Transcription

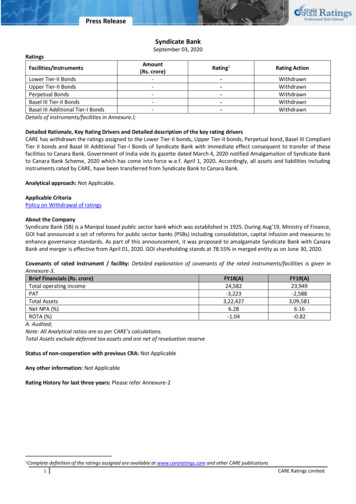

Press ReleaseSyndicate BankSeptember 03, 2020RatingsFacilities/InstrumentsLower Tier-II BondsUpper Tier-II BondsPerpetual BondsBasel III Tier-II BondsBasel III Additional Tier-I BondsDetails of instruments/facilities in Annexure.l;Amount(Rs. crore)-Rating1Rating wnDetailed Rationale, Key Rating Drivers and Detailed description of the key rating driversCARE has withdrawn the ratings assigned to the Lower Tier-II bonds, Upper Tier-II bonds, Perpetual bond, Basel III CompliantTier II bonds and Basel III Additional Tier-I Bonds of Syndicate Bank with immediate effect consequent to transfer of thesefacilities to Canara Bank. Government of India vide its gazette dated March 4, 2020 notified Amalgamation of Syndicate Bankto Canara Bank Scheme, 2020 which has come into force w.e.f. April 1, 2020. Accordingly, all assets and liabilities includinginstruments rated by CARE, have been transferred from Syndicate Bank to Canara Bank.Analytical approach: Not Applicable.Applicable CriteriaPolicy on Withdrawal of ratingsAbout the CompanySyndicate Bank (SB) is a Manipal based public sector bank which was established in 1925. During Aug’19, Ministry of Finance,GOI had announced a set of reforms for public sector banks (PSBs) including consolidation, capital infusion and measures toenhance governance standards. As part of this announcement, it was proposed to amalgamate Syndicate Bank with CanaraBank and merger is effective from April 01, 2020. GOI shareholding stands at 78.55% in merged entity as on June 30, 2020.Covenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given inAnnexure-3.Brief Financials (Rs. crore)FY18(A)FY19(A)Total operating income24,58223,949PAT-3,223-2,588Total Assets3,22,4273,09,581Net NPA (%)6.286.16ROTA (%)-1.04-0.82A: Audited;Note: All Analytical ratios are as per CARE’s calculations.Total Assets exclude deferred tax assets and are net of revaluation reserveStatus of non-cooperation with previous CRA: Not ApplicableAny other information: Not ApplicableRating History for last three years: Please refer Annexure-21Complete1definition of the ratings assigned are available at www.careratings.com and other CARE publicationsCARE Ratings Limited

Press ReleaseAnnexure-1: Details of Instruments/FacilitiesName of theInstrumentBonds-LowerTier IIBonds-UpperTier tualBondsBonds-LowerTier IIBonds-Tier IIBondsBonds-Tier-IIbondsBonds-Tier IIBondsBonds-Tier-IIbondsBonds-Tier IBondsBonds-Tier IBondsBonds-Tier IbondsBonds-Tier IBondsBonds-Tier IIBondsBonds-Tier IBondsBonds-LowerTier II2ISIN No.Date NE667A09110December 26,2008July 11, 2006INE667A09128March 25, 20089.90%December 26,2018February 28,2022PerpetualINE667A09144January 12, 20099.40%INE667A09169June 29, 2009INE667A09177December 31,2012December 02,2014INE667A08021INE667A08013INE667A08039March 23, thdrawn8.90%Perpetual0.00Withdrawn9.00%December 31,2022December 00Withdrawn8.95%8.95%INE667A0806211.25%September 28,2025December 18,2025PerpetualINE667A08054March 30, 201611.25%PerpetualJuly 15, 201611.25%INE667A080708.58%March 23, 2025September 28,2015December 18,2015March 30, 2016INE667A08047Size of the Rating assignedIssuealong with Rating(Rs. 88 October 24, 20169.95%Perpetual0.00WithdrawnINE667A08096May 03, 20178.00%May 03, 20270.00WithdrawnINE667A08104July 25, 20179.80%Perpetual0.00WithdrawnINE667A09151June 15, 20098.49%June 15, 20190.00WithdrawnCARE Ratings Limited

Press ReleaseAnnexure-2: Rating History of last three yearsSr.Name of theNo. Instrument/BankFacilitiesType1.Bonds-Lower TierIILT2.Bonds-Upper LTBonds-PerpetualBondsLT3.4.5.3Current RatingsRating historyAmountRating Date(s) & Date(s) & Rating(s) Date(s) &OutstandingRating(s) assigned in 2019Rating(s)(Rs. crore)assigned in2020assigned in2020-20212018-20191)CARE AA1)CARE AA;(Under CreditNegativewatch -19)AA ;2)CARE AA;NegativeNegative(06-Jul-18)(04-Jul-19)-1)CARE AA(Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE AA-;Negative(04-Jul-19)1)CARE AA; Negative(12-Nov18)2)CARE AA;Negative(06-Jul-18)1)CARE AA;Negative(20-Jul-17)-1)CARE AA(Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE AA-;Negative(04-Jul-19)1)CARE AA; Negative(12-Nov18)2)CARE AA;Negative(06-Jul-18)1)CARE AA;Negative(20-Jul-17)-1)CARE AA(Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE AA-;Negative(04-Jul-19)1)CARE AA; Negative(12-Nov18)2)CARE AA;Negative(06-Jul-18)1)CARE AA;Negative(20-Jul-17)-1)CARE AA(Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE AA-;Negative(04-Jul-19)1)CARE AA; Negative(12-Nov18)2)CARE AA;Negative(06-Jul-18)1)CARE AA;Negative(20-Jul-17)---1)CARE AA ;Negative(20-Jul-17)--Date(s) & Rating(s)assigned in 20172018CARE Ratings Limited

Press Release6.Certificate OfDepositSTBonds-Lower TierIILTBonds-Tier IIBondsLTBonds-Tier IIBondsLT10. Bonds-Tier I BondsLT7.8.9.----1)CARE AA;Negative(12-Nov18)2)CAREAA ;Negative(06-Jul-18)1)CARE AA ;Negative(20-Jul-17)-1)CARE AA(Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE AA;Negative(04-Jul-19)1)CARE AA;Negative(12-Nov18)2)CAREAA ;Negative(06-Jul-18)1)CARE AA ;Negative(20-Jul-17)-1)CARE AA(Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE AA;Negative(04-Jul-19)1)CARE AA;Negative(12-Nov18)2)CAREAA ;Negative(06-Jul-18)1)CARE AA ;Negative(20-Jul-17)-1)CARE A (Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE A ;Negative(04-Jul-19)1)CARE A (Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE A ;Negative(04-Jul-19)1)CARE A ;Negative(12-Nov18)2)CARE AA; Negative(06-Jul-18)1)CARE AA-;Negative(20-Jul-17)1)CARE A ;Negative(12-Nov18)2)CARE AA; Negative(06-Jul-18)1)CARE AA-;Negative(20-Jul-17)1)CARE A (Under Creditwatch withDevelopingImplications)(11-Sep-19)1)CARE A ;Negative(12-Nov18)2)CARE AA; Negative1)CARE Jul-17)1)CARE AA(Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE AA;Negative(04-Jul-19)-12. Bonds-Tier I Bonds---11. Bonds-Tier I Bonds--CARE Ratings Limited

Press Release13. Bonds-Tier IIBondsLT14. Bonds-Tier I BondsLT-2)CARE A ;Negative(04-Jul-19)(06-Jul-18)-1)CARE A (Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE A ;Negative(04-Jul-19)1)CARE A ;Negative(12-Nov18)2)CAREAA ;Negative(06-Jul-18)1)CARE AA ;Negative(20-Jul-17)-1)CARE A (Under Creditwatch withDevelopingImplications)(11-Sep-19)2)CARE A ;Negative(04-Jul-19)1)CARE A ;Negative(12-Nov18)2)CARE AA; Negative(06-Jul-18)1)CARE AA-;Negative(20-Jul-17)--Annexure-3: Detailed explanation of covenants of the rated instrument / facilities-Not ApplicableAnnexure 4: Complexity level of various instruments rated for this companySr. No.1.2.3.4.5.Name of the InstrumentBonds-Lower Tier IIBonds-Perpetual BondsBonds-Tier I BondsBonds-Tier II BondsBonds-Upper Tier IIComplexity LevelComplexHighly ComplexHighly ComplexComplexHighly ComplexNote on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of complexity.Investors/market intermediaries/regulators or others are welcome to write to care@careratings.com for any clarifications.5CARE Ratings Limited

Press ReleaseContact usMedia ContactMradul Mishra 91-22-6837 4424mradul.mishra@careratings.comAnalyst Contact 1Himanshu st Contact 2Karthik Raj ip ContactNitin Kumar DalmiaContact no. : 080-46625555Email ID: nitin.dalmia@careratings.comAbout CARE Ratings:CARE Ratings commenced operations in April 1993 and over two decades, it has established itself as one of the leading creditrating agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI) and also recognized as anExternal Credit Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE Ratings is proud of its rightful place inthe Indian capital market built around investor confidence. CARE Ratings provides the entire spectrum of credit rating thathelps the corporates to raise capital for their various requirements and assists the investors to form an informed investmentdecision based on the credit risk and their own risk-return expectations. Our rating and grading service offerings leverage ourdomain and analytical expertise backed by the methodologies congruent with the international best practices.DisclaimerCARE’s ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are notrecommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security.CARE’s ratings do not convey suitability or price for the investor. CARE’s ratings do not constitute an audit on the ratedentity. CARE has based its ratings/outlooks on information obtained from sources believed by it to be accurate and reliable.CARE does not, however, guarantee the accuracy, adequacy or completeness of any information and is not responsible forany errors or omissions or for the results obtained from the use of such information. Most entities whose bankfacilities/instruments are rated by CARE have paid a credit rating fee, based on the amount and type of bankfacilities/instruments. CARE or its subsidiaries/associates may also have other commercial transactions with the entity. Incase of partnership/proprietary concerns, the rating /outlook assigned by CARE is, inter-alia, based on the capital deployedby the partners/proprietor and the financial strength of the firm at present. The rating/outlook may undergo change in caseof withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the financialperformance and other relevant factors. CARE is not responsible for any errors and states that it has no financial liabilitywhatsoever to the users of CARE’s rating. Our ratings do not factor in any rating related trigger clauses as per the terms ofthe facility/instrument, which may involve acceleration of payments in case of rating downgrades. However, if any suchclauses are introduced and if triggered, the ratings may see volatility and sharp downgrades.**For detailed Rationale Report and subscription information, please contact us at www.careratings.com6CARE Ratings Limited

Tier II bonds and Basel III Additional Tier-I Bonds of Syndicate Bank with immediate effect consequent to transfer of these facilities to Canara Bank. Government of India vide its gazette dated March 4, 2020 notified Amalgamation of Syndicate Bank to Canara Bank Scheme, 2020 which has come into force w.e.f. April 1, 2020.