Transcription

2021 GEHAMEDICAL PLANSChoose from five unique medical plans designedto meet you where you are in life.geha.com 800.262.43421

Choose from five unique medical plans for 2021.GEHA offers you five unique medical plans that empower you to achieve the health you need to live the life you want.Whether you’re focused on wellness, saving for future health care needs or needing a lot of (or a little) health care, GEHA has anoption that is right for you. All GEHA plans offer worldwide coverage and a mix of benefits.Choose possible.ElevatePage 4geha.com/ElevateX GEHA’s lowest premium plan.X Earn up to 500 for Self Only or 1,000 for Self Plus One and Self and Family through Wellness Pays rewards.X Low 10 copays for unlimited primary care visits and 25 copays for unlimited specialist visits.HDHPPage 6geha.com/HDHPX An HSA-compatible plan with a low premium.X GEHA contributes 900 (Self Only) or 1,800 (Self Plus One or Self and Family) to your HSA, which can reduce the yearlynet deductible¹ to 600 or 1,200, respectively.X You pay only 5% of medical services after your low deductible is met.X Includes a complete vision benefit along with 0 in-network preventive dental benefits, all with no deductible.1 Net deductible is the remaining amount after you subtract the annual GEHA contribution from the annual deductible. This is your out-of-pocket cost before plan benefits begin.2

Standard OptionPage 8geha.com/StandardX 15 copay for in-network primary care visits, 30 copay for in-network specialist visits.X Pay 0 for routine, in-network maternity care.X Pay 0 for unlimited telehealth visits, including pediatricians, licensed behavioral health therapists and dermatologists,through MDLIVE.Elevate PlusPage 10geha.com/ElevatePlusX Fixed costs, no in-network deductible, copays for common medical expenses and out-of-network medical coverage.X Earn up to 500 for Self Only or 1,000 for Self Plus One and Self and Family through Wellness Pays rewards.X 0 out-of-pocket costs for common surgeries through BridgeHealth.High OptionPage 12geha.com/HighX Comprehensive brand-name and specialty prescription coverage.X Low copays for doctor visits ( 20 primary and specialist).X 600 Medicare Part B premium reimbursement.X 2,500 hearing aid benefit.X Low cost-share for a variety of inpatient and outpatient services (10% coinsurance).geha.com 800.262.43423

ElevateSelf Only premiums.Enroll code 254. geha.com/EnrollNon-Postal worker biweekly 47.32Postal worker biweekly – Category 1 45.43Postal worker biweekly – Category 2 39.28Retirees monthly 102.53Self Plus One premiums.Get rewarded for healthy living and enjoyGEHA's lowest premium plan.X Earn up to 500 for Self Only or 1,000 for Self Plus One and Selfand Family through Wellness Pays rewards.X Low 10 copays for unlimited primary care visits and 25 copays forunlimited specialist visits.X Low copays for chiropractic and acupuncture visits.Enroll code 256. geha.com/EnrollNon-Postal worker biweekly 108.84X Digital tools to navigate your health care experience. Learn more atgeha.com/ElevateLearnPostal worker biweekly – Category 1 104.49Benefits included with your Elevate plan.Postal worker biweekly – Category 2 90.34Retirees monthly 235.83Self and Family premiums.Enroll code 255. geha.com/EnrollNon-Postal worker biweekly 132.51Postal worker biweekly – Category 1 127.21Postal worker biweekly – Category 2 109.98Retirees monthly 287.10These rates do not apply to all enrollees. If you are in a special enrollmentcategory, please refer to the FEHB Program website or contact the agency orTribal Employer that maintains your health benefits enrollment.4Unlimited telehealth visits with MDLIVEgeha.com/MDLIVEVision discount6geha.com/VisionGym membership6geha.com/FitnessElectric toothbrush6geha.com/ToothbrushTeeth whitening6geha.com/Whitening 0 out-of-pocket surgery costs and conciergecare coordinator through BridgeHealth7geha.com/BridgeHealthYearly deductible & out-of-pocket max2 for Elevate.What you pay in-network.3Self OnlyYearly deductibleOut-of-pocket max 500 7,000Self Plus OneSelf and FamilyYearly deductibleOut-of-pocket max 1,000 14,000

Medical benefits for Elevate. What you pay ited telehealth visits with MDLIVE geha.com/MDLIVEPreventive care; adult routine screeningsWell-child visit; up to age 22Maternity; routine preventive careChiropractic X-rays 10– Specialist care; office visit 25– Urgent care 50––––––25%1– Inpatient professional surgical servicesCalendar year deductible applies.2The out-of-pocket maximum is the maximumamount of coinsurance, copays anddeductibles you pay for all family membersbefore GEHA begins paying for 100% ofof covered services. This is a combinedmaximum for both medical careand prescriptions.3In-network providers agree to limit whatthey will charge you. You pay a fixed dollaramount or a percentage of the provider’snegotiated amount.4Refer to geha.com/Prescriptionsfor formulary and specialty coverage forspecific medications.5Over 30-day specialty copay based on daysof therapy. The drug cost share is two timesfor drugs that provide 60 days‘ worth oftherapy and three times the copay for drugsthat provide 90 days‘ worth of therapy.6These benefits are neither offered norguaranteed under contract with the FEHBProgram, but are made available to allenrollees who become members of aGEHA medical plan and their eligiblefamily members.7Subject to any eligibility limitations.See info.bridgehealth.com/GEHA formore information. 0– Primary physician office visit– MinuteClinic (where available) geha.com/MinuteClinic– Chiropractic care; up to 12 visits per year(spinal manipulation therapy)– Acupuncture; up to 20 treatments per yearEmergency careHospital care; inpatient including maternityHospital care; outpatientLab servicesOther diagnostic servicesOutpatient professional surgical services1 250Prescription benefits for Elevate. What you pay in-network.3,4geha.com/Prescriptions30-day retailGenericPreferred brand-nameNon-preferred brand-name 450% ( 500 max)100%30-day5 specialtyCVS exclusiveGeneric and preferred brand-nameNon-preferred brand-name50% ( 500 max)100%To provide a low premium, this plan does not include mail order prescriptions orout-of-network pharmacy coverage, and it has a limited pharmacy network. Find a pharmacy atgeha.com/Find-Caregeha.com/Elevate800.262.43425

HDHPSelf Only premiums.Enroll code 341. geha.com/EnrollNon-Postal worker biweekly 61.37Postal worker biweekly – Category 1 58.91Postal worker biweekly – Category 2 50.94Retirees monthly 132.96Enroll code 343. geha.com/EnrollBenefits included with your HDHP plan.Non-Postal worker biweekly 131.94Postal worker biweekly – Category 1Retirees monthlyX GEHA contributes 900 (Self Only) or 1,800 (Self Plus One or Selfand Family) to your HSA, which can reduce the yearly net deductible8to 600 or 1,200, respectively.X Reduce your out-of-pocket expenses with a health savings account(HSA). geha.com/HSASelf Plus One premiums.Postal worker biweekly – Category 2A lower-than-expected deductible. Low premiums.GEHA contributes to an HSA.Unlimited telehealth visits with MDLIVE6geha.com/MDLIVE 126.66Vision benefit and discount8geha.com/Vision 109.51Hearing aid discountgeha.com/HearingGym membership7geha.com/FitnessElectric toothbrush7geha.com/ToothbrushTeeth whitening7geha.com/WhiteningHealth Advice Linegeha.com/HealthlineMedical alert system7geha.com/LifeAlertBiometric screeninggeha.com/Screenings 285.87Self and Family premiums.Enroll code 342. geha.com/EnrollNon-Postal worker biweekly 159.04Postal worker biweekly – Category 1 152.68Postal worker biweekly – Category 2 132.01Retirees monthly 344.607Yearly net deductible8 for HDHP. What you pay in-network.3Yearly deductibleYearly net deductibleafter GEHA contributionSelf Only 1,500 600Self Plus One, Self and Family 3,000 1,200Out-of-pocket max2 for HDHP. What you pay in-network.3These rates do not apply to all enrollees. If you are in a special enrollmentcategory, please refer to the FEHB Program website or contact the agency orTribal Employer that maintains your health benefits enrollment.6Self OnlyOut-of-pocket max 5,000Self Plus One, Self and FamilyOut-of-pocket max 10,000

Medical benefits for HDHP. What you pay in-network.3geha.com/Find-Care– Unlimited telehealth visits with MDLIVEgeha.com/MDLIVE– Hospital care; inpatient maternity– Maternity; routine care 01,6– Preventive care; adult routine screenings– Well-child visit; up to age 22– Preventive dental care, twice yearly 0––––––––––Primary physician office visitSpecialist care; office visitUrgent careEmergency careHospital care; inpatient and outpatientMinuteClinic (where available)geha.com/MinuteClinicLab servicesOther diagnostic servicesProfessional surgical servicesAcupuncture; up to 20 treatments per year5%¹– Chiropractic care; up to 20 visits per year(spinal manipulation therapy)Balance after GEHApays 20 per visit¹– Chiropractic X-raysBalance after GEHApays 25 per year¹1Calendar year deductible applies.2The out-of-pocket maximum is the maximum amountof coinsurance, copays and deductibles you pay for allfamily members before GEHA begins paying for 100%of covered services. This is a combined maximum forboth medical care and prescriptions.3In-network providers agree to limit what they willcharge you. You pay a fixed dollar amount or apercentage of the provider’s negotiated amount. Forout-of-network benefits, refer to GEHA’s 2021 planbrochure RI 71-014 (HDHP) atgeha.com/PlanBrochure4Refer to geha.com/Prescriptions for formulary andspecialty coverage for specific medications.5If you choose a brand-name medication when ageneric is available, you will be charged the genericcopay plus the difference in cost between the brandname and the generic.6If deductible is met, high deductible health plan(HDHP) member will be charged by MDLIVE but GEHAwill then reimburse the member 100% of thebilled charge.7These benefits are neither offered nor guaranteedunder contract with the FEHB Program, but are madeavailable to all enrollees who become members of aGEHA medical plan and their eligible family members.8Net deductible: This is the remaining amount afteryou subtract the annual GEHA contribution from theannual deductible. This is your out-of-pocket costbefore plan benefits begin.Prescription benefits for HDHP.What you pay in-network.1,3,4,5 geha.com/Prescriptions30-day retailGeneric and preferred brand-nameNon-preferred brand-name25%40%90-day mail serviceGeneric and preferred brand-nameNon-preferred brand-name25%40%30-day specialtyCVS exclusiveGeneric and preferred brand-nameNon-preferred brand-name25%40%geha.com/HDHP800.262.43427

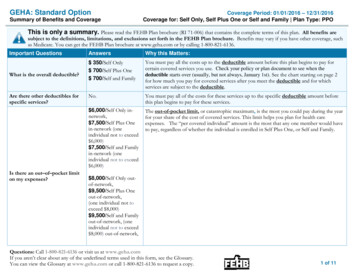

Standard OptionSelf Only premiums.Enroll code 314. geha.com/EnrollNon-Postal worker biweekly 62.66Postal worker biweekly – Category 1 60.16Postal worker biweekly – Category 2 52.01X 15 copay for in-network primary care visits, 30 copay forin-network specialist visits.Retirees monthly 135.77X Pay 0 for routine, in-network maternity care.X Pay 0 for unlimited telehealth visits, including behavioral healththerapists and dermatologists, through MDLIVE.Self Plus One premiums.X Plan works well with Medicare. geha.com/MedicareEnroll code 316. geha.com/EnrollNon-Postal worker biweekly 134.73Postal worker biweekly – Category 1 129.35Postal worker biweekly – Category 2Retirees monthlyBenefits included with your Standard plan.Unlimited telehealth visits with MDLIVEgeha.com/MDLIVEVision discount7geha.com/Vision 111.83Hearing aid discount7geha.com/Hearing 291.92Gym membership7geha.com/FitnessElectric toothbrush7geha.com/ToothbrushTeeth whiteninggeha.com/WhiteningHealth Advice Linegeha.com/HealthlineMedical alert system7geha.com/LifeAlertBiometric screeninggeha.com/ScreeningsLab Card servicesgeha.com/LabCardSelf and Family premiums.7Enroll code 315. geha.com/EnrollNon-Postal worker biweekly 164.85Postal worker biweekly – Category 1 158.26Postal worker biweekly – Category 2 136.83Retirees monthly 357.17These rates do not apply to all enrollees. If you are in a special enrollmentcategory, please refer to the FEHB Program website or contact the agency orTribal Employer that maintains your health benefits enrollment.8Traditional coverage. Affordable premiums.Yearly deductible & out-of-pocket max2 for Standard.What you pay in-network.3Self OnlyYearly deductibleOut-of-pocket max 350 6,500Self Plus OneSelf and FamilyYearly deductibleOut-of-pocket max 700 13,000

Medical benefits for Standard. What you pay in-network.3geha.com/Find-Care1Calendar year deductible applies.2The out-of-pocket maximum is the maximum amountof coinsurance, copays and deductibles you pay for allfamily members before GEHA begins paying for 100%of covered services. This is a combined maximum forboth medical care and prescriptions.3In-network providers agree to limit what they willcharge you. You pay a fixed dollar amount or apercentage of the provider’s negotiated amount. Forout-of-network benefits, refer to GEHA’s 2021 planbrochure RI 71-006 (High and Standard) atgeha.com/PlanBrochure– Unlimited telehealth visits with MDLIVE geha.com/MDLIVE– Preventive care; adult routine screenings– Well-child visit; up to age 22– Maternity; routine preventive care 0– Hospital care; inpatient maternity– Lab Card services geha.com/LabCard– MinuteClinic (where available) geha.com/MinuteClinic 104Refer to geha.com/Prescriptions for formulary andspecialty coverage for specific medications.– Primary physician office visit 155– Specialist care; office visit 30– Urgent care 35If you choose a brand-name medication when ageneric is available, you will be charged the genericcopay plus the difference in cost between the brandname and the generic.– Lab services (non-Lab Card)15%6Over 30-day specialty copay based on days of therapy.The drug cost share is two times for drugs that provide60 days‘ worth of therapy and three times the copayfor drugs that provide 90 days‘ worth of therapy.7These benefits are neither offered nor guaranteedunder contract with the FEHB Program, but are madeavailable to all enrollees who become members of aGEHA medical plan and their eligible family members.––––––Emergency careHospital care; inpatient and outpatientProfessional surgical servicesX-ray servicesOther diagnostic servicesAcupuncture; up to 20 treatments per year15%1– Preventive dental care; twice yearly50%– Chiropractic care; up to 20 visits per year(spinal manipulation therapy)Balance after GEHA pays 20 per visit– Chiropractic X-raysBalance after GEHA pays 25 per yearPrescription benefits for Standard. What you pay in-network.3,4geha.com/Prescriptions30-day retailGenericPreferred brand-nameNon-preferred brand-name 1050% ( 200 max5)50% ( 300 max5)90-day mail serviceGenericPreferred brand-nameNon-preferred brand-name 2050% ( 500 max5)50% ( 600 max5)30-day6 specialtyCVS exclusiveGeneric and preferred brand-nameNon-preferred brand-name50% ( 250 max5)50% ( 400 max5)geha.com/Standard800.262.43429

Elevate PlusSelf Only premiums.Enroll code 251. geha.com/EnrollNon-Postal worker biweekly 75.36Postal worker biweekly – Category 1 72.35Postal worker biweekly – Category 2 62.55Retirees monthly 163.28Self Plus One premiums.Predictable costs and no in-network deductible.Copays for common medical expenses andincludes out-of-network medical coverage.X Earn up to 500 for Self Only or 1,000 for Self Plus One and Selfand Family through Wellness Pays rewards.X 0 out-of-pocket surgery costs and concierge care coordinatorthrough BridgeHealth.7Enroll code 253. geha.com/EnrollX Low copays for chiropractic and acupuncture visits.Non-Postal worker biweekly 175.81Postal worker biweekly – Category 1 168.62Postal worker biweekly – Category 2 147.06Unlimited telehealth visits with MDLIVEgeha.com/MDLIVERetirees monthly 380.93Vision discount6geha.com/VisionX Digital tools to navigate your health care experience. Learn more atgeha.com/ElevateLearnBenefits included with your Elevate Plus plan.Hearing aid discountgeha.com/HearingGym membership6geha.com/FitnessElectric toothbrush6geha.com/ToothbrushTeeth whiteninggeha.com/Whitening 0 out-of-pocket surgery costs and conciergecare coordinator through BridgeHealth7geha.com/BridgeHealth6Self and Family premiums.Enroll code 252. geha.com/EnrollNon-Postal worker biweekly 186.89Postal worker biweekly – Category 1 179.42Postal worker biweekly – Category 2 155.12Retirees monthly 404.93These rates do not apply to all enrollees. If you are in a special enrollmentcategory, please refer to the FEHB Program website or contact the agency orTribal Employer that maintains your health benefits enrollment.106Yearly deductibles & out-of-pocket max1 forElevate Plus. What you pay in-network.2Self OnlyYearly deductibleOut-of-pocket max 0 6,000Self Plus OneSelf and FamilyYearly deductibleOut-of-pocket max 0 12,000

Medical benefits for Elevate Plus. What you pay in-network.21The in-network out-of-pocket maximum isthe maximum amount of coinsurance andcopays you pay for all family membersbefore GEHA begins paying for 100%of covered services. This is a combinedmaximum for both medical careand prescriptions.2In-network providers agree to limit whatthey will charge you. You pay a fixed dollaramount or a percentage of the provider’snegotiated amount.3Refer to geha.com/Prescriptions forformulary and specialty coverage forspecific medications.4If you choose a brand-name medicationwhen a generic is available, you willbe charged the generic copay plus thedifference in cost between the brand-nameand the generic.5Over 30-day specialty copay based on daysof therapy. The drug cost share is two timesfor drugs that provide 60 days‘ worth oftherapy and three times the copay for drugsthat provide 90 days‘ worth of therapy.6These benefits are neither offered norguaranteed under contract with the FEHBProgram, but are made available to allenrollees who become members of aGEHA medical plan and their eligiblefamily members.7Subject to any eligibility limitations.For more information, seeinfo.bridgehealth.com/GEHA8You pay 25% for advanced outpatientdiagnostic tests such as, CT scans and MRIs.Refer to GEHA’s 2021 plan brochureRI 71-018 (Elevate and Elevate Plus) for acomplete list at �Unlimited telehealth visits with MDLIVE geha.com/MDLIVEPreventive care; adult routine screeningsWell-child visit; up to age 22Lab services– MinuteClinic (where available) geha.com/MinuteClinic 0 10– Primary physician office visit– Chiropractic care; up to 15 visits per year(spinal manipulation therapy)– Acupuncture; up to 20 treatments per year 20– Specialist care; office visit 35– Urgent care 50– Other diagnostic services 50– Emergency care– Outpatient and in-office professional surgical services 150– Inpatient professional surgical services 200– Hospital care; inpatient including maternity 200 per day up to 1,000 per admission– Hospital care; outpatient 200 per day per facility8Prescription benefits for Elevate Plus. What you pay in-network.2,3geha.com/Prescriptions30-day retailGenericPreferred brand-nameNon-preferred brand-name 5 80440%490-day mail serviceGenericPreferred brand-nameNon-preferred brand-name 12 200440%430-day5 specialtyCVS exclusiveGeneric and preferred brand-nameNon-preferred brand-name40% ( 500 max4)40%4This plan has no out-of-network pharmacy coverage and a limited pharmacy network. Find apharmacy at 11

High OptionSelf Only premiums.Enroll code 311. geha.com/EnrollNon-Postal worker biweekly 108.14Postal worker biweekly – Category 1 104.78Postal worker biweekly – Category 2 94.72Comprehensive brand-name and specialty prescriptioncoverage. Works best with Medicare and includes a 600Medicare Part B premium reimbursement. geha.com/MRARetirees monthly 234.31X Low copays for doctor visits ( 20 primary and specialist).X 600 Medicare Part B premium reimbursement. geha.com/MedicareSelf Plus One premiums.X 2,500 hearing aid benefit.Enroll code 313. geha.com/EnrollNon-Postal worker biweekly 251.93Postal worker biweekly – Category 1 244.74Postal worker biweekly – Category 2 223.18Retirees monthly 545.85Self and Family premiums.Enroll code 312. geha.com/EnrollNon-Postal worker biweekly 314.13Postal worker biweekly – Category 1 306.32Postal worker biweekly – Category 2 282.90Retirees monthly 680.61These rates do not apply to all enrollees. If you are in a special enrollmentcategory, please refer to the FEHB Program website or contact the agency orTribal Employer that maintains your health benefits enrollment.12X Low cost-share for a variety of inpatient and outpatient services(10% coinsurance).Benefits included with your High plan.Unlimited telehealth visits with MDLIVEgeha.com/MDLIVEVision discountgeha.com/VisionHearing aid discount8geha.com/HearingGym membership8geha.com/FitnessElectric toothbrush8geha.com/ToothbrushTeeth whitening8geha.com/WhiteningHealth Advice Linegeha.com/HealthlineMedical alert system8geha.com/LifeAlertBiometric screeninggeha.com/ScreeningsLab Card servicesgeha.com/LabCard8Yearly deductible & out-of-pocket max2 for High.What you pay in-network.3Self OnlyYearly deductibleOut-of-pocket max 350 5,000Self Plus OneSelf and FamilyYearly deductibleOut-of-pocket max 700 10,000

Medical benefits for High. What you pay �Unlimited telehealth visits with MDLIVE geha.com/MDLIVEPreventive care; adult routine screeningsWell-child visit; up to age 22Maternity; routine preventive careEmergency care; accidental (must be within 72 hours)Hospital care; inpatient maternityLab Card services geha.com/LabCard 10– Primary physician office visit– Specialist care; office visit 20– Urgent care 35– Lab services (non-Lab Card)10%Emergency care; medicalHospital care; outpatientProfessional surgical servicesX-ray servicesOther diagnostic servicesAcupuncture; up to 20 treatments per yearCalendar year deductible applies.2The out-of-pocket maximum is themaximum amount of coinsurance,copays and deductibles you pay forall family members before GEHAbegins paying for 100% of coveredservices. This is a combined maximumfor both medical careand prescriptions.3In-network providers agree to limitwhat they will charge you. You pay afixed dollar amount or a percentageof the provider’s negotiated amount.For out-of-network benefits, refer toGEHA’s 2021 plan brochure RI 71-006(High and Standard) atgeha.com/PlanBrochure4Refer to geha.com/Prescriptions forformulary and specialty coverage forspecific medications.5If you choose a brand-namemedication when a generic isavailable, you will be charged thegeneric copay plus the difference incost between the brand-name andthe generic.6Costs for initial prescription andfirst refill. You pay 50% for third andadditional refills at retail for 30-daysupply. For long-term prescriptions,use mail order or your local retail CVSPharmacy store (90-day supply) forgreater cost savings.7Over 30-day specialty copay based ondays of therapy. The drug cost shareis two times for drugs that provide60 days‘ worth of therapy and threetimes the copay for drugs that provide90 days‘ worth of therapy.8These benefits are neither offerednor guaranteed under contract withthe FEHB Program, but are madeavailable to all enrollees who becomemembers of a GEHA medical plan andtheir eligible family members. 0– MinuteClinic (where available) geha.com/MinuteClinic––––––110%1– Hospital care; inpatient 100 per admission plus 10%– Chiropractic care; up to 20 visits per year(spinal manipulation therapy)Balance after GEHA pays 20 per visit– Chiropractic X-raysBalance after GEHA pays 25 per year– Preventive dental care, twice yearlyBalance after GEHA pays 22 per visitPrescription benefits for High. What you pay in-network.3,4geha.com/Prescriptions30-day retailGenericPreferred brand-nameNon-preferred brand-name 10625% ( 150 max5,6)40% ( 200 max5,6)90-day mail serviceGenericPreferred brand-nameNon-preferred brand-name 2025% ( 350 max5)40% ( 500 max5)30-day specialtyCVS exclusiveGeneric and preferred brand-nameNon-preferred brand-name25% ( 150 max )40% ( 200 max5)75geha.com/High800.262.434213

Included benefits & discounts.Unlimited MDLIVE4 telehealth visitsAccess certified doctors, including pediatricians,licensed behavioral health therapists anddermatologists, through MDLIVE.Vision benefits &discounts for GEHA plans.geha.com/MDLIVEWith all GEHA medical plans, you get discounts on eyeexams, frames and lenses through EyeMed. The EyeMednetwork includes LensCrafters, Target Optical, independenteye doctors and top optical retailers. Members also save onLASIK at participating locations.Gym membership310,000 Active&Fit fitness centers nationwide.geha.com/FitnessElectric toothbrush2,3To learn more, visit geha.com/Visiongeha.com/ToothbrushThe HDHP plan also includes additional vision benefits. Learn more atgeha.com/HDHPVisionHealth Advice LineExamples of what you pay for common in-network1 vision servicesfor all plans.370% off a cariPRO premium electric toothbrush.Talk with a nurse 24/7.geha.com/HealthlineBiometric screeningFree screenings at select nationwide locations for HDHP,Standard Option and High Option plan members.geha.com/ScreeningsMedical alert system3Get free activation, plus a 10% monthly discount.geha.com/LifeAlertTeeth whitening3Discounts for Smile Brilliant home teeth whiteningproducts such as trays, whitening and desensitizing gel.geha.com/Whitening14What you payElevateHDHPStandardElevatePlusHighEye examsretail price 0 5 5 0 5Framesretail price60%of price 0 under 100 plus80% over 10060%of price60%of price60%of priceEyeglass lenses,standard plasticsingle visionretail priceUp to 50 10Up to 50Up to 50Up to 50Contact lens,conventionalretail price85%of price 10 under 110 plus85% over 11085%of price85%of price85%of price

Hearing aid benefits & discounts forGEHA plans.Three GEHA plans – Standard Option, Elevate Plus and High Option – offer a hearing aid benefit, with no deductible.When you combine with TruHearing discount pricing³, you can save thousands of dollars off the retail price for newhearing aids.Although GEHA’s Elevate and HDHP plans don’t include hearing aid benefits, members of those plans can use the TruHearinghearing aid discount program. For more information, visit geha.com/HearingStandard Option and High Option plan benefit.GEHA’s Standard and High hearing aid benefit is 2,500 per person every 36 months for adults. Subtract the GEHA benefit from theTruHearing discounted price to determine what you pay.Elevate Plus plan benefit.GEHA’s Elevate Plus hearing aid benefit is 1,500 per person every 36 months for adults. Subtract the GEHA benefit from theTruHearing discounted price to determine what you pay.Example: Starkey Livio 1000StandardElevate PlusHighAverage retail price- 3,590- 3,590- 3,590TruHearing discounted price- 1,950- 1,950- 1,950GEHA benefit pays- 2,500- 1,500- 2,500You pay- 0- 450- 01Elevate, Standard, Elevate Plus and High only when you visit an EyeMed provider.2The cariPROTM premium toothbrush removes seven times more plaque than a regular brush, is completely waterproof and comes with a two-year manufacturer‘s warranty. Replacement brushheads with high-quality DuPontTM bristles are also available at this exclusive, member-only price.3These benefits are neither offered nor guaranteed under contract with the FEHB Program, but are made available to all enrollees who become members of a GEHA medical plan and theireligible family members.4If deductible is met, high deductible health plan (HDHP) member will be charged by MDLIVE but GEHA will then reimburse the member 100% of the billed charge.15

It’s easy to earn rewards withWellness Pays.Elevate & Elevate Plus plansearn Wellness Pays rewards.GEHA‘s digital platform hostedby RallyA fun, interactive health and wellnessportal that keeps you motivated tolive healthier.geha.com/ElevateLearnAchieve your health & wellness goals on your terms and earnrewards for healthy living. Two adult members per household (18 )can earn dollars on a Wellness Pays rewards card as you completeactivities. Earn up to 500 each (maximum 1,000 per household)per year.Learn more at geha.com/WellnessPaysHealth surveyGet rewarded for healthy habits andget personalized recommendations foractivities and programs that you canwork into your daily routine.Online health coachingThis coaching program createsa personalized program for yourpreferred learning style andcommitment level.Hit your Stride, onlineUse the app to monitor your dailyStride goal. Get rewarded monthlywhen you hit your goals.16Rewardable activitiesElevateElevate Plus– Achieve Stride step goal 10 per month 10 per month––––– 50 50– Health survey 75 75– Annual physical– Cervical cancer screening (Pap)*– Colorectal cancer screening(colonoscopy)*– Breast cancer screening (mammogram)*– First trimester prenatal appointment– Complete online Rally coaching 100 100– Complete Real Appeal– Quit for Life 200 200Flu shotOne MDLIVE telehealth visitComplete three Rally missionsComplete wellness quizzesBiometric screening

HDHP, Standard Option and High Option plansearn Health Rewards.Earn Health Rewards for completing healthy activities like a health risk assessment, a biometric screening, and onlinewellness workshops such as weight management, stress management or smoking cessation.Two adult members per household (18 ) can earn dollars on a Health Rewards card as you complete activities. Earn upto 250 each (maximum 500 per household) per year. The money you earn can be used for qualified medical expenses with yourHealth Rewards card. Learn more about Health Rewards available for HDHP, Standard Option and High Option plans atgeha.com/HealthRewardsRewardable activitiesHDHPStandardHigh– Online wellness workshops 10 per workshop 10 per workshop 10 per workshop– Flu shot 25 25 25––––– 50 50 50– Health risk assessment– Biometric screening 75 75 75– Wellness portal activities and preventive services 10 - 175 10 - 175 10 - 175

5 Over 30-day specialty copay based on days of therapy. The drug cost share is two times for drugs that provide 60 days' worth of therapy and three times the copay for drugs