Transcription

Simfund MF DatabaseOverview & Functionality

Table of Contents Overview of Simfund MFAsset & Flow DataMorningstar DataLipper DataGraphsBenchmark Index ReturnsFee & Expense DataProspectus DataService Provider DataViewsLinks to Simfund Filing345691415172122232

What’s Included In Simfund MF?Simfund MF Includes Data on All US Registered Mutual Funds, ETFsand Closed-End Funds Including: Total Assets & Net New FlowsMorningstar Data– Classifications, Performance, Star Ratings, Rankings, Investment Statistics, andMPT Statistics Lipper Data (150 Data Items)– Classifications, Performance, Leader Scores, Survivorship-Bias Free Rankings,Statistics, and Link to Lipper’s Fund Fact Sheets Fee & Expense Data– Key Expenses and Operating Expenses, both current and historical, AdvisoryContract Details Prospectus Data– Fees, Sub-Advisors, Benchmarks Service Provider Data– Advisor, Administrator, Auditor, Custodian, Legal Counsel, Sub-Advisor, TransferAgent Pre-Stored Graphs & Reports3

Asset & Flow Data (At Share Class Level) Fund Assets– Historical Data – monthly to Dec 1992, quarterly to Q1 1988, annually to 1985 Net New Flows– Monthly net flows collected directly from manager for many funds– Proprietary calculation utilized to estimate net flows for funds not directlyreported to Strategic Insight– Historical Data – monthly to Jan 1993, quarterly to Q1 1988, annually to 1988Data Aggregation– Ability to aggregate data to various levels of micro or macro industry analysis Fund Share Class Portfolio (Combines All Share Classes) Manager Service Providers (Sub-Advisor, Custodian, Transfer Agent, etc.) Morningstar / Lipper Categories Various Fund Types / Asset Classes / Objectives Specialty Fund Structures (ETFs, Fund of Funds, Lifecycle, Index, SRI, etc.)4

Morningstar Data Morningstar Data Points––––––Categories (Current and Historical)Performance – Monthly Total Return Data for 10 YearsCategory RankingsMorningstar Category Average and Index Total ReturnsStar Ratings (Current and Historical)Portfolio Composition Details on Fund Holdings Including Style, Market Cap, Country, Region,Equity Sectors, Fixed-Income Ratings, Valuations Metrics– MPT Statistics Alpha, Beta, R-Squared, Sharpe, Treynor, etc.– Top 10 Holdings Name of Security, % of Fund’s Assets, Ticker Symbol, CUSIP– Portfolio Manager Information Up to 5 Managers: Start Date, Tenure, Biographical Info5

Lipper Data Lipper Data Points––––––––Classifications (Current and Historical)PerformanceRankings (Survivorship Bias-Free Rankings)Lipper IndicesLipper Leader ScoresAsset CompositionLipper FlagsMPT Statistics Link to Lipper’s Fund Fact Sheets– Link directly from Simfund to pre-formatted PDF fund fact sheets fromLipper’s website Early Update for Lipper Performance– Includes Performance and Rankings– Released 5th business day of each month vs. 9th business day for fulldataset6

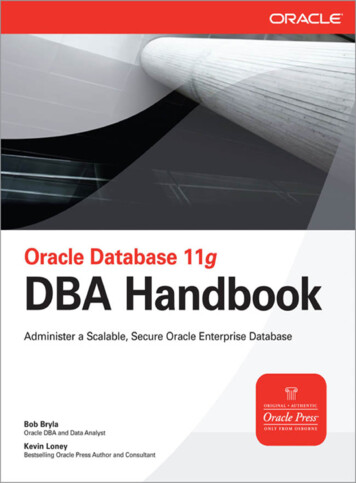

Multi Source Data IntegrationStrategic Insight Asset& Flow DataFund NameJanus Contrarian FundJanus OverseasJanus Adv Forty -SJanus Adv Intl Growth -SJanus Mid Cap Value -InvJanus High Yield BondJanus Global ResearchJanus Adv Long/Short -AJanus Adv Contrarian -AJanus Adv Fundamental Equity-SJanus INTECH RiskMgd StockJanus Adv Small Company Val -SJanus Adv INTECH RiskMngd Cr-SJanus Adv Mid Cap Value -SJanus Adv INTECH RiskMngd Gr-SJanus ResearchJanus Adv INTECH RiskMgdIntl-AJanus Adv Orion -AJanus Adv Float Rate Hi Inc -AJanus Adv Mid Cap Growth -SJanus Adv Intl Equity -AJanus Adv INTECH RiskMngd Vl-AJanus Adv Small Mid Growth -AJanus Adv High Yield -AJanus EnterpriseJanus Adv Flexible Bond -SJanus Federal TxExJanus Short Term BondJanus Glbl OpportunitiesJanus Adv Large Cap Growth -S6/07Assets Net New Flows ( 47-13Jun'07MstarRating55553354343343332323Lipper Data (Classifications, Returns,Ranks, Class Averages, etc.)LipperClassificationMulti-Cap CoreIntl Multi-Cap GrowthLarge-Cap GrowthIntl Multi-Cap GrowthMid-Cap ValueHigh Current YieldMulti-Cap GrowthLong/Short EquityMulti-Cap CoreLarge-Cap CoreMulti-Cap CoreSmall-Cap CoreMulti-Cap CoreMid-Cap ValueMulti-Cap GrowthLarge-Cap GrowthTotalRet %38.5843.9121.9041.7322.0011.0129.25Mid-Cap GrowthLoan ParticipationMid-Cap GrowthIntl Multi-Cap GrowthMulti-Cap ValueSmall-Cap GrowthHigh Current YieldMid-Cap GrowthIntmdt Inv GradeGeneral Muni DebtShort Inv GradeGlobal Multi-Cap ValueLarge-Cap 024.1319.0025.0510.8624.655.653.065.1228.5420.021 Year as of 6/07 (Lipper)Class Quintile Fund # Funds TotalAvg % RankRank in Class Ret 715.0318.7254385148.4916.371171712.873 Years as of 6/07 (Lipper)Class Quintile Fund # FundsAvg % RankRank in 182783827448545022119538614Early update for Lipper performance and rankings is available on the 5th business day of each month.7

Lipper Data – Link to Fund Fact SheetsUse Lipper’s Fund Fact Sheets for a quickfund overview.8

Extensive Graphing CapabilityA full range of pre-stored graphs in Simfund allows you to run analysis on assets andflows, risk/return characteristics, fees and expenses and portfolio composition.American Funds - Equity FundsYTD Flows & 3Yr Risk/Return w/in Mstar Ctg as of Sep'07100%New EconomyFundamental InvestorsSmall Cap WorldLower 3 YR RELATIVE RETURN HigherGrowth Fund of America80%Income Fund of AmericaCapital World Growth & IncomeEuropacific Growth60%Investment Company of AmericaNew PerspectiveCapital Income BuilderAmerican Balanced40%AMCAPEndowments Growth & Income Washington MutualAmerican Mutual20%BLUE Bubble InflowsRED Bubble OutflowsBubble Size Net Flow New World0%100%80%60%40%Lower 3 YR DOWNSIDE RISK Higher920%0%

Morningstar GraphsFirst Am Mid Cap Growth OpportPortfolio Opportunity Profile by Morningstar Categoryas of Sept '07Historical Assets and FlowsNet New Flows (SI)Portfolio (SI)2.50Avg of Mstar Category (SI)Avg of SI Fund Type (SI)6001.884501.253000.631500.000-0.63-1.251997 1998 1999 2000 2001 2002 2003 2004 2005 0560%12/0140%20%0%80%60%40%20%0%Lower 3 YR Relative Downside RISK Higher80% 29 MM60%40%20%0%100%80%60%40%20%Lower 3 YR Relative Downside RISK HigherFacts as of 9/07Annual Total ReturnsPortfolio (SI)Avg of Mstar Category (SI)Morningstar CategoryLipper ClassificationSI ObjectiveProspectus Benchmark - 1st706050SI Fund TypeTotal AssetsNet New Flows - YTD40% ReturnMar'0712/069/07100%Dec'06Latest 3-Month Flows vs. Risk/Return PositioningRelative to Morningstar Category12/0412/02Lower 3 YR Relative RETURN Higher0.00-0.50Risk vs. Return Consistency 3-Year PeriodsRelative to Morningstar Category12/0380%0.50-150Lower 3 YR Relative RETURN Higher100%1.00Flows as % AssetsTotal Assets - B1.50Net New Flows - MMUse thePortfolioOpportunityProfile toanalyze a fundrelative to itsMorningstarCategory,Lipper Class orSI Objectivepeer group.Monthly Cash Flows as a % of AssetsTotal Assets (SI)Mid GrowthMid-Cap GrowthMidcap EquityRussell Mid Cap GrowthEquity 1.96 B 27 MM30Annualized Returns:1 Yr3 Yr5 Yr10 992000200120022003200420052006Ytd9/0710Lipper Leader Consistent ReturnMorningstar RatingSharpe Ratio 3YrBeta (S&P 500) 3 Yr1¹¹¹¹1.321.240%

Morningstar Investment ProfileDodge & Cox StockMorningstar Investment ProfileFund InformationMorningstar RatingCategoryNASDAQ TickerInception DateClosed to All InvestorsClosed to New Investors¹¹¹¹¹Large ValueDODGX1/4/1965NoYesComposition%US StocksNon-US StocksUS BondsNon US BondsPreferredConvertibleCashOtherStock owth31%1%ManufacturingServicesInformationSectors %HardwareSoftwareMediaTelecomConsumer ServicesHealthcareBusiness ServicesFinancial ServicesIndustrial MaterialsEnergyConsumer 8.5%18.2%0.3%7.2%9.2%-2.0%1 Month-1.5%394611,4546 Months7.2%505861,4241 Year19.7%687651,3463 Years16.0%151341,0995 Years14.8%64183010 Years13.1%13392Morningstar RatingsMorningstar ReturnMorningstar Risk3 Year¹¹¹¹Above AvgAvg5 Year¹¹¹¹¹HighAvg10 Year¹¹¹¹¹HighAvgOverall¹¹¹¹¹HighAvgAlpha vs. (S&P 500)Beta (S&P 500)R2 (S&P 500)Sharpe RatioTreynor 70.7666.60.6912.34Net New Flows MMAssets MMOverall Star RatingCategoryAnn. Total Return %Category Average% /- DifferenceTotal Return %Percentile RankFund Rank# of FundsPrice/EarningPrice/BookPrice/Cash FlowPrice/SalesAvg Market Cap MM14.961.748.951.1349,60811StatisticsAsset in top 10 Holdings %Number of StocksNumber of BondsTurnover Ratio29.1%8114.00

Morningstar ScorecardMixed Equity FundsMix-Asset Targ 2010Mix-Asset Targ 2020MstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 YearPrice Retirement 201Price Retirement t Targ 2030MstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 YearPrice Retirement 2020Price Retirement 201541,297.1646.15,6542,83019.65Sector12.92 EquityPriceRetirement 203Funds18.19 12.03Price Retirement 202Financial ,261412251821.8721.8421.8114.4414.40Price Instl Large CapPrice InstlConcntrt LOptions Arbitrage/ StrategiesMstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 257723.2414.70MstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 YearCoreEquityPortfolios20.30 Domestic12.11 Long/Short14.75Price NewEraEquity13.19 Price Capital Opportu3-0.624421.4311.70Real turns as of 6/07MstarFlows AssetsRating Ytd-6/076/07 1 Year 3 Year 5 YearReturns as of 6/07MstarFlows AssetsRating Ytd-6/076/07 1 Year 3 Year 5 Year11.08 Price Growth Stock53,662.24614.72-1.0Price Tax Efficient GFlowsPriceAssetsInstl LargeReturnsCap3as of 6/07-17.0PriceBlue Chip GrowS&P 500IndexMstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 YearPriceAllRealEstateMix TgtMod4MstarFlows Assets Returns as of 6/07Rating CoreYtd-6/076/07 1 Year 3 Year 5 YearMstarRating Ytd-6/0723.09 Mix20.47TgtPriceEquityIndex 50AllocCon11.04MstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 810.346.099.0211.9010.347.116/07 1 Year 3 Year 5 Year9,27020.1811.3310.40MstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 Year9.2011.1613.6111.479.18 Price Retirement Inco 4172.4 1,138 12.378.3310.20 Price Tax Efficient B3-2.439 10.825.406.06Returns as of 6/07Returns as of 6/07Returns as of 6/07MstarFlows AssetsMstarFlows AssetsMstarFlows Assets12.816/07 1 Year 3 Year 5 YearRating Ytd-6/076/07 1 Year 3 Year 5 YearRating Ytd-6/076/07 1 Year 3 Year 5 YearRating e & TechSector Equity FundsSpecialty & Misc525.53,86623.2315.4414.20 Price New America G 3-44.283418.798.8310.58Price Spectrum GrowReturnsMstarFlows Assets Returns as of 6/07MstarFlowsMstar 11.69Flows Assets Returns as of 6/0752120.0712.57PriceAssetsTotal EquityMk 4as of 6/0719.9Price DividendGrow 3 Year4-27.291522.18 Rating12.53 Ytd-6/0710.42Rating Ytd-6/076/07 1 Year 3 Year 5 YearRating Ytd-6/076/07 1 Year5 Year6/07 1 Year 3 Year 5 Year-207.61,57421.0511.109.89Price Growth & Incom 3Price Global Technol44.9157 24.28 11.27 15.28-3.551 22.699.11 12.59Price Developing Tec 33-336.3 3,193 26.197.45 10.70Price Science & TechMulti-CapPrice Persnl StrategyPrice BalancedPrice Persnl StrategyPrice Persnl Strategy4MstarFlows Assets Returns as of 6/07RatingValueYtd-6/076/07 1 Year 3 Year 5 YearMstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 YearMix Tgt All Gro3,7792,564Natural ResourcesReturns as of 6/07MstarFlows Assets6/07 1 Year 3 Year 5 YearRating Ytd-6/07Large-Cap55876.1599.5MstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 Year13.05Mix-Asset12.43 PriceHealthSciencesTarg2050 MstarFlows Assets Returns as of 6/076/07 1 Year 3 Year 5 YearRating Ytd-6/07Price Retirement 204Price Retirement 203Price Retirement 204Price Retirement 205Price Retirement 20555Health/BiotechMstarFlows Assets Returns as of 6/076/07 1 Year 3 Year 5 YearRating Ytd-6/07PriceFinancialServicMix-AssetTarg2030 MstarFlows Assets Returns as of 6/07Rating Ytd-6/076/07 1 Year 3 Year 5 YearSpecialty Dvsfd EqReturns as of 6/07MstarFlows Assets6/07 1 Year 3 Year5 YearRating Ytd-6/07TelecommunicationMid-CapMstarFlows Assets Returns as of 6/076/07 1 Year 3 Year 5 YearRating Ytd-6/07MstarRating Ytd-6/07Price Media & Teleco5272.9Returns as of 6/07MstarFlows Assets6/07 1 Year 3 Year 5 YearRating Ytd-6/07128,64942026.3719.276/07 1 Year 3 Year 5 17,95114.4114.3014.42Returns as of 6/07MstarFlows AssetsRating Ytd-6/076/07 1 Year 3 Year 5 Year16.8916.57 Price Diversified Mid37.6ReturnsMstar 15.92Flows15.66PriceAssetsTax EfficientM2as of 6/07-0.44-39.5Price InstlCap E 3 YearRating Ytd-6/076/07Mid1 Year5 Year4-311.5Price Mid-Cap GrowtReturns as of 6/07MstarFlows AssetsRating Ytd-6/076/07 1 Year 3 Year 5 YearPrice Instl Small CapPrice Small Cap ValuPrice Small Cap StockSmall-CapView a manager’s entireproduct line usingMorningstar Categories orLipper Classifications.Returns as of 6/07MstarFlows AssetsRating Ytd-6/076/07 1 Year 3 Year 5 YearUtilityPrice Mid Cap Value5382.1ReturnsFlowsM 4as of 6/0741.6PriceAssetsExtended Eqty13.5615.9413.2913.30 Price Diversified Sm15.86 Price New 409.6016.2215.7710.9115.8615.25Returns as of 6/07MstarFlows AssetsRating Ytd-6/076/07 1 Year 3 Year 5 9

Lipper GraphsAlger Capital Appreciation - A vs. M ulti-Cap Growth FundsTrailing Returns as of 6/07 (Primary Class Only)Alger Capital Appreciation - A vs. M ulti-Cap Growth FundsRolling 3 Year Returns (Primary Class Only)50.040.03 Year Total Return (LI) - %45.0Total Return (LI) - 05.00.0-80.0YTD1st Quintile2nd Quintile1 Year3rd Quintile3 Year4th Quintile5 Year5th Quintile10 Year12/02Alger Capital Appreciation -A1st Quintile12/032nd Quintile3rd Quintile12/044th Quintile12/055th Quintile12/06Alger Capital Appreciation -AAccess additional graphs that use Lipper data. For example, floating bar charts comparethe performance of an individual fund to the performance range of its Lipper peer group.You can also create your own peer groups in Simfund MF.136/07

Benchmark Index Returns Performance Data on Over 900 Indices Ability To View Benchmark Returns AlongsideFund Returns Benchmark Providers–––––MSCI BarraRussellStandard & Poor’sMorningstarLipper14

Fee & Expense Data Researched From Audited Annual Report Key Expenses (both as % of AUM and amount)––––––Advisory FeeSub-Advisory FeeAdministration Fee12b-1 FeeReimbursementsTotal Expense Ratio Operating Expenses (both as % of AUM and amount)––––Auditor FeeTransfer Agent FeeCustodian FeeMore Detailed Fee Breakout Advisory / Administrator Fee Contract Data– Advisory / Administrator Fee Contract Breakpoint Schedules– Hypothetical Breakpoint Fee Schedules 12b-1 Details15

Fee & Expense AnalysisMorningstar Mid Cap Growth CategoryHypothetical Advisory Fees by Portfolio with Benchmarks1.100Hypo Advisory Fee % 0,000Asset Level MM80th PercentileMedianAverage20th PercentileFirst Am Mid Cap Growth OpportConduct a wide range of fee and expense analysis in Simfund. For example, youcan compare a fund’s hypothetical advisory fee schedule to its peer funds.16

Prospectus Data Prospectus Fees–––––Prospectus data complements fee andManagement Feeexpense data from the the auditedExpense WaiversAnnual Report.12b-1 FeeTotal Expense RatioUnderlying Funds’ Composite Expense Ratio (Fund of Funds) Advisory / Sub-Advisory Fee Contract Data– Advisory / Sub-Advisory Fee Contract Breakpoint Schedules– Hypothetical Breakpoint Fee Schedules Stated Performance BenchmarksBreakout of Multiple Sub-AdvisorsDate of Latest Prospectus or SupplementLink to SEC Documents (i.e. Latest Prospectus)17

Prospectus Data - Prospectus FeesView the underlying funds’composite expense ratio forFund of Funds.The prospectus fee data complements the fee data from the auditedannual report. This allows users to view fee data for newer funds andobtain forward looking expense information.ManagementFee %Fund of Funds6/07 TotalAssets MMFranklin Tmpl Founding All-AFranklin Tmpl Coreflio -AFranklin Tmpl Modrt Trgt -AFranklin Tmpl Growth Trgt -AFranklin Tmpl Perspct Aloc-AFranklin Tmpl Consrv Trgt -AFranklinTmpl 2025 RtrmTrgt-AFranklinTmpl 2015 RtrmTrgt-AFranklinTmpl 2035 RtrmTrgt-AFranklinTmpl 2045 0.25Regular FundsFund NameFranklin Income Series -ATempleton Growth -AMutual Shares -ZFranklin CA TxFr Income -ATempleton Foreign Series -ATempleton World -ATIFI Foreign Equity SeriesFranklin Federal TxFr Inc -AFranklin Small-Mid Cap Gro-AFranklin Hi Yield TxFr 0.250.25ExpenseWaiver %OtherFee %12b-1Fee%UnderlyingFund Exp %Total Exp %ProspectusUpdate .250.10

Prospectus Data – Stated BenchmarksPortfolio NameBaron PartnersMeridian GrowthLongleaf Partners Small CapBaron AssetFidelity Low Priced StockOppenheimer Small Mid Cp ValueRoyce Premier SharesDFA US Micro CapDFA US Small CapDWS Dreman Small Cap ValFidelity Small Cap StockKeeley Small Cap ValueLord Abbett Sml Cap ValueManagers Special EquityOppenheimer Main St Sm CapPennsylvania MutualRoyce Low Priced StockThird Avenue Small Cap ValueWells Fgo Avtg Small Cap ValueiShares Russell 2000 IndexFidelity Adv Small CapRoyce Value PlusRoyce Total ReturnNB GenesisBaron GrowthBaron Small CapFidelity Small Cap IndependSEI SIIT Small CapArtisan Small Cap ValueRoyce Opportunity6/07 TotalAssets 2,777ProspectusBenchmark 1Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000Russell 2000R

Janus Adv Mid Cap Value -S 107 15 25. 6. 3 Mid-Cap Value 21.97 22.33 3 140 297 15.03 16.35 4 152 232 Janus Adv INTECH RiskMngd Gr-S 163 36 44. 3. 3 Multi-Cap Growth 13.92 18.72 5 438 514 8.49 11.41 5 330 410 Janus Research 4,463 -408 -1,028. 3. 4 Large-Cap Growth 27.70 16.37 1 1 717 12.87 8.14 1 11 614 Janus