Transcription

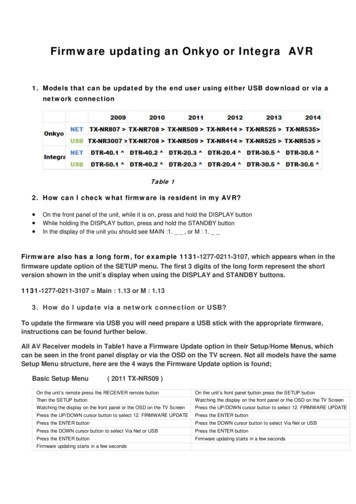

May 2003Published Since 1984ALSO INTHIS ISSUE –What to Do—An IRACustomers Wants HelpCorrecting an ExcessContribution?, Page 2How Many 5498s Mustan Institution Preparefor an Accountholder?,Page 3IRS Guidance—Fair Market Value (FMV)of Stocks and Bonds,Page 3Taking a Look at SafeHarbor 401(k) Plans andSIMPLE 401(k) Plans,Page 4Ten-Year Averaging, Page 7Collin W. Fritz andAssociates, Inc.,“The Pension Specialists” 2003 Collin W. Fritz and Associates, Ltd.Copyright is not claimed in any materialsecured from official U.S. Governmentsources. Published by Collin W. Fritz andAssociates, Ltd. Subscription Rate: 65 peryear.SEP UPDATING —USE PROTOTYPE ORIRS FORM 5305-SEP?There seems to be confusion as to thedifferences in using CWF’s prototype SEP planversus the IRS Model Form 5305-SEP toupdate a financial institution’s SEP customersas required by the IRS.Why Amend?The IRS has mandated that all SEP plans beamended if the adopting employers wish touse the new increased contribution limits. Thelimits have increased to the lesser of 25% ofcompensation, or 40,000. The former limitswere the lesser of 15% of compensation, or 25,000. This is a substantial increase; yourSEP employers will want to be made aware ofthis change and take advantage of it.Why Use a Prototype —You will have to review the SEP plans whichyour customers have had and determine ifthere is a reason for using the prototype. Yourcustomer will want to use a prototype if:1) Their business is run on a fiscal year basis(the 5305-SEP allows only a calendar-yearbasis);2)They desire to have their plan integratedwith social security (in which case the highlycompensated employees can receive a slightlylarger contribution)3) The employer has established any otherpension plan(s). The 5305-SEP can only beused if it is the sole plan of the employer.One other reason is that, for the bank’smarketing purposes, a prototype plan maylook more “professional” than the 5305-SEP.For example, CWF’s SEP kit is provided in aprofession-looking folder, and the adoptionagreement and plan document are in bookletform (8 1/2” x 11”).If none of these reasons are a factor, thenyou will probably want to use the 5305-SEP toupdate your customers.Updating Using a Prototype —To update using a prototype, the customerwill have to complete and sign a newadoption agreement. If you have CWF’sprototype, we have SEP kits available for oneperson and multiple-person SEP plans. In thesekits, you will receive all the forms necessary toupdate your customer’s SEP plan. You willneed to provide them with the IRS opinionletter which was sent to you in April.Updating Using IRS Form 5305-SEP —Unless there is a specific reason to use aprototype (as discussed above), the IRS Form5305-SEP is a perfectly valid means to updateyour SEP customers.To amend using the IRS Form 5305-SEP(available from CWF in a 2-part carbonlessform, or from the IRS web site), your customermerely has to complete and sign the form.They will then be eligible to use the new,increased contribution limits. The advantageto using the 5305-SEP is that it is very simpleto complete, and no IRS filing/fees areinvolved, as with the prototype. Adisadvantage is that, if you do not have CWF’sprototype contract in force, we will not benotifying you as to when changes/updates arenecessary to SEP plans, and you will loseaccess to CWF’s Hotline Consulting on SEPmatters unless you have purchased our totalconsulting through another contract/service.Inactive SEPs — What Can Be Done?Another question financial institutions faceis what can/should be done with a SEP plan towhich contributions haven’t been made foryears. To simplify administration for the bankand the SEP customer, we suggest contactingthose who have not made SEP contributions in4-5 years or longer and putting them on noticethat you will be retitling their SEP-IRA to be anormal, traditional IRA. The letter shouldexplain that the same IRA rules apply to atraditional IRA that applied to the SEP-IRA.You could also state in the letter that if they donot reply to the contrary within 30 days of theContinued on page 2

May, 2003Page 2SEP Updating—Use Prototype or IRS Form 5305-SSEP?Continued from page 1date of the letter, you will automatically retitle the SEP-IRA tobe a traditional IRA.Deadline to Amend —Amending the SEP of your customers is not needed at all ifthey do not wish to take advantage of the larger contributionlimits now allowed (the lesser of 25% of compensation, or 40,000).The deadline to amend using the IRS Form 5305-SEP was tobe 12/31/02, if an employer wished to use the newcontribution limits for 2002. The IRS had set the 12/31/02deadline, and then set yet another deadline of 4/15/03 plusextensions. This obviously is inconsistent, but CWF believes itwould be permissible to use the 4/15/03 plus extensions, ifyour institution would have an employer who has not yetamended and who wishes to use the IRS Form 5305-SEP.The deadline for using CWF’s prototype to amend is 180days after the date on your institution’s IRS opinion letter. Thisdate is April 7, 2003; therefore, institutions using CWF’sprototype have until October 4, 2003, to have their customerssign revised CWF SEP Adoption Agreements.WHAT TO DO—AN IRA CUSTOMERWANTS HELP CORRECTING ANEXCESS CONTRIBUTION?You and other IRA custodians have just mailed out your5498 forms. Some of your customers are realizing they madean excess contribution for 2002. They are now coming to youfor help. The purpose of this article is to suggest a course ofaction and why. Our suggestion is not that you simply tell yourcustomer that he or she must see their tax advisor, or that he orshe must figure it out. You can render some assistance withoutit amounting to tax advice.Example #1 –Contribution Made in 2003 and Withdrawn in 2003Mary Doe (age 55) made a traditional IRA contribution of 3,500 on 4-15-03 for 2002. The problem is—on February 4,2003 she had made a contribution for 2002 to the sametraditional IRA in the amount of 500. She forgot she had madethis contribution. She knows she has an excess contribution of 500 because the 2002 Form 5498 shows she contributed 4,000. She is asking what she must do. She filed her incometax return on April 15, 2003. She is asking if she must amend her2002 tax return and pay the 6% excess tax on the 500, or 30.Suggested Approach to Resolve the SituationYou should suggest she talk with her tax advisor and reviewthe 8606 form (nondeductible contributions) and relatedinstructions. However, you, as the IRA custodian, will need tohelp her because you have the information needed to correctthe situation. You should furnish her with a copy of CWF’s Form#67, Special Explanation for Withdrawing an Excess or CurrentYear Contribution for 2002. This form explains what needs to bedone to qualify for certain special income tax treatment. Theincome earned by the 500 excess contribution must bewithdrawn along with the 500. You may use CWF Form #67Wto calculate the allocable income. You will want to furnish acopy of Form #67W also to the accountholder. Note that a lastin, first-out rule is used. This means the excess was made onApril 15, 2003, rather than on February 4, 2003. It is assumedthe earnings were 7. Five hundred and seven dollars ( 507) willneed to be returned to the accountholder. Your institution, as theIRA custodian, will prepare for her a 2003 Form 1099-R (inJanuary of 2004), and the reason code “81” should be insertedin box 7. The “8” tells the IRS there was an excess contributionand that it is taxable in 2003, and the “1” tells the IRS she owesthe 10% additional tax because she is younger than 591 2.On her 2003 federal income tax return she will show an IRAgross distribution of 507 and that the 7 of income is taxable.The rule is—the income is taxed in the year in which thecontribution is made (2003) and not the year for which thecontribution was made (2002).She is NOT required to amend her 2002 federal income taxand pay the 6% excess contribution tax of 30 because sheeliminated the excess by withdrawing it on or beforeOctober 15, 2003. A few years ago, the IRS changed thedeadline for correcting excess contributions to October 15 ofthe following year rather than April 15 as modified by anyextension. You may want to explain to her that the IRS maywrite her a letter indicating that she made an excesscontribution and asking if she corrected it. In which case, shecould furnish a written explanation that she withdrew theexcess and attach CWF Forms #67 and #67W with her reply.This should resolve the matter.Example #2 –Contribution Made in 2002 and Withdrawn in 2003Tom Doe (age 57) made a traditional IRA contribution of 3,000 on 12-15-02 for 2002. The problem is—on February 4,2002 he also made a contribution for 2002 in the amount of 3,500 to an IRA at another financial institution. He hadforgotten he had made this contribution. He knows he has anexcess contribution of 3,500 because his two 2002 Form5498s showing he contributed a total of 7,000. He is askingwhat he should do. He filed his income tax return on April 1,2003. He is asking if he must amend his 2002 tax return andpay the 6% excess tax on the 3,500, or 195.Suggested Approach to Resolve the SituationYou should suggest he talk with his tax adviser. However,you, as the IRA custodian, will need to help him because youhave the information needed to correct the situation. Youshould furnish him with a copy of CWF’s Form #67, SpecialExplanation for Withdrawing an Excess or Current-YearContribution for 2002. This form explains what needs to beContinued on page 3

May, 2003Page 3Correcting an Excess Contribution,Continued from page 2done to qualify for certain special income tax treatment. Theincome earned by the 3,500 excess contribution must bewithdrawn along with the 3,500. You may use CWF Form#67W to calculate the allocable income. You will also want tofurnish a copy of Form #67W to the accountholder. Note that alast-in, first-out rule is used. This means the excess was madeon December 15, 2002 rather than February 4, 2002. It isassumed the earnings were 130. Three thousand six hundredthirty dollars ( 3,630) will need to be returned to theaccountholder. Your institution, as the IRA custodian, willprepare for him a 2003 Form 1099-R (in January of 2004), andthe reason code “81” should be inserted in box 7. The “8” tellsthe IRS there was an excess contribution and that it is taxablein 2002, and the “1” tells the IRS he owes the 10% additionaltax because he is younger than age 591 2.The rule is—the income is taxed in the year in which thecontribution is made. Since the contribution was made in2002, he is required to amend his already filed 2002 return. Hewill need to amend his return to show he received an IRAdistribution (line 15) of 3,630, of which 3,500 is not taxableas it is the return of an excess contribution. The earnings of 130 must be shown as taxable income, and Form 5329 mustbe completed to show 13 is owing (i.e. the 10% additionaltax). He will want to attach an explanation and the formsshowing he has corrected the situation prior to October 15,2003. Again, a few years ago the IRS changed the deadline forcorrecting excess contributions to October 15 of the followingyear rather than April 15 as modified by any extension. Byfiling the amended return and attaching an explanation, thematter should be resolved.HOW MANY 5498s MUST ANINSTITUTION PREPARE FOR ANACCOUNTHOLDER?CWF received a consulting call with the following situation.A customer brought a Form 5498 to the institution and askedwhy all of his various accounts were combined onto one 5498.The institution’s software vendor had prepared the 5498 in thismanner. When the question was raised that this may not becorrect, the software vendor wanted proof from the institutionthat combining all a customer’s accounts on one 5498 is notcorrect.In answer to this question, CWF provide the applicablesection of the 5498 instructions for 2003 (the 2002 instructionscontained identical language). It reads as follows:Specific Instructions for Form 5498File Form 5498, IRA Contribution Information, with the IRSby May 31, 2004, for each person for whom in 2003 youmaintained any Individual retirement arrangement (IRA),including a deemed IRA under section 408(q).An IRA includes all investments under one IRA plan. It is notnecessary to file a Form 5498 for each investment under oneplan. For example, if a participant has three certificates ofdeposit (CDs) under one IRA plan, only one Form 5498 isrequired for all contributions and the fair market values (FMVs)of the CDs under the plan. However, if an individual hasestablished more than one IRA plan with the same trustee, aseparate Form 5498 must be filed for each plan” (emphasisadded).Obviously a Roth IRA and traditional IRA have separate planagreements, and therefore cannot be combined onto one 5498.Your institution will want to be certain your software provider ispreparing all governmental reporting correctly. You need to beaware that IRS penalties can be assessed for incorrect reporting.The penalty is 50 per incorrect 5498.We at CWF find it interesting that when this situation wasbrought to the software vendor’s attention, they required thefinancial institution to prove them wrong! We do not think it isunreasonable to expect the software vendor to perform its ownresearch to determine the correctness of the reports they areproviding to financial institutions, once a question has beenraised regarding the accuracy of the reports. There coulddefinitely be liability issues for the software vendor, should theinstitution be penalized for incorrect 5498 reporting. Softwarevendors who are providing incorrect 5498s will hopefully makethe necessary corrections to their software program.IRS GUIDANCE —FAIR MARKET VALUE (FMV) OFSTOCKS AND BONDSThe value of stocks and bonds is the FMV of a share or bondon the valuation date.Selling prices on valuation date. If there is an active marketfor the contributed stocks or bonds on a stock exchange, in anover-the-counter market, or elsewhere, the FMV of each shareor bond is the average price between the highest and lowestquoted selling prices on the valuation date. For example, if thehighest selling price for a share was 11, and the lowest 9, theaverage price is 10. You get the average price by adding 11and 9 and dividing the sum by 2.No sales on valuation date. If there were no sales on thevaluation date, but there were sales within a reasonable periodbefore and after the valuation date, you determine FMV bytaking the average price between the highest and lowest salesprices on the nearest date before and on the nearest date afterthe valuation date. Then you weight these averages in inverseorder by the respective number of trading days between theselling dates and the valuation date.Continued on page 6

May, 2003Page 4TAKING A LOOKAT SAFE HARBOR401(k) PLANSAND SIMPLE401(k) PLANSIn order to understand thepossible advantages ofadopting or converting toeither a Safe Harbor 401(k)Plan or SIMPLE 401(k) Plan,let’s take a brief look at thechallenges facing a non-safeharbor plan. Every year, anemployer who sponsors a401(k) plan must have theirplan tested to ensure it meetsthe general nondiscriminationrequirements set forth inInternal Revenue Code401(a)(4). Two of these testsare the Actual DeferralPercentage Test and the ActualContribution Percentage Test,more commonly referred to asthe ADP and ACP tests. TheADP test limits highlycompensated employees(HCEs) to a level of electivedeferrals that is not excessivelyabove the level chosen bynon-highly compensatedemployees (NHCEs). Similarly,the ACP test ensures that HCEsdo not utilize matching andemployee after-taxcontributions substantiallymore than the NHCEs. If theplan fails either one of thesetests, corrective measures mustbe taken, or the Plan riskslosing its qualification. Inmost cases, a failed ADP orACP test is corrected throughthe return of excesscontributions to the HCEs.Unfortunately, this means theperson administering the planmust tell the HCE(s) (usuallythe owner or his/her boss) thata portion of their electivedeferrals made in the pastyear will have to be returnedto them. If this isn’t dreadfulenough, they may even haveto notify the HCE(s) that theyare required to amend theirtax return, depending on thetiming of the correction.Alternatively, the employermay elect to make additionalcontributions to the NHCEs toensure the ADP and ACP testsare satisfied.As a means of avoiding thedilemma outlined above, agrowing number of employersare adopting or converting toa Safe Harbor 401(k) Plan ora SIMPLE 401(k) Plan.Safe Harbor 401(k) PlansThe beauty of the SafeHarbor Plan is that it allowsthe HCEs to defer themaximum amount under law( 12,000 for 2003 and 13,000 for 2004) withouthaving to worry about failinga nondiscrimination test.However, having this featurein a plan does come with acost, as the employer mustcommit to providing aminimum employercontribution or a specifiedmatching contribution. Thesecontributions must also havecertain characteristics asoutlined below.Employers have twocontribution choices:1. The Non-Elective EmployerContribution – Under thismethod, the employer isrequired to make acontribution of at least 3%of compensation to alleligible employees,whether they defer or not.2. Employer MatchingContributions – (Basic orEnhanced Formula)Basic Formula – Thismethod requires theemployer to make acontribution of 100% of theemployee’s electivedeferrals to the extent theydo not exceed 3% ofcompensation, and 50% ofthe employee’s electivedeferrals between 3% and5% of compensation.Enhanced Formula – Thismethod may be used if, atany rate of electivedeferrals, the matchingcontribution equals orexceeds the contributionunder the basic formula (forexample, matchingcontributions of 100% ofelective deferrals up to 4%of compensation). Inaddition, the rate ofmatching contributionscannot increase as anemployee’s rate of electivedeferrals increases.If the plan is top heavy,meaning more than 60% ofthe plan’s assets are held bykey employees, a properlydesigned Safe Harbor Plandoes not require theemployer to make the socalled top-heavy minimumrequired contributions. Thisis the case only when theemployer makes nocontributions other than oneof those outlined above.Furthermore, if an employerwants to match more thanthe basic or enhancedamounts they may do so,but to satisfy the ACP safeharbor they are subject tofurther restrictions.Safe Harbor contributionsare subject to the followingrules and issues: Vesting and DistributionRestrictions: Thecontributions must be100% vested immediately,and can only be withdrawnin accordance with therules applicable to a 401(k)plan. However, hardship isnot considered adistributable event for thesafe harbor contributions. No last-day or 1,000 hourrequirement: The plancannot require that aparticipant be employed onthe last day of the plan yearor work a minimum of1,000 hours to receive aportion of the employer’snon-elective or matchingcontribution. Theemployer must make thenon-elective contribution toall employees who areeligible to make electivedeferrals, and must makethe safe harbor match to allemployees who makeelective deferrals. Employee After-TaxContributions still includedin ACP Test: Like a regular401(k) plan, employeeafter-tax contributions mustbe taken into considerationwhen determining theplan’s ACP. Plan Language: The plandocument must indicatewhether the employerintends to use the nonelective contribution or thematching formula to satisfythe safe-harborrequirements. Notice to Participants:Existing 401(k) plans mustprovide a Safe-HarborNotice to participants 3090 days before the start ofthe plan year; otherwise theplan is not eligible to usethe safe harbor provisionsfor the entire year. New401(k) plans, or existingplans that are adding a401(k) feature for the firsttime, must provide suchnotice at least 3 monthsContinued on page 5

May 2003Page 5Safe Harbor,Continued

date of the letter, you will automatically retitle the SEP-IRA to be a traditional IRA. Deadline to Amend — Amending the SEP of your customers is not needed at all if they do not wish to take advantage of the larger contribution limits now allowed (the lesser of 25% of compensation, or 4