Transcription

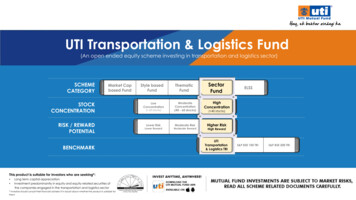

UTI Transportation & Logistics Fund(An open ended equity scheme investing in transportation and logistics sector)SCHEMECATEGORYMarket Capbased FundSTOCKCONCENTRATIONRISK / REWARDPOTENTIALBENCHMARKStyle basedFundLowConcentration( 60 stocks)Lower RiskLower 40 - 60 stocks)HighConcentrationModerate RiskHigher RiskModerate RewardELSS( 40 stocks)High RewardUTITransportation& Logistics TRIS&P BSE 100 TRIS&P BSE 200 TRIThis product is suitable for investors who are seeking*: Long term capital appreciationInvestment predominantly in equity and equity related securities ofthe companies engaged in the transportation and logistics sector* Investors should consult their financial advisers if in doubt about whether the product is suitable forthemInformation Classification: UTI AMC - Confidential

Landscape of Transportation & Logistics sectorPorts/ Shipping/ShipyardsRailway Dedicated FreightCorridor (DFC) Solid / Liquid &Container Cargo Port Logistics ServicesAuto AncillaryAirports/ Airlines Auto Components:Engine Parts/ Body &Chassis / Electricalparts & othersAuto OEMs Two-wheelers/ PV/CV / MHCV2 Public PrivatePartnership (PPP)CompaniesCatering toTransportation &LogisticsOEMs – Original Equipment Manufacturer, PV – Private Vehicles, CV – Commercial VehiclesCourier & Logistics Express Logistics Warehousing &Cold-storageInformation Classification: UTI AMC - Confidential

Drivers of Growth: Transportation & Logistics SectorProduct/ ServicesAutoOEMsAutoAncillariesLogistics3OEMs – Original Equipment Manufacturer Two WheelersThree WheelersPassenger VehiclesCommercial VehiclesTractorsClientele DealersEnd UsersGrowth Opportunity LED Lights, Plastic Moldings,Electrics, ElectronicsBatteries, MirrorsTyres, Airbags, SensorsInfotainment systems, Rail & ShippingAir & Surface logisticsSupply ChainsPorts & Terminals OEMsAuthorised ServiceCentersDealersEnd Users Manufacturers &DistributorsBusiness ServiceProvidersRetailers Surge in volume led by growinglevels of penetration &upgradationIncrease in average sellingPriceRegulatory t potentialShifts from unorganized toorganized marketsOpportunities fromOutsourcingImproving InfrastructureInformation Classification: UTI AMC - Confidential

Passenger Vehicles (PV): Well-positioned for growthVisible Trends: Premiumisation: Desire for high-end vehicles Improving Affordability: Cost of ownership going down; easy access to finance Low penetration: Volume is most likely at inflection pointIndia per capita GDP (Rs)Average price per car/ Per capita GDP (x) (RHS)1,70,000New PV sales (mn)109UV/PV in India (%) : Ambit Capital Private LimitedWith improving affordability, demand for high-end cars is relatively increasing,resulting in value as well as volume growth for the industry4Information Classification: UTI AMC - Confidential

Two-wheelers (2W): Increasing demand for high-end 2W & tapping of rural marketVisible Trends: Premiumisation: Desire for high-end 2Ws Demand for Scooters (Unisex product) dropped; however has high preferenceGrowth (%) (RHS)Moped FY1715%Scooter shareFY1620%20125cc plus MC shareFY152325%75-125cc MS 22W domestic industry (mn)Source: Ambit Capital Private LimitedExpected improvement in trend on back of improved affordability and leverage from auto financing5Information Classification: UTI AMC - Confidential

Medium and Heavy Commercial Vehicles (MHCV)Visible Trends: Increase in tonnage capacity of vehicles leading to cost economies Improving Infrastructure to aid in volume growthDomestic goods M&HCV volumeGoods M&HCV growth (%) (RHS)Goods M&HCV population (mn units)3,50,000Ton transported/truck/km/day Y08FY07FY06FY05FY04FY03(50)FY0250,000Source: Ambit Capital Private LimitedEconomics favour up-gradation of older fleet, could possibly trigger higher demand for MHCV6Information Classification: UTI AMC - Confidential

Auto Ancillary: Growth potential reinforced by InnovationVisible Trends: Change in regulations to trigger demand for newer products Indigenisation of products to improve domestic demand and also increase exports Improved cost efficiency and access to newer technology to expand the market sizeIndia auto ancs market size (Rs tn)Growth YoY (RHS)4.04.03.53.53.5Auto ancs exports (Rs tn)20%1.115%1.010%2.93.0Growth YoY 0%Source: Ambit Capital Private LimitedMarket growth to be led by expected demand growth in domestic market and expanding global reach7Information Classification: UTI AMC - Confidential

Logistics: Continued reforms including DFC to drive the growthStructural DriversDedicated Freight Corridor Higher aggregation of cargo to lead to scalebenefits for transporters Biggest rail freight capacity additionexercise ever done in history of India Consolidation of warehouses Road to Rail shift likely on WDFC route(Delhi – Mumbai) Higher movement of double-stackcontainers leading to efficiency gains Huge impetus for container rail operators Fewer Tax incidence will drive focus towardsturnaround time rather than freight costarbitrage Possible shift from unorganized sector toorganized sector Positive for domestic transportation focusedplayersIndian logistics sector at an inflection point8Information Classification: UTI AMC - Confidential

To summarise Passenger Vehicle (PV) Market― India's domestic PV market size is 2.7 million units as of FY21; While the segment grew at a 8.1% CAGR overFY09 to FY19, declined by 20% from a peak of FY19.― Likely acceleration in growth led by lower penetration, improving affordability & increasing demand forhigher-end cars. Two Wheeler (2W) Market― Domestic market grew by 11% CAGR over FY 09 to FY19 before declining by 29% in FY21 over FY19 andwithin which scooters grew by 19% over FY 09 to FY19 before declining by 33% in FY21 over FY19.― Rural penetration per household is much lower than in Urban India.― In the urban market, there is a likely shift in demand towards scooters & premium bikes, which accounts for30% and 7% Sow respectively for FY21. Auto Ancillary― Early adoption of new technology would lead growth & increase in export base.― Edge over cost leadership and access to newer technology.― Change in regulation and indigenization of products to help in demand growth.― Likely shift of unorganized players to organized market would lead to cost normalization.― Growing aspirations to continue to lead growth and increase export base. Logistics― Outsourcing of non-core operation of logistics would bring larger opportunities for larger players.― Improvement in infrastructure to further enable industry growth.9Information Classification: UTI AMC - Confidential

Product Spectrum on Risk v/s Return Grid (Active Funds)CORE ALLOCATIONCORE SATELLITE ALLOCATIONTACTICAL ALLOCATIONUTI B&FS FundUTI Healthcare FundRETURN POTENTIALUTI T&L FundUTI Focused Equity FundUTI Core Equity FundUTI Dividend Yield FundUTI MNC FundUTI Flexi Cap FundUTI Mid Cap FundUTI LTEF (Tax Saving)UTI Small Cap FundUTI India Consumer FundUTI Infrastructure FundUTI Mastershare Unit SchemeUTI Value Opportunities FundRISK / STANDARD DEVIATIONUTI LTEF (Tax Saving) – UTI Long Term Equity Fund (Tax Saving); UTI B&FS Fund – UTI Banking & Financial Services Fund; UTI T&L Fund – UTI Transportation & Logistics Fund10The above representation is only for understanding purpose, one should not constitute portfolio only based on the above and advised to approachtheir financialInformationClassification:advisors based on the investors respective risk profile before making investment decisions.UTI AMC - Confidential

Investment Strategy12Focus on good companies in a transient weak operational phase34Consideration for growth-oriented companies having strong returnratios available at reasonable valuationBottom–Up Stock Picking511Focus on companies having substantial earning quality (highoperating cash flows)Agnostic to market capitalization and would take concentratedexposure to certain stocksInformation Classification: UTI AMC - Confidential

UTI Transportation & Logistics Fund – Fund FactsType of schemeAn open ended equity schemeinvesting in transportation andlogistics sectorFund Inception11th April, 2008Investment ObjectiveThe objective of the scheme is to generate long term capitalappreciation by investing predominantly in equity and equityrelated securities of companies engaged in the transportationand logistics sector.However, there can be no assurance or guarantee that theinvestment objective of the scheme would be achieved.Asset AllocationFund ManagerIndicative Allocation(% of total assets)Sachin Trivedi, B.Com, MMS, CFA(Sep 2016)Total Experience: 20 YearsBenchmarkUTI Transportation & Logistics TRIMinimum Investment 5,000/- and in multiples of 1/Subsequent min. investment, 1,000/- and in multiples of imumAllocation(%)80100Mediumto HighDebt and Money Market instrumentsincluding securitized debt#020Low toMediumUnits issued by REITs & InvITs010Mediumto HighEquity and equity related instruments(minimum 80% of the total assetswould be in equity and equity relatedinstruments of companies engaged inthe transportation and logistics sector)#Thefund may invest up to 50% of its debt portfolio in securitized debt.Information Classification: UTI AMC - Confidential

Fund Facts (contd.)Fund SnapshotFund Size:Monthly Avg. AuM: 1,520 CroresLast Day AuM : 1,550 CroresNo. of Unit Folios: 1,24,960Market Capitalisation (%)LargeMidSmall:::Fund711811No. of %35%22%3.77Price toEarningsQuantitative IndicatorsBetaSD (3 Years)PTR (Annual)Sharpe RatioOCFC1:C2:C3:Price toBookBM79174Fund0.9325.47%16.00%0.17Portfolio Composition#4.1229.64Return onEquity5.24UTI T&L Fund35.125.40UTI T&L IndexActive Share : 22.10%Top 5 / Top10 Stocks56.50% / 77.20%Avg. AuM – Average Asset under Management, SD – Standard Deviation, PTR – Portfolio Turnover Ratio, Market cap – Market Capitalisation, ROCE – Return onCapital Employed. # Operating Cash Flow Tiers (C)- 3 Tiers based on the number of years in which they have generated positive operating cash flows in the previous 5years (for manufacturing companies). RoCE/ Implied RoE Tiers (R) - 3 Tiers based on the previous 5 year average return on capital (for manufacturing companies &non-lending non banking finance companies (NBFCs)) & based on the previous 5 year average return on asset for banks & NBFCs companies). All data are as of December 31, 2021UTI AMC - Confidential

Detailed PortfolioSTOCK NAME14% to NAVAct. Wt %MARUTI SUZUKI INDIA LTD.16.14-1.15TATA MOTORS LTD.13.00MAHINDRA & MAHINDRA LTD.STOCK NAME% to NAVAct. Wt %SUNDRAM FASTENERS LTD.1.491.49-2.15JAMNA AUTO INDUSTRIES LTD.1.321.3210.99-3.05SCHAEFFLER INDIA LTD1.181.18BAJAJ AUTO LTD.8.951.54SUBROS LTD.1.071.07ADANI PORTS AND SEZ7.42-1.98MAHINDRA LOGISTICS LTD.1.021.02EICHER MOTORS LTD7.381.05INTERGLOBE AVIATION LTD1.00-2.40ASHOK LEYLAND LTD5.272.18MAHINDRA & MAHINDRA FINANCIAL0.970.97BOSCH LTD.3.070.48TATA MOTORS – DVR0.930.93HERO MOTOCORP LTD.3.07-2.53TVS MOTOR COMPANY LTD0.930.93APOLLO TYRES LTD.1.910.62MAHINDRA CIE AUTOMOTIVE LTD0.750.75VRL LOGISTICS LTD1.861.86MRF LTD.0.49-2.18MOTHERSON SUMI SYSTEMS LTD.1.821.82SANDHAR TECHNOLOGIES LTD0.490.49CONTAINER CORP. OF INDIA LTD1.58-1.37ZOMATO LTD0.420.42BHARAT FORGE LTD.1.56-1.57GREAT EASTERN SHIPPING CO. LTD0.40-0.15MINDA CORPORATION LTD1.551.55RANE HOLDINGS LTD.0.220.22ESCORTS LTD.1.54-0.80GUJARAT PIPAVAV PORT LTD.0.210.21Portfolio above shows Top 20 equity holdings under the scheme, for detailed portfolio visit www.utimf.comAct. Wt % - Active Weight % (as compared to the Benchmark Index – UTI Transportation & Logistics Fund Index)Data as of December 31, 2021Information Classification: UTI AMC - Confidential

Portfolio SnippetsMajor Portfolio ChangesPortfolioCommentary(over the previous quarter) Demand is expected to improve in the coming years in the M&HCV industry.Increase in Allocation(Top 5) Bajaj Auto Ltd.Apollo Tyres Ltd.Adani Ports & SEZM&M FinanceEicher Motors Ltd.Based on the study of past cycles in this category, recovery in demand should besharp. The Fund has exposure to leading OEM players in India and has Gujarat Pipavav Port Ltd VRL Logistics Ltd. Schaeffler India Ltd.exposure through suppliers/ auto ancillaries which are expected tobenefit from a potential uptick in demand. Auto ancillaries are direct beneficiaries of improving domesticvehicle demand as well as beneficiaries of globalization. The Fund isDecrease in Allocationwell positioned to capitalise from this and has 19% exposure to Autoancillaries. Fund has an underweight position in the logistics space. The FundStocks ExitedStocks Enteredcontinues to believe logistics players have a long runway for fundamentals, the fund has reduced its position. N/A N/A The Fund’s preference continues to remain with companies withstrong balance sheet and high return ratios and also on those one’swhich can deliver higher growth in cash flows over a longer period.15Information Classification: UTI AMC - ConfidentialData as of December 31, 2021. OEM - Original equipment manufacturer, 2W - 2 Wheelers, PV - Passenger vehicle, GST - Goods and Services Tax

Performance Track Record 10,000 Invested at Inception: UTI Transportation & Logistics Fund Vs UTI Transportation & Logistics Index1,04,00094,000 89,762/-84,00074,00064,000 59,152/-54,00044,00034,00024,00014,000UTI Transportation & Logistics 14Dec-13Dec-12Dec-11Dec-10Dec-09Dec-084,000UTI Transportation & Logistics Index One time investment of Rs. 10,000/- made at the time of launch of the Scheme i.e., April 11, 2008 Total Value of investment under UTI Transportation & Logistics Fund – Rs. 89,762/- as against Rs. 59,152/- underUTI Transportation & Logistics TRI as on 31/12/202116Information Classification: UTI AMC - Confidential

Performance Track Record (Contd.)UTI Transportation & Logistics Fund Performance Vs Benchmark as of 31/12/2021Fund Performance Vs BenchmarkPeriodGrowth of 10,000/-SchemeReturns (%)B: UTI T&L IndexTRI (%)AB: Nifty 50TRI (%)SchemeReturns ( )B: UTI T&L IndexTRI ( )AB: Nifty 50TRI ( )1 Year24.3423.2725.5912,43412,32712,5593 Years7.998.9918.2712,59612,95016,5515 Years7.196.9617.6614,15314,00222,560Since Inception17.3313.8211.1789,76259,15242,803B - Benchmark, AB - Additional Benchmark, TRI - Total Return IndexPast performance may or may not be sustained in future. Different plans shall have a different expense structure. The performance details provided herein are of regular plan (growthoption). Returns greater than 1 year period are Compound Annual Growth Rate (CAGR). Inception of UTI Transportation & Logistics Fund : April 11th, 2008. Date of allotment in thescheme/plan has been considered for inception date. The Scheme is currently managed by Mr. Sachin Trivedi since Sep- 2016.This product is suitable for investors who are seeking*: Long term capital appreciation Investment predominantly in equity and equity relatedsecurities ofthe companies engaged in the transportation andlogistics sectorFund –UTI Transportation & Logistics FundBenchmark –UTI Transportation & Logistics Index* Investors should consult their financial advisers if in doubt about whetherthe product is suitable for them#Risk-o-meter for the fund is based on the portfolio ending December 31, 2021. The Risk-o-meter of the fund/s is/are evaluated on monthly basis andany changes to Risk-o-meter are disclosed vide addendum on monthly basis, to view the latest addendum on Risk-o-meter, please visit addendasection on n Classification: UTI AMC - Confidential

Performance Track Record (contd.)Performance of other open-ended schemes managed by the Fund Manager Mr. Sachin TrivediSchemeUTI Infrastructure Fund1 Year (%)InceptionDateManaging theFund SinceBenchmark07-Apr-04Sep-21Nifty InfrastructureTRI3 Years (%)5 Years 7715.4218.0512.9114.78a. Mr. Sachin Trivedi manages 2 open-ended schemes of UTI Mutual Fund.b. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement.c. Different plans shall have a different expense structure. The performance details provided herein are of Growth Option (Regular Plan).18Information Classification: UTI AMC - Confidential

Why Invest in UTI Transportation & Logistics Fund? The Fund predominantly invests in stocks of companies:- Principally engaged transportation & logistic sector- Companies engaged in the design, manufacture, distribution or sale oftransportation component/ services The growing income levels, increasing aspirations and also led by low vehiclepenetration in India, relative to the similar economies is a signal for an uptick in thefuture demand and would be a positive factor for the sector. The Fund would be agnostic to market capitalization spectrum and may takeconcentrated exposure to certain stocks. The Fund with a differentiated portfolio exposure may complement diversifiedequity funds for considerable return generation.Suitable for: Investors looking for a tactical allocation to their overall equity portfolio Investors willing to increase the risk spectrum of their portfolio with an exposure to a sectoral philosophy ofinvesting in stocks of companies catering to transportation and logistics sector19Information Classification: UTI AMC - Confidential

Product LabelName of the SchemeThis product is suitable for investors who are seeking*RiskometerUTI Mastershare Unit Scheme(Large Cap Fund- An open ended equity schemepredominantly investing in large cap stocks) Long term capital appreciation Investment predominantly in equity instruments of large capcompaniesUTI Core Equity Fund(Large & Mid Cap Fund- An open ended equity schemeinvesting in both large cap and mid cap stocks) Long term capital appreciation Investment predominantly in equity instruments of both large capand mid cap companiesUTI Mid Cap Fund(Mid Cap Fund- An open ended equity schemepredominantly investing in mid cap stocks) Long term capital appreciation Investment predominantly in mid cap companiesUTI Value Opportunities Fund(An open ended equity scheme following a valueinvestment strategy) Long term capital appreciation Investment in equity instruments following a value investmentstrategy across the market capitalization spectrumUTI Flexi Cap Fund(Flexi Cap Fund- An open ended dynamic equity schemeinvesting across large cap, mid cap, small cap stocks) Long term capital appreciation Investment in equity instruments of companies with good growthprospects across the market capitalization spectrumUTI Small Cap FundSmall Cap Fund - An open ended equity schemepredominantly investing in small cap stocks Long term capital appreciation Investment predominantly in equity and equity related securities ofsmall cap companiesUTI Dividend Yield Fund Long term capital appreciation(An open ended equity scheme predominantly investing in Investment predominantly in dividend yielding equity and equitydividend yielding stocks)related securitiesUTI Focused Equity Fund Long term capital growth(Focused Fund- An open ended equity scheme investing in Investment in equity and equity related securities across marketmaximum 30 stocks across market caps)capitalisation in maximum 30 stocks*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.#Risk-o-meter for the fund is based on the portfolio ending December 31, 2021. The Risk-o-meter of the fund/s is/are evaluated on monthlybasis and any changes to Risk-o-meter are disclosed vide addendum on monthly basis, to view the latest addendum on Risk-o-meter,please visit addenda section on https://utimf.com/forms-and-downloads/Information Classification: UTI AMC - Confidential

Product LabelName of the SchemeThis product is suitable for investors who are seeking*RiskometerUTI Infrastructure Fund Long term capital appreciation(An open ended equity scheme following the Infrastructure Investment predominantly in equity and equity related securities oftheme)companies forming part of the infrastructure sectorUTI MNC Fund(An open ended equity following the theme of investingpredominantly in equity and equity related securities ofMulti-National Companies) Long term capital appreciation Investment predominantly in equity and equity related securities ofMulti-National companiesUTI India Consumer Fund(An open ended equity scheme following the theme ofchanging consumer aspirations, changing lifestyle andgrowth of consumption) Long term capital growth Investment in equity instruments of companies that are expected tobenefit from of the changing consumer aspirations, changing lifestyleand growth of consumptionUTI Banking and Financial Services Fund(An open ended equity scheme investing in Banking andFinancial Services Sector) Long term capital appreciation Investment predominantly in equity and equity related securities ofcompanies engaged in banking and financial services activities.UTI Healthcare Fund Long term capital appreciation(An open ended equity scheme investing in the Healthcare Investment predominantly in equity and equity related securities in theServices Sector)Healthcare Services sector.UTI Transportation and Logistics Fund(An open ended equity scheme investing in transportationand logistics sector) Long term capital appreciation Investment predominantly in equity and equity related securities of thecompanies engaged in the transportation and logistics sectorUTI Long Term Equity Fund (Tax Saving)(An open ended equity linked saving scheme with astatutory lock in of 3 years and tax benefit) Long term capital growth Investment in equity instruments of companies that are believed tohave growth potential*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.#Risk-o-meter for the fund is based on the portfolio ending December 31, 2021. The Risk-o-meter of the fund/s is/are evaluated on monthlybasis and any changes to Risk-o-meter are disclosed vide addendum on monthly basis, to view the latest addendum on Risk-o-meter,please visit addenda section on https://utimf.com/forms-and-downloads/Information Classification: UTI AMC - Confidential

Thank YouThe information contained in this document is for general purposes only and is not an offer to sell or a solicitation to buy/ sell any mutual fund units /securities. The information / data here in alone are not sufficient and should not be used for the development or implementation of an investmentstrategy. The same should not be construed as investment advice to any party.REGISTERED OFFICE: UTI Tower, ‘Gn’ Block, Bandra Kurla Complex, Bandra (E), Mumbai - 400051. Phone: 022 – 66786666. UTI Asset Management CompanyLtd (Investment Manager for UTI Mutual Fund) Email: invest@uti.co.in. (CIN-L65991MH2002PLC137867). For more information, please contact the nearestUTI Financial Centre or your AMFI/NISM certified Mutual Fund Distributor (MFD) for a copy of the Statement of Additional Information, Scheme InformationDocument and Key Information Memorandum cum Application Form.Disclaimers: The information on this document is provided for information purposes only. It does not constitute any offer, recommendation or solicitationto any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely futuremovements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration. Users of thisdocument should seek advice regarding the appropriateness of investing in any securities, financial instruments or investment strategies referred to onthis document and should understand that statements regarding future prospects may not be realized. The recipient of this material is solely responsiblefor any action taken based on this material. Opinions, projections and estimates are subject to change without notice.UTI AMC Ltd is not an investment adviser, and is not purporting to provide you with investment, legal or tax advice. UTI AMC Ltd or UTI Mutual Fund(acting through UTI Trustee Company Pvt. Ltd) accepts no liability and will not be liable for any loss or damage arising directly or indirectly (includingspecial, incidental or consequential loss or damage) from your use of this document, howsoever arising, and including any loss, damage or expensearising from, but not limited to, any defect, error, imperfection, fault, mistake or inaccuracy with this document, its contents or associated services, or dueto any unavailability of the document or any part thereof or any contents or associated services.Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.Information Classification: UTI AMC - Confidential

Passenger Vehicle (PV) Market ― India's domestic PV market size is 2.7 million units as of FY21; While the segment grew at a 8.1% CAGR over FY09 to FY19, declined by 20% from a peak of FY19. ― Likely acceleration in growth led by lower penetration, improving affordability & increasing demand for higher-end cars. Two Wheeler (2W) Market