Transcription

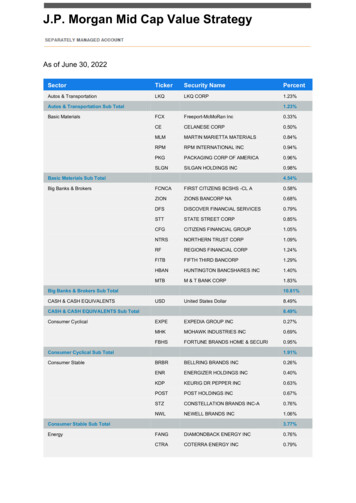

J.P. Morgan Mid Cap Value StrategyAs of June 30, 2022SectorTickerSecurity NamePercentAutos & TransportationLKQLKQ CORP1.23%Autos & Transportation Sub TotalBasic Materials1.23%FCXFreeport-McMoRan Inc0.33%CECELANESE CORP0.50%MLMMARTIN MARIETTA MATERIALS0.84%RPMRPM INTERNATIONAL INC0.94%PKGPACKAGING CORP OF AMERICA0.96%SLGNSILGAN HOLDINGS INC0.98%Basic Materials Sub TotalBig Banks & Brokers4.54%FCNCAFIRST CITIZENS BCSHS -CL A0.58%ZIONZIONS BANCORP NA0.68%DFSDISCOVER FINANCIAL SERVICES0.79%STTSTATE STREET CORP0.85%CFGCITIZENS FINANCIAL GROUP1.05%NTRSNORTHERN TRUST CORP1.09%RFREGIONS FINANCIAL CORP1.24%FITBFIFTH THIRD BANCORP1.29%HBANHUNTINGTON BANCSHARES INC1.40%MTBM & T BANK CORP1.83%Big Banks & Brokers Sub TotalCASH & CASH EQUIVALENTS10.81%USDUnited States DollarCASH & CASH EQUIVALENTS Sub TotalConsumer Cyclical8.49%EXPEEXPEDIA GROUP INC0.27%MHKMOHAWK INDUSTRIES INC0.69%FBHSFORTUNE BRANDS HOME & SECURI0.95%Consumer Cyclical Sub TotalConsumer Stable1.91%BRBRBELLRING BRANDS INC0.26%ENRENERGIZER HOLDINGS INC0.40%KDPKEURIG DR PEPPER INC0.63%POSTPOST HOLDINGS INC0.67%STZCONSTELLATION BRANDS INC-A0.76%NWLNEWELL BRANDS INC1.06%Consumer Stable Sub TotalEnergy8.49%3.77%FANGDIAMONDBACK ENERGY INC0.76%CTRACOTERRA ENERGY INC0.79%

J.P. Morgan Mid Cap Value StrategyAs of June 30, 2022SectorTickerSecurity NamePercentWMBWILLIAMS COS INC0.87%NFGNATIONAL FUEL GAS CO0.98%Energy Sub TotalFinancial Services3.40%CBRECBRE GROUP INC - A0.79%TROWT ROWE PRICE GROUP INC0.82%FLTFLEETCOR TECHNOLOGIES INC1.14%LLOEWS CORP1.60%Financial Services Sub TotalHealth Services & Systems4.36%UHSUNIVERSAL HEALTH SERVICES-B0.58%HSICHENRY SCHEIN INC1.21%ABCAMERISOURCEBERGEN CORP1.56%LHLABORATORY CRP OF AMER HLDGS1.63%Health Services & Systems Sub TotalIndustrial Cyclical4.98%LUVSOUTHWEST AIRLINES CO0.46%TKRTIMKEN CO0.59%SNXTD SYNNEX CORP0.62%IEXIDEX CORP0.70%LDOSLEIDOS HOLDINGS INC0.80%APHAMPHENOL CORP-CL A0.83%AMEAMETEK INC0.90%MIDDMIDDLEBY CORP0.90%ITTITT INC0.94%LECOLINCOLN ELECTRIC HOLDINGS1.10%AYIACUITY BRANDS INC1.11%SNASNAP-ON INC1.12%CSLCARLISLE COS INC1.30%HUBBHUBBELL INC1.32%Industrial Cyclical Sub TotalInsurance12.69%MTGMGIC INVESTMENT CORP0.54%LNCLINCOLN NATIONAL CORP0.59%VOYAVOYA FINANCIAL INC0.60%YALLEGHANY CORP0.61%ACGLARCH CAPITAL GROUP LTD0.69%RNRRENAISSANCERE HOLDINGS LTD0.73%WRBWR BERKLEY CORP0.96%HIGHARTFORD FINANCIAL SVCS GRP1.08%

J.P. Morgan Mid Cap Value StrategyAs of June 30, 2022SectorTickerSecurity NamePercentRJFRAYMOND JAMES FINANCIAL INC1.11%AMPAMERIPRISE FINANCIAL INC1.49%Insurance Sub TotalMedia8.39%TTWOTAKE-TWO INTERACTIVE SOFTWRE0.79%LSXMKLIBERTY MEDIA COR-SIRIUSXM C0.90%IACIAC/INTERACTIVECORP0.90%Media Sub TotalPharm/MedTech2.59%JAZZJAZZ PHARMACEUTICALS PLC0.76%ZBHZIMMER BIOMET HOLDINGS INC1.00%Pharm/MedTech Sub TotalREITs1.76%HSTHOST HOTELS & RESORTS INC0.33%JBGSJBG SMITH PROPERTIES0.33%FRTFEDERAL REALTY INVS TRUST0.38%VTRVENTAS INC0.41%SUISUN COMMUNITIES INC0.44%ESSESSEX PROPERTY TRUST INC0.44%REXRREXFORD INDUSTRIAL REALTY IN0.46%REGREGENCY CENTERS CORP0.46%MAAMID-AMERICA APARTMENT COMM0.49%BRXBRIXMOR PROPERTY GROUP INC0.53%KIMKIMCO REALTY CORP0.66%BXPBOSTON PROPERTIES INC0.71%WPCWP CAREY INC0.73%AVBAVALONBAY COMMUNITIES INC0.80%AMHAMERICAN HOMES 4 RENT- A0.87%WYWEYERHAEUSER CO0.95%RYNRAYONIER INC0.98%REITs Sub TotalRetail9.97%GPSGAP INC/THE0.17%BBWIBATH & BODY WORKS INC0.33%KSSKOHLS CORP0.35%DRIDARDEN RESTAURANTS INC0.41%BBYBEST BUY CO INC0.44%CRICARTER'S INC0.66%USFDUS FOODS HOLDING CORP0.68%GPCGENUINE PARTS CO0.72%

J.P. Morgan Mid Cap Value StrategyAs of June 30, 2022SectorTickerSecurity NamePercentTPRTAPESTRY INC0.73%RLRALPH LAUREN CORP0.73%KRKROGER CO0.88%AZOAUTOZONE INC1.69%Retail Sub TotalSemi & Hardware7.78%JBLJABIL INC0.55%CDWCDW CORP/DE0.97%MSIMOTOROLA SOLUTIONS INC1.57%Semi & Hardware Sub TotalSoftware & Services3.09%GDDYGODADDY INC - CLASS A0.58%NLOKNORTONLIFELOCK INC1.01%Software & Services Sub TotalTelecommunications1.59%LBRDKLIBERTY BROADBAND-CTelecommunications Sub TotalUtilities1.04%1.04%SRESEMPRA ENERGY0.40%EIXEDISON INTERNATIONAL0.73%ETRENTERGY CORP1.39%CMSCMS ENERGY CORP1.55%WECWEC ENERGY GROUP INC1.70%XELXCEL ENERGY INC1.85%Utilities Sub Total7.63%Total100.00%

For illustration and information purposes only. The above chart refers to the representative portfolio for the J.P. Morgan Mid Cap Value Strategyproduct as of 30-06-22. The representative portfolio is compromised of securities corresponding to the investment management strategy of therelated product. Actual accounts will differ based on individual client account restrictions, investment guidelines and account inception date.Therefore an account's performance may differ from the performance of the representative portfolio.The securities listed above are not to be construed as recommendations. For a complete list of recommendations, contact yourJ.P. Morgan representative.It should not be assumed that the performance of any of the securities mentioned above are or were profitable or did not incur losses.You should also contact your J.P. Morgan representative to assist you in evaluating your investment objectives and to make specificrecommendations regarding your account.J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co., and its affiliates worldwide.JPMorgan Chase & Co., June, 2022If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Health Services & Systems UHS UNIVERSAL HEALTH SERVICES-B 0.58% . Insurance Sub Total 8.39% Media TTWO TAKE-TWO INTERACTIVE SOFTWRE 0.79% . AZO AUTOZONE INC 1.69% Retail Sub Total 7.78% Semi & Hardware JBL JABIL INC 0.55% CDW CDW CORP/DE 0.97% MSI MOTOROLA SOLUTIONS INC 1.57%