Transcription

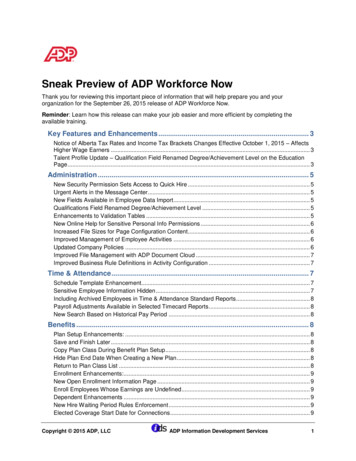

HealthDentalLife/AD&DShort- & LongTerm DisabilityBENEFIT SUMMARYPaid Time Off &Medical LeaveBank401K PlanFlexible SpendingAccountHealth SavingsAccountAccident &Critical IllnessWelcome to the North MemorialAmbulatory Surgery Center, the officialsponsor of your benefits program! As anactive employee, you are eligible toparticipate in a competitive benefitsprogram.Plan Year for all Benefits:01.01.2021-12.31.2021January 2021EmployeeAssistanceProgram1

Health Insurance Health: The health plan is provided byHealthPartners. Your health plan coverage iseffective on the first day of the month following yourhire date. This chart gives a side-by-side look atthe plan options provided by NMASC.2

TRADITIONAL PLANHealth Plan Option 1 - 2000/ 45/75%HealthPartners01.01.2021 FTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 FTEmployeeContribution:Per pay periodSingle 121.00 858.61 55.85Single Spouse 390.00 1863.12 180.00Single Children 255.00 1557.29 117.69Family 540.00 2379.27 249.23Premium amounts for full-time employees(64-80 hours per pay period) are as follows:Premium amounts for part-time employees(40-63 hours per pay period) are as follows:HealthPartners01.01.2021 PTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 PTEmployeeContribution:Per pay periodSingle 144.00 835.61 66.46Single Spouse 459.00 1794.12 211.85Single Children 330.00 1482.29 152.31Family 656.00 2263.27 302.773

HIGH-DEDUCTIBLE HEALTH PLANWITHHEALTH SAVING ACCOUNTHealth Plan Option 2 - 4500/100%Premium amounts for full-time employees(64-80 hours per pay period) are as follows:HealthPartners01.01.2021 FTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 FTEmployeeContribution:Per pay period 75.00 750.21 34.61Single Spouse 255.00 1643.00 117.69Single Children 150.00 1376.64 69.23Family 330.00 2129.15 152.31SinglePremium amounts for part-time employees(40-63 hours per pay period) are as follows:HealthPartners01.01.2021 PTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 PTEmployeeContribution:Per pay period 90.00 735.21 41.54Single Spouse 290.00 1608.00 133.85Single Children 194.00 1182.56 89.54Family 398.00 1776.92 183.69SingleNOTE: If you elect the High Deductible (HSA Qualified Plan), NMASC willcontribute 875.00 to your HSA Bank Account. You may also contributetoward the HSA fund through payroll deductions (pre-tax).4

TRADITIONAL PLAN**ACHIEVE NETWORK**Health Plan Option 3 - 2000/ 45/75%Premium amounts for full-time employees(64-80 hours per pay period) are as follows:HealthPartners01.01.2021 FTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 FTEmployeeContribution:Per pay periodSingle 108.00 812.83 49.85Single Spouse 375.00 1742.93 173.08Single Children 230.00 1473.55 106.15Family 510.00 2234.12 235.38Premium amounts for part-time employees(40-63 hours per pay period) are as follows:HealthPartners01.01.2021 PTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 PTEmployeeContribution:Per pay periodSingle 130.00 790.83 60.00Single Spouse 440.00 1677.93 203.08Single Children 285.00 1418.55 131.54Family 624.00 2120.12 288.005

HIGH-DEDUCTIBLE HEALTH PLANWITHHEALTH SAVING ACCOUNT**ACHIEVE NETWORK**Health Plan Option 4 - 4500/100%Premium amounts for full-time employees(64-80 hours per pay period) are as follows:HealthPartners01.01.2021 FTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 FTEmployeeContribution:Per pay period 70.00 812.83 32.31Single Spouse 240.00 1742.93 110.77Single Children 135.00 1473.55 62.31Family 315.00 2234.12 145.38SinglePremium amounts for part-time (40-63 hours per pay period)employees are as follows:HealthPartners01.01.2021 PTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 PTEmployeeContribution:Per pay period 86.00 689.70 39.69Single Spouse 274.00 1510.12 126.46Single Children 175.00 1260.04 80.77Family 379.00 1932.60 174.92SingleNOTE: If you elect the High Deductible (HSA Qualified Plan), NMASC willcontribute 875.00 to your HSA Bank Account. You may also contributetoward the HSA fund through payroll deductions (pre-tax).6

Dental Insurance DentalThe Dental Plan is provided by HealthPartners. Your dental plan coverage iseffective on the first of the month following your hire date. This chart shows howthe plan works and how each type of service is covered.Type of ServicePreventive ServicesBenefit Level 1Benefit Level 2Out 50%50%50%50%50% (with lifetimemax benefit of 1,000 paid by theplan)50% (with lifetimemax benefit of 1,000 paid by theplan)50% (withlifetime maxbenefit of 750 paid bythe plan)None 25 50 75 150 1,000 750Includes Oral Examinations,Dental Cleanings, X-rays,Fluoride TreatmentsBasic ServicesBasic Restorative Care (Fillings)Composite (white) fillingsOral Surgery ServicesBasic ExtractionsComplex SurgicalExtractionsBasic EndodonticsBasic and Complex PeriodonticsMajor ServicesMajor Restorative ServicesPosterior composite resins,InlaysCrowns and Crown Repairs,OnlaysProsthetic ServicesBridges and DenturesImplantsOrthodontics (dependent childrenonly, 1000 Lifetime Maximum)Deductible: Does not apply toPreventiveMemberFamilyAnnual Plan Maximum per person 2,0007

DENTAL HEALTHPARTNERS2021 Premium Amounts for Full-time (64-80 hours per pay period) employees areas follows:HealthPartners01.01.2021 PTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 PTEmployeeContribution:Per pay period 6.66 30.74 3.08Single 1 40.23 39.06 18.57Family 64.32 60.86 29.68Single2021 Premium Amounts for Part-time (40-63 hours per pay period)as follows:HealthPartnersemployee are01.01.2021 PTEmployeeContribution:Per monthEmployerContribution:Per month01.01.2021 PTEmployeeContribution:Per pay period 8.71 28.69 4.02Single 1 50.48 28.81 23.30Family 84.31 40.87 38.91Single8

Basic Life & AD&D Insurance The North Memorial Ambulatory Surgery provides employees working 64 or morehours per pay period with one times your annual salary, up to 50,000, of group lifeand accidental death and dismemberment (AD&D) insurance, and pays the full cost ofthis benefit. You are eligible the first of the month following your hire date. Employee Paid Life & AD&D Insurance The North Memorial Ambulatory Surgery offers employees working 20 or more hoursper pay period an opportunity to purchase additional life insurance and accidentaldeath and dismemberment (AD&D) at an affordable group rate through payrolldeductions. Highlights to voluntary buy-up life listed below: 100,000 Guarantee Issue for Employees 20,000 Guarantee Issue for Spouse 10,000 Guarantee Issue for Dependent Children No health questions or physicals and cannot be denied for guarantee issueamounts.9

Short-Term and Long-Term Disability The North Memorial Ambulatory Surgery provides employees working 64 or morehours per pay period with short term and long term disability income benefits. In theevent you become disabled from a non work-related injury or sickness, disabilityincome benefits are provided as a source of income. You are not eligible to receiveshort-term disability benefits if you are receiving workers’ compensation benefits. Youare eligible the first of the month following your hire date.Short-term DisabilityClassificationElimination PeriodInjury/AccidentSicknessDuration of BenefitMaternity CoverageEmployer ContributionWeekly Benefit PercentageMaximum Weekly BenefitAll eligible employees14 days14 days76 daysSame as any other disability100%60% 500Long-term DisabilityClassificationElimination PeriodMaximum Period of BenefitMonthly Benefit PercentageMaximum Monthly BenefitAll eligible employees90 daysSocial Security Retirement Age60% 500010

Paid Time Off & Medical Leave Bank Paid Time OffYou begin earning Paid Time Off at your date of hire, based on the schedule below.Accrued PTO may be used after 90 days of employment. PTO and Medical Leaveinclude Vacation, Holidays and Sick Time.Years ofContinuous FTEmploymentCompleted0-4 Years5 YearsFulltime Employee (40 Hours)Paid Time Off Earned24 days (7.38 hrs/pay period or 192 Hours)29 days (8.92 hrs/pay period or 232 Hours)Maximum Accrual of PTOThe maximum accumulation of PTO for all employees is 1.5 times annual PTO rate ormaximum of 300 hours, whichever is less. Unused PTO is carried forward from year toyear until maximum accrual hours are reached. Employees with the maximum numberof accrued hours will not continue to accrue PTO. All payment for accumulated andunused PTO will be paid to a terminating employee in the paycheck for their last hoursworked, providing the employee has completed their 90-day probationary period andemployee gives the appropriate termination notice (depending on your jobclassification).Medical Leave Bank (MLB)Any available PTO must be used initially for any illness or accident. However, medicalleave bank can be accessed after an employee has been out of work for threeconsecutive days. Accrual rate is seven days (56 hours) per year for a full-timeperson. Maximum accrual rate will be 21 days (168 hours) for a full-time employee.MLB time is not payable to the employee upon termination.* PTO and MLB time will be prorated to reflect the position in which the employee ishired. Refer to PTO/MLB policy for your accrual rate.11

401(k) Plan 401(k) PlanTo help you prepare for the future, the North Memorial Ambulatory Surgery sponsors a401(k) Plan as part of its benefits package. You may start participating in this plan onthe first day of the month following 90 days of employment if you are 21 years of ageor older.After one year of service, the North Memorial Ambulatory Surgery Center will match50% of your contribution up to 6%, (up to a maximum employer match of 3%) andyou may direct the contributions among several investment options. Mass Mutualadministers the plan.With the addition of the Roth 401(k), there are now three different ways to make yoursalary deferral contributions. Your contributions can be made with pre-tax dollars(traditional 401(k)), giving you the benefit of deferring taxes until your retirement.Another alternative you might want to consider is the Roth 401(k) option. With theRoth 401(k), you make after-tax contributions to your retirement account, enablingyou to make tax free withdrawals (contributions and earnings) in the future if certainconditions are met. You may also utilize a combination of the Traditional pre-taxsaving method and the Roth 401(k).In addition to your contributions, the North Memorial Ambulatory Surgery Center helpsyou save by matching the money that you saved based on your years of service. Youvest, or gain ownership, in the matching contributions from the Surgery Center basedon the schedule below.Years ofServiceTotal AmountVested0-1234560%20%40%60%80%100%12

Flexible SpendingAccounts (FSA) FSAs provide you with an important tax advantage that can help you pay health care,dependent care and commuter expenses on a pre-tax basis. By anticipating yourfamily’s health care, dependent care and commuter costs for the next year, you canactually lower your taxable income. .Health Care Reimbursement FSAThis program allows North Memorial Ambulatory Surgery Center employees to pay forcertain IRS-approved medical care expenses not covered by their insurance plan withpre-tax dollars. The annual maximum amount you may contribute to the Health CareReimbursement FSA for 2021 is 2,750 per calendar year. Some examples include: Hearing services, including hearing aids and batteries Vision services, including contact lenses, contact lens solution, eye examinations,and eyeglasses Dental services and orthodontia Chiropractic services Acupuncture Prescription contraceptivesDependent Care FSAThe Dependent Care FSA lets the North Memorial Ambulatory Surgery Centeremployees use pre-tax dollars towards qualified dependent care such as caring forchildren under the age 13 or caring for elders. The annual maximum amount you maycontribute to the Dependent Care FSA in 2021 is 5,000 (or 2,500 if married andfiling separately) per calendar year. Examples include: The cost of child or adult dependent care The cost for an individual to provide care either in or out of your house Nursery schools and preschools (excluding kindergarten)13

Health Savings Account (HSA) The NMASC Health Saving Account (HSA) is a full-service Health Saving Account thatprovides a comprehensive benefit package for participating employees. Enrolling inour qualified HDHP allows you to open a tax-advantage savings account (HSA) –financial tool to save for future medical/dental/vision expenses.Additional Information about HSA’s: A HSA is an individually owned, special tax-advantage account (regulated bythe IRS). You may open a HSA if you enroll in our HDHP and you do not have otherhealth care coverage (excludes vision/dental). A HSA is used to save and pay for medical expenses now and in the future. You may withdraw from your HSA (tax-free) to pay for qualifiedmedical/dental/vision expenses. The money in the Health Savings Account (HSA) is owned by the employee,just like a bank account. There is no limit on the maximum accumulation. Unspent balances remain inthe account until spent. The interest on the funds accrues tax-free. The unused contributions carry over each year. No “use it or lose it rules” like Flexible Spending Arrangements. You may no longer make contributions once you are enrolled in Medicare.Who is eligible to enroll in the HSA? Covered by a Qualified HDHP Not enrolled in Medicare Not covered under a traditional health insurance plan (one with office visitcopays, RX copays) Not participating in a Flexible Spending AccountNMASC will contribute 875 annually (prorated based on date of eligibility) to thoseemployees who enroll in our HDHP with HSA. NMASC has the right to changecontribution amounts annually.The annual limit on HSA contributions for 2021 will be 3,600 for self-only and 7,200for family coverage. Due to HSA limits for CY 2021, the maximum amount employeescan contribute is as follows:Plan ElectionSingle CoverageFamily CoverageNMASC AnnualContribution 875 87514Employee AnnualContribution 2,725 6,325

ASSURITY Voluntary Accident Insurance (On/Off-the-Job Coverage)The Assurity Accident Plan provides cash benefits to you, regardless of otherinsurance, when you or a covered family member have an accident that causes aninjury that you seek medical treatment for. These cash benefits can be used to payyour out-of-pocket medical costs, day to day expenses or put them into savings. Examples of Accidents: Lacerations, Sports Injuries, Car Accidents, HomeImprovement Mishaps, etc.Voluntary Critical Illness/Cancer InsuranceThe Assurity Critical Illness/Cancer Plan provides cash benefits to you when you or acovered family member are diagnosed with a benefit payable critical illness. Thesecash benefits can be used to pay your out-of-pocket medical costs, day to dayexpenses or put them into savings. Employee chooses the lump sum benefit amountbetween 5,000 and 30,000.The premium is automatically deducted from your paycheck.15

VISION INSURANCE As part of our Employee Benefits program, NMASC is pleased to offer Visioncoverage through the Standard. This insurance plan is offered to you withthe convenience of having the premium automatically deducted from yourpaycheck. This new options builds on the benefits already provided ByNMASC, giving you additional protection that you and your family may need.VSP CHOICENETWORKPer monthPer pay period 7.74 3.57Single Spouse 15.53 7.17Single Children 13.14 6.06Family 21.68 10.01Single*Final rates are based on actual enrollment on the effective date16

Employee Assistance Program (EAP) There are times in life when you might need a little help coping orfiguring out what to do. Take advantage of the Employee AssistanceProgram1 (EAP) which includes WorkLife Services and is available toyou and your family in connection with your group insurance fromStandard Insurance Company (The Standard). It’s confidential —information will be released only with your permission or as requiredby law.Our program includes depression, grief, loss, emotional well-being;family, maritalVisit workhealthlife.com/Standard3 to explore a wealth ofinformation online, including videos, guides, articles, webinars,resources, self-assessments, and calculators.Contact EAP at 888.2936948; TDD: 800.327.1833, 24 hours a day,seven days a week.The information in this Enrollment Guide is presented for illustrative purposes and is based on informationprovided by the employer. The text contained in this Guide was taken from various summary plandescriptions and benefit information. While every effort was taken to accurately report your benefits,discrepancies, or errors are always possible. In case of discrepancy between the Guide and the actual plandocuments the actual plan documents will prevail. All information is confidential, pursuant to the HealthInsurance Portability and Accountability Act of 1996. If you have any questions about your Guide, contactHuman Resources.17

Welcome to the North Memorial Ambulatory Surgery Center, the official sponsor of your benefits program! As an active employee, you are eligible to participate in a competitive benefits program. Plan Year for all Benefits: 01.01.2021-12.31.2021 January 2021 Assistance Health Dental Life/AD&D Short- & Long-Term Disability Paid Time Off &