Transcription

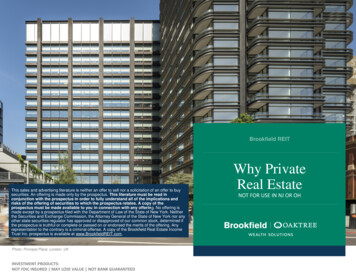

Brookfield REITThis sales and advertising literature is neither an offer to sell nor a solicitation of an offer to buysecurities. An offering is made only by the prospectus. This literature must be read inconjunction with the prospectus in order to fully understand all of the implications andrisks of the offering of securities to which the prospectus relates. A copy of theprospectus must be made available to you in connection with any offering. No offering ismade except by a prospectus filed with the Department of Law of the State of New York. Neitherthe Securities and Exchange Commission, the Attorney General of the State of New York nor anyother state securities regulator has approved or disapproved of our common stock, determined ifthe prospectus is truthful or complete or passed on or endorsed the merits of the offering. Anyrepresentation to the contrary is a criminal offense. A copy of the Brookfield Real Estate IncomeTrust Inc. prospectus is available at www.BrookfieldREIT.com.Photo: Principal Place, London, UKINVESTMENT PRODUCTS:NOT FDIC INSURED MAY LOSE VALUE NOT BANK GUARANTEEDWhy PrivateReal EstateNOT FOR USE IN NJ OR OH

DisclosuresRisk Factors:An investment in shares of common stock of Brookfield EstateIncome Trust Inc. (“Brookfield REIT”) involves a high degree ofrisk. These securities should only be purchased if you can afford tolose your complete investment. Please read the prospectus for adescription of the material risks associated with an investment inBrookfield REIT. These risks include but are not limited to thefollowing: Brookfield REIT has a limited operating history, and itsoperating history should not be relied upon due to thechanges to its business resulting from the adviser transition,including the engagement of Brookfield REIT Adviser LLC (the“Adviser”) and Brookfield Oaktree Wealth Solutions LLC andthe changes to Brookfield REIT’s board of directors, executiveofficers and investment portfolio. There is no assurance thatBrookfield REIT will be able to successfully achieve itsinvestment objectives. Brookfield REIT has only made limited investments to dateand you will not have the opportunity to evaluate its futureinvestments before Brookfield REIT makes them. Since there is no public trading market for shares of BrookfieldREIT’s common stock, repurchase of shares by it will likely bethe only way to dispose of your shares. Brookfield REIT’sshare repurchase plan will provide stockholders with theopportunity to request that it repurchase their shares on amonthly basis, but Brookfield REIT is not obligated torepurchase any shares and may choose to repurchase onlysome, or even none, of the shares that have been requestedto be repurchased in any particular month in its discretion. Inaddition, repurchases will be subject to available liquidity andother significant restrictions. Further, Brookfield REIT’s boardof directors may modify or suspend the share repurchase planif it deems such action to be in our best interest and the bestinterest of stockholders. As a result, the shares should beconsidered as having only limited liquidity and at times may beilliquid. Brookfield REIT cannot guarantee that it will makedistributions, and if it does, it may fund such distributions fromsources other than cash flow from operations, and there areno limits on the amounts Brookfield REIT may pay from suchsources. Brookfield REIT believes that the likelihood that itpays distributions from sources other than cash flow fromoperations, will be higher in the early stages of the offering. The purchase and repurchase price for shares of BrookfieldREIT common stock will generally be based on its priormonth’s net asset value (NAV) (subject to material changes asdescribed in the prospectus) and will not be based on anypublic trading market. While there will be independent annualappraisals of Brookfield REIT’s properties, the appraisal of properties is inherently subjective, and its NAV may notaccurately reflect the actual price at which its assets could beliquidated on any given day.Brookfield REIT has no employees and is dependent on theAdviser to conduct its operations. The Adviser will faceconflicts of interest as a result of, among other things, theallocation of investment opportunities among Brookfield REITand other Brookfield funds and accounts, the allocation of timeof its investment professionals and the substantial fees thatBrookfield REIT will pay to the Adviser.This is a “best efforts” offering. If Brookfield REIT is not able toraise a substantial amount of capital in the near term, its abilityto achieve its investment objectives could be adverselyaffected.Principal and interest payments on any borrowings will reducethe amount of funds available for distribution or investment inadditional real estate assets. Borrowing also increases the riskof loss and exposure to negative economic effects.There are limits on the ownership and transferability ofBrookfield REIT’s shares.If Brookfield REIT fails to maintain its qualification as a REITand no relief provisions apply, its NAV and cash available fordistribution to stockholders could materially decrease as aresult of being subject to corporate income tax.Investing in commercial real estate assets involves certainrisks, including but not limited to Brookfield REIT’s tenants’inability to pay rent; increases in interest rates and lack ofavailability of financing; tenant turnover and vacancies; andchanges in supply of or demand for similar properties in agiven market.Brookfield REIT’s operating results will be affected by globaland national economic and market conditions generally and bythe local economic conditions where its properties are located,including changes with respect to rising vacancy rates ordecreasing market rental rates; fluctuations in the averageoccupancy; inability to lease space on favorable terms;bankruptcies, financial difficulties or lease defaults by itstenants; and changes in government rules, regulations andpolicies, such as property taxes, zoning laws, limitations onrental rates, and compliance costs with respect toenvironmental and other laws.The novel coronavirus (“COVID-19”) may have an adverseimpact on Brookfield REIT’s NAV, results of operations, cashflows and fundraising, ability to source new investments,obtain financing, pay distributions to stockholders and satisfyrepurchase requests, among other factors.Forward-Looking Statements:Statements contained in this sales material that are not historicalfacts are based on our current expectations, estimates,projections, opinions or beliefs. Such statements are not facts andinvolve known and unknown risks, uncertainties, and other factors.Prospective investors should not rely on these statements as ifthey were fact. Certain information contained in this sales materialconstitutes “forward-looking statements,” which can be identifiedby the use of forward-looking terminology such as “may,” “will,”“should,” “expect,” “anticipate,” “project,” “target,” “estimate,”“intend,” “continue,” “forecast,” or “believe” or the negatives thereofor other variations thereon or other comparable terminology. Dueto various risks and uncertainties, including those described in theprospectus, actual events or results or our actual performancemay differ materially from those reflected or contemplated in suchforward-looking statements. No representation or warranty is madeas to future performance or such forward-looking statements. Inlight of the significant uncertainties inherent in these forwardlooking statements, the inclusion of this information should not beregarded as a representation by us or any other person that ourobjectives and plans, which Brookfield REIT considers to bereasonable, will be achieved.You should carefully review the “Risk Factors” section of theprospectus for a discussion of the risks and uncertainties thatBrookfield REIT believes are material to its business, operatingresults, prospects and financial condition. Except as otherwiserequired by federal securities laws, Brookfield REIT does notundertake to publicly update or revise any forward-lookingstatements, whether as a result of new information, future eventsor otherwise.Brookfield Oaktree Wealth Solutions LLC (member FINRA/SIPC)is the dealer manager for the Brookfield Real Estate Income TrustInc. offering.2

Income GenerationPrivate real estate offers the potential for higher yield than other asset classes—even thoseknown for income generation—as well as appreciationTotal Return20-year annualized returns through 202112.0%10.0%8.0%6.0%4.0%2.0%0.0%U.S. equitiesPrivate U.S. real estateIncomeInternational equitiesU.S. fixed incomeAppreciationPast performance does not guarantee future results. As of December 31, 2021. Private U.S. real estate represented by NCREIF Property Index (NPI), U.S. equities represented byS&P 500 Index, international equities represented by MSCI EAFE Index and U.S. fixed income represented by Bloomberg Barclays U.S. Aggregate Index. An investor cannot invest inan index.The NCREIF Property Index is an index of quarterly returns reported by institutional investors on investment-grade commercial properties owned by those investors and is not ameasure of non-listed REIT performance. Brookfield REIT is a non-listed REIT that will invest its portfolio in commercial-grade properties as well as in real estate-related securities. TheNCREIF Property Index is based on appraisals and is calculated before the effects of leverage. Brookfield REIT uses appraisals in its calculation of NAV and will employ leverage. TheNCREIF Property Index does not reflect the impact of transaction costs, management and other investment-entity fees and expenses or the costs associated with raising capital or beinga public company, which lower returns. Brookfield REIT is a public company with an external advisor conducting a perpetual offering and will incur the aforementioned costs. Its sharesshould be considered as having limited liquidity and may be illiquid.Source: Bloomberg, National Council of Real Estate Investment Fiduciaries.3

Lower VolatilityPrivate real estate has historically exhibited significantly less volatility than public real estateand equity markets, often with stronger risk-adjusted returnsAnnual Standard Deviation (10 years)Private Real Estate2.3%Public Real Estate16.6%S&P 920202021-10%-20%-30%Private Real EstatePublic Real EstateS&P 500Past performance does not guarantee future results. There can be no assurance that current trends will continue.As of December 31, 2021Represents quarterly returns for each index, and 10-year, annualized standard deviations. Private Real Estate is represented by the NFI-ODCE Index. Public real estate represented byS&P United States REIT Index. An investor cannot invest in an index.The NCREIF Property Index is an index of quarterly returns reported by institutional investors on investment-grade commercial properties owned by those investors and is not ameasure of non-listed REIT performance. Brookfield REIT is a non-listed REIT that will invest its portfolio in commercial-grade properties as well as in real estate-related securities. TheNCREIF Property Index is based on appraisals and is calculated before the effects of leverage. Brookfield REIT uses appraisals in its calculation of NAV, which is not based on a publicmarket, and will employ leverage. The NCREIF Property Index does not reflect the impact of transaction costs, management and other investment-entity fees and expenses or the costsassociated with raising capital or being a public company, which lower returns. Brookfield REIT is a public company with an external advisor conducting a perpetual offering and will incurthe aforementioned costs. Its shares should be considered as having limited liquidity and may be illiquid.Source: Bloomberg.4

Better Risk-Adjusted ReturnsPrivate real estate has historically increased returns and lowered risk when added to atraditional 60% equity and 40% bond portfolioReturns and Risk Trailing 20 Years as of December 31, 2021Traditional PortfolioAdding Private Real turnU.S. equitiesRiskInternational equities12.5%U.S. fixed incomeReturnRiskPrivate U.S. real estatePast performance does not guarantee future results. Total return and risk as measured by standard deviation of quarterly returns for 20 years ending as of December 31, 2021, of ahypothetical portfolio as displayed of private U.S. real estate represented by NCREIF Property Index (NPI), U.S. equities represented by S&P 500 Index, international equitiesrepresented by MSCI EAFE Index and U.S. fixed income represented by Bloomberg Barclays U.S. Aggregate Index. An investor cannot invest in an index.The NCREIF Property Index is an index of quarterly returns reported by institutional investors on investment-grade commercial properties owned by those investors and is not ameasure of non-listed REIT performance. Brookfield REIT is a non-listed REIT that will invest its portfolio in commercial-grade properties as well as in real estate-related securities. TheNCREIF Property Index is based on appraisals and is calculated before the effects of leverage. Brookfield REIT uses appraisals in its calculation of NAV, which is not based on a publicmarket, and will employ leverage. The NCREIF Property Index does not reflect the impact of transaction costs, management and other investment-entity fees and expenses or the costsassociated with raising capital or being a public company, which lower returns. Brookfield REIT is a public company with an external advisor conducting a perpetual offering and will incurthe aforementioned costs. Its shares should be considered as having limited liquidity and may be illiquid.Source: Bloomberg, National Council of Real Estate Investment Fiduciaries.5

DiversificationOver the past 20 years, private real estate has exhibited effective diversification to stocksand bonds, as well as public real estateAsset Class Correlation20-Year Annualized Returns Through 2021U.S. onalEquitiesPublic Real U.S. Fixed Private U.S.EstateIncome Real 0.040.25Public RealEstateU.S. FixedIncomePrivate U.S.Real Estate1.00Correlation is a statistic that measures thedegree to which two investments move in relationto each other.A correlation coefficient of 1 indicates a perfectpositive correlation, meaning that they move inthe same direction by the same amount.(0.17)A coefficient of -1 indicates a perfect negativecorrelation, meaning that they have historicallymoved in the opposite direction.1.00Therefore, the lower the number, the better thediversification.Past performance does not guarantee future results. Diversification does not ensure a profit or protect against loss in a declining market.As of December 31, 2021. Private U.S. real estate represented by NCREIF Property Index (NPI), U.S. equities represented by S&P 500 Index, international equities represented byMSCI EAFE Index, public real estate represented by S&P United States REIT Index and U.S. fixed income represented by Bloomberg Barclays U.S. Aggregate Index. An investorcannot invest in an index.The NCREIF Property Index is an index of quarterly returns reported by institutional investors on investment-grade commercial properties owned by those investors and is not ameasure of non-listed REIT performance. Brookfield REIT is a non-listed REIT that will invest its portfolio in commercial-grade properties as well as in real estate-related securities. TheNCREIF Property Index is based on appraisals and is calculated before the effects of leverage. Brookfield REIT uses appraisals in its calculation of NAV, which is not based on a publicmarket, and will employ leverage. The NCREIF Property Index does not reflect the impact of transaction costs, management and other investment-entity fees and expenses or the costsassociated with raising capital or being a public company, which lower returns. Brookfield REIT is a public company with an external advisor conducting a perpetual offering and will incurthe aforementioned costs. Its shares should be considered as having limited liquidity and may be illiquid.Source: Bloomberg, National Council of Real Estate Investment Fiduciaries.6

Inflation HedgeReal estate has generated strong returns amid high inflationAverage Quarterly Returns When U.S. ConsumerInflation Was Higher Than Average1Past 20 YearsPast 44 Years(Private Real Estate Index Incepted)Total Return During Periods with the LargestSpikes in U.S. Consumer InflationTime PeriodCPI 0%2.5%2.2%1.8%2.0%1.5%1.0%1.0%0.3%0.5%Private U.S. real estateThe Late 1970s toEarly 1980s3/31/1978–6/30/1980 11.8% 18.9%Late 1980sGulf War I12/31/1986–9/30/1990 4.9% 7.8% 5.8% 12.8%Global Health Crisis6/30/2020–12/31/20210.0%U.S. equitiesPrivate U.S.Real EstateU.S. fixed incomePast performance does not guarantee future results. As of December 31, 2021.1Higher-than-averageinflation is measured as when the year-over-year U.S. Consumer Price Index exceeded 4%. During those periods, we examined the average returns of privateU.S. real estate (as measured by the NCREIF Property Index (NPI)); U.S. equities (as measured by the S&P 500 Index); and U.S. fixed income (as measured by the Bloomberg USAggregate Bond Index). The 44 time period represents the number of years since the inception of the NPI. The NCREIF Property Index is an index of quarterly returns reported byinstitutional investors on investment-grade commercial properties owned by those investors and is not a measure of non-listed REIT performance. Brookfield REIT is a non-listed REITthat will invest its portfolio in commercial-grade properties as well as in real estate-related securities. The NCREIF Property Index is based on appraisals and is calculated before theeffects of leverage. Brookfield REIT uses appraisals in its calculation of NAV, which is not based on a public market, and will employ leverage. The NCREIF Property Index does notreflect the impact of transaction costs, management and other investment-entity fees and expenses or the costs associated with raising capital or being a public company, which lowerreturns. Brookfield REIT is a public company with an external advisor conducting a perpetual offering and will incur the aforementioned costs. Its shares should be considered as havinglimited liquidity and may be illiquid. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated,fixed-rate taxable bond market. The S&P 500 Index is an equity index of 500 widely held, large-capitalization U.S. companies. The Consumer Price Index (CPI) is a measure of theaverage change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areasfrom the U.S. Bureau of Labor Statistics.Source: Bloomberg, National Council of Real Estate Investment Fiduciaries.7

Tax AdvantagesTax benefits unique to direct real estate ownership can reduce investors’ effective tax rateand increase after-tax yields—particularly in scenarios where return of capital is highAttractive After-Tax Yield6%5.0%5%4.9%4.4%4% For tax purposes, distributions from non-tradedREITs may be classified as “return of capital.” Distributions are paid out of available cashflow, which reflects non-cash items such asdepreciation, instead of net income. Return of capital distributions are tax-deferredand reduce the shareholder’s cost basis. If the investment is sold at a gain after morethan a year, it would be taxed at the long-termcapital gains rate.3.5%3%2%1%0%Pre-tax yield90% return of capital 60% return of capital 0% return of capitalHistorical analysis does not guarantee future results. As of December 31, 2021. For illustrative purposes only and assumes 100,000 investment with 5% ( 5,000) annualizeddistribution taxed at highest federal tax bracket. The example does not include state taxes. An investor could be subject to state income tax in their state of residence, which would lowerthe after-tax yield received by the investor.Source: Brookfield.8

Brookfield REITHighlights Brookfield REIT is advised by Brookfield,1 one of the world’slargest real estate owners and operators, and is sub-advisedby Oaktree,2 allowing Brookfield REIT to leverage Oaktree’sworld-renowned credit expertise. Applying a flexible approach to identify high-quality, incomeproducing opportunities across real estate equity and debtregardless of location or property type. Potential benefits and features:Monthly Distributions3Monthly PricingPhoto: The Burnham, Nashville, TNCapital AppreciationMonthly Liquidity4DiversificationAnnual Form 1099-DIVInflation HedgeDiversification does not ensure a profit or protect against loss in a declining market.1“Brookfield”2“Oaktree”refers to Brookfield Asset Management Inc., together with its affiliates.refers to Oaktree Capital Management, L.P., together with its affiliates.3Distributionsare authorized by Brookfield REIT's board of directors and are not guaranteed.4Liquidityis provided through Brookfield REIT's share repurchase plan, which has monthly and quarterly limits andmay be suspended.9

Brookfield AdvantageDelivering best-in-class real estate and credit capabilities toindividual investorsUnparalleled Scale: Brookfield is one of the world’s largest real estate investors,with 251 billion in AUM, providing access to opportunities that others can’t match.Differentiated Insights: A network of more than 500 on-the-ground sector expertscommitted to sourcing the best income-generating assets.Operational Excellence: Owners and operators with a hands-on approach tomanaging every property aspect—with 29,500 operating employees focused onproviding best-in-class service and creating long-term value.Powerful Partnership: Leveraging Oaktree’s world-renowned credit expertise with 166 billion AUM and roots dating back three decades. 251BBROOKFIELD REALESTATE AUM500 SECTOR SPECIALISTS29,500OPERATING EMPLOYEES“Brookfield” refers to Brookfield Asset Management Inc. and its consolidated subsidiaries.Assets under management for Brookfield Asset Management Inc. and its affiliates. Number of operating employees includes investment andoperating professionals across all of Brookfield’s real estate platform as of Dec. 31, 2021.10

Summary of Terms1STRUCTUREPublic non-listed, perpetual life real estate investment trust (REIT)INVESTMENT PORTFOLIOTarget 80% (potentially ranging between 65% and 90%) in real estate property investmentsand 20% (potentially ranging between 10% and 35%) private loans and debtSUITABILITYEither (1) a net worth of at least 250,000 or (2) a gross annual income of at least 70,000 and anet worth of at least 70,000. Certain states have additional suitability standards.NAV 3Monthly (not guaranteed, subject to board approval)LIQUIDITY4Monthly, subject to monthly 2% of NAV cap and quarterly 5% of NAV capMANAGEMENT FEE1.25% per annum on NAVPERFORMANCE PARTICIPATION INTEREST12.5% of total return, subject to 5% hurdle and 100% catch-up; also subject to a high-water markLEVERAGETarget 60% of gross real estate assetsTAX REPORTINGForm 1099-DIVsummarized herein are for informational purposes and qualified in their entirety by the more detailed information set forth in Brookfield REIT’s prospectus. You should read theprospectus carefully prior to making an investment.1TermsREIT may offer shares at a price that Brookfield REIT believes reflects the NAV per share of such common stock more appropriately than the prior month’s NAV per share,including by updating a previously disclosed offering price, in cases where Brookfield REIT believes there has been a material change (positive or negative) to the Brookfield REIT NAVper share since the end of the prior month.2Brookfield3Thereis no assurance Brookfield REIT will pay distributions in any particular amount, if at all. Any distributions Brookfield REIT makes will be at the discretion of the Brookfield REITboard of directors. Brookfield REIT may fund any distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, return ofcapital or offering proceeds, and Brookfield REIT has no limits on the amounts Brookfield REIT may pay from such sources. Distributions may be funded by sources other than cash flowfrom operations, including, without limitation, the sale of assets, borrowings, return of capital or offering proceeds, although Brookfield REIT cannot guarantee that it will makedistributions. Brookfield REIT believes that the likelihood that it pays distributions from sources other than cash flow from operations will be higher in the early stages of the offering.4Liquidityis provided through Brookfield REIT’s share repurchase plan, which has monthly and quarterly limits and may be suspended.11

Share Classes & Fee StructuresCLASS T SHARESCLASS S SHARESCLASS D SHARESCLASS I SHARESAVAILABILITYThrough transactionalbrokerage accountsThrough transactionalbrokerage accountsThrough fee-based (wrap)programs, broker-dealers,registered investmentadvisers, and bank trustdepartmentsThrough fee-based (wrap)programs, endowments,foundations, pension fundsand other institutionalinvestors, broker-dealersand executive officersSELLING COMMISSIONS1(UP FRONT) AS APERCENTAGE OFTRANSACTION PRICEUp to 3.0%Up to 3.5%Up to 1.5%N/ADEALER MANAGER FEE1(UP FRONT) AS APERCENTAGE OFTRANSACTION PRICEUp to 0.5%N/AN/AN/ASTOCKHOLDER SERVICINGFEES1 (PER ANNUM,PAYABLE MONTHLY, AS APERCENTAGE OF NAV)(ONGOING)0.65% advisor stockholderservicing0.20% dealer stockholderservicing0.85%0.25%N/AMINIMUM INITIALINVESTMENT1 2,500 2,500 2,500 1 million1Selectbroker-dealers may have higher suitability standards, may not offer all share classes, or may offer shares at a higher minimum initial investment. With respect to Class T shares,the amount of up-front selling commissions and dealer manager fees may vary at select broker-dealers, provided that the sum will not exceed 3.5% of the transaction price. The advisorand dealer stockholder servicing fees for Class T shares may also vary at select broker-dealers, provided that the sum of such fees will always equal 0.85% per annum of NAV.12

Index DisclosuresThe quoted indexes within this publication are unmanaged and cannot be purchased directly by investors.Index performance is shown for illustrative purposes only and does not predict or depict the performance ofany investment. There may be material factors relevant to any such comparison such as differences involatility and regulatory and legal restrictions between the indexes shown and any investment in aBrookfield strategy, composite or fund. Brookfield obtained all index data from third-party index sponsorsand believes the data to be accurate; however, Brookfield makes no representation regarding its accuracy.Indexes are unmanaged and cannot be purchased directly by investors.Brookfield does not own or participate in the construction or day-to-day management of the indexesreferenced in this document. The index information provided is for your information only and does not implyor predict that a Brookfield product will achieve similar results. This information is subject to change withoutnotice. The indexes referenced in this document do not reflect any fees, expenses, sales charges or taxes.It is not possible to invest directly in an index. The index sponsors permit use of their indexes and relateddata on an "as is" basis, make no warranties regarding same, do not guarantee the suitability, quality,accuracy, timeliness and/or completeness of their index or any data included in, related to or derivedtherefrom, and assume no liability in connection with the use of the foregoing. The index sponsors have noliability for any direct, indirect, special, incidental, punitive, consequential or other damages (including lossof profits). The index sponsors do not sponsor, endorse or recommend Brookfield or any of its products orservices. Unless otherwise noted, all indexes are total-return indexes.MSCI makes no express or implied warranties or representations, and shall have no liability whatsoeverwith respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used asa basis for other indices, any securities or financial products. This report is not approved, reviewed orproduced by MSCI.contact usIndex DefinitionsBloomberg Barclays U.S. Aggregate Index is a broad-base, market capitalization-weighted bond marketindex representing intermediate-term investment-grade bonds traded in the United States.Consumer Price Index (CPI) is a measure of the average change in prices over time in a fixed marketbasket of goods and services.FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S.equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of totalassets in qualifying real estate assets other than mortgages secured by real property.MSCI EAFE Index is a stock market index that is designed to measure the equity market performance ofdeveloped markets (Europe, Australasia and Far East) outside of the U.S. and F Property Index (NPI) is the primary index used by institutional investors in the United States toanalyze the performance of commercial real estate and use as a benchmark for actively managed realestate portfolios.S&P 500 Index is an equity index of 500 widely held, large-capitalization U.S. companies.S&P United States REIT Index measures the investable universe of publicly traded real estate inves

Past performance does not guarantee future results. As of December 31, 2021. Private U.S. real estate represented by NCREIF Property Index (NPI), U.S. equities represented by S&P 500 Index, international equities represented by MSCI EAFE Index and U.S. fixed income represented by Bloomberg Barclays U.S. Aggregate Index. An investor cannot invest in