Transcription

United Launch Alliance 401(k) Savings PlanPLAN NEWSChanges to Your Investment OptionsUnited Launch Alliance (ULA) regularly reviews the funds in the 401(k) Savings Plan to make sure they offer acombination of competitive long-term investment performance and reasonable fees. After the most recent fundreview, ULA decided to replace several of the Plan funds, effective June 1, 2011.What investment funds are changing All six SSgA Lifecycle funds will be replaced with similarage-based funds from Northern Trust (NTGI Focus Funds) All of the passively managed index funds will be replacedwith new index funds of the same typeWhat investment funds are staying the same All current actively managed core funds will remain in the Plan The Self-Managed Account will continue to be an option forexperienced investorsThese changes will become effective after 4:00 p.m. EasternTime on May 31, 2011. The first trading day for the new fundswill be June 1, 2011.New Beneficiary ToolYou are now able to manage your Plan beneficiary electionswith just a few clicks on the Plan website, instead of having tocomplete a paper form.See inside for details.Not contributing to the 401(k)?Time to start savingThe revised fund lineup gives you a good excuseto enroll in the Plan and start saving for yourfuture. It only takes a few minutes to enroll. First,decide how much of your eligible pay you’d liketo contribute. You can contribute a portion ofyour eligible pay, subject to the 2011 IRS limitof 16,500 in before-tax contributions plus anadditional 5,500 in catch-up contributions if youare age 50 or older. Total contributions (includingbefore-tax, after-tax and any company contribution)to the ULA 401(k) Savings Plan cannot exceed 49,000 in 2011. After you choose how muchyou want to contribute to the Plan, you will chooseyour investment mix.Go to https://ula401k.ingplans.com to enroll in thePlan. If you prefer, you can call the Information Lineat (877) ULA-401K (877-852-4015) and follow theautomated enrollment instructions or have aCustomer Service Associate help you.

Your New Investment OptionsEffective after 4:00 p.m. ET May 31, 2011Below is a listing of your new investment options. ULA believes these funds offer you better opportunities forlong-term growth potential. The passively-managed core options and the Lifecycle funds are all new. The newfunds are very similar to the funds they are replacing in objectives and risk level.You can invest in any combination of funds. Each Target Date Fund is designed as a complete, standalonediversified investment strategy. If you choose to invest in a Target Date Fund, it’s recommended that you invest100% of your savings into your selected fund. Or, if your expected retirement date is halfway between twotargeted fund dates, you may want to split your investment 50/50 between the two funds. For additional informationon the Target Date Funds, you can visit retirement.northerntrust.com.For details on the new funds, including investment objectives, risks, expenses and portfolio holdings, pleasesee the enclosed fund fact sheet booklet or log on to the Plan website at https://ula401k.ingplans.com andselect Fund Information from the Plan Investments page.Your New Fund Line-Up as of June 1, 2011Type of FundTarget Date (Balanced Funds)NTGI Focus Income FundIncome Target Date(for those in or very near retirement)NTGI Focus 2010 Fund2010 Retirement Target DateNTGI Focus 2020 FundNTGI Focus 2030 FundNTGI Focus 2040 FundNTGI Focus 2050 Fund2020 Retirement Target Date2030 Retirement Target Date2040 Retirement Target Date2050 Retirement Target Date(for those near retirement)Core Option Array (Passively Managed)NTGI Aggregate Bond FundNTGI S&P 500 FundNTGI Dow Jones US Completion FundNTGI ACWI ex-US Index FundCore Fixed IncomeLarge Cap Core EquitySmall Cap EquityInternational EquityCore Option Array (Actively Managed)Wells Fargo Stable Return FundPIMCO Total Return FundIntrinsic Value FundAmerican Funds Growth Fund of America FundLord Abbett Small Cap Blend FundAmerican Funds EuroPacific Growth FundBrokerage WindowSelf-Managed AccountUnited Launch Alliance 401(k) Planhttps://ula401k.ingplans.com(877) ULA-401K (877-852-4015)Stable ReturnCore Plus Fixed IncomeLarge Cap Value EquityLarge Cap Growth EquitySmall/Mid Cap Core EquityInternational Equity

Transferring Money into the New FundsAll money currently invested and all future contributions designated to be invested in the funds beingreplaced will automatically transfer into new funds through a process called “mapping,” as shown in thetable below. You do not have to take any action. This transfer will take place automatically on May 31,2011. You will continue to have full access to your account throughout the mapping process.Starting on June 1, 2011, you can transfer your current balances to any combination of funds, change howyour future contributions are invested, or simply leave your money and contribution elections in the mappedfunds as shown below.This Current FundMaps ToSSgA Lifecycle Income FundSSgA Lifecycle 2010 FundSSgA Lifecycle 2020 FundSSgA Lifecycle 2030 FundSSgA Lifecycle 2040 FundSSgA Lifecycle 2050 FundSSgA Passive Bond Market FundSSgA S&P 500 Index FundSSgA U.S. Extended Markets Index FundSSgA Daily EAFE Index FundThis New FundNTGI Focus Income FundNTGI Focus 2010 FundNTGI Focus 2020 FundNTGI Focus 2030 FundNTGI Focus 2040 FundNTGI Focus 2050 FundNTGI Aggregate Bond FundNTGI S&P 500 FundNTGI Dow Jones US Completion FundNTGI ACWI ex-US FundEasy Online Beneficiary ManagementYour beneficiary is the person who will receive the value of your 401(k) account if you die before receiving it.So it’s important to make sure you’ve always got the right person or persons designated.Now you can elect or change your beneficiary in seconds on the Plan website. No need to complete andreturn paper forms. After you log on to your account at https://ula401k.ingplans.com, go to My Account and under PersonalInformation select Beneficiary Information. Follow the easy online instructions to make changes. You can log onat any time to change your beneficiary. If you are married and designating anyone other than your spouse as aprimary beneficiary, you must print and fill out the Beneficiary Form located in the Forms section on the topnavigation bar and have your spouse’s consent notarized. If you do not complete and submit the form, thedesignation of anyone other than your spouse as a primary beneficiary will be deemed invalid.We encourage you to keep your beneficiary elections up-to-date so you can control how your retirementmoney gets distributed—particularly if you’ve recently experienced a change in family status, such as adivorce, marriage or the birth of a child.Questions?If you have questions about how these changes may affect youraccount, please contact a Customer Service Associate by calling theInformation Line at (877) ULA-401K (877-852-4015), Monday throughFriday, from 8:00 a.m. to 8:00 p.m. Eastern time (7:00 a.m. to 7:00 p.m.Central time; 6:00 a.m. to 6:00 p.m. Mountain time; 5:00 a.m. to 5:00p.m. Pacific time), except on New York Stock Exchange holidays.

Investment Advice and Managed Account ServicesWith the ING Advisor Service*, you can get personalized, objective investment and retirement planningadvice through two levels of service: the Personal Online Advisor or the Professional Account Manager.Personal Online AdvisorProfessional Account ManagerThis easy-to-use retirement planning Web-basedservice, powered by Financial Engines , is designedfor individuals who prefer to manage their own retirement account(s). Personal Online Advisor offers:With the Professional Account Manager program,powered by Financial Engines, professionals selecta personalized mix of funds appropriate for you,out of the funds available in the plan. This programprovides: Personalized retirement forecasts and risk assessments Personalized advice, forecasts and one-on-one support Step-by-step instructions that include savings and specific fund recommendationsAccess to the Personal Online Advisor is available24/7 to all plan participants. Ongoing account management Quarterly progress reportsProfessional Account Manager is available for anadditional fee.To learn more about these services or to complete a no-obligation retirement assessment, call theInformation Line at (877) ULA-401K (877-852-4015). ING Investment Advisors are available from 8:00 a.m.to 8:00 p.m. Eastern Time.Make Sure Your Portfolio is DiversifiedNow is a good time to make sure you are invested in a diversified mix of funds that matches your long-terminvestment goals and your risk tolerance. A diversified portfolio will contain a number of funds coveringdifferent asset classes, or types of investments, such as U.S. and foreign stocks, bonds and stable valueinvestments. Since different investment types often take turns at the top of the performance charts,diversification may help smooth out some of the market’s ups and downs.You have three ways to create a diversified portfolio:1. Pick your date. Simply select one of the Plan’s Target Date Funds. Each Target Date Fund is a fullydiversified investment portfolio. Simply select the fund with the year closest to your expected retirementyear and put all of your savings into that one fund.2. Mix your own. Choose from any combination of the Plan’s funds. If you select a mix of individual funds,remember to review your fund mix on a regular basis to make sure it stays balanced, diversified andfocused on your investment goals.3. Hire a Pro. Sign up for the ING Advisor Service* Professional Account Manager program and a teamof professionals will design your investment portfolio, choosing from the funds available in the Plan.This personalized service is a valuable benefit regardless of how much or how little you’ve saved.Make Sure You Are Contributing as Much as You CanIf you are an active employee, the ULA 401(k) Savings Plan allows you to contribute a portion of your eligiblepay subject to the 2011 IRS limit of 16,500 in before-tax contributions. Today might be a good time toincrease your contribution rate and save even more for your future. If you are age 50 or older, you cancontribute an additional 5,500 in catch-up contributions. Total contributions (including before-tax, after-taxand any company contributions) to the ULA 401(k) Savings Plan cannot exceed 49,000 in 2011.*Advisory Services provided by ING Investment Advisors, LLC for which Financial Engines Advisors, LLC acts as sub advisor. INGInvestment Advisors does not give tax or legal advice. If you need tax advice, consult your accountant or lawyer, if you need legaladvice, consult your lawyer. For more information about the ING Advisor Service, please read the ING Investment Advisors DisclosureStatement. A Disclosure Statement may be viewed online by accessing the ING Advisor Service link through your Plan’s Web site athttps://ula401k.ingplans.com. You may also request a Disclosure Statement from an ING Investment Advisor by calling your Plan'sInformation Line at 877-852-4015. Financial Engines Advisors, LLC is not a corporate affiliate of ING Investment Advisors, LLC orING Institutional Plan Services, LLC.09IAS-10-007C10-0831-003 (11/10)ULAFundChangeNL 4.11

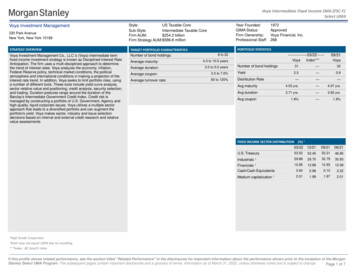

FUND FACTSQuarter Ending March 31, 2011NORTHERN TRUST FOCUS INCOME FUND TMA target retirement date fund that provides an asset allocation for people already retiredWhat it isTARGETED ASSET ALLOCATIONA target retirement date investment option provided through a collectivetrust fund that is available only to qualified retirement plans. This is not amutual fund.Stocks21.00%GoalA target retirement date fund that provides an asset allocation for peoplealready retired.Inflation Hedge17.00%CashReserves5.00%Bonds57.00%What it invests inThe Fund invests in a broadly diversified portfolio of primarily passive investment funds comprised of U.S. and international stocks, securities that act as ahedge against inflation, U.S. bonds and U.S. Government cash reserves. Theinvestment risks of each target retirement date fund change over time as itsallocation changes. These funds are subject to the volatility of the financialmarkets including equity and fixed income investments in the U.S. andabroad and may be subject to risks associated with investing in high yield,small cap and foreign securities. Principal invested is not guaranteed at anytime, including at or after their target dates. Unit price and return will vary.Note: Fund holdings and asset allocation are subject to change.PORTFOLIO CHARACTERISTICSas of March 31, 2011HOLDINGS (% of Portfolio) as of April 1, 2011Stock 20.95 %Northern Trust Collective S&P 500 Index Fund - Non LendingNorthern Trust Collective S&P 400 Index Fund - Non LendingNorthern Trust Collective Russell 2000 Index Fund - Non LendingU.S. StockNorthern Trust Collective EAFE Index Fund - Non LendingNorthern Trust Collective Emerging Markets Index Fund - Non LendingInternational StockThe asset allocation shown on the pie chart above reflects the portfolio’s approximatetargeted asset allocation under normal market conditions between rebalancings.Asset allocation does not guarantee a profit, nor does it protect against loss.9.95%1.50%1.00%12.45%8.50%0.00%8.50%Inception Date: October 16, 2009Investment Management Expense – NTGIAgent Revenue Sharing Expense – Recordkeeper:Combined Expense:0.15%0.25%0.40%Investment management expenses do not include additional expenses that may be paid tocover operational costs of the fund. These expenses may vary, are subject to change and arereflected in the net asset value of the fund and the performance shown on the reverse side.StockInflation Hedge 16.94%Northern Trust Collective Global Real Estate Index Fund - Non LendingiPath Dow Jones UBS Commodity Index Total Return ETNNorthern Trust Collective TIPS Index Fund - Non Lending4.99%0.00%11.95%Bond 56.91%Northern Trust Collective High Yield FundNorthern Trust Collective Aggregate Bond Index Fund - Non Lending 71,134.07 million15.611.94Bond6.95%49.96%Cash Reserves 5.20%Northern Trust Collective Government Short Term Investment FundAverage WeightedMarket CapitalizationTrailing Price/Earnings RatioPrice/Book RatioAverage DurationAverage CouponAverage Credit Quality5.42 years4.54%AA5.20%Northern Trust Global InvestmentsNorthern Trust Global Investments (NTGI) is a global multiasset class investment manager serving clients worldwide.NTGI brings together the resources of The Northern TrustCompany, Northern Trust Investments, Inc., Northern TrustGlobal Advisors, Inc. and other affiliates to offer investmentproducts and services to personal and institutional markets.P FCT(3/11)

Quarter Ending March 31, 2011NORTHERN TRUST FOCUS INCOME FUND TMThe Northern Trust Focus Funds’ Glidepath (subject to change)100%Cash90%80%Inflation HedgeBondFOCUS INCOME FUNDTARGET ALLOCATION% of Portfolio70%60%50%40%Stock30%20%Expanded asset classes resultin portfolios designed to delivergreater return potential for theamount of risk taken.The glidepath becomes moreconservative over time, whichhelps provide lower volatility tothe overall portfolio.10%0% 25303540455055606570 75Participant AgeInitially, the Stock and Inflation Hedgeallocations total 85% to maximize wealthaccumulation in early saving years.Bond and Cash allocations increaseover time to add stability and generateincome necessary in retirement years.FUND TRAILING TOTAL RETURNS FOR PERIODS ENDING March 31, 2011QuarterYTD1-YearSince Inceptionas of November 1, 2009Northern Trust Focus Income Fund1.98%1.98%8.81%9.41%Focus Income Benchmark2.06%2.06%9.12%9.91%The performance information shown represents past performance and is not a guarantee of future results. Current performance may be lower or higher than the performance information shown. Performance is shown net of investment management and agent revenue sharing expenses. These expenses do not include additional expenses that may be paid to coveroperational costs of the fund. These expenses may vary, are subject to change and are reflected in the net asset value of the fund and the performance shown on the above.The Northern Trust Focus Fund Benchmark is a weighted index for each Northern Trust Focus fund comprised of the S&P 500 Index, the S&P 400 MidCap Index, the Russell 2000 Index,the MSCI EAFE Index, the MSCI Emerging Markets Index, the FTSE EPRA/NAREIT Global Index, the Dow Jones-UBS Commodity Index, the Barclays Capital US TIPS Index, the BarclaysCapital US Aggregate Index, the Barclays Capital US Corporate High Yield 2% Issuer Capped Bond Index and the BofA Merrill Lynch 3-month U.S. Treasury Bill Index. Each index isweighted at the appropriate strategic neutral allocation of its respective asset class, which is predetermined and changes over time. These benchmark rates of return should not be considered as exact replications of any particular asset class, security or strategy returns, but rather as an approximation for illustrative purposes. Direct investment in an index is notpossible and does not reflect an actual portfolio's investment results.This is for your information only and does not constitute investment advice, a recommendation to buy or sell any security or to invest in any strategy and is subject to change withoutnotice. Information contained herein is current as of the date appearing in this material only and is subject to change without notice.The Northern Trust Focus Funds are collective investment funds maintained by NTI as trustee. These are bank collective funds, not mutual funds. As provided in each Fund's declaration of trust, the Funds are available for investment by qualified and governmental retirement plans. Various asset classes of the underlying funds, such as small-cap and internationalequities may carry additional risks. Principal value and investment return will fluctuate, so that a participant's units when redeemed may be worth more or less than the original investment. Fund portfolio statistics change over time. The information provided herein is obtained from sources deemed to be reliable, however, its accuracy cannot be guaranteed.Information was provided by Northern Trust Global Investments. The plan recordkeeper is not responsible for its content.Not FDIC insured May lose value No bank guaranteeNorthern Trust Global Investments50 South La Salle Street Chicago, Illinois 60603P FCT(3/11)

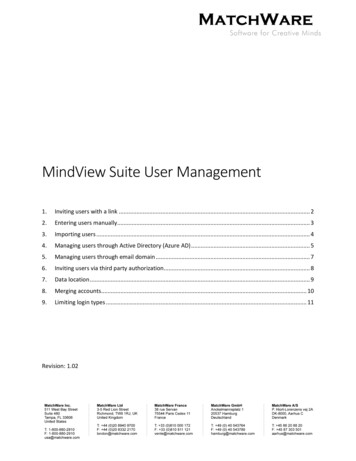

FUND FACTSQuarter Ending March 31, 2011NORTHERN TRUST FOCUS 2010 FUND TMA target retirement date fund that provides an asset allocation for people planning to retire between 2008 and 2012What it isTARGETED ASSET ALLOCATIONA target retirement date investment option provided through a collectivetrust fund that is available only to qualified retirement plans. This is not amutual fund.Stocks34.63%GoalA target retirement date fund that provides an asset allocation for peopleplanning to retire between 2008 and 2012. Over time, the asset allocationbecomes more conservative as the fund approaches its target date.Approximately ten years after the fund reaches its target date, the targetedasset allocation is estimated to be 21% in stocks, 17% in inflation-hedge securities, 57% in bonds and 5% in cash reserves. Eventually, the fund mergeswith the Focus Income Fund.What it invests inThe Fund invests in a broadly diversified portfolio of primarily passive investment funds comprised of U.S. and international stocks, securities that act as ahedge against inflation, U.S. bonds and U.S. Government cash reserves. Theinvestment risks of each target retirement date fund change over time as itsallocation changes. These funds are subject to the volatility of the financialmarkets including equity and fixed income investments in the U.S. andabroad and may be subject to risks associated with investing in high yield,small cap and foreign securities. Principal invested is not guaranteed at anytime, including at or after their target dates. Unit price and return will vary.HOLDINGS (% of Portfolio) as of April 1, on Hedge 15.46%Northern Trust Collective Global Real Estate Index Fund - Non LendingiPath Dow Jones UBS Commodity Index Total Return ETNNorthern Trust Collective TIPS Index Fund - Non LendingCashReserves3.71%Bonds46.20%The asset allocation shown on the pie chart above reflects the portfolio’s approximatetargeted asset allocation under normal market conditions between rebalancings.Asset allocation does not guarantee a profit, nor does it protect against loss.Note: Fund holdings and asset allocation are subject to change.PORTFOLIO CHARACTERISTICSas of March 31, 2011Inception Date: October 16, 2009Investment Management Expense – NTGIAgent Revenue Sharing Expense – Recordkeeper:Combined Expense:Stock 34.66 %Northern Trust Collective S&P 500 Index Fund - Non LendingNorthern Trust Collective S&P 400 Index Fund - Non LendingNorthern Trust Collective Russell 2000 Index Fund - Non LendingU.S. StockNorthern Trust Collective EAFE Index Fund - Non LendingNorthern Trust Collective Emerging Markets Index Fund - Non LendingInternational StockInflation t management expenses do not include additional expenses that may be paid tocover operational costs of the fund. These expenses may vary, are subject to change and arereflected in the net asset value of the fund and the performance shown on the reverse side.StockAverage WeightedMarket CapitalizationTrailing Price/Earnings RatioPrice/Book Ratio 68,304.01 million15.551.93BondAverage DurationAverage CouponAverage Credit Quality5.38 years4.44%AABond 46.16%Northern Trust Collective High Yield FundNorthern Trust Collective Aggregate Bond Index Fund - Non Lending6.49%39.67%Cash Reserves 3.72%Northern Trust Collective Government Short Term Investment Fund3.72%Northern Trust Global InvestmentsNorthern Trust Global Investments (NTGI) is a global multiasset class investment manager serving clients worldwide.NTGI brings together the resources of The Northern TrustCompany, Northern Trust Investments, Inc., Northern TrustGlobal Advisors, Inc. and other affiliates to offer investmentproducts and services to personal and institutional markets.P FCT(3/11)

Quarter Ending March 31, 2011NORTHERN TRUST FOCUS 2010 FUND TMThe Northern Trust Focus Funds’ Glidepath (subject to change)100%Cash80%Inflation HedgeFixed Income% of Portfolio70%60%50%Stock40%30%20%10%0% 25303540455055602010 FUND TARGET ALLOCATION90%65Expanded asset classes resultin portfolios designed to delivergreater return potential for theamount of risk taken.The glidepath becomes moreconservative over time, whichhelps provide lower volatility tothe overall portfolio.70 75Participant AgeInitially, the Stock and Inflation Hedgeallocations total 85% to maximize wealthaccumulation in early saving years.Fixed Income and Cash allocationsincrease over time to add stability andgenerate income necessary inretirement years.FUND TRAILING TOTAL RETURNS FOR PERIODS ENDING March 31, 2011QuarterYTD1-YearSince Inceptionas of November 1, 2009Northern Trust Focus 2010 Fund2.74%2.74%10.76%12.09%Focus 2010 Benchmark2.80%2.80%11.04%12.56%The performance information shown represents past performance and is not a guarantee of future results. Current performance may be lower or higher than the performance information shown. Performance is shown net of investment management and agent revenue sharing expenses. These expenses do not include additional expenses that may be paid to coveroperational costs of the fund. These expenses may vary, are subject to change and are reflected in the net asset value of the fund and the performance shown on the above.The Northern Trust Focus Fund Benchmark is a weighted index for each Northern Trust Focus fund comprised of the S&P 500 Index, the S&P 400 MidCap Index, the Russell 2000 Index,the MSCI EAFE Index, the MSCI Emerging Markets Index, the FTSE EPRA/NAREIT Global Index, the Dow Jones-UBS Commodity Index, the Barclays Capital US TIPS Index, the BarclaysCapital US Aggregate Index, the Barclays Capital US Corporate High Yield 2% Issuer Capped Bond Index and the BofA Merrill Lynch 3-month U.S. Treasury Bill Index. Each index isweighted at the appropriate strategic neutral allocation of its respective asset class, which is predetermined and changes over time. These benchmark rates of return should not be considered as exact replications of any particular asset class, security or strategy returns, but rather as an approximation for illustrative purposes. Direct investment in an index is notpossible and does not reflect an actual portfolio's investment results.This is for your information only and does not constitute investment advice, a recommendation to buy or sell any security or to invest in any strategy and is subject to change withoutnotice. Information contained herein is current as of the date appearing in this material only and is subject to change without notice.The Northern Trust Focus Funds are collective investment funds maintained by NTI as trustee. These are bank collective funds, not mutual funds. As provided in each Fund's declaration of trust, the Funds are available for investment by qualified and governmental retirement plans. Various asset classes of the underlying funds, such as small-cap and internationalequities may carry additional risks. Principal value and investment return will fluctuate, so that a participant's units when redeemed may be worth more or less than the original investment. Fund portfolio statistics change over time. The information provided herein is obtained from sources deemed to be reliable, however, its accuracy cannot be guaranteed.Information was provided by Northern Trust Global Investments. The plan recordkeeper is not responsible for its content.Not FDIC insured May lose value No bank guaranteeNorthern Trust Global Investments50 South La Salle Street Chicago, Illinois 60603P FCT(3/11)

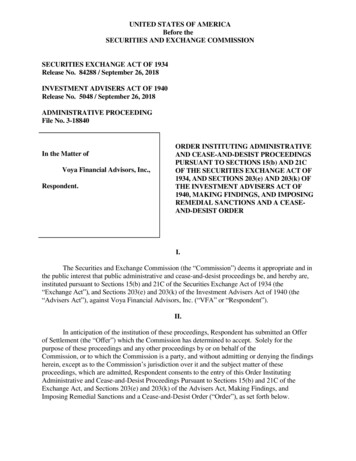

FUND FACTSQuarter Ending March 31, 2011NORTHERN TRUST FOCUS 2020 FUND TMA target retirement date fund that provides an asset allocation for people planning to retire between 2018 and 2022What it isTARGETED ASSET ALLOCATIONA target retirement date investment option provided through a collectivetrust fund that is available only to qualified retirement plans. This is not amutual fund.Stocks 49.77%Inflation Hedge 13.74%GoalA target retirement date fund that provides an asset allocation for peopleplanning to retire between 2018 and 2022. Over time, the asset allocationbecomes more conservative as the fund approaches its target date.Approximately ten years after the fund reaches its target date, the targetedasset allocation is estimated to be 21% in stocks, 17% in inflation-hedge securities, 57% in bonds and 5% in cash reserves. Eventually, the fund mergeswith the Focus Income Fund.What it invests inThe Fund invests in a broadly diversified portfolio of primarily passive investment funds comprised of U.S. and international stocks, securities that act as ahedge against inflation, U.S. bonds and U.S. Government cash reserves. Theinvestment risks of each target retirement date fund change over time as itsallocation changes. These funds are subject to the volatility of the financialmarkets including equity and fixed income investments in the U.S. andabroad and may be subject to risks associated with investing in high yield,small cap and foreign securities. Principal invested is not guaranteed at anytime, including at or after their target dates. Unit price and return will vary.HOLDINGS (% of Portfolio) as of April 1, on Hedge 13.74%Northern Trust Collective Global Real Estate Index Fund - Non LendingiPath Dow Jones UBS Commodity Index Total Return ETNNorthern Trust Collective TIPS Index Fund - Non LendingCash Reserves 2.29%The asset allocation shown on the pie chart above reflects the portfolio’s approximatetargeted asset allocation under normal market conditions between rebalancings.Asset allocation does not guarantee a profit, nor does it protect against loss.Note: Fund holdings and asset allocation are subject to change.PORTFOLIO CHARACTERISTICSas of March 31, 2011Inception Date: October 16, 2009Investment Management Expense – NTGIAgent Revenue Sharing Expense – Recordkeeper:Combined Expense:Stock 49.82 %Northern Trust Collective S&P 500 Index Fund - Non LendingNorthern Trust Collective S&P 400 Index Fund - Non LendingNorthern Trust Collective Russell 2000 Index Fund - Non LendingU.S. StockNorthern Trust Collective EAFE Index Fund - Non LendingNorthern Trust Collective Emerging Markets Index Fund - Non LendingInternational StockBonds 34.20%5.00%2.17%6.57%0.15%0.25%0.40%Investment management expenses do not include additional expenses that may be paid tocover operational costs of the fund. These expenses may vary, are subject to change and arereflected in the net asset value of the fund and the performance shown on the reverse side.StockAverage WeightedMarket CapitalizationTrailing Price/Earnings RatioPrice/Book Ratio 67,095.42 million15.521.92BondAverage DurationAverage CouponAverage Credit Quality5.34 years4.32%AABond 34.16%Northern Trust Collective High Yield FundNorthern Trust Collective Aggregate Bond Index Fund - Non Lending5.91%28.25%Cash Reserves 2.28%Northern Trust Collective Government Short Term Investment Fund2.28%Northern Trust Global InvestmentsNorthern Trust Global Investments (NTGI) is a global multiasset class investment manager serving clients worldwide.NTGI brings together the resources of The Northern TrustCompany, Northern Trust Investments, Inc., Northern TrustGlobal Advisors, Inc. and other affiliates to offer investmentproducts and services to personal and institutional markets.P FCT(3/11)

Quarter Ending March 31, 2011NORTHERN TRUST FOCUS 2020 FUND TMThe Northern Trust Focus Funds’ Glidepath (subject to change)100%Cash80%2020 FUND TARGET ALLOCATION90%Inflation Hedge% of Portfo

Wells Fargo Stable Return Fund Stable Return PIMCO Total Return Fund Core Plus Fixed Income Intrinsic Value Fund Large Cap Value Equity American Funds Growth Fund of America Fund Large Cap Growth Equity Lord Abbett Small Cap Blend Fund Small/Mid Cap Core Equity American Funds EuroPacific Growth Fund International Equity Brokerage Window

![The DaVita Retirement Savings Plan [401(k)]](/img/16/enrollment-guide.jpg)