Transcription

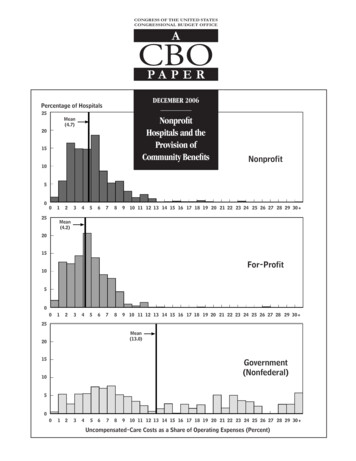

CONGRESS OF THE UNITED STATESCONGRESSIONAL BUDGET OFFICEACBOPAPERDECEMBER 2006Percentage of Hospitals25NonprofitHospitals and theProvision ofCommunity BenefitsMean(4.7)201510Nonprofit5002512345678910 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Mean(4.2)2015For-Profit10500123456789 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 8910 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Uncompensated-Care Costs as a Share of Operating Expenses (Percent)

Pub. No. 2707

ACBOPA P ERNonprofit Hospitals and theProvision of Community BenefitsDecember 2006The Congress of the United States O Congressional Budget Office

NoteThe histogram on the cover was developed by the Congressional Budget Office based onthe Medicare Hospital Cost Report, 2003, and on data from the Government AccountabilityOffice on uncompensated care. The bar height indicates the share of hospitals, in percent.The distributions are weighted by operating expenses and truncated at 30 percent. Thesolid vertical lines represent the weighted average uncompensated-care share for eachownership type.

PrefaceNonprofit hospitals receive various tax exemptions from federal, state, and local governments with the expectation that, in return, they will provide benefits to the community.In this paper, requested by the Chairman of the House Committee on Ways and Means,the Congressional Budget Office (CBO) examines several measures of community benefitsprovided by hospitals of different ownership types. Nonprofit hospitals are compared withfor-profit hospitals, which do not receive tax exemptions. The analysis focuses primarilyon differences in the provision of uncompensated care but also examines the provision ofMedicaid-covered services and the provision of certain specialized services, such as emergencyroom care. In keeping with CBO’s mandate to provide objective, nonpartisan analysis, thepaper makes no policy recommendations.Chapin White, Robert Nguyen, and Alshadye Yemane of CBO’s Health and HumanResources division prepared the report under the supervision of James Baumgardner andBruce Vavrichek. The report benefited from comments by Thomas Bradley, DouglasHamilton, and Dennis Zimmerman, all of CBO. Several outside reviewers also providedcomments, including Richard Frank of Harvard University and William Gentry of WilliamsCollege. (The assistance of external reviewers implies no responsibility for the final product,which rests solely with CBO.)Loretta Lettner edited the report, and John Skeen proofread it. Maureen Costantino designedthe cover and prepared the report for publication. Lenny Skutnik produced the printedcopies, and Simone Thomas prepared the electronic version for CBO’s Web site(www.cbo.gov).Donald B. MarronActing DirectorDecember 2006

ContentsIntroduction and Summary1Provision of Uncompensated Care1Provision of Medicaid-Covered Services2Provision of Specialized Services3The Value of Tax Exemptions for Nonprofit Hospitals3Background3Differences in Ownership Structure4Differences in Tax Treatment4The Value of Tax Exemptions for Nonprofit Hospitals5Approaches to Providing Collective Goods6Defining Community Benefits7Previous Research on Differences Between For-Profit andNonprofit Hospitals8Study Data and Methods9Measures of Community Benefits9Data Sources10Methods of Analysis11Characteristics of Hospitals12Differences in the Provision of Uncompensated Care14Effect of Location on Adjusted Differences15Differences by State17Distribution of Hospitals’ Uncompensated-Care Shares17Differences in the Provision of Medicaid-Covered Services17Differences in the Provision of Specialized Services20Limitations of the Analysis21Appendix: Detailed Results from Regression Models ofUncompensated-Care Shares23

VINONPROFIT HOSPITALS AND THE PROVISION OF COMMUNITY BENEFITSTables1.Estimated Value of Tax Exemptions Provided toNonprofit Hospitals, 200252.Hospital Ownership Types, by Region123.Characteristics of Hospitals, by Ownership Type134.Uncompensated-Care Shares, by Hospital OwnershipType and State15Economic Characteristics of Hospitals’ Communities, byHospital Ownership Type and State166.Medicaid Shares, by Hospital Ownership Type197.Share of Hospitals That Provide Specialized PatientServices, by Hospital Ownership Type20Uncompensated-Care Shares (Ordinary least squaresregression models)24Distribution of Hospitals, by Uncompensated-CareShare and by Ownership Type185.A-1.Figure1.

Nonprofit Hospitals and theProvision of Community BenefitsIntroduction and SummaryThe various tax exemptions provided to nonprofit hospitals have come under scrutiny by policymakers, with thecentral concern being whether those hospitals providecommunity benefits that justify forgone government taxrevenues. In this paper, the Congressional Budget Office(CBO) measures the provision of certain communitybenefits and compares nonprofit hospitals with for-profithospitals. For-profit hospitals do not receive tax exemptions and are not required to meet community-benefitstandards; the level of community benefits providedby for-profit hospitals serves, therefore, as a useful benchmark against which to compare nonprofit hospitals.The analysis also examines the provision of communitybenefits by nonfederal government hospitals.1Although nonprofit hospitals must provide communitybenefits in order to receive tax exemptions, there is littleconsensus on what constitutes a community benefit orhow to measure such benefits. For the purposes of this1. Hospitals are identified as nonprofit, for-profit, or governmentalon the basis of classifications reported by hospitals in the “controltype” variable in the Medicare Hospital Cost Report. According tothe control type variable, “nonprofit” refers to voluntary nonprofit(with or without church affiliation); “for-profit” refers to proprietary hospitals owned by individuals, corporations, partnerships,or other entities; and “government” refers to state, county, citycounty, city, hospital-district, or other governmental entities (federal hospitals were excluded from the analysis).analysis, community benefits include the provision ofuncompensated care, the provision of services to Medicaid patients, and the provision of certain specialized services that have been identified as generally unprofitable.Those services were selected because they benefit thecommunity but are not typically considered financiallyrewarding.In general, the comparisons of nonprofit and for-profithospitals yielded mixed results. CBO found that, onaverage, nonprofit hospitals provided higher levels ofuncompensated care than did otherwise similar for-profithospitals. Among individual hospitals, however, theprovision of uncompensated care varied widely, and thedistributions for nonprofit and for-profit hospitals largelyoverlapped. Nonprofit hospitals were more likely thanotherwise similar for-profit hospitals to provide certainspecialized services but were found to provide care tofewer Medicaid-covered patients as a share of their totalpatient population. On average, nonprofit hospitals werefound to operate in areas with higher average incomes,lower poverty rates, and lower rates of uninsurance thanfor-profit hospitals.Provision of Uncompensated CareThe level of uncompensated care provided by communityhospitals is examined here for hospitals located in fivestates—California, Florida, Georgia, Indiana, andTexas—using data from 2003 (the latest year for which

2NONPROFIT HOSPITALS AND THE PROVISION OF COMMUNITY BENEFITSsuch data are available).2 “Uncompensated care” refers tothe sum of charity care (services for which a hospital doesnot expect payment) and bad debt (services for which ahospital expects but does not collect payment). Althoughcharity care is a better measure of the community benefitsprovided by a hospital, data limitations precluded CBO’sanalyzing charity care and bad debt separately.The five selected states were chosen in part becausesufficiently reliable data on uncompensated care wereavailable in those areas. The data were provided to CBOby the Government Accountability Office (GAO) andwere developed by GAO for use in its analyses of issuesrelating to the level of uncompensated care providedby different types of hospitals.3 CBO’s analysis expandson GAO’s findings in several ways: first, regression techniques are used to calculate adjusted differences betweennonprofit and for-profit hospitals in the provision ofuncompensated care, taking into account hospital characteristics and the characteristics of local populations; and,second, the provision of Medicaid services and specializedservices, such as emergency room care, are analyzedquantitatively.2. “Community hospitals” include nonfederal short-term generalhospitals. This definition includes most hospital facilities butexcludes, for example, federal hospitals run by the VeteransAdministration, psychiatric hospitals, and long-term-care hospitals. Several of the key data sources used are Medicare administrative files. Therefore, only Medicare-certified community hospitalswere included in the analyses in this paper. Throughout the text“all community hospitals” refers to all Medicare-certified community hospitals. The findings are referred to as representing the year2003, but the data are actually taken from either 2003 or 2002.For the analysis of uncompensated care, which includes hospitalsin only five states, the data for 57 percent of hospitals are fromfederal fiscal year (FFY) 2003, and those for 43 percent of hospitals are from FFY 2002. For convenience, 2003 is used to describethe findings because the majority of hospitals report data for FFY2003. For consistency, the analysis for all community hospitalsused the same data years that were used to analyze uncompensatedcare costs in the five states. The FFY 2003 data were used for allhospitals not in the five states. For the other analyses, whichinclude hospitals in all of the states, 90 percent of hospitals hadFFY 2003 data and 10 percent of hospitals had FFY 2002 data.3. See Statement of David M. Walker, Comptroller General of theUnited States, before the House Committee on Ways and Means,published as Government Accountability Office, Nonprofit, ForProfit, and Government Hospitals: Uncompensated Care and OtherCommunity Benefits, GAO-05-743T (May 26, 2005), available atwww.gao.gov/new.items/d05743t.pdf.CBO’s five-state analysis of uncompensated care yieldedthe following key findings:BIn the five states analyzed, nonprofit hospitals provided a total of about 3 billion in uncompensatedcare, government hospitals provided more than 3 billion, and for-profit hospitals provided about 1 billionin uncompensated care. The difference in the totalamount of uncompensated care provided by nonprofitand for-profit hospitals is largely attributable to thefact that nonprofit hospitals accounted for a muchlarger share of the hospital market than did for-profits.BThe average “uncompensated-care share”—the cost ofuncompensated care as a share of hospitals’ operatingexpenses—was much higher at government hospitals(13.0 percent) than at either nonprofit hospitals(4.7 percent) or for-profit hospitals (4.2 percent).BIndividual hospitals varied widely in their uncompensated-care shares. Although nonprofit hospitals, onaverage, have slightly higher uncompensated-careshares than for-profits (by 0.5 percentage points), thedistributions of uncompensated-care shares amongthose two types of hospitals overlap to a large extent.BWhen regression techniques were used to adjustfor the hospitals’ size and location and for the characteristics of the local populations, nonprofit hospitalswere estimated to have an average uncompensatedcare share that was 0.6 percentage points higher thanthat for otherwise similar for-profit hospitals. Thatestimated difference corresponds to nonprofit hospitals in the five selected states providing between 100million and 700 million more in uncompensatedcare than would have been provided if they had beenfor-profits.4Provision of Medicaid-Covered ServicesMedicaid’s payment rates have, in general, been foundto be somewhat below the costs that hospitals incur inproviding Medicaid-covered services. Because providinghospital services to Medicaid patients is often unprofitable and serves a needy population, it can be thought ofas a type of community benefit. Among all communityhospitals nationwide, CBO found that the Medicaidshare—Medicaid-covered days as a share of all patient4. The range of 100 million to 700 million represents the 90 percent confidence interval from the underlying statistical analysis.

NONPROFIT HOSPITALS AND THE PROVISION OF COMMUNITY BENEFITSdays—was, on average, 1.5 percentage points loweramong nonprofit hospitals than it was among for-profithospitals (15.6 percent versus 17.2 percent). The Medicaid share was substantially higher among governmenthospitals (27.0 percent). When regression techniqueswere used to control for hospital characteristics, nonprofit hospitals were found to have adjusted Medicaidshares that were 1.3 percentage points lower than thoseof otherwise similar for-profit hospitals.Provision of Specialized ServicesCBO also examined the share of hospitals of differentownership types that provide four specific types of specialized patient services: intensive care for burn victims,emergency room care, high-level trauma care, and laborand delivery services.5 Each of those services addresses acommunity need and has been identified as being generally unprofitable. Among all community hospitals nationwide, emergency room care and labor and deliveryservices were both quite common, whereas few hospitalsprovided burn intensive care or high-level trauma care.CBO found that nonprofit hospitals were more likelythan for-profit hospitals to provide each of the four specialized services examined. After adjustment for hospitalcharacteristics, nonprofit hospitals were found to be significantly more likely than for-profit hospitals to providetwo of the four specialized patient services (emergencyroom care and labor and delivery services). Comparedwith otherwise similar for-profit hospitals, the share ofnonprofit hospitals providing emergency room care was3.8 percentage points higher, and the share providinglabor and delivery services was 10.5 percentage pointshigher. CBO did not attempt to quantify the value tothe community of the availability of those specializedservices.5. In CBO’s analysis, a hospital provides “high-level trauma care” if itis a level 1 or level 2 adult trauma center (stand-alone pediatrictrauma centers are not included). A hospital may be designatedas a trauma center if it meets certain criteria developed by theAmerican College of Surgeons. Trauma centers are assigned a levelranging from 1 through 5, with level 1 being the highest. To bedesignated a level 1 or level 2 trauma center, a hospital must“[provide] comprehensive trauma care” and must “have immediate availability of trauma surgeons, anesthesiologists, physicianspecialists, nurses, and resuscitation equipment.” See Ellen J.MacKenzie and others, “National Inventory of Hospital TraumaCenters,” Journal of the American Medical Association, vol. 289,no. 12 (March 26, 2003), pp. 1515-1522.The Value of Tax Exemptions for NonprofitHospitalsThe Joint Committee on Taxation (JCT) recently examined the value to nonprofit hospitals and their supportingorganizations of the major tax exemptions they receivefrom federal, state, and local governments. Together,the value of the various tax exemptions in 2002 wasestimated to be 12.6 billion, with exemptions fromfederal taxes accounting for about half of the total andexemptions from state and local taxes accounting for theremaining half.JCT also estimated the value of some of the tax exemptions for nonprofit hospitals located in the five statesfor which uncompensated-care data were available. Inthose five states, the exemptions from federal and statecorporate income taxes, state and local sales taxes, andlocal property taxes were valued at 2.5 billion. (Twoimportant categories of tax exemptions—tax-exemptbond financing and the deductibility of charitable contributions—were included in the national totals but werenot available for the five states and are not included in thefive-state total.)BackgroundThe hospital industry in the United States includes a mixof ownership forms. Nonprofit hospitals are the mostcommon type, but for-profit and government hospitalsalso play substantial roles.6 Of the 630,000 beds inMedicare-certified community hospitals in the UnitedStates in 2003, 68 percent were located in nonprofithospitals, 16 percent were located in for-profit hospitals,and 15 percent were located in government (nonfederal)facilities.This section of the analysis examines the differences between nonprofit hospitals and for-profit hospitals in theirownership structure, tax treatment, and the provision ofcollective goods. (Collective goods are defined as goods orservices that, when used or consumed, generate well6. The terms “nonprofit” and “tax-exempt” (or “untaxed”) are sometimes used interchangeably, but they are technically distinct. Forthe purposes of federal taxation, an organization may be deemedtax-exempt by meeting the requirements of section 501 of theInternal Revenue Code. Nonprofit status, on the other hand, isgranted by state governments on the basis of criteria that varyfrom state to state. In CBO’s analysis, hospitals that identifythemselves as nonprofit in Medicare Hospital Cost Reports areassumed to be exempt from federal, state, and local taxes.3

4NONPROFIT HOSPITALS AND THE PROVISION OF COMMUNITY BENEFITSbeing or utility for more than one individual at the sametime.7) The tax exemptions for nonprofit hospitals arediscussed as one approach to promoting the provision ofcollective goods, and other approaches are identified aswell.Differences in Ownership StructureOwnership of a business entity entails the right to directthe operations of that business and the right to receive itsprofits. Like for-profits, nonprofit hospitals have governing boards that guide their operations. And, like for-profits, nonprofit hospitals may earn surpluses or accountingprofits, meaning an excess of revenues over expenses. Butnonprofits face a “nondistribution constraint,” whichmeans that they do not have shareholders and may notdistribute surpluses to managers, individual owners, ormembers of the governing board. Surpluses generated bynonprofit hospitals’ activities are expected to be reinvested in the hospitals’ operations rather than distributedto individual owners.Differences in Tax TreatmentNonprofit hospitals receive tax exemptions that allowthem to use funds that would have been paid in taxes forpatient care or other purposes. Tax exemptions providedto nonprofit hospitals, therefore, can be viewed as a formof government subsidy for the activities of a certain typeof hospital. Whether that subsidy is justified from a public policy perspective depends on whether policymakersbelieve that the activities of hospitals in general should besubsidized, and, if so, whether those subsidies shouldbe targeted at hospitals that organize themselves asnonprofits.One possible rationale for providing tax exemptions tononprofit hospitals would be if nonprofit hospitalstended to provide more collective goods than did forprofit hospitals. The provision of uncompensated medical care to an indigent individual might be thought of as atype of collective good: the medical care directly benefitsthe indigent individual who receives it and might alsobenefit members of the community (by fulfilling compassionate impulses, for example, or by preventing thespread of a communicable disease). The managers ofnonprofit organizations, because they do not directly receive the profits from the activities they oversee, might, in7. Burton A. Weisbrod, The Nonprofit Economy (Cambridge, Mass.:Harvard University Press, 1988).principle, be more willing than the managers of for-profitfirms to provide collective goods when doing so is unprofitable.8Unlike for-profit hospitals, nonprofit hospitals are generally exempt from federal and state corporate incometaxes, and local sales and property taxes. Nonprofit hospitals can also obtain tax-exempt-bond financing and receive charitable contributions that are tax-deductible tothe donor. For a hospital to qualify for exemption fromfederal income taxes, it must be organized and operatedexclusively for a charitable, educational, or scientific purpose and meet Internal Revenue Service (IRS) requirements under section 501(c)(3) of the tax code.The IRS does not specifically require that a hospitalprovide a certain level of charity care to qualify for taxexempt status, as long as the hospital provides somebenefits to the community. The criteria the IRS uses todetermine whether a hospital qualifies as tax-exempt havechanged over time and have been the subject of some debate. Activities that could support a hospital’s applicationfor federal tax-exempt status include operating an emergency room that is open to all members of the community regardless of their ability to pay; having a governingboard composed of community members; and usingearnings to improve facilities, patient care, medical education, training, and research.8. A concept in the discipline of economics that is similar to a collective good is that of a “public good.” Public goods are defined ashaving two properties: (1) nonrivalry in consumption (meaningthat one person’s consumption does not diminish another person’sability to consume the same good) and (2) nonexcludability(meaning that, because of the nature of the good, it is not feasible,once the good has been produced, to stop someone from consuming it; therefore, it is not possible for a seller of the good to recoupadequate payment for it). If nonindigent members of the community are made better off when indigent individuals are given healthcare, and if it is not possible for the hospital that provides suchcare to prevent nonindigent community members who have notcontributed to the hospital from being made better off, then theprovision of uncompensated care to poor people fits the definitionof a public good. Because people can benefit from a public goodwithout paying anything toward its production, a private marketplace may not produce an appropriate amount of such goods.Governments may intervene to bring about adequate productionof public goods by either having the government produce thosegoods or by providing subsidies to private producers of suchgoods. Prevention of the spread of communicable disease also fitsthe definition of a public good and provides an additional rationale for subsidization of certain hospital activities, including carefor the indigent.

NONPROFIT HOSPITALS AND THE PROVISION OF COMMUNITY BENEFITSTable 1.Estimated Value of Tax ExemptionsProvided to Nonprofit Hospitals, 2002Value(Billions of dollars)Corporate Income Tax (Federal)Tax-Exempt-Bond Financing (Federal)Charitable Contributions (Federal)Corporate Income Tax (State)Sales Tax (State and local)Property Tax (Local)Total2.51.81.80.52.83.112.6Source: Joint Committee on Taxation.To qualify for exemption from state corporate incometaxes and for exemption from state and local property andsales taxes, hospitals are subject to local requirements thatmay differ from federal requirements. State and local governments have, in many cases, required that, in order toreceive tax exemptions, hospitals meet standards that arestricter than those imposed by the IRS. For example, in1985 the Utah Supreme Court ruled that, to qualify forthe property-tax exemption, hospitals must engage insome “act of giving,” such as providing charity care. InIllinois, property-tax exemptions are limited to nonprofithospitals that dispense charity care to all who need it.Some states have already taken or have proposed takingthe additional step of imposing specific reporting andperformance requirements on nonprofit hospitals. Forexample, in Texas, to receive a property-tax exemption,nonprofit hospitals must regularly report on the charitycare and other community benefits that they provide andmust meet specified quantitative standards.9 Those stateand local requirements can represent significant constraints on nonprofit hospitals, given the financial valueto nonprofit hospitals of the exemptions from state andlocal taxes.To evaluate how nonprofit hospitals currently meet thecommunity benefits standard, the IRS recently distributed a questionnaire to a selected group of nonprofit hos9. For details on Texas’s charity-care standards for the nonprofithospital tax exemption, see Statement of David M. Walker, May26, 2005; and Kathryn J. Jervis, “A Review of State Legislationand a State Legislator Survey Related to Not-for-Profit HospitalTax Exemption and Health Care for the Indigent,” Journal ofHealth Care Finance, vol. 32, no. 2 (Winter 2005), pp. 36-71.pitals. Those hospitals were asked to provide a detailedreport on their community-benefit policies, admissionspolicies, billing policies, and the amount of uncompensated care they provide. The IRS may use the responses tothe questionnaire to issue further guidance or standardsrelating to tax exemptions for nonprofit hospitals.The Value of Tax Exemptions for NonprofitHospitalsJCT recently examined the value to nonprofit hospitalsof the major tax exemptions they receive from federal,state, and local governments.10 Together, the value ofthe various tax exemptions for nonprofit hospitals nationwide was estimated to be 12.6 billion in 2002 (seeTable 1). Exemptions from federal taxes accounted forabout half of the total, and state and local taxes accountedfor the other half. The largest categories were the exemption from local property taxes ( 3.1 billion) and theexemption from state and local sales taxes ( 2.8 billion).(The exemption from sales taxes applies to supplies thatnonprofit hospitals purchase, such as medical and officeequipment.)JCT also estimated the value of certain tax exemptionsprovided to nonprofit hospitals located in the five statesfor which GAO data on uncompensated care wereavailable. In those five states, the exemptions from thefederal and state corporate income taxes, state and localsales taxes, and local property taxes in 2002 were valuedat 2.5 billion. (Two important categories of tax exemptions—tax-exempt-bond financing and the deductibilityof charitable contributions—were included in thenational totals but were not calculated for the five statesand are not included in the five-state total.)In terms of reduced tax revenues, the costs to the variouslevels of government of the tax exemptions for nonprofithospitals are difficult to quantify. Part of the difficulty inmeasuring the value of the tax exemptions arises from thefact that nonprofits, because of their tax-exempt status,do not file the same types of tax returns as for-profits and,thus, do not provide some information needed to calculate their potential tax liability. A more fundamental issuein valuing the tax exemptions provided to nonprofits isthe fact that nonprofit hospitals, if they were to lose theirtax-exempt status, would likely change their behavior.10. See Congressional Budget Office, Nonprofit Hospitals and TaxArbitrage (December 2006).5

6NONPROFIT HOSPITALS AND THE PROVISION OF COMMUNITY BENEFITSTo calculate the value of the tax exemptions listed inTable 1, hospitals’ observed tax bases were multiplied bythe applicable tax rates. That method follows JCT’sstandard approach to calculating “tax expenditures,”which are defined as revenue losses resulting from specialprovisions or preferences in tax law.11 The calculationof tax expenditures implicitly assumes no behavioralresponses—in other words, it assumes that if special taxpreferences were removed there would be no changein firms’ income, capital structure, or physical assets.A revenue estimate, which is the estimated change in taxrevenues arising from a change in tax policy, differs froma tax expenditure in that the revenue estimate incorporates behavioral responses. The value of the tax exemptions detailed in Table 1 does not incorporate behavioralresponses and should not be interpreted as revenueestimates.Identifying the potential behavioral responses of nonprofit hospitals to removal of or restrictions on taxexemptions is complex. If nonprofit hospitals lost theirtax-exempt status but maintained their nonprofit ownership status, they would face financial pressure to reducetheir accounting profits and thereby reduce their tax burden.12 That pressure could lead nonprofit hospitals tochange their accounting practices as well as lower theprices they charge patients and insurers, and increasetheir costs of production.13 At the same time, adding newrestrictions on tax-exempt status for nonprofit hospitalsmight prompt some of those facilities to convert to forprofit ownership, which might also result in changes intheir tax bases (taxable income for converting hospitals,for example, might increase).Approaches to Providing Collective GoodsBesides offering tax exemptions to nonprofit hospitals,governments have several options if they wish to promotethe provision of collective goods such as health care for11. See Joint Committee on Taxation, Estimates of Federal TaxExpenditures for Fiscal Years 2006-2010, JCS-2-06 (2006).12. For-profit hospitals also face an incentive to minimize their taxburden, but they are constrained from doing so by their owners’interests in generating and distributing income.13. See Congressional Budget Office, Taxing the Untaxed BusinessSector (July 2005).low-income individuals. The first approach is to producethose goods directly. Government hospitals that providecharity care are an example of direct production. The second approach is to purchase collective goods from privateorganizations. An ex

1. Estimated Value of Tax Exemptions Provided to Nonprofit Hospitals, 2002 5 2. Hospital Ownership Types, by Region 12 3. Characteristics of Hospitals, by Ownership Type 13 4. Uncompensated-Care Shares, by Hospital Ownership Type and State 15 5. Economic Characteristics of Hospitals' Communities, by Hospital Ownership Type and State 16 6.