Transcription

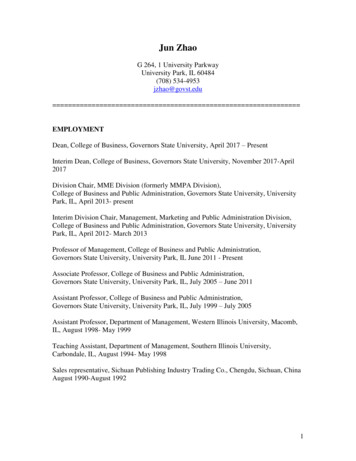

InternationalMonetary FundVOLUME 28NUMBER 19www.imf.orgOctober 11, 1999Contents1999 Annual MeetingsGovernors welcome recovery from crisis,endorse debt relief for poorest countriesA far-reaching commitment toprovide increased debt relief tothe poorest developing countries was endorsed by the governors of the World Bank and theIMF at their fifty-fourth AnnualMeetings, held in Washington,D.C. from September 28 toSeptember 30. The governorsalso welcomed the progressmany countries have made inrecovering from the financialcrises that had affected theireconomies in 1997–98 and early1999, even though in a numberof cases deep problems stillremain.The Annual Meetings openedon September 28 with theaddress of Mahesh Acharya,At the opening session of the 1999 Annual Meetings are (left to right) World BankPresident James Wolfensohn, Annual Meetings Chair Mahesh Acharya, and IMFFinance Minister of Nepal,Managing Director Michel Camdessus.who chaired the meetings (seepage 312). His remarks were folIt is important, Camdessus said, to move ahead withlowed by the opening addresses of IMF Managing Directorbuilding “a safer, more robust, more adaptable architecMichel Camdessus and World Bank President Jamesture” of the monetary and financial system. Essential eleWolfensohn.ments of this new architecture, he observed, are measures to prevent crises, enhance transparency, improveRecovery from crisisfinancial sector stability, and define global standards toIn his address, Camdessus stressed that “the recoveryunderpin stable, fair, efficient, and transparent markets.comes from the intense effort, the wisdom, and, mostUltimately, the Managing Director said, “finances andemphatically, the sense of cooperation of all concerned.”markets are about people and for people.” With theBuilding on this theme, hetransformation of the Enhanced Structural Adjustmentemphasized that, “in the newFacility (ESAF) into the Poverty Reduction and Growthworld of globalization, cooperFacility (PRGF); the deeper, faster, and broader debtation is a must.” A second lesrelief provided by the new Initiative for Heavily Indebtedson, he said, “is that we alwaysPoor Countries (HIPC); and the strong link establishedrun the risk, when economicbetween debt relief and increased expenditure on humanprospects have improved, ofdevelopment, he said, “the IMF is now well equipped tomoving too slowly to implegive a new impulse to the fight against poverty.”ment the reforms that areThis theme was echoed by the central bank governorsneeded. There is still an urgentand finance ministers of the IMF’s 182 member counneed for action.”305OverviewOpening addresses309IMF ManagingDirector312Chair of meetings313World BankPresident314Joint Interim andDevelopmentCommittees statement315Interim Committeepress conferenceCommuniqués317Interim Committee323Group of 24326DevelopmentCommittee317Transformation ofInterim Committee321Group of Sevenstatement322New on the Web328Recent publications329Managing Director’sclosing address330Managing Director’sclosing pressconference333UNCTAD report on FDI334World EconomicOutlook335Y2K facility336Selected IMF rates305

tries, who, in their addresses, were unanimous in welcoming the progress toward recovery in the crisis economies. At the same time, a number of speakers recognized the continuing problems that, despite progress,affect the Russian economy and the recent threats toIndonesia’s economic stability. Speakers also welcomedthe progress that had been made in Brazil and othercountries of Latin Americain recovering from the recentcrisis. Representatives ofdeveloping countries, inparticular, welcomed theprogress that had been madeon the debt issue and stressedthe urgent need to move forward in the fight againstworld poverty.Action on debtU.S. President BillClinton addressedthe plenarysession onSeptember 29.Announcing a significantcommitment, U.S. PresidentBill Clinton said in the plenary session on September 29that he was directing hisadministration to move toforgive 100 percent of thedebt owed to the UnitedStates by the heavily indebtedpoor countries when theycommit to using the moneyto finance basic humanneeds. A similar commitment was later made by GordonBrown, the U.K. Chancellor of the Exchequer.Under the terms of the agreement on debt, which isnow being considered by the IMF Executive Board, theIMF would conduct off-market transactions with member countries, on the basis of market prices, of up to14 million fine ounces of gold. The balance of the salesproceeds will be used for investments benefiting theESAF-HIPC Trust (see page 308). The framework of theunderstanding on debt was outlined in the CologneDebt Initiative, approved by the members of the Groupof Eight countries in June 1999 (IMF Survey, July 5,page 209).Consensus of the meetings“These have been a truly productive few days,”Camdessus said in his concluding remarks onSeptember 30 (see page 329). Summing up the consensus of the meetings, he welcomed the “striking unity”displayed by the governors in their assessment of current economic prospects; their “overwhelming endorsement” of the efforts to deal with the recent crises; and“above all, the enhancement of the HIPC Initiative, thelaunching of our Poverty Reduction and GrowthFacility, and all that goes with these steps,” which havecreated a “strong new impetus to the war on poverty.”Camdessus said he had detected three key themes inthe discussions. These were the determination to avoidcomplacency; the encouraging impetus toward actionand implementation in the twin areas of internationalmonetary and financial reform and poverty reduction,with the IMF’s partnership with the World Bank beingcritical in the latter area; and the obligation to deliveron the part of both the international community andnational governments.The plenary sessions were preceded by meetings ofthe Interim Committee of the IMF’s Board ofGovernors—the IMF’s principal advisory body—andof the Development Committee (the Joint Bank-IMFCommittee on the Transfer of Real Resources toDeveloping Countries), as well as meetings of theGroup of Seven industrial countries and the Group of24 developing countries.As a mark of the growing status of the InterimCommittee, on September 30, the IMF Board ofAnnual Meetings 1999 on the webOctober 11, 1999306In addition to the full transcripts of the speeches, communiqués, and press conferences covered in this issue, the IMF’swebsite (www.imf.org) has posted a number of items ofinterest related to the 1999 Annual Meetings (dates posted inparentheses). Financial Sector Crisis and Restructuring: Lessons fromAsia (the report and the transcript of the press briefing givenby Stefan Ingves, Director, Monetary and Exchange AffairsDepartment, and other members of the department)(September 25). Overview: Transforming the Enhanced StructuralAdjustment Facility and the Debt Initiative for the HeavilyIndebted Poor Countries (September 26). Statement by the Managing Director on Progress inStrengthening the Architecture of the InternationalFinancial System (September 26). Economic Prospects for the Countries of SoutheastEurope in the Aftermath of the Kosovo Crisis (September 27). The 1999 Per Jacobsson Lecture, “The Past and Futureof European Integration: A Central Banker’s Perspective,”by Willem F. Duisenberg (September 27). Debt Initiative for the Heavily Indebted PoorCountries: Progress Report (September 28). Press Briefing on IMF Financing of Debt Relief,September 27, by Benedicte Christensen of the IMFTreasurer’s Department and Anthony R. Boote of the IMFPolicy Development and Review Department (September 29).

Chilean Finance Minister and incoming IMF DeputyManaging Director Eduardo Aninat (right) meets withMichael Moore (left), Director-General of the WorldTrade Organization, and Juan Somavia, DirectorGeneral of the International Labor Organization.Governors adopted a resolution transforming theCommittee into the International Monetary andFinancial Committee of the Board of Governors (seepage 318). In addition to the name change, there is nowan explicit provision for preparatory meetings of committee deputies.Interim Committee meetingIn his capacity as Chair of the Interim Committee,Gordon Brown welcomed the agreement on debt reliefas marking the birth of a “worldwide alliance againstpoverty.” Speaking at a joint press conference with theManaging Director following the Committee’s meetingon September 26, he said, “those to whom the world’sgreatest wealth has been given have joined with thoseburdened down with the world’s greatest debt anddestitution” (see page 315).The increased emphasis on action on debt relief wassymbolized by the first joint meeting of the InterimCommittee and the Development Committee of theIMF and the World Bank, which was also held onSeptember 26. This joint meeting, Brown said, was asign of “the cooperation and commitment of all countries and institutions to the enhanced debt-relief initiative, which will provide faster, deeper, and broader debtrelief with the central goal of reducing poverty in theworld’s poorest countries.” The joint meeting, heexplained, made progress in three areas: in reforms todeliver faster, deeper, and wider debt relief; in strengthening the focus on poverty reduction; and in agreeingon the financing arrangements for the enhanced HIPCInitiative through off-market gold transactions withIMF member countries (see page 314).In its communiqué (see page 317), the InterimCommittee welcomed the improvement in global economic and financial conditions since the beginning of1999, and noted that recovery was taking hold in the crisisaffected countries of Asia, but with further effortsneeded to accelerate financial sector reform and corporate restructuring; stressed the urgent need for further progress withreforms in Russia; noted the need for stronger adjustment and reformefforts in much of Latin America; noted the renewed opportunity for fiscal consolidation and economic diversification in countries in theMiddle East and Africa that had benefited from higheroil prices; and urged the heavily indebted countries of subSaharan Africa to take full advantage of the opportunity offered by debt relief under the enhanced HIPCInitiative to intensify and press ahead with reforms.Regarding the industrial countries, the Committeenoted that a sustained pickup in domestic demand inEurope and Japan, together with medium-termgrowth in the United States in line with potential,would help to achieve a more balanced pattern ofgrowth among this group of countries. It called forcontinued efforts to strengthen the banking systemand foster corporate restructuring in Japan, as well asfurther efforts towardfiscal consolidationand structural reformin Europe.TheCommitteestressed that open andcompetitive marketswere a key componentof efforts to sustaingrowth and stability inthe global economy. Itstated that the proposed launch of newtrade negotiations atthe November 1999meeting of the World Trade Organization in Seattle,Washington, provided an opportunity to make furtherprogress in this direction.Poverty reductionThe Interim Committee endorsed the replacement ofthe IMF’s ESAF by a new Poverty Re-duction andGrowth Facility, which will aim to make povertyreduction efforts among low-income member countries a more explicit element of a renewed growth-oriented economic strategy. Under this new approach, each country will prepare a comprehensive PovertyReduction Strategy Paper, with assistance from the IMFand the World Bank, to guide the design of programs; social and sectoral programs to reduce poverty willbe taken fully into account in the design of growth-oriented economic policies; great emphasis will be accorded to good governance through greater transparency, improved moni-Mohammad ZuhdiNashashibi (left), thePalestinianAuthority’s Ministerof Finance, greetsJacob Frenkel,Governor of theBank of Israel.October 11, 1999307

toring, anticorruption initiatives, accountability, andinvolvement of all sectors of society; and high priority will be given to key reforms designedto achieve governments’ social goals.The Committee also welcomed the agreement onfinancing the HIPC Initiative and the IMF’s continuedlending for growth and poverty reduction in its lowincome member countries. It stated that the planned offmarket transactions of up to 14 million fine ounces ofgold would be an exceptional measure and part of aHilde FrafjordJohnson (left),Norway’sMinister ofInternationalDevelopmentand HumanRights, conferswith MarianneJelved,Denmark’sMinister ofEconomicAffairs.broader financing package to allow the IMF to contributeto resolving the debt problems of the HIPCs at the turnof the millennium.Financial architectureThe Committee welcomed the progress made in developing and monitoring standards of importance for theinternational monetary and financial system. In particular, it adopted the Code of Good Practices onTransparency in Monetary and Financial Policies:Declaration of Principles, developed by the IMF staff.The Committee also reiterated the importance ofgreater transparency in policymaking. It welcomed thewidespread release of Public Information Notices (PINs)Board of Governors envisions off-marketgold sales to finance debt reliefOctober 11, 1999308On September 30, the IMF announced it was considering a onetime gold sales operation as part of a broader financing package.The text of Press Release No. 99/47, which is also available on theIMF’s website (www.imf.org), follows.The IMF Executive Board is considering conducting offmarket transactions of up to 14 million fine ounces of gold.On the basis of market prices, the IMF will sell gold tosome central banks of member countries with repaymentobligations to the IMF, on the understanding that these central banks will use the gold to make the repayment. Thesetransactions will allow the IMF to place an amount ofand many other papers and reports; the decisions of 46countries to participate in the pilot program to releaseArticle IV reports; and the presumption in favor of publishing Letters of Intent, Memorandums of Economicand Financial Policies, and Policy Framework Papers.Corruption and money laundering raise importantissues for the credibility of IMF programs, theCommittee warned. It called on the IMF to review itsprocedures and controls to identify ways to strengthensafeguards on the use of its funds and to report at theCommittee’s next meeting on April 16, 2000. It emphasized that further actions to strengthen governance atboth the national and international levels were crucial.The Committee welcomed the further measurestoward greater transparency that had been adopted,including the progress made in financial sector reformand bank restructuring in the context of IMF surveillance; the external evaluation of IMF surveillanceand research activities (IMF Survey, September 27,page 303); the continuing efforts to involve the privatesector in forestalling and resolving financial crises; andrecent work on the appropriate pace and sequencing ofcapital account opening. It called on all member countries to put in place millennium contingency plans andendorsed the IMF Executive Board’s decision to introduce a temporary facility to help members facing Y2Krelated payments needs (see page 335).Development CommitteeThe HIPC Initiative was also the major issue of concern atthe meeting of the Development Committee, chaired byTarrin Nimmanahaeminda, the Thai finance minister.In its communiqué (see page 326), the DevelopmentCommittee endorsed the enhancements to the HIPCInitiative and expressed support for lowering the debtsustainability thresholds; providing faster debt reliefthrough interim assistance; introducing floating completion points to focus on positive achievements andoutcomes; and, as a consequence, increasing the number of countries eligible for debt relief.the sales proceeds equivalent to SDR 35 an ounce in theGeneral Resources Account, and the balance in the SpecialDisbursement Account for investments benefiting the ESAFHIPC Trust.According to a resolution adopted by the Board ofGovernors on September 30, “off-market transactions of upto 14 million ounces of gold by the IMF that are envisagedwill be a onetime operation of a highly exceptional naturethat is part of a broader financing package to allow the IMFto contribute to the resolutions of the debt problems of theHIPCs at the turn of the millennium and to the continuationof concessional operations to support countries’ efforts toachieve sustained growth and poverty reduction.”

Managing Director’s opening addressCamdessus says cooperation is essential,calls for action to ensure reformsFollowing are edited excerpts of the opening address byIMF Managing Director Michel Camdessus to the Boardof Governors of the IMF on September 28 in Washington,D.C. The complete text is available on the IMF’s website(www.imf.org).Governors, the global economy has passed through agreat ordeal. For a time, we faced the threat of the mostextensive and the harshest crisis since our institutionswere established. Its human cost has been immense, andwe may need a few more years to heal all the wounds.Now, the storm is abating, even though some risksremain. Several countries that were in the depths of crisis—Korea, Thailand, the Philippines, Brazil, and others—are advancing in their recovery. Above all, therecovery comes from the intense effort, the wisdom,and, most emphatically, the sense of cooperation of allconcerned.A major lesson of this crisis is that, in the new worldof globalization, cooperation is a must. A second lessonis that we always run the risk, when economic prospectshave improved, of moving too slowly to implement thereforms that are needed. There is still an urgent need foraction. So I shall largely confine my remarks to the twodomains where I see a pressing need to move quickly toimplementation: reform of the international monetaryand financial system and the offensive to eradicatepoverty and humanize globalization.In his openingaddress,Managing DirectorMichel Camdessusholds up theDeclaration onPartnership forSustainable GlobalGrowth, this is partof the 1996 InterimCommitteecommuniqué.ing, when the day comes, to the rebuilding and sustainable development of East Timor.Monetary and financial reformRussia and Indonesia make progressBefore proceeding, let me say a few words about IMFprograms with two of our largest members—Russiaand Indonesia. In Russia, the economy is recovering,and the program that began in July this year is on track.We look forward, as the program moves ahead, toRussia’s advance in both structural reforms andimproved governance. We should not lose sight of thereal progress that has been achieved during seven yearsof endless efforts to assist Russia in its journey towarda market economy. Nor should we ignore the fundamental decision, on which Russia has not wavered, toseek to develop a modern market economy and integrate itself into the international community.In troubled Indonesia, the government turned theeconomy around after taking office last year. Economicstability in turn helped make possible the freest elections in Indonesia’s history. Now, these achievementsare threatened. But, we stand ready to resume our assistance as soon as the shadows hanging over the programare lifted. We expect to continue working with the nextgovernment of Indonesia to help the country achieveits great potential, while we look forward to contribut-First, in the area of architecture, work is in progress.Sunday’s communiqué of the Interim Committee contains an impressive catalog of steps. They focus on prevention; transparency; financial sector stability; and thedefinition of global standards to underpin stable, fair, efficient, and transparent markets. An important step forward is the Committee’s adoption of the Code of GoodPractices on Transparency in Monetary and FinancialPolicies. New facilities have been created: the ContingentCredit Lines and the Y2K facility. The foundations of asafer, more robust, more adaptable architecture are there.But progress is slower in other areas where full consensushas yet to emerge.First, on the scope and focus of surveillance, severalaspects are unquestionable: its central role in the work of the IMF; its priority in allocating our human and budgetaryresources, since only the IMF has this mandate; its growing importance in a new environmentwhere early detection of emerging problems is of theessence; and its primary focus on matters that are the traditional mandate of the IMF—monetary stability, bal-October 11, 1999309

ance of payments sustainability, and growth-orientedeconomic policies.But major destabilizing factors can emerge anywhere. These risks call for robust banking and financialsystems; sound, transparent, and participatory governance; arm’s-length relationships among governments,banks, and enterprises; and supportive social policies.How, and to what extent, do we integrate these concerns into our surveillance and how do we interact withthe many other agencies? How can we avoid furtherstretching an already overloaded staff? And, last, howcan we proceed with the monitoring and implementation of standards, particularly where they lie outsideour traditional mandate?We must clarify these issues. A significant part of ourresponse will rely on the arrangements we will set upwith other agencies to share the task of disseminatingand monitoring standards that lie outside the IMF’smain areas of expertise.Next, we have the problem of private sector involvement in crisis prevention and resolution. The volatility ofprivate capital flows can and must be diminished by7 pledges on sustainable development Reducing extreme povertyThe proportion of people living in extreme poverty in developing countries should be reduced by at least one-half by2015. Universal primary educationThere should be universal primary education in all countriesby 2015. Gender equalityProgress toward gender equality and the empowerment ofwomen should be demonstrated by eliminating gender disparity in primary and secondary education by 2005. Infant and child mortalityThe death rates for infants and children under the age of5 years should be reduced in each developing country by twothirds of the 1990 level by 2015. Maternal mortalityThe rate of maternal mortality should be reduced by threefourths between 1990 and 2015. Reproductive healthAccess should be available through the primary health-caresystem to reproductive health services for all individuals ofappropriate ages, by no later than 2015.October 11, 1999310 EnvironmentThere should be a current national strategy for sustainabledevelopment, in the process of implementation, in every country by 2005, so as to ensure that current trends in the loss ofenvironmental resources are effectively reversed at both globaland national levels by 2015.promoting a mature relationship between creditors andtheir sovereign clients and between the financial community and the official sector. The involvement of theprivate sector is a matter of practical necessity, since theprivate sector will be increasingly important for financing the emerging market and developing countries.But, crises may arise that would benefit from closercooperation. We must try, drawing on the lessons of thecases that have arisen recently, to distill a set of principles that could help to resolve crises at less cost than inthe past. That being done, it will remain important tohave—for the protection of both creditors anddebtors—a way of ensuring that countries are giventime, in extreme circumstances, to seek orderly resolution with their creditors. One avenue consists in designing a mechanism that will permit a temporary stay oflitigation through an appropriate amendment or interpretation of the IMF’s Article VIII(2b).Third, we have the debate on the relative merits ofall-out liberalization of capital movements and the illusory virtues of exchange controls. Consensus is achievable on the way to proceed with the orderly liberalization of capital movements. We have two core messages:in the long term, liberal arrangements for capital movements are beneficial to global economic development,and liberalization should be orderly and tailored toindividual countries’ situations.Fourth, the question of exchange rate regimes. Weknow quite well that many of the problems of the socalled casino economy are related to the nature ofexchange rate regimes and to the shortcomings ofinternational cooperation in this field. We have witnessed the effect of deficiencies in exchange systems orexchange rate management in triggering or amplifyingcrises and their key role in transmitting domesticallygenerated crises. And we know well the role played bythe volatility of exchange rates in what seems, at times,the sheer irrationality of market developments. For thetime being, today’s diversity of exchange rate regimeswill continue, but the greater mobility of capital hasmade the maintenance of fixed exchange rates moredemanding. In considering how to improve exchangestability, we can be encouraged by the widespread recognition of the essential role ofthe soundness of economic fundamentals, and the remarkable success of the introduction of theeuro with its potential to become a strong player in anorderly multipolar system.Humanizing globalizationSound finances clearly involve sophisticated instruments, standards, and smoothly working markets,but, ultimately, finances and markets are about peopleand for people. And it is the hard, demanding task ofthe IMF, even if it is not a development institution, totry to help governments to be responsive to the cries

of the poor. I believe that we must keep in our mindsand hearts the heartbreaking message of the twoteenagers from Guinea, found dead in the landinggear bay of an airliner. They said, “we suffer enormously in Africa. Help us. We lack rights as children.We have war and illness, we lack food. We want tostudy, and we ask you to help us to study so we can belike you.” This is a message from those in absolutepoverty. It tells us that the extent of poverty still present at the end of a century of affluence is intolerable.So it is time to respond.But this is not new for you: social policies are centralelements of government budgets, of donors’ aid programs, and of international communiqués. Nor arethese issues new to the IMF; for many years, IMFsupported programs have explicitly incorporated socialpolicies. During the past decade, in most countriesimplementing IMF-supported programs, educationand health care have significantly increased in real percapita terms. At the same time, there have beenimprovements in important social indices. But thevoices of the poor around the world are telling us in nouncertain terms that this is not enough.There are two dimensions in the war against poverty:one national, the other international. The first willremain predominant. Poor countries themselves needto generate high-quality growth. We can learn from thepositive experiences of many African countries that,assisted by IMF-supported programs, have begun toreverse the sad cycle of declining per capita growth,high inflation, and external imbalances. We know theingredients: a stable macroeconomic environment; anopen, efficient market economy; a framework that fosters private investment; and transparency, financial sector soundness, robust economic institutions, and goodgovernance—in particular, respect for the rule of lawand an independent judicial system that recognizesproperty rights, enforces contracts, and protects basiccitizens’ rights.A vital interrelationship exists between growth andsocial development. Strong social policies that addresspoverty at its roots lay the foundation for sustainedeconomic growth. This is why we must aim to eradicatepoverty. For that, an international contribution isindispensable.A central element will be the transformation of theEnhanced Structural Adjustment Facility (ESAF) intothe Poverty Reduction and Growth Facility, to incorporate the lessons of more than 10 years of experience, anew level of cooperation with the World Bank, newsteps for debt reduction, and an explicit link withpoverty reduction. A key feature will be the formulation by countries of their own comprehensive growthoriented policies designed to reduce poverty. We lookforward to the continued deepening of cooperationwith the World Bank and the regional developmentbanks to implement these changes and to tap theirexpertise. Equally, we believe this approach will fostermore fruitful contacts with donors, official agencies,and civil society.With the integration of social objectives at the heartof our programs; the deeper, faster, and broader debtrelief provided by the new initiative for HeavilyIndebted Poor Countries (HIPCs); the strong linkestablished between debt relief and increased humandevelopment expenditure; and the adoption of the keyprinciples of the new facility, the IMF is now wellequipped to give a new impulse to the fight againstpoverty.But, there is a price to pay for debt reduction. Andfor the IMF it is high. It has implied that we engage inexhaustive negotiations to convince countries to contribute to this effort. For their contributions, I thank allof them—more than 90 countries, of whom the largemajority are developing or transition countries, including several who have used ESAF resources themselves.We have accepted that the IMF should almost triplefrom 5 million ounces to as much as 14 million ouncesthe stock of gold we will utilize to generate, through offmarket transactions, the earnings needed to completeour contribution.For this strategy of poverty eradication to be credible, one important element is to boost trade as well asaid. The industrial countries must make a bolder effortto open their economies to all the exports of the poorest countries. At the same time, the trend decline inofficial develop

Overview: Transforming the Enhanced Structural Adjustment Facility and the Debt Initiative for the Heavily Indebted Poor Countries (September 26). Statement by the Managing Director on Progress in St rengthening the Ahitture ofthe Intnational Financial Syst m (S pt mb r 26). Ec onomic P rospects fr the Counties oSoutheast