Transcription

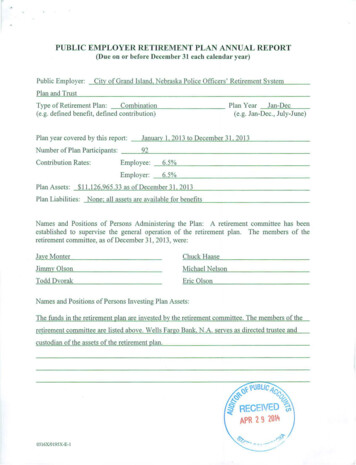

PUBLIC EMPLOYER RETIREMENT PLAN ANNUAL REPORT(Due on or before December 31 each calendar y ear)Public Employer:City of Grand Island. Nebraska Police Officers' Retirement SystemPlan and TrustType of Retirement Plan: ,C"""o'-m!;'-!.:b"-'i""'n,-" ,at, io, ,"-'n-.o PIan YearJan-Dec(e.g. defined benefi t, defined contribution)(e.g. Jan-Dec., July-June)Plan year covered by this report:.:!J an:!.!.u:::.:a:!!.r.L.y- .1 , , .20 1!.:3 t o D::::.:e c e:!.!m b e r 3.!:.1 "-',2 .:0 1""'3:.-92 ------ - - - - - - - - -- - - - -Number of Plan Participants: ---::.Contribution Rates:Employee:- 6 :.:::.S.:.o/c:!.oEmployer: .:::.6.:.::.S o/c o - - - -- -- - - - - - - - -Plan Assets: 11.126.965.33 as of December 31. 2013Plan Liabilities:None: all assets are available for benefitsNames and Positions of Persons Administering the Plan: A retirement committee has beenestablished to supervise the general operation of the retirement plan. The members of theretirement committee, as ofDecember 31,2013, were:Jaye MonterChuck HaaseJimmy OlsonMichael NelsonTodd DvorakEric OlsonNames and Positions of Persons Investing Plan Assets:The funds in the retirement plan are invested by the retirement committee. The members of theretirement committee are listed above. Wells Fargo Bank, N.A. serves as directed trustee andcustodian of the assets of the retirement plan.0516X/0195X-E-l

Form an ;! Nature of Investments:The assets of the plan are invested in mutual funds and a bank collective investment fund.If a defined contribution plan, full description of investment policies and options available toplan participants:A list of the investment options available to plan participants is attached to this report.If a defined benefit plan, the number of members who are eligible for a benefit and the totalpresent value of such members' benefits, as well as the funding sources which will pay for suchbenefits:A copy of the most recent quadrennial actuarial report for the plan is attached to this report.Date:Jaye Monter. City Treasurer/Finance DirectorMailing Address:100 East 1st StreetGrand Island, NE 68801Telephone Number:(308) 385-5444 ext. 169OS16X/019SX-E-2

"City of Grand Island , NebraskaPolice Officers' R etirement Sys tem Plan and TrustDescription oflnvestment Options Available to ParticipantsT he retirement committee has selected the fo llowing investment options to be available to planparticipants:NAME OF FUNDWells Fargo Stable Return Fund N4Federated Total Return Gov SSWells Fargo Advtg Core Bond AdminAmerican Funds American Balanced R4MFS Value R3Wells Fargo Advtg Index AdminHartford Cap App HLS IBMainStay Large Cap Growth R lJP Morgan Large Cap Growth SelectJHancock3 Disciplined Value M id Cap AAston I air-pointe M id Cap NArtisan Mid Cap InvWells Fargo Advtg Small Cap Value InvT. Rowe Price Small Cap StockWells Fargo Advtg Emerging Grovvth AdminAmerican Funds EuroPac ific Growth R4Wells Fargo Advtg Diversified Equity Adm inWells Fargo Advtg Dow Jones Target Today AdminWells Fargo Advtg Dow Jones Target 20 10 AdminWells Fargo Advtg Dow Jones Target 2020 AdminWells Fargo Advtg Dow Jones Target 2030 AdminWells Fargo Advtg Dow Jones Target 2040 AdminWells Fargo Advtg Dow Jones Target 2050 AdminCUSIPPF99660033 1429A20494975J59902407 184755273H64394975G6864 1652876856062X63348 12C053047803W50500078I-I315043 14H3039499 152847795724039499 94975G15794975G11 DEXWFLOXWFLGX\VFLPXWFLIXWFLWXWFQDX

City Of Grand IslandRetirement System ForPolice OfficersJanuary 1, 2011Actuarial Valuation Report

Millimantt 20 S. t Ot " Street, Suite 400Omaha, NE, 68124USATelFax t 402 393 9400 1 402 393 1037milliman.comMay 12,2011ACTUARIAL CERTIFICATIONMs. Mary Lou B rownFinance Directo r/ City TreasurerCity of Grand Island100 East First StreetBox 1968G rand Island, NE 68802Re: City of Grand Island Police Officers Retirem ent PlanD ear Ms. B rown:As requested, we have performed an Actuarial Valuation o f the City of G rand Island Po lice O fficersRetirement Plan as o f January 1, 2011 . The major findings o f the val uation are contained in thi sreport. Tlus report reflects the benefit provisio n and contribution rates in effect as of January 1,2011 .In preparing tlus repo rt, we relied, without audit, on information (some o ral and some in writing)supplied by the System's staff. This informatio n includes, but is no t limited to, statutmy provisions,employee data, and finan cial info rmation. [n o ur examination o f tl1ese da ta, we have fo und them tobe reasonably consistent and comparable \vith data used for oilier purposes. Since tl1e valuatio nresults are dependent o n tile integrity o f the data supplied, tl1e results can be expected to differ if tl1eunderlying data is incomplete or missing. lr should be no ted tl1at if any da ta or other information isinaccurate o r incomplete, our calculations may need to be revised.AJJ costs, liabilities, rates of interest, and o ther factors for the System have been determined on thebasis of actuarial assumptions and methods wluch are individually reasonable (taking into accounttile experience of the System and reasonable expectations); and which , in combinatio n, offer ourbest estimate o f an ticipated experience affecting tl1e System.Future actuarial measurements may di ffer significantly from the current measurements presented inthis report due to such factors as tl1e fo llowing: plan experience differing fro m tilat anticipated bytile econo mic or demographic assumptions; changes in economic or demographic assumptions;increases o r decreases expected as part of the natural operatio n of tl1e metilodology used for thesemeasurements (such as the end o f an amo rtization period o r additio nal cost o r co ntributio nrequirements based on tile plan's funded status); and changes in plan provision s o r applicable law.Due to tl1e limited scope of our assignment, we did no t perform an analysis o f tile po tential ran ge offurure measurements. The B oard of T rustees has the final decisio n regarding tile appropriateness oftile assumptions and adopted tilem .Offices 111 Prrncrpal Cil!es Worldwide

MillimanMs. Mary Lou BrownMay 12, 2011Page 2Actuarial computations presented in this report are for purposes of determining the recommendedfunding amounts for the System. The calculations in the enclosed report have been made on a basisconsistent with our understanding of the System's funding requiremen ts and goals. Determinationsfor purposes o ther than meeting these requirements may be significantly diffe rent from the resultscontained in this report. Accordingly, additional determinations may be needed for other purpo ses.Milliman's work is prepared solely for the in ternal business use of the City of Gra nd Island("System"). To the extent that :M.il.liman's work is not subject to disclosure under applicable publicrecords laws, filliman 's work may not be provided to third parties \vithout l'vlilliman's prior writtenconsent. 1Vfilliman does no t intend to benefit or create a legal duty to any third party recipient of itswork product. Glliman's con sent to release its wo rk prod uc t to any third party may be conditionedon the third party signing a Release, sub ject to the following exception s:(a) The System may provide a copy of lilliman's work, in irs entirety, to the System'sprofessional service advisors who are subjecr to a duty of confidentiality and who agree tonot use Millima n's work fo r any purpose o ther tha n to benefit the System.(b) The System may provide a copy of i\'liUiman's wade, in its en tirety, to oth er governmentalentities, as required by law.No third party recipient of lilliman's work product should rely upon l'vlilliman's work product. Suchrecipients should engage qualified professionals for advice appropriate to their own specific n eeds.T he consultants who worked on this assignment are pension actuaries. filliman's advice is notintended to be a substitute for qualified legal or acco unting counsel.On the basis of the foregoing, we hereby certify tha t, to the best of our knowledge and belief, thisreport is complete and accurate and h as been prepared in accordance with generally recognized andaccepted actuarial principles and practices. We are members of the American Academy of .Actuariesand meet the Q ualification Standards to render the actuarial opinion contained herein.\Y/e respectfully submit the following report, and we look forward to d iscussing it with you.I, Gregg Rueschhoff, am a consulting actuary for lilliman . I am a member of the AmericanAcademy of Ac tuaries and meet the Qualification Standards of the American Academy of .Actuariesto render the actuarial opinion contained herein.Sincerely,Gregg Rueschhoff, A.S.A.Principal & Consulting ActuaryEnrolled Actuary No. 11-04349Enclosure

Table of ContentsValuation Summary Report SummaryDisplay of Annual Cost12Valuation Detail eFund Assets.A.nnual Normal Costs34Valuation Basis Actuariali\tfethodsActuarial AssumptionsSummary of Retirement System ProvisionsParticipant Census Statistics5679

Report SummaryOn January 1, 1984, the Retirement Systems for Police Officers of First Class Cities in the State ofNebraska were revised. The system that became effective was a Defined Contribution system, withthe employees and the City each making annual contributions to the Pension Funds.Pre-84 HiresOfficers who were hired prior to January 1, 1984 were assured of receiving retirement benefits underthe new system at least as great as those that would have been available under the prior system. Thisactuarial valuation has been prepared to evaluate the additional funding required, if any, to providethese benefit guarantees.Based on the actuarial valuation, it is anticipated that the unallocated account is sufficient to providethe minimum defined benefits for the remaining pre-84 hires. Therefore, it is anticipated that noadditional contribution will be required to be contributed to the unallocated account.Post-84 HiresPolice Officers hired after January 1, 1984 are eligible for special duty-related death and disabilitybenefits. However, the expected number of occurrences is considerably less than 1.0. Therefore,·any prefunding of the benefit will generate way too little funds (if an actual death or disabilityoccurs), or will create unneeded funds (if none occur). We have not included a specific liability forthe post-84 benefit.-1-

Display of Annual CostThe annual cost for the year beginningJanuacy 1, 2011 is displayed below. 01.i\nnual N annal Cost fot 20112.Projected 2011 Payroll for pre-84 Hires3.Total Annual Contributions as a Percentage of Pay (1542,681-2- 2)O.Oo/o

Fund AssetsFund Assets on March 8, 2011Employer and Employee Contribution Accounts * 2,918,877442.064Unallocated and Forfeiture Account* 3,360,941Total Assets*For pre-84 officers only.-3-

Annual Normal CostThe annual normal cost is determined by following the steps outlined below. The annual normalcost is the portion of the total plan costs assigned to the current plan year by the Actuarial CostMethod.January 1, 20111.Actuarial Present Value of Future J\ifinimum Benefits Active ParticipantsRetired ParticipantsTotal 2.Unallocated Assets3.Actuarial Present Value of Future Normal Costs(1 - 2, but not less than zero)4.Actuarial Present Value of Future Salaries*5.Normal Cost Accrual Rate (36.Total Current Annual Covered Salaries*7.Annual Normal Cost (5 x 6)88,953088,953442,06401,678,096 4)542,681 0*Only includes employees eligible for minimum benefits and employees younger than the assumed retirement age.-4-

Actuarial MethodsActuarial Cost MethodThe Aggregate Actuarial Cost Ivfethod was used to determine annual plan costs. Using this method,the present value of benefits to be funded by future annual costs is determined by subtracting planassets from the present value of projected benefits. This result, the present value of unfunded costs,is divided by the present value of future salaries of employees included in the valuation to determinea normal cost accrual rate. The normal cost accrual rate is multiplied by the total of current annualsalaries of employees in the valuation to detennine the nonnal cost.Using the .Aggregate Ivfethod, gains and losses that arise due to actual experience are not directlydetermined and recognized each year. Gains and losses are included in the unfunded costs andaffect the normal cost accrual rate. As a result, gains and losses are spread over the remainingperiod to retirement of employees in the valuation and are recognized as a portion of future annualcosts.Asset Valuation MethodAssets are valued at market value.-5-

Actuarial AssumptionsInvestment Return7 /o- pre-retirement5.5 /o - post-retirementMortality1994 Group Annuity l\tlortality TableSalary ScaleRetirement Agel\tiembers who are eligible to retire are assumed toretire according to the probabilities in the followingtable:Probabilityof Retirement55-5960DisabilityNoneTerminationNone prior to retirement eligibilityMarital Status100 /o married, males assumed to be 3 years olderthan females.Load for Lump SumsLiabilities were loaded by 10 /o to reflect the potentialadverse interest and mortality selection withparticipants choosing the lump sum option.-6-

Summary of Retirement System ProvisionsParticipationDefmitionsCredited ServiceAll first-class city paid police officers are coveredautomatically. There are no eligibility requirements.iVIost recent period of uninterrupted service as a City ofGrand Island police officer.Average CompensationAverage of the regular monthly pay of a police officerduring the final 5 year period prior to normalretirement, early retirement, disability or death.Normal Retirement DateAge 60 and 25 years of service (21 years beforeNovember 18, 1965).Early Retirement DateAge 55 and 25 years of service.Retirement Value1he Retirement Value consists of the followingcomponents, all accumulated at the net rate of interestean1ed by the Fund:1. Police officer contributions made prior to January1, 1984 with interest accumulated to that date.2. l\tlatching 6 /o police officer/City contributionsmade after January 1, 1984.BenefitsNormal RetirementThe monthly benefit which can be provided by theofficer's Retirement Value at the t:in:!e of retirement.For officers participating iii the system prior to January1, 1984, and satisfying the requirements for normalretirement, the monthly benefit is to be no less than50o/o of Average Compensation.Early RetirementSame as Normal Retirement, except that for officersparticipating in the system prior to January 1, 1984, andsatisfying the requirements for early retirement, theminimum benefit is 40 /o of Average Compensation.Duty-Related DisabilityMonthly annuity equal to 50 /o of AverageCompensation, reduced by the amount of Workmen'sCompensation benefits.-7-

Non-Duty Related DisabilityIf not eligible to retire, same as termination benefit. Ifeligible to retire, same as retirement benefit.Duty-Related Deathl\tlonthly annuity, payable to spouse or dependentchildren, equal to 50 /o of Average Compensation,reduced by the amount of Workmen's Compensationbenefits. The monthly benefit will be the amount thatcan be purchased by the Retirement Value, if greater.Non Duty-Related DeathFor officers participating in the system prior to January1, 1984, a minimum monthly annuity, payable to spouseor dependent children, equal to 25 /o of AverageCompensation, if death occurs between ages 55 and 60,after 21 years of service. Otherwise, benefit is same astermination benefit, except that the officer will beconsidered to be fully vested at the date of death. Ifeligible to retire on date of death, benefit is same asduty-related.Termination BeneBtBenefits upon tennination equal to the officer's vestedThe vesting percentages areRetirement Value.determined according to the following schedule and areapplicable only to that portion of the Retirement Valueattributable to City contributions:Years of ServiceLess than 445678910ContribudonMemberCityVested PercentageQOJo40so60708090100Police officers contribute at the rate of 6 /o ofcompensation.The City contributes 6 /o of each police officer'scompensation plus any additional amounts needed tofund system benefits.-8-

PARTICIPANT C ENSUS STATISTICSPOLICE O FFICERSJanuary 1, 2011ACTIVE PARTICIPANTS IN CLUDED IN VALUATION- PRE-84 HIRES ONLYAge a tValuation D a teM a leUnder 2020-2425-2930-3435-3940-4445-4950-5455-5960-6465 & Over0000000350Q0000000000Q0000000350Q808NumberF emaleTotalNON-ACTIVE PARTICIPANTS INCLUD ED IN VALUATIONRetired Participants or Bene ficiariesDisabled ParticipantsTotal-9-Numb erAnnual Benefits0Q 0Q0 0

.1PUBLIC EMPLOYER RETIREMENT PLAN ANNUAL REPORT(Due on or before December 31 each calendar year)Public Employer:Citv of Grand Island, Nebraska Firefighters' Retirement SystemPlan and TrustType of Retirement Plan: .:C o n;!.!1 b in a;!.!ti o! .n Plan YearJan-Dec(e.g. defmed benefit, defined contribution)(e.g. Jan-Dec., July-June)Plan year covered by this report: --'J an uar ·J.y-21'-'-,- -2: .0 13 to D ec e m b e r - -3 1-'-',2 0 1!:. 3 ------Number ofPlan Participants:Contribution Rates:81Employee:6.5%Employer: .21. .3.!. .o o/c - - - - - -- - - - - -- - - - Plan Assets: 13.243.022.08 as of December 3 1 201 3P lan Liabilities:None: all assets are available for benefitsNames and Positions of Persons Administering the Plan : A retirement committee has beenestablished to supervise the general operation of the retirement p lan. The members of theretirement committee, as of December 3 1,20 13, were:Jaye MonterPhil ThomasTom CoxTodd MorganScott KuehlChuck HaaseNames and Positions of Persons Investin g Plan Assets:The funds in the retirement plan are invested by the retirement committee. The m embers of theretirement committee are listed above. Wells Fargo Bank. N.A. serves as directed trustee andcustodian of the assets of the retirement plan .OS 16X/019SX-E-l

Form and Nature of Investments:The assets of the plan are invested in mutual funds and a bank co llective investment fund.If a defined contribution plan, full description of investment policies and options available toplan participants:A list of the investment options avail able to plan participants is attached to this report.If a defined benefit plan, the number of members who are eligible for a benefit and the totalpresent value of such members' benefits, as well as the funding sources which will pay for suchbenefits:A copy of the most recent quadrennial actuarial report for the plan is attached to tllis report.Date:Jaye Monter. City Treasurer/Finance DirectorMai ling Address:100 East 1st StreetGrand Island, NE 6880 1Telephone Number:(308) 385-5444 ext. l 690516X/O 195X-E-2

City of Grand Island, NebraskaFirefighters' Retirement System Plan and TrustDescription of Investment Options Available to ParticipantsThe retirement committee has selected the following investment options to be available to planparticipants:NAME OF FUNDWells Fargo Stable Return Fund N4Federated Total Return Gov SSWells Fargo Advtg Core Bond AdminAmerican Funds American Balanced R4MFS Value R3Wells Fargo Advtg Index AdminDreyfus AppreciationMainStay Large Cap Growth R1JP Morgan Mid Cap Value AArtisan Mid Cap InvWells Fargo Advtg Small Cap Value InvT. Rowe Price Small Cap StockWells Fargo Advtg Emerging Growth AdminAmerican Funds EuroPacific Growth R4Wells Fargo Advtg Diversified Equity AdminWells Fargo Advtg Dow Jones Target Today AdminWells Fargo Advtg Dow Jones Target 2010 AdminWells Fargo Advtg Dow Jones Target 2020 AdminWells Fargo Advtg Dow Jones Target 2030 AdminWells Fargo Advtg Dow Jones Target 2040 AdminWells Fargo Advtg Dow Jones Target 2050 IXWFLWXWFQDX

,,City Of Grand Island. Retirement System ForFirefightersJanuary 1, 2011Actuarial Valuation Report

t; Milliman1120 S. 101 51 Street, Suite 400Omaha, NE, 68124USATelFax 1 402 393 9400 1 402 393 1037milliman.comMay 12,2011ACTUARIAL CERTIFICATIONMs. !vlary Lou BrownFinance Director/City TreasurerCity of Grand Island100 East First StreetBox 1968Grand Island, NE 68802Re:City of Grand Island Firefighters Retirement PlanDear Ms. Brown:As requested, we have performed an .Actuarial Valuation of the City of Grand Island FirefightersRetirement Plan as of January 1, 2011. The major findings of the valuation are contained in thisreport. This report reflects the benefit provision and contribution rates in effect as of January 1,2011.In preparing this report, we relied, without audit, on information (some oral and some in writing)supplied by the System's staff. This information includes, but is not limited to, statutory provisions,employee data, and financial information. In our examination of these data, we have found them tobe reasonably consistent and comparable with data used for other purposes. Since the valuationresults are dependent on the integrity of the data supplied, the results can be expected to differ if theunderlying data is incomplete or missing. It should be noted that if any data or other information isinaccurate or incomplete, our calculations may need to be revised.All costs, liabilities, rates of interest, and other factors for the System have been determined on thebasis of actuarial assumptions and methods which are individually reasonable (taking into accountthe experience of the System and reasonable expectations); and which, in combination, offer ourbest estimate of anticipated experience affecting the System.Future actuarial measurements may differ significandy from the current measurements presented inthis report due to such factors as the following: plan experience differing from that anticipated bythe economic or demographic assumptions; changes in economic or demographic assumptions;increases or decreases expected as part of the natural operation of the methodology used for thesemeasurements (such as the end of an amortization period or additional cost or contributionrequirements based on the plan's funded status); and changes in plan provisions or applicable law.Due to the limited scope of our assignment, we did not perform an analysis of the potential range offuture measurements. The Board ofTrustees has the final decision regarding the appropriateness ofthe assumptions and adopted them.Offices in Principal Cities Worldwide

Ms. Mary Lou BrownMay 12, 2011Page 2MillimanA ctuarial computations presented in this report are for purposes o f determining the recommendedfunding amounts for the System. The calculations in the enclosed repoti have been made on a basisconsistent with our understanding of the System's funding requiremen ts and goals. D eterminationsfor purposes o ther than meeting these requirements may be significantly different fro m the resultscontained in tlus report. Accordingly, additional determinations may be needed for other purposes .iVlilliman's work is prepared solely for the internal business use of the City of Grand Island("System"). To the extent that l'vlilliman's work is not subject to disclosure under applicable publicrecords laws, iVlilliman's work m ay no t be provided to tlurd parties without iVIill.iman's prior writtenconsent. :i'vlilliman does not intend to benefit or create a legal du ty to any third party recipient of itswork product. Nfill.iman's consent to release its work product to any third party may be conditionedo n the tllird party signing a Release, subject to tl1e following exceptions:(a) T he System may provide a copy of Mjlliman's work, in its entirety, to the System'sprofessional service advisors who are subject to a duty of confidentiality and who agree tonot use iVIilliman's work for any purpose o ilier ilian to b enefit the System.(b) The System may provide a copy of i\ 1illiman's work, in its entirety, to otl1er governmental1entities, as required by law.No third party recipient of iVIill.iman's work product should rely upon iVlilliman's wod product. Suchrecipients should engage qualified professionals for advice appropriate tO tl1e.ir own specific needs.T he consultants who worked on tlus assignment are pension actuaries. iVlilliman's advice .is notintended to be a substitute for qualified legal or accounting counsel.On tl1e basis of tl1e foregoing, we hereby certify that, to tl1e best of our knowledge and belief, thjsreport is complete and accurate and has been prepared in accordance wiili generally recognized andaccepted actuarial principles and practices. We are members of the American Academy of Actuariesand meet the Qualification Standards to render the ac tuarial opinion contained herein.We respectfully submit the following report, and we look fo rward to discussing it wiili yo u.I, Gregg Rueschhoff, am a consulting actua ry for iVIilliman. I am a member of tl1e AmericanAcademy of Actuaries and meet ilie Qualification Standards of ilie American Academy of Actuariesto render tl1e actuarial opinion contained he rein.Sincerely,6 ··d Gregg Rueschhoff, ASAPrincipal & Consulting ActuaryEnrolled Actuary No. 11-04349Enclosure

Table of ContentsValuation Summary Report SummaryDisplay of .Annual Cost12V aluati.on Detail Fund AssetsAnnual Normal Costs34Valuation Basis Actuarial JviethodsActuarial AssumptionsSummary of Retirement System ProvisionsParticipant Census Statistics5679

Report SummaryOn January 1, 1984, the Retirement Systems for Firefighters of First Class Cities in the State ofNebraska were revised. The system that became effective was a Defined Contribution system, withthe employees and the City each making annual contributions to the Pension Funds.Pre-84 HiresFirefighters who were hired prior to January 1, 1984 were assured of receiving retirement benefitsunder the new system at least as great as those that would have been available under the priorsystem. This actuarial valuation has been prepared to evaluate the additional funding required, if. any, to provide these benefit guarantees.Based on the actuarial valuation, it is anticipated that the unallocated account is sufficient to providethe minimum defined benefits for the remaining pre-84 hires. Therefore, it is anticipated that noadditional contribution will be required to be contributed to the unallocated account.Post-84 HiresFirefighters hired after January 1, 1984 are eligible for special duty-related death and disabilitybenefits. However, the expected number of occurrences is considerably less than 1.0. Therefore,any prefunding of the benefit will generate way too little funds (if an actual death or disabilityoccurs), or will create unneeded funds (if none occur). We have not included a specific liability forthe post-84 benefit.-1-

Display of Annual CostT he annual cost fo r the year beginning J anuary 1, 2011 is displayed below. 01.Annual N ormal Cost for 20112.Projected 2011 Payroll for pre-84 H ires3.Total Annual Contributions as a Percentage of Pay (1 7 2)66,508-2-0.0%

Fund AssetsFund Assets on March B, 2011Employer and Employee Contribution Account * 527,96221,853Unallocated and Forfeiture Account 549,815Total Assets* For pre-84 Firefighters only-3-

Annual Normal CostT he annual no rmal cost is de termined by following the s teps o utlined below. T he annual no rmalcost is the portion o f the to tal plan co sts assigned to the current plan year by the Actua ria l CostMethod.January 1, 20111.Actuarial Present Value of Future l'v.linimum BenefitsssActive ParticipantsRetired ParticipantsTotal2.Unallocated Assets3.Ac tuarial Present Value offi'uture Normal Costs(1 - 2, but not less than zero)4.Actuarial P resent V alue of F utu re Salaries:t5.Normal Cost Accmal Rate (3 7 4). 6.7. 5705721,8530452,3990Total Current Annual Covered Salaries *66,5080A nnual Normal Cost (5 x 6)Only includes employees eligible for minimum benefits.-4-

Actuarial MethodsActuarial Cost MethodThe Aggregate Actuarial Cost Ivfethod was used to detennine annual plan costs. Using this method,the present value of benefits to be funded by future annual costs is detennined by subtracting planassets from the present value of projected benefits. This result, the present value of unfunded costs,is divided by the present value of future salaries of employees included in the valuation to determinea normal cost accrual rate. The normal cost accrual rate is multiplied by the total of current annualsalaries of employees in the valuation to determine the normal cost.Using the Aggregate l\'Iethod, gains and losses that arise due to actual experience are not directlydetermined and recognized each year. Gains and losses are included in the unfunded costs andaffect the normal cost accrual rate. As a result, gains and losses are spread over the remainingperiod to retirement of employees in the valuation and are recognized as a portion of future annualcosts.Asset Valuation MethodAssets are valued at market value.-5-

Actuarial AssumptionsInvestment Return7 /o - pre-retirement5.5 /o - post-retirementMortality1994 Group .Annuity Mortality Table.Salary ScaleRetirement AgelVIembers who are eligible to retire are assumed toretire according to the probabilities in the followingtable:Probabilityof Retirement55-5960DisabilityNoneTerminationNone prior to retirement eligibilityMarital Status100 /o married, males assumed to be 3 years olderthan females.Load for Lump SumsLiabilities were loaded by 10 /o to reflect the potentialadverse interest and mortality selection withparticipants choosing the lump sum option.-6-

Summary of Retirement Sys

NAME OF FUND Wells Fargo Stable Return Fund N4 Federated Total Return Gov SS Wells Fargo Advtg Core Bond Admin American Funds American Balanced R4 MFS Value R3 Wells Fargo Advtg Index Admin Hartford Cap App HLS IB MainStay Large Cap Growth Rl JP Morgan Large Cap Growth Select JHancock3 Disciplined Value Mid Cap A Aston I air-pointe Mid Cap N