION FILING OPTIONTEAS RFNUMBER OF CLASSES1FEE PER CLASS275*TOTAL FEE DUE275*TOTAL FEE PAID275SIGNATURE INFORMATIONSIGNATURE/John A. Mattoon/SIGNATORY'S NAMEJohn A. MattoonSIGNATORY'S POSITIONAttorney of Record, New York bar memberSIGNATORY'S PHONE NUMBER212-269-4900DATE SIGNED08/18/2016

Under the Paperwork Reduction Act of 1995 no persons are required to respond to a collection of information unless it displays a valid OMB control number.PTO Form 1478 (Rev 09/2006)OMB No. 0651-0009 (Exp 02/28/2018)Trademark/Service Mark Application, Principal RegisterSerial Number: 87142642Filing Date: 08/18/2016To the Commissioner for Trademarks:MARK: WorkersComp Guard (Standard Characters, see mark)The literal element of the mark consists of WorkersComp Guard.The mark consists of standard characters, without claim to any particular font, style, size, or color.The applicant, Hanover Stone Partners, LLC, a limited liability company legally organized under the laws of Delaware, having an address of260 Madison Avenue, 8th FlNew York, New York 10016United States212-269-4900(phone)XXXX (not authorized)requests registration of the trademark/service mark identified above in the United States Patent and Trademark Office on the Principal Registerestablished by the Act of July 5, 1946 (15 U.S.C. Section 1051 et seq.), as amended, for the following:International Class 036: Providing information in the field of workers' compensation; Providing information regarding workers'compensation insurance policy rates; Insurance consulting in the field of workers' compensation insurance; Advising clients with respect to thepurchase and cost of workers' compensation insurance; Advising clients with respect to claims administration in the field of workers'compensation insuranceIntent to Use: The applicant has a bona fide intention, and is entitled, to use the mark in commerce on or in connection with the identifiedgoods/services.DisclaimerNo claim is made to the exclusive right to use WorkersComp apart from the mark as shown.The applicant's current Attorney Information:John A. Mattoon of Ford Marrin Esposito Witmeyer & Gleser LLPNew York, New York 10005United States212-269-4900(phone)jamattoon@fmew.com (authorized)The attorney docket/reference number is 1960-1.88 Pine Street, 23rd FlThe applicant's current Correspondence Information:John A. MattoonFord Marrin Esposito Witmeyer & Gleser LLP88 Pine Street, 23rd FlNew York, New York 10005212-269-4900(phone)jamattoon@fmew.com (authorized)E-mail Authorization: I authorize the USPTO to send e-mail correspondence concerning the application to the applicant or applicant's attorneyat the e-mail address provided above. I understand that a valid e-mail address must be maintained and that the applicant or the applicant'sattorney must file the relevant subsequent application-related submissions via the Trademark Electronic Application System (TEAS). Failure todo so will result in an additional processing fee of 50 per international class of goods/services.A fee payment in the amount of 275 has been submitted with the application, representing payment for 1 class(es).Declaration

The signatory believes that: if the applicant is filing the application under 15 U.S.C. § 1051(a), the applicant is the owner of thetrademark/service mark sought to be registered; the applicant is using the mark in commerce on or in connection with the goods/services in theapplication; the specimen(s) shows the mark as used on or in connection with the goods/services in the application; and/or if the applicant filedan application under 15 U.S.C. § 1051(b), § 1126(d), and/or § 1126(e), the applicant is entitled to use the mark in commerce; the applicant has abona fide intention, and is entitled, to use the mark in commerce on or in connection with the goods/services in the application. The signatorybelieves that to the best of the signatory's knowledge and belief, no other persons, except, if applicable, concurrent users, have the right to use themark in commerce, either in the identical form or in such near resemblance as to be likely, when used on or in connection with the goods/servicesof such other persons, to cause confusion or mistake, or to deceive. The signatory being warned that willful false statements and the like arepunishable by fine or imprisonment, or both, under 18 U.S.C. § 1001, and that such willful false statements and the like may jeopardize thevalidity of the application or any registration resulting therefrom, declares that all statements made of his/her own knowledge are true and allstatements made on information and belief are believed to be true.Declaration SignatureSignature: /John A. Mattoon/ Date: 08/18/2016Signatory's Name: John A. MattoonSignatory's Position: Attorney of Record, New York bar memberRAM Sale Number: 87142642RAM Accounting Date: 08/18/2016Serial Number: 87142642Internet Transmission Date: Thu Aug 18 10:50:30 EDT 2016TEAS Stamp: 93b2ac7d84605a47e2f4-CC-9005-20160818102754687333

HANOVER000001

HANOVER000002

4/19/2018Hanover Stone Partners, LLC Specialty PracticesSearch SiteRisk ConsultingRisk ServicesMember LoginIndustry ExpertiseTel: CapabilitiesResourcesSpecialty PracticesNewsSENIOR ADVISORSContactPARTNER FIRMSOur specialty practices bring together industry thought leaders andprofessionals that have executive-level experience solving complexbusiness challenges for global organizations. Our branded consultingpractices, Hanover Stone Partners CaptiveGuard (SM) andWorkersCompGuard (SM), focus on the key cost drivers and regulatoryissues that directly impact board members, c-suite executives,investors, and shareholders. In 2014, Hanover Stone CaptiveGuard (SM)was recognized as “Risk Consulting Initiative of the Year” by CaptiveReview, a leading alternative risk trade publication.Our Global Insurance Compliance Practice includes multilingual senioradvisors with decades of experience evaluating, designing andoptimizing risk and insurance programs for clients with billions ofdollars in assets and exposures around the world.INDUSTRY EXPERTISE CaptiveGuard (SM)Hanover Stone Partners dedicated nearly two years to the formation of a specialty practice that provides awide range of governance and related advisory services for captive insurance companies and their parentorganizations. The practice, known as CaptiveGuard (SM), draws on HSP's network of senior advisors andpartner firms with deep expertise in captives and alternative risk as well as former insurance regulators tooffer a full complement of professional resources. Typical services include:Objective captive manager performance evaluationActuarial reviewsGlobal and local insurance regulatory complianceCoverage reviews of directly issued policiesFacultative and treaty reinsurance agreement reviewsAnalysis of insurance and reinsurance market securityOrganize, manage & support RFP processes, including evaluations andrecommendationsIdentification of independent captive board members with insuranceleadership experienceNext Top Practice LeaderJohn J. Kelly, CPCUFounder & Managing Partner, Hanover Stone PartnersFull BioO: 646-216-2181F: 646-216-2001New York, NYJohn J. Kelly, CPCU is Managing Partner at Hanover Stone Partners which he founded in2009 as a holding company with targeted investments in risk management consulting, riskmanagement services, claims and loss control services, specialty insurance brokering andproduct distribution. He has 40 years of experience in the insurance brokerage industry, withan extensive background in strategic planning, acquisitions, investments, tners.com/specialtypractices1/3

4/19/2018Hanover Stone Partners, LLC Specialty Practicesmanagement, sales leadership, new business development and senior client relationships.Operationally, John has had responsibility for both property/casualty and employee benefitscompanies and has overseen operations in all business segments including Fortune 1000,Middle Market Programs, Construction & Environmental, Health Care, Personal Lines, Marineand Aviation. Mr. Kelly earned a degree in Accounting from Baruch College and an MBAfrom Rutgers University.WorkersCompGuard (SM)Hanover Stone Partners works with employers across the country on tailored measures to drive down theirtotal cost of casualty risk with a focus on workers' compensation. Our dedicated, national practice group,known as WorkersComp Guard , collaborates with our clients to develop and execute focused solutionsto reduce costs and improve claim outcomes.Led by Barry E. Thompson, a widely known expert with more than 30 years of experience in all areas ofworkers' compensation cost management, WorkersComp Guard provides strategies and methods toevaluate risk-financing options, implement best claims management practices, assess employer safetyculture and practices, and leverage data for program measurement and more effective resourcedeployment.The following includes six areas where we can help employers have an immediate impact on their cost ofrisk:I'm a paragraph. Click here to addyour own text and edit me. It's easy.1. Explore optimal risk-financing alternatives:We can work with the client and their broker in an advisory capacity to fully evaluate and select the mostcost-effective risk-financing alternatives. Our analysis can include risk/reward trade-offs of higherretentions, utilization of annual aggregate protections, safety groups, self-insurance, captive programs(single parent or group), as well as analysis of existing claims reserves and collateral requirements andevaluation of alternative forms of collateral.2. Focused claims management. Clients can reduce current open reserves:with better defined and controlled claim strategies and more effectively engaged claim adjusters. We cancraft optimal internal programs to suit any workplace size and culture. Correctly focused employerprograms will drive insurer, claims and other vendors beyond mere status-quo claim handling.3. Accelerated claim closures:Clients can quickly improve loss history to hedge against future premiums. We clean up older claims withexpedited closures and/or strategies that better contain open reserves. PrevNext Top Global Insurance ComplianceHistorically, a global risk and insurance program could be placed in one primary country covering anorganization's exposures around the world, with local policies issued in a few strictly regulated countries.Nowadays, companies face challenges such as; increased electronic surveillance of capital flows; theneed for governments to increase local tax revenues; and legal contractual compliance issues coupledwith a concerted effort to retain the maximum insurance premiums on-shore. The combination hasprompted new and demanding standards to which global risk programs must comply. Hanover StonePartners has responded by assembling a team of global insurance and risk management experts capableof reviewing client programs and assessing in-country compliance objectively and comprehensively. OurGlobal Insurance Compliance Practice includes multilingual senior advisors with decades of experienceevaluating, designing and optimizing complex programs for Fortune 500 companies, non-profitorganizations and governmental entities. Take a few minutes to contemplate the following questions andContact Us to learn more.Are premium taxes paid equivalent to the risk exposure (whether assets epartners.com/specialtypractices2/3

4/19/2018Hanover Stone Partners, LLC Specialty PracticesAre locally issued policies in compliance with each country’slaws/regulations?If a loss occurs, are the documents aligned in such a manner that a localinsurance/premium tax audit will not be automatically triggered?Are policies congruent in coverage interface so that the payment of a localcountry claim will not trigger a compliance audit? PrevTop Practice LeaderErik M. Severeid, ARMO: 646-216-2181F: 646-216-2001Senior Advisor - Global ProgramsFull BioFairfax Station, VAErik M. Severeid is a senior advisor at Hanover Stone Partners and leads the GlobalInsurance Compliance Practice. He joined HSP in 2013 and has more than three decades ofexperience in international insurance broking and risk advisory services. Most recently, Mr.Severeid was director of Strategic Development and International Practice Leader atRutherfoord International. In addition to working directly with clients facing substantial globalexposures, he was responsible for the firm’s international placement activities andestablishing and maintaining relationships with partner insurance brokerages and networkson a worldwide basis. Earlier in his career Erik spent more than 20 years with Marsh andJ&H, holding various senior level positions in the U.S., France, Germany and Denmark. Hespeaks Norwegian, Swedish, Danish and French. Mr. Severeid earned a BBA degree fromPacific Lutheran University and an MBA from the American Graduate School of InternationalManagement.About Hanover Stone PartnersSuccess StoriesNews & EventsCapabilitiesLeadership TeamMember LoginResourcesIndustry ExpertiseContact Us 2017 Hanover Stone Partners, LLC created with s.com/specialtypractices3/3

4/20/2018HSP Establishes Practice Group to Help Employers Control Workers' Compensation CostsHSP Establishes Practice Group to HelpEmployers Control Workers'Compensation CostsBarry E. Thompson to Lead WorkersComp Guard (TM)NEW YORK, April 6,2017 - Hanover Stone Partners, a risk managementservices firm with expertise in a broad range of critical risk disciplines,today announced it has established a dedicated, national practice group tohelp employers manage workers' compensation costs. Barry E. Thompson, awidely recognized expert with more than 30 years of experience in all areas ofworkers' compensation cost management, will lead the new practice.Known as WorkersComp Guard (TM), thenew practice will work in collaborationwith employers on tailored solutions toreduce costs and improve claimoutcomes. The practice will providestrategies and methods to assessemployer safety culture and practices, evaluate risk financing options,implement best claims management practices, and leverage data for programmeasurement and more effective resource deployment."For employers throughout the U.S. workers' compensation represents thelargest component of their overall casualty cost of risk, and has become agrowing source of pain due to a number of variables that has resulted indouble-digit increases in many jurisdictions," said John J. Kelly, managingdirector, Hanover Stone Partners. "Under Barry's leadership, the new ontact.com/render?m 1109406199584&ca 49f6d255-8f38-4e56-abca-19c6340077021/3

4/20/2018HSP Establishes Practice Group to Help Employers Control Workers' Compensation Costswill leverage the diverse and specialized expertise of our risk advisors andpartner firms throughout the U.S. to help clients manage complex workers'compensation issues and control costs.""In an operating environment marked by thinmargins, C-level management is realizingthat a measurable impact on workers'compensation costs can improve overallfinancial performance," said Mr. Thompson."WorkersComp Guard (TM) is totallyindependent and therefore brings anexceptionally unique alternative foremployers who feel failed by the deliverysystem and have hit a wall in working with their vendors to lower costs. Weapply insight, analytics and validation to tailor programs allowing employers tocontrol the process rather than be controlled by status-quo. When we helpchange the paradigm employers experience measurable impact on costs."In addition to leading Hanover Stone PartnersWorkersComp Guard (TM), Mr. Thompson concurrently ispresident of Risk Acuity, LLC, a national consulting firmspecializing in workers' compensation, which he foundedin 2002. Previously, he was National Practice Co-Leaderwith Deloitte where he co-founded the firm's NationalDisability Management Services Unit. Earlier, he was vicepresident and managing consultant with Aon, where hewas among the founders of the Aon Management Institute, a practice builtaround workers' compensation cost containment and education.He began his career with Liberty Mutual where he became senior claimsadjuster before joining Marsh in 1986 as assistant vice president and claimaccount representative. He also served as a claim manager with Air ExpressInternational. Mr. Thompson earned a B.S. degree in communications andpublic relations from Syracuse University.About Hanover Stone PartnersHanover Stone Partners is the first network of recognized and accomplished risk managementadvisors and specialized risk management services firms. The firm assembles multidisciplinary, cross-industry teams that work collaboratively to help clients identify, analyze,manage and finance enterprise risks. This comprehensive approach offers clients theadvantage of superior risk management advice and risk management services, delivered moreeconomically. Hanover Stone Partners evaluates existing risk programs, guides enterprise riskmanagement initiatives, implements new strategies, and provides unbundled services that helpclients reduce the total cost and volatility of risk, protect earnings, and preserve liquidity t.com/render?m 1109406199584&ca 49f6d255-8f38-4e56-abca-19c6340077022/3

4/20/2018HSP Establishes Practice Group to Help Employers Control Workers' Compensation Coststheir enterprises.Visit Hanover Stone Partners at www.HanoverStonePartners.com.Join the HSP Community 2017 Hanover Stone Partners, t.com/render?m 1109406199584&ca 49f6d255-8f38-4e56-abca-19c6340077023/3

4/20/20182018 - What's in Your Plan? HSP Top 10 Capabilities and Resources2018 - What's in Your Plan?Greetings!It is that time of the year when most organizations are deeply engaged in thebudgeting and planning processes for 2018.We have identified the Top Ten Hanover StonePartners capabilities that we believe will be ofmost interest to risk managers, particularlyconsidering continued reduced internal staffs,expanding areas of responsibility andaccountability, the need to do "more with less"and increased dissatisfaction with the qualityand cost of services provided by outside thirdparty vendors.Beyond budgetary constraints, time is the biggest constraint for most riskmanagers and prioritization is the biggest challenge. Leverage our highlyexperienced available resources to your advantage consisting of: 50 Senior Risk Advisors with an average 30 years of risk managementexperience. 30 Partner Firms that provide a full range of unbundled riskmanagement services. 2,000 Work at Home "Vintage Experts" 100 countries with boots on the ground, as a result of our Associatenon-broker membership in Worldwide Broker Network (WBN)We hope you can find the time to review these comprehensive tools andresources that can support you in meeting your objectives and demonstratingthe continued value that the risk management function brings to the ntcontact.com/render?m 1109406199584&ca e808bf7c-2a51-4f60-983a-592e83968dd31/5

4/20/20182018 - What's in Your Plan? HSP Top 10 Capabilities and ResourcesTop 10 HSP Capabilities1Comprehensive Cyber Risk Coverage Reviews: There is no standard cyberrisk insurance policy form and, sadly, the products available in the commercialinsurance market are incongruent with each other. Additionally, there arepotentially limited coverages available.Read More 2Vendor Risk Management: In most organizations, effective vendor riskmanagement is difficult to accomplish.HSP has an established framework tomanage the process and works with our partner firms to deliver a tailored andsustainable solution.Read More 3Global Insurance Compliance Reviews: Increasingly, countries around theworld are enforcing more stringent local insurance requirements, motivated bythe combined objectives of increasing premium tax revenues and retainingmore capital in country. Staying abreast of country-by-country changes andavoiding regulatory problems that can range from fines, severe penalties.Read More 4CaptiveGuard : Our award winning comprehensive review of all operationalaspects of operating a captive insurance company ntcontact.com/render?m 1109406199584&ca e808bf7c-2a51-4f60-983a-592e83968dd32/5

4/20/20182018 - What's in Your Plan? HSP Top 10 Capabilities and ResourcesCaptiveGuard provides strategic and financialreviews of a captive's underwriting portfolio andwill evaluate potential alternative strategies toaccelerate growth, improve underwritingprofitability, and increase return on capital.Read More 5WorkersComp Guard : Our dedicated, national practice group, works withemployers across the country to develop tailored solutions to reduce workers'compensation costs and improve claim outcomes.WorkersComp Guard provides strategiesand methods to evaluate risk-financingoptions, implement best claimsmanagement practices, assess employersafety culture and practices, and leveragedata for program measurement and more effective resource deployment.For more information: http://conta.cc/2oKDqNFRead More 6ERM Support: Our ERM practice is available to support enterprises at anystage in the ERM maturity model. We have also developed ERM Prime, a newproprietary HSP product developed for companies that have decided toembark on an ERM initiative, but due to limited resource commitments, want tobegin the journey "lightly".Read More 7SCOUT: An innovative new consultative methodology and analytical tool forCaptives. SCOUT offers a platform for supporting the business and growthstrategies of the organization's captive insurance company by offering a act.com/render?m 1109406199584&ca e808bf7c-2a51-4f60-983a-592e83968dd33/5

4/20/20182018 - What's in Your Plan? HSP Top 10 Capabilities and Resourcesdefined framework and methodology for consistent, sophisticated andcontinuous assessment of captive performance.The product attributes and methodologies were described in an articlepublished in RIMS' August issue of Risk Management Magazine, "A NewMethod for Measuring Captive Performance." You can access the full articlevia the following thod-for-measuring-captiveperformance/Read More 8Environmental Liability Risk Management: Advisory services focused onrisk treatment for ongoing loss exposures and legacy liability, in addition toproviding corporate environmental risk management strategies for ERMprograms. Our industry leading partner firms bring experts in all facets of theenvironmental insurance business.Read More 9Outsourcing or In-sourcing "lower value" but necessary risk managementprocesses.(Contract reviews, insurance compliance monitoring, policy checking, claimsreporting, claims auditing, claims reserve analysis, etc.).Read More 10Formal RFP or performance evaluations for insurance programs, brokerageservices, other risk management services.Read More om/render?m 1109406199584&ca e808bf7c-2a51-4f60-983a-592e83968dd34/5

4/20/20182018 - What's in Your Plan? HSP Top 10 Capabilities and ResourcesIf you are interested in learning more please Contact Us or connect on socialmedia:About Hanover Stone PartnersHanover Stone Partners is the first network of recognized and accomplished riskmanagement advisors and specialized risk management services firms. The firmassembles multi-disciplinary, cross-industry teams that work collaboratively to help clientsidentify, analyze, manage and finance enterprise risks. This comprehensive approachoffers clients the advantage of superior risk management advice and risk managementservices, delivered more economically. Hanover Stone Partners evaluates existing riskprograms, guides enterprise risk management initiatives, implements new strategies, andprovides unbundled services that help clients reduce the total cost and volatility of risk,protect earnings, and preserve liquidity for their enterprises.Visit Hanover Stone Partners at www.HanoverStonePartners.com or connect with t.com/render?m 1109406199584&ca e808bf7c-2a51-4f60-983a-592e83968dd35/5

4/20/2018HSP offers solutions to manage Florida's rising workers' comp ratesHSP Offers Solutions to ManageFlorida's Rising Workers' Comp RatesBarry E. Thompson to Lead WorkersComp Guard (TM)With Florida's appellate court recently upholding a 14.5 percent increase inworkers' compensation insurance rates, the time is right for employersthroughout the state to examine their workers' compensation costs and look forways to manage or reduce them.Hanover Stone Partners works with employers across the country on tailoredmeasures to drive down their total cost of

WESTGUARD INSURANCE COMPANY, Opposer, v. HANOVER STONE PARTNERS, LLC, Applicant. Opposition No. 91234475 Appln. Serial No. 87142642 APPLICANT'S NOTICE OF RELIANCE Pursuant to 37 C.F.R. §2.122, Applicant HANOVER STONE PARTNERS, LLC ("Applicant") hereby gives notice that it will or may rely on the following materials relevant to