Transcription

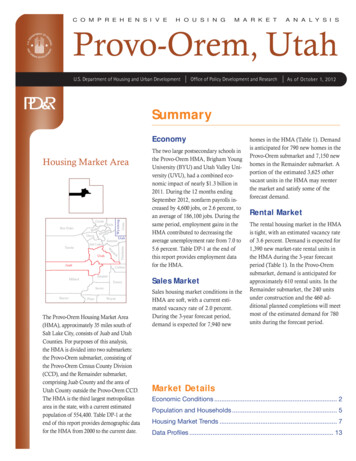

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018City of Orem56 North State StreetOrem, Utah 84057www.orem.org

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018TABLE OF CONTENTSEXHIBIT "A"Revenues 1Budget Summary 2Operating Departments:Project Area #85-01 3Project Area #85-02 5Project Area #85-03A 7Project Area #85-03B 9Project Area #85-04 11Project Area #87-10 13Project Area #90-08 15Active Participation Agreements 17Related Outstanding Debt 17Redevelopment Agency Map 18EXHIBIT "B"Budget Amendments for FY 2016-2017 19

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDThe Redevelopment Agency of the City of Orem (RDA) is a separate legal entity from the City of Orem that has thestatutory ability to provide redevelopment services within the City. These redevelopment services includeimproving, rehabilitating, and redeveloping blighted areas within the City. The City Council acts as the governingauthority for the Redevelopment Agency.REVENUESRevenues for the Redevelopment Agency Fund are primarily derived from property taxes collected by Utah Countyand remitted to the City.REVENUE DES CRIPTIONACTUALFY '14-'15Tax Increment - Project Area #85-01Haircut - Project Area #85-01Tax Increment - Project Area #85-02Haircut - Project Area #85-02Tax Increment - Project Area #85-03ATax Increment - Project Area #85-03BHaircut - Project Area #85-03AHaircut - Project Area #85-03BTax Increment - Project Area #85-04Haircut - Project Area #85-04Tax Increment - Project Area #87-10Haircut - Project Area #87-10Tax Increment - Project Area #90-08Haircut - Project Area #90-08Interest EarningsRental / Lease Revenue ,525215,76339,78361,996-FUND TOTALS 2,466,2551ACTUALFY '15-'16 6,05816,08547,539121,95979,957- 1,814,888ES TIMATEDACTUALFY '16-'17ADOPTEDBUDGETFY '17-'18 9161,631183,65032,38771,00080,000 0185,00035,00062,242- 1,677,242

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDBUDGET SUMMARYREDEVELOPMENT AGENCY FUNDFY 2017 - 2018PERS jectArea #85-01Area #85-02Area #85-03AArea #85-03BArea #85-04Area #87-10Area #90-08TOTALS - -OPERATIONS CAPITAL - 677,242 - 1,677,242REDEVELOPMENT AGENCY FUNDExpenditures by 00387,242100,000125,00050,000

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDEXPENDITURESPROJECT AREA #85-01Expenditures in this area improve, rehabilitate, or redevelop areas within the project and provide funds for thepayment of debt service on bonds issued for the construction of recreational facilities in 2002. This area no longerhas any remaining active project participation agreements.This project area’s normal tax increment expired in calendar year 2014 and its additional tax increment (haircut)expires in calendar year 2021.EXPENDITURES DES CRIPTIONACTUALFY '14-'15ACTUALFY '15-'16ES TIMATEDACTUALFY '16-'17ADOPTEDBUDGETFY '17-'18Participation Agreement 85-c-002-001Professional & Technical ServicesFiber Optics Conduit ProjectContributions to Other Funds 900,2005,000174,671 3,060371,276 1,945375,645 365,000PROJECT AREA TOTALS 1,079,871 374,336 377,590 365,0003

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018Project 85-01: Orem Business ParkDate Created:Base Year for Computing Tax Increment:Initial Tax Increment Request:Calendar Year Ending December 31, 2016 Taxable Value:Base Year Taxable Value:Marginal Value:Calendar Year Beginning January 1, 2018 Increment Percentage:March 26, 19851985Fiscal Year 1990-91 128,108,341 1,472,221 126,636,120Normal Increment ExpiredNon-educational “Additional Tax Increment” Requested(as allowed in Utah Code Annotated 17C-1-403)Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 370,000 365,000Use: Debt service on refunding bonds issued in 2017 (original bonds were issued in 2002) for the construction ofrecreational facilities as allowed in Utah Code 17C-1-403.Normal Increment Requested:Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 20178: 0 04

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDEXPENDITURESPROJECT AREA #85-02Expenditures in this area improve, rehabilitate, or redevelop areas within the project and provide funds for thepayment of debt service on bonds issued for the construction of recreational facilities in 2002.This project area’s normal tax increment expired in calendar year 2013 and its additional tax increment (haircut)expires in calendar year 2020.EXPENDITURES DES CRIPTIONACTUALFY '14-'15ACTUALFY '15-'16ES TIMATEDACTUALFY '16-'17ADOPTEDBUDGETFY '17-'18Professional & Technical ServicesFiber Optics Conduit ProjectContributions to Other Funds 5,000185,171 669,902 6,500177,211 210,000PROJECT AREA TOTALS 190,171 669,902 183,711 210,0005

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018Project 85-02: Timpanogos Research and Technology ParkDate Created:Base Year for Computing Tax Increment:Initial Tax Increment Request:Calendar Year Ending December 31, 2016 Taxable Value:Base Year Taxable Value:Marginal Value:Calendar Year Beginning January 1, 2018 Increment Percentage:May 14, 19851985Fiscal Year 1989-90 70,348,063 7,333,972 63,014,091Normal Increment ExpiredNon-educational “Additional Tax Increment” Requested(as allowed in Utah Code Annotated 17C-1-403)Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 215,000 210,000Use: Debt service on refunding bonds issued in 2017 (original bonds were issued in 2002) for the construction ofrecreational facilities as allowed in Utah Code 17C-1-403.Normal Increment Requested:Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 0 06

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDEXPENDITURESPROJECT AREA #85-03AExpenditures in this area improve, rehabilitate, or redevelop areas within the project and provide funds for thepayment of debt service on bonds issued for the construction of recreational facilities in 2002.This project area’s normal tax increment expired in calendar year 2013 and its additional tax increment (haircut)expires in calendar year 2020.EXPENDITURES DES CRIPTIONACTUALFY '14-'15ACTUALFY '15-'16ES TIMATEDACTUALFY '16-'17ADOPTEDBUDGETFY '17-'18Professional & Technical ServicesParticipation Agreement - Orem M azdaParticipation Agreement - Ken GarffProperty PurchasesContributions to Other Funds 16,40075,000292,438 34,74359,722150,800285,037 26,00072,1541,000,0001,530,778152,723 65,000210,000PROJECT AREA TOTALS 383,838 530,302 2,781,655 275,0007

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018Project 85-03A: 1300 South, 200 East to 800 East (Various Properties)Date Created:Base Year for Computing Tax Increment:Initial Tax Increment Request:Calendar Year Ending December 31, 2016 Taxable Value:Base Year Taxable Value:Marginal Value:Calendar Year Beginning January 1, 2018 Increment Percentage:December 3, 19851985Fiscal Year 1989-90 88,642,380 30,552,708 58,089,672Normal Increment ExpiredNon-educational “Additional Tax Increment” Requested(as allowed in Utah Code Annotated 17C-1-403)Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 215,000 210,000Use: Debt service on refunding bonds issued in 2017 (original bonds were issued in 2002) for the construction ofrecreational facilities as allowed in Utah Code 17C-1-403.Normal Increment Requested:Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 0 0Use: During Fiscal Year 2009-2010, the RDA entered into a participation agreement (RDA-A-09-0001)requiring the use of a maximum of 75,000 of normal tax increment for Fiscal Years 2010-2011, 2011-2012,2012-2013 and 2013-2014; and a maximum of 125,000 of normal tax increment for Fiscal Years 2014-2015,2015-2016 and 2016-2017.8

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDEXPENDITURESPROJECT AREA #85-03BExpenditures in this area improve, rehabilitate, or redevelop areas within the project and provide funds for thepayment of debt service on bonds issued for the construction of recreational facilities in 2002.This project area’s normal tax increment expired in calendar year 2013 and its additional tax increment (haircut)expires in calendar year 2020.EXPENDITURES DES CRIPTIONACTUALFY '14-'15ACTUALFY '15-'16ES TIMATEDACTUALFY '16-'17ADOPTEDBUDGETFY '17-'18Professional & Technical ServicesFuture ProjectsContributions to Other Funds 552,328 1,657- 36,400587,714 552,242PROJECT AREA TOTALS 552,328 1,657 624,114 552,2429

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018Project 85-03B: 1300 South, 200 East to 1500 West (Various Properties)Date Created:Base Year for Computing Tax Increment:Initial Tax Increment Request:Calendar Year Ending December 31, 2016 Taxable Value:Base Year Taxable Value:Marginal Value:Calendar Year Beginning January 1, 2018 Increment Percentage:December 12, 19851985Fiscal Year 1989-90 119,743,869 6,854,457 112,889,412Normal Increment ExpiredNon-educational “Additional Tax Increment” Requested(as allowed in Utah Code Annotated 17C-1-403)Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 345,000 552,242Use: Debt service on refunding bonds issued in 2017 (original bonds were issued in 2002) for the construction ofrecreational facilities as allowed in Utah Code 17C-1-403.Normal Increment Requested:Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 0 010

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDEXPENDITURESPROJECT AREA #85-04Expenditures in this area improve, rehabilitate, or redevelop areas within the project and provide funds for thepayment of debt service on bonds issued for the construction of recreational facilities in 2002.This project area’s normal tax increment expired in calendar year 2013 and its additional tax increment (haircut)expires in calendar year 2020.EXPENDITURES DES CRIPTIONACTUALFY '14-'15ACTUALFY '15-'16ES TIMATEDACTUALFY '16-'17ADOPTEDBUDGETFY '17-'18Professional & Technical ServicesImprovement - Right Turn Lane 400 SContributions to Other Funds 50,000 50,000 180,40030,000 100,000PROJECT AREA TOTALS 50,000 50,000 210,400 100,00011

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018Project 85-04: State Street, 400 South to 800 South (Various Properties)Date Created:Base Year for Computing Tax Increment:Initial Tax Increment Request:Calendar Year Ending December 31, 2016 Taxable Value:Base Year Taxable Value:Marginal Value:Calendar Year Beginning January 1, 2018 Increment Percentage:September 30, 19861986Fiscal Year 1989-90 55,812,851 18,801,179 37,011,672Normal Increment ExpiredNon-educational “Additional Tax Increment” Requested(as allowed in Utah Code Annotated 17C-1-403)Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 103,000 100,000Use: Debt service on refunding bonds issued in 2017 (original bonds were issued in 2002) for the construction ofrecreational facilities as allowed in Utah Code 17C-1-403.Normal Increment Requested:Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 0 012

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDEXPENDITURESPROJECT AREA #87-10Expenditures in this area improve, rehabilitate, or redevelop areas within the project and provide funds for thepayment of debt service on bonds issued for the construction of recreational facilities in 2002.This project area’s normal tax increment expired in calendar year 2014 and its additional tax increment (haircut)expires in calendar year 2021.EXPENDITURES DES CRIPTIONACTUALFY '14-'15ACTUALFY '15-'16ES TIMATEDACTUALFY '16-'17ADOPTEDBUDGETFY '17-'18Participation Agreement - BoyerProfessional & Technical ServicesFuture ProjectsContributions to Other Funds 220,0005,00054,447 121,959 56,000161,631 125,000PROJECT AREA TOTALS 279,447 121,959 217,631 125,00013

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018Project 87-10: State Street, 400 North to 400 South (Various Properties)Date Created:Base Year for Computing Tax Increment:Initial Tax Increment Request:Calendar Year Ending December 31, 2016 Taxable Value:Base Year Taxable Value:Marginal Value:Calendar Year Beginning January 1, 2018 Increment Percentage:February 2, 19881988Fiscal Year 1990-91 88,234,425 32,815,215 55,419,210Normal Increment ExpiredNon-educational “Additional Tax Increment” Requested(as allowed in Utah Code Annotated 17C-1-403)Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 156,924 125,000Use: Debt service on refunding bonds issued in 2017 (original bonds were issued in 2002) for the construction ofrecreational facilities as allowed in Utah Code 17C-1-403.Normal Increment Requested:Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 0 014

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDEXPENDITURESPROJECT AREA #90-08Expenditures in this area improve, rehabilitate, or redevelop areas within the project and provide funds for thepayment of debt service on bonds issued for the construction of recreational facilities in 2002.This project area’s normal tax increment expires in calendar year 2020 and its additional tax increment (haircut)expires in calendar year 2023.EXPENDITURES DES CRIPTIONACTUALFY '14-'15ACTUALFY '15-'16ES TIMATEDACTUALFY '16-'17ADOPTEDBUDGETFY '17-'18Professional & Technical ServicesFuture ProjectsContributions to Other Funds 5,000104,288 100,000 70,000 50,000PROJECT AREA TOTALS 109,288 100,000 70,000 50,00015

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018Project 90-08: 500 North to 1200 North between 100 West & State Street (Various Properties)Date Created:Base Year for Computing Tax Increment:Initial Tax Increment Request:Calendar Year Ending December 31, 2016 Taxable Value:Base Year Taxable Value:Marginal Value:Calendar Year Beginning January 1, 2018 Increment Percentage:May 1, 19901990Fiscal Year 1992-93 39,874,116 11,172,447 28,701,66970%Non-educational “Additional Tax Increment” Requested(as allowed in Utah Code Annotated 17C-1-403)Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 25,000 50,000Use: Debt service on refunding bonds issued in 2017 (original bonds were issued in 2002) for the construction ofrecreational facilities as allowed in Utah Code 17C-1-403.Normal Increment Requested:Calendar Year Ending December 31, 2017:Calendar Year Beginning January 1, 2018: 240,000 185,000Use: RDA costs as allowed in Utah Code 17C-1 in this district and debt service on refunding bonds issued in2017 (original bonds were issued in 2002) for the construction of recreational facilities as allowed in Utah Code17C-1-403.16

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-2018REDEVELOPMENT AGENCY FUNDACTIVE PARTICIPATION 5-03ANameM LP Orem, LLCDescriptionTermsM aximum of 3 payments of 75,000 and 3 paymentsof 125,0008 YearsStarted: Fiscal Year 2010-2011Ends: Fiscal Year 2017-2018RELATED OUTSTANDING DEBT 2,898,000 Series 2017 Sales Tax Revenue Refunding BondsAmortization ScheduleFiscal 0202020-20212021-20222022-2023 1,231,000459,000352,000360,000243,000253,000 64,34232,34023,43516,6069,6234,908 1,295,342491,340375,435376,606252,623257,908Totals 2,898,000 151,254 3,049,25417

REDEVELOPMENT AGENCYOF THECITY OF OREMADOPTED BUDGETFISCAL YEAR 2017-201818

EXHIBIT "B"BUDGET AMENDMENTSFISCAL YEAR 2016-2017REDEVELOPMENT AGENCY FUNDREVENUESAccount aircut 85-01Haircut 85-02Haircut 85-03AHaircut 85-03BHaircut 85-04Tax Increment 90-08Haircut 87-10Interest EarningsRental/Lease Revenue - 85-03APreviousBudget 32,613.17156,924.000.000.00 1,627,334.54Net Fund Increase (Decrease)CurrentBudget 183,649.86161,631.2984,063.0094,759.64 1,738,953.36 111,618.82EXPENDITURESAccount NumberProject Area 85-0153-9701-731-462Project Area 85-0353-9703-731-10053-9703-731-101Project Area 85-0453-9704-731-100TotalNoteDescriptionFiber Optics Conduit ProjectTemp Proj 85-03ATemp Proj 85-03BTemp Proj 85-04Net Fund Increase (Decrease)PreviousBudget 2,797.97CurrentBudget 8353.25 5,379,171.8329,007.25 5,490,790.65 111,618.8219

City of Orem56 North State StreetOrem, Utah 84057www.orem.org

redevelopment These redevelopment services include improving, rehabilitating, and redeveloping blighted areas within the City. . PERSONNEL OPERATIONS CAPITAL TOTAL . Orem Mazda 75,000 59,722 72,154 65,000 Participation Agreement - Ken Garff - - 1,000,000 - Property Purchases - 150,800 1,530,778 - .