Transcription

Transfer pricingMake your frontline defenseagainst transfer pricingaudits cohesive, consistent,and cost-efficient

2

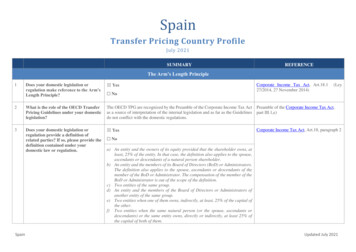

What is transfer pricing?Transfer pricing ensures that taxpayers clearly reflect income attributable tocontrolled transactions (i.e. transactions between related parties) and preventsavoidance of taxes with respect to those transactions.Transfer pricing rules place a controlled taxpayer on tax parity with anuncontrolled taxpayer by determining the true taxable income of thecontrolled taxpayer. In the Turkish transfer pricing landscape, Corporate TaxLaw Article 13 on Disguised Income Distribution Through Transfer Pricing laysout the details of the principal regulations governing transfer pricing. TheTurkish regulations are generally consistent with OECD Guidelines and othertransfer pricing regulations around the world.A controlled transaction meets the "arm’s length standard" if the results ofthe transaction are consistent with the results that would have been realized ifuncontrolled taxpayers had engaged in the same transaction under the samecircumstances.1

MethodologySeveral different methods are available for evaluating whether transactionsbetween or among members of the controlled group satisfy the arm’s lengthstandard: Comparable uncontrolled pricemethod offers a direct comparisonbetween an intra-group transfer priceand the price charged for the same orsimilar property or services transferredbetween third parties Resale price method takes theprice at which a product is resold toan independent entity after beinginitially purchased from an associatedentity, and reduces this price by anappropriate gross margin, the “resaleprice margin” Cost plus method adds anappropriate mark-up to the costsincurred by the supplier of propertyor services in a controlled transactionfor property transferred or servicesprovided to a related purchaser Transactional net margin methodexamines the operating profitfrom controlled transactions as apercentage of a base such as sales,costs, or assets Profit split method allocatesoperating profits or losses fromcontrolled transactions in proportionto the relative contributions made byeach party in creating the combinedprofits or losses Other methodsAlthough the methodology iscomplex and laid out in quite detail inregulations: Judgment calls are frequentlyneeded; and Its practice requires prowess ina wide array of backgrounds suchas economics, statistics, tax law,accounting, etc.Managing the processGatherBackgroundInformation1Transfer pricingprojects start with thegathering of qualitativeand quantitative data2Functionalanalysis2Establish the functionsundertaken, risks assumed,assets employed andcapital committed by eachbusiness entity and therelative importanceof eachBenchmarkingSelect internal orexternal comparablesfor CUT/CUP orcomplete databasesearch for TNMM34Documentation

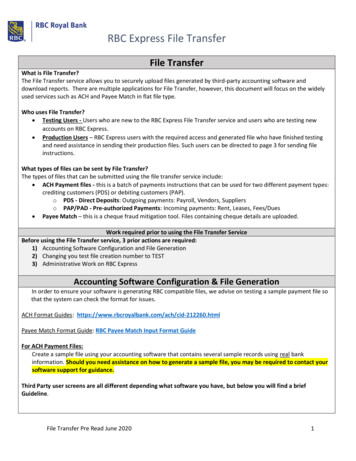

Documentation requirementsDocumentation obligations in Turkeyare twofold:1) “Form Relating to Transfer Pricing,Controlled Foreign Companies, andThin Capitalization”; and2) Annual Documentation Report.Taxpayers are required by law tomaintain annual documentation withthe Turkish Revenue Authority whichis to be submitted to officials uponrequest.The documentation must becompleted by the deadline in order tobe deemed “contemporaneous”: Turkish and non-Turkish taxjurisdictions may have differentdeadlines for contemporaneousdocumentation; and In Turkey, documentation must becompleted by the time taxes arefiled.If TP documentation is not completedbefore filing taxes: TP adjustments may requireamendment and re-filing of taxreturns; Re-files may raise red flags with theTurkish Revenue Administration;and Possible asymmetries in upwards vs.downwards adjustments may leadto suboptimal outcomes.Turkish TP EnvironmentDoes taxpayer have related transactions?NoYesIs taxpayer registered to LTP* tax office?YesScope of TP report: domestic related transactions cross-border related transactionsNoNo need for transferpricing documentationScope of TP report: cross-border related transactions* LTP: Large Tax Payers3

Risk managementWhat needs to be done to avoid TP-related penalties and income adjustments? Must have a sound and locally &globally consistent TP policy; Must make sure that the TP policiesare actually implemented; and Must have proper documentationin place.TP compliance efforts may fail if notcareful with implementation – in theend actual conduct is looked at andnot the intention.Globally inconsistent TP policies mayhave significant tax consequences.It is a good idea to haveintercompany agreements in place:e.g. for HQ services, distributorship,technical assistance, etc. Make TP policies more transparent;and Lay out the distribution of functions& risks clearly.CAUTION4PastPresent Flexible ad hoc defenses Adversarial approach to tax office Show documentation up front Stiff enforcement and penalties Conflicts over methodology

How we may assist youWe provide a wide-array of tailor-made solutions for specific transfer pricingissues you may face. The enumeration below provides a partial list of ourservices: Transfer pricing documentationservices for Turkish tax compliancepurposes Global masterfile localizationservices for Turkish tax compliancepurposes Transfer pricing planning studies toensure compliance on a go-forwardbasisDr. Özgür TorosTransfer Pricing ServicesPartner, Tax Transfer pricing risk analyses toidentify past and/or future risks Headquarter cost allocation servicestudies Audit defense support for transferpricing disputes Support with advance pricingagreement (APA) petitions andnegotiationsDr. Toros is a Partner in the transfer pricingservice line in Deloitte’s Istanbul office. Priorto joining the Turkish transfer pricing practice,he has worked as a transfer pricing specialistin the Dallas and Washington, D.C. Nationaloffices of Deloitte Tax LLP in the U.S.A. forover 7 years. Dr. Toros’ work has involvedspecial emphasis on intellectual propertymigration and global documentation projects.5

For more informationDr. Özgür TorosTransfer Pricing ServicesPartner, Tax 90 (212) 366 60 96ozgurtoros@deloitte.comDeloitte Turkeyİstanbul OfficeDeloitte Values HouseMaslak No134398İstanbul 90 (212) 366 60 00Ankara OfficeArmada İş MerkeziA Blok Kat:7 No:8Söğütözü, Ankara06510 90 (312) 295 47 00İzmir OfficePunta Plaza 1456 Sok.No:10/1 Kat:12Daire:14 - 15Alsancak, İzmir 90 (232) 464 70 64Bursa OfficeZeno Center İş MerkeziOdunluk Mah. Kale Cad.No:10 dNilüfer, Bursa 90 (224) 324 25 00Çukurova OfficeGünep Panorama İş Merkezi ReşatbeyMah. Türkkuşu Cad. Bina No:1 B BlokKat:7Seyhan, Adana 90 (322) 237 11 t.netDeloitte provides audit, tax, consulting, and financial advisory services to public and private clients spanning multiple industries. With a globallyconnected network of member firms in more than 150 countries and territories, Deloitte brings world-class capabilities and high-quality serviceto clients, delivering the insights they need to address their most complex business challenges. Deloitte’s more than 200,000 professionals arecommitted to becoming the standard of excellence.Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of memberfirms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “DeloitteGlobal”) does not provide services to clients. Please see www.deloitte.com/about for a more detailed description of DTTL and its member firms. 2014. For information, contact Deloitte Turkey, Member of Deloitte Touche Tohmatsu Limited.

In the Turkish transfer pricing landscape, Corporate Tax Law Article 13 on Disguised Income Distribution Through Transfer Pricing lays out the details of the principal regulations governing transfer pricing. The Turkish regulations are generally consistent with OECD Guidelines and other transfer pricing regulations around the world.