Transcription

5/25/2011Managing YourInstitution’s Default RateJudith Kerzner, SVP Edfinancial ServicesFASFAA The problemReasons for increasing defaultsIdentify the at-risk borrowersCommunication strategiesAction plansOutside expertisep1

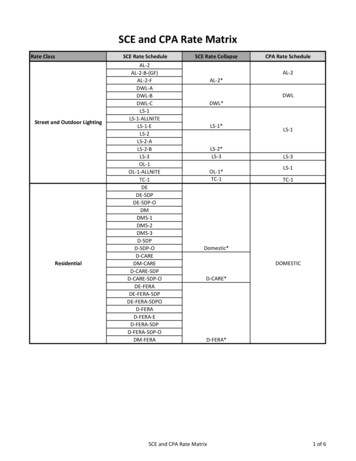

5/25/2011Increasing 2 yr CDR and the migration to a 3 yr CDR canimpact schools 30 day disbursement delay for 1st time borrower trigger Program participation trigger - 25% to 30%2 yr CDR Trend by School TypeSchool TypePublic 2 yrPublic 4 yrPrivate 4 ly published draft .2%8.9%22% increaseover FY 2008Source: U.S. Department of Education16%15.2%Proprietary14%12%P bli 2 %3.6%3.8%200720088%6%8.9%5 2%5.2%4%4.6%TotalPublic 4 yrPrivate 4 yr2%2009**Recently published draft rate2

5/25/2011Reasons for increasing default rates– Graduate underemployment– Economic slump– Student intent– Split servicing– TIVAS vs. FFEL– Private loansPell grant recipientsThe data suggests that colleges with a greater percentage of PellGrant recipients are more likely to have a higher cohort default rate.Average Loan Repayment RatesCollege TypePublic 4 yearPublic 2 yearPrivate 4 yearProprietaryTotal 10% Pell GrantRecipients68.4%43.9%68.6%53 3%53.3% 66% Pell GrantRecipients12.7%21.0%29.0%25 9%25.9%66.3%26.3%Source : Mark Kantrowitz, Student Aid Policy Analysis, “The Impact of LoanRepayment Rates on Pell Grant Recipients” 2010.3

5/25/2011Parent educational attainmentDefault is less likelyy if at least oneparent has a Bachelor’s degreeLarger household sizeStudents from larger householdsmay be at higher risk of defaultThink about the students served by yourschool – what are your risk factors?Students who do not graduate– 62% of borrowers who default did not complete theirprogram off study!t d !– Risk factors affecting persistence and attainment Delayed enrollment Part-time enrollment Working full-time while enrolled Single parent status4

5/25/2011Educating your administration can be challenging.Do they understand scope of the problem?Maybe not!“So what happens if I just wait and don’t do anything?”‐ A quote from a Private college VP to the FAD“WhenWhen is (the loan counselor) going to start working on defaultmanagement so we can get this rate down?”‐ A recent quote from a Community College Student Services VP to FADRetention & CDR: “Fraternal Twins”– School expenditure on retention isincreasing Outcome-based funding movement Gainful employment– Is your institution preparing students torepay loans?– Is help available if they can’t?Similar to retention efforts,efforts CDRmanagement should be school widenot just a financial aid office initiative5

5/25/2011 Share the trends – it’s not just yourschool Explain the reasons for rateincreases Discuss the potential impact ofTrigger rates– 30 day delay on disbursements– Participation in Title IV Offer an Action PlanExpanded counseling requirementsExample: Tidewater Tech Community College Student loanborrowers must:. Complete personalbudget worksheets, outlining a “realisticpicture of their financial situation” both before and after graduation Establish a student loan repayment plan estimating how theirmonthly payments fit into those budgets6

5/25/2011Financial literacy programs– Freshman 101 courses should haverobust student loan curriculumcurriculum.Information is better retained when it isrepeated.– Third-party providers offer FinancialLiteracy programs.Early intervention– Use information in your school database to target efforts toborrowers who are at most risk of defaulting– Leverage campus wide retention efforts to bolster earlyintervention efforts Does the academic advisor ever ask, “Do you have a loan? If so,call the financial aid office to talk about the impact of droppingout”?– Leverage aid office to improve retention Allocate internal financial aid office staff to counsel borrowerswho drop to less than half time or separate. Train them to discussre-enrollment options7

5/25/2011CDR appealsEach February, the Department releases draft rates for each institution.Schools have the opportunity to review their draft rates and maychallenge the calculations.Incorrect data challengeThe process by which a school challenges any errors contained in itsdraft cohort default rate data. The borrower might be incorrectlyincluded, excluded or misreported.CDR appeals– Effective this year schools must use eCDR Appeals to prepareand submit their IDC,, UDA and NDA.https://ecdrappeals.ed.gov/ecdra/index.html– The challenge must be submitted within 45 calendar days ofreceiving the most recent draft CDR.8

5/25/2011Default management services offered by––––Small specialty companiesCollection agenciesGuarantorsFFEL servicersProgram fee structure varies greatly by provider– Activity– Per Delinquency– Per BorrowerService provider must be able to aggregate data frommultiple data sources––––NSLDSTIVASSchoolAlso, other servicers and guarantors Look for experience, transparency andaccountability Monitor the progress of youro r proproviderider Consider your budget Check references based on your school type Just like weight loss programs, results are notguaranteed9

5/25/2011Judith KerznerSenior Vice PresidentEdfinancial Services865-806-7747jkerzner@edfinancial.comInside Higher Education– ent loan default rates rise sharply especially for for profit colleges– water community college requiring tidewater community college requiring students with federal loans to complete personal budget and repayment planFederal Student Aid IFAP– ouncement.htmlFinaid.org– loymentimpactonpell.pdf– cdifferences.pdf10

Example: Tidewater Tech Community College Student loanExample: Tidewater Tech Community College Student loan borrowers must: Complete personal budget worksheets, outlining a "realistic picture of their financial situat ion" both before and after graduation Establish a student loan repayment plan estimating how their