Transcription

Qatar Tax webinarTransfer Pricing developments in QatarMarch 2021

AgendaGlobal transfer pricing landscape4Introduction to Transfer Pricing10Transfer Pricing compliance requirements in Qatar15Recommended .E.).(M.E.).rightsreserved. 2021AllAllrightsreserved.22

Global transfer pricing landscape

Global transfer pricing landscape110 Countries have adopted or drafted someform of transfer pricing compliance intotheir domestic law 2021 Deloitte & Touche (M.E.). All rights reserved.4

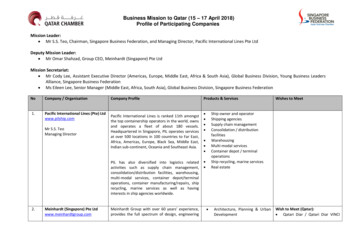

Qatar TP regulations timeline1234December 2018December 2019February 2021April 2021Qatar joins theInclusive Framework 2021 Deloitte & Touche (M.E.). All rights reserved.Qatar issues theExecutive Regulationsintroducing detailedTP requirementsQatar releasesDecision No. 4 of 2020with TP clarificationsFirst reportingobligations5

Transfer Pricing requirements in the Middle EastCountryStatus of TP rulesInclusiveframework Standard corporate TaxrateRequiredRequiredCbC equired 20% for non Saudi's redN/AN/AN/AN/AN/AN/AN/A 12.5%15%0%0%20%25%15%MF requirementLF requirementEgyptQatarRequiredRequiredSaudi nonSyriaYemen22.50%10%15%17%28%20%LegendSpecific TP rules and documentationrequirements in place 2021 Deloitte & Touche (M.E.). All rights reserved.There are TP requirementsto a certain extentNo specific TP rules nordocumentation requirements6

Global Transfer Pricing Environment 2021 Deloitte & Touche (M.E.). All rights reserved.1Over time, the volume and complexity of trade between nations has increased (intercompanytrade as a % world trade has been increasing).2Nowadays, as a result of increase of TP regulations globally, tax authorities have a visibility onthe allocation of profits of the companies across the world.3As such, it is important to align the results of each company in the group with the actualvalue it creates and with the relevant level of substance.4Establishing principle entities in tax havens without substance is becoming very risky and isbeing challenged more often.560% of transfer pricing audits result into adjustments.80% of enterprises expect a transfer pricing audit in next two years.7

Trends observed in the MENA regionTransfer Pricing auditsTax authoritieshave startedconducting fieldinspections aspart of tax audits. 2021 Deloitte & Touche (M.E.). All rights reserved.In field inspections,the TP inspectormight beaccompanied by hiscorporate taxcolleagues to identifyTP and internationaltax issues.In some instances,tax authoritieshave requesteddetails on relatedparty transactiondata prior toissuance of TPrules.Tax authoritieschallenging lowprofit mark-ups.8

Introduction to Transfer Pricing

What is Transfer Pricing (TP)?The ConceptTransfer Pricing can be commonlyreferred to as the prices that are chargedby individual entities for property,service, intangible or financialtransaction that are suppliedor provided to one anotherwithin the MNE (i.e., Inter –Group transaction).The IssueSetting of these prices (i.e.Transfer Pricing) is typicallyan issue that is relevant forthe tax, accounting andcontrolling departmentsof each entity operatingwithin a group.TransferPricingThe PrincipleThe Arm’s LengthPrinciple as aninternational acceptedprinciple. 2021 Deloitte & Touche (M.E.). All rights reserved.The definition ofassociationWhen are entitiesconsidered to be related? For Qatar - as peraccounting standards10

What are the common intercompany transactions?Services received or furnished,such as: accounting,management, engineering, andlegal servicesIntra-entity billings based onallocations of common costsCommonintercompanytransactionsBorrowings, lending's,and guarantees.Royalties 2021 Deloitte & Touche (M.E.). All rights reserved.Use of property andequipment by lease orotherwiseSales, purchases, and transfers ofproperty11

Intercompany transaction typesParent entityParent entityCommon Parent/ HoldingSubsidiarySubsidiaryDownstream transaction 2021 Deloitte & Touche (M.E.). All rights reserved.SubsidiarySubsidiaryUpstream transactionLateral transaction12

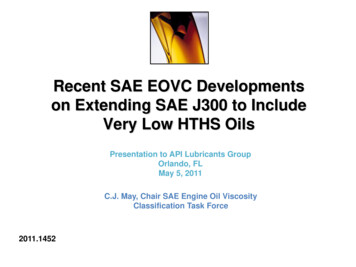

Transfer Pricing Methods Selecting the appropriate transfer pricing method is key both during planning for a new transaction/products/service and when putting in placedocumentation to support in current transfer pricing. The OECD guidelines provides a description of all the acceptable methods and when they should or could be applied. Below diagram illustrates the OECD acceptable methods:Transfer PricingMethodsTraditional transactionmethodsComparableuncontrolledprice (CUP)ExternalCUP 2021 Deloitte & Touche (M.E.). All rights reserved.Resale pricemethod(RPM)Transactionaltransaction methodsCost plusmethod(CPM)Profit splitmethod(PSM)Transactional netmargin method(TNMM)InternalCUP13

Transfer Pricing compliance requirements in Qatar

Transfer Pricing compliance requirements in QatarOverview1234Disclosure FormLocal FileMaster FileCbC Report When total assets orrevenue is equal to orexceeds QAR 10 million Has related partytransactions (domesticor international) duringthe year. 2021 Deloitte & Touche (M.E.). All rights reserved. When total assets orrevenue is equal to orexceeds QAR 50 million When total assets orrevenue is equal to orexceeds QAR 50 million If consolidated revenueof multinational groupis more than QAR 3billion15

When do you need to take action?30 AprilSubmit TPDisclosure Formalong with incometax returnNowStart preparations 2021 Deloitte & Touche (M.E.). All rights reserved.31 DecemberSubmit TP CbCReport to GTA30 JuneSubmit TP LocalFile and Master Fileto GTA16

Transfer Pricing Disclosure FormOverviewDhareeba portalsubmission 2021 Deloitte & Touche (M.E.). All rights reserved.17

Transfer Pricing Disclosure FormOverviewApplicability Qatar resident entitieswith domestic orinternational related partytransactions 2021 Deloitte & Touche (M.E.). All rights reserved.Manner ofsubmission To be filed with theincome Tax return inDhareeba PortalThreshold More than QAR 10 millionof total assets or revenuesin FY20 TP form is currently activein Dhareeba for taxpayersthat cross the thresholdand declare they haverelated party transactions.Due date To be submitted alongwith the Income Taxreturn – i.e., by 30 April2021.18

Transfer Pricing Disclosure Form1General information about the Group Main business activity Confirmation whether there has been any change in the Group policy Any changes in the business during the year Intangibles used or owned by the reporting entityRequiredcontentRelated party transactions Nature of transaction Role of the reporting entity2 Transaction currency Transaction amount Residence of related party Transfer pricing method 2021 Deloitte & Touche (M.E.). All rights reserved.19

Transfer Pricing Local FileOverviewApplicability As per executiveregulations - local file tobe prepared by entitiesthat undertake crossborder related partytransactions. 2021 Deloitte & Touche (M.E.). All rights reserved.Manner ofsubmission Local file is not part ofexchange mechanism andwill have to be submittedlocally in Qatar.ThresholdDue date More than QAR 50 millionof Assets or revenues inFY20 In case threshold is met,Local file to be submittedby 30 June Entities with related partytransactions need tomaintain transfer pricingdocumentation for FY2020 onwards. In case threshold is notmet, Local file to bemaintained and providedon request20

Transfer Pricing Local FileRequired contentEntity Description of managementstructure Business and businessstrategy pursued by the localentity Local organization chart anddescription of individuals, towhom local managementreports and their country ofoffices 2021 Deloitte & Touche (M.E.). All rights reserved.Controlledtransactions A description of the materialcontrolled transactions (e.g.procurement ofmanufacturing services,purchase of goods, provisionof services, loans, financialand performanceguarantees, licenses ofintangibles, etc.)Financialinformation Details on Intercompanytransactions and financialinformation Disclosure of bilateral APAsand rulingsEconomicanalysis Search for comparablecompanies needs to berefreshed once in everythree years, if the functionalprofile of the company hasnot changed Functional analysis21

Transfer Pricing Master FileOverviewApplicability Master file to beprepared by Parentcompany (HQ) for thewhole group.Manner ofsubmission 2021 Deloitte & Touche (M.E.). All rights reserved.Master file is not partof exchangemechanism and willhave to be submittedlocally in Qatar.Subsidiary companiescan use Master fileprepared by HQ.ThresholdDue date More than QAR 50million of Assets orrevenues in FY20 In case threshold ismet, Master file to besubmitted by 30 June Groups with relatedparty transactionsshould maintainMaster file for FY 2020onwards. In case threshold is notmet, Master file to bemaintained andprovided on request22

Transfer Pricing Master FileRequired contentOrganizationstructure Chart illustrating group’slegal and ownershipstructure and geographicallocation of operating entitiesDescriptionof group’sbusiness Description of importantdrivers of business profit Description of supply chainfor the specified category ofproducts Functional analysis of theprincipal contributors tovalue creation 2021 Deloitte & Touche (M.E.). All rights reserved.Group’sIntangibles Group’s strategy forownership, development andexploitation of intangibles List of important intangibleswith ownership Important agreements andcorresponding transferpricing policies in relation toR&D and s Description of how theGroup is financed, includingidentification of importantfinancing arrangements withunrelated lenders Identification of entitiesperforming central financingfunction including their placeof operation and effectivemanagement23

Transfer Pricing CbC ReportOverviewApplicability CbC reporting andnotification requiredby Ultimate ParentEntity (‘UPE’) residentin Qatar.No Notificationrequired byConstituent Entitiesresident in Qatar. 2021 Deloitte & Touche (M.E.). All rights reserved.Manner ofsubmission CbC Report to be filedthrough GTA AEOIPortal electronically.Threshold Consolidated revenueof multinational groupis more than QAR 3billion in the precedingfinancial year.(approx. EUR 700million or USD 824million).Due date CbC Report to be filedby 31 December 2021for FY 2020. CbCR Notification to befiled by UPE inDhareeba/ Letter toQFC by 31 Dec 2021.24

Transfer Pricing CbC ReportFinancial information per jurisdiction1Requiredcontent Revenues (related, unrelated, total) Stated capital Profit/loss before income tax Accumulated earnings Income tax paid (on cash basis) Number of employees Income tax accrued (reportable accounting year) Tangible assets other than cash and cash equivalents2General information per entity Main business activity Incorporation and location details3 2021 Deloitte & Touche (M.E.). All rights reserved.Additional information Further brief information or explanation that taxpayer may consider necessary or that would facilitate theunderstanding of the compulsory information provided in the CbC Report.25

Recommended actions

How to get ready for future enquiries from tax authority?1Perform holistic TP health check of the current intercompany/related party arrangements.2Maintain robust transfer pricing documentation to justify the arm’s length nature of your related partytransactions.3Maintain supporting documents (intercompany agreements and invoices, transfer pricing policy etc.).Take actiontoday4 2021 Deloitte & Touche (M.E.). All rights reserved.Address the TP adjustments mechanism during the year.27

Transfer Pricing Dos and Don'tsDon’t view Transfer Pricing as a complianceexercise only. TP is the gateway for realigningyour businessCareful planning can have a positive impacton your ETRContinuous losses likely to raise a feweyebrows – so have a business rationaledocumented for lossesRefrain from entering in to ad-hoctransactions with group companies.Always adhere to TP policy and any deviationshould be supported with solid businessrationaleDo not fail to report a transaction or do notassume that a transaction is not required tobe reported without consulting your advisors 2021 Deloitte & Touche (M.E.). All rights reserved.Have in place a TP policy/planning documentBefore entering in any intragroup transactionHave in place a written AGREEMENT for theintragroup arrangements.Have the agreement reviewed by specialistsMaintain internal supporting documentsforming the basis of an intra-grouptransaction.This is important from a potential TP auditperspectiveComply with the regulations.TP is a low hanging fruit for tax authoritiesand non-compliance is the starting point forprotracted litigation28

Q&A29

This document has been prepared by Deloitte LLP for the sole purpose of providing a proposal to the parties to whom it is addressed in order that they may evaluate the capabilities of Deloitte LLP to supply the proposed services.This document and its contents are confidential and prepared solely for your information to allow you to assess if you would like to engage Deloitte LLP in a formal contractual relationship, for the proposed service. This proposal should not be reproduced,redistributed or passed on directly or indirectly, to any other person or party, in whole or in part. Therefore, you should not refer to or use our name or this document for any other purpose, disclose it or refer to it in another document, or make it available orcommunicate it to any other party. In any event, no other party is entitled to rely on our documentation for any purpose whatsoever and thus we accept no liability to any other party who sees or gains access to this document.This document is not contractually binding. Should this proposal be acceptable to you, and following the conclusion of our in ternal acceptance procedures, we would be pleased to discuss the contractual terms and conditions with you prior to our appointment.Deloitte & Touche (M.E.) LLP (DME) is the affiliate for the territories of the Middle East and Cyprus of Deloitte NSE LLP (“NSE”), a UK limited liability partnership and member firm of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee(“DTTL”).Deloitte refers to one or more of DTTL, its global network of member firms, and their related entities. DTTL (also referred to as “Deloitte Global”) and each of its member firms are legally separate and independent entities. DTTL, NSE and DME do not provideservices to clients. Please see www.deloitte.com/about to learn more.Deloitte is a leading global provider of audit and assurance, consulting, financial advisory, risk advisory, Tax and related services. Our network of member firms in more than 150 countries and territories, serves four out of five Fortune Global 500 companies.Learn how Deloitte’s approximately 300,000 people make an impact that matters at www.deloitte.com.DME is a leading professional services firm established in the Middle East region with uninterrupted presence since 1926. DME’s presence in the Middle East region is established through its affiliated independent legal entities, which are licensed to op erate andto provide services under the applicable laws and regulations of the relevant country. DME’s affiliates and related entities cannot oblige each other and/or DME, and when providing services, each affiliate and related entity engages directly and independentlywith its own clients and shall only be liable for its own acts or omissions and not those of any other affiliate. 2021 Deloitte & Touche (M.E.). All rights reserved.

60% of transfer pricing audits result into adjustments. 80% of enterprises expect a transfer pricing audit in next two years. Nowadays, as a result of increase of TP regulations globally, tax authorities have a visibility on the