Transcription

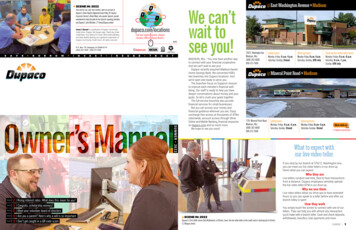

SCENE IN: 2022Jose and his son, also Jose (center), open an account atDupaco’s Cedar Rapids Edgewood branch May 20. DupacoInsurance Service’s Derek Wood, who speaks Spanish, quicklyvolunteered to help translate for the Spanish-speaking membersand Dupaco’s Julia Michalec. (T. Freese/Dupaco photo)Owner’s Manual is a publication of Dupaco CommunityCredit Union. Dupaco, the Dupaco logo, Thank Use, GreatCredit Race, Your Money For Good, Shine Online Bankingand Shine Mobile Banking are registered trademarks ofDupaco Community Credit Union. All rights reserved.Find your nearest branch, DupacoConnect, ATM or Shared Branch.MADP.O. Box 179, Dubuque, IA 52004-0179(563) 557-7600 / e can’twait tosee you!SUMMERMADISON, Wis.—You now have another wayto connect with your financial cooperative.And we can’t wait to see you!Dupaco recently acquired Madison-basedHome Savings Bank. We converted HSB’stwo branches into Dupaco locations. Andwe’re open and ready to serve you.The branches focus on Dupaco’s missionto improve each member’s financial wellbeing. Our staff is ready to help you havedeeper conversations about money and yourgoals. So let’s crush your goals together.The full-service branches also providefinancial services for small businesses.But you can access your money andfinancial guidance wherever you are. Enjoysurcharge-free access at thousands of ATMsnationwide, account access through ShineOnline and Mobile Banking, financial resourceson dupaco.com and so much more.We hope to see you soon!@ East Washington Avenue » Madison3762 E. Washington Ave.Madison, Wis.(608) 282-6000800-373-7600Lobby hoursDrive-up hoursMonday–Friday: 9 a.m.–5 p.m.Saturday–Sunday: ClosedMonday–Friday: 9 a.m.–5 p.m.Saturday–Sunday: ATM onlyDrive-up live video teller hoursMonday–Friday: 8 a.m.–6 p.m.Saturday: 8 a.m.–1 p.m.Sunday: ATM only@ Mineral Point Road » Madison7701 Mineral Point RoadMadison, Wis.(608) 282-6000800-373-7600Lobby hoursMonday–Friday: 9 a.m.–5 p.m.Saturday–Sunday: ClosedDrive-up hoursMonday–Friday: 9 a.m.–5 p.m.Saturday–Sunday: ClosedMeet with usat dupaco.com/access2022What to expect withour live video tellerIf you stop by our branch at 3762 E. Washington Ave.,you can meet our live video tellers in our drive-up.Here’s what you can expect:Who they areLive tellers conduct real-time, face-to-face transactionsfrom a distance. Dupaco employees remotely operatethe live video teller/ATM in our drive-up.Why we use them 2 Rising interest rates: What does this mean for you?PAGE 3 Congrats, scholarship winners!PAGE 5 Meet your volunteer board of directorsPAGE 8 Are you a parent? Here’s why a will is so importantPAGE 9 Don’t get caught in a QR code scamLive video tellers allow our drive-ups to have extendedhours so you can speak to a teller before and after ourbranch lobby is open!PAGEHow they workSCENE IN: 2022Dupaco’s Chris Helle shows Bob Mullenbach, of Grimes, Iowa, the live video teller at the credit union’s learning lab in Grimes.(S. Morgan photo)You simply touch the screen to connect with one of ourtellers. They can help you with almost any transactionyou’d make with a branch teller: Cash and check deposits,withdrawals, transfers, loan payments and more.SUMMER 1

Together, Members Share.By participating in your credit union, you share in its success. The more you use Dupaco, the more you’rethanked with participation dividends. An active checking account indicates your commitment to yourcooperative and is the key to unlocking your Thank Use. It all adds up. Since 2016, Dupaco membershave received more than 20.5 million in Thank Use.How much will you earn this year?Learn how to earn at dupaco.com/ThankUse3 smart ways to use your home equityWhat is home equity?Debt consolidation1.It’s the difference between your home’s currentvalue and the amount you owe on your loan.(It’s the part of the house that belongs to you,not your lender.)Did you know?You can borrow against the value of yourhome with a home equity line of credit orhome equity loan. A line of credit works kindof like a credit card—borrow what you need,when you need it, up to your limit.Combine your loans and credit cardbalances into one easy payment.2.3.Home improvementProjects like a kitchen or bathroomremodel can increase your home’s value.Anything at any timeShould you refinanceyour studentloans?Repaying student loans can be stressful—and expensive. Consolidating andrefinancing your student loan debt mighthelp. Combining your loans into one newloan might lower your interest rate, monthlypayment or repayment term. Refinancingisn’t the best option for everyone. But itmight be the right choice if you: Pay a high interest rate on your loans. Have multiple private student loans orfederal loans with high interest rates. Have a good credit history or a strongco-signer.Use the funds for an emergency, a vacation orsomething else.Get started at at dupaco.com/HomeEquityLearn moreRising interest rates: What does this mean for you?The sky isn’t falling, but interest rates are rising.While a lot can feel out of your control, thereare steps you can take to protect and manageyour money:Refinance your debtWhen interest rates rise, the cost of borrowingmoney becomes higher. You might be able toconsolidate high-interest debt to make yourpayments more manageable.Review your home loanHome loan rates change daily. If you haven’trefinanced your home loan in awhile, it’s worthfinding out whether you’d benefit from it beforerates continue to climb.Save for your futureSavings rates typically increase in time too.When deposit rates rise, you’ll earn even morein your interest-bearing savings accounts.Stay calm, and balance your portfolioSpeak with a financial advisor to ensure yourinvestment portfolio is properly balanced forthe changing market conditions.Get started at at dupaco.com/makeoverDID YOU KNOW?As a rule, the Federal Reserve raisesits interest rate to slow down a strongeconomy or inflation.2 SUMMERFederal student loan updateat dupaco.com/StudentDebtThe pause for federal student loan payments, interest and collections hasbeen extended through Aug. 31, 2022. This freeze began more than twoyears ago in response to the COVID-19 pandemic.Congrats, scholarship winners!Dupaco is a proud supporter of education. And we love to help you succeed in yours. That’s why the Dupaco R.W. HoeferFoundation awarded 30 nonrenewable 2,000 scholarships for the 2022–2023 academic year.Four-year college/university:Drake BlakesleyDevin DigmanReece GallagherAnna GehlEmma HilkinEllen KirbyAlex LinkMorgan MescherLeanna ScottMacy StevensonCommunity college/trade school:Amra AlibasicBryce BowmanHarley BradtkeJaci BriesTate DeahlAshton GoldsmithAvery HeatonMiles ReynoldsNatalie ScullySabrina SplinterCurrent college student:Ashley CostelloSophia HeislerNicole JohnsonCarson JonesJessica LuekenAshley OwensLillian SchmidtAlissa StanleyRiley UtheGracie WeeksDupaco member AmandaDougherty received a Warren A.Morrow Memorial Scholarshipfrom the Iowa Credit UnionFoundation.Get the details at dupaco.com/scholarshipsSUMMER 3

Meet your volunteer board of directorsWe’re committed tohelping you get aheadA letter from President and CEO Joe HearnSifting through endless socialwhere you are. Your well-beingunion, you can trust that wemedia posts, news articles andis our priority.continually work hard andvideos can sometimes feelI’m proud of Dupaco’sdedicated team that continuesDupaco remains strong andinformation, it’s hard to knowto lead with heart and smart.ready to help when you need us.When I hear stories like theWe’re here for you—and we’re atwhich resources you can trust.As your not-for-profit financialFranks’ {on page 7}, I’m gratefulcooperative, we’re committed tothat they found a trusting handproviding expert guidance andat Dupaco to get back on tracktools to help you get ahead inwhen circumstances outsideyour financial life.their control put them in aIt’s our mission.It’s who we are and what weare trained to do.financial bind.As a Dupaco member, yousolutions that were created withpinch everywhere from the gasyour financial well-being in mind.pump to the grocery store. RisingThat includes one-on-one guid-prices impact all of us. Andance with our financial coaches,we know the Federal Reserve’sanytime access to your accountsinterest rate hikes affect borrowersand credit score through Shine,and savers differently.expert advice on our blog andOwner’s Manual is filled withthrough the twists and turnsacquisition of Madison-basedimpacting you in today’s economy.Home Savings Bank, we nowprovide members in south-centraltimes. So, no matter where youWisconsin more ways to connectare in your financial journey,with their financial cooperative.FALL44 SUMMERat dupaco.com/CUDifference456FINANCIAL STRENGTHAs of: May. 31, 2022789Members: 150,792Nomination committee 4 Andy Schroeder, treasurer, chair of CreditUnion Service Organization Board of Managersand Salary Savings Plan Oversight committeeDeposits: 2.43 billionOnward and upward, 5 Steve Chapman, chair of Investment/ALM/ALCO committee 6 Denise Dolan, chair of Personnelcommittee 7 Jeff Gonner, chair of Audit committee 8 Ellen Goodmann Miller, chair of Credit/Delinquent Loan committee 9 Bob Wethal, chair of Marketing committeeMeet your board at dupaco.com/boardLoans: 2.0 billionAssets: 2.9 billionJoe HearnPresident and CEOReserves: 307 millionReserve Ratio: 10.6%Free tools to help you run a businessStarting—and running—a business is a labor of love. But you don’t have to do it alone. Our free Business Resource Center can help you every step of the way.Head to dupaco.com/business/resources to start exploring these free tools:ARTICLESBUSINESS PLANNERSCALCULATORSCHECKLISTSFILLABLE TEMPLATESSTEP-BY-STEP GUIDESUse the tools at dupaco.com/business/resourceshave two additional branches toalso happen during excitingLearn more 1 Ron Meyers, chair of the board 2 Randy Skemp, vice chair, chair ofexperiences at our learning labs.And with Dupaco’s recentknow that we will meet you3interactive touch screeninformation to help guide youBut money conversations can2 3 Renee Poppe, secretary, chair oftoo have access to innovativeWe know you’re feeling theThat’s why this edition of theyour service.1Business Lending committee and DupacoR.W. Hoefer Foundationadvocate for your best interests.paralyzing. With so muchAs a member-owned cooperative, all Dupaco members have an equal say in their creditunion. Each member gets one vote.Earlier this year, members reelected Steve Chapman, Ron Meyers and Renee Poppeto serve three-year terms on the credit union’s volunteer board of directors. EllenGoodmann Miller was elected to serve the unexpired term of the late Ron Mussehl.Meet your volunteer directors, and learn how they serve your financial cooperative:HOW TOAs your member-owned creditSCENE IN: 2022Dupaco President and CEO Joe Hearn thanks those who helped create the Dupaco Voices Buildingduring a ribbon-cutting ceremony May 17. The revitalized building, located at 1000 Jackson St.,Dubuque, Iowa, serves as the credit union’s operations center. (M. Burley photo)Switch users in Shine MobileHave more than one Shine account(personal, business, kids, trust)?You can easily switch between themin Shine Mobile Banking. Here’s how:1 2Log into ShineMobile.From your homedashboard, tap“Log out,” then tap“Switch user.”3From here, youcan add, remove,edit or switch toa different user.Sign up at dupaco.com/shineSUMMER 5

One member at a timeBe on the lookout forupcoming eventsby checking Dupaco’s Member Eventsand Discounts web page.facebook.com/dupacoThe right messageat the right timeMembers:twitter.com/dupacoIf you have any questions on Community Calendar information,contact Dupaco at 800-373-7600, ext. 0.SCENE IN: 2022Dupaco’s Melissa King (from left), Jeff Vaassen and Michelle Becwar accept the Best Building Rehabilitation Award for the recentrenovation of the Dupaco Voices Building in Dubuque, Iowa. The award was presented April 22 during the annual Main Street IowaDevelopment Awards ceremony in Des Moines. The renovated building in Dubuque’s historic Millwork District is now home to Dupaco’soperations center, where more than 200 employees work. (A. Vaassen/Dupaco photo)Deanna and Rod Frank MANNING, IOWAMANNING, Iowa—A few years ago, Deanna and Rod Frankfelt buried.Medical issues had forced Rod to cut back on his hours atwork. And with less money coming in, the Manning couple usedcredit cards and expensive loans to help cover expenses that stillneeded to be paid.“We had gotten into a big bind and couldn’t get ourselvesunburied,” Deanna said.It was around that time when they heard about Dupaco’s freeMoney Makeover service. It couldn’t hurt, they agreed.The Franks met Dupaco’s Amy Meyer at the Carroll LearningLab. And the three of them got to work.The Franks talked about home improvements they’d like tomake. They reviewed their monthly expenses, credit scores anddebts. And they created a plan to start building credit and payingdown debt.Meyer also put them in touch with Dupaco Insurance Services.By moving their insurance to Dupaco, the Franks significantly cuttheir premium payments—freeing up money in their budget.“You would be amazed at where you can find savings,” Deannasaid. “It puts it in perspective where all of your money is going.”Today, the Franks feel lighter.They’ve stuck to their plan. And they’re reaping the benefitswith higher credit scores, less debt and more savings.Eventually, Deanna would love to remodel their house to makemore room to host their growing family, which now includes fivegrandchildren.“It does take self-discipline,” Deanna said. “But we startedturning things around. And it feels good. We have the flexibility toreplace something if it falls apart and not worry about how we’regoing to pay for it.”Read more at dupaco.com/YourMoneyForGoodSCENE IN: 2022Dupaco’s Amy Meyer helped membersDeanna and Rod Frank create a plan tostart building their credit and payingdown debt so they can reach theirgoals. (A. Rexrode/Dupaco photo)Adventures with#FlatDollarCalling all DoPACK members!Dupaco’s youngest members, ages 12 and younger, canparticipate in Dupaco’s #FlatDollar contest for a chanceto win Dupaco prizes.Get started at at dupaco.com/DoPackFALL64 SUMMERSCENE IN: 2022Dubuque Fighting Saints Head Coach Greg Brown adds the 2021–22 plaque to the Dupaco Cowbell Cup hockey trophy May 10 whilevisiting the Dupaco Voices Building in Dubuque, Iowa. Congrats to the Fighting Saints for bringing home the trophy three years in a row!(C. Rodewald/Dupaco photo)SUMMER 7

History supportsstaying calm and investedBy Michael Poppen Financial consultantTeddy Roosevelt once said, “The more youknow about the past, the better preparedyou are for the future.” This statement is justas true now as it was then.This is a distinctive period in our lives.And the impact of these times—a lingeringpandemic, worker shortages, inflation andrising interest rates—has been far-reaching.But if we look at this from a historicalcontext, we can expect that the economy willeventually improve. People will be back towork. And markets will stabilize to grow again.And most importantly—until those timescome—we can count on those we trust andlove to help us through.It’s important to continue to invest in respective retirement plans, budget and be patient.In the past, unique hardships and sacrificesled to many triumphs and progress. It is withinthese trials that we also see the purest expressions of gratitude, humanity and strength.History repeats itself, as do ouremotions. Stay calm and stay invested.And please continue to stay safe andlet us know how we can help guide you.Start investing at dupaco.com/investSecurities and advisory services are offered through LPL Financial (LPL),a registered investment advisor and broker-dealer (member FINRA/SIPC). Insuranceproducts are offered through LPL or its licensed affiliates. Dupaco Community Credit Unionand Dupaco Financial Services are not registered as a broker-dealer or investment advisor.Registered representatives of LPL offer products and services using Dupaco FinancialServices, and may also be employees of Dupaco Community Credit Union. These productsand services are being offered through LPL or its affiliates, which are separate entitiesfrom, and not affiliates of, Dupaco Community Credit Union or Dupaco Financial Services.Securities and insurance offered through LPL or its affiliates are:Not insured by NCUA or any other Government Agency Not Credit Union GuaranteedNot Credit Union Deposits or Obligations May Lose ValueTipsto have a safe tripReady for a road trip this summer? A little preparation goes a long way. 1 Know your route. Get familiar with your route ahead of time. Andpack some paper maps in case you lose your cell signal. 2 Know your vehicle. Make sure your vehicle maintenance is up todate. Don’t forget to bring an emergency road kit.Michael SchroederSuzan Martin-Hallahan, CFP Michael PoppenAre you a parent?If you have children, you know how difficultit can be to find spare time. And when youhave a free moment, end-of-life planning isabout the last way you’d like to spend it.But if you don’t make those decisions,someone else will. If you die without a willor trust, most states have laws determiningwho will take care of your children.Not sure where to begin? These questionscan help you get started: Who do I want to settle my affairs? Theexecutor of your will collects and sells8 SUMMERDavid AndrewCole SchmelzerHere’s why a willis so importantyour assets, takes care of final debts andfiles final tax returns. Who do I want to take care of mychildren? This person is called the guardianin your will. Who do I want to take care of any money Ileave my children? This person or entity isnamed the trustee in your will. What else do I need to consider? Thinkabout when and why your children canaccess money from the trust. Are there otherspecial conditions that are important to you?Wednesday, Aug. 24Estate Planning Webinar5:30 p.m. CTFreeGet answers to your estate-planning questionsat this free webinar, presented by FirstCommunity Trust. Dupaco partners with FCT toprovide you estate, retirement and investmentplanning services.TIME:COST:Register at dupaco.com/trustGet a quote at dupaco.com/insureDon’t get caught in a QR code scamPROTECTION CONNECTIONDan Smith, CFP 3 Know your riders. Line up snacks and entertainment foryoung passengers so you can focus on the road. 4 Know yourself. Plan for rest breaks along the way. (TheNational Highway Traffic Safety Administration estimates thatdrowsy driving causes 100,000 crashes every year!) 5 Know your insurance. Does your policy include tripcontinuation or rental car coverage? What about roadsideassistance and towing? Keep your current insurance ID cardsin your glove compartment.QR codes are everywhere.We scan these square Quick Responsebarcodes with our smartphones to godirectly to websites or apps to viewrestaurant menus, read concert programsand even make purchases.But scammers use QR codes too. Theyreplace legitimate QR codes with their ownin hopes that we’ll pay them instead.These scams can be challenging torecognize. But there are ways to stay safewhen scanning a QR code:S TA Y I N T H E K N O W 1 Make sure the URL is a secure website,with the lock icon and an “s” in “https.” 2 Double-check that the URL takes youto the company’s website. 3 Look for signs of tampering if the QRcode is on a public sign. 4 Leave the website if it’s full of typosor looks suspicious. 5 When in doubt, go to the website onyour own instead of through a link.Follow us on social media to learn about the latest scams:facebook.com/dupacotwitter.com/dupacoPut what you’velearned to the test.Scan this (safe)QR code for morefraud-fighting tips.Protect yourself at dupaco.com/fraudPOLICY FOR THE PEOPLESCENE IN: 2022Dupaco’s Torri Freese shares a storyabout the credit union difference withU.S. Sen. Chuck Grassley (R-Iowa)March 1 during the Credit Union NationalAssociation Governmental AffairsConference in Washington, D.C.Raise your voiceat dupaco.com/PoliticalActionDID YOU KNOW?Look up your elected officialsand enroll to receive memberadvocacy emails and updates atiowacreditunions.com/StrongerTogether.Trent SteinesSUMMER 9

Meet your #DupacoCrew: Staff storiesThe adventuresof sharing a carStaff:Robert Daughters Help Desk managerDon’t forgetabout yourJoin our teamat dupaco.com/careersMy wife and I have never had more than one vehicle in our 10 years of marriage.Early on, we were both students and could only afford one car.It was a struggle at first. But we made it work. We found alternative ways toget where we needed to go—public transportation, carpooling, biking or walking.Now, we don’t feel the need for another car. We’re trying to minimize ournegative impact on the environment.Sharing a car does require some planning and coordination. Thankfully, ourhome is within walking distance of most places we visit.We occasionally get caught out in bad weather. I remember a time whenwe walked our dog to Dairy Queen. Even though it was only a couple of miles,our dog got overheated and decided he was done walking. We had to call mymother-in-law to pick us up.As far as troubles go, waiting for a ride while enjoying a chocolate dip coneisn’t too bad.I joined my city’s transit board because I know how important it is to havereliable transportation. I’ve used my time on the transit board to advocate forgreater access to public transportation.I used to work at Dupaco’s Sycamore branch taking loan applications. And I’veseen how the cost of unexpected car repairs can put a strain on a family’s budget.I talked to members who relied on the bus to get to work or the doctor’s office.When I was at the Sycamore branch, my supervisor said I’d be a good fit for anopen position in a new department. I understood why our organization needed aHelp Desk.There were many times I wished I had a lifeline while opening new accounts atthe branch. The thought of being that lifeline for other employees excited me.I’m thankful Dupaco has given me this opportunity to shine, and I will forever begrateful to the supervisor who encouraged me to take on a new challenge.I’ve been with Dupaco for eight years now. And every day, I’m thankful to havemeaningful work.Dupaco is serious about achieving its mission to improve each member’sfinancial position. I feel fortunate to have found an employer whose core valuesalign so well with my own.I believe I have a responsibility to care for others and use my strengths tobenefit my community. Working for Dupaco has helped me develop my skills andprovided ample opportunities to use them while giving back to the community.10 SUMMER401(k)Changing jobs? If you have a 401(k)retirement plan, you’ll need todecide what to do with it. Hereare four things to consider:Get startedat dupaco.com/ira 3 Know how rollovers work 1 Know your optionsYou likely have a few options: Leave your retirement account where it is. Roll it over to your new employer’s401(k) plan. Roll it into an Individual RetirementAccount (Dupaco offers IRAs). Cash out your savings (notrecommended).The best option for you depends onyour circumstances and goals. And eachemployer plan is different. A trustedfinancial advisor can help you weighyour options.when youchange jobs 2 Keep your funds in a retirementaccountIt might be tempting to cash out your401(k). But if you take this money outearly, you’ll face tax liabilities and penalties.Remember, it’s meant for retirement. Everylittle bit you save now adds up later!If you move your funds to a new employerplan or IRA, you need to complete theprocess within a certain period to avoidpotential tax liabilities and penalties. Your60-day clock starts when the funds arereleased from your old retirement plan.Dupaco can help you roll your 401(k) intoa Dupaco IRA. 4 Keep saving for retirementIf your new employer offers a 401(k) plan,start contributing to it as soon as you’reeligible. And lean on Dupaco for other waysto save for retirement. Your future self willthank you!Consult with your tax advisor.D U PA C O S TA F F C A R E E R M I L E S T O N E SFive-year employeesSailu AryalLynn DemmerRyan FitchBrandon JohnsonNate RolingLatoya SchwartzBrad SchweikertLynn TomkinsJess TroyKatie Vander Velden10-year employeesLisa ElskampJessica LehvSpencer Smith15-year employeesBrad LanganAbbi LaPage20-year employeeTonya McGlaughlin25-year-plus employeesJeann Digman (34)Deb Digmann (31)Georgia Slade (29)Dan Smith (25)RetirementsMike Felderman,commercial insuranceagent: 4 years of serviceNancy Laugesen,assistant vice president,Community Outreach &Education: 39 years ofserviceDiann Mozena, tellerservice associate: 32years of serviceDeb Schroeder, vicepresident, CommunityOutreach & Education:29 years of serviceSUMMER 11

Dupaco's Cedar Rapids Edgewood branch May 20. Dupaco Insurance Service's Derek Wood, who speaks Spanish, quickly volunteered to help translate for the Spanish-speaking members and Dupaco's Julia Michalec. (T. Freese/Dupaco photo) Owner's Manual is a publication of Dupaco Community Credit Union. Dupaco, the Dupaco logo, Thank Use, Great