Transcription

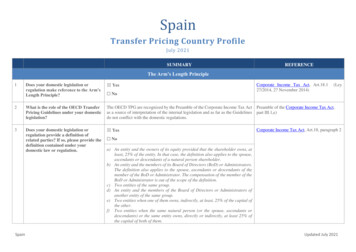

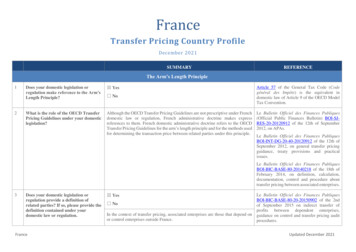

FranceTransfer Pricing Country ProfileDecember 2021SUMMARYREFERENCEThe Arm’s Length Principle12Does your domestic legislation orregulation make reference to the Arm’sLength Principle? YesWhat is the role of the OECD TransferPricing Guidelines under your domesticlegislation?Although the OECD Transfer Pricing Guidelines are not prescriptive under Frenchdomestic law or regulation, French administrative doctrine makes expressreferences to them. French domestic administrative doctrine refers to the OECDTransfer Pricing Guidelines for the arm’s length principle and for the methods usedfor determining the transaction price between related parties under this principle. NoArticle 57 of the General Tax Code (Codegénéral des Impôts) is the equivalent indomestic law of Article 9 of the OECD ModelTax Convention.Le Bulletin Officiel des Finances Publiques(Official Public Finances Bulletin) BOI-SJRES-20-20120912 of the 12th of September2012, on APAs.Le Bulletin Officiel des Finances PubliquesBOI-INT-DG-20-40-20120912 of the 12th ofSeptember 2012, on general transfer pricingguidance, treaty provisions and practicalissues.Le Bulletin Officiel des Finances PubliquesBOI-BIC-BASE-80-20140218 of the 18th ofFebruary 2014, on definition, calculation,documentation, control and procedure abouttransfer pricing between associated enterprises.3Does your domestic legislation orregulation provide a definition ofrelated parties? If so, please provide thedefinition contained under yourdomestic law or regulation.France Yes NoIn the context of transfer pricing, associated enterprises are those that depend onor control enterprises outside France.Le Bulletin Officiel des Finances PubliquesBOI-BIC-BASE-80-20-20150902 of the 2ndof September 2015 on indirect transfer ofprofits between dependent enterprises,guidance on control and transfer pricing auditprocedures.Updated December 2021

Article 57 of the General Tax Code refers to the notion of dependence but does notdefine it; dependence can be either de jure or simply de facto. Moreover, Article57 dispenses the tax authorities from having to prove the relationship ofdependence or control in respect of profit transfers to enterprises located in aforeign State or territory outside France that has a preferential tax regime, or thatare incorporated or constituted in a non-cooperative jurisdiction or territory as it isdetermined by French law.Article 57 of the General Tax Code (Codegénéral des Impôts)Administrative doctrine stipulates that:De jure dependence is established if a French enterprise is dependent on a foreignenterprise, which is the case if the foreign enterprise holds a preponderant share ofthe French enterprise’s equity or an absolute majority of the voting rights. Inpractice, holding more than 50 % of the shares is enough to characterizedependency or control.De facto dependence may either be contractual or stem from conditions underlyingthe dealings between the two enterprises (there is abundant case law illustratingthis notion of de facto dependence). For example, if the foreign enterprise isempowered to perform functions that include decision-making affecting theFrench enterprise, either directly or through intermediaries.Transfer Pricing Methods4Does your domestic legislation providefor transfer pricing methods to be usedin respect of transactions betweenrelated parties? Yes NoIf affirmative, please check those provided for in your ther (If so,please describe) Le Bulletin Officiel des Finances PubliquesBOI-BIC-BASE-80-10-10-20140218 of the18th of February 2014 on indirect transfer ofprofits between dependent enterprises,providing guidance on definitions andprinciples on determining transfer pricing.There is no specific legislation or regulation on transfer pricing methods to be used,but the French administrative doctrine provides that the guidance in the OECDTransfer Pricing Guidelines should be followed.FranceUpdated December 2021

5Which criterion is used in yourjurisdiction for the application oftransfer pricing methods?Please check all that apply: Hierarchy of methodsLe Bulletin Officiel des Finances PubliquesBOI-BIC-BASE-80-10-10-20140218 of the18th of February 2014. Most appropriate method Other (if so, please explain)There is no specific legislation or regulation on transfer pricing methods to be used,but the French administrative doctrine provides that the guidance in the OECDTransfer Pricing Guidelines should be followed. The most appropriate method isto be selected after performing a functional analysis in order to identify the arm’slength price between independent companies.6If your domestic legislation orregulations contain specific guidance oncommodity transactions, indicate whichof the following approaches is followed. For controlled transactions involving commodities, the guidance contained inparagraphs 2.18-2.22 of the TPG is followed. Domestic legislation mandates the use of a specific method for controlledtransactions involving commodities (if so, please explain) Other (if so, please explain)There is no specific guidance on commodity transactions.Comparability Analysis7Does your jurisdiction follow (or largelyfollow) the guidance on comparabilityanalysis outlined in Chapter III of theTPG? YesBOI-INT-DG-20-40 §50 NoFrench guidance mention the need to carry out a comparability analysis in order totest the arm’s length principle.8Is there a preference in yourjurisdiction for domestic comparablesover foreign comparables? Yes NoThere is no preference defined in the French domestic law or regulation.However, in practice, because of the specificities of each domestic market, nationalcomparables are deemed to better meet the requirement of comparability. Then, inthe absence of usable national comparables, the use of foreign comparables doesnot present difficulties.FranceUpdated December 2021

91011Does your tax administration use secretcomparables for transfer pricingassessment purposes? YesDoes your legislation allow or requirethe use of an arm’s length range and/orstatistical measure for determiningarm’s length remuneration? YesAre comparability adjustmentsrequired under your domesticlegislation or regulations? Yes No NoFrench domestic legislation does not contain as such specific guidance oncomparability analysis. However, French domestic administrative doctrine refersto the OECD Transfer Pricing Guidelines for the arm’s length principle and for themethods used for determining the transaction price between related parties underthis principle. NoComparability adjustments can be accepted (not required) when specificcircumstances justify it.Intangible Property121314Does your domestic legislation orregulations contain guidance specific tothe pricing of controlled transactionsinvolving intangibles? YesDoes your domestic legislation orregulation provide for transfer pricingrules or special measures regardinghard-to-value intangibles (HTVI)? YesAre there any other rules outsidetransfer pricing rules that are relevant YesFrance NoLe Bulletin Officiel des Finances PubliquesBOI-BIC-BASE-80-10-10-20140218 of the18th of February 2014.There is no specific legislation or regulation on transactions involving intangibles,but the French administrative doctrine provides some general guidance in thisrespect.HTVI Implementation Questionnaire NoArticle 238 of the General tax code (GTC) NoUpdated December 2021

for the tax treatment of transactionsinvolving intangibles?Article 238 of the General tax code provides a special rule for transactionsinvolving capital gains on the transfer of patents, patentable inventions orimprovements made therein. This rule provides that companies may, under certainconditions, subject to separate taxation at a reduced rate the net income issued fromthe sale, concession or sub-concession of patents and similar intangible assets.Intra-Group Services15Does your domestic legislation orregulations provide guidance specific tointra-group services transactions? Yes NoThere is no specific legislation or regulation on intra-group services, but the Frenchadministrative doctrine provides some general guidance on those transactions.16Do you have any simplified approachfor low value-adding intra-groupservices? Yes NoThere is no specific legislation or regulation on low value-adding intra-groupservices, but the French administrative doctrine provides some general guidance.17Are there any other rules outsidetransfer pricing rules that are relevantfor the tax treatment of transactionsinvolving services?Le Bulletin Officiel des Finances PubliquesBOI-BIC-BASE-80-10-10-20140218 of the18th of February 2014 on indirect transfer ofprofits between dependent enterprises aboutdefinitions and principles on determiningtransfer pricing.Le Bulletin Officiel des Finances PubliquesBOI-BIC-BASE-80-10-10-20140218 of the18th of February 2014 on indirect transfer ofprofits between dependent enterprises aboutdefinitions and principles on determiningtransfer pricing. Yes NoFinancial Transactions18[NEW] Does your domestic legislationor regulations provide guidance specificto financial transactions? Yes NoArticle 57 of the General Tax Code (GTC) allows the tax administration to ensurecompliance with the arm's length principle and to reassess profits declared incorporate income tax returns when these profits have been indirectly transferredabroad, either by way of increase or decrease in purchase or sale prices, or by anyother means.FranceArticle 57 of the General Tax Code (Codegénéral des Impôts) is the equivalent indomestic law of Article 9 of the OECD ModelTax Convention.Updated December 2021

These provisions are intended to apply to all types of transactions, includingfinancial transactions such as loans, cash pooling, or guarantees.19[NEW] Are there any other rulesoutside transfer pricing rules that arerelevant for the tax treatment offinancial transactions? Yes NoArticle 39 of the GTC allows the deduction of interest paid to partners on certainconditions as long as they do not exceed the average rates charged by banks.Article 212 bis of the GTC caps the deduction of net financial charges ofcompanies subject to corporation tax at 30% of their profit before taxes, interest,depreciation and amortization (“EBITDA fiscal”), or at EUR 3 million if thisamount is higher. Moreover, this article also provides for mechanisms for deferralto subsequent years of net financial charges not allowed in deduction under thelimitation rules, as well as unused deduction capacities for a year. These rules arestricter for under-capitalized companies.An anti-hybrid rule (Article 205 B of the GTC) prohibits the deduction of sumswhen the income is not included in the taxable income of the beneficiary due to ahybrid asymmetry.Cost Contribution Agreements20Does your jurisdiction have legislationor regulations on cost contributionagreements? Yes NoLe Bulletin Officiel des Finances PubliquesBOI-BIC-BASE-80-10-10-20140218 of the18th of February 2014.There is no specific legislation or regulation on cost contribution agreements, butthe French administrative doctrine provides some general guidance in this respect.French administrative doctrine provides some general guidance on costcontribution agreements (CCA) as follows: the possibility of setting up a CCA ismentioned. This agreement must relate to services which must be remunerated atthe same price as if they were provided between independent companies. Theindividualized services must be invoiced directly and for other services thevaluation methods must be sufficiently precise so that the prices conform to themarket price. The method adopted must be representative of the value of theservices rendered, which excludes any flat-rate allocation method. The use of anindividualized distribution key is recommended.FranceUpdated December 2021

Transfer Pricing Documentation21Does your legislation or regulationsrequire the taxpayer to prepare transferpricing documentation? Yes NoIf affirmative, please check all that apply: Master file consistent with Annex I to Chapter V of the TPG Local file consistent with Annex II to Chapter V of the TPG Country-by-country report consistent with Annex III to Chapter V of theTPG Specific transfer pricing returns (separate or annexed to the tax return) Other (specify):22Please briefly explain the relevantrequirements related to filing oftransfer pricing documentation (i.e.timing for preparation or submission,languages, etc.)The transfer pricing documentation requirements in the French tax law covers alltransactions between associated companies.Article L 13 AA of the Tax procedure code(TPC)Under Article L 13 AA of the Tax Procedure Code (TPC), any entity whichbelongs to a group, whose annual turnover or balance sheet assets is at least EUR400 million, is required to keep available both a master and a local file for the taxadministration services.Article L 13 AB of the TPCThe first document provides background information about the related companieswithin the group whereas the second contains additional information about thelocal company under tax audit.Entities dealing with related parties located in non-cooperative jurisdictions aresubject to additional requirements (Article L 13 AB of the TPC). It involvesproviding documents that are required from corporations liable to the corporationtax under French law, including balance sheet and income statement.Article 223 quinquies B and quinquies C of theGeneral tax code (GTC). Deadline for the filingdate is within 6 months after filing corporatetax result for 223 quinquies B and it is within12 months of the group’s financial year closurefor CBC under Article 223 quinquies.More informationArticle 223 quinquies B of the General Tax Code (GTC) requires from companieswhose turnover or balance sheet assets is at least EUR 50 million to file every yeara simplified version of the master and local file. Furthermore, companies that donot exceed the threshold above mentioned of EUR 400 million can be required, incase of control, to produce targeted and lightened information (Article L. 13 B ofthe TPC). Article L. 13B of TPC provides, in case of a tax audit, the possibility,for the administration, to request legal, economic, fiscal, accounting,methodological information on the methods according to which the price oftransactions was set between a company and companies located abroad. Thisprocedure occurs only if the company has not provided the information requestedFranceUpdated December 2021

by the administration. This article introduces documentation obligations fortransfer pricing policy of the company.Finally, Article 223 quinquies C of the GTC faithfully transposes the OECDrecommendations regarding the country-by-country (CBC) reporting, for MNEsexceeding the threshold of EUR 750 million.Declarations must be filled on the tax forms provided by the administration andelectronically sent.The administration has the possibility to request the documents written in a foreignlanguage to be translated in French.Where an enterprise does not produce the required documentation, or when itproduces it partially, the administration shall send a formal notice to produce it orto complete it within a period of thirty days.Some specific information could be asked in case of a tax audit.23Does your legislation provide forspecific transfer pricing penaltiesand/or compliance incentives regardingtransfer pricing documentation? YesArticle 1735 ter of the GTC NoAn audited enterprise that fails to produce the required documentation or producespartial documentation provided for in Articles L 13 AA and L 13 AB of the TPCcan be liable to a fine provided by Article 1735 ter of the GTC. This fine, thatcannot be less than EUR 10 000, may reach 0.5% of the amount of transactionscovered by the documents undelivered, or 5% of the profits reassessment. In casean enterprise does not fulfil the conditions provided under Article L 13 B of theTPC, Article 1735 of the GCT provides that such enterprise is liable to a fine ofEUR 10 000 per tax year.Article 1735 of the GTCArticles 1729B and 1729 F of the GCTWith regard to Article 223 quinquies B of the GTC, the common penaltiesmechanism is applicable, consisting in the application of a fine of EUR 150 asprovided by article 1729 B of the GTC.Finally, as far as the country-by-country report is concerned, the fine provided inArticle 1729 F of the GCT cannot exceed EUR 100 000.24If your legislation provides forexemption from transfer pricingFranceThe French tax law does not provide any exemption other than those resulting fromturnover and/ or assets balance thresholds.Updated December 2021

documentation obligations, pleaseexplain.Administrative Approaches to Avoiding and Resolving Disputes25Which mechanisms are available inyour jurisdiction to prevent and/orresolve transfer pricing disputes?Please check those that apply:France’s MAP Profile Rulings Enhanced engagement programs Advance Pricing Agreements (APA) Unilateral APAs Bilateral APAs Multilateral APAs Mutual Agreement Procedures Other (please specify): ICAPRegarding MAP, the French tax administration does apply arbitration with partnerswith which France has an agreement containing an arbitration clause (27 countrieswith the MLI).For further information on APAs, please refer to the French MAP profile, doctrinePT APA.Safe Harbours and Other Simplification Measures2627Does your jurisdiction have rules onsafe harbours in respect of certainindustries, types of taxpayers, or typesof transactions? YesDoes your jurisdiction have any othersimplification measures not listed in thisquestionnaire? If so, please provide abrief explanation. YesMore information NoTransfer pricing guideline for SMEsFrance NoSimplified APA procedure for SMEs and simplified TPG application for SMEs.Updated December 2021

SMEs wishing to secure their transfer pricing tax purposes can request an APA.In practice, this agreement guarantees the company that the prices charged in thisintra-group industrial, commercial or financial relations do not qualify for atransfer of profits.French tax administration has also drawn up an explanatory guide on transferpricing, adapted to the expectations of SMEs.Other Legislative Aspects or Administrative Procedures28Does your jurisdiction allow/requiretaxpayers to make year-endadjustments? Yes NoFrance considers year-end adjustments as a possibility to reach an arm's lengthprice for economic and financial transactions within the limit of the tax statute oflimitation. French legal framework does not contain a reference to year-endadjustments. However, in practice, this may be allowed in the event of specialcircumstances assessed on a case-by-case basis (e.g. change in economic situationor correction of an accounting error).29Does your jurisdiction make secondaryadjustments? Yes NoFrance makes secondary adjustments when the conditions exposed in the doctrineare met. In application of our domestic legislation, when the adjustment is carriedout by the French tax authorities and is considered to constitute a deemeddistributed profit, subject to the stipulations of the bilateral tax treaty, awithholding tax may be levied at the conventional rate on the deemed distributedprofit. However, if the company agrees to repatriate the sums considered toconstitute a transfer of profits within 90 days of receipt of the proposal, the notifiedwithholding tax will not be maintained.Le Bulletin Officiel des Finances PubliquesBOI-INT-DG-20-30-10-20170201 §630 of the1st of February 2017 on Mutual agreementprocedures.Attribution of Profits to Permanent Establishments30[NEW] Does your jurisdiction followthe Authorised OECD Approaches forthe attribution of profits to PEs (AOA)? Yes NoIn how many tax treaties?FranceUpdated December 2021

France has not adopted the Authorised OECD Approaches for the attribution ofprofits to PEs (AOA). Nonetheless, France has already used this method to solveMAP cases for fiscal years post-2010. In practice, this methodology was used tosolve cases involving the banking sector regarding the question of capitalallocation.31[NEW] Does your jurisdiction followalso another approach? Yes NoOther Relevant Information32Other legislative aspects oradministrative procedures regardingtransfer pricingFor more information on the MAP and APA procedures, please refer to the OECDMAP Portal.33Other relevant information (e.g. whetheryour jurisdiction is preparing new transferpricing regulations, or other relevantaspects not addressed in thisquestionnaire)N/AFrance’s MAP ProfileFor more information, please visit: nceUpdated December 2021

Master file consistent with Annex I to Chapter V of the TPG Local file consistent with Annex II to Chapter V of the TPG Country-by-country report consistent with Annex III to Chapter V of the TPG Specific transfer pricing returns (separate or annexed to the tax return) Other (specify): 22 Please briefly explain the relevant