Transcription

Market BulletinRef: Y5307Title2021 Members’ subscriptions, Central Fund contributions and other MarketChargesPurposeNotification of 2021 charges, contributions, subscriptions and payment datesTypeScheduledFromBurkhard Keese, CFOTel: 44(0)20 7327 6509email burkhard.keese@lloyds.comDate30 September 2020The purpose of this bulletin is to set out the charges applicable to Lloyd’s members for2021.Summary of charges for 2021There will be no changes to market charges for 2021; all existing charges will be held atcurrent levels:- Members’ subscriptions are 0.36% of planned gross written premium;- Central Fund contributions are 0.35% and 1.40% of planned gross written premium forexisting and new members respectively; and- All other charges, including overseas operating charges and user pay charges, are heldat current levels.Delegated Contract and Oversight ManagerDuring the second quarter of 2020 Lloyd’s confirmed it would assume responsibility fordelivery and administration of the Delegated Contract and Oversight Manager service to theLloyd’s market from 2021. This service was initially planned to be administered by LIMOSS,with the associated costs being recovered from market participants. With the switch inadministration to Lloyd’s, the associated costs of administering this service will be absorbedby the Corporation without any additional charges being levied upon market participants.A schedule of changes applicable to Lloyd’s members for 2021 is set out below with furtherdetails in the Appendix.2021 Market Charges BulletinPage 1 of 17Lloyd’s is authorised under the Financial Services and Markets Act 2000Classification: Confidential

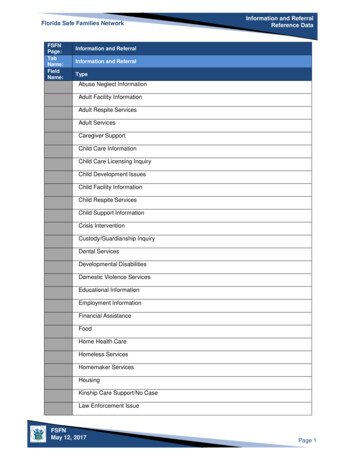

MARKET BULLETINAreaMarket ndicates inrun-offCapacityMarketsMembers’ SubscriptionNew Central Fund ContributionsNew Corporate Members Central Fund ContributionsDirectAll locationsReinsuranceCoverholderLloyd's Italian office (Additional charge)Syndicates in Run-offSchedule 3ChargesTrust FundLeviesCalculation basis PGSSPGSSPGSSPGWP 1 Per 1,000net insuranceliabilitiesApproval of capacity offer by means of announced auction offer 2,400Approval of formal capacity offer (cash only) 6,250Approval of formal capacity offer (with shares or a share alternative) 7,850Approval of conversion scheme (with inter-availability) 12,000Commingled investment accounts*Funds at Lloyd’s (FAL) cash sweep, LMDTACurrency Conversion Service (CCS)FX execution serviceInvestment of overseas regulatory deposits* 15,000,001 or greater* 10,000,001 to 15,000,000*Overall 5,000,001 to 10,000,000*Premium Limitfor member per 2,000,001 to 5,000,000*syndicate 2,000,000 or less*participationMembers participating on 2017 or prior run-offyears only*Australian Trust FundCanadian Margin FundCredit for Reinsurance and Surplus Lines Trust FundIllinois Trust FundKentucky Trust FundSouth African Trust FundPremium tax charges (main syndicates only)*SyndicateSyndicate UK tax returns*ChargesCertificate of UK Tax Residence*Treasury2021 rateTax ChargesMemberChargesFlat fee8.5bp3.5bp5bpUp to 5bp8.5bp 150 125 90 50 50AUMAUMPer transactionPer transactionAUMMax Fee 4,475Max Fee 3,700Max Fee 2,625Max Fee 1,550Max Fee 1,025 50Max Fee 1,025IND 165,050 51,000 34,900 51,000 68,650 52,200 20,000 500 1,000CORPUS (incl. income and excise taxes, FATCA)* 750 1,000 10,000Canada*Singapore*UK tax advices (incl. CTA1/2, foreign taxschedules, etc.)*Third Party Funding Providers*Japan* 250 250 250 250 3,500 3,500DCP 250 250 100 250Country by Country Reporting* 750LLP / SLP charge for 2nd and each furtherpartner* 500Classification: ConfidentialFlat fee 3,500 1,000US Controlled Foreign Corporations reports (onlyaffected members)*2021 market charges bulletin finalAnnual flat fee(received quarterly) inlocal currency.Page 2 of 17

MARKET BULLETINAreaMarket ChargeMemberChargesCalculation basis /Limits2021 rateTrustee / Regulatory ServicesThird Party FAL Providers (TPFP)Interavailable Recipient Monitoring Charge – openparticipationInteravailable Recipient Monitoring Charge –closed participationInteravailable Recipient Monitoring Charge –closed 2 yearsCitibank Holding Charge where value held inCitibank 10m*Cash Service ChargeIND 515CORP 2,800 200DCP 13,900N/A 500Per donorN/A 1,500Per finalised donorN/A 2,500Per finalised donor 5,000Flat feeUp to 0.14% 120Cash heldper day per 5m, upto 10 working daysper day per 5m 10working daysper hour 52,000per application 5,250per application 10,500per application 1,050per application 5,250per application 520per TPFP 2,600per TPFP 10,500Per TPFPRecommencement of Underwriting – No changes 1,050Flat feeRecommencement of Underwriting – Simple 5,250Flat feeRecommencement of Underwriting – Complex 10,500Flat feeExtension/Late/Breach/Non-submission fee incl.Declaration of Compliance, PTF trustees 520Flat feeResults & Stamp Processing – Simple (Aligned)* 5,150per syndicateResults & Stamp Processing – Complex (Spread)* 15,450per syndicate0.06%per successful bidUp to 50,000per members’ agent,based on number ofmembers 10,000Per ceasing membersubject to amaximum of 50,000per corporate group 250Coming into Line Extension Request 500Complex issues*Corporate Member Application –Non Private CapitalCorporate Member Application – Private CapitalSimpleCorporate Member Application – Private Capital –ComplexChange of Control Application – SimpleChange of Control Application – ComplexMemberServicesMemberApplication &CorporateMemberChangesSyndicateChargesApproval of New Third Party Funding Provider –Simple (known entity)Approval of Third Party Funding Provider – Simple(new entity)Approval of Third Party Funding Provider –Complex (new entity)Auction – buy/sell capacityProvision of systems to members’ agents*CorporateInteravailableFALFlat feeper TPFPCorporate groups seeking to consolidate andmake their individual corporate members' FALinteravailable *2021 market charges bulletin finalClassification: ConfidentialPage 3 of 17

MARKET BULLETINAreaMarket ChargeUK, Australia &New ZealandComplaintsInternationalComplaintsAll Complaints2021 rateAdministration fee 150Additional fee for full investigation - Tier 1 229Additional fee for full investigation – Tier 2 655Additional fee for full investigation – Tier 3 983Additional fee for full investigation – Tier 4 1,310Claim reserve of 10,000- 25,000Claim reserve above 25,001Per letterPer complaintreceived by direct byLloyd’s 50Administration fee 262Additional fee for International complaint 131Per DOI extensionAdditional fee for full investigation 524Additional Administration Fee 200Per stage two reviewPer chase / failure tocomply withrequirementsFailure to Meet Performance Metrics and other Systemic IssuesRecovery of UK Financial Ombudsman ServiceFinancial(FOS) case feeOmbudsmanRecovery of External Dispute Resolution FeesService(including UK FOS)ComplaintsHandled byLloyd’sAustraliaPer complaintreceived by direct byLloyd’sClaim reserve of 500 and underClaim reserve 501 10,000 and all nonclaim related issuesIssue Investigation Ongoing Letter (UK Only)Automated Chase for Documentation / InformationComplaintsCalculation basis /Limits 50Per chase issuedUp to 25,000Flat feeFOS revises their case fee on the 1st April eachyear. 2020/2021 charge fixed at 650Levy is recovered from relevant syndicatesAdministration fee for complaintA 268Charged for mattersmanaged at AFCAand/or IFSOFee for full investigation – Tier 1A 410Claim reserve ofA 900 and underFee for full investigation – Tier 2A 1,185Claim reserve ofA 901-A 18,000 andall non-claim relatedissuesFee for full investigation – Tier 3A 1,772Claim reserve ofA 18,001 – A 45,000Fee for full investigation – Tier 4Additional Administration FeeResponse to potential systemic issues and/orsignificant code breach investigationsAustralian AFCA and New Zealand IFSO case feeis payable by coverholder / DCA / managing agent2021 market charges bulletin finalClassification: ConfidentialClaim reserve ofabove A 45,001Per chase/ failure toA 360comply withrequirements.Depending oncomplexity of issueA 1,000- 3,000and time taken tofinalise.AFCA charges range from AU 100 to AU 13,300dependent on the stage the matters resolve. Higherfees are charged for legacy complaints. IFSOcharges approx. NZ 1,100A 2,370Page 4 of 17

MARKET BULLETINArea2021 rateCalculation basis /LimitsManpower Hourly RatePlus MaterialsPer cableFibre Optic Cable – Infrastructure Support &Rental* 967Per Fibre PairBlock Wiring. Charge for use of BT block wiring tosupport private PBX's (price per pair)* 22Per PairFibre Installation. One-off charge for provision offibre to an U/W box or office* 502Per UnitBlack Box Park 1 (BBP1) Rack Space - 1 unit* 369Per Unit 2,010 3,969 7,836Per UnitPer UnitPer Unit 142Per UnitManpower Hourly RatePer UnitStandard Extension Rental & Handset* 649Per ExtensionDigital Telephone Handset Additional Rental* 143Per Handset 176 88 125 305 731 264 555 833 1,110Double Room Rent 32 105 5,000 20,000 50,000 10,000 300,000 200,000 75,000 5,000 10,000Per HandsetPer SocketPer UnitPer LinePer UnitPer UnitMarket ChargeInstallation of Cabling within the Lloyd’s building*CablingServicesGroupTechnologyBlack Box Park(BBP1)ServicesBBP1 Lockable Rack Space - 10 units*BBP1 Lockable Rack Space - 20 units*BBP1 Floor Space*BBP1 Cross Connect installation (Meet Me)*Installation of Voice Services*Digital Add-on Unit*Additional Telephone Socket Rental*Voicemail Rental*Fax / Modem Line Rental*Support for IPT Infrastructure*Rental of an IP Conference Unit*G1,G2 &G3Room RentGroundG2 & G3CompanyMarket RentCompany MarketMarket wideSecurityPassesNon-u/w working members*Change in Shareholding (below 10%)Change in Shareholding (10% - 49.99%)Change in ownership ( 50%)Non – notification and retrospective applicationNew Underwriting Agent (see note 2)New Syndicate (see note 2)New Special Purpose Arrangement (see note 2)Syndicate merger or Transfer of Management of a syndicateNew Accredited BrokerVoice ServicesCorporateReal EstateAdmissionsper sq. ft.per sq. ft.per passPer applicationVAT Status (OutsideScope)Key: Individual (IND), Corporate (CORP), Direct Corporate (DCP), Gross Written Premium (GWP), Gross Signed & SettledPremium (GSSP), Assets Under Management (AUM),Items denoted with an asterisk (*) are exclusive of VAT and will be incurred additionally.2021 market charges bulletin finalClassification: ConfidentialPage 5 of 17

MARKET BULLETINAppendix1. Market-wide chargesMarket charge2021 rateCalculation basisMembers’ Subscription0.36%GWPNew Central Fund Contributions0.35%GWPNew Corporate Members Central Fund Contributions1.40%GWP1. Members’ SubscriptionsMember’s subscriptions are levied at 0.36% of GWP (as set out in the syndicates’ approvedbusiness plans). Annual subscriptions are exempt from VAT (per Market Bulletin Y2870issued on 13 September 2002) and are payable in two instalments; the first instalment of 0.18% shall be paid 7 January 2021, and the second instalment of 0.18% shall be paid 1 June 2021.2. New Central Fund contributionsExisting membersThe annual contribution rate of 0.35% of GWP (as set out in the syndicates’ approvedbusiness plans) is payable by all members (other than new corporate members participatingon new syndicates) for the 2021 year of account. The annual contribution rate for RITCsyndicates is 3.5% of Notional Capacity (Net Reserves x 3%, rounded up to the nearest 0.5m).New corporate membersNew corporate members pay contributions at the rate of 1.4% of gross written premiums inthe approved business plans for the syndicates on which the member participates, for eachof their first three years of operations. A new corporate member is one which joins Lloyd’s in2019, 2020 or 2021 and establishes / participates on one or more new syndicates. It shouldbe noted that if that member writes on a mix of existing and new syndicates, then the higherrate will only be payable in respect of its participations on new syndicates. Where a ceasedmember recommences underwriting they will be deemed a new corporate member if they hadnot underwritten business for three or more consecutive years of account.Where a newcomer to the Lloyd’s market chooses to participate by purchasing an existingcorporate member that has reinsured to close all its liabilities, that corporate member will betreated as a new member and it will be required to pay the higher contribution in respect ofits participations on new syndicates.Within the category of new corporate members, the increased charges will not apply toconversion vehicles which meet the current definition of a “successor corporate member” in2021 market charges bulletin finalClassification: ConfidentialPage 6 of 17

MARKET BULLETINthe Membership (Entrance Fees and Annual Subscriptions) Byelaw – i.e. in broad terms, anyvehicle which is 85% owned by converting Names.Callable contributionThe callable contribution remains equal to 3% of capacity, valued according to theUSD / GBP mix of business.Payment dateEntire amount due on 26 March 2021, with the option to make payments in US dollars. NewCentral Fund contributions are exempt from VAT.If a mid-year pre-emption or a new syndicate is approved after 1 April 2021, the due date forthe on-account payment of the contribution will be the later of the date of approval or invoiceddate.2. Overseas operating chargesMarket chargeAll locations2021 rateCalculation r0.73%GSSP0.75%GWPLloyd's Italian office (Additional)The Overseas Operating Charge will be charged on Overseas Gross Signed & SettledPremium (i.e. excluding UK and Channel Islands) to cover the overseas operating costs. Thecharge will be collected on 27 January, 27 April, 27 July and 27 October 2021.An additional charge of 0.75% of gross written premium is levied on business administeredthrough the Lloyd’s Italian office, reflecting the additional services provided locally.Lloyd’s Japan coverholder fees (applied to net premium after brokerages) are 12.5% onbusiness from local intermediaries, and 5% on pooled business. In addition there is an annualcoverholder fee of 15k per binder.Overseas User Pay ChargesOverseas User Pay Charges will apply for costs incurred on behalf of specific syndicates orwork requested by specific market customers where that work requires substantialadditional effort and has resulted in extra cost. These charges will normally be on a time andmaterials basis and, where applicable, the cost implications will be made clear to thesyndicate before proceeding with the work.2021 market charges bulletin finalClassification: ConfidentialPage 7 of 17

MARKET BULLETIN3. Syndicates in run-offMarket ChargeSyndicates in Run-off2021 rateCalculation basis 1 Per 1,000net insurance liabilitiesAgents with syndicates with years of account in run-off bear a run-off charge at a flat rate of 1 per 1,000 of reported net insurance liabilities, assessed by reference to the most recentaudited accounts of the syndicate for each year of account in run-off. For this purpose, arun-off syndicate means a syndicate which no longer accepts new or renewal insurancebusiness (other than the variation or extension of risk previously underwritten or reinsuranceto close off an earlier year of account of that syndicate).In this context, net insurance liabilities mean the amounts retained by each syndicate in runoff, in respect of each year of account in run-off, to meet all known and outstanding liabilitiescarried forward as at 31 December 2020. If the relevant audited financial statements areunavailable and their production appears likely to be significantly delayed, an interim charge(to be adjusted if necessary on subsequent publication of the relevant audited accounts) maybe assessed by reference to the most recently submitted quarterly monitoring return (QMR)made by the run-off managers to Lloyd’s for the syndicate for the relevant years of account.Run off payments shall be collected via ARCS in July 2021.4. Capacity MarketsMarket Charge2021 rateApproval of capacity offer by means of announced auction offer 2,400Approval of formal capacity offer (cash only) 6,250Approval of formal capacity offer (with shares or a share alternative) 7,850Approval of conversion scheme (with inter-availability) 12,000Calculation basisFlat feeAll charges are exempt from VAT. An additional fee may be charged to sponsors to cover,for example: additional costs incurred in processing particularly complex schemes, especially wherefeatures not directly necessary to the scheme are included; and the reimbursement of any external legal (or other professional) fees incurred by Lloyd’sin developing a particular scheme. An example of this is where bespoke trust deeds areprepared for reverse inter-availability schemes.2021 market charges bulletin finalClassification: ConfidentialPage 8 of 17

MARKET BULLETIN5. Treasury servicesServices provided by Lloyd’s Treasury and Investment Management (LTIM):Commingled investment accounts: Market assets are effectively pooled into 3 singleaccounts in order to deliver efficiency and economies of scale for the market. Accountsinclude CAD regulated, CAD non-regulated and CAD (USD denominated) regulated. Agentstend to use these for convenience as individual agent balances in CAD do not warrant fullyfledged investment mandatesFAL cash sweep, LMDTA: Sweeps any cash balances left on accounts by members and isinvested as a pooled money market type fund. This fee is not collected separately, it’sincluded within the Member Services Cash Service Charge.Currency Conversion Service (CCS): Agents sign up to this service which effectively poolsand nets all foreign exchange movements for participating agents allowing us to transact onan aggregate basis whilst meeting individual agent FX needs.FX execution service: LTIM also offers FX trade execution on-demand.Investment of overseas regulatory deposits: LTIM manages these investment portfolios onbehalf of the market, as is required by overseas regulators. The Corporation currently haseleven of these funds plus the ASL deposits.Market Charge2021 rateCommingled investment accounts8.5bpFAL cash sweep, LMDTA3.5bpCurrency Conversion Service (CCS)FX execution serviceInvestment of overseas regulatory depositsCalculation basisAssets UnderManagementAssets UnderManagement5bpPer transactionUp to 5bpPer transaction8.5bpAssets UnderManagement2021 rateMaximum fee6. Schedule 3 InformationMarket ChargeOverall Premium Limit for member persyndicate participation2021 market charges bulletin final 15,000,001 or greater 150 4,475 10,000,001 to 15,000,000 125 3,700 5,000,001 to 10,000,000 90 2,625 2,000,001 to 5,000,000 50 1,550 2,000,000 or less 50 1,025Members participating on 2017 orprior run-off years only 50 1,025Classification: ConfidentialPage 9 of 17

MARKET BULLETINCorporate members of Lloyd's are required to prepare their accounts in accordance withSchedule 3 of the Large and Medium-sized Companies and Groups (Accounts and Reports)Regulations 2008. The Central Finance department offers a central facility to providecorporate members with the data that they need in order to be able to prepare their accountsin accordance with Schedule 3.Each corporate member that wishes to subscribe to this service is required to pay a fee asprescribed under the Syndicate Accounting Byelaw (No. 8 of 2005) as amended. This fee iscalculated by reference to the highest overall premium limit (OPL) of the corporate memberconcerned and number of syndicates (disregarding syndicate years of account for thispurpose) in which the corporate member participates. OPL is defined as the highest OPLwritten for any year of account within the last three years of account.7. Trust Fund LeviesMarket Charge2021 rateAustralian Trust FundCalculationbasis 165,050Canadian Margin Fund 51,000Credit for Reinsurance and Surplus Lines Trust Fund 34,900Illinois Trust Fund 51,000Kentucky Trust Fund 68,650South African Trust Fund 52,200Annual flat fee(receivedquarterly) inlocal currencyTrust Fund levies are collected in respect of two charge elements, Custodian Fees (chargedto the Corporation by Trustee Banks) and Treasury Investment/Central Finance Managementfees.Custodian Fees are paid by the Corporation and recovered from the Trust Fundparticipants. The GBP equivalent is recovered at the prevailing FX rate.When the total charge for each Trust Fund has been calculated it is apportioned across therelevant population of that Trust Fund. The quarter is further split across two periods withinthe quarter.Period 1 – End of last quarter to day before adjustment datePeriod 2 – Adjustment date to end of current quarter2021 market charges bulletin finalClassification: ConfidentialPage 10 of 17

MARKET BULLETIN8. Tax services2021 rateCalculationbasisMarket ChargeINDPremium tax charges (main syndicates only)SyndicateChargesDCP 20,000Syndicate UK tax returns 500Certificate of UK Tax ResidenceMemberChargesCORP 1,000US (incl. income and excise taxes, FATCA) 750 1,000 10,000Canada 250 250 3,500Singapore 250 250 3,500UK tax advices (incl. CTA1/2, foreign tax schedules, etc.) 250Third Party Funding Providers 100Japan 250 250Country by Country ReportingFlat fee 3,500 1,000US Controlled Foreign Corporations reports (only affectedmembers) 750LLP / SLP charge for 2nd and each further partner 500 Any charges for work commissioned directly with Eversheds-Sutherland LLP in relation(e.g.) to quota share policies or other issues affecting a member’s US tax return andbilled to Lloyd’s will continue to be on-charged to the relevant member in addition to anyof the above charges. Where other third party costs are incurred, for example, in providing additional servicessuch as dealing with change of ownership, Reinsurance adjustments and calculation ofpotential tax liabilities for release of FAL, these will be charged to the memberconcerned. Where a member of managing agent raises an ad hoc query which requires aninvestigation, or where an error is identified resulting in the need to re-file a tax return,work undertaken by Lloyd’s will be charged at 120 per hour All of the above charges are subject to VAT9. Member ServicesMember Services charges members and agents for admitting new members and third-partyfunding providers, changes of control within corporate members, maintaining FAL anddistribution of profits. The descriptions of the key services are set out below:Trustee / Regulatory Services: Services for members underwriting on the current year, orwith open participation or whose last remaining participation was closed at previous yearend.2021 market charges bulletin finalClassification: ConfidentialPage 11 of 17

MARKET BULLETINThird Party FAL Providers (TPFP): Administration of a Third Party providing Funds atLloyd’s (FAL).Corporate interavailable FAL: Corporate groups may wish to rationalise their Lloyd'soperations and reduce the number of underwriting subsidiaries. Lloyd's has developed amechanism and the documentation to deal with the provision of Funds at Lloyd's to supportboth the business being run-off by the ceasing corporate members and the increased level ofunderwriting by the continuing corporate member.Interavailable Recipient Monitoring Charges: Charges for administration of FAL madeinteravailable to Corporate Member, where the donor has open participation, where thedonors last remaining participation was closed at 31 December 2019 or where the donorhas failed to end their interavailable arrangement within two years of the closure of their lastremaining participation, as required by M&URsCitibank Holding Charge: Charge for holding securities in Citibank, where the value held inCitibank exceeds 10m as at 1 January 2021Cash service Charge: Charge for administration of cash held. Subject to reduction to avoidnegative return to membersComing into Line Extension Request: Granting an extension to the coming-into-line deadlineand subsequent monitoring of the extension, including funds provided by new Third PartyComplex issues: Complex/bespoke transactions, investigation of proposals outside the scopeof existing trust, regulatory and policy obligations. Dependent on level of seniority involved.2021 rateMarket ChargeCalculation basisTrustee / Regulatory Services (see descriptionbelow)AnnualchargesThird Party FAL Providers (TPFP) (seedescription below)Interavailable Recipient Monitoring Charge –open participation (see description below)Interavailable Recipient Monitoring Charge – lastparticipation closed at 31/12/2019 (seedescription below)Interavailable Recipient Monitoring Charge –arrangement not ended within 2years of closureof last participation (see description below)Citibank Holding Charge* (see description below)INDCORPDCP 515 2,800 13,900 200per TPFPN/A 500per donorN/A 1,500per finalised donorN/A 2,500per finalised donor 5,000 where value held inCitibank 10mFlat feeUp to 0.14%cash heldCash Service Charge (see description below)2021 market charges bulletin finalFlat feeClassification: ConfidentialPage 12 of 17

MARKET BULLETIN2021 rateMarket ChargeCalculation basisINDComing into Line Extension Request (seedescription below)Complex issues* (see description below)SyndicateCharges 500per day per 5m up to10 working daysper day per 5m 10working daysper hour 52,000per application 5,250per application 10,500per applicationChange of Control Application – Simple 1,050per applicationChange of Control Application – Complex 5,250per application 520per TPFP 2,600per TPFP 10,500per TPFPRecommencement of Underwriting – Simple 5,250Flat feeRecommencement of Underwriting – Complex 10,500Flat feeExtension/Late/Breach/Non-submission fee incl.Declaration of Compliance, PTF trustees 520Flat feeResults & Stamp Processing – Simple (Aligned)* 5,150per syndicateResults & Stamp Processing – Complex(Spread)* 15,450per syndicateApproval of New Third Party Funding Provider –Simple (known entity)Approval of Third Party Funding Provider –Simple (new entity)Approval of Third Party Funding Provider –Complex (new entity)Auction – buy/sell capacity0.06%Provision of systems to members’ agents*CorporateInteravailableFAL 250DCP 120Corporate Member Application – Non PrivateCapitalCorporate Member Application – Private CapitalSimpleCorporate Member Application – Private Capital– ComplexMemberApplication& CorporateMemberChangesCORPCorporate groups seeking to consolidate andmake their individual corporate members' FALinteravailableUp to 50,000 10,000per successful bidper members’ agent,dependent on numberof membersPer ceasing membersubject to a maximumof 50,000 percorporate group All fees are Outside the scope of VAT except those charges marked with an asterisk (*)which are Standard Rated. Where third party costs are incurred by Member Services in providing a service, thesewill be charged to the member concerned (e.g. bank charges for holding Euros). A member that commences underwriting mid-year will attract pro rata charges. Member Services may, at its discretion, reduce the application charges payable for theearly submission of member applications (20% reduction) or where more than onemember applies for membership with the same corporate structure (50% reduction).2021 market charges bulletin finalClassification: ConfidentialPage 13 of 17

MARKET BULLETIN Where a Corporate Member Application is submitted, approved and subsequentlywithdrawn, 50% of the application fee will apply. For Corporate Member Applications seeking consent for an ‘on the shelf’ vehicle duringnon-peak periods (Jan-April, July-mid August), 20% of the application fee will apply tocomplete the first stage. The final balance of the application fee will be payable whenthe applicant completes the second stage. Where a Third Party Funding Provider (TPFP) is a partner of a LLP new memberapplication, then the fee for the approval of the TPFP will be waived. Discounts noted above will only apply where applications are submitted fully completed,by the due date and free from errors.10. Complaint Handling ChargesMarket charge2021Calculation basisrateUK, Australia &New ZealandComplaintsInternationalComplaints 150Additional fee for full investigation - Tier 1 229Additional fee for full investigation – Tier 2 655Claim reserve 501- 10,000and all non-claim related issuesAdditional fee for full investigation – Tier 3 983Claim reserve of 10,000 25,000Additional fee for full investigation – Tier 4 1,310Per letter 50Administration fee 262Additional fee for International complaint 131Per complaint received direct byLloyd’sPer DOI extensionAdditional fee for full investigation 524Per stage two reviewAdditional Administration Fee 200Automated Chase for Documentation / Information 50Failure to Meet Performance Metrics and other Systemic IssuesComplaintsHandled byLloyd’sAustraliaClaim reserve above 25,001Issue Investigation Ongoing Letter (UK Only)All ComplaintsFinancialOmbudsmanServicePer complaint received direct byLloyd’sClaim reserve of 500 and underAdministration feeUp to 25,000Per chase / failure to complywith requirementsPer chase issuedFlat feeRecovery of UK Financial Ombudsman Service(FOS) case feeFOS revises their case fee on the 1st April eachyear. 2019/2020 charge fixed at 550Recovery of External Dispute Resolution Fees(including UK FOS)Levy is recovered from relevant syndicatesAdministration fee for complaintA 268Charged for matters managed atAFCA and/or IFSOFee for full investigation – Tier 1A 410Claim reserve of A 900 andunderFee for full investigation – Tier 2 (claim reserve ofA 901- A 18,000 and all non-claim related issues)A 1,185Fee for full investigation – Tier 3 (claim reserve ofA 18,001 – A 45,000)A 1,7722021 market charges bulletin finalClassification: ConfidentialClaim reserve of A 901A 18,000 and all non-claimrelated issuesClaim reserve of A 18,001 –A 45,000Page 14 of 17

MARKET BULLETINMarket charge2021Calculation basisrateFee for full investigation – Tier 4 (claim reserve ofabove

Additional fee for International complaint 131 Per DOI extension Additional fee for full investigation 524 Per stage two review All Complaints Additional Administration Fee 200 Per chase / failure to comply with requirements . Syndicate merger or Transfer of Management of a syndicate 5,000 New Accredited Broker 10,000 Key .