Transcription

JetraderJuly 2007ISTATInternational Society of Transport Aircraft TradingQ ARobert DelucePorter AirlinesAirbus Targets Appraisers007 The Hong Kong ExperienceA380 World TourRenaissance of the TurbopropBombardier Aerospace Q400

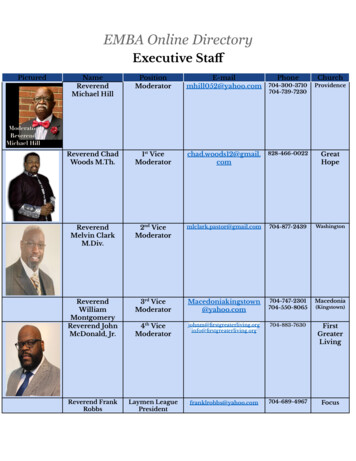

Who’sWhoISTATNew RejoiningMembersWe welcomethese recentlyregistered ISTATmembers andlook forward toseeing them atupcoming ISTATevents.For a completemembershiplisting seeISTAT’s onlinemembershipdirectory bylogging on toour web site www.istat.orgSusan M. Yata Fortis Bank Transportation Capital GroupPaul Oechsli UT Finance CorporationAmit Mittal Veling, Ltd.Richard Wall RBS Aviation CapitalMurrae Ross-Eskell Horizone Executive Search Int’l LtdJamies W. Jarvis Jarvis & Associates, P.A.Harold Dawes H.W. Dawes PartnershipPatrick Hartwilk KLM Royal Dutch AirlinesRussell Echlov Stadia CapitalScott R. Blumenfeld GE Commercial Aviation ServicesHarry Forsythe Macquarie AirFinanceDavid Weiss Dovebid Inc.John Poindexter The Flightstar Group, Inc.Bessie Wong Kate Scholer LLPDavid Rhodes 1100 N. Wood Dale RdAllan Jiron Aerospace Engineering GroupJason Barany Aeroturbine, Inc.Mike King Aeroturbine, Inc.Lisa Garcia MAC Aerospace LLCBrian Hynes MBIAJames Skiles ALAFCODavid Hoak MBIA Insurance CorporationSean Hopkins Allegiant Air, LLCJohn Wangermann Mercer Management ConsultingMin Lin Merrill LynchDeric Stafford Blue Star AviationAndrew Loadsman Merrill LynchBrandt Wilson Merrill LynchSpike Hioka Mitsubishi International CorporationDouglas Castle Mojave Jet Group LLCRichard Libby Bombardier AerospaceTony Khoury NewJet Engine Services LLCAnthony Siracusa Bombardier AerospaceJoel Hussey Oasis LeasingR. Terrence Rendleman Cavok Groupe AeroconseilLynne Gochanour Chapman and CutlerAndrew Holmes Philip Morris Capital CorporationIan Rollo Planetechs LLCMark Calver Relaer AsiaJohn Gleason Contrails Capital, Inc.Osman Parvez Republic Financial Corp.Charley Cleaver Republic Financial CorporationAmy Hufft Davidson Kempner Capital ManagementGene D’souza Republic Financial CorporationRobert Kuller Rockton ManagementSusan Lau DVB Transport (UC) LLCKevin Evans Rolls RoyceSylvie Morvan DVB Transport (UC) LLCMartin Wills SGI Aircraft Management BVJoao Felipe Gomes EmbraerAstrid Horn SkyBlue Capital LLCSergio Guedes EmbraerJane Jurgensen Smiths Aerospace LLCLucas Aardenburg SNECMAKarl Stahlke EmbraerSteve Costley SpeedNewsJoseph Englert Export Assist Inc.Leo Nadeau Flight Director IncGlaine Russell TAECOFleet Lentz FS Lentz LLCSteven Oldenburg TER CapitalPaul Righi The Boeing CompanyCarl Swabek GE AviationJeff Portanova Tiger Aircraft Trading, Inc.David Romansky GE Aviation / SalesWayne Mihailov GECASRuben Romero Tiger Aircraft Trading, Inc.Jill Levi Todd & Levi LLPBrian Rogol GECASElias Gedeon Gedeon Aviation ConsultantsRichard Goodrich Trident Aviation Industries Inc.Kevin McAllister General Electric - AviationDaniel Hoffman Turbo Resources Int’lRuss Shelton General Electric- AviationPhil Watkins Global Aircraft SolutionsJustin Werth Turbo Resources Int’lJoe Fallon UPSDane McBroom Global Aircraft SolutionsDavid De Mars ILFCNeville Taylor West Shore AdvisorsPhilip Scruggs ILFCMarty Olson International Lease Finance Corp.Yamato Uchikoshi Jalux Inc.Stuart Peebles Jet Managers International (JMI)Thomas Leimkuhler Jet Trading and Leasing, LLCMichael Finch Jetlease Inc.Richard MacDonald Kingman Airline ServicesPradeep Hathiramani KKR FinancialGlen Langdon Langdon Asset Management, Inc.Devon Cottrell Laserline Lease Finance Corp.Kenichi Watanabe Sumitomo CorporationMaureen SantaMaria Volvo Aero Services Corp.Erik Dahmen Oasis LeasingChristian Castang Altair & CompagnieBrian Tumulty Pembroke GroupPeter Moylan Pembroke GroupTom Henricks Aviation WeekAnnie Wolf First WaveEd Clark First WaveDarren Lowitt First WaveGuy Liddle Stephenson HarwoodSeiji Masui Fuyo General Lease Co, Ltd.Harnish Davidson BAE SystemsJeff Evans BAE SystemsBrian J. Olds Aurora Aviation GroupStephen Kennicott Aurora Aviation GroupChristopher Olds Aurora Aviation GroupJohn Van Der Menlen Aurora Aviation GroupLuis A. Ayala Jet Trading and Leasing, LLCJean-Louis Chevrot Dragon Aviation Leasing Company LtdDon Lachman EvergreenTilmann Gabriel EvergreenJohn Breitenbach EvergreenRaymond Buzz Wright EvergreenJohn Cozzi, Jr EvergreenRobert A. Bray Odgers Ray & BerndtsonCarlo Sari RotorJet GroupBen Clark First Wavephoto Bert van Leeuwen DVB Bank

ISTAT President Michael PlattTimes are good for aircraft financing.There is more demand than product. Most airlines are extendingleases rather than returning aircraftand the manufacturers’ backlogsmake it impossible to acquire new aircraft forseveral years. When an airline issues an RFPfor sale leasebacks on popular equipmentthey have to assign several managers just tofilter all the responses they receive.It seems like we are all chasing many of thesame deals. While it is always fun to see yourcompetitors in hotel bars around the world orwalking into an airline CEO’s office as youare walking out, sometimes I wonder if thisis becoming a commodity business. Otherthan the relative cost of funds, what separates one bidder in a deal from the next?My father was a salesman his whole career and he used to tell me that agood salesman could sell anything. While there is a lot of truth to that adage, ISTAT members that spend their time visiting airlines and talking aboutairplanes have to be experts at what they do in order to distinguish themselves and their companies. Our business requires expertise in both financeand in the products we finance. While there will always be some airlinesthat make decisions based solely on quantifiable economic differences suchas lease rates, I would like to think that at least sometimes there is more toit. Who best understands the airline’s business, their route structure, whichaircraft are best for the missions they fly, what flexibility they might needin the future, how their maintenance program and regulatory environmentaffects return conditions. How does an airline’s specification requirementsenhance their in-fight experience or revenue earning capacity? What roledo the various unions play in fleet decisions? Who is willing to tell anairline that they think they are making a mistake with their specification orequipment choice? We have the opportunity to visit with and analyze thebusiness of lots of airlines and that experience and expertise is valuable toour airline clients.Much of this expertise is learned on the job. The manufacturers do a prettygood job of disseminating information but that information must be evaluated critically. I think ISTAT can do a better job helping our members gainexpertise on the products they are marketing. It is my intention during myterm as ISTAT President to use the Jetrader and our conferences to advancethis purpose. When is the last time you saw independent analysts comparethe operating economics of competing products on particular routes? Whatare the true differences in maintenance costs between two different enginechoices on the same aircraft on the same missions? Within the ISTAT community we have this expertise. ISTAT is here to serve its members and we cando it by presenting critical analysis. While it is not our mission to endorseproducts or argue that one is better than the other, we should provide anopportunity to learn, and facilitate the dissemination of information.If we can’t get you the information you want and need, why should weexpect you to read the Jetrader or sit through the presentations at the conferences? I am working on this and need your help. If you are willing toshare your expertise, just raise your hand and let me or any of our officersor directors know. thisissueThe Hong KongExperience By Bert van Leeuwen6 Q A Robert DelucePorter Airlines8 The Renaissance of theBy Bombardier AerospaceTurboprop Regional Aircraft5 007 ::10Insurance Trends By Don KennyFoundation12 Airbus targets appraiserson values By Scott Hamilton17 Aircraft Appraisals11The ISTAT1 Boeing 777-200ER by Steve Rehrmann,Morten Beyer & Agnew2 Boeing 767-200ER by Clive Medland,Senior Vice President, SH&E19 Purdue Aviation TechnologyBy Denver Lopp and David Stanley—leading the way - Part III20BIG MOVES Brief CVSiggi KristinssonGreg May21 Jacques Scheider The Spitfire By Bill Bath18 June 2007ISTATParis Air Show ReceptionLe Pré-CatelanSponsorsBombardierGA TelesisGuggenheimAviation PartnersPratt & Whitney

JetraderISTATJetrader is a bi-monthly publication of ISTAT, the InternationalSociety of Transport Aircraft Trading. ISTAT was founded in1983 to act as a forum and to promote improved communications among those involved in aviation and supportingindustries, who operate, manufacture, maintain, sell, purchase, finance, lease, appraise, insure or otherwise engagein activities related to transport category aircraft.OfficersMichael PlattThomas W HeimsothJohn W VitalePresidentImmediate Past PresidentVice PresidentGregory A MayVice President TreasurerConnie LaudenschlagerVice President SecretaryBoard of DirectorsFred KleinMark Pearman-WrightJoseph W OzimekMarc AllinsonDaniel PietrzakStephen RimmerFred E BeardenAnthony DiazSigthor EinarssonJay W HancockPeter HuijbersCalendar18 June 2007Paris Air Show ReceptionLe Pré-Catelan by invitation30 September - October 2 200714th European ConferenceHilton Vienna11 November 2007Dubai Air Show ReceptionDubai Creek Golf & Yacht Club9 - 11 March 200825th Annual ConferenceOmni Orlando Resort at ChampionsgateISTAT International AppraisersBoard of Governors Steve BoeckerFred E BeardenAppraiser FellowChairmanWilliam BathDoug EmersonJay HancockSiggi KristinssonAl NigroFred KleinAppraiser FellowAdministrative DirectorISTAT Appraisers ProgramSenior AppraiserISTAT FoundationTrusteesStephen T RimmerChairmanRobert BrownVice ChairmanMichael PlattISTAT PresidentThomas W HeimsothISTAT ImmediatePast PresidentGregory A MayNeil G WhitehouseSenior AppraiserJohn BatchelorKlaus HeinemannWayne LippmanJames MorrisRoland H MooreChris PartridgeNick PopovichDavid P SuttonDavid TreitelWarren WillitsSecretary TreasurerRoland Moore .ISTAT HistorianInternational Society of Transport Aircraft TradingRon Pietrzak, Executive Director, rpietrzak@istat.orgBen Barclay, Project Coordinator, bbarclay@istat.orgDana Henninger, Member Services, dhenninger@istat.org401 N Michigan Avenue, Chicago, Illinois 60611 USAT 1 312-321-5169 F 1 312-673-6579E istat@istat.org W www.istat.orgA/E art /editorial content / advertising salesBarbara Rogers . Stephen Iverson publishersAjax News . 1006 E First Street . Long Beach CA 90802 e.comT 1 213 784 0219All articles submitted are the sole property and responsibility of the authors and the JETRADER disclaimsall liability for any data, information, or opinions contained herein and makes no representation or warranties as to their accuracy. The article’s authors bear sole responsibility for accuracy. The authors retainresponsibility for obtaining permission when incorporating copyrighted materials into their articles, including photographs and charts and any other display items. Any comments related to the content of individualauthors should be directed to the author of the articles. Ajax News 20074

007 TheA380Hong Kong ExperienceWorld TourBy Bert van LeeuwenNo , not the title of a new Bond movie, but the story of oneof the first passengers flying the new Airbus A380. F-WW”JB” (for“James Bond”), the registration Airbus selected for the A380 with theiconic msn. 007. Make no mistake, this plane is not the giant “Skyfleet” jetliner, featuring as the target for villain “Le Chiffre” in the latest Bond movie “Casino Royale. The Skyfleet jet was actually basedon a Boeing 747 although heavily modified and as such barely recognizable for the average movie-goer. However, even without thehelp of the Secret Service’s most popular agent, this plane, the realmsn. 007 succeeded in conquering its position as a world media starfor a few days in March 2007. Airbus A380 msn. 007 was the aircraftAirbus and Lufthansa selected for a number of high profile “RouteProving Flights” , all part of the test program for the new giant in thesky. As DVB Bank’s Head of Aviation Industry Research, I was one ofthe fortunate representatives of the financial community to be invitedas guinea-pig on one of these flights. Exclusively for ISTAT’s Jetraderfollows a description of the experience of one of the first A380 flightsfrom a passenger’s point of view.It was already late on February 2nd, when an e-mail from“Airbus-events” popped up on the computer screen. Although initiallyjust one of the daily flood or e-mails, the contents of this one immediately got “red alert” status as it turned out to be an invitation forone of three – all equally attractive – flights aboard the spectacularnew Airbus A380. The menu offered a flight to New York on Monday,a “weekend special” to Hong Kong and a Sunday trip to Washington (DC). Difficult choice, as NY had the attraction of the first transatlantic passenger flight, Hong Kong the longest flight of the threeand the most exotic destination and Washington would maybe givethe opportunity to visit the National Air and Space Museum’s StevenF.Udvar-Hazy center (would an A380 fit in there in the distant future?) near Dulles airport. The attraction of the exotic gained the upperhand and Hong Kong it would be.Friday April 23rd the day of what turned out to be flightLH8946/AIB201 from Frankfurt to Hong Kong started at Amsterdam’s Schiphol airport aboard a Lufthansa A319. A smooth flightto Frankfurt followed and during the final approach the A380 in Airbus livery could already be seen on the platform, although not yetanywhere near the dedicated A380 terminal area. According to theinstructions, check-in for the Hong Kong flight would be at a dedicated counter. With the usual German efficiency this counter was veryeasy to find as the entire airport was littered with “LH Route Proving”signs, pointing guests in the right direction. Check-in was friendly andefficient, albeit no Mile & More points for this flight, and the boarding pass indicated seat 23C as well as gate E5, a dedicated “A380Parking Only”-gate in Terminal 2. The gate area was transformedinto a reception area with plenty of snacks and drinks for the nearly500 expected guests. It turned out that most of the other passengerswere either Lufthansa invited VIP-guests, Lufthansa employees or winners of a LH/A380 contest organized by a local radio station. In thiscrowd of around 500 people however a few familiar faces couldstill be recognized, other aerospace bankers and representatives ofEuropean leasing companies. It was interesting to note that most ofthe bankers had swapped their pin-stripes and HP’s for more casualoutfits and big SLR camera’s, once more revealing the usually hiddenbut oh so obvious “toys for the boys” character of our industry.As the scheduled departure time of 15.30 approached, more andmore people started to wonder why the big bird was still hiding. Wasthis to be an attempt to break the record of fastest boarding a commercial airplane ? Soon the news broke that mechanics had discovered a minor leak in the hydraulic system and that would causephotos Bert van Leeuwen45a delay. Replacing the damaged pipe should normally be an easyevery day routine job, but as Lufthansa did not carry a stock of A380PMA parts yet, an OEM replacement part had to be jetted in fromToulouse. Surprisingly the news of the delay did not impact the festiveatmosphere around the gate at all and – as a solution to all problemsin Germany – the hosts quickly arranged additional catering in theform of massive kettles containing . German sausages.In the meantime, the A380 had made its appearance atgate E5 and even before all sausages were gone, the boarding procedure started. Contrary to personal fear of a chaotic mass-boardingrun, the two jetways (one for the upper deck, one for the main deck)could easily handle the number of passengers, effectively splittingthe A380 into two separate 250-seaters. Seat 23C turned out to bean economy seat on the main-deck. To mask some of the author’senvy versus the First and Business Class passengers, the argumentwas found that the qualities of a new aircraft can only be truly experienced in Economy as Business and First are OK in any aircraft typeanyhow.A380 continued page 16

Q ARobertDelucePresident and CEOPorter AirlinesJETRADER: Good AfternoonBob. Thank you for taking thetime to speak to the members ofISTAT and the JETRADER Magazine.RD: It’s a pleasure to be able tomeet with you.J: Last issue of the JETRADER weinterviewed Wolfgang Mayrhuberof Lufthansa, a premier international legacy carrier. Porter Airlines is an interesting contrast asa successful startup. Could youshare your operating philosophy?RD: Our operating strategy is tobring back a certain refinement tothe industry, restoring some dignity to air travel, to all of our passengers both business and leisure.It starts with a strong brand thatincludes a stylish livery, a mascotin the form of a mischievous raccoon, easy web booking, convenient shuttle bus service from thecity center of Toronto, convenientweb check-in, although we havea call in service as well. We havea business class lounge here inToronto, retro looking uniformsthat are a throw back to earliertimes when there was a bit moredignity associated with flying. Weoffer a high end in-flight servicewhich we couple with our newQ400 aircraft which are quiet,spacious and quick. When youadd this all up our passengersget a more refined, warm experience than you would typically geton an airline.From a more technicalpoint of view we operate one typeof aircraft, the quiet, fuel efficient,low emissions and fast Bombardier Q400. We operate fromone main hub, Toronto, and ourdestinations are all within 500nautical miles. We are a low costairline but without the discountmentality. We cater to a timesensitive business traveler so ouryields are higher than typical forthis environment. Our service isconvenient, geared towards saving people time and not nickeland dime them to death for thelittle extras that is more typical ofmany carriers.J: With your unique position atToronto City Centre is your operating model unique to this environment or is it exportable toother airports?RD: Our business plan is basedon Toronto and to access as manycities as feasible. When we go toChicago we will target MidwayAirport and in Washington DCwe are looking at Ronald Reagan National Airport. We reallyattempt to connect city center tocity center where ever we can aswe emphasize convenience andan upscale level of service.J: How do you see the aviationmodel changing in the US andCanada over the next few years?RD: Our experience shows thatthe level of service in our terminals and airplanes pleasantlysurprises passengers. They areprice conscious but service andconvenience are very importantto them. We have a couple ofcarriers in Canada who are dominant but when we run up againstthem we find our passengers prefer our convenience and the levelof passenger experience. Whenyou combine this with good flightschedules and competitive fareswe think we have a winning combination. LCCs in some marketsare attractive. In Canada, LCCstend to look like the legacy carriers. True LCCs like Ryan Air,SouthWest or an easyJet are notin our market which is dominatedby legacies or regionals. In thecase of JetBlue we offer servicessimilar to them although we goa little further by offering leatherseats and a culture of service.We are a regional carrier servingan upscale market using efficientairports and flying a very efficientaircraft.J: It has been attributed to RyanAir that over time fares will approach zero and airline revenueswill come from selling all of theother services. How do you seethe market for LCC’s developand how does Porter Airlines operate in this environment?RD: The RyanAir model is onething but is based on a differentphilosophy. Look at the success ofVirgin Atlantic or Singapore Airlines. They have not sacrificed theflight experience in anyway andthey have been particularly successful with the highest rated passenger satisfaction. In our casewe have very competitive airportand a very efficient aircraft withaccess to a time sensitive business traveler who is prepared topay a premium for time savingand efficiency. This unique to ourenvironment and gives us somecomfort in terms of what we areproviding and how its being received.J: What is your view of Chapter11 as a business tool to forcelower costs and how does that affect the surviving carriers?RD: Using Chapter 11 or CCAAhere in Canada, Air Canada wentto the wall, left a lot of debt behind and many unhappy people.When that happens, there is a bitof a cloud over you and peopledon’t forget how they were treated all that quickly, whether theyare employees, passengers orsuppliers. Everyone was pushedto the limit. There are so few carriers to choose from in Canadathat when someone with a new,refreshing service comes alongand a different view of operatingan airline the reaction is very interesting. We are enjoying a verystrong reaction to the productwe are providing. Chapter 11 orCCAA seems an inappropriateway of sorting out the marketplace. Normally if you are successful you survive, if you are notyou don’t. But Chapter 11 or theCCAA approach is a bit contraryto the way we are doing business.J: What is your forecast for fuelprices for the next couple ofyears?RD: When you are dealing withthe Q400 you are a bit less sensitive to fuel price fluctuations. TheQ400 burns typically 30 to 40%less than your typical regional ornarrow body on a cost per seatbasis. It gives you a great dealof flexibility to respond to marketconditions. We know that whenfuel prices goes up it affects everyone but it hits us a bit less. Ican’t imagine fuel going downand we are planning for a gradual increase over time and areprepared to pass the cost on toour customers. But we are lessat the mercy of fuel prices thansome of our competitors.J: What parameters do you usein selecting your aircraft and areregional jets going to play a rolein Porter Airlines growth strategy?RD: The Toronto City Centre Airport has a restrictive agreementthat precludes the use of Jet Aircraft. So our equipment acquisition strategy was based on finding the most competitive aircraftto meet this requirement and theurban environment we were going to operate from. We camedown to looking at the Bombardier Q400, the ATR72 and theSAAB 2000 even though this lastone is no longer being manufacJetrader 6

Robert Deluce Porter Airlines“Our operating strategy is to bringback a certain refinement to the industry, restoring some dignity to air travel,to all of our passengers both businessand leisuretured. The Q400 was the mostcompetitive from an operationsperspective and the fact that itis manufactured here in Torontodid not hurt. As a new start carrier it was not easy to finance newaircraft. So we focused on raising enough capital to buy our firstfour aircraft outright out of a total20 aircraft on order.J: Do you see leasing playing arole in your acquisition strategy?RD: We see room for some aircraft to be owned and some to beleased. At the moment they areowned and that is our short-termstrategy.J: Is Porter Airlines going to moveinto the 100-seat market?RD: The Q400 is the core of ourequipment and the one we planon using for a long period of time.It a new generation aircraft and itis state of the art and meets ouroperating parameters from thisairport. Who knows, there maybe a longer version or a bigger7”version of this aircraft; there arerumors that Bombardier is looking at alternatives. We are betteroff right now to add frequencyrather than size to our destinations as our loads improve andwe get a bigger percentage ofthe market.J: With the increasing demandsof the public for environmentalawareness, what impact will thishave on the Industry and yourcompany?RD: There is an increasing awareness in Canada, that for certainand we see it worldwide. Europeis a bit ahead of the curve on thisissue. We are fortunate to havean aircraft that is technologicallyadvanced. It burns less fuel, emitsless pollutants, a six bladed propthat lowers exterior noise and anoise suppression system to improve the cabin environment andthese all bode well. We are careful to choose options on the aircraft that help improve its envi-ronmental friendliness such as theability to lower engine speeds forlanding which lowers the exteriornoise level. We will move soon topresent ourselves as greener because we have the right aircraftto do that. We will look at otheraspects such as carbon creditsand other means to ensure wedo our part to improve our impact on the environment. On anoperational level to improve ourreliability and to lower our noisefootprint on the surrounding areas we have increased the glidepath to 4.8 degree at TorontoCity Center instead of the moretraditional 3.3-degree approach.That gives us a straight-in ILSapproach rather than the moretraditional offset approach and itallows us to bypass residential areas. This also allows us to reduceour noise footprint on the surrounding area. We are alreadyquietly changing our operationsto address these environmentalissues and will soon start publicizing the more environmentallydriven initiatives we have and areundertaking.J: Is Porter Airlines sensitive to theimpact the coming Baby BoomGeneration retirement will haveon the Aviation Industry?RD: Everyone needs to lookahead on this issue as it is goingto affect everyone. We have closeworking relationships with training organizations and universities.Because we work from an urbanairport and our employees live inthat environment, this has been aplus for us. With the dramatic restructuring of the airlines in Canada, many of the aircrews havebeen disbursed to Dubai, HongKong and elsewhere. So we havebeen able to give these specialists an opportunity to comeback.That is a good source of recruitsbut eventually we will have to address their replacements.J: What are the major challengesfacing the aviation industry overthe next 18 months.RD: We are newly launched eventhough we have been in the planning for over 5 years. We havean aggressive expansion planwhich has us operating 16 to 20aircraft over the next 3 years. Theavailability of qualified people isone that concerns us and couldaffect us at some point. My focusis on growing our market share ina competitive environment whereyou need to be flexible. One ofthings we would like to see somebetter use of biometrics when itcomes to putting in place a securepassenger environment wherepassengers who are well knowncan have an easier time to movethrough the system. This is reallyfocused on high users and shouldallow them to be pre-qualified.The challenge is to work in thishigh security environment andstill offer a superior passengerexperience.J: That theme made its appearance at the last ISTAT Conferencein Phoenix. I hope you have anopportunity to join us in Viennafor the next European Conference in September and on behalfof ISTAT and its members, thankyou for taking the time for talkwith the JETRADER.RD: Thank you for the invitation.

Q400 BombardierThe Renaissance of the TurbopropBy Bombardier Aerospace Regional AircraftAtthe height of the regional jet boom in thelate1990s and early 2000s, many industryobservers predicted that the era of the turboprop was over. And, for a few years, turboprop ordersplummeted from a high of 501 in 1989 to 26 in 2002as operators stocked up on jets.Canada’s Bombardier Aerospace, whichmanufactures both regional jets and turboprops, realized that the latter needed a new image. Too manypeople considered them noisy, uncomfortable and oldtechnology. The first improvement was a Noise andVibration Suppression (NVS) system. A similar systemwas developed originally by Ultra Electronics in Cambridge, England to make nuclear submarines run morequietly. Bombardier saw its potential for aircraft andworked with Ultra Electronics to adapt it for Bombardier’s line of Dash 8 turboprops. In 1996, the Dash8 was re-branded as the Q Series, the Q meaningQuiet.The NVS system attacks noise at its source– airframe vibration caused by pressure pulses fromthe propellers beating against the fuselage. Duringflight, concealed microphones measure noise levels and propeller vibration and send this informationto the onboard computer. This computer continuallyanalyzes the information before sending it to devicescalled Active Tuned Vibration Absorbers, or ATVAs,which are mounted on the fuselage walls. The absorb-ers produce counter vibrations that all butcancel out the original vibrations. The resultis a sharp reduction in both cabin vibrationand noise, and a remarkable increase incabin comfort, even next to the propellers.NVS worked so well that one Bombardierturboprop operator painted “The Soundof Silence” on the engine nacelles – surelya first for any propeller-driven aircraft.NVS was the first step in the renaissance of the turboprop and sales ofBombardier’s 37 to 39-seat Q200 and 50to 56-seat Q300 began a slow climb. Andin 2005, turboprops outsold regional jets.The second step was developmentof the 68- to 78-seat Q400. Here was a twinengine turboprop that cruised at 360 knots andwith a cockpit at least as state-of-the-art as thosefound in Airbus and Boeing aircraft. It was the firstregional airliner to be certified for a Head-up Guidance System (HGS); it was the first regional airlinerto be certified for Cat. III weather minima on a singleengine; and it was the first regional airliner to meet Required Navigation Performance (RNP) standards thatrequire pinpoint navigation accuracy. The HGS, Cat.III and RNP were pioneered by Horizon Air of Seattle,Washington, which also operates a fleet of Bombardier CRJ700 regional jets.ContactBert Cruickshank,Director, Industry Airline Communications416-375-3030 .bert.cruickshank@aero.bombardier.comGlobal Records

Morten Beyer & Agnew 2 Boeing 767-200ER airplanes have to be experts at what they do in order to distinguish them-by Clive Medland, Senior Vice President, SH&E By Denver Lopp and David Stanley Siggi Kristinsson Greg May By Don Kenny T imes are good for aircraft financing. There is more demand than prod-uct. Most airlines are extending