Transcription

Contents1. Learning Outcome Statements (LOS)2. Reading 31: Introduction to Corporate Governance and Other ESG Considerations1. Exam Focus2. Module 31.1: Stakeholder Management3. Module 31.2: Factors Affecting Corporate Governance4. Key Concepts5. Answer Key for Module Quizzes3. Reading 32: Capital Budgeting1. Exam Focus2. Module 32.1: Capital Projects, NPV, and IRR3. Module 32.2: Payback Period, Project Rankings4. Key Concepts5. Answer Key for Module Quizzes4. Reading 33: Cost of Capital1. Exam Focus2. Module 33.1: Weighted Average Cost of Capital3. Module 33.2: Project Cost of Capital4. Key Concepts5. Answer Key for Module Quizzes5. Reading 34: Measures of Leverage1. Exam Focus2. Module 34.1: Measures of Leverage3. Key Concepts4. Answer Key for Module Quiz6. Reading 35: Working Capital Management1. Exam Focus2. Module 35.1: Working Capital Management3. Key Concepts4. Answer Key for Module Quiz7. Topic Assessment: Corporate Finance8. Topic Assessment Answers: Corporate Finance9. Reading 36: Market Organization and Structure1. Exam Focus2. Module 36.1: Markets, Assets, and Intermediaries3. Module 36.2: Positions and Leverage4. Module 36.3: Order Execution and Validity5. Key Concepts6. Answer Key for Module Quizzes10. Reading 37: Security Market Indexes1. Exam Focus2. Module 37.1: Index Weighting Methods3. Module 37.2: Uses and Types of Indexes4. Key Concepts5. Answer Key for Module Quizzes11. Reading 38: Market Efficiency1. Exam Focus2. Module 38.1: Market Efficiency

12.13.14.15.16.17.18.19.20.21.3. Key Concepts4. Answer Key for Module QuizReading 39: Overview of Equity Securities1. Exam Focus2. Module 39.1: Types of Equity Investments3. Module 39.2: Foreign Equities and Equity Risk4. Key Concepts5. Answer Key for Module QuizzesReading 40: Introduction to Industry and Company Analysis1. Exam Focus2. Module 40.1: Industry Analysis3. Module 40.2: Pricing Power and Company Analysis4. Key Concepts5. Answer Key for Module QuizzesReading 41: Equity Valuation: Concepts and Basic Tools1. Exam Focus2. Module 41.1: Dividends, Splits, and Repurchases3. Module 41.2: Dividend Discount Models4. Module 41.3: Relative Valuation Measures5. Key Concepts6. Answer Key for Module QuizzesTopic Assessment: Equity InvestmentsTopic Assessment Answers: Equity InvestmentsReading 42: Fixed-Income Securities: Defining Elements1. Exam Focus2. Module 42.1: Bond Indentures, Regulation, and Taxation3. Module 42.2: Bond Cash Flows and Contingencies4. Key Concepts5. Answer Key for Module QuizzesReading 43: Fixed-Income Markets: Issuance, Trading, and Funding1. Exam Focus2. Module 43.1: Types of Bonds and Issuers3. Module 43.2: Corporate Debt and Funding Alternatives4. Key Concepts5. Answer Key for Module QuizzesReading 44: Introduction to Fixed-Income Valuation1. Exam Focus2. Module 44.1: Bond Valuation and Yield to Maturity3. Module 44.2: Spot Rates and Accrued Interest4. Module 44.3: Yield Measures5. Module 44.4: Yield Curves6. Module 44.5: Yield Spreads7. Key Concepts8. Answer Key for Module QuizzesReading 45: Introduction to Asset-Backed Securities1. Exam Focus2. Module 45.1: Structure of Mortgage-Backed Securities3. Module 45.2: Prepayment Risk and Non-Mortgage-Backed ABS4. Key Concepts5. Answer Key for Module QuizzesReading 46: Understanding Fixed-Income Risk and Return

22.23.24.25.26.27.1. Exam Focus2. Module 46.1: Sources of Returns, Duration3. Module 46.2: Interest Rate Risk and Money Duration4. Module 46.3: Convexity and Yield Volatility5. Key Concepts6. Answer Key for Module QuizzesReading 47: Fundamentals of Credit Analysis1. Exam Focus2. Module 47.1: Credit Risk and Bond Ratings3. Module 47.2: Evaluating Credit Quality4. Key Concepts5. Answer Key for Module QuizzesTopic Assessment: Fixed IncomeTopic Assessment Answers: Fixed IncomeAppendixFormulasCopyright

List of 2728293031323334353637383940

09192

29130131132133134135136137138139140141142143144145

7198199

9250251

0301302

2353355

8379381382383384385386387388389

LEARNING OUTCOME STATEMENTS (LOS)

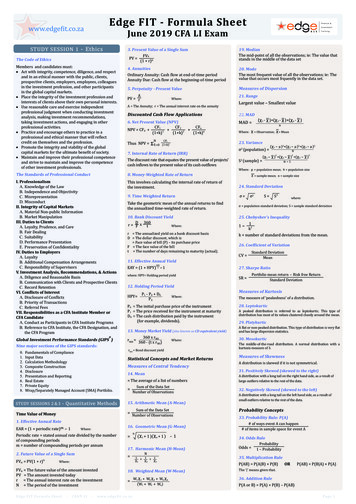

STUDY SESSION 10The topical coverage corresponds with the following CFA Institute assigned reading:31. Introduction to Corporate Governance and Other ESG ConsiderationsThe candidate should be able to:a. describe corporate governance. (page 1)b. describe a company’s stakeholder groups and compare interests of stakeholder groups.(page 2)c. describe principal–agent and other relationships in corporate governance and theconflicts that may arise in these relationships. (page 3)d. describe stakeholder management. (page 4)e. describe mechanisms to manage stakeholder relationships and mitigate associated risks.(page 4)f. describe functions and responsibilities of a company’s board of directors and itscommittees. (page 5)g. describe market and non-market factors that can affect stakeholder relationships andcorporate governance. (page 8)h. identify potential risks of poor corporate governance and stakeholder management andidentify benefits from effective corporate governance and stakeholder management.(page 10)i. describe factors relevant to the analysis of corporate governance and stakeholdermanagement. (page 11)j. describe environmental and social considerations in investment analysis. (page 13)k. describe how environmental, social, and governance factors may be used in investmentanalysis. (page 13)The topical coverage corresponds with the following CFA Institute assigned reading:32. Capital BudgetingThe candidate should be able to:a. describe the capital budgeting process and distinguish among the various categories ofcapital projects. (page 21)b. describe the basic principles of capital budgeting. (page 23)c. explain how the evaluation and selection of capital projects is affected by mutuallyexclusive projects, project sequencing, and capital rationing. (page 24)d. calculate and interpret net present value (NPV), internal rate of return (IRR), paybackperiod, discounted payback period, and profitability index (PI) of a single capitalproject. (page 25)e. explain the NPV profile, compare the NPV and IRR methods when evaluatingindependent and mutually exclusive projects, and describe the problems associated witheach of the evaluation methods. (page 31)f. contrast the NPV decision rule to the IRR decision rule and identify problems associatedwith the IRR rule. (page 33)g. describe expected relations among an investment’s NPV, company value, and shareprice. (page 35)The topical coverage corresponds with the following CFA Institute assigned reading:33. Cost of CapitalThe candidate should be able to:

a. calculate and interpret the weighted average cost of capital (WACC) of a company.(page 41)b. describe how taxes affect the cost of capital from different capital sources. (page 41)c. describe the use of target capital structure in estimating WACC and how target capitalstructure weights may be determined. (page 43)d. explain how the marginal cost of capital and the investment opportunity schedule areused to determine the optimal capital budget. (page 44)e. explain the marginal cost of capital’s role in determining the net present value of aproject. (page 45)f. calculate and interpret the cost of debt capital using the yield-to-maturity approach andthe debt-rating approach. (page 45)g. calculate and interpret the cost of noncallable, nonconvertible preferred stock. (page 46)h. calculate and interpret the cost of equity capital using the capital asset pricing modelapproach, the dividend discount model approach, and the bond-yield-plus risk-premiumapproach. (page 47)i. calculate and interpret the beta and cost of capital for a project. (page 50)j. describe uses of country risk premiums in estimating the cost of equity. (page 52)k. describe the marginal cost of capital schedule, explain why it may be upward-slopingwith respect to additional capital, and calculate and interpret its break-points. (page 53)l. explain and demonstrate the correct treatment of flotation costs. (page 55)

STUDY SESSION 11The topical coverage corresponds with the following CFA Institute assigned reading:34. Measures of LeverageThe candidate should be able to:a. define and explain leverage, business risk, sales risk, operating risk, and financial riskand classify a risk. (page 63)b. calculate and interpret the degree of operating leverage, the degree of financialleverage, and the degree of total leverage. (page 64)c. analyze the effect of financial leverage on a company’s net income and return on equity.(page 67)d. calculate the breakeven quantity of sales and determine the company’s net income atvarious sales levels. (page 68)e. calculate and interpret the operating breakeven quantity of sales. (page 68)The topical coverage corresponds with the following CFA Institute assigned reading:35. Working Capital ManagementThe candidate should be able to:a. describe primary and secondary sources of liquidity and factors that influence acompany’s liquidity position. (page 77)b. compare a company’s liquidity measures with those of peer companies. (page 78)c. evaluate working capital effectiveness of a company based on its operating and cashconversion cycles and compare the company’s effectiveness with that of peercompanies. (page 80)d. describe how different types of cash flows affect a company’s net daily cash position.(page 81)e. calculate and interpret comparable yields on various securities, compare portfolioreturns against a standard benchmark, and evaluate a company’s short-term investmentpolicy guidelines. (page 81)f. evaluate a company’s management of accounts receivable, inventory, and accountspayable over time and compared to peer companies. (page 83)g. evaluate the choices of short-term funding available to a company and recommend afinancing method. (page 86)

STUDY SESSION 12The topical coverage corresponds with the following CFA Institute assigned reading:36. Market Organization and StructureThe candidate should be able to:a. explain the main functions of the financial system. (page 99)b. describe classifications of assets and markets. (page 101)c. describe the major types of securities, currencies, contracts, commodities, and realassets that trade in organized markets, including their distinguishing characteristics andmajor subtypes. (page 102)d. describe types of financial intermediaries and services that they provide. (page 105)e. compare positions an investor can take in an asset. (page 108)f. calculate and interpret the leverage ratio, the rate of return on a margin transaction, andthe security price at which the investor would receive a margin call. (page 110)g. compare execution, validity, and clearing instructions. (page 112)h. compare market orders with limit orders. (page 112)i. define primary and secondary markets and explain how secondary markets supportprimary markets. (page 115)j. describe how securities, contracts, and currencies are traded in quote-driven, orderdriven, and brokered markets. (page 117)k. describe characteristics of a well-functioning financial system. (page 119)l. describe objectives of market regulation. (page 120)The topical coverage corresponds with the following CFA Institute assigned reading:37. Security Market IndexesThe candidate should be able to:a. describe a security market index. (page 129)b. calculate and interpret the value, price return, and total return of an index. (page 129)c. describe the choices and issues in index construction and management. (page 130)d. compare the different weighting methods used in index construction. (page 130)e. calculate and analyze the value and return of an index given its weighting method.(page 1

The topical coverage corresponds with the following CFA Institute assigned reading: 33. Cost of Capital The candidate should be able to: a. calculate and interpret the weighted average cost of capital (WACC) of a company. (page 41) b. describe how taxes affect the cost of capital from different capital sources. (page 41) c. describe the use of target capital structure in estimating WACC and .