Transcription

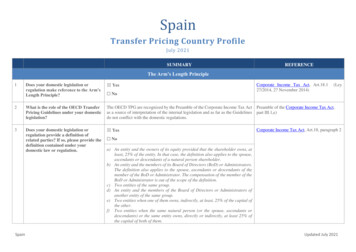

SpainTransfer Pricing Country ProfileJuly 2021SUMMARYREFERENCEThe Arm’s Length PrincipleDoes your domestic legislation orregulation make reference to the Arm’sLength Principle? Yes2What is the role of the OECD TransferPricing Guidelines under your domesticlegislation?The OECD TPG are recognized by the Preamble of the Corporate Income Tax Actas a source of interpretation of the internal legislation and as far as the Guidelinesdo not conflict with the domestic regulations.Preamble of the Corporate Income Tax Act,part III.1,e)3Does your domestic legislation orregulation provide a definition ofrelated parties? If so, please provide thedefinition contained under yourdomestic law or regulation. YesCorporate Income Tax Act, Art.18, paragraph 21Spain NoCorporate Income Tax Act, Art.18.127/2014, 27 November 2014)(Ley Noa) An entity and the owners of its equity provided that the shareholder owns, atleast, 25% of the entity. In that case, the definition also applies to the spouse,ascendants or descendants of a natural person shareholder.b) An entity and the members of its Board of Directors (BoD) or Administrators.The definition also applies to the spouse, ascendants or descendants of themember of the BoD or Administrator. The compensation of the member of theBoD or Administrator is out of the scope of the definition.c) Two entities of the same group.d) An entity and the members of the Board of Directors or Administrators ofanother entity of the same group.e) Two entities when one of them owns, indirectly, at least, 25% of the capital ofthe other.f) Two entities when the same natural person (or the spouse, ascendants ordescendants) or the same entity owns, directly or indirectly, at least 25% ofthe capital of both of them.Updated July 2021

g) An entity resident in Spain and its permanent establishments in otherjurisdictions.Transfer Pricing Methods4Does your domestic legislation providefor transfer pricing methods to be usedin respect of transactions betweenrelated parties? YesCorporate Income Tax Act, Art.18, paragraph 4 NoIf affirmative, please check those provided for in your ther (If so,please describe) Other methods (not specified) and valuation techniques, generally accepted, maybe used when none of the five recognized methods can be applied, as long as theyare in accordance with ALP.5Which criterion is used in yourjurisdiction for the application oftransfer pricing methods?Please check all that apply:Corporate Income Tax Act, Art.18, paragraph 4 Hierarchy of methods Most appropriate method Other (if so, please explain)The most appropriate method rule applies regarding the five recognized methods.Other methods (not specified) and valuation techniques may be used only whennone of the five recognized methods can be applied, as long as they are inaccordance with ALP.6If your domestic legislation orregulations contain specific guidance oncommodity transactions, indicate whichof the following approaches is followed. For controlled transactions involving commodities, the guidance contained inparagraphs 2.18-2.22 of the TPG is followed. Domestic legislation mandates the use of a specific method for controlledtransactions involving commodities (if so, please explain) Other (if so, please explain)Spain’s domestic legislation does not contain specific guidance on commoditytransactions. The TPG apply as a source of interpretation.SpainUpdated July 2021

Comparability Analysis7Does your jurisdiction follow (or largelyfollow) the guidance on comparabilityanalysis outlined in Chapter III of theTPG? YesCorporate Income Tax Regulations, Art. 17 No(Real Decreto 634/2015, de 10 de julio)The internal regulations (Please, see the specific Reference) follow the processoutlined in Chapter III of the TPG.89Is there a preference in yourjurisdiction for domestic comparablesover foreign comparables? YesDoes your tax administration use secretcomparables for transfer pricingassessment purposes? Yes No NoBased on several court decisions, the use of secret comparables is not allowed fortransfer pricing assessment purposes.10Does your legislation allow or requirethe use of an arm’s length range and/orstatistical measure for determiningarm’s length remuneration? YesCorporate Income Tax Regulations, Art. 17.7 NoThe internal regulations (Please, see the specific Reference) allow for the use ofan arm s length range and statistical measures in specific circumstances, but thereis not a requirement to do so.11Are comparability adjustmentsrequired under your domesticlegislation or regulations? YesCorporate Income Tax Regulations, Art. 17.4 NoComparability adjustments are not necessarily required under internal regulations,but, in some cases, they may be necessary to account for differences between thesituations being compared.Intangible Property12SpainDoes your domestic legislation orregulations contain guidance specific to Yes NoUpdated July 2021

1314the pricing of controlled transactionsinvolving intangibles?Spain’s domestic legislation does not contain specific guidance on intangibletransactions. As a source of interpretation, the TPG are used.Does your domestic legislation orregulation provide for transfer pricingrules or special measures regardinghard to value intangibles (HTVI)? YesAre there any other rules outsidetransfer pricing rules that are relevantfor the tax treatment of transactionsinvolving intangibles? YesHTVI Implementation Questionnaire No NoIntra-group Services15Does your domestic legislation orregulations provide guidance specific tointra-group services transactions? YesCorporate Income Tax Act, Art.18, paragraph 5 NoArticle 18, paragraph 5 refers to specific requirements applicable to intra-groupservices transactions, e.g., the benefits test, rational allocation of centralisedservices or the methods to be applied.16Do you have any simplified approachfor low value-adding intra-groupservices? Yes NoThe simplified approach for low value-adding intra-group services has not beenimplemented.As a source of interpretation, the work of the EU Joint Transfer Pricing Forum onlow-value adding intra-group services and the OECD TPG may be used (e.g., inorder to understand what a low value-adding service is.17SpainAre there any other rules outsidetransfer pricing rules that are relevantfor the tax treatment of transactionsinvolving services? Yes NoUpdated July 2021

Financial transactions18[NEW] Does your domestic legislationor regulations provide guidance specificto financial transactions? Yes NoSpain’s domestic legislation does not contain specific guidance on financialtransactions. As a source of interpretation, the TPG are used.19[NEW] Are there any other rulesoutside transfer pricing rules that arerelevant for the tax treatment offinancial transactions? YesCorporate Income Tax Act, Arts. 15.h), 15 bisand 16 NoThe following rules would apply to financial transactions: General limitation to the deductibility of financial expenses. CTA, Art. 16includes a general limitation on the deduction of financial expenses accordingto Art. 4 of the Council Directive (EU) 2016/1164, of July 12, 2016 (ATAD1) and it is consistent with standards set up on Action 4 final report of theOECD/G20 BEPS project.Specific limitation to the deductibility of financial expenses in cases ofleveraged intra-group sales of shares. CTA, Art. 15, letter h), establishes thenon-deductible of financial expenses generated within a commercial group tocarry out certain operations between entities belonging to the same group (i.e:acquisition of intragroup shares), unless the taxpayer proves the transaction isreasonable from an economic perspective.No deductibility of financial expenses in the case of hybrid instruments orentities. CTA, Art. 15 bis contains anti-hybrid rules fulfilling transposition ofCouncil Directive (EU) 2016/1164, of July 12, 2016, laying down rules againsttax avoidance practices that directly affect the functioning of the internalmarket as amended by Council Directive (EU) 2017/952, of May 29, 2017regarding hybrid mismatches with third countries. Provisions to neutralizehybrid mismatches contained in the aforementioned article are consistent withstandards set up on Action 2 final report of the OECD/G20 BEPS project.Cost Contribution Agreements20Spain YesCorporate Income Tax Act, Art.18, paragraph 7 NoCorporate Income Tax Regulations, Art. 18Updated July 2021

Does your jurisdiction have legislationor regulations on cost contributionagreements?Article 18, paragraph 7 refers to specific requirements applicable to costcontribution agreements, e.g., the value of contributions should be properly relatedto the expected benefits, the members should participate in the intangibles, assetsor services obtained through the CCA, the agreement should include provisionsrelated to balancing payments, changes in the membership, withdrawal ortermination.Transfer Pricing Documentation21Does your legislation or regulationsrequire the taxpayer to prepare transferpricing documentation? YesCorporate Income Tax Act, Art.18, paragraph 3 NoCorporate Income Tax Regulations, Arts. 13 to16If affirmative, please check all that apply: Master file consistent with Annex I to Chapter V of the TPG Local file consistent with Annex II to Chapter V of the TPG Country-by-country report consistent with Annex III to Chapter V of theTPG Specific transfer pricing returns (separate or annexed to the tax return) Other (specify):22Please briefly explain the relevantrequirements related to filing oftransfer pricing documentation (i.e.timing for preparation or submission,languages, etc.)The Master file and the Local file corresponding to a year should be at the disposalof the Tax Administration on the last day for submitting the tax return for that year.This information is provided to the Tax Administration only in case of a specificrequest to the taxpayer.Corporate Income Tax Act, Art.18, paragraph 3Corporate Income Tax Regulations, Arts. 13 to16The CbC corresponding to a year should be submitted to the Tax Administrationno later than 12 months after the last day of the corresponding fiscal year.Spain requires a specific transfer pricing information requirement. It contains basicinformation for risk assessment, including the type and amount of the controlledtransactions, the methods used, etc. The information has to be filed in the monthfollowing the 10 months after the end of the tax year period.23SpainDoes your legislation provide forspecific transfer pricing penalties YesCorporate Income Tax Act, Art.18, paragraph 13 NoUpdated July 2021

and/or compliance incentives regardingtransfer pricing documentation?The internal legislation (Please, see the specific Reference) provide fordocumentation-related penalties in some circumstances (e.g. when the taxpayerdoes not provide the documentation to the Tax administration or thedocumentation is incomplete or false).In addition, the legislation also provides a legal ground for penalties when a taxadjustment is made and some other conditions are met (i.e. the taxpayer does notprovide the documentation to the Tax administration or the documentation isincomplete or false or when the transfer prices are declared in the tax return aredifferent from those of the documentation).24If your legislation provides forexemption from transfer pricingdocumentation obligations, pleaseexplain.There are some exemptions (e.g. transactions below EUR 250 000 or intra-grouptransactions if a tax consolidated regime is applied, do not need to be documented)and some measures of simplification for medium (with income not exceeding EUR45 million a year) and small taxpayers (with income not exceedingEUR 10 million a year).Corporate Income Tax Act, Art.18, paragraph 13Corporate Income Tax Regulations, Arts. 13,15and 16Administrative Approaches to Avoiding and Resolving Disputes25Which mechanisms are available inyour jurisdiction to prevent and/orresolve transfer pricing disputes?Please check those that apply:Corporate Income Tax Law Art. 18.9. RulingsChapter VII of Corporate Income TaxRegulations. Enhanced engagement programs Advance Pricing Agreements (APA) Unilateral APAsReal Decreto Legislativo 5/2004 , 1stAdditional disposition Bilateral APAsMAP on Direct Tax Matters Regulation,approved by Royal Decree 1794/2008, 3rdNovember. Multilateral APAsSpain’s MAP Profile Mutual Agreement Procedures Other (please specify): Multilateral Controls – Joint AuditsThe possibility to request an APA was established in 1995, under Law 43/1995, of27 December on Corporations Tax and remains present in the current CorporateIncome Tax LawThe period of coverage may roll-back to the years immediately preceding theperiod in which the APA is signed if the domestic time limit has not expired andthere has not been a firm tax assessment related to these years.SpainUpdated July 2021

The related persons or enterprises may make a request before the controlledtransactions take place.There are domestic rules for MAP.Detailed information is available at the OECD MAP profile of Spain.Safe Harbours and Other Simplification Measures26Does your jurisdiction have rules onsafe harbours in respect of certainindustries, types of taxpayers, or typesof transactions? YesCorporate Income Tax Act, Art.18, paragraph 6 NoIn Spain, transfer pricing rules apply to certain transactions between someindividuals and companies. There is a safe harbour for services provided byprofessional shareholders (e.g., lawyers, doctors) to their related entities whencertain specific circumstances are met. The safe harbour is looking for simplicityin common low complex transactions between professionals and their entities,while avoiding that profits are accumulated in excess in those entities. (CTA, Art18.6).27Does your jurisdiction have any othersimplification measures not listed in thisquestionnaire? If so, please provide abrief explanation. Yes NoOther Legislative Aspects or Administrative Procedures28Does your jurisdiction allow/requiretaxpayers to make year-endadjustments? Yes NoThe domestic legislation is silent regarding year-end adjustments. In relevantcircumstances, they may be allowed.29Does your jurisdiction make secondaryadjustments? YesCorporate Income Tax Act, Art.18, paragraph 11 NoCorporate Income Tax Regulations, Art. 20The domestic regulations provide relief if the taxpayer repatriates the funds.SpainUpdated July 2021

Attribution of Profits to Permanent Establishments30[NEW] Does your jurisdiction followthe Authorised OECD Approaches forthe attribution of profits to PEs (AOA)? Yes2010 Approach when included in the relevant tax treaty. So far it has been includedin one Tax treaty. The rest of the treaties follow the 2008 OECD MTC Article 7and relevant commentaries. No31[NEW] Does your jurisdiction followalso another approach? Yes NoOther Relevant Information32Other legislative aspects oradministrative procedures regardingtransfer pricingN/A33Other relevant information (e.g. whetheryour jurisdiction is preparing new transferpricing regulations, or other relevantaspects not addressed in thisquestionnaire)N/AFor more information, please visit: inUpdated July 2021

Transfer Pricing Country Profile July 2021 SUMMARY REFERENCE The Arm's Length Principle 1 Does your domestic legislation or regulation make reference to the Arm's Length Principle? Yes No Corporate Income Tax Act, Art.18.1 (Ley 27/2014, 27 November 2014) 2 What is the role of the OECD Transfer Pricing Guidelines under your domestic