Transcription

Supports for farmersIf.de ;.C1t1zensn ormat1on Boarinformation. advice. advocacy

Contents How to use this booklet4Introduction5Farming grants and schemesSocial welfare supports13. 19Employing agricultural workersTaxation for farmers21Pensions and farm partnerships25The Nursing Homes Support Scheme30Education and training33Supports for rural businesses and farm diversificationWellbeing supportsFurther information 735. 38. 39This leaflet is published by Teagasc and the CitizensInformation Board.Teagasc – the Agriculture and FoodDevelopment Authority – is the nationalbody providing integrated research, advisoryand training services to the agriculture andfood industry and rural communities.Olli nsIn ormatioll'!o,rdThe Citizens Information Board providesindependent information advice andadvocacy on public and social servicesthrough citizensinformation.ie, theCitizens Information Phone Service and thenetwork of Citizens Information Services.It is responsible for the Money Advice andBudgeting Service and provides advocacyservices for people with disabilities.Published September 20183

How to use this bookletThis booklet provides an overview of entitlements for farmers,so that you can get to know the range of services and supportsthat are available.When you see text printed in bold inthis leaflet, you can go to theonline guide to find out more:citizensinformation.ie/guidesYou can also get information about supports for farmers fromthe network of Citizens Information Centres and from thenational Citizens Information Phone Service on 0761 07 4000.The objective of this publication is to provide up-to-dateinformation to help improve the situation of farmers in ruralIreland. It is intended to provide up-to-date information tohelp improve the situation of farmers and people involvedin providing services to the farming community and is basedon our understanding of current regulation and practice. Theinformation in this guide is intended as a general guide onlyand is not a legal interpretation.4

IntroductionMembers of the farming community know that they can depend onCitizens Information to provide information and advice on a broadrange of public and social services. Teagasc is pleased to partner withCitizens Information in providing information on public services andentitlements. Working together represents the best approach for thefuture.Farming has been challenging recently and the fallout from lowcommodity prices and extreme weather events has taken its toll. Notonly have business and household bank balances been hit but theseevents have also put a huge strain on relationships as well as people’sphysical and mental health.Teagasc is aware of the problems, and is working hard trying tosupport families who are under extreme pressure and no longercoping well. But challenges can bring opportunity and farm businessesshould take a fresh look at diversification opportunities because thereis still room for alternative options, particularly in agri-tourism.The Irish Government and EU supports, through the CommonAgricultural Policy, provide a number of measures to assist farmfamilies, farm businesses and rural communities to prepare for, andget through difficult times. This publication brings together practicalinformation on a broad range of supports and presents them in adirect accessible manner.Great care has been taken to ensure that all the information in thisbooklet is correct and presented in a form that is practical and usefulat the time of publication. The aim is to provide you with introductoryinformation and to guide you towards more detailed sources if youwish to learn more.Access to good quality and trustworthy information can make all thedifference when making decisions and considering options. I hope youfind this booklet helpful.Professor Gerry BoyleDirector of Teagasc5

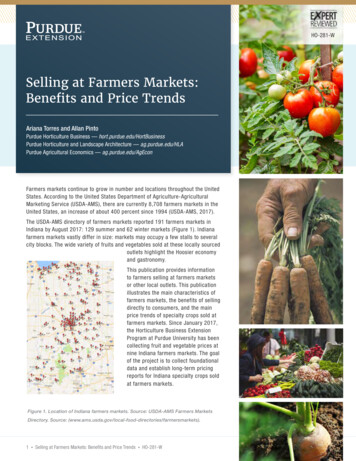

Introduction (cont.)We are delighted to partner with Teagasc on this publicationSupports for farmers. In 2016, there were 137,500 farms in Ireland(CSO 2016). Almost all of these (137,100) were family farms andnearly 12% were owned by women. However, just over half offarmers (53%) view farming as a sole occupation – showing thatmany farmers cannot rely on income from farming to supportthemselves and their families. Many work off-farm, someneed social welfare income support and some are looking foropportunities to diversify into other areas to supplement theirincome.Teagasc understands farmers’ issues and provides a huge rangeof supports and training to agricultural and rural communities.Citizens Information, with offices all over Ireland, serves ruralcommunities in almost 300 locations around Ireland and we knowthe questions that farm families have. They have asked and ourservices have answered - questions about social welfare supportsfor farmers, pensions for farming families (in 30% of farms thefarmer was aged 65 or more) and taxation of farm income.This booklet signposts the entitlements and supports availablefor farming families including direct payments, Farm Assist andthe Rural Social Scheme. If you have questions about any ofthe information in this booklet, you can find out more online atcitizensinformation.ie, by dropping into the network of CitizensInformation Centres around Ireland or by calling the CitizensInformation Phone Service on 0761 07 4000. MABS, the MoneyAdvice and Budgeting Service can help if you have questionsabout managing your finances.With best wishesAngela BlackCEO, Citizens Information Board6

Farming grants and schemes7

Farming grants and schemesFarmers can apply for a number of farm schemes and directpayments, funded through the EU Common AgriculturalPolicy (CAP) funding and national exchequer funding. TheCAP is a common policy for EU countries that aims to protectthe viable production of food, manage natural resourcessustainably and support rural viability. It provides directpayments to stabilise farm revenues and finances ruraldevelopment programmes. The CAP consists of two pillars.CAP – Pillar I schemesPillar I includes direct annual payments to farmers to helpstabilise farm revenues (in the face of volatile market prices andweather conditions) and market measures (to tackle specificmarket situations and to support trade promotion).Direct paymentsUnder the Direct Payment system, a farmer’s payment can be acombination of payments under four separate schemes. Basic Payment Scheme Greening Payment Young Farmer Scheme Protein Aid SchemeBasic Payment SchemeThe Basic Payment Scheme (BPS) is the main EU support forfarmers (it replaced the Single Payment System in 2015). Youmust apply for your Basic Payment online each year, usually by15 May.You must apply online at the Department of Agriculture andFood website, agfood.ie8

Services available on Agfood.ieFarmers registered on Agfood.ie can use the followingsupports: Complete your Basic Payment Scheme application Edit maps relating to your land parcels Upload correspondence TAMS application Organic Farming Scheme Cattle herd register facility Online movement notification Calf birth registration facility Forestry services Financial self-services Nitrogen and Phosphorous statementsFor registration and more information, see agfood.ieor call 0761 064424. The Department also provides clinics tohelp farmers with their applications before the deadline date.Greening PaymentIf you are eligible for the BPS, you will also get a GreeningPayment (which is approximately 44% of the total value ofentitlements). You must implement three environmentallyfriendly farming practices: crop diversification, maintainingpermanent grassland and conserving areas of ecologicalinterest. Your greening obligations apply to all hectares onyour farm and not just the eligible hectares. Payment is madewith your BPS.National Reserve and Young Farmers SchemeIf you are a ‘young farmer’ you can get an extra payment withyour BPS. To qualify as a ‘young farmer’ you must be: Participating in the Basic Payment Scheme in the year thatyou apply Aged 40 or under during that calendar year9

Setting up an agricultural holding for the first time, or haveset up such a holding during the 5 years before your firstBPS applicationFor further information see agriculture.gov.ieProtein Aid SchemeYou can get a payment for growing protein crops or nitrogenfixing crops (beans, peas and lupins). The maximum rate ofaid payable is 250 per hectare (although this can be reducedon a pro-rata basis if the amount of aid claimed is more thanthe ceiling of 3 million in a year). Payment is made from 1December each year.For further information see agriculture.gov.ieCAP – Pillar II SchemesThe second pillar of the CAP budget is financed under theEuropean Agricultural Fund for Rural Development (EAFRD).The EAFRD aims to develop rural economies across the EUin a balanced way and to sustain a farming sector that isenvironmentally sound as well as competitive and innovative.Areas of Natural Constraint SchemeIf you farm land in a disadvantaged area, you could be eligiblefor the Areas of Natural Constraint Scheme (ANC). ANCsare divided into: mountain areas, severely handicapped areas,and less severely handicapped areas. The Scheme providespayments on a per-hectare basis for people farming theseareas. You can get more information from agriculture.gov.ieTargeted Agricultural Modernisation SchemeYou can get grant aid from the Targeted Agricultural10

Modernisation Scheme (TAMS) for certain on-farm capitalinvestments. The Scheme offers grant aid of 40% towardsthe cost of certain investments (and offers 60% for youngfarmers).Seven TAMS schemes are currently in operation: Young Farmers’ Capital Investment Scheme Dairy Equipment Scheme Low Emission Slurry Spreading Scheme Animal Welfare, Safety and Nutrient Storage Scheme Pig & Poultry Investment Scheme Organic Capital Investment Scheme Tillage Capital Investment SchemeYou can apply online for TAMS on agriculture.gov.ieCollaborative Farming Grant SchemeThe Collaborative Farming Grant Scheme provides a grantto cover part of the legal, advisory and financial servicescosts incurred in the drawing-up of partnership agreementsbetween farmers.The main collaborative arrangements being encouraged inIreland are: Registered Farm Partnerships Share Farming (mainly suitable for the Crops sector) Contract Rearing of Replacement HeifersYou can find out more on teagasc.ieForestry supportsThe Forestry programme 2014-2020 has been recentlyrevised to improve the uptake of forestry into Irish farmingsystems. There are various grants and premium categories.11

For more information on forestry supports, visit forestry atteagasc.ie.TB compensation schemeIf you cannot sell your animals due to a TB breakout, youmay be entitled to compensation from the Department ofAgriculture, Food and the Marine. The following supports areavailable: Income supplement – paid when more than 10% of thecow herd is removed and where depopulation isnot appropriate Hardship grant – paid between 1 November and 30April towards fodder when you have to feed animals whosemovement has been restrictedClosed schemesSeveral schemes are no longer open to new applicants: theGreen Low-Carbon Agri-Environment Scheme (GLAS), theBeef Data and Genomics Programme, the Organic FarmingScheme and the Knowledge Transfer Scheme. You can getinformation about these schemes on agriculture.gov.ie12

Social welfare supports18 - 6613

Social welfare supportsFarm AssistFarm Assist is a means-tested social welfare payment forfarmers aged between 18 and 66. It is paid by the Departmentof Employment Affairs and Social Protection (DEASP). Toqualify, you must satisfy a means test. You do not need to beavailable for work to qualify.To qualify for Farm Assist, you must show that your means arebelow a certain level. Your means include: Any income you and your spouse/partner have (includingincome from farming, other forms of self-employment andfrom schemes) Property which you and your spouse/partner have (exceptyour home) Other assets which could provide you with an incomeDifferent assessment rules apply to different types of income.For farm income, 70% is assessed but there is an annualdisregard of 254 for the first two dependent children and 381 for the third and other children. (The disregards for yourchildren are applied first and 70% of the balance is assessed.)When you apply for Farm Assist, a social welfare officer will visityou to carry out the means test.Your means from all sources are added together to get atotal assessed weekly means. You will be paid the differencebetween your total weekly means and the maximum rate ofFarm Assist that you could get if you had no means (includingincreases for adult and child dependants).You can apply by filling out the form Farm 1, which you candownload on welfare.ie or pick up at your local Intreo Centreor Social Welfare Branch Office. You return this form to yourlocal Intreo Centre or Social Welfare Branch Office.14

Who is defined as a farmer?The definition of a farmer can be different for social welfarepayments, VAT, tax and EU payments – so you should alwayscheck the definitions before assuming you are eligible.For Farm Assist, you are considered a farmer if you farmland that you own or lease and that you use for the purposeof husbandry. Husbandry means working the land with theobjective of taking produce from the land.To show that you are a farmer for the Rural Social Scheme,you must provide confirmation of your application for theBasic Payment Scheme for the current year, including a validherd number.Online calculator for Farm AssistThe IFA have an online calculator to help youwork out whether you are eligible for Farm Assist.You can access the calculator on ifa.ie.,. Other benefitsIf you are getting Farm Assist, you may be entitled to: Fuel Allowance – a payment to help with the cost ofheating your home during the winter A medical card – many farmers qualify for medical cardseven if they are not getting a social welfare payment (applyto your HSE Local Health Office or apply online atmedicalcard.ie) Back to School Clothing and Footwear Allowance Rent Supplement or the Housing Assistance Payment(HAP) The Rural Social Scheme and Community EmploymentProgrammes15

Jobseeker’s Benefit and Jobseeker’s AllowanceIf you have been employed, but are now out of work, you maybe eligible for Jobseeker’s Benefit if you have paid enough PRSIcontributions. If you are entitled to both Jobseeker’s Benefitand Farm Assist, you can choose the more favourable payment.There are differences in the extra benefits available with thetwo payments. Jobseeker’s Benefit is taxable and Farm Assist isnot. If you are receiving Jobseeker’s Benefit, you must also beavailable for and actively seeking work.You may be eligible for Jobseeker’s Allowance if you do notqualify for Jobseeker’s Benefit and if you pass the means test.Again, you must be actively seeking work. If you are eligible forboth Jobseeker’s Allowance and Farm Assist, you may choosewhichever suits you better – and for most farmers, Farm Assistis more favourable.Rural Social SchemeThe Rural Social Scheme is aimed at low-income farmersand fishermen/women. In the Scheme, you get a ‘top-up’payment in addition to your social welfare payment in returnfor providing services to the community.Work under the Scheme could include maintaining walkingroutes and bog roads, social care and care of older people,community care for pre-school and after-school groups,caretaking of community and sporting facilities, or communityadministration work.You work 19.5 hours per week. These hours are based on afarmer-friendly schedule so participation on the Scheme doesnot affect your farming activities.16

To qualify for the Rural Social Scheme, you must either begetting Farm Assist or be actively farming and getting anothersocial welfare payment, such as Jobseeker’s Allowance orDisability Benefit. To prove you are actively farming, youmust provide confirmation of your application for the BasicPayments Scheme for the current year and a valid herdnumber.To apply for the Rural Social Scheme, you should contact yourlocal RSS implementing body for an application form.You can find more information about the Rural Social Schemeon citizensinformation.ie and in the Department ofEmployment Affairs and Social Protection’s Guide to the RuralSocial SchemeTúsTús is a community work placement scheme that works in asimilar way to the Rural Social scheme, but you do not haveto be farming or fishing to qualify. You do work that benefitsthe community in return for a top-up to your regular socialwelfare payment.There is no application process. If you are eligible to take part,you will be selected and contacted by your Intreo Centre orlocal Social Welfare Branch Office.17

Getting sickIf you get sick, you may be able to apply for a social welfarepayment from the DEASP to help support you and yourdependants. To qualify for a social welfare payment becauseyou are sick or have a disability, you must be certified as sick ordisabled by a doctor.You may get Illness Benefit if you cannot work becauseyou are sick or ill. You must be aged under 66 and satisfy thePRSI conditions. If you are self-employed and pay Class S PRSIcontributions, you do not qualify for Illness Benefit.You may get Invalidity Pension if you cannot work becauseof a long-term illness or disability and are covered by socialinsurance (PRSI). Since 2017, self-employed people who havepaid sufficient class S PRSI contributions can get InvalidityPension.You may get Disability Allowance if you become disabled.The disablement is expected to last at least one year andsubstantially restricts you from working. Disability Allowance isa means-tested payment.If you become sick and do not qualify for any payment youmay be eligible for Supplementary Welfare Allowance. Thisis a weekly allowance paid to people who do not have enoughincome to meet their basic needs and those of their families.18

Employing agricultural workers19

Employing agricultural workersIf you are employing people to work on the farm, you mustensure that they are paid the statutory minimum wage rateand that you are aware of your employees’ basic employmentrights (such as a written statement of terms and conditionsof employment, breaks, rest periods, annual leave and noticeperiod).You must keep records (of wages paid, working hours and otherinformation) and you must retain these records for 3 years. Ifyou need advice and support on any employment matters, youshould contact the Workplace Relations Commission.Before you hire anyone, you need to be clear on why you areemploying them to assist you to operate your farm business.You need to be sure that your business needs additional labourand that the business can afford to pay for this labour. Teagaschave produced a guide that gives advice on the hiring process:Teagasc Farm Labour Manual – Best Practice in Recruitingand Managing Employees.Employment permits for foreign workersSince 21 May 2018, new regulations allow for a GeneralEmployment Permit for horticulture workers, meatprocessing operatives and dairy-farm assistants. Permitsavailable are subject to quotas. Certain criteria must bemet (annual salary at least 22,000 based on 39-hourweek, labour market test carried out, and access to suitableaccommodation and training provided). You can get moreinformation on the application process from theDepartment of Business, Enterprise and Innovation at dbei.ie20

Taxation for farmers21

Taxation for farmersYou are taxed on the profits you make from your farm businessand on any other income you have. Farm profit is the incomeyou earn from farming less your allowable farming expenses.You are responsible for keeping records and for assessing thetax due each year.Universal Social ChargeThe Universal Social Charge is a tax you must pay if yourgross income (your income before tax) is over a certain amountper year. Farm-related capital allowances are deductible.You can find out more about the current rates of USC andexempted income on citizensinformation.ie.PRSI for farmersIf you are a self-employed farmer, you pay Class S PRSI. Whenyou pay PRSI, you build up entitlements to social insurancebenefits.Class S contributions only cover you for a limited number ofpayments. In general, they do not cover you for any short-termpayments including illness and disability payments. They donot cover you for Jobseeker’s Benefit. If you satisfy all the otherconditions, Class S contributions can entitle you to: Maternity Benefit Adoptive Benefit Paternity Benefit Widow’s, Widower’s or Surviving Civil Partner’s(Contributory) Pension State Pension (Contributory) Treatment Benefit Scheme Invalidity PensionWhen you take up self-employment, you should informRevenue that you are now self-employed and you wish to22

register for self-assessment. You can register online withRevenue as self-employed. When you register for selfassessment with Revenue, you will automatically becomeregistered for PRSI purposes. When you submit your annualreturns, Revenue will let you know if you have to pay PRSI. Ifyou do not have to pay PRSI, you may be able to pay voluntarycontributions to maintain your social insurance record.You can read more about the current rules and rates for Class SPRSI on citizensinformation.ie or in the DEASP’s leaflet, PRSIfor the Self-Employed.If you are unclear on whether or not you or your spouse areliable to pay PRSI, you should contact the Scope section ofthe DEASP.Tax reliefs and allowancesThere are many farmer-specific tax reliefs and allowanceswhich may help to reduce the amount of tax you pay.Income from long-term leasingIf you lease land on a long-term lease, the income you get fromthis may be exempt from tax up to certain thresholds. Leasesbetween close relatives do not qualify and a lease of farm landmust be in writing and for a definite term of 5 years or more.For more information, see revenue.ieThe Succession Farm Partnership SchemeThe Succession Farm Partnership Scheme provides a taxincentive where you and your successor enter an approvedpartnership which culminates in the transfer of at least 80%23

of the farm assets to the successor. For more information, seeteagasc.ieCapital Acquisitions Tax Agricultural reliefAgricultural property that is given as a gift or inherited canhave its market value reduced by 90% for tax calculationpurposes. The person receiving the property must either be anactive farmer or someone who is leasing out the property on along-term basis for agricultural use to active farmers.Forestry tax exemptionIncome, including grants and premiums, from commercialforestry is exempt from income tax but not from PRSI orUniversal Social Charge. The IFA have produced a useful factsheet on profits from the occupation of woodlands.Further informationThe Department of Agriculture, Food and the Marine havepublished a Schemes and Services booklet which lists themain reliefs. You can also get more information from theRevenue Commissioners at revenue.ie24

Pensions and farm partnerships25

Pensions and farm partnershipsIf you have paid Class S PRSI contributions for most of yourworking life, you will probably be eligible for a State Pension(Contributory) when you reach 66. If you have not made enoughPRSI contributions, you can apply for a State Pension (NonContributory), which is means-tested.You may also be entitled to Free Travel and to the HouseholdBenefits Package.You can claim for your spouse or partner as a qualified adult onyour pension. Any income they have will be taken into account.Your spouse or partner may qualify for a non means-testedcontributory State Pension in their own right, if they have paidenough PRSI contributions. Relatives of self-employed peoplewho help out in the running of the business, but who are notactive business partners, do not pay PRSI. These people are calledprescribed relatives. They include spouses and civil partners.In general, your spouse pays PRSI in three scenarios:1. They are actively engaged in a commercial partnership. Thismeans that they are treated as an individual self-employedcontributor and are liable for social insurance contributions. Thesecontributions (at Class S PRSI) allow them to build up an insurancerecord in their own right and to receive related benefits. The mainbenefit is a State Pension (Contributory).2. If a family business is incorporated as a limited company, thenspouses or other relatives involved in the business can establisha social insurance record as either employees or as self-employedcontributors.263. Farming spouses can build up a social insurance record on thebasis of their off-farm earnings. Also, farming spouses who werepreviously employed can maintain their social insurance coveragein the long-term by paying voluntary PRSI contributions.

Social welfare cover for spouses and civil partnersEmployment arrangementSocial welfare cover forspouse or civil partnerYou are a sole trader andemploy your spouse or civilpartnerNoneYou are self-employed andyour spouse or civil partnerassists you, but is not apartner in the businessNoneYour spouse or civil partnerworks as an employee for apartnership in which you area partnerThey will be covered underClass A PRSI. This is becausetheir employment relationshipis with the partnership as abusinessYour spouse or civil partnerprovides a service as aself-employed person to apartnership in which you area partnerThey will be covered underClass S PRSI. This is becausethey are self-employedYour spouse or civil partnerworks as an employee for alimited company in which youare a shareholderThey will be covered underClass A PRSI. This is becausetheir employment relationshipis with the limited companyYour spouse or civil partnerprovides a service as a selfemployed person to a limitedcompany in which you are ashareholderThey will be covered underClass S PRSI. This is becausetheir relationship is withthe limited company as abusiness.27

What is a partnership?A partnership is the relationship that exists between peoplecarrying on a business in common with a view to making aprofit. For your spouse or partner to be considered an activepartner in your farming business, they must meet certaincriteria. The fact that you and your spouse or partner co-own afarm does not in itself create a partnership.When you work with your spouse or partner in a businesspartnership, you must make tax returns under the Revenueself-assessment system (for self-employed people). These taxreturns must show the partnership income of each person sothat PRSI contributions can be calculated accurately. Teagaschave published Guidelines on forming a farm partnership.When deciding whether a partnership exists, or has existed inthe past, the Department of Employment Affairs and SocialProtection (DEASP) and the Revenue Commissioners examineyour situation to see if some or all of the following apply: There is a written partnership agreement (although this isnot legally required)Each of you writes cheques on the business accounts inyour own rightThere is a joint business accountIt is apparent to those doing business with the partnershipthat a partnership existsEach partner makes a significant contribution to therunning of the businessThe business is owned jointly by the partnershipThe profits and losses of the partnership are shared by eachpartnerIf some or all of these do exist, then the arrangement is likely tobe regarded as a partnership.28

Claiming partnership status retrospectivelyIf you and your spouse were farming in a partnership but didnot claim to be in a partnership when you were making tax andPRSI returns, you can claim partnership status retrospectively.Each case is investigated by the DEASP under the spouses’partnership criteria. If you wish to claim partnershipretrospectively, you must have supporting documentation forthe relevant years.If a social welfare inspector from the DEASP decides that apartnership existed your spouse can pay Class S contributionsretrospectively. The contributions due are worked out bysplitting the income from the partnership (for each year thepartnership existed) between you and your spouse. ThePRSI liabilities are then recalculated. Any additional PRSIcontributions due can then be collected from your spouse.If the deciding officer decides that a partnership did not exist,you may appeal the decision to the Social Welfare AppealsOffice. It is important to remember that even if a partnershipexisted and your spouse pays any outstanding social insurancecontributions, this does not entitle them to a pension at age 66unless they meet all the other criteria.You should check the full eligibility conditions for benefits andpensions before deciding whether to apply for retrospectivepartnership status. Your local Citizens Information Centre canhelp you work out whether you may qualify for a pension.29

The Nursing HomesSupport Scheme30

The Nursing Homes Support SchemeThe Nursing Homes Support Scheme – also known as the‘Fair Deal Scheme’ – provides financial support to people whoare ordinarily resident in the State and need long-termnursing home care.Under this Scheme, you make a contribution towards the costof your care and the State pays the balance. The Scheme coversapproved private nursing homes, voluntary nursing homes andpublic nursing homes. You can get the list of approved nursinghomes from the HSE.When you apply for the Scheme, your care needs are assessedto confirm that long-term nursing home care is the mostappropriate option for you. Your financial situation is alsoassessed to see how much you will have to contribute towardsyour nursing home fees. If your contribution is less than theamount of the fees, the HSE pays the rest.Assets, such as saving

citizensinformation.ie/guides . You can also get information about supports for farmers from the network of Citizens Information Centres and from the national Citizens Information Phone Service on 0761 07 4000. The objective of this publication is to provide up-to-date information to help improve the situation of farmers in rural Ireland. It is .