Transcription

DEVELOPING & UPDATING YOURESOP ADMINISTRATION TIMELINE

“If you fail to plan, you plan to fail” A good administration timeline accomplishes these objectives:– Outlines the key requirements and deadlines to keep your ESOPon track– Covers the issues, month by month, throughout the plan year– Provides the framework of an annual review process to help satisfyyour fiduciary obligations as Plan Administrator and/or Plan TrusteeNote, this guide was developed based on an ESOP with aDecember plan year end.2

Pre-planning in December Perform due diligence on your team of ESOP advisorsEngage ESOP advisors as neededPre-allocation meeting with your Third Party Administrator (TPA)– Review of the prior year’s administration process– Discuss any amendments that took place during the plan year– Will the ESOP need an audit for the plan year?– Review key dates for the upcoming administration timeline for the currentplan year end Preparation of the employee census data file for the plan year Delivery of bank statements and employer contribution Expected date of receipt of the final stock value (check with valuationfirm/Trustee)Year-end Data Request from TPAProcess Required Minimum Distributions (RMDs)3

January Distribute Preliminary ESOP Diversification FormsOrganize census informationComplete Annual Information and Questionnaire FormsPrepare benefit payment government filings– IRS Form 1099-R– IRS Form 1096– IRS Form 9454

January Amend and restate Plan Document based on the IRS scheduleLast Digit of PlanSponsor's EINCycleCurrent Submission Period (and Next5-Year Cycle) Opens and Ends1 or 6A02/01/2016 - 01/31/20172 or 7B02/01/2017 - 01/31/20183 or 8C02/01/2018 - 01/31/20194 or 9D02/01/2019 - 01/31/20205 or 0E02/01/2015 - 01/31/2016Submit to IRS for Determination LetterNotify new participants– Distribute Summary Plan Description (SPD) and Summary ofMaterial Modification(s) (SMM) to new participantsNote, this must be done within 90 days of eligibility, so depending on yourplan’s entry dates (quarterly, semi-annual, etc.) you’ll do this multiple timesduring the plan year5

February Census data review by TPADetermine eligibilityPerform preliminary compliance testing– Compensation Limit Determination– Elective Deferral Limit– Deduction Test– Restricted Participant Determination– Anti-Abuse Test (S Corp only)– Coverage TestGather ESOP trust activity for the Plan YearDraft preliminary ESOP trust accounting reports6

March Complete company financial statements for prior yearProvide financial statements to Valuation Firm (a.k.a. “Appraiser”)Corporate tax return due date if not extended – March 15thDraft preliminary Allocation Report on a participant levelEligible participants should return Preliminary Diversification Forms(within 90 days after the plan year end)7

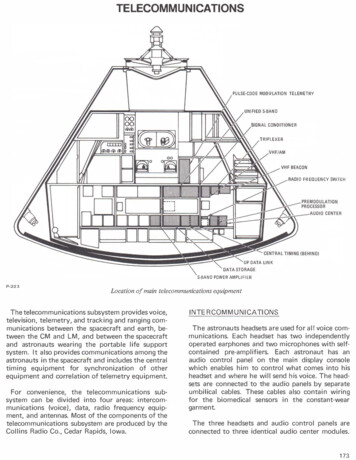

April Last day to distribute RMDs for participants who first met requirementsduring prior calendar year – due by April 1stAppraiser conducts on-site due diligence and/or management interviewsAppraiser delivers draft Valuation Report to the Trustee(s)Trustee meets with Appraiser to review draft Valuation ReportThe Stock Valuation ProcessCompanyfinancialstatementspreparedCompany financialstatements provided toValuation serand ESOP Trusteereview valuationreportTrusteedetermines finalstock value8

May Appraiser provides final Valuation Report to the Trustee(s)Trustee determines stock value and forwards copies to accounting firmand TPAAccounting firm releases final financial statementsTPA issues final ESOP administration reports and compliance testingreportsReconfirm ESOP plan audit dates (if applicable)Post-allocation meeting with TPAConduct employee meetingsDeliver participant statementsDetermine distribution and diversification eligibility amountsDeliver distribution and diversification packages to eligible participants9

June Distribution and diversification election windows closeElection forms are reviewed and Advice to Trustee Report is preparedDiversification election amounts are processed (within 90 daysfollowing election period or 180 days after the plan year end)Distribution elections are processedAccounting firm completes ESOP plan audit10

July File IRS Form 5500, IRS Form 8955-SSA, appropriate schedules, andaudit report (if needed) – July 31st if not extendedDue date for delivery of participant statement is the same as the duedate for the IRS Form 8955-SSA – July 31st if not extendedIf the SPD was updated or an SMM was prepared, deliver it to allparticipants within 210 days after the close of the plan year in whichadoptedNote, you are required to provide all participants with an updated SPDat least every 5 years, even if there were no amendments11

AugustTake a break from the ESOP administration cycle – you deserve it!12

September Corporate tax return due date if extended – September 15thPrior year accrued contributions must be deposited in the ESOP Trustby corporate tax return filing– If contributions are made in stock, company’s Board must authorizein-kind contribution and stock certificates must be issued to theESOP TrustDeliver Summary Annual Report (SAR) to ESOP participants –September 30th if the IRS Form 5500 was not extended (SAR is due nolater than 9 months after the close of the plan year or 2 months afterthe extended due date of IRS Form 5500)13

October Perform preliminary 409(p) compliance testing for S Corporations– Projected contributions– Projected share releasePerform ESOP repurchase obligation forecasting and planningRevisit distribution policyFile IRS Form 5500, IRS Form 8955-SSA, appropriate schedules, andaudit report (if needed) by October 15th if filing was extended14

November Contact ESOP counsel to:– Draft any needed ESOP amendments– Prepare documents for current year ESOP transactions, ifapplicable New ESOP stock purchase from outside shareholders Re-leveraging former redeemed shares15

December Deliver SAR to ESOP participants – December 15th if the IRS Form5500 was extended to October 15thMake sure current year RMDs have been processedStart the December Pre-Planning Process all over again!16

For more information contact:ESOP Partners LLCP.O. Box 1773Appleton, Wisconsin 54912Phone: (920) 659-6000Fax: (866) 337-1095www.esoppartners.com17

- Outlines the key requirements and deadlines to keep your ESOP on track - Covers the issues, month by month, throughout the plan year - Provides the framework of an annual review process to help satisfy your fiduciary obligations as Plan Administrator and/or Plan Trustee Note, this guide was developed based on an ESOP with a .