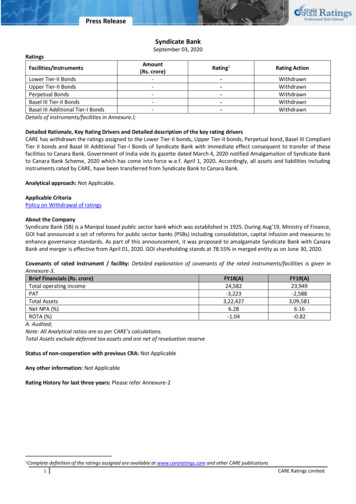

Transcription

Annual Report and Accounts 2021Syndicate 1084

About Lloyd’sLloyd’s is the world’s leading insurance and reinsurance marketplace. Through the collective intelligenceand risk-sharing expertise of the market’s underwriters and brokers, Lloyd’s helps to create a braver world.The Lloyd’s market provides the leadership and insight to anticipate and understand risk, and theknowledge to develop relevant, new and innovative forms of insurance for customers globally.It offers the efficiencies of shared resources and services in a marketplace that covers and shares risksfrom more than 200 territories, in any industry, at any scale.And it promises a trusted, enduring partnership built on the confidence that Lloyd’s protects whatmatters most: helping people, businesses and communities to recover in times of need.Lloyd’s began with a few courageous entrepreneurs in a coffeeshop. Three centuries later, the Lloyd’smarket continues that proud tradition, sharing risk in order to protect, build resilience and inspirecourage everywhere.

ContentsSyndicate Information4Underwriter’s Report5Managing Agent’s Report7Statement of Comprehensive Income for the year ended 31 December 202117Statement of Financial Position as at 31 December 202118Statement of Changes in Member’s Balance for the year ended 31 December 202119Statement of Cash Flows for the year ended 31 December 202120Notes to the Accounts for the year ended 31 December 202121Statement of Managing Agent’s Responsibilities42Independent Auditors’ Report to the Member of Syndicate 108443Syndicate 1084 Annual Report and Accounts 20213

Syndicate InformationDirectors of the Managing AgentD C BendleR J CallanJ FaureJ FowleP A JardineN J Stacey (appointed 8 January 2021)L S WatkinsDr H ZuoChief Operating OfficerChief Financial OfficerSenior Independent Non-Executive DirectorChief Executive OfficerChairman and Independent Non-executive DirectorChief Underwriting OfficerIndependent Non-Executive DirectorGroup Non-Executive DirectorManaging Agent’s company secretaryR N BarnettManaging Agent’s registered office52 Lime StreetLondon EC3M 7AFManaging Agent’s registered number00184915Managing Agent’s independent auditorPricewaterhouseCoopers LLP7 More London RiversideLondonSE1 2RTSyndicate active underwriterE Lines (to 31 December 2021)K Hunt (from 1 January 2022)Syndicate bankersThe custodians of the Syndicate’s investment funds are as follows:Citibank N.A.Royal Bank of CanadaSyndicate investment managersGoldman Sachs Asset Management InternationalOpus Investment Management, Inc. (to 31 December 2021)China Re Asset Management (Hong Kong) Company Limited (from 1 January 2022)Syndicate independent auditorPricewaterhouseCoopers LLP7 More London RiversideLondonSE1 2RTSyndicate 1084 Annual Report and Accounts 20214

Underwriter’s ReportResults and PerformanceThe profit for the year was 129.0m (2020: 11.0m loss), and the combined ratio improved to 89.2%(2020: 104.5%).The Syndicate’s key performance indicators during the year were as follows:2021 m2020 mGross written premium1,753.21,490.3Net written premium1,320.31,089.7Net earned g resultInvestment returnTechnical profit for the financial yearNon-technical account for the financial yearProfit/(Loss) for the financial yearCombined ratioAmount due from memberPremiumsGross written premiums for the Syndicate have increased by 17.6% in 2021 to 1,753.2m (2020: 1,490.3m),with growth in both the Direct Insurance and Reinsurance elements of the portfolio, as a result of thefavourable market conditions in most classes. Significant growth was anticipated in the Syndicate’sbusiness plan for 2021.Rates on renewal business continued the improvement which began in 2019, with the cumulative year onyear strengthening also now providing sufficient margin in business which had either previously beendeclined or non-renewed, due to pricing concerns. 2021 also saw growth in our targeted strategic areas anda healthy flow of attractive new business opportunities.Analysis of the gross written premiums by class of business is presented in Note 3: Segmental Analysis inthe notes to the accounts.Net written premiums increased by 21.2% to 1,320.3m in 2021 (2020: 1,089.7m) largely driven by theincreased gross written premium volumes, and revision to some proportional reinsurance arrangementsas we sought to capitalise on the current market conditions.Underwriting resultThe underwriting result for 2021 is a profit of 128.1m, an improvement of 175.1m on 2020.Net earned premiums have increased by 239.5m (24%) to 1,215.4m however net incurred losses haveremained stable, a key factor being catastrophe losses in 2021 have reduced compared to 2020.During 2021, the Syndicate experienced losses from natural catastrophes Hurricane Ida, US winter stormUri and European Floods Bernd, and also from the civil unrest in South Africa, whereas 2020 includedsignificant losses arising from the Covid-19 pandemic and associated global economic slump, in additionto Hurricanes Laura, Zeta, Sally and Delta and the Midwest Derecho.Attritional loss experience has also improved year on year due to the strengthening rating environment.Syndicate 1084 Annual Report and Accounts 20215

Underwriter’s ReportOverall resultThe profit for the year was 129.0m (2020: 11.0m loss), and the combined ratio improved to 89.2%(2020: 104.5%). The improvement in the combined ratio is a reflection of the favourable market conditions inmost lines of business, and the absence of any unprecedented loss events such as Covid-19.Financial assets continued to grow in 2021 to 1,626.6m (2020: 1,446.6m) delivering a total return of (9.5)m(2020: 54.4m). The majority of Syndicate assets are held in fixed income securities which were significantlyimpacted by rising bond yields throughout 2021 as markets began to price in the unwinding of accommodativemonetary policy and in particular the increase of interest rates.The Syndicate’s fixed income portfolio is of high credit quality and has a duration in line with liabilities whichallows the Syndicate to take a longer term view on total return.Strategy and outlookSyndicate 1084 remains integral to our business proposition of continuing to write a specialtyunderwriting portfolio, underpinned by strong and distinctive underwriting capabilities, and headlinedby market leadership in selected specialty segments. The portfolio should continue to provide a goodunderwriting balance and opportunities for profitable business development in 2022, whilst maintainingunderwriting discipline and robust portfolio management.The 2022 Business Plan, in which capacity has increased by a further 9% to 1.25bn ( 1.58bn), reflectsour firm belief that profitable growth continues to be achievable. The Syndicate will also continue tounderwrite through the Lloyd’s Brussels platform in accordance with the updated operating model, as thisallows underwriters to access EEA business and then reinsure it back to Syndicate 1084.The components remain in place for continued long-term successful development. We have a broad, highlyvalued specialty product range, a strong underwriting team with the right focus on delivering technicallyand commercially smart solutions for brokers and clients, and first class delivery of a clear and valuedservice proposition.Further headwinds are forecasted for fixed income with monetary policy tightening in response toinflationary pressures. The increase in rates is accretive to income but will put pressure on total return.The Syndicate is a hold to maturity investor and focuses on income but does monitor mark to marketmovements closely. To manage the risk, the Syndicate will continue to hold increased cash and purchaselow duration bonds. Expectations for income in 2022 remain modest and total return is expected tobe negative.Effective 1 January 2022, the Syndicate accepted the reinsurance to close (RITC) of the liabilities ofSyndicate 2088 for the 2019 Year of Account. Refer to Note 26 for further details on the RITC transaction.K HuntActive UnderwriterChaucer Syndicate 10842 March 2022Syndicate 1084 Annual Report and Accounts 20216

Managing Agent’s ReportThe Directors of the Managing Agent present their report and the audited annual accounts for the yearended 31 December 2021.This annual report is prepared using the annual basis of accounting as required by Statutory InstrumentNo. 1950 of 2008, The Insurance Accounts Directive (Lloyd’s Syndicate and Aggregate Accounts)Regulations 2008 (Lloyd’s Regulations 2008).The Managing AgentThe Managing Agent is Chaucer Syndicates Limited, whose registered office is 52 Lime Street, LondonEC3M 7AF and registered number is 00184915.Principal activitiesThis report covers the business of Syndicate 1084, whose principal activity during the year continued tobe the transaction of worldwide general insurance and reinsurance business in the United Kingdom,underwriting at Lloyd’s of London.Future developmentsIt is too early to accurately estimate the impact of the Ukraine and Russia conflict on the Syndicate’s futureresults. The Managing Agent’s risk management and underwriting teams have completed a preliminaryreview of potential exposures and will continue to monitor the exposure as the conflict develops. Currentunderwriting exposures are concentrated in the Political Risk, Credit and Political Violence segments,which all benefit from extensive reinsurance programmes and as such the net potential loss to thesyndicate is not expected to be material. The impact of sanctions on premiums or investment holdings isexpected to be minimal, but are being monitored.At the time of writing, there are no material reported losses as a result of the conflict.The Syndicate continues to maintain strong solvency and liquidity positions, and is well positioned to payclaims and other liabilities as they fall due.Principal risks and uncertaintiesThe following paragraphs describe the principal risks and uncertainties facing the Syndicate.Underwriting riskEach underwriting division of the Managing Agent undertakes an extensive annual underwriting planningprocess in order to determine its targets for premium income and return on capital for the Syndicate.The detailed stochastic modelling of underwriting risk, both gross and net of reinsurance, using dynamicfinancial analysis techniques, assists with the setting and management of risk appetite.Catastrophe risk is the main component of underwriting risk and the Managing Agent uses ExceedanceProbability (EP) curves as one of the tools for managing this risk. For a defined underwriting portfolio, anEP curve plots expected probability against loss size. This represents a sliding scale of risk appetite againstassociated exceedance probabilities.Syndicate 1084 Annual Report and Accounts 20217

Managing Agent’s ReportManaging risk aggregationThe Managing Agent monitors the aggregation of underwriting exposure using specialist modellingsoftware tools where appropriate. The Managing Agent monitors its loss exposure to a suite of naturalcatastrophe events (including the prescribed Lloyd’s Realistic Disaster Scenarios) and man-made events on aquarterly basis. Modelled loss caps are set at an underwriting business unit level for each event; this providesthe underwriters with a practical tool for managing exposures.Concentrations of riskThe Syndicate has exposure to losses arising through the aggregation of risks in geographical areasThis mainly affects the property, marine and energy portfolios. Events giving rise to such aggregations aretypically natural disasters such as earthquakes or weather-related disasters such as hurricanes, windstormsand typhoons. Other examples include major terrorism events.As part of the risk management process, the Managing Agent assesses the Syndicate’s exposures to RealisticDisaster Scenarios every quarter to enable the Managing Agent to monitor potential accumulations ofunderwriting exposure against a pre-determined suite of catastrophic events and to confirm no breach ofunderwriting risk appetite.Maximum linesUnderwriters manage individual risks through adherence to set maximum line sizes.Underwriting controlsThe Managing Agent operates a number of underwriting controls, details of which are set out below.Monitoring performance against planThe Managing Agent manages Syndicate performance against plan through monthly divisional reporting;utilising centrally prepared underwriting management information packs. Each underwriting divisionreports to an Underwriting Board, which in turn reports to the Underwriting Committee and through tothe Board of the Managing Agent. This control process ensures several layers of review for underwritingrisks, with particular focus on pricing, loss ratio forecasts, risk aggregation, catastrophe modelling andreinsurance protection.Emerging risksAn emerging risk is a risk that is perceived to be potentially significant but which may not be fully understoodor allowed for in insurance terms and conditions, pricing, reserving, capital setting or the operationalactivities of the Managing Agent. The Managing Agent has a defined emerging risk process to identify andassess the potential impact of such risks.Peer, independent and underwriting risk reviewsPeer review is performed on a risk-based sample of business by a fellow underwriter to ensure adherenceto sound underwriting practices. The independent review process involves detailed review of individualunderwriting risks and supporting documentation. Themed underwriting reviews are conducted by theUnderwriting Risk Management Function to ensure that underwriting procedures and discipline are followed.Internal auditThe Managing agent’s internal audit function provides assurance over the performance of theunderwriting controls.Syndicate 1084 Annual Report and Accounts 20218

Managing Agent’s ReportClaims riskWhile claims events are inherently uncertain and volatile, the claims department is an experienced teamcovering a wide range of business classes. The Managing Agent has various management controls in placeto mitigate claims risk; some of these controls are outlined below.Claims settlement and reserving authority limitsThe Managing Agent employs strict claims handling authority limits. All transactions in excess of anindividual claims handler’s authority are referred in a tiered approach to a colleague with the requisiteknowledge and experience.Peer reviewThe Managing Agent currently commissions an external random peer review on a quarterly basis.This review incorporates both qualitative and quantitative measures and findings are collated andreported to relevant committees.Monthly reportingReports are produced for different aspects of the claims handling process, including significantmovements, catastrophes, and static claims. These reports are communicated both within the businessand with key external stakeholders, including Lloyd’s Claims Management.Management of external expertsThe Managing Agent appoints third party loss adjusters, surveyors and legal advisors for claims investigationand assessment services. The development of long standing relationships with key experts and agreed Termsof Engagement aims to ensure the Syndicate receives a high quality service. Direct contact with externalexperts is actively encouraged. However, this process is not exclusive. If no suitable expert exists on theManaging Agent’s panel for any one particular claim, an ‘Expert Exception’ process operates to ensure atimely appointment of an appropriate expert.Reserving riskThe reserving policy for the Syndicate seeks to ensure appropriate allowance for reserving risk,consistency in reserving from year to year and the equitable treatment of capital providers on the closureof a year of account.Reserves are set on a two tier hierarchical basis.Tier 1: Actuarial best estimate reservesActuarial best estimate reserves are prepared on an underwriting year basis and are intended to be truebest estimates, i.e. estimates of expected value claims reserves. These are the basis for internal reportingand the derivation of expected loss ratios for business planning. The actuarial best estimate reserves arethe responsibility of the Internal Signing Actuary. The Managing Agent’s Actuarial Team calculates thereserves in conjunction with extensive discussions with underwriting, claims and reinsurance staff.Syndicate 1084 Annual Report and Accounts 20219

Managing Agent’s ReportTier 2: Syndicate reservesDetermination of Syndicate reserves is a two-stage process: first, they are determined on an underwritingyear basis and then they are converted to an annually accounted basis.(A) Underwriting year Syndicate reservesUnderwriting year Syndicate reserves are prepared on an underwriting year basis and equal the Tier 1reserves plus any reserve risk loadings. The intention of such risk loadings is to match areas within theSyndicate where the perception is that there is a particularly high risk that the best estimate reserve maybe inadequate. Such areas include, but are not limited to, the following:––––new classes of businessclasses where early development is materially better or worse than expectedclasses or events with abnormally skewed claim distributionsclaim events or reserving categories with a poorly understood distributionTo ensure consistency in the application of risk loadings, the starting point in their assessment is, wherepossible, formulaic. The formulaic risk loadings are adjusted wherever considered either excessive orunderstated. There may also be additional risk loadings in respect of risks not covered by the formulaic basis.The underwriting year Syndicate reserves provide the basis for all Syndicate results and forecasts.(B) Annually accounted Syndicate reservesAnnually accounted Syndicate reserves are the underwriting year Syndicate reserves converted to anannually accounted basis, plus additional loadings.The Managing Agent’s Board approves all risk loadings within Syndicate reserves.The assessment of actuarial best estimate reserves is a rolling quarterly process. The underwritingportfolio comprises a number of heterogeneous business types, each of which the analysis projects toultimate. Where certain contracts or claim events obscure development trends, the analysis splits theseout for separate review. The application of standard actuarial techniques to the historical attritional,large and catastrophe claims data supports the estimation of ultimate loss ratios. The analysis also drawson external data or market data or non-standard methodologies where appropriate. Whenever actualdevelopment of premiums or claims within a reserving category during a quarter is materially differentfrom expected development based on the existing methodology, then that methodology is reassessed and,where appropriate, amended. The analysis takes credit for reinsurance recoveries and provides for thepossibility of reinsurer failure.Reserving risk is controlled by the robust application of actuarial methodologies, stepped sign-offprocedures, quarterly tracking of projected ultimate loss ratios and reassessment of methodologies whereappropriate, regular dialogue between actuaries and practitioners and access to a history of loss data. Finally,explicit risk loadings are applied in respect of the areas of greatest risk within the reserve assessment.Although the risk loadings provide important protection against adverse developments in reserves,the degree of subjectivity in the reserving process, the exposure to unpredictable external influences(e.g. the legal environment) and the quantum of reserves relative to net tangible assets, mean thatreserving remains a significant source of risk to the Syndicate.Syndicate 1084 Annual Report and Accounts 202110

Managing Agent’s ReportFinancial RisksCredit riskThe Managing Agent reviews all reinsurer counterparties with whom the Syndicate wishes toconduct business and sets credit thresholds for the total potential recoveries due from each reinsurer.The review includes an analysis of the financial strength of the reinsurer, its payment performancerecord and standing in the market. Thereafter, management of reinsurer credit risk follows active andregular review, with the assistance of outside expertise, of the credit rating and financial exposure to allapproved reinsurers.The Syndicate predominantly purchases reinsurance from reinsurers rated strong or better by Standard& Poor’s (or equivalent). Maximum exposures per reinsurer are set in response to a reinsurer’s rating andnet assets.Broker credit risk limits are also determined depending on the grading of the relevant broker andexposures monitored against limits on a monthly basis.Investment riskThe Managing Agent’s approach is that investment activities are complementary to the primaryunderwriting activities of the business and should not therefore divert or utilise financial resourcesotherwise available for insurance operations.The preservation of capital and maintenance of sufficient liquidity to support the business and theenhancement of investment returns, within a set of defined risk constraints, are at the heart of thefinancial market risk policies adopted by the Managing Agent.Investment risk constraints, which quantify the maximum amount of investment risk permitted over a oneyear time horizon, are approved by the Managing Agent’s Board on an annual basis and are used to derive themaximum allocation, or risk budget, that can be allocated to each asset class.The Managing Agent reviews and amends asset allocations in accordance with investment risk constraints.Due regard is given to the outlook for each asset class because of changes in market conditions andinvestment returns. Proposed asset allocations are tested using stochastic modelling techniques priorto formal adoption.The Syndicate invests a proportion of funds in fixed income and variable yield securities managed byprofessional portfolio managers. Each manager operates within a defined set of investment guidelinesand against an appropriate benchmark. On 1 January 2022, Opus Investment Management, Inc. werereplaced by China Re Asset Management (Hong Kong) Company Limited as an investment manager of theSyndicate’s portfolio.Refer to Note 13 (page 30) for more details on the Syndicate’s exposure to investment risk and processes inplace for managing these risks.Operational riskThis is the risk that events caused by people, processes, systems or external events, lead to losses to theSyndicate. The Managing Agent seeks to manage this risk through business performance measures,formal disaster recovery and business continuity planning and other governing procedures, which arereviewed through a structured programme of testing of processes and systems by Internal Audit and otherassurance processes.Syndicate 1084 Annual Report and Accounts 202111

Managing Agent’s ReportRegulatory and legal riskRegulatory risk is the risk of loss or reputational damage owing to a breach of regulatory and legalrequirements or failure to respond to regulatory change.The Managing Agent is required to comply with the requirements of the Prudential Regulatory Authority,Financial Conduct Authority and Lloyd’s. Lloyd’s requirements include those imposed on the Lloyd’s marketby overseas regulators, particularly in respect of US situs business. The Managing Agent has a ComplianceOfficer, who monitors regulatory developments and assesses the impact on agency policy. The Syndicate alsoundertakes a compliance-monitoring programme.Legal risk is the risk that exposes the Managing Agent to actual or potential legal proceedings. The ManagingAgent has legal risk resource, which monitors legal developments and assesses impact on the business.Conduct riskConduct risk is the risk of treating our customers unethically or unfairly by delivering inappropriateoutcomes due to improper attitudes, systems, controls and governance. The Managing Agent operates asuitable risk management and governance framework across the syndicate, which monitors the variousareas of potential exposure to conduct risk matters and ensures appropriate design and performance ofcontrols and the effective escalation and resolution of items as required.Staff mattersChaucer Underwriting Services Limited (CUSL), the service company employing staff who performwork on behalf of the Syndicate, considers its staff to be a key resource, seeks to provide a good workingenvironment for its staff that is rewarding and safe, and complies with appropriate employee legislation.During the year there have been no significant injuries to staff in the workplace or any significant actionstaken by any regulatory bodies with regard to staff matters.Climate related risksThe Managing Agent’s Board is responsible for the effectiveness and oversight of the risk managementsystem and the general management and mitigation of risks including climate change risk. It hasdelegated the detailed regular oversight of climate related risk management processes and activities to itsRisk and Capital Committee.The Managing Agent recognises that its business activities and the performance of the Syndicate arelikely to be affected by risks arising from climate change and that those risks may arise over differenttime horizons. In delivering its business strategy, the Managing Agent is committed to considering andaddressing those risks, including those that are longer term and extend beyond its usual business andstrategy planning timescales.Syndicate 1084 Annual Report and Accounts 202112

Managing Agent’s ReportClimate risk strategyThe Managing Agent will continue to develop its strategy to bolster the management of the risks andopportunities arising from climate change. Planned actions include:– T he Syndicate will support its client base through the transition from fossil fuel exploration andproduction to renewable energy production. The Syndicate already underwrites a book of renewableenergy business and this book is targeted to grow.– Exposure management activities undertaken to date have demonstrated the importance of datacollection, in particular for modelling exposures and assessing loss scenarios. The Managing Agent willimprove exposure data categorisation to improve the assessment of the Syndicate’s exposures to climatechange risk. The Managing Agent will prioritise the assessment of its exposure to vulnerable regions andwill insist that the exposure to these vulnerable regions is adequately priced when accepting risk.– The Managing Agent plans to enhance its due diligence process to understand the potential current andfuture impacts of climate risks on material existing counterparty arrangements and all future materialcounterparty arrangements;– The Managing Agent will commit to increases of risk appetite where the business is profitably priced andmix of catastrophe versus non-catastrophe exposure and reserving risk is appropriate. However, riskappetites will not increase where it may lead to increased exposure to climate change risks where it is notprofitable to do so.Identification and assessment of climate risksThe major climate risks are recognised as Physical, Transition and Liability risks, which are monitoredthrough the Managing Agent’s Enterprise Risk Management (ERM) framework processes.The Managing Agent has been developing specific risk management tools and processes to address climaterisks and ensure the sustainability of its business and targeted performance of the Syndicate. Existingstrategies implemented to date include:– E nhanced focus on catastrophe perils where climate change is identified as a driver of increased risk,including improved modelling capability and reporting;– Underwriting of renewable energy;– Enhanced risk management capability and framework specifically adapted to improve understandingand management of climate change risks;– Changes to investment strategy to mitigate the transition risks of climate change;– Formation of an ESG Group and the ongoing development of an ESG strategy and objectives which willcontribute to the mitigation of climate-related operational risks;– Development of Own View of Risk which is core to managing climate risk; and– Production of a quarterly Climate Change Risk Dashboard highlighting the material climate riskexposures categorising these risks into Physical, Transitional and Litigation risk types, recognising thetime horizon around expected emergence of issues.Syndicate 1084 Annual Report and Accounts 202113

Managing Agent’s ReportTransition RisksThe Syndicate’s investment portfolio is exposed to transition risk, and in particular, any impacts to theliquidity of the portfolio as a result of policy changes and/or risks associated with the transition to a lowcarbon economy. Risk management actions taken to date are:– C ontinual monitoring of the investment portfolio against multiple climate change and ESG-related screensto ensure the Managing Agent has as much foresight as possible to any potential issues which may arise;– The Managing Agent is in the process of formalising risk appetites and investment strategies for theSyndicate which fully embed ESG considerations to investment decisions; and– Quantitative scenario testing of the investment portfolio to understand the potential impact to the assetsthe Syndicate holds, across a range of time horizons.The Syndicate has a very short-dated portfolio and is a hold to maturity investor. As such, the risk fromclimate change on the portfolio is seen as minimal. The periodic reinvestment of a portion of the portfolioprovides flexibility in investment decisions and the ability to react to developing market conditions.The Syndicate could also be exposed to transition risk arising from uncertainty as to the depth and degreeof alignment between the climate

Goldman Sachs Asset Management International Opus Investment Management, Inc. (to 31 December 2021) China Re Asset Management (Hong Kong) Company Limited (from 1 January 2022) . allows underwriters to access EEA business and then reinsure it back to Syndicate 1084. . marine and energy portfolios. Events giving rise to such aggregations are

![Index [beckassets.blob.core.windows ]](/img/66/30639857-1119689333-14.jpg)