Transcription

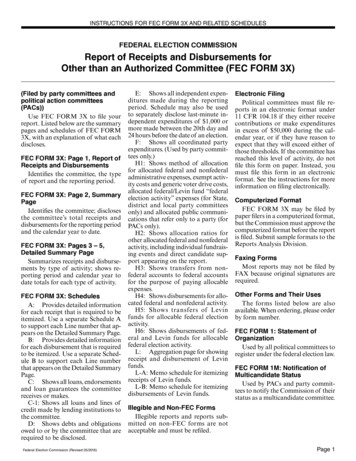

INSTRUCTIONS FOR FEC FORM 3X AND RELATED SCHEDULESFEDERAL ELECTION COMMISSIONReport of Receipts and Disbursements forOther than an Authorized Committee (FEC FORM 3X)(Filed by party committees andpolitical action committees(PACs))Use FEC FORM 3X to file yourreport. Listed below are the summarypages and schedules of FEC FORM3X, with an explanation of what eachdiscloses.FEC FORM 3X: Page 1, Report ofReceipts and DisbursementsIdentifies the committee, the typeof report and the reporting period.FEC FORM 3X: Page 2, SummaryPageIdentifies the committee; disclosesthe committee’s total receipts anddisbursements for the reporting periodand the calendar year to date.FEC FORM 3X: Pages 3 – 5,Detailed Summary PageSummarizes receipts and disbursements by type of activity; shows reporting period and calendar year todate totals for each type of activity.FEC FORM 3X: SchedulesA: Provides detailed informationfor each receipt that is required to beitemized. Use a separate Schedule Ato support each Line number that appears on the Detailed Summary Page.B: Provides detailed informationfor each disbursement that is requiredto be itemized. Use a separate Schedule B to support each Line numberthat appears on the Detailed SummaryPage.C: Shows all loans, endorsementsand loan guarantees the committeereceives or makes.C-1: Shows all loans and lines ofcredit made by lending institutions tothe committee.D: Shows debts and obligationsowed to or by the committee that arerequired to be disclosed.Federal Election Commission (Revised 05/2016)E: Shows all independent expenditures made during the reportingperiod. Schedule may also be usedto separately disclose last-minute independent expenditures of 1,000 ormore made between the 20th day and24 hours before the date of an election.F: Shows all coordinated partyexpenditures. (Used by party committees only.)H1: Shows method of allocationfor allocated federal and nonfederaladministrative expenses, exempt activity costs and generic voter drive costs,allocated federal/Levin fund “federalelection activity” expenses (for State,district and local party committeesonly) and allocated public communications that refer only to a party (forPACs only).H2: Shows allocation ratios forother allocated federal and nonfederalactivity, including individual fundraising events and direct candidate support appearing on the report.H3: Shows transfers from nonfederal accounts to federal accountsfor the purpose of paying allocableexpenses.H4: Shows disbursements for allocated federal and nonfederal activity.H5: Shows transfers of Levinfunds for allocable federal electionactivity.H6: Shows disbursements of federal and Levin funds for allocablefederal election activity.L: Aggregation page for showingreceipt and disbursement of Levinfunds.L-A: Memo schedule for itemizingreceipts of Levin funds.L-B: Memo schedule for itemizingdisbursements of Levin funds.Electronic FilingPolitical committees must file reports in an electronic format under11 CFR 104.18 if they either receivecontributions or make expendituresin excess of 50,000 during the calendar year, or if they have reason toexpect that they will exceed either ofthose thresholds. If the committee hasreached this level of activity, do notfile this form on paper. Instead, youmust file this form in an electronicformat. See the instructions for moreinformation on filing electronically.Computerized FormatFEC FORM 3X may be filed bypaper filers in a computerized format,but the Commission must approve thecomputerized format before the reportis filed. Submit sample formats to theReports Analysis Division.Faxing FormsMost reports may not be filed byFAX because original signatures arerequired.Other Forms and Their UsesThe forms listed below are alsoavailable. When ordering, please orderby form number.FEC FORM 1: Statement ofOrganizationUsed by all political committees toregister under the federal election law.FEC FORM 1M: Notification ofMulticandidate StatusUsed by PACs and party committees to notify the Commission of theirstatus as a multicandidate committee.Illegible and Non-FEC FormsIllegible reports and reports submitted on non-FEC forms are notacceptable and must be refiled.Page 1

INSTRUCTIONS FOR FEC FORM 3X AND RELATED SCHEDULESFEC FORM 7: Report ofCommunications Costs byCorporations and MembershipOrganizationsUsed by corporations and labororganizations to disclose internal partisan communication costs that exceed 2,000 for an election.FEC FORM 8: Debt SettlementPlanUsed by terminating committees todisclose the terms of debt settlements.These Forms may be duplicated.To obtain additional forms,call the Information Division at1-800/424-9530 or 202/694-1100or visit the FEC’s Web site atwww.fec.gov.Page 2Federal Election Commission (Revised 05/2016)

INSTRUCTIONS FOR FEC FORM 3X AND RELATED SCHEDULESINSTRUCTIONS FORSUMMARY PAGE(FEC FORM 3X, PAGES 1–2)Who Must FileAny political committee which is notan authorized committee is required tofile periodic Reports of Receipts andDisbursements on FEC FORM 3X.Note: Political committees mustfile reports in an electronic formatunder 11 CFR 104.18 if they haveeither received contributions or madeexpenditures in excess of 50,000, orif they have reason to expect that theywill exceed either of those thresholdsduring the calendar year. If the committee has reached this level of activity,DO NOT FILE THIS FORM ONPAPER. Instead, you must file thisform in an electronic format.A political committee is consideredto have reason to expect it will exceedthe electronic filing threshold for thenext two calendar years after the calendar year in which it exceeds 50,000in contributions or expenditures. If itis a new committee, it is considered tohave reason to expect it will exceed theelectronic filing threshold if it exceeds 12,500 in contributions or expenditures during the first calendar quarterof the calendar year, or 25,000 incontributions or expenditures in thefirst half of the calendar year.Contact the FEC for more information on filing electronically.ALL POLITICAL COMMITTEESAUTHORIZED IN WRITING BYA CANDIDATE FOR THE OFFICE OF PRESIDENT OR VICEPRESIDENT MUST FILE ON FECFORM 3P.ALL POLITICAL COMMITTEESAUTHORIZED BY A CANDIDATEFOR THE HOUSE OF REPRESENTATIVES OR SENATE MUST FILEON FEC FORM 3.When to FileAll political committees required tofile on FEC FORM 3X must file either:election and non-election year reportsFederal Election Commission (Revised 05/2016)as specified in (A) below; or monthlyreports as specified in (B) below.Note: State, district and local committees of political parties that arepolitical committees under the Actmust disclose receipts and disbursements for Federal election activity. Ifthe committee’s aggregate amount ofsuch receipts and disbursement is lessthan 5,000 in a calendar year, it mustreport only receipts and disbursementsof Federal funds for Federal electionactivity. If the aggregate amount ofsuch receipts and disbursements during the calendar year equals or exceeds 5,000, the committee must report allreceipts and disbursements for Federalelection activity. 52 U.S.C. § 30104(e)(2). The reporting periods for politicalparty committees disclosing receiptsand disbursements for Federal election activity are monthly, except forpre-general and post-general election reports. 52 U.S.C. § 30104(e)(4)(citing 52 U.S.C. § 30104(a)(4)(B)).Otherwise, political committees thatare State, district and local committeesof political parties must file quarterlyand pre- and post-election reports inelection years and semi-annual reportsin non-election years for their otheractivity. 52 U.S.C. § 30104(a).(A) Election Year and NonElection Year ReportsIn any calendar year in which thereis a “regular” November generalelection, the following reports are required: Quarterly reports must be filed nolater than April 15, July 15, October15 and January 31 of the followingcalendar year. Each such report mustdisclose all transactions from the lastreport filed through the last day ofthe calendar quarter. A quarterlyreport is not required to be filed if aPre-Election report is required to befiled during the period beginning onthe 5th day and ending on the 15thday after the close of the calendarquarter. Pre-Election reports must be filedno later than the 12th day before anyprimary or general election in whichthe committee supports (i.e., makescontributions to or expenditures onbehalf of) or opposes a candidateand must include all transactionsfrom the closing date of the last report filed through the 20th day beforethe election. A 12-Day Pre-ElectionReport sent by certified or registeredmail must be mailed no later thanthe 15th day before the election. APre-Primary election report is notrequired where the contribution(s)or expenditure(s) has been disclosedon a previous report. All committees must file a 30-DayPost-General Election Report. A 30Day Post-General Election Reportmust be filed no later than 30-Daysafter the general election and includeall transactions from the closing dateof the last report filed through the20th day after the general election.In any other calendar year, the following reports are required: A Mid Year Report must be filedno later than July 31 and includetransactions beginning January 1and ending June 30. A Year End Report must be filed nolater than January 31 of the followingcalendar year and include transactions beginning July 1 and endingDecember 31.(B) Monthly ReportsMonthly reports must be filed nolater than 20 days after the last dayof the month and must disclose alltransactions from the last report filedthrough the last day of the month.In lieu of the monthly reports due inNovember and December for a year inwhich there is a “regular” Novembergeneral election, a 12-Day Pre-General election report must be filed including all transactions from the closingdate of the last report filed throughthe 20th day before the election and a30-Day Post-General election reportmust be filed including all transactions from the closing date of thePre-Election report through the 20thday after the general election. A YearEnd Report must be filed no later thanPage 3

INSTRUCTIONS FOR FEC FORM 3X AND RELATED SCHEDULESJanuary 31 of the following calendaryear and include transactions fromthe closing date of the Post-GeneralElection Report through the last dayof the calendar year.Except for State, district and local party committees required to filemonthly under 11 CFR 300.36(c)(1) (see above) and national partycommittees required to file monthlyunder 11 CFR 104.5(c)(4), a politicalcommittee may elect to change thefrequency of its reporting from quarterly and semi-annually under (A)to monthly under (B) or vice versa.A committee may change its filingfrequency only after notifying theCommission in writing of its intentionat the time it files a required reportunder its current filing frequency. Thecommittee will then be required to filethe next required report under its newfiling frequency. A committee maychange its filing frequency no morethan once per calendar year.A document is timely filed upondelivery to the appropriate office(see “Where To File”) by the closeof the prescribed filing date or upondeposit as registered or certified mailin an established U.S. Post Office andpostmarked no later than midnight ofthe day the report is due, except thatPre-Election Reports so mailed mustbe postmarked no later than midnightof the 15th day before the date of theelection. Reports and statements sentby first class mail must be receivedby the appropriate office by the closeof business of the prescribed filingdate to be timely filed. Reports filedelectronically are timely filed if thereport is received and validated by theCommission’s computer system on orbefore 11:59 p.m. Eastern Standard/Daylight Savings time on the prescribed filing date.Where to FileAn original and any amendmentsto an original report must be filed asfollows: All committees must file with theFederal Election Commission, 1050First Street, N.E., Washington, D.C.Page 420463. Reports shipped via FedEx,UPS or DHL should use the ZIPcode 20002.Political committees filing FECFORM 3X must file with the appropriate officer in Guam and PuertoRico a copy of that portion of thereport applicable to candidates seeking election in those territories (as ofMarch 2006, those territories had notqualified for the Commission’s statefiling waiver program).Report Preparation A political committee may use anyrecordkeeping or accounting systemwhich will enable it to comply withthe Act. The Commission recommends thatthe political committee keep a recordkeeping or accounting systemthat keeps a separate accountingfor each of the various categoriesof receipts and disbursements onpages 3, 4 and 5 (Detailed SummaryPage). This separate accounting willhelp the political committee fill outthe reporting forms, since separatereporting schedules are required foreach category. The reporting schedules should befilled out so that totals can be derivedfor each category. The total figures should be carriedforward to pages 3, 4 and 5 (DetailedSummary Page) and then (whereappropriate) from the DetailedSummary Page to page 2 (SummaryPage). Pages 3, 4 and 5 (Detailed SummaryPage) should be filled out beforecompleting page 2 (Summary Page).Line-by-Line Instructions forPage 2 (Summary Page)LINE 1. Enter the complete name andmailing address of your committee.LINE 2. Enter the FEC IdentificationNumber assigned to the committee.LINE 3. If this is an original report,check the “NEW” box. If this is anamendment to a previous report, checkthe “AMENDED” box.LINE 4. Check the appropriate boxfor “Type of Report”. If the reportis a 12-Day Pre-Election or 30-DayPost-General election report, supplythe type of election (primary, general,convention, special or run-off), the dateof the election, and the State in whichthe election is held.LINE 5. Enter the coverage dates forthis report. All activity from the endingcoverage date of the last report filedmust be included.LINE 6(a). Enter the total amountof cash on hand at the beginning ofthe calendar year. The term “cash onhand” includes: currency; balance ondeposit in banks, savings and loaninstitutions, and other depository institutions; traveler’s checks owned bythe committee; certificates of deposit,treasury bills and other committeeinvestments valued at cost.LINE 6(b). Enter the total amount ofcash on hand at the beginning of thereporting period.LINE 6(c). Transfer the amounts fromColumn A and Column B of Line 19to the corresponding Columns on Line6(c).LINE 6(d). Add Lines 6(b) and 6(c) toderive the figure for Column A, andTreasurer’s Responsibilitiesadd Lines 6(a) and 6(c) to derive theA copy of this Report must be pre- figure for Column B.served by the treasurer of the politicalcommittee for a period of not less than LINE 7. Transfer the amounts fromthree years from the date of filing. The Column A and Column B of Line 31 totreasurer of the political committee is the corresponding Columns on Line 7.personally responsible for the timely LINE 8. For both Column A and Coland complete filing of the report and umn B subtract Line 7 from Line 6(d)the accuracy of any information con- to derive the figure (which should bethe same for both columns) for cashtained in it.Federal Election Commission (Revised 05/2016)

INSTRUCTIONS FOR FEC FORM 3X AND RELATED SCHEDULESon hand at the close of the reportingperiod of Line 8.LINE 9. Transfer the total amountof debts and obligations owed TOthe committee from Schedule C or D.LINE 10. Transfer the total amountof debts and obligations owed BY thecommittee from Schedule C or D.Multicandidate CommitteeStatusCheck box if the political committee has qualified as a “multicandidatecommittee” and has filed FORM 1M.A committee qualifies as a “multicandidate committee” when it:(i) has been registered with the Commission for at least six months;(ii) has received contributions forfederal elections from more than50 persons; and(iii) (except for any State politicalparty organization) has made contributions to five or more federalcandidates; or satisfies requirements (i)-(iii) by affiliation withanother committee.Federal Election Commission (Revised 05/2016)Page 5

INSTRUCTIONS FOR FEC FORM 3X AND RELATED SCHEDULESINSTRUCTIONS FORDETAILED SUMMARY PAGE(FEC FORM 3X,PAGES 3, 4 AND 5)A political committee must reportthe total amount of receipts anddisbursements during the reportingperiod and during the calendar yearfor each category of receipts anddisbursements on FEC FORM 3X.The committee’s full name and thecoverage dates of the report must beentered in the appropriate blocks. Ifthere are no receipts or disbursementsfor a particular category for a reporting period or calendar year, enter “0”.To derive the “Calendar Year-toDate” figure for each category, thepolitical committee should add the“Calendar Year-to-Date” total fromthe previous report to the “Total ThisPeriod” from Column A for the current report. For the first report filedfor a calendar year, the “CalendarYear-to-Date” figure is equal to the“Total This Period” figure.LINE 11(a)(i). Itemized Contributions from Individuals/Persons OtherThan Political Committees. Enterthe total amount of contributions(other than loans) from individuals,partnerships, and other persons whoare not political committees that arerequired to be itemized on Schedule A.For each such person who has madeone or more contributions during thecalendar year aggregating in excessof 200, the committee must itemizeon Schedule A and provide the identification (full name, mailing address,occupation and name of employer) ofthe person, date and amount of eachcontribution aggregating in excess of 200 and the aggregate year-to-datetotal.LINE 11(a)(ii). Unitemized Contributions from Individuals/Persons OtherThan Political Committees. Enterthe total amount of all contributionsfrom individuals/persons other thanpolitical committees not required tobe itemized on Schedule A.Page 6LINE 11(a)(iii). Total Contributionsfrom Individuals/Persons Other ThanPolitical Committees. Add Lines 11(a)(i) and 11(a)(ii) to derive the figure forColumn A. For the Column B figure,see above instructions on how tocalculate the Calendar Year-to-Datefigure.LINE 11(b). Contributions from Political Party Committees. For politicalcommittees (other than political partycommittees), enter the total amountof contributions (other than loans)from political party committees onLine 11(b). These contributions mustbe itemized on Schedule A, regardlessof the amount. For each contribution, provide the identification (fullname and address) of the committee,date and amount of the contributionand the aggregate year-to-date total.Political party committees should useLine 12.LINE 11(c). Contributions fromOther Political Committees (such asPACs). Enter the total amount ofcontributions (other than loans) fromother political committees on Line11(c). These contributions must beitemized on Schedule A, regardless ofthe amount. For each contribution,provide the identification (full nameand address) of the committee, dateand amount of the contribution andthe aggregate year-to-date total. Donot abbreviate committee names.LINE 11(d). Total Contributions. Forboth Column A and Column B addLines 11(a)(iii), 11(b) and 11(c) toderive the figures for Line 11(d).LINE 12. Transfers from Affiliated/Other Party Committees. Politicalparty committees must enter the totalamount of transfers from other partycommittees on Line 12. All otherpolitical committees must enter thetotal amount of transfers from otheraffiliated committees on Line 12. (Seealso 11 CFR 102.5 and 102.6.) Loansand loan repayments received fromother political party committees oraffiliated committees (as appropriate)must be included on Line 12, and noton Line 13. These transfers must beitemized on Schedule A, regardless ofthe amount. For each transfer providethe identification (full name and mailing address) of the committee, dateand amount of the transfer and theaggregate year-to-date total.LINE 13. All Loans Received. Enterthe total amount of loans received(other than loans from affiliated/other party committees) on Line 13.All loans received by the committeemust be itemized on Schedule A,regardless of the amount. For eachloan, provide the identification (fullname, mailing address and, whereapplicable, occupation and name ofemployer) of the person making theloan, date and amount of the loanand the aggregate year-to-date total.The committee must also provide onSchedule C the identification of anyendorser or guarantor and the amountof the endorsement or guarantee. (Seealso instructions for Schedule C.)LINE 14. Loan Repayments Received. Enter the total amount ofloan repayments received (other thanloan repayments from affiliated/otherparty committees) on Line 14. All loanrepayments received by the committee must be itemized on Schedule A,regardless of the amount. For eachloan repayment, provide the identification of the person making the loanrepayment, date and amount of theloan repayment and the aggregateyear-to-date total.LINE 15. Offsets to Operating Expenditures. Enter the total amountof offsets to operating expenditures(including refunds, rebates, and returns of deposits) on Line 15. Foreach person who provides rebates,refunds and other offsets to operatingexpenditures aggregating in excess of 200 for the calendar year, the committee must provide on Schedule A theidentification of the person, date andamount of each receipt aggregatingin excess of 200 and the aggregateyear-to-date total.Federal Election Commission (Revised 05/2016)

INSTRUCTIONS FOR FEC FORM 3X AND RELATED SCHEDULESLINE 16. Refunds of ContributionsMade to Federal Candidates andOther Political Committees. Enter thetotal amount of refunds of contributions made to federal candidates andother political committees on Line16. If the original check was passedthrough the account of the recipientcommittee and a check for the refundis written on the recipient committee’saccount, the refund must be itemizedas a receipt on Schedule A, regardlessof the amount, and the amount of therefund must be included in the totalfigure for Line 16. For each contribution refund received, provide thefull name and address of the federalcandidate or political committee, dateand amount of the refund and the aggregate year-to-date total. DO NOTuse this Line if the original check isreturned uncashed. The return mustbe reported as a negative entry onSchedule B and subtracted from thetotal amount for Line 23.LINE 18(b). Transfers from LevinFunds. Enter the total of any transfers from Levin funds brought tothe federal account or a separate allocation account in order to pay forallocated federal/Levin “federal election activity.” Only committees withseparate federal and Levin funds whoundertake allocated federal electionactivity should report transfers fromLevin funds or accounts. The totaltransfers for this period come fromthe last page of Schedule H5 whichitemizes any such transfers made forallocated activity.LINE 17. Other Federal Receipts. Enter the total amount of other receipts(including dividends and interest) onLine 17. For each person who provides any dividends, interest or otherreceipts aggregating in excess of 200for the calendar year, the committeemust provide on Schedule A the identification of the person, the date andamount of each receipt aggregatingin excess of 200 and the aggregateyear-to-date totalLINE 20. Total Federal Receipts. ThisLine represents the difference betweentotal receipts reported on Line 19 andthe sum of any transfers into the federal account by nonfederal account(s)for allocated activity or from Levinfunds for allocated federal electionactivity. The value is equal to Line 19minus Line 18(c).LINE 18(a). Transfers from Nonfederal Account for Allocated Activity.Enter the total of any transfers fromnonfederal accounts to the federal account or a separate allocation accountin order to pay for allocated federal/nonfederal activity. Only committeeswith separate federal and nonfederalaccounts who undertake allocatedactivity affecting both types of campaigns may make transfers amongthese accounts. The total transfers forthis period come from the last page ofSchedule H3 which itemizes any suchtransfers made for allocated activity.See the instructions for Schedule H3for more information.Federal Election Commission (Revised 05/2016)LINE 18(c). Total Transfers. For bothColumn A and Column B add Lines18(a) and 18(b) to derive the figuresfor Line 18(c).LINE 19. Total Receipts. For bothColumn A and Column B add thetotals on Lines 11(d), 12, 13, 14, 15,16, 17, and 18(c) to derive the figuresfor Line 19.LINE 21. Note: Line 21(a) is requiredonly for those committees undertakingactivity which is allocated among federal and nonfederal accounts. Committees with no nonfederal accounts,or who do not undertake activitieswhich are allocated among federaland nonfederal accounts completeonly Lines 21(b) and (c). All operating expenses for those purely federalcommittees must be included on Line21(b).Operating Expenditures: Enter thetotal amount of operating expenditures and allocated federal/nonfederalactivity on the appropriate Line under Line 21. Examples of operatingexpenditures are: travel, rent andtelephones. Committees report onlythose operating expenditures paid forfrom committee funds.LINE 21(a). Allocated Federal/Nonfederal Activity. Enter the federalportion of all operating expenses forallocated federal and nonfederal activity on Line 21(a)(i). This is equal to thefederal share value from the bottomof the last page of Schedule H4 forthis period. These allocated activitiesmust be itemized on Schedule H4 regardless of amount. Party committeesmust also include disbursements forallocable exempt activity. Line 21(a)(ii) contains the sum of the nonfederalshare of operating expenses for allocated federal and nonfederal activity.This value also is brought forwardfrom the last page of Schedule H4 forthis period. See the instructions forSchedule H4 for more information.LINE 21(b). Other Federal OperatingExpenditures. Enter on Line 21(b)the sum of all other federal operatingexpenditures, including those itemizedon Schedule B as well as any unitemized federal operating expenditures.Separate segregated funds and nonconnected committees must reportdisbursements for public communications and voter drives that refer tofederal candidates (but not nonfederalcandidates), or refer to federal candidates and a party (but not nonfederalcandidates), on Line 21(b) or Line 23,as appropriate. See the instructions forSchedule B for more information. Foreach person who receives payments forother federal operating expendituresaggregating in excess of 200 for thecalendar year, the committee mustprovide on Schedule B the full nameand mailing address, date and amountof the expenditure.LINE 21(c). Total Operating Expenditures. Enter the total of the amountslisted on Lines 21(a)(i), 21(a)(ii) and21(b).LINE 22. Transfers to Affiliated/Other Party Committees. Politicalparty committees must enter the total amount of transfers to all otherpolitical party committees on Line 22.Page 7

INSTRUCTIONS FOR FEC FORM 3X AND RELATED SCHEDULESAll other political committees mustenter the total amount of transfers toother affiliated committees on Line22. Loans and loan repayments madeto other political party committees oraffiliated committees (as appropriate)must be included on Line 22, not onLine 26 or 27. These transfers must beitemized on Schedule B, regardless ofthe amount. For each transfer, providethe full name and mailing address ofthe recipient committee, date, amountand state that the purpose of the disbursement is a “transfer.”LINE 23. Contributions to FederalCandidates/Committees and OtherPolitical Committees. Enter the totalamount of contributions to federalcandidates and other federally-registered political committees on Line 23,including any in-kind contributionsmade. These contributions must beitemized on Schedule B, regardless ofthe amount. DO NOT include transfers reported on Line 22 on this Line.Do not enter contributions made tononfederal candidates or committeeson this Line, but on Line 29. For eachcontribution to a federal candidateor political committee, provide thefull name and address of the political committee or candidate, date andamount of the contribution and, inthe case of a candidate or authorizedcommittee, the office sought by thecandidate. (Include State and congressional district, where applicable.)LINE 24. Independent Expenditures.Enter the total amount of independent expenditures on Line 24. (Seealso the instructions for Schedule E.)LINE 25. Coordinated Party Expenditures. For political party committees,enter the total amount of coordinated party expenditures made bythe committee pursuant to 52 U.S.C.§ 30116(d) on Line 25. Note: Politicalcommittees which are not politicalparty committees may not make coordinated party expenditures pursuantto the special allowance at 52 U.S.C.§ 30116(d). (See also the instructionsfor Schedule F.)Page 8LINE 26. Loan Repayments Made.Enter the total amount of loan repayments made on Line 26. All loanrepayments made must be itemized onSchedule B, regardless of the amount.For each person who receives a loanrepayment, provide the full name,mailing address, date, amount, andstate that the purpose of the disbursement is a “loan repayment.”LINE 27. Loans Made. Enter thetotal amount of loans made (excluding transfers reported on Line 22) onLine 27. For each loan made by thecommittee provide the full name andmailing address of the person, dateand amount of the loan, and statethat the purpose of the disbursementis a “loan.”LINE 28(a). Refunds of Contributions Made to Individuals/PersonsOther Than Political Committees. Enter the total amount of contributionrefunds to individuals/persons otherthan political committees on Line28(a). For each person who receivesa refund of a contribution whichwas previousl

FEC FORM 8: Debt Settlement Plan Used by terminating committees to disclose the terms of debt settlements. These Forms may be duplicated. To obtain additional forms, call the Information Division at 1-800/424-9530 or 202/694-1100 or visit the FEC's Web site at www.fec.gov.