Transcription

SYNDICATE 1969ANNUAL REPORT AND ACCOUNTSFOR THE YEAR ENDED 31 DECEMBER 2015

CONTENTSDirectors and Administration02SYNDICATE ANNUAL ACCOUNTS FORTHE YEAR ENDED 31 DECEMBER 2015Active Underwriter’s Report03Report of the Directors of the Managing Agent09Statement of Managing Agent’s Responsibilities17Independent Auditor’s Report to the Members of Syndicate 196919Profit and loss account: Technical Account – General Business21Profit and loss account: Non-technical account – General Business24Statement of Comprehensive Income24Balance sheet - Assets25Balance sheet - Liabilities26Statement of Changes in Members’ Balances27Statement of Cash Flows28Notes to the Annual Accounts29SYNDICATE UNDERWRITING YEAR ACCOUNTSFOR THE 2013 YEAR OF ACCOUNTReport of the Directors of the Managing Agent65Statement of Managing Agent’s Responsibilities69Independent Auditor’s Report to the Members of Syndicate 1969 –2013 Closed Year of Account70Profit and loss account: Technical Account74Profit and loss account: Non-technical Account75Statement of Changes in Members’ Balances75Balance sheet - Assets76Balance sheet - Liabilities77Statement of Cash Flows78Notes to the Syndicate Underwriting Year Accounts79Four Year Summary of Underwriting Results87SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 01

SYNDICATE ANNUALACCOUNTS FOR THEYEAR ENDED 31DECEMBER 2015

DIRECTORS ANDADMINISTRATIONMANAGING AGENTApollo Syndicate Management LimitedREGISTERED OFFICEOne BishopsgateLondon, EC2N 3AQCOMPANY REGISTRATION NUMBER09181578COMPANY SECRETARYIF MacdowallDIRECTORSJM Cusack (Non-Executive Chairman)S Althoff (Non-Executive Director)AP Hulse (Non-Executive Director)JN Owen (Non-Executive Director)DC B IbesonPA EllisNG JonesJD MacDiarmidSAC WhiteACTIVE UNDERWRITERNG JonesBANKERSLloyds Bank plcCitibankRoyal Bank of CanadaAUDITORDeloitte LLP, LondonSYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 02

SYNDICATE 1969ACTIVE UNDERWRITER’S REPORT03 SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015

SYNDICATE 1969ACTIVE UNDERWRITER’S REPORTBACKGROUNDAND CURRENTPORTFOLIOSYNDICATE 1969 BEGAN TRADINGON 1 JANUARY 2010, UNDERWRITINGA SHORT-TAIL DIRECT PROPERTYFOCUSED ACCOUNT.The 2015 year of account was theSyndicate’s sixth year of underwritingand is showing steady progress towardsbuilding a balanced specialist insurancebusiness at Lloyd’s.We are fully established in the areasof Direct & Facultative Property (D&F),North American Binding Authorities andInternational Property Treaty. During2012 we commenced underwritingSpecie & Cargo and in 2013 expandedthe Non-marine Liability account andadded Offshore Energy. More recentlywe have added Aviation, Terrorism,Personal Accident and Marine andEnergy Liability to the portfolio.We aim to build a high quality, profitableand flexible business for the long term.We aim to have a spread portfolio toreduce volatility and dependence onany one class but also to be able toreact effectively to changing marketconditions for the benefit of capitalproviders and clients. The Syndicatewill maintain its focus on specialist,profitable, predominantly short-taillines of business.We will only recruit the highest calibreunderwriters who have a profitabletrack record and experience in theirclass. We believe adding experiencedand well respected underwriting teamswill deepen the internal challenge andpeer review aspect of the businessand bring further intellectual capacityinto the development of the businessand controls for the future. Theseunderwriters are capable of growingor shrinking their books depending onmarket conditions and can deliver topquartile performance based on theirtrack record.SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 04

ACTIVEUNDERWRITER’SREPORTIn arriving at our forecast premium income figuresand building out the newer classes of business, weare anticipating that market conditions will remaincompetitive over at least the next two years. Ourobjective is to build a business that delivers profit in acompetitive market place rather than waiting for shiftsin the market as a result of external events. We will,however, ensure that the infrastructure is capable ofreacting to enable us to take advantage of an improvedmarket, should such an event occur.As a result of the traditional structure of our capitalsupport and the fact that many senior underwriters andmanagement are capital providers to the Syndicate, ourbusiness is not unduly influenced by capital or investorrequirements to achieve growth targets. The thirdparty capital structure provides added discipline.The Syndicate continually reviews the performanceof each class and aims to reallocate premium wherenecessary (with Lloyd’s approval), either to rebalancethe portfolio in light of emerging experience or to takeadvantage of market opportunities. Underwriters aimto produce profit on both a gross and net ofreinsurance basis. 160mFollowing the 14.3% pre-emptionapproved by Lloyd’s, the Syndicatestamp was increased to 160.0mfor the 2015 year of account.The approved gross net writtenpremium is 152.9m.2015 PORTFOLIOFollowing the 14.3% pre-emption approved by Lloyd’s,the Syndicate stamp was increased to 160.0m for the2015 year of account. The approved gross net writtenpremium is 152.9m. The strategy and focus of theD&F, Binding Authority and International Treaty classescontinued unchanged for 2015. The D&F team is amarket leader and has a successful track record sincethe Syndicate’s inception.The territorial focus continued to be the US, Caribbeanand Mexico, where we believe more attractive ratingconditions prevail. The Property Binding Authority bookgives the Syndicate exposure to a spread of risks thatcannot be accessed in the open market and is focusedon Managing General Agent based in the US.Our approach to assuming risk in the InternationalTreaty account is highly disciplined and extremelyselective. No risk excess, quota share or aggregatestop loss covers are underwritten. The territorial scoperemained unchanged, targeting regionally specificaccounts in Canada, UK, Western Europe, South Africa,Japan, Australia and New Zealand. This provides anatural balance to the D & F account as the exposuresdo not accumulate.The Specie and Cargo team writes a diversified accountand added an additional underwriter to bolster theteam and help deliver further growth for 2015. TheCargo book specialises in smaller cargo accounts, mostof which include an element of storage.The largest sub classes of cargo are oil, which is writtenon a worldwide basis with a bias towards Chinese risks(which do not cover storage), project cargo withconsequential loss, primary and excess US motor truckcargo, and carnets.05 SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015

ACTIVEUNDERWRITER’SREPORTThe Specie book consists predominantly of high valuerisks with very good security. The fine art and generalspecie (precious metals, securities and excess SecuritiesInvestor Protection Corporation) books are the largestpart of the Specie account and jewellers block is thesmallest. A consortium has been in place since 2013,supported by Novae. The consortium has been renewedfor 2016 with the support of two more syndicates.The Non-Marine Liability team, which joined theSyndicate in 2013, writes a diverse book of businesson both an open market and facilities basis. Themajority of the account is written on a direct excessbasis focussing on Fortune 1000, transportation, civilconstruction and mining companies.The Energy plan did not anticipate the extent of theoil price crash that occurred in the second half of2014 and as a result premium income has fallen belowthe original planned amount. The team have significantexperience and a profitable track record in this classwithin the Lloyd’s and company market and havenavigated their way through difficult marketconditions before.Underwriters seek to position their attachment pointsabove attritional levels so that the portfolio loss profileis generally low frequency, high severity, with theexposures being well protected by reinsurance. TheNon-Marine Liability class continued to grow steadily,building on the platform established in 2013 and 2014and enhancing the team with further recruitment ofadditional underwriters. Since 2013 the team has leda consortium supported by Hiscox and Argenta. We aremindful of the current competitive environment andwill continue our careful underwriting approach.The Non-Marine Liability classcontinued to grow steadily,building on the platformestablished in 2013 and 2014and enhancing the team withfurther recruitment of additionalunderwriters.Our planned increase in premium income for theOffshore Energy account in 2015 was put into reverseas we reacted to very competitive market conditionsand a global slowdown in the energy sector. Theaccount is primarily focused on the upstream sectorand includes oil and gas lease operators, drilling andconstruction contractors, and gas utilities.The cover offered is for property damage, operatorsextra expense and construction. Incidental to thesemajor heads of cover are loss of production income,business interruption, loss of hire, war and terrorism.Having had a great start in 2013 and 2014, receivingconsiderable broker, reinsurer and client support, weplanned to increase premium income for 2015 to allowus to fully establish the account.2014The Syndicate also recruited a very well regardedAviation team with a long track record in the class.Although the aviation market is currently verychallenging we consider this class offers attractivelong-term opportunities.We have recruited a market leading class underwriterand will initially look to write only a small amount ofincome, whilst positioning ourselves on selected areasof the class in order to take full advantage of hardening in market conditions when this occurs. As aviationbusiness requires significant line size capability, theconsortium established with ANV Syndicate 1861in 2015 has been renewed for 2016.SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 06

ACTIVEUNDERWRITER’SREPORT2016 PORTFOLIOThe 2016 Lloyd’s approved plan is to underwrite 162m of premium income (net of commission) witha stamp capacity of 180m.We have added a new class underwriter for Marine& Energy Liability for 2016. When developing ouroriginal plan for Energy in 2013, it had always beenour intention to establish a presence in the EnergyLiability market.Our plan was to provide the Syndicate with greatertechnical strength in an area that is often written ona packaged basis with Energy Property and also tofacilitate a broader product offering, making us morerelevant to Energy brokers and clients.We now have one of the leading underwriters in thissector with a historically profitable track record inthe Lloyd’s market. We believe this to be a significantstep forward for Apollo and this book. In additionto Energy Liability, this class will also cover MarineLiability business which sits well with our existingCargo & Specie account. It is a natural step for usto build out this area with a dedicated resource.07 SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015

ACTIVEUNDERWRITER’SREPORTThe plan for Syndicate 1969 for 2016 can besummarised as follows: continue with the disciplined approach in theexisting Property classes build on the 2015 base for Specie & Cargo andNon Marine Liability renew the Offshore Energy portfolio cautiouslygiven challenging market conditions further develop the Aviation account positioningourselves on selected areas of the class renew the Personal Accident account bysupporting a consortium led by ANVSyndicate 1861 develop the new Marine & Energy Liability class.The Syndicate will seek to add new lines ofbusiness as opportunities arise but will maintainits focus on specialist, profitable lines with a shorttail bias. We will consider adding new classes whichoffer profitable diversity to improve the overallportfolio in line with our strategy to expand ourcapability and expertise for the long term.Once again we would like to thank you for youron-going support for Syndicate 1969. I would alsolike to take the opportunity to thank our staff fortheir hard work and dedication to further developthe business during the past year.NG JonesActive Underwriter15 March 2016SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 08

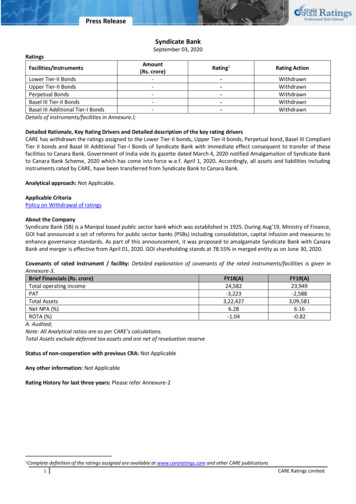

REPORT OF THEDIRECTORS OF THEMANAGING AGENTREPORT OF THE DIRECTORSOF THE MANAGING AGENTThe Directors of the Managing Agent presenttheir report, which incorporates the strategicreview, for Syndicate 1969 for the year ended31 December 2015.This Annual Report is prepared using the annualbasis of accounting as required by StatutoryInstrument No. 1950 of 2008, The InsuranceAccounts Directive (Lloyd’s Syndicate andAggregate Accounts) Regulations 2008 (“Lloyd’sRegulations 2008”).Separate underwriting year accounts for theclosed 2013 account of Syndicate 1969 areincluded following these annual accounts.PRINCIPAL ACTIVITYThere have not been any significant changes tothe Syndicate’s principal activity during the year,which continues to be the transaction of generalinsurance and reinsurance business.Syndicate 1969 trades through Lloyd’s worldwidelicenses and rating and has the benefit of theLloyd’s brand. Lloyd’s has an A (Excellent) ratingfrom A.M. Best, A (Strong) from Standard & Poor’sand AA- (Very Strong) from Fitch.The Syndicate’s capacity for the 2015 yearof account was 160m (2014 year of account: 140m). Capacity for the 2016 year of accounthas increased to 180m.RESULTSThe result for the financial year 2015 is a profitof 7.8m (2014: profit of 5.9m). Apollo SyndicateManagement Limited (“ASML”) uses a range of keyperformance indicators to measure the performanceof the Syndicate against its objectives and overallstrategy. These indicators are regularly reviewedand are measured against plan and prior yearoutcomes. A selection of the Syndicate’s financialkey performance indicators during the year wereas follows:2015 Restated% ’m2014 change ’mGross premium written188.4152.224%Net premium written149.4121.223%Net premium earned130.5105.524%Profit for the financial year7.85.933%Claims ratio52.6%54.7% (2.1%)Expense ratio40.3%38.9%1.4%Combined ratio92.9%93.6% (0.7%)Profits and losses will be distributed and calledrespectively by reference to the results of individualunderwriting years.Notes:The claims ratio is the ratio of net claims incurred to net premiums earned.The expense ratio is the ratio of net operating expenses to net premiums earned.The combined ratio is the sum of the claims and expense ratios.The expense and combined ratios exclude investment income, realised and unrealised gains and losses and foreign exchangesgains and losses.Lower ratios represent better underwriting and operational performance.09 SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015

180mThe Syndicate’s capacity for the2015 year of account was 160m(2014 year of account: 140m).Capacity for the 2016 year ofaccount has increased to 180m.SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 10

REPORT OF THEDIRECTORS OF THEMANAGING AGENTREVIEW OF THE BUSINESSWe are pleased to report that 2015 has been anothersuccessful year for the Syndicate. Despite challengingmarket conditions the Syndicate has delivered to itsplan for the years.The 2015 calendar year result is made up ofcontributions from earnings on all open years ofaccount (2013, 2014 and 2015).Turning to the traditional three year accounting basis,we are closing the 2013 year of account at a returnon stamp capacity of 0.4%, which is just below themidpoint of the previously published forecast rangeof -2% to a profit of 3% of stamp capacity. The 2013Year of Account suffered from Hurricanes Manuel andIngrid, Central European flooding and the Julius KleinDiamond heist.The 2014 year of account has a forecast return in therange of 4% to 9% on stamp capacity at the 24 monthstage. Whilst the year has benefited from a relativelylow level of catastrophe events, the result has absorbedlosses from Hurricane Odile and two notable risk losseson the Energy account.Whilst it is too early in the development of the 2015year of account to publish a forecast result for the year,loss experience in the first 12 months has been withinexpectations and the Syndicate has written 92% ofits planned income, having decided to restrict writingon the Energy account due to weak market conditions.ASML will publish its first forecast range for the 2015account in the second quarter of 2016.There has been no early release of profit on the2014 and 2015 open years of account at this stageof development.The Syndicate is now well established in the Lloyd’smarket and is receiving excellent support from a widerange of brokers. We believe we are well positionedto deliver consistent profits in future years.Further information regarding the Syndicateunderwriting portfolio is contained in the ActiveUnderwriter’s Report.92%The Syndicate has written92% of its planned income,having decided to restrictwriting on the Energyaccount.INVESTMENT PERFORMANCEThe Syndicate produced an investment return of 0.3min the year (2014: 0.3m).The investment objective is to invest the Premium TrustFunds in a manner designed primarily to preserve capitalvalues and provide liquidity. Within those constraints theSyndicate’s assets have been invested in money marketfunds in order to limit exposure to adverse priceconditions and capital market volatility.11 SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015

REPORT OF THEDIRECTORS OF THEMANAGING AGENTSIGNIFICANT EVENTSDuring 2015, ASML was granted approval to establishManaging Agency at Lloyd’s and has been authorisedby the Prudential Regulation Authority. ASML alsoregulated by the Financial Conduct Authority andPrudential Regulation Authority.With effect from 1 August 2015 responsibility for themanagement of the affairs of Syndicate 1969 wastransferred from ANV Syndicates Ltd (“ANV”) to ASML.ASML’s vision is to be a specialist, mid-sized, efficient,Lloyd’s oriented business with a balanced portfolio andbroker-led distribution.ASML business model is Lloyd’s centric with a purelyLondon-based operation and distribution model. Forthe foreseeable future Lloyd’s will be the only platform.ASML aims to establish long-standing and valuedrelationships with all of its clients and brokers byworking in partnership with them and is continuallylooking to provide client solutions and an excellentservice.CAPITALOne of the advantages of operating in the Lloyd’smarket is the lower capital ratios that are available dueto the diversification of business written in Syndicate1969 and in Lloyd’s as a whole.ASML assesses the Syndicate’s capital requirementsthrough a rigorous process of risk identification andquantification, using an internal capital model at a 1:200confidence level. The model is based on regulatoryrequirements and has been approved by Lloyd’s. TheSyndicate ultimate Solvency Capital Requirement (“SCR”)is subject to an uplift determined by the Lloyd’s FranchiseBoard based on their assessment of the economic capitalrequirements for the Lloyd’s market in total.The SCR together with the Lloyds’ uplift is referredto as the Economic Capital Assessment (“ECA”). TheSyndicate ECA for the 2016 underwriting year is setat 64.2% of planned premium income.ASML fully embraces and supports Lloyd’s visionof being a broker market, as well as accessing localmarkets through third party coverholders.ASML’s skills and market-leading capability meansthat it does not only compete on price: it attractsbusiness through differentiated service and a betterunderstanding of risk and clients’ needs.With ASML’s focus on risk selection, long termrelationships and experience it believes that it canout-perform the market when rates are soft and is wellpositioned for when markets turn.As a mid-sized business in a single location, ASML’swill be capable of expanding and contracting as marketconditions dictate. Through the use of specific outsourcingit will be able to maintain an appropriate supportfunction commensurate with its underwriting capacity.SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 12

REPORT OF THEDIRECTORS OF THEMANAGING AGENTLloyd’s unique capital structure provides excellentfinancial security to policy holders and capital efficiencyfor members. The Lloyd’s chain of security providesthe financial strength that ultimately backs insurancepolicies written at Lloyd’s and has three links:1. All premiums received by Syndicates are heldin trust as the first resource for settling policyholders’ claims;2. Every member is required to hold capital at Lloyd’swhich is held in trust and known as Funds atLloyd’s (“FAL”). FAL is intended primarily tocover circumstances where Syndicate assetsare insufficient to meet participating members’underwriting liabilities. They are set withreference to the Syndicate ECA. Since FAL isnot under the control of the Managing Agent,it has not been shown in the Syndicate financialstatements. The Managing Agent is, however,able to make a call on members’ FAL to meetliquidity requirements or to settle underwritinglosses;3. L loyd’s central assets are available at the discretionof the Council of Lloyd’s to meet any valid claimthat cannot be met through the resources of anymember further up the chain. Lloyd’s also retainsthe right to request a callable contribution equalto 3% of capacity from the Syndicate.PRINCIPAL RISKS AND UNCERTAINTIESThe Managing Agent has established a riskmanagement function for the Syndicate with clearterms of reference from the Board of Directors and itscommittees. The ASML Board approves the risk management policies and meets regularly to approve anycommercial, regulatory and organisational requirementsof these policies.The risk appetite is set annually as part of theSyndicate business planning and capital settingprocess. The risk management function is alsoresponsible for maintaining the Syndicate’s Own Riskand Solvency Assessment (“ORSA”) process andprovides regular updates to the Board. ASML alsoprovides a formal ORSA report to the Board at leastannually for approval.The Managing Agent recognises that the Syndicate’sbusiness is to accept risk which is appropriate to enableit to meet its objectives and that it is not realistic orpossible to eliminate risk entirely.A description of theprincipal risks and uncertainties facing the Syndicate isset out in the notes to the financial statements.CORPORATE GOVERNANCEThe management of Syndicate 1969 transferred fromANV to ASML on 1 August 2015. The Boards of ASMLand ANV ran in parallel between 1 January and 31 July2015.The ASML Board is chaired by Julian Cusack, who issupported by three further non-executive directors,two of whom are independent. David Ibeson is theChief Executive Officer and there are four furtherexecutive directors.Defined operational and management structuresare in place and terms of reference exist for all Boardcommittees.The ASML Board meets at least four times a year andmore frequently when business needs require. TheBoard has a schedule of matters reserved for its decisionand is supported by an Audit and Risk Committee, aRemuneration and a Nominations Committee.ASML also receives regular reports from five executivecommittees; the Underwriting Committee, ReservingCommittee, Risk and Capital Committee, FinanceCommittee, and Operations and Outsourcing Committee.13 SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015

REPORT OF THEDIRECTORS OF THEMANAGING AGENTSTAFF MATTERSASML considers its staff to be a key resource and theretention of staff is also fundamental to the successof the business. The strategy adopted by ASML isdesigned to ensure that the terms and conditionsoffered to employees, as part of their overallremuneration package, remain competitive with therest of the London market insurance industry and staffare provided with opportunities to develop their skillsand capabilities.The Managing Agent seeks to provide a good workingenvironment for its staff that is safe and complies withrelevant legislation. During the year, there has beenno injury to staff in the workplace or any actions takenby any regulatory bodies with regard to staff matters.DIRECTORS AND DIRECTORS’ INTERESTSThe Directors who held office during the year areshown on page 2. Directors’ interests are shown in note26 as part of the related parties note to the accounts.DISCLOSURE OF INFORMATIONTO THE AUDITOREach person who is a Director of the Managing Agentat the date of approving this report confirms that: s o far as the Director is aware, there is no relevantaudit information of which the Syndicate’s auditoris unaware; and e ach Director has taken all the steps that theyought to have taken as a Director in order to makethemselves aware of any relevant audit informationand to establish that the Syndicate’s auditor isaware of that information.AUDITORDeloitte LLP has indicated its willingness to continue inoffice as the Syndicate’s auditor.ANNUAL GENERAL MEETINGThe Directors do not propose to hold an Annual GeneralMeeting for the Syndicate. If any members’ agent ordirect corporate supporter of the Syndicate wishes tomeet with them the Directors will be prepared to do so.SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 14

SYNDICATE 1969REPORT OF THE DIRECTORS OF THE MANAGING AGENT15 SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015

SYNDICATE 1969REPORT OF THE DIRECTORS OF THE MANAGING AGENTFUTUREDEVELOPMENTSAS A SYNDICATE WE HAVE RECEIVEDSTRONG SUPPORT FROM BOTHEXISTING AND NEW CAPITALPROVIDERS.The initial capital base of Hays Group,Hannover Re and traditional Nameshas been joined by a small number ofhighly respected global insurance andreinsurance entities. We are delightedto have such a strong, diversified andknowledgeable spread capital basesupporting the business.ASML aims to further diversify theSyndicate’s portfolio to reduce volatilityand dependence on any one class whilstbeing able to react effectively tochanging market conditions for thebenefit of capital providers and clients.Approved on behalf of the Board.DCB IbesonChief Executive Officer15 March 2016SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 16

STATEMENT OFMANAGING AGENT’SRESPONSIBILITIESTHE MANAGING AGENT IS RESPONSIBLE FOR PREPARINGTHE SYNDICATE ANNUAL ACCOUNTS IN ACCORDANCE WITHAPPLICABLE LAW AND REGULATIONS.The Insurance Accounts Directive (Lloyd’s Syndicateand Aggregate Accounts) Regulations 2008 requirethe Managing Agent to prepare Syndicate annualaccounts at 31 December each year in accordancewith United Kingdom Generally Accepted AccountingPractice (United Kingdom Accounting Standardsand applicable law). The Syndicate annual accountsare required by law to give a true and fair view ofthe state of affairs of the Syndicate as at that dateand of its profit or loss for that year.In preparing the Syndicate annual accounts, theManaging Agent is required to:The Managing Agent is responsible for keepingproper accounting records which disclose withreasonable accuracy at any time the financialposition of the syndicate and enable it to ensurethat the Syndicate annual accounts comply withthe 2008 Regulations. It is also responsible forsafeguarding the assets of the Syndicate andhence for taking reasonable steps for preventionand detection of fraud and other irregularities.Legislation in the UK governing the preparationand dissemination of annual accounts may differfrom legislation in other jurisdictions. s elect suitable accounting policies and thenapply them consistently; m ake judgements and estimates that arereasonable and prudent; s tate whether applicable UK AccountingStandards have been followed, subject to anymaterial departures disclosed and explainedin the notes to the Syndicate annual accounts;and p repare the Syndicate annual accounts on thebasis that the Syndicate will continue to writefuture business unless it is inappropriate topresume that the Syndicate will do so.17 SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015

The Managing Agent is responsiblefor keeping proper accountingrecords which disclose withreasonable accuracy at any timethe financial position of thesyndicate and enable it to ensurethat the Syndicate annual accountscomply with the 2008 Regulations.SYNDICATE 1969 ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2015 18

INDEPENDENT AUDITOR’SREPORT TO THE MEMBERSOF SYNDICATE 1969We have audited the Syndicate annual financialstatements for the year ended 31 December 2015which comprise the Profit and Loss Account, Statementof Comprehensive Income, Balance Sheet, Statementof Changes in Members’ Balances, the Statementof Cash Flows and the related notes 1 to 26. Thefinancial reporting framework that has been applied intheir preparation is applicable law and United KingdomAccounting Standards (United Kingdom GenerallyAccepted Accounting Practice), including FRS 102“The Financial Reporting Standard applicable in theUK and Republic of Ireland”.This report is made solely to the Syndicate’s members,as a body, in accordance with regulation 10 of TheInsurance Accounts Directive (Lloyd’s Syndicate andAggregate Accounts) Regulations 2008. Our auditwork has been undertaken so that we might stateto the Syndicate’s members those matters we arerequired to state to them in an auditor’s report andfor no other purpose. To the fullest extent permittedby law, we do not accept or assume responsibility toanyone other than the Syndicate’s members as a b

The Non-Marine Liability team, which joined the Syndicate in 2013, writes a diverse book of business on both an open market and facilities basis. The majority of the account is written on a direct excess basis focussing on Fortune 1000, transportation, civil construction and mining companies. Underwriters seek to position their attachment points