Transcription

An Overview Guidefor ConsumersDesign yourWhole Life policyA guide to Whole LifeInsurance RidersInsurance Strategies

2 Disability protection with Waiverof Premium4 Increase coverage no questionsasked with the GuaranteedInsurability Rider6 Enhance your policy values withthe Additional Life Insurance Rider8 Balance coverage and costwith the Life InsuranceSupplement Rider10 Grow into Whole Life with theRenewable Term Rider12 Other available riders

When you buy whole lifeinsurance, you’re helping to protectthe financial security of your familyor your business. In addition to thebase coverage, there are additionalbenefits provided by riders that canenhance your policy to provideeven more features and flexibility.Many riders can be added atthe time of purchase to enhanceyour coverage today or in thefuture so that your coverage canadapt to your changing protectionneeds throughout the course ofyour lifetime.1

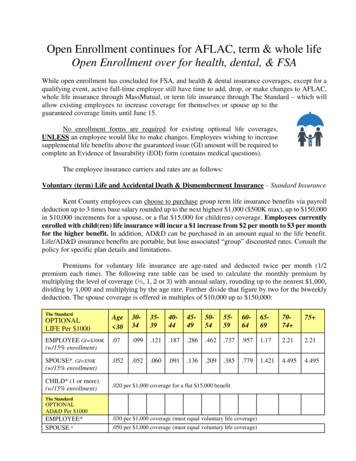

Disability protection withWaiver of PremiumWhat is it?Waiver of Premium provides a layer ofprotection on your whole life policy thatensures your death benefit coverage willstay in place and your cash value willcontinue to grow during a time when youare disabled and may not be able to paythe premiums.Why is it important?You may not be aware, but we are threetimes more likely to suffer a long-termdisability than die during our working years.1Furthermore, some studies indicate that halfof all bankruptcies in the United States areattributable to illness or medical bills.21 The Council of Disability Insurers, The Long TermDisability Claims Review: 2005.2 “Illness and Injury as Contributors to Bankruptcy,”Health Affairs, February 2, 2005.2

The Waiver of Premium rider is a featurethat can be of tremendous value during aperiod of time when your income may bereduced and other expenses begin to take atoll on your savings.How does it work?If the insured becomes totally disabled,the Waiver of Premium Rider will paythe premiums on your whole life policy,along with the premiums due on theLife Insurance Supplement, GuaranteedInsurability and Renewable Term Riders.The annual cost for Waiver of Premium willdepend on the insured’s health and age atpolicy issue, but will never increase. Waiverof Premium can stay in effect on yourpolicy until age 65, or ten years, if later.3

Increase coverageno questions asked with theGuaranteed Insurability RiderWhat is it?The Guaranteed Insurability Rider (GIR)guarantees you the right to purchaseadditional insurance, without proof of goodhealth, at specified dates in the future. Theadditional insurance can be an increase tothe face amount on your existing whole lifepolicy, or the purchase of a new whole life,universal life or variable universal lifepolicy that is available for sale when youexercise an option.Why is it important?GIR is an excellent way to lock ininsurability if you anticipate needing morecoverage in the future. This can bebeneficial on policies for juveniles or youngadults who may want their policy to growwith them throughout their lifetime.4

It can also be an advantage on businessowned policies. Adding the GIR optionallows business owners to increase their lifeinsurance coverage as the value of theirbusiness increases, particularly for businesssuccession plans.How does it work?On the Option Dates, you may purchasespecific additional amounts of insurance.The Option Dates occur every three yearsbetween the insured’s ages 25 and 46. Youcan also accelerate an available option dateafter marriage or the birth or legal adoptionof a child.5

Enhance your policy valueswith the Additional LifeInsurance RiderWhat is it?The Additional Life Insurance Rider(ALIR) allows you to make payments inaddition to your base premiums to increaseyour policy’s death benefit and accelerateits cash value growth.Why is it important?ALIR allows you to purchase more coverageand achieve greater policy growth based onyour need for more coverage over time. Youcan use non-regular sources of income, suchas annual bonuses or tax refunds, to boostyour cash values and death benefit coverage.The payments made with ALIR can bescheduled or unscheduled and in manyinstances can be made without showingevidence of good health. The additionalcash values can be used for any purpose youchoose, including to pay policy premiums.3How does it work?ALIR allows you to purchase what is calledpaid-up additional insurance. “Paid up”6

means that no further premiums arerequired on the additional life insurancecoverage purchased. ALIR payments maybe increased, decreased or skipped andcaught up within limits (may be subject tounderwriting). This gives you the flexibilityto fund the rider on your terms.ALIR’s cash value can be surrenderedat any time for any purpose. ALIR alsoearns its own dividend, which can makeeven more cash value available as aliving benefit.3A 7.5 percent service charge will bededucted from each ALIR payment made.3 Distributions under your policy (including cashdividends, withdrawals and partial/full surrenders)are not subject to taxation up to the amount paidinto the policy (your cost basis). If the policy is aModified Endowment Contract, policy loans and/ordistributions are taxable to the extent of gain andare subject to a 10% tax penalty. Access to cashvalues through borrowing, withdrawals or partialsurrenders can reduce the policy’s cash value anddeath benefit, increase the chance the policy willlapse, and may result in a tax liability if the policyterminates before the death of the insured.7

Balance coverageand cost with the LifeInsurance Supplement RiderWhat is it?The Life Insurance Supplement Rider(LISR) is ideal for those looking tomaximize the death benefit purchasedwith their premium dollars and who don’trequire the supplemental death benefitto be guaranteed.Why is it important?With LISR, you can select your coverage topay the premium you choose, in effectswapping guarantees for greater premiumflexibility and lower cost. LISRaccomplishes this by blending lower costterm insurance with whole life insurance.8

How does it work?You pick a target death benefit amount,which is paid with out-of-pocket premiumsand non-guaranteed dividends. Initially,your policy is a combination of permanentand term insurance. Each year, as the basepolicy earns dividends and you make LISRpremium payments, the permanentinsurance within LISR builds and its terminsurance portion reduces until, at a futurepoint, the LISR becomes all permanentinsurance.The timing of when the policy becomes allpermanent insurance is a function of theamount of non-guaranteed dividends paideach year.An 8 percent service charge will bededucted from each LISR purchasepayment made.9

Grow into Whole Life with theRenewable Term RiderWhat is it?The Renewable Term Rider (RTR) isdesigned to help provide the amount ofdeath benefit protection you’re looking forat a more affordable cost. RTR allows youto own a policy with a significantly higherdeath benefit than a single whole life policywith a comparable premium.Why is it important?RTR allows you to grow into your wholelife coverage as your budget permits. RTRis pure term insurance. Unlike LISR, whichbuilds permanent coverage automatically,RTR is converted to whole life based onyour needs over time.10

How does it work?RTR can be converted after the first policyyear until the insured is age 65 or within thefirst 10 policy years, whichever is later. Ifyou decide at any time that you no longerneed the additional coverage that RTRprovides, it can be dropped from yourpolicy.11

Other available riders Accelerated Death Benefit Rider(ABR): Allows you to receivean advance of the policy death benefitif the insured has a terminal illnessthat is expected to result in deathwithin 12 months. The proceeds maybe used for any purpose, but often canbe used to pay medical and livingexpenses. Transfer of Insured Rider (TIR):Allows you to transfer or exchangethe original policy for a new policyon the life of another person. Thisrider is especially useful for businessowners who insure the lives of theirkey employees. If that employeeleaves your company, you can havethe policy now insure a new keyemployee (subject to underwriting).12

Some of the riders in this guide havepremium charges, and others haveadministrative fees that are assessed only ifthose riders are exercised. There are certainrestrictions and limitations associated withthese riders. Contact your financialprofessional for complete information aboutthese valuable supplemental benefits.13

Life insurance products are issued by Massachusetts MutualLife Insurance Company, 1295 State Street, Springfield, MA01111-0001. 2008 Massachusetts Mutual Life Insurance Company, Springfield, MA.All rights reserved. www.massmutual.com. MassMutual Financial Group isa marketing name for Massachusetts Mutual Life Insurance Company(MassMutual) and its affiliated companies and sales representatives.LI1712CRN201008-106370

the premiums on your whole life policy, along with the premiums due on the Life Insurance Supplement, Guaranteed Insurability and RenewableTerm Riders. The annual cost forWaiver of Premium will depend on the insured's health and age at policy issue, but will never increase.Waiver of Premium can stay in effect on your